Accountants often have difficulty recording shared-equity construction transactions. Questions are raised by the nature of the relationship between the developer and the shareholder from the point of view of civil law. For tax accounting purposes, it is considered that the developer receives targeted financing from shareholders, while for accounting purposes the funds received are not targeted because they are of a compensatory nature (the shareholder transfers the money, the developer transfers the apartment). The article “Equity Construction Accounting” will talk about all the intricacies of recording transactions.

Shared construction accounting – main points

Under the concept of “shared construction”

is understood as a form of investment activity in the field of construction, during which the developer (represented by an investment or construction company) plans the construction of real estate objects (equity-shared construction projects) and for these purposes engages in attracting funds from organizations and individuals (shareholders, participants in shared construction). The completed construction project, according to the share participation agreement, after its commissioning becomes the property of the shareholders.

Before delving into the instructions regarding accounting, you should pay attention to the text of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 11, 2011 No. 54. It contains some conclusions that will help to understand the validity of the requirements regarding the reflection of records of business transactions with the developer. The Resolution states that any agreement (including agreements for participation in shared construction) related to investments in the construction sector, in which it is planned to transfer to the investor a financed share in real estate, cannot be considered as a separate type of agreements. It is necessary to build on the concepts provided for by the Civil Code of the Russian Federation.

Thus, an agreement for participation in shared construction is close in essence to the contracts for the sale and purchase of a future property mentioned in the Civil Code of the Russian Federation. Based on this statement, we are considering

the agreement will be considered as a special purchase and sale agreement with an individual procedure for registering ownership rights - directly to the buyer, without the participation of the seller-developer.

How does an escrow account work?

Opening and servicing of escrow (or otherwise “conditional”) accounts is carried out in accordance with Art. 860.7 Civil Code of the Russian Federation. The presence of three parties is necessary: the seller (beneficiary), the buyer (depositor) and the escrow agent (bank), who acts as a guarantor of the reliability of the transaction. The beneficiary cannot use the money from the account until he fulfills the terms of the contract (Article 15.4 of the Law of December 30, 2004 No. 214-FZ).

Also, in accordance with Law No. 214-FZ, not any financial organization can become an escrow agent, but only one that meets the requirements of Decree of the Government of the Russian Federation dated June 18, 2018 No. 697.

Shared construction accounting

The legislative framework and practice of reflecting transactions related to shared construction in accounting accounts have not been fully developed at the moment. Accountants of organizations that are customers in shared construction often experience difficulties in reflecting the relevant business transactions in accounting.

So, as has already become clear, an agreement for shared participation in the construction of an object is a type of purchase and sale agreement. Then it can be argued that the transfer of commissioned objects to the shareholder is an operation for the sale of finished residential premises (construction products). But here the fact of transfer of ownership from the seller to the buyer is not revealed, which means that the sale transaction cannot be opened in the developer’s sales accounts (clause 12 of PBU 9/99).

Then the accountants decided to reflect transactions for the sale of finished products (houses, apartments, parking spaces, non-residential premises), since it can be assumed that special conditions may be provided for by Law No. 214-FZ.

Important!

Based on the results of the posting, the savings of the shareholders’ funds are not determined, because the cost of the contract (not taking into account the developer’s remuneration) is reflected in full as proceeds from the sale of the completed construction project.

| Operation | DEBIT | CREDIT |

| Reflection of funds of participants in shared construction (shareholders) | 51 | 76 |

| Accounting for construction costs | 20 | 60 |

| Reflection of VAT presented by contractors and suppliers | 19 | 60 |

| Formation of the cost of finished construction products (apartments, parking spaces, non-residential premises) | 43 | 20 (19) |

| Reflection of turnover on the sale of construction projects in the amount of the total amount of funds received from equity holders | 76 | 90 |

| Write-off of sold finished construction products | 90 | 43 |

Developer services for DDU wiring

Alexander DEMENTYEV, General Director of Audit-Escort LLC

The main thing in the article

- The first method is safe if you keep track of construction expenses on account 08

- The second method is reliable, but risky, if you take into account construction costs in account 20 and reflect the proceeds from the sale of objects

The developer transfers apartments and non-residential premises in an apartment building to individual shareholders. The developer's services are not specified in the contract.

The developer's procedure for shared construction

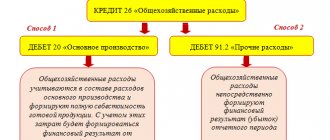

The financial result is defined as savings - the difference between the amount of funds received from shareholders and construction costs. In such a situation, the developer has two options for accounting transactions. Which one suits you, choose for yourself. But keep in mind that the first is safe, and the second is more reliable from an accounting point of view.

Method one is safe

The developer reflects the funds received from shareholders on the loan of account 76. These funds are used to cover the costs of building a house. In this case, the developer accounts for expenses in the debit of account 08.

Upon completion of construction, the developer closes account 08 to the debit of account 76 and determines the savings. It is reflected as revenue from the credit of account 90 in correspondence with the debit of account 76.

The developer does not reflect the sale of transferred shared construction projects, since he does not formalize ownership of the constructed objects before transferring them to shareholders.

