How to properly report money

When issuing cash to report on a cash receipt order, the accountant must adhere to certain rules established by the procedure for conducting cash transactions (clause 6 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U).

Let's consider the main steps when issuing money:

- An application is accepted from the employee, which contains a request for the payment of a certain amount for a specified period, written in free form addressed to the manager. The manager's decision, signature and date are checked. Instead of an application, a completed administrative document (instruction/order) can be submitted to the accounting department. Such a statement (instruction/order) serves as the basis for issuing money for reporting.

ATTENTION! From November 30, 2020, an administrative document can be drawn up for several cash payments to one or more employees. In this case, you need to indicate the name, amount and period for which the money is issued for each employee.

What other innovations in the procedure for recording cash transactions have come into effect, ConsultantPlus experts told. Get trial access to the K+ system and go to the review material for free.

IMPORTANT! From August 19, 2017, the absence of debt on accountable amounts is not a limitation for receiving a new advance (clause 1.3 of instruction No. 4416-U).

- Next, a cash receipt order is issued in a single copy. Signed by an accountant or manager (if there is no accountant and he (the manager) combines the position of accountant and manager).

- The completed RKO, together with the application, is handed over to the cashier, who checks all items of the consumables for correct filling, and checks them with the document - the grounds for issuance.

- The cashier prepares the money, verifies the identity of the accountant using the passport received from him, and hands him the cash register for signature.

- After the employee signs the cash order, the cashier issues the money and puts his signature in the cash register.

- An entry is then made in the cash book.

IMPORTANT! Individual entrepreneurs, in accordance with the instructions of the Central Bank of the Russian Federation No. 3210-U, from 06/01/2014 may, at their own discretion, not issue receipts and expenditure orders and not maintain a cash book.

What you need to know

Today, the cashier of any organization that issues funds in cash to employees or other persons must be able to draw up a special document - RKO (expenditure cash order).

A sample of filling out a cash expense order for a sub-report (2019 form) can be easily found on the Internet.

But at the same time, it is necessary to use only the most reliable sources - the presence of any errors is simply unacceptable. Presence may lead to excessive interest on the part of the Federal Tax Service.

In order to avoid typical shortcomings and inaccuracies, the employee drawing up this document will need to understand, first of all, the following issues:

- basic definitions;

- purpose of the document;

- legal regulation.

Basic definitions

In order to understand the current legislation on the issue under consideration, it will be necessary to familiarize yourself with all kinds of terms.

This will avoid misinterpretation of any regulations, legislative documents, or acts.

The fundamental concepts that are strictly necessary to know include the following:

- cash transactions;

- cash inventory;

- expense cash order No. KO-2;

- register of cash orders.

The term “cash transactions” refers to any action directly related to the issuance or receipt of money.

They are what is displayed in a document called a cash receipt order - the abbreviation RKO is also used quite often.

You can often find the term “inventory of funds” in regulations and legal acts. It means keeping records of money received, as well as subsequently issued.

“Expense cash order” or RKO means a special document that is generated in a single copy when issuing cash through the cash register.

At the same time, you should remember the fairly extensive list of rules and features of drawing up this document. Their implementation is strictly mandatory.

“Cash Order Registration Journal” is a specialized register that includes a list of all cash orders (expenses and receipts).

This journal must indicate all the characteristics of the RKO - date of formation, purpose, as well as other important ones.

How much money can be issued for reporting in 2021, see the article: maximum amount for reporting.

Read all about accountable persons here.

Also, if possible, it is worth familiarizing yourself with other terms found in the legislation on this matter.

Purpose of the document

The main purpose of the cash expenditure order for reporting to the general director is announced in as much detail as possible in Resolution of the State Statistics Committee of the Russian Federation No. 88 as amended by the State Statistics Committee of the Russian Federation.

This regulatory document has a separate section called “Cash expenditure order” (Form No. KO-2).

The document of this type is used to process cash withdrawal:

- when implementing the traditional method of data processing;

- when processed using computer technology.

It should be remembered that a document of the type in question must be signed by a fairly extensive list of persons.

