In certain cases, severance pay is subject to insurance contributions - this rule is established in the Tax Code. Let's figure out when you need to pay insurance premiums and when you don't.

Is severance pay subject to insurance contributions? If so, in what cases and under what circumstances? When terminating an employment agreement, these pressing questions arise not only for the chief accountant, but also for the manager.

Before answering the question, let us recall that since last year, insurance transfers have been collected by the Federal Tax Service, and it is the Federal Tax Service that monitors the correctness and timeliness of contributions. A new chapter 34 has been introduced into the Tax Code of the Russian Federation, called “Insurance premiums”. Thus, now legal norms regarding the procedure for calculating and paying insurance premiums must be sought specifically in the Tax Code of the Russian Federation.

Now let's return to the question of whether severance pay is subject to insurance premiums. More on this below.

The main mistakes when calculating severance pay to an employee laid off from work

The process of laying off employees entails large costs for the employer, so most organizations that dismiss their subordinates from service due to a reduction in the number of staff try by hook or by crook to avoid unnecessary expenses. Most often, they insist that the employee write a letter of resignation of his own free will or offer a transfer to another position. However, this cannot be done. The current legislation clearly defines the sequence of the staff reduction procedure, as well as information regarding all payments and their taxation. Therefore, every employer is obliged to adhere to the correct dismissal “scheme” in order to avoid problems with the law.

Results

Personal income tax from severance pay is withheld only in cases where the amount of payments exceeds the established non-taxable barrier or they are not provided for by decisions of legislative bodies and labor (collective agreements). The taxpayer should include amounts exceeding this limit in the calculation of 6-NDFL.

Sources:

- Labor Code of the Russian Federation

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How is severance pay calculated upon dismissal due to staff reduction?

Judging by the Labor Code of the Russian Federation, upon termination of an employment relationship due to the liquidation of an enterprise or a reduction in the number of staff, the employer is obliged to pay a severance pay to the dismissed employee, the amount of which is formed from the amount of average earnings for 1 calendar month. In addition, the employee is entitled to an average monthly salary and compensation payments for vacation days not taken off.

It is also worth noting that if, during employment at this enterprise, a clause was specified in the contract containing information about the amount of compensation in the event of dismissal at the initiative of the employer, then in such a situation the law allows for increased payments to the employee. However, its size cannot be increased more than 6 times.

Category: “Questions and answers”

- What are the deadlines for submitting documents to the Social Insurance Fund for reimbursement of sick leave benefits?

Answer: The employer has the right to apply to the Social Insurance Fund for reimbursement of sick leave benefits at any time - these deadlines are not established by law.

- The Social Insurance Fund refused to make payments on sick leave. We covered these expenses and made all payments to the employee. Are the payments we made subject to insurance premiums?

Answer: A payment not accepted by the FSS is considered as a payment by the organization in favor of an individual, and, accordingly, is subject to all insurance premiums.

- Our organization makes additional payments for sick leave up to average earnings. Are these co-payments subject to insurance premiums?

Answer: Your additional payments, if they were provided for in the employment contract with the employee, can be classified as an income tax expense, but they are subject to all insurance contributions.

- I work as a choreographer in a dance studio and lead paid groups. The employer deducts social contributions from my salary. Is this true?

Answer: No, this is incorrect - social contributions are paid by the employer. Only personal income tax is deducted from you.

When is severance pay due?

Upon receipt of written notice of dismissal due to staff reduction, the employee is not required to write a letter of resignation of his own free will, because then he will not be able to receive severance pay. To reduce the number of employees, the company must have a reason for this. As a rule, the reason for reducing staff is most often the closure of one of the company’s branches, liquidation of production, financial problems, etc.

Immediately after making a decision to reduce staff, the manager issues an order, which must be correctly executed and registered. The document specifies a list of positions subject to reduction and the dates of their planned dismissal. Then a commission is assembled that checks the correctness of the reduction process and the timing of the execution of the order. All workers subject to dismissal with subsequent receipt of severance pay must be familiarized with the order.

According to Articles 178, 180 and 140 of the Labor Code of the Russian Federation, the employer is obliged to transfer severance pay and all other payments upon dismissal due to reduction on the employee’s last working day.

