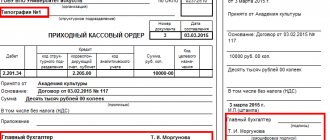

Payment

Accountants often have difficulty recording shared-equity construction transactions. Character raises questions

Classification of the enterprise's vehicle fleet and transportation costs Formation of a detailed plan of transportation costs by type of transportation

If dividends are received by an individual, then income from them is subject to personal income tax, and for an organization

Who is a tax resident and who is a non-resident? Statuses are determined by the Tax Code of the Russian Federation (chapter

Organizations using the 15% tax rate are required to keep strict records of their transactions, in particular

The Tax Service recommends that enterprises and individual entrepreneurs exercise independent control over the volume of tax revenues to the budget.

In the program “1C: Public Institution Accounting 8”, ed. 2.0 supports accounting for separate divisions, such as

Updated: January 2, 2021, at 09:33 pm When an employee leaves, not only the organization’s calculations take place

The procedure for paying fines The Federal Tax Service has the right to impose monetary sanctions on taxpayers for violations listed in

Features of maintaining a work book, as well as the procedure for making changes and edits to it are determined by: Instructions