For example, an expense cash order for reporting must be certified by the director. Some of the most important sections of the document of this type are the following:

In fact, the purpose of the document in any particular case is stated in the “grounds” field. The formation of cash settlements is required in almost all cases when issuing cash from the organization’s cash desk.

Legal regulation

It should be remembered that the formation of a document of this type must necessarily be carried out within the framework of the legislation in force in this regard.

The most important regulatory documents in this regard are the following:

You should know that immediately from the city, all document formats indicated in the above-mentioned resolution are not required to be used. This means you don't have to use standard forms.

All organizations, based on current legislative acts, as well as their own internal regulations, can prepare their own samples.

But at the same time, it must be remembered that this rule does not apply to various primary accounting documentation.

Moreover, this applies, first of all, to cash documents – including cash receipts.

Therefore, when forming a RKO, you should in no case deviate from the model established in the current legislation. Otherwise, there is a high probability of problems arising.

Sample RKO for issuance for reporting: what does the document consist of?

Looking at the cash receipt order form, we can roughly divide it into three main parts:

- the first indicates the details of the document;

- in the second it is written for what purposes and to whom the money is given, with corresponding accounts and signatures of responsible persons;

- in the third, the procedure for issuing cash with the signatures of the performers is formalized.

Here you can issue a cash order in form KO-2, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Let's look at a sample of line-by-line filling of RKO for a sub-report - what information should be entered into it and how.

| Line name | Content |

| Organization | The name is written as indicated in the constituent documents |

| According to OKPO | The code received upon registration in the statistics department is entered |

| Structural subdivision | If there is such a unit, the line is filled in; if not, a dash is placed |

| Document Number | The next RKO number is indicated |

| Date of preparation | The date of issue of money is written in the report |

| Structural unit code | Enter the assigned code for the existing branch |

| Corresponding account | In case of issuance, a score of 71 is entered into the report. |

| Analytical accounting code | The code assigned to a specific accountant is written |

| Credit | The score is set to 50 |

| Amount, rub., kopecks | The amount issued is indicated in numbers |

| Issue | Enter the full name of the accountable person |

| Base | In the case of issuing a report, the following is written: “under report”, the purpose is indicated, for example, “for the purchase of goods” or “for travel expenses”, and the document is “employee application” |

| Sum | Rubles are written in capital letters, kopecks are written in numbers, an empty space on the line is crossed out |

| Application | The document is indicated: the employee’s statement and the date of its preparation |

| Supervisor, Chief Accountant | Responsible persons sign with full name and full name. |

| Received | The accountant indicates the amount in capital letters and makes a dash in the empty space, then enters the date of receipt of funds |

| Signature | The accountant signs to confirm receipt of funds. |

| By | Enter the details of the identity document of the employee to whom the cash is issued |

| Issued by the cashier | The employee who issued the money signs and makes a full transcript of his full name. |

When completing cash transactions, be sure to follow the rules. Exactly what rules are established for cash discipline were explained in detail by ConsultantPlus experts. Get trial access to the legal reference system and switch to the Ready Solution for free.

Corrections when filling out RKO are not allowed. The document must be drawn up without errors or blots. In an organization, a manager can perform the functions of an accountant and cashier. In this case, it is recommended to issue an administrative document assigning accountant responsibilities to the manager.

To find out what documents regulate the rules for filling out an expense cash order, read the article “How to fill out an expense cash order?” .

Issuance of cash receipts for reporting

It should be remembered that not only the procedure for drawing up, but also the issuance of a cash receipt order is necessarily regulated by the legislation in force in the territory of the Russian Federation.

This procedure has a very large number of different features. Therefore, it is imperative to familiarize yourself with it in as much detail as possible in advance.

It is also worth studying the following fundamental questions in advance:

- Who exactly should fill it out?

- instructions for drawing up an order;

- basis for issuance.

An example of filling out will be required if you have no experience in drawing up documents of this type.