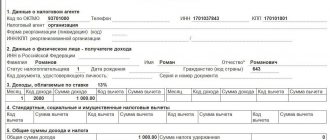

In case of termination of the employment relationship, regardless of the reason, the calculation of benefits is carried out on the form T61. It takes into account the hours actually worked and calculates the salary and other payments due to the resigning employee.

Is income tax withheld?

Is severance pay subject to personal income tax upon dismissal? Personal income tax is an amount calculated from any cash income of citizens (residents and non-residents of the Russian Federation). Including the severance pay of the resigning employee.

However, not in all cases income tax is charged on benefits, namely:

- Liquidation of company;

- conscription of an employee for military service;

- staff reduction;

- change of the employment contract by the manager, which did not suit the employee;

- violation of employee rights, officially proven.

According to the explanations of the Russian Ministry of Finance, personal income tax is not withheld from these payments, regardless of the grounds for dismissal. In addition, an indication of the absence of income tax withholding is contained in Art. 178 Labor Code of the Russian Federation. But the employer has the right to prescribe additional conditions regarding the calculation of personal income tax in the employment contract.

Income tax is deducted from severance pay in the following cases:

- the amount of compensation exceeds three months' earnings of the employee;

- dismissal by agreement of the parties;

- termination of an employment contract with an employee at his own request;

- excess or equal to the amount of the average earnings of the former employee.

Thus, in relation to severance pay, withholding personal income tax from it is relevant only if the amount of the payment exceeds three times the employee’s average earnings. The basis for the calculation is the part of the amount that exceeds the wage.

How is severance pay calculated for employees during layoffs?

The issuance of severance pay upon dismissal is a mandatory detail during the personnel reduction procedure. Its size in 2018 can be calculated using the following formula:

VP = RD*NW, in which

VP is the amount of severance pay;

RD - the number of working days in the month following dismissal;

SZ – average daily earnings.

Average daily earnings are calculated using the formula:

SZ = GD/730, in which GD is the income for the last 2 years worked at the enterprise.

Let's look at an example:

Ivanov M.I worked for the company for 2 years, after which he was laid off due to a reduction in the number of staff. His earnings during this time amounted to 153,750 rubles, minus sick leave, travel allowance and other payments not related to payroll. Based on this, we calculate the average earnings using the formula: 153,750 rubles / 730 = 210.62 rubles.

To determine the amount of severance pay, we turn to the formula indicated above: 20 * 210.62 rubles = 4212.40 rubles.

Thus, the amount of benefits for dismissal due to reduction due to M.I. Ivanov is 4212.40 rubles.

What does the payment mean and how much is the amount?

Severance pay is awarded in case of layoffs, regardless of most reasons. Article 178 of the Labor Code of the Russian Federation establishes the grounds for issuing funds and the specific amounts of compensation in a given case. The legislation specifies only a number of cases where such payments are higher. Such conditions are written down in the contract or collective labor agreements without fail.

The amount of benefits for some categories of specialists has some restrictions. An example is senior managers. Three times the average monthly salary will be the maximum compensation provided for such situations.

Dismissal by agreement of the parties is a popular situation that also deserves separate consideration. At the same time, the payment is considered both remuneration for the agreement to terminate the agreements and compensation. Such accruals are prohibited only for managers and their deputies and chief accountants.

Attention! The only reason when a refusal to pay benefits is fair is if it was the employer who initiated the dismissal. The Supreme Court of Russia issued an explanation that confirms this.

When determining sizes, managers need to take into account some nuances:

- During the first two months after termination of the contract, citizens must receive the average salary.

- For the third month, employees receive compensation if problems arise with employment, even if the person is registered with the employment service.

The amount of payment often also has a direct connection with the reason for which the dismissal occurred. The amount of remuneration for labor also matters. Managers have the right to draw up employment contracts that stipulate in advance not only the financial assistance itself, but also the situations in which it is paid. It is allowed to increase the amount of severance pay.

It is also useful to read: Do I need to pay insurance premiums from vacation pay?

What insurance premiums are deducted from the severance pay upon dismissal due to reduction?

Severance pay paid to an employee upon dismissal from work is not subject to insurance contributions, but only if its limit does not exceed the amount established by law. As a rule, its amount is determined based on the average monthly salary for the last 2 years of work.

