Procedure for paying fines

The Federal Tax Service has the right to impose monetary sanctions on taxpayers for violations listed in the Tax Code of the Russian Federation. Such offenses include failure to meet reporting deadlines, failure to pay taxes on time, refusal to provide tax authorities with requested information, errors in registration procedures, etc. The amount of the fine is indicated in the decision or demand sent to the business entity.

Transfer of taxes, penalties and fines according to the decision of the Federal Tax Service is made in separate payments. It is unacceptable to combine these amounts in one order.

The law does not oblige companies to make all transfers on one day: the taxpayer has the right to split them into different dates. It is recommended to pay off the arrears first so that no penalties are charged on them. Next, the penalties themselves are transferred for the entire period of delay. The latter can be sent a fine, the main thing is to meet the deadlines specified in the demand.

Address of the individual payer

From January 1, 2021, a change is provided for individual payers who are not individual entrepreneurs. Order of the Ministry of Finance dated September 14, 2021 No. 199n updated the rules approved by Order of the Ministry of Finance dated November 12, 2013 No. 107n.

Previously, in order for inspectors to be able to determine who the payment came from, an individual had to indicate his TIN. Instead of the TIN, you could fill out field 108 “Number of the document that is the basis for the payment”, or enter the UIN in field 22 “Code” (in the absence of a UIN, it was possible to indicate the address of residence or stay).

Now, if you do not have a TIN and UIN, you can indicate the series and number of your passport or SNILS.

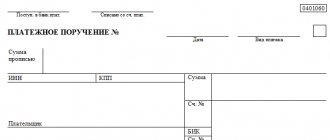

How to correctly fill out a payment order to transfer a fine?

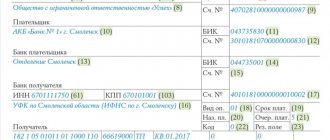

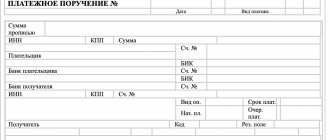

A step-by-step algorithm for how to submit a payment for a fine to the tax office involves specifying the following information in the fields of the order:

Recipient details

The fine is paid to the same branch of the Federal Tax Service as the tax itself. This means that the name of the recipient, his BIC, correspondent account and current account will remain “standard”. If the transfer is made for the first time, the details can be clarified at the tax office or on its official website.

Purpose of payment

The type of transfer and a link to the base document are indicated. For example, an accountant writes: “Fine for failure to submit a VAT return in accordance with requirement No. 1 of 01/01/2019.”

Fields 15 and 17

From January 1, 2021, when filling out the recipient’s details, you need to take into account changes in two fields. Innovations are associated with the transition to a new treasury service and treasury payment system.

- Field 17: the account number of the territorial body of the Federal Treasury (TOFK) is changed;

- Field 15: starting from January 2021, it is necessary to indicate the account number of the recipient's bank (the number of the bank account included in the single treasury account (STA)). In 2021 and earlier, this field was not filled in when paying taxes and contributions.

The table with new details is given in the letter of the Federal Tax Service dated October 8, 2020 No. KCh-4-8/ [email protected] Use this table.

For each region, the BIC and the name of the recipient bank are indicated (fields 14 and 13). For each recipient bank - the corresponding new and outdated (closed) TOFK account (field 17), as well as the account number of the recipient bank (field 15).

In January, February, March and April 2021, it is permissible to enter both a new and an outdated TOFK account in field 17 of the payment order. Starting from May 1st - only new ones.

Let's use the proposed table and select from it (as an example) the necessary data to fill out a payment receipt for the tax office that has an account related to the Federal Treasury Department for the Astrakhan Region.

Field 13 – Recipient's bank: ASTRAKHAN BRANCH OF THE BANK OF RUSSIA//UFK for the Astrakhan region, Astrakhan

Field 14 – BIC: 011203901

Field 15 – Account No. (number of the bank account included in the single treasury account): 40102810445370000017

Field 17 - number of the recipient's new account (treasury account number): 03100643000000012500, number of the previous (closed) TOFK account: 40101810400000010009.

Select the data you need to fill out these fields in payment orders.

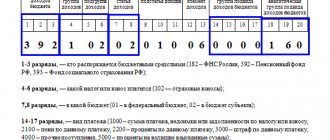

KBK

It is important to take into account that different BCCs have been established for repaying arrears, paying penalties and fines. The difference lies in symbols 14-17, which show the subtype of payment. For fines, their combination is set as “3000”, for the “body” of the tax - “1000”. You can find the required code on the websites of information and legal systems; it is indicated in the request received from the Federal Tax Service.

Basis of payment

In field 106 an abbreviation is entered, depending on the document for which the fine is paid. “AP” is indicated if the basis was a decision of the tax inspectorate based on the results of an audit, or “TR” if the organization received a request.

The abbreviation “ZD” should not be indicated when listing fines. It is used in cases where the taxpayer voluntarily repays the identified debt.

Document number and date

In field 108 of the payment order, enter the number of the claim for which the fine is transferred. Field 109 indicates the date of this document.

Code

In field 22, the UIN is written if it is indicated in the request received by the taxpayer. If this information is not in the document, “0” is entered.

OKTMO

The OKTMO corresponding to the tax office where the funds are sent is indicated. For example, if a company transfers money to the Federal Tax Service, where its separate division is registered, the code must be entered not at the registration address of the parent organization, but at the location of the branch.

The taxpayer’s responsibility is to remit the fine within the time limits specified in the request. If the funds are not received by the inspectorate in a timely manner, it will foreclose on the bank accounts of the business entity and its electronic wallets.

Next you can

Read also

15.08.2018

Where to find KBK for correctly filling out payment slips

Before filling out a payment slip for penalties or fines, check the KBK. In case of an error, the debt owed to the company will remain outstanding, and the amount of financial sanctions will increase. The current codes are contained in the order of the Ministry of Finance on the approval of the BCC for the current year. For 2021, this is order No. 99n dated 06/08/20.

If you receive a request from the Federal Tax Service, then sometimes it indicates only the main BCC for the tax, without any indication of a penalty or fine. The code itself consists of 20 digits, values 14 to 17 indicate the type of payment. The value “2100” indicates payment of a penalty, “3000” - a fine.

Thus, penalties for transport tax are paid from KBK 182 1 06 04011 02 2100 110, and the fine is paid from KBK 182 1 0600 110.

If you have any doubts about how to fill out a payment order for the fine KBK 39