This means that there is no formal transfer of ownership from the developer to participants in shared construction for these objects.

Accounting entries:

| DEBIT 51 CREDIT 76 – received funds from equity holders to cover the costs of constructing an apartment building; |

| DEBIT 51 CREDIT 62 – received funds from shareholders to pay remuneration to the developer for services; |

| DEBIT 08 CREDIT 10, 70, 60... - reflected the costs of building a house; |

| DEBIT 20 CREDIT 70, 60... - reflected expenses associated with the provision of services to shareholders; |

| DEBIT 62 CREDIT 90 – reflected revenue from the sale of services to shareholders; |

| DEBIT 90 CREDIT 20 – expenses related to the provision of services to shareholders were written off; |

| DEBIT 76 CREDIT 08 – reflected the transfer of shared construction objects (residential and non-residential premises) to shareholders; |

| DEBIT 76 CREDIT 90 – reflected the savings of equity holders. |

Method two is risky

In tax accounting, the developer takes into account funds received from shareholders as earmarked funds.

This approach is applied by the developer if he is guided by the conclusions of paragraph 11 of the resolution of the Plenum of the Supreme Arbitration Court of July 11, 2011.

No. 54 “On some issues of resolving disputes arising from contracts regarding real estate...” It is based on the assertion that the transfer of a shared construction project within the framework of a shared construction agreement is a type of purchase and sale transaction.

Thus, in accounting, the developer reflects the proceeds from the sale of transferred objects within the framework of shared-equity construction.

Accounting entries:

| DEBIT 51 CREDIT 76 – reflected the funds of shareholders received under share agreements; |

| DEBIT 20 CREDIT 60 – reflected the costs of construction of the facility; |

| DEBIT 19 CREDIT 60 – reflected VAT presented by suppliers and contractors; |

| DEBIT 43 CREDIT 20, 19 – formed the cost of finished construction products; |

| DEBIT 76 CREDIT 90 – reflected the proceeds from the sale of shared construction projects in the amount of the entire amount of funds received from shareholders to finance construction costs; |

| DEBIT 90 CREDIT 43 – sold finished construction products were written off. |

With this approach in accounting, the developer does not need to separately account for the sale of its services. But tax risks are possible. Let's look at why.

In tax accounting, the developer takes into account the funds received from shareholders as earmarked funds (Clause 14, Article 251 of the Tax Code of the Russian Federation).

The developer has the right to spend funds from shareholders only for those purposes provided for in paragraph 1 of Article 18 of the Federal Law of December 30, 2004.

No. 214-FZ “On participation in shared-equity construction of apartment buildings...” The company does not recognize received funds from targeted financing as revenue, and construction costs are not recognized as expenses when calculating income tax.

If, under the terms of the contract, the developer does not return the savings to shareholders, then he takes them into account in non-operating income or as part of revenue from the sale of services.

If, under the terms of the contract, the developer does not return the savings to shareholders, then he takes them into account in income

Shareholders' funds may not be enough to cover construction costs. If the developer covers the difference with his own funds, then he will not be able to take the overexpenditure into account for profit tax purposes. At the same time, the developer determines savings and overruns for the construction project as a whole.

If the developer uses the second approach to accounting within the framework of shared construction, the question of VAT arises. Is it necessary to charge this tax on proceeds from the sale of shared construction projects? It all depends on how to qualify these operations.

On the one hand, operations for the sale of non-residential premises and parking spaces are subject to VAT. On the other hand, the taxpayer has the right to interpret all ambiguities in his favor (Clause 7, Article 3 of the Tax Code of the Russian Federation).

Sales of goods (works, services) are subject to VAT taxation. But sales mean the transfer of ownership of goods, works, and services (Article 39 of the Tax Code of the Russian Federation).

In our case, there is no formal transfer of ownership. After all, the developer does not formalize ownership until the property is transferred to the participant in shared construction.

This means that the object of taxation does not arise.

In addition, funds received from shareholders are earmarked and are not reflected as proceeds from sales.

However, tax authorities may think differently, since the developer will reflect the proceeds from sales in accounting. Therefore, disputes with tax authorities on this issue are likely.

Shared construction: accounting and taxation

After receiving permission to put the facility into operation, the developer transfers the shared construction projects to its participants.

From the moment the participant pays in full the funds under the agreement and the parties sign the transfer deed or other document on the transfer of the shared construction project, the obligations of the developer and the participant under the agreement are considered fulfilled (Article 12 of Law No. 214-FZ). The following entry is made in the records of the developer:

D-t 86, K-t 08-3 - capital costs were written off from the funding received.

The amounts of recorded VAT are also written off from the funding received, and the invoice is transferred to the organizations that own the constructed facilities.

The financial result from the implementation of an investment project is defined as the difference between the target financing received and the amount of capital costs associated with construction.

Accounting for the developer

The following entries are made in the developer's accounting:

D-t 86, K-t 91-1 - reflects the amount of savings (income) received;

D-t 91-3, K-t 68, subaccount “Calculations for VAT” - VAT is charged;

D-t 91-9 “Balance of other income and expenses”, K-t 99 “Profits and losses” - the amount of profit is reflected;

Dt 99, Kt 68, subaccount “Calculations for income tax” - the amount of income tax has been accrued to the budget.