Insurance contributions are accrued on severance pay assigned upon dismissal due to reduction in the following cases:

- the amount of payments accrued to a laid-off employee for the period of searching for a new job exceeds the average monthly salary by 3 times. In this situation, the amount of deductible contributions will be calculated from the excess amount;

- the amount of payments given to an employee dismissed due to layoffs from an enterprise located in the Far North exceeds the average monthly salary by more than 6 times. In this case, insurance premiums will be deducted from the excess portion of the benefit.

3 mistakes in taxing sick leave with insurance premiums

Error No. 1. Insurance premiums are calculated for the first 3 days of sick leave

At ABV LLC, driver Ivanov I.I. The accountant calculated payments for sick leave and issued payments to the Social Insurance Fund, Pension Fund, and Compulsory Medical Insurance:

- the average daily earnings was 628.54 rubles.

- sick leave: 628.54 * 3 = 1885.62

- Personal income tax 1885.62 * 13% = 245.13

- FSS 1885.62 * 2.9% = 54.67

- Compulsory medical insurance 1885.62 * 5.1% = 96.17

- PF 1885.62 * 22% = 414.83

In total, insurance payments accrued amounted to 565.67 rubles.

In accordance with Federal Law No. 125-FZ, sick leave is not subject to insurance contributions either in the part paid by the employer or in the part paid from the funds of the Social Insurance Fund and insurance organizations.

Error No. 2. Insurance premiums were charged for sick leave issued in connection with rehabilitation after an industrial injury.

At ABV LLC, turner P.P. Petrov received an industrial injury, and therefore underwent long-term rehabilitation at the Osinka sanatorium. The accountant calculated payments for sick leave and issued payments to the Pension Fund.

The law exempts the employer from insurance premiums in the event of a work-related injury or illness. Moreover, payment for treatment refers to compensation payments and is also not subject to payment of insurance premiums.

Error No. 3. The sick leave certificate is filled out with a blue ballpoint pen, and therefore the Social Insurance Fund refuses to reimburse insurance payments for the certificate of incapacity for work.

According to Order No. 624-n.56, when filling out a certificate of temporary incapacity for work, a number of requirements must be observed:

- recording language: Russian;

- font: block capital letters;

- ink color: black ink (use capillary or gel pen), or using printing devices;

- entries on the certificate of incapacity for work should not go beyond the boundaries of the cells provided for making the corresponding entries.

Is personal income tax withheld from severance pay assigned upon dismissal due to reduction?

Income tax on wages and compensation for unused vacation, which are paid upon dismissal, is withheld at 13%. The reason for the employee leaving work does not play any role here.

Severance pay assigned to an employee resigning due to staff reduction, according to Article 217 of the Tax Code of the Russian Federation, is not subject to taxes. However, as mentioned earlier, its size should not exceed the average monthly earnings by more than 6 times in the regions of the Far North, and more than 3 times in other constituent entities of the Russian Federation.

From the obviously inflated amount of payments, a tax deduction will be withheld to the budget according to all the rules. Based on Article 226 of the Tax Code of the Russian Federation, the transfer of personal income tax in this case is carried out no later than the next working day after the total payment amount is transferred to the employee.

Is it subject to taxation?

If the employee quit by agreement of the parties, then insurance premiums are not applied to the part that does not exceed three times the average monthly salary. The amount is increased to six times the average monthly earnings when it comes to the Far North and other territories of equal importance. The opinion from the Supreme Court presented similar conclusions.

Reference! Contributions for “injuries” are not subject to severance pay under the same conditions as already described above.

When does an employer pay compensation to an employee?

Most often, the second amount includes the first, however, if severance pay is due to all persons who were laid off, then only those employees who could not immediately find a new job will receive payment for the period of employment.

