Classification of an enterprise's vehicle fleet and transportation costs

Formation of a detailed plan of transport costs by type of transportation and equipment based on optimal routes, travel time, duration of technological downtime, approved fuel consumption standards and labor costs

Adjustment of the developed plan for actual transportation and comparative analysis of the actual costs of operating vehicles and planned transportation costs adjusted to the fact

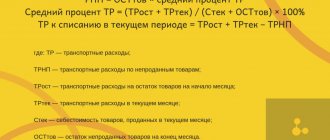

Formula for calculating TRP for the remaining goods

Most companies use the methodology prescribed in Article 320 of the Tax Code of the Russian Federation. This formula for calculating TZR should apply exclusively to transportation costs. The remaining costs associated with the sale are written off in full. In this way, the company will be able to bring accounting and tax accounting at the enterprise as close as possible.

For the distribution of TZR, it would be fair to use the following calculation option:

K = (TP0 + TR1) / (T1 + T2) * 100%, where:

- K is the average percentage of transportation costs for the remaining goods at the end of the month;

- TP0 are those transportation costs that fall on the balance of unsold products at the beginning of the period;

- TP1 – transport costs incurred in the month under review;

- Т1 – purchase price of products sold in this period;

- T2 – the cost of purchasing products that remained unsold.

After which, transportation costs for the remaining goods are calculated by multiplying the indicators T2 and K.

Example . calculates transportation costs for the remaining goods. In April 2021, products were sold with a total cost of 800,000 rubles. Goods worth 200,000 rubles remained unsold. The balance of TRP at the beginning of the month was 25,000 rubles, and the total amount of TRP for April was 45,000 rubles. How to calculate the TRP for the balance in this case?

Let's use the previously given formula:

P = (25,000 + 45,000) / (800,000 + 200,000) * 100% = 7%. Therefore, transportation costs for the remainder will be: 200,000 * 0.07 = 1,400 rubles.

Moreover, the remaining expenses from last month and the expenses incurred, minus those that fall on the balance, can be written off as cost. That is, you first need to calculate the TZR for write-off: 25,000 + 45,000 – 1,400 = 68,600 rubles.

Tax accounting of transport expenses

The procedure for reflecting transport costs in tax accounting depends directly on the terms of the agreement with the supplier. According to Article 320 of the Tax Code of the Russian Federation, the amount of costs for delivery (transportation costs) of purchased goods to the warehouse of the taxpayer - the buyer of the goods are considered direct transport costs if these costs are not included in the purchase price of the goods. In supplier accounting, the procedure for reflecting transportation costs depends on the terms of the concluded agreement (see Table 1 on p. 48).