The developer’s income also includes the amount of remuneration for services for the execution of the contract, which is included in the price of the contract in accordance with Part 1 of Art. 5 of Law No. 214-FZ.

Funds received from participants for remuneration are taken into account in advance in subaccount 2 “Settlements for advances received” of account 62 “Settlements with buyers and customers”.

VAT is calculated on the amounts of advances received.

The costs of maintaining the developer can be taken into account on account 20 “Main production” and listed as work in progress until the end of construction.

In tax accounting, these expenses can be written off in the reporting (tax) period to reduce income from the sale of services without distribution to the balances of work in progress (Article 318 of the Tax Code of the Russian Federation as amended by Federal Law No. 58-FZ of 06.06.2005).

VAT related to the costs of maintaining the developer is deductible in the generally established manner.

Source: https://buh-experts.ru/uslugi-zastrojshhika-po-ddu-provodki/

Tax accounting in shared construction

For the purposes of calculating income tax, money from shareholders collected in the developer’s accounts is considered targeted financing, and therefore does not form a tax base. As for VAT, the issue is controversial. In some cases, investor money is considered revenue and is taxed. However, pp. 22 clause 3 art. 149 of the Tax Code of the Russian Federation exempts from taxation transactions for the sale of residential premises and shares in them. But non-residential premises and parking spaces can also be built. Let us turn to the text of paragraphs. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, according to the provisions of which taxes are imposed on transactions involving the sale (transfer of ownership rights) of goods, works and services. But in the case of a developer, there is no transfer of property, which means no tax has to be paid.

Shared construction accounting – construction is carried out independently

It happens that the developer collects funds from shareholders in order to later independently engage in the construction of the facility, not by contract. In this case, accounting is also carried out: expenses are accumulated in the DEBIT of account 20 in correspondence with the CREDIT of accounts 10, 70, 60, etc., after which the price of finished construction products is formed in the DEBIT of account 43. Turnovers on the sale of objects are reflected as usual . The money that will be paid to him as remuneration should be accounted for as advances on the CREDIT of account 62. Costs related to the provision of services are reflected on the DEBIT of account 20.

According to the provisions of Letter of the Ministry of Finance of the Russian Federation dated July 12, 2005 No. 03-04-01/82, if the developer carries out construction and installation work on his own, the investments of shareholders must be included in the tax base as advance payments for future construction work on the basis of paragraphs. 1 clause 1 art. 162 of the Tax Code of the Russian Federation. However, in 2011, the clarifications of IFRIC 15 came into force, paragraphs 10-12 of which provide:

- entry into the scope of application of IFRS 11 “Construction Contracts” of contracts for the construction of real estate in the event that shareholders have the right to significantly influence the design of the future construction project;

- classification of a shared construction agreement as an agreement for the sale of goods within the framework of the application of IAS 18 “Revenue”, if shareholders cannot choose the design or make adjustments to the main elements of the structure during construction.

And international standards can be used in conjunction with accounting regulations approved by the Ministry of Finance, if the regulations do not establish methods of accounting for a specific issue. And if we apply the clarifications in the field of construction contracts, the contract will be considered as a purchase and sale agreement in any case, and the sale of construction projects is not subject to VAT. Conclusion - funds of shareholders should not be subject to VAT.

Common mistakes

Error:

The developer reflected in the accounting the funds of the shareholders transferred to him under the shared construction agreement as revenue.

A comment:

Investor money is not revenue; funds are recognized as targeted financing.

Error:

The developer imposes VAT on the funds of shareholders under a shared construction agreement.

A comment:

Money transferred by shareholders is not subject to VAT, since shared construction projects are not taxed.

Answers to common questions about shared construction accounting

Question #1:

Can a developer carry out the construction of a shared construction project, thereby providing services to shareholders, if the contract does not provide for a division of the contract price into covering construction costs and remuneration for the developer?

Answer:

No, in this case there is no need to talk about the services provided by the developer.

Question #2:

Savings and cost overruns for the developer under a shared construction agreement are established for the construction project as a whole. Are savings calculated for tax purposes subject to VAT?

Answer:

This depends on the economic nature of the amount in question. If savings were created because funds to cover construction costs were not fully used, the savings are attributed to an increase in the developer's remuneration (revenue). If the contract price does not include a fee for the developer's services, the savings cannot be recognized as his revenue, and then it is not subject to VAT.

Accounting: attracting a technical customer

The developer may engage a technical customer to partially or fully perform its functions. The developer reflects the services of the technical customer as its expenses for providing services to the investor in organizing construction. To reflect these expenses, use account 26 “General business expenses”.

At the same time, make the following entries in accounting:

Debit 26 Credit 60 – costs under the contract with the technical customer related to the performance of the functions of the developer were written off;

Debit 19 Credit 60 – VAT presented by the technical customer is taken into account;

Debit 68 subaccount “Calculations for VAT” Credit 19 – accepted for deduction of VAT presented by the technical customer.