As a general rule, the period of such payments is two months, but if an employee, after dismissal, registered with the employment service, no later than two weeks from the date on which his employment relationship with his previous employer was terminated, but was unable to find a new place of employment, then the organization will have to compensate him for payment upon layoff. In this case, the organization pays monetary compensation in proportion to the remaining time until the date of dismissal. Its amount is also calculated based on the average earnings of each employee. Let us consider the features of the calculation in more detail. All redundancy payments are calculated based on the average earnings of each employee.

https://www.youtube.com/watch?v=Z93fRGCIFpI

The employer decided to optimize its business and cut several staff positions to reduce operating costs. The workers were notified about this in advance, they were offered other jobs, and in general, all the requirements of labor legislation were met. When it came to dismissal, the question arose:

- severance pay

- payments in the amount of average earnings (until the employee finds a new job)

- vacation pay, or rather compensation for unused vacation (if at the time of dismissal there were unspent vacation days left)

- salary

The exact amount of the benefit depends on the average salary of the citizen at the previous place of work. Depending on the period, it is: The first 3 months - 75% of the average earnings for the last three months before the reduction, but not more than the maximum limit; The next 4 months - 60% of the average salary; The next 5 months - 45% of the average salary.

Everything flows, everything changes. Some workers leave companies, others come to take their place. Therefore, settlements with resigning employees are quite routine operations for accounting. But in order to avoid later claims from regulatory authorities, the financial services of the organization must take into account some features of the taxation of such payments. We will tell you about them today.

Students who successfully complete the program are issued certificates of the established form. Students who successfully complete the program are issued certificates of the established form. A reduction in the number or staff of an organization’s employees is one of the grounds for termination of an employment contract at the initiative of the employer, clause

- VP - severance pay.

- ГЗ – salary for the last year. All accrued amounts are taken into account, with the exception of financial assistance and social payments.

- KD - the number of days actually worked over the last year. Sick leave and vacation are not taken into account.

- NWD – the number of working days in a conditional month after dismissal. For example: if the last shift falls on May 13, then the calculation will be made from May 14 to June 15.

Citizens of retirement age are dismissed according to the standard procedure. There are no benefits for them. When calculating the amount of benefits, the average salary is taken into account. Pensioners included in the list do not receive the third payment.

Is severance pay subject to insurance contributions? If so, in what cases and under what circumstances? When terminating an employment agreement, these pressing questions arise not only for the chief accountant, but also for the manager. Before answering the question, let us recall that since last year, insurance transfers have been collected by the Federal Tax Service, and it is the Federal Tax Service that monitors the correctness and timeliness of contributions. Thus, now legal norms regarding the procedure for calculating and paying insurance premiums must be sought specifically in the Tax Code of the Russian Federation.

The Labor Code of the Russian Federation determines that when an employee is dismissed, three types of payments are provided:

- average earnings;

- severance pay;

- additional compensation.

In accounting parlance, most often all these types of compensation are simply called severance pay.

To find out whether personal income tax needs to be withheld from these payments, read the article “Is severance pay subject to personal income tax upon dismissal”

The circumstances preceding payments can be very different: the organization has gone bankrupt or is being liquidated by decision of the founders, it is reducing its staff, and finally, the employee resigns of his own free will due to the impossibility of continuing work. Similar circumstances are given in Art. 178, 180 and 181 of the Labor Code of the Russian Federation.

In addition, a collective or labor agreement, in accordance with Part 4 of Art. 178, part 2 art. 307 of the Labor Code of the Russian Federation, may contain other motives for paying severance pay, as well as establish higher amounts. However, in order to limit the initiative of employers, Art. 181.1 of the Labor Code of the Russian Federation introduces exceptions that must be taken into account.

The employer’s responsibility on the day of dismissal is to make a final settlement with the employee and pay him all amounts provided for in Art. 84.1, Art. 140 of the Labor Code of the Russian Federation, namely:

Salary for days actually worked in the last month of work.- Compensation for days of unused vacation (if any). It is worth noting that upon dismissal due to staff reduction, if the employee has already used his vacation in full before the end of the working year, compensation for vacation is not withheld, as stated in Art. 137 Labor Code of the Russian Federation.

- Severance pay in the amount of one average monthly salary. If the collective agreement of the organization or the employment contract indicates a larger amount of this benefit, then the enterprise is obliged to reimburse all payments in the specified amount.

- Additional compensation for early termination of an employment contract. This payment is calculated from the amount of the employee’s average earnings, calculated based on the days that remained unworked before the employer’s notice of layoff.

Such compensation is paid if the employer, with the consent of the employee, terminates the relationship earlier than the period specified in Part 3Art. 180 Labor Code of the Russian Federation

.

