Before the release of “1C:ERP Enterprise Management” version 2.4.2 (hereinafter referred to as 1C:ERP), in which 1C company automated the procedure that allows reflecting losses of previous years, users were asked to use articles in the directory of deferred costs to account for them and reflect them in the operational outline . But even with the advent of version 2.2, where it became possible to independently indicate the amounts of management, accounting and tax accounting in the BPR distribution documents, the ability to indicate distribution items for the BPR with posting 99 accounts and the automatic calculation of offset amounts from the profit received remained unrealized.

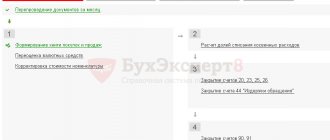

Fig.1 1C:ERP

Therefore, starting from version 1C:ERP Enterprise Management 2.0 to version 1C:ERP 2.4.2, to reflect losses in regulated accounting for organizations conducting regulatory accounting on the general taxation system, the document “Operations” (regulating) was used, in which users were prompted to manually fill in the distribution amounts for NU and BP.

Reflection of losses in 1C:ERP

The main innovation of update 2.4.2 is the ability to maintain records within tax accounting, as well as reflect losses when preparing an income tax return, without the need to carry out manual operations.

For these tasks, the following were introduced into the system: account 97.11 and a directory with the same name. At the same time, the added directory is the only subaccount available for the added account.

As a rule, filling out the directory of past losses is carried out automatically: when closing the calendar year and before the balance sheet is reformed, the system checks for the presence in the directory of an entry with a year that would correspond to the period being closed. If there is no date, a new element for the current year will be added automatically.

To account for time differences in financial losses, in accordance with the requirements of the accounting standard of the Russian Federation 18/02, an asset of the same name is added to the list of types of tax liabilities/assets (ONO/ONA).

Closing the month for enterprises on the OSN (general taxation system) in terms of calculation and accounting of losses is carried out as follows:

- According to account 99.01.1 (Losses and income from activities with special tax purposes), the balance in tax accounting is calculated.

- If the balance presented in the paragraph above corresponds to financial losses, the amount of the latter is written off from this account, transferred to account 97.11 (Dt 97.11 - Kt 99.01.1), at the same time filling in the NU amount in the account assignment. Already on this account, in the account assignment of the analytical account of past losses, the element of the directory of the same name is filled in in accordance with the year being closed. If such an element does not exist, the system will create it automatically.

- If at the enterprise for which the year is closed, a flag appears in the accounting policy, accounting provision 18/02 is required, and the amount of the transferred loss is entered into the “Amount Kt BP” and “Amount Dt BP” with a negative value. The balance in the debit of account 09 “Deferred tax assets” at the time of closing the calendar year in the analytical account “Loss of the current period” is transferred to the debit of account 09 to the analytical account “Losses of previous years” (account assignment creation is required Dt 09 “Losses of previous years” - Kt 09 "Loss of the current period"). The existing balance on the above account 09 according to the analytical account “Loss of the current period” at the end of the last year and at the beginning of the current year is taken as an error that must be corrected, followed by repeating the registration procedure for closing it.

“1C: Accounting 8” (rev. 3.0): how to reflect the repayment of a loss in accounting (+ video)?

The video was made in the program “1C: Accounting 8” version 3.0.58.26.

The net profit (loss) indicator is formed on balance sheet account 99 “Profits and losses” and represents the final financial result of the organization’s activities for the reporting period (Instructions for the use of the Chart of Accounts for accounting the financial and economic activities of an organization, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). The debit balance of account 99 at the end of the year indicates the presence of a net loss.

At the end of the reporting year, account 99 is closed. With the final entry of December, which is part of the accounting procedure - balance sheet reformation, the debit balance (the amount of net loss) is written off to the debit of account 84.02 “Loss to be covered.”

Already next year, based on the decision of the competent body (meeting of company participants), a decision is made on the sources of covering the loss. The loss can be covered by accumulated retained earnings in circulation (in correspondence with subaccount 84.03 “Retained earnings in circulation”), reserve funds (in correspondence with account 82 “Reserve capital”), etc.

In “1C: Accounting 8”, the specified operations are reflected in the Operation document (section Operations - Operations entered manually). Generated wiring:

Debit 84.03 Credit 84.02 - write-off of losses from retained earnings;

Debit 82 Credit 84.02 - write-off of losses from reserve capital.

See also:

How to reflect the distribution of profits received (+ video)

buh.ru

Closing last year's losses in 1C 8.3

Closing of recorded losses from last year is carried out by performing the regulatory process of closing the month, if there is a profit for the current period. For these purposes, in the program updated to version 2.4.2, the list of month-closing procedures includes the “Write-off of losses from previous years” procedure, carried out automatically if there is a balance on the debit of account 97.11. When performing this step, the system calculates the amount of losses for previous years (up to ten years) and, if there is a profit for the current period, writes off the loss to the amount of previously recorded profit, as a result of which account assignments Dt 99.01.1 - Kt 97.11 of the amount according to NU are formed .