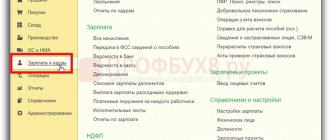

Specialized software from 1C can make this task somewhat easier. All documentation of this type, including cash registers (RKO and others), is already included in the database.

Video: issuing money for reporting from the cash register, how to document it in the cash register department

For registration and subsequent printing, all you need to do is fill in the appropriate fields. Which is very convenient - the likelihood of making any mistakes will be minimal.

To be filled in by

The procedure for drawing up an expense cash order can be carried out by the following officials:

- cashier;

- accountant.

If for some reason the above-mentioned officials are absent or do not have the opportunity to generate this documentation, then another person can draw up the RKO.

It should only be remembered that it must have the appropriate authority to do this. For example, this document can be drawn up by a director or chief accountant.

At the same time, regardless of the employee’s position, it is imperative to comply with all the rules for drawing up a cash settlement order.

Instructions for drawing up an order

It is important to study the instructions for filling out the order in advance. Thus, it will be possible to significantly reduce the time required to generate a document of this type.

The procedure for compiling RKO today is as follows:

It should be remembered that this document must be registered in a journal specially designed for this purpose. It is drawn up according to form No. KO-3.

RKO is valid only if there are signatures of the following persons:

After all the necessary signatures have been affixed, the cash register is handed over to the cashier. This employee must check the correctness of filling out a document of this type.

After completing all the above operations, you must fill out the “received” column. It indicates in words the entire monetary amount. Moreover, with a capital letter, while kopecks must be indicated by numbers.

Grounds for issuance

It should be remembered that directly when issuing money from the cash register, the recipient will be required to present an identification document. This could be a passport of a citizen of the Russian Federation, a driver’s license, or something else.

Any other document that contains the seal of the organization, a photo of the person applying and his full name can also be used.

Find out how to correctly draw up an act of acceptance of goods for reporting to the seller from the article: reporting.

Where to view a sample contract agreement for car repairs, read here.

How to draw up an agreement to terminate a contract, see here.

In this case, the details of the document must be indicated regardless of who exactly the recipient is - an individual or an organization.

Filling example

If for some reason it is not possible to use automated software to generate the document in question, it is worth using the RKO example.

However, it is still worthwhile to first familiarize yourself with the relevant resolution of the State Statistics Committee. This will make it possible to avoid various types of mistakes.

Basis in RKO when issuing for reporting

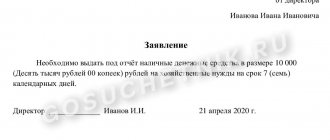

As we have already found out, money can be issued on the basis of an issued administrative document or a statement from the accountant signed by the manager. The application can be written either by hand or submitted in printed form. It might look something like this:

To the Director of Rassvet LLC

M. M. Shipovalov

from the driver Yu. V. Zvyagintsev

Statement

Please give me 1,000 rubles. 00 kop. (one thousand rubles) for a period of 10 calendar days for the purchase of fuel and lubricants for a company car.

______________ Yu. V. Zvyagintsev 05/11/20XX

I allow

Director ______________ M. M. Shipovalov 05/11/20XX

When registering RKO, in the line to indicate the basis, write “under report” and indicate the document (“application”) with the date of its preparation. It is also recommended that the application form be approved by order on accounting policies as an annex to the regulations on settlements with accountable persons.

IMPORTANT! From 06/01/2014, on the basis that an employee of an organization is considered to be a person working under both an employment and a civil law contract, money on account can also be issued to persons who have entered into a civil law contract with the organization.

Do you want to know when a director can receive money to report? Then read the article “How to properly report money to the director?” .

Registration procedure

The main provisions for issuing funds for reporting through cash settlement services are established in clause 6.3 of Bank of Russia Instructions No. 3210-U dated. According to the Bank’s Instructions, the accountant issuing funds must follow specific rules - details in the article “How to organize settlements with accountable persons” . The accountant-cashier generates cash settlements for the amount specified in the order for the issuance of money. If you have to spend more, it is possible to reimburse the accountable person. If it is less, the balance is returned to the cashier or deducted from the salary.