Severance pay, as specified in Art. 178 of the Labor Code of the Russian Federation, is assigned to the person being laid off in the amount of 1 average monthly salary:

- Upon dismissal.

- If during the month following the layoff the former employee was not officially employed, then he is entitled to the average earnings for the current month.

- If during the next third month the employee has not found a job, then the entrepreneur also undertakes to pay him another average salary, but for this, the dismissed person must be registered with the employment center no later than two weeks after the calculation, because in order to receive the payment he will need present a document from this authority.

We invite you to familiarize yourself with: The amount exceeding the maximum amount of insurance premiums

Since benefits for the next 2 months are paid only if the person was not officially employed, such payments are not made on the day of calculation, but are paid at the enterprise where the employee previously worked, on the days when wages are paid in this structure.

If the organization is liquidated, then the body by whose decision this structure was liquidated is obliged to ensure the payment of average earnings, or must designate a successor who will be obliged to pay the amount of severance pay in full.

Funeral benefit in the RSV

This payment can be transferred by the employer to the relatives of the deceased employee. The normative basis is stat. 10 of Law No. 8-FZ of January 12, 1996. Money is transferred if a person takes over the funeral. The payment amount from 02/01/2020 is 6124.86 rubles. Additionally, when calculating the amount, a territorial coefficient may be applied.

In the RSV, the 2021 funeral benefit is reflected on page 070 of Appendix 2. The explanation is given on page 090 of Appendix 3. If the employer decides, on its own initiative, to provide financial assistance to an employee in connection with the death of his family members, such a payment is considered non-taxable (subclause 3 p. 1 Article 422 of the Tax Code of the Russian Federation). In the RSV, this financial assistance is not included in the calculation base.

Read: Discrepancy between 6-NDFL and RSV – explanations

Temporary disability benefit in the RSV

A one-time allowance in the DAM, a benefit under the BiR, for early registration, and sick leave benefits for incapacity for work are non-contributory amounts. In general cases, these amounts are either paid directly from the Social Insurance Fund to the employee, or are transferred first by the employer with subsequent reimbursement by the fund. For the first 3 days of illness, funds are provided by the employer. If the reason for issuing the ballot was quarantine (code “03”), such period is entirely paid for by the Social Insurance Fund.

Payment for the first 3 days is reflected in subsections 1.1, 1.2 and Appendix 2 on the following lines:

- The total amount of payments is in page 030 subsection. 1.1, 1.2 and on page 020 of Appendix 2.

- Non-taxable amounts - see page 040 subsection. 1.1, 1.2 and page 030 of Appendix 2.

- Employer's expenses - see page 010 of Appendix 3.

- The total amount of payments to the employee is in section 140. 3.

Note! If the region takes part in the pilot project from the Social Insurance Fund “Direct Payments”, the employee’s benefits are paid directly from the fund, bypassing the employer. The exception is the first 3 days of illness. In this case, in Appendix 2 in the line “Payment attribute”, code 1 is entered, and the amount of benefits is not indicated in the report.

How to fill out the DAM in 2021 - general information

The current form of calculation for insurance premiums (DAM) was approved in the Order of the Federal Tax Service of Russia dated September 18, 2021 N ММВ-7-11/ [email protected] The procedure for filling out the document is also given here. The calculation of social insurance contributions is carried out in Appendix 2 to Section 1. When reflecting data, you must remember that part of the payments in favor of employees relates to taxable amounts, the other - to non-taxable amounts. Accrued income (according to Article 420 of the Tax Code of the Russian Federation) is indicated on page 020 of Appendix 2, of which non-taxable payments (according to Article 422 of the Tax Code of the Russian Federation) are specified on page 030.

The taxable base for contributions is given on page 050 of Appendix 2. Most employee benefits are non-taxable payments. This is, for example, benefits for labor and labor (pregnancy and childbirth), child benefits, temporary disability benefits, etc. When reflecting such amounts, you need to remember the main rule:

- Non-taxable payments are not included in the base for calculating social insurance contributions. But they must be recorded in the total amount of payments accrued in favor of individuals, as well as in non-taxable income - that is, on line 020 and line 030 of Appendix 2. If reflected correctly, the correct final result is obtained on line 050 = line 020 - page 030.