If a flag is set in the enterprise’s accounting policy indicating that the organization maintains accounting in accordance with accounting regulations 18/02, then the amount of financial losses written off from account 97.11 is expressed in the amount of time differences with a negative value.

The write-off is carried out before the calculation of the direct state tax, which comes from the profit of the enterprise. The result of the procedure is taken into account in the process of calculating income tax at the subsequent stage of closing the month.

Features of account 84

The peculiarities of conducting operations on account 84 consist of several points:

- Correspondence on account 99 is reflected in the general ledger in December of the current financial year. This is the last posting, all accounts are closed.

- Correspondence with other accounts is reflected on the date of the decision on the distribution of profits and methods of covering losses. This can happen in the new financial year, it all depends on the company’s statutory documents and its accounting policies.

- Transactions involving the authorized capital of the company are reflected after state registration of the relevant changes.

Transfer of last year's losses when updating 1C ERP settings to the latest version

All of the above applies to new systems that do not provide information on losses for previous years, which remain after the system is updated from previous versions. But what to do if the system has already accounted for account 97.21 and the losses were closed manually?

In this case, after updating the settings, the balance will need to be manually assigned to the beginning of the current year from account 97.21 to account 97.11, using the “Operation (reg.)” document. Since after updating the settings, the directory of last year’s losses will be empty, you will need to manually prepare elements for those years for which there are unclosed losses, and when transferring from the account, fill out analytical account 97 yourself and correctly.

It is important not to forget the fact that the write-off of last year's losses (up to ten years) is not carried out automatically. In this case, a notification will appear about the presence of such amounts when closing regulated accounting for the last month of the year.

In order to write off last year's losses for a period of ten years or more from the current moment, you will need to use the document “Operation (reg.)”, starting from the decision made and filling out the following entries:

- Dt 91.02 PR – Kt 97.11 NU for a loss that is subject to write-off;

- Dt 91.02 VR – Kt 97.11 VR for a loss with a negative value that is subject to write-off.

Entering initial balances of losses from previous years

If by the time you start using the 1C program the enterprise already has losses from previous periods, they must be reflected in the system. This is required.

First, record the balance of the deferred tax asset with data entered on the last day of the previous year. To create the document “Entering initial data for account 09” you need to go through the menu “Main” - “Initial balances” - “Balance entry assistant”.

Balances are reflected in account 97.21

At the same time, it is important that this balance is entered into 1C not with other balances, but as an independent document. Overall this transfer is complete. Moreover, in situations where the transfer is carried out for a long period, for example, several years, a similar operation will need to be performed at the end of each calendar year.

Financial results

To determine the financial result of an organization’s activities, it is necessary to close the reporting period.

In accounting, a month is recognized as a reporting period (clause 48 of PBU 4/99). The overall financial result (profit or loss) for the month consists of the results:

– for ordinary activities (formed on account 90 “Sales”);

– for other transactions (formed on account 91 “Other income and expenses”).

The financial result for the current reporting period is summed up with the total financial result for previous reporting periods.

Determine profit (loss) from ordinary activities as the difference between:

– revenue from sales of products (goods, works, services) (excluding VAT and excise taxes);

– costs associated with production and sales.

This follows from the provisions of paragraph 5 of PBU 9/99 and paragraph 5 of PBU 10/99.

Determine the result of other operations as the difference between:

– other income;

– other expenses.

The list of other income is established in paragraph 7 of PBU 9/99, and other expenses - in paragraph 11 of PBU 10/99.

Closing procedure

The procedure for closing the reporting period includes:

- write-off of the total amount of expenses associated with its production and sale to sold products (by the time the reporting period closes, this amount must be generated);

- comparison of final data on debit and credit turnovers on subaccounts opened to account 90 “Sales” and account 91 “Other income and expenses”;

- writing off the positive difference between these data to the credit of account 99 “Profits and losses” (if a profit is made);

- writing off the negative difference between these data to the debit of account 99 “Profits and losses” (if a loss is received).

Synthetic account 90 “Sales” is designed to record income and expenses for ordinary activities (clause 5 of PBU 9/99, clause 5 of PBU 10/99). However, no transactions are reflected directly on this account. All indicators necessary to determine the financial result are formed in sub-accounts opened for it. Therefore, at the reporting date of any reporting period, synthetic account 90 cannot have either a debit or a credit balance.

Sub-accounts are opened for account 90:

- 90-1 “Revenue”. As shipment proceeds, the credit of this subaccount reflects the proceeds from the sale of products (goods, works, services), taking into account VAT and excise taxes;

- 90-2 “Cost of sales”. All expenses associated with production and sales are written off to the debit of this subaccount;

- 90-3 “Value added tax”. The debit of this subaccount reflects the amounts of VAT included in the price of products sold (goods, works, services);

- 90-4 "Excise taxes". The debit of this subaccount reflects the amounts of excise taxes included in the price of products sold (goods, works, services);

- 90-9 “Profit/loss from sales”. This subaccount reflects the financial result for ordinary activities. If the total credit turnover of subaccount 90-1 is greater than the sum of the debit turnovers of subaccounts 90-2, 90-3 and 90-4, then the difference between them forms profit. If the total credit turnover of subaccount 90-1 is less than the sum of the debit turnovers of subaccounts 90-2, 90-3 and 90-4, then the difference between them forms a loss.