Results

It must be remembered that before starting to fill out the cash register accountant, the accountant must receive from the employee his own handwritten application, endorsed by the manager. You need to draw up an expense cash order carefully; you must not make mistakes or make corrections. To do this, we advise you to download our sample and always have it at hand.

An internal document describing the procedure for settlements with accountable persons can help you follow the procedure for issuing funds on account and control their intended use.

Such a document can be found in the article “Regulations on settlements with accountable persons - sample”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Who issues and fills out such documentation?

This document is drawn up by the person responsible for handling cash. Basically this is an accountant and cashier. But these duties can also be performed by another employee authorized by the relevant order.

At some enterprises, consumables are written out by an accountant:

- calculator;

- by accountable persons.

The above-mentioned persons do not always have the opportunity to draw up a document; then another person can draw up the RKO. Eg:

- supervisor;

- Chief Accountant.

Just don’t forget that the person completing the cash settlement must have documentary authority to do so. After an expense transaction, the cash register remains in the cash register. In addition, it is subject to mandatory registration in a special journal.

Expense cash order: filling rules

A sample of filling out the RKO is available to anyone, but in addition to seeing it, you also need to know the rules for filling it out.

Sample of filling out a cash receipt order

These rules are quite simple, but without them successful reporting is impossible.

- The first line is intended to indicate both the name of the organization conducting the RKO and the legal form of its activities.

- If the company has an OKPO code, then it fits into the appropriate column. It must completely coincide with data from Rosstat. If it is missing, then you can put a dash, as in other cases when the line is not filled in.

- When filling out papers not by the parent company, but by its structural division, the name of the latter is entered in the column intended for this.

- In the field intended for the document number, the cash settlement number is entered based on continuous numbering from the beginning of the calendar year.

- The date entered in the required line must coincide with the day when the money was actually issued from the cash register.

- In the line allocated for this, structural divisions enter their code. Otherwise, a dash is placed, as noted above.

- The account number on the debit of which money is issued must be indicated in the column “Corresponding account, subaccount”. To fill out, you need to check the accounting chart of accounts:

- If a deposit is made to a bank account – 51;

- If money is needed for settlements with contractors or suppliers - 60;

- If they are needed to pay salaries - 70;

- For settlements with all kinds of accountable persons – 71;

- With employees, but not in terms of wages – 73;

- Payments of income to founders – 75-2.

- If the company does not have an analytical code, then a dash must be placed in the corresponding column.

- The credit account number for which cash withdrawal from the cash register is displayed is indicated in the “Credit” line.

- The amount should be indicated in numbers on one line and in letters on the next line below. Kopecks are also indicated in numbers in the latter version.

- If a target coding system is used, then it is necessary to fill in the line that is intended for this.

- The column provided for this purpose indicates the name of the person or the name of the organization to whom cash is issued from the cash register.

- The next line indicates the reason and purpose for which the payment was made.

- If documents are attached to the RKO, then their details are entered in the “Appendix” line.

- In the appropriate lines, fill in the information for the head of the legal entity and its chief accountant. They also put their signatures.

- The recipient's information is also indicated. He fills out the columns himself, entering the amount given out in letters (if there are kopecks, then they are in numbers). At the end he puts his own signature.

- The cashier writes out the data from the document, which is evidence of the recipient’s identity. Usually this is a passport.

- The cashier fills out the line with personal information and his signature only after he hands over the money to the recipient.

Correcting any errors after filling out is strictly prohibited. The head of a legal entity is not required to sign directly on the document if he signed the papers from the attachment.

The completed order does not need to be given to the cash recipient - it remains in the cash register.

An example of how to fill out a cash receipt order

Today, any current sample of filling out the RKO, including for 2015, can be freely downloaded on the Internet.

An example of filling out a cash receipt order

Or look in this article.

- For settlements with contractors or suppliers;

- Issuing cash from the cash register for financial assistance to an employee;

- For transfer to a bank account.

Each form clearly shows the simplicity and complexity of correctly observing cash discipline and filling out cash registers.