When closing the reporting period, the difference between the total debit turnover on subaccounts 90-2, 90-3 and 90-4 and the credit turnover on subaccount 90-1 (profit or loss) is reflected in account 99 “Profit and loss” subaccount “Profit (loss) before tax” in correspondence with subaccount 90-9.

Debit 90-9 Credit 99 subaccount “Profit (loss) before tax”

– profit from ordinary activities for the reporting period is reflected;

Debit 99 subaccount “Profit (loss) before tax” Credit 90-9

– loss on ordinary activities for the reporting period is reflected.

Entries for subaccounts 90-1, 90-2, 90-3, 90-4, 90-9 are made on an accrual basis from the beginning of the year. These sub-accounts are not closed during the year. Their closure occurs when the balance sheet is reformed.

An example of reflecting in accounting financial results from ordinary activities for the reporting period (month)

Alpha LLC is engaged in wholesale trade and applies a general taxation system. In January, the organization sold goods worth 1,180,000 rubles, including VAT - 180,000 rubles. The cost of goods sold was 600,000 rubles. The amount of depreciation of fixed assets, warehouse, transportation and management costs is equal to 300,000 rubles.

As of January 31, Alpha’s accounting records reflected the following data:

– on the loan of subaccount 90-1 – proceeds from sales in the amount of 1,180,000 rubles; – on the debit of subaccount 90-2 – cost of goods sold in the amount of 600,000 rubles; – on the debit of subaccount 90-3 – VAT on sales proceeds in the amount of 180,000 rubles; – on the debit of account 44 – sales expenses in the amount of 300,000 rubles.

On January 31, Alpha's accountant closes the reporting period. He makes the postings:

Debit 90-2 Credit 44 – 300,000 rub. – sales expenses for January were written off;

Debit 90-9 Credit 99 subaccount “Profit (loss) before tax” – 100,000 rubles. (RUB 1,180,000 – (RUB 600,000 + RUB 300,000 + RUB 180,000)) – profit from sales for January is reflected.

Synthetic account 91 “Other income and expenses” is intended for accounting for income and expenses on other operations (clauses 7, 9 PBU 9/99, clauses 11, 13 PBU 10/99). However, no transactions are reflected directly on this account. All indicators necessary to determine the financial result are formed in sub-accounts opened for it. Therefore, at the reporting date of any reporting period, synthetic account 91 cannot have either a debit or a credit balance.

Sub-accounts are opened for account 91:

- 91-1 “Other income”. As the credit of this subaccount is received, income from other transactions is reflected;

- 91-2 “Other expenses”. All expenses for other transactions are written off to the debit of this subaccount;

- 91-9 “Balance of other income and expenses.” This subaccount reflects the financial result of other transactions. If the total credit turnover of subaccount 91-1 is greater than the debit turnover of subaccount 91-2, then the difference between them forms profit. If the total credit turnover of subaccount 91-1 is less than the debit turnover of subaccount 91-2, then the difference between them forms a loss.

When closing the reporting period, the difference between the credit turnover in subaccount 91-1 and the debit turnover in subaccount 91-2 is reflected in account 99 “Profits and losses” subaccount “Profit (loss) before tax” in correspondence with subaccount 91-9:

Debit 91-9 Credit 99 subaccount “Profit (loss) before tax”

– profit on other operations for the reporting period is reflected;

Debit 99 subaccount “Profit (loss) before tax” Credit 91-9

– loss on other transactions for the reporting period is reflected.

Entries for subaccounts 91-1, 91-2, 91-9 are made on an accrual basis from the beginning of the year. These sub-accounts are not closed during the year. Their closure occurs when the balance sheet is reformed.

An example of determining the balance of other income and expenses for the reporting period (month) and reflecting it in accounting

In January, Alpha LLC rented out property and paid interest on the loan. Renting out property is not the main activity of the organization. The accrued amount of rent is RUB 59,000. (including VAT – 9000 rubles). The amount of interest on the loan is RUB 30,000.

As of January 31, Alpha’s accounting records reflected the following data:

– on the loan of subaccount 91-1 – rent in the amount of 59,000 rubles; – in the debit of subaccount 91-2 – VAT on rent in the amount of 9,000 rubles; – on the debit of subaccount 91-2 – interest for using the loan in the amount of 30,000 rubles.

On January 31, Alpha's accountant closes the reporting period. He does the wiring:

Debit 91-9 Credit 99 subaccount “Profit (loss) before tax” – 20,000 rubles. (59,000 rubles – (9,000 rubles + 30,000 rubles)) – profit on other transactions for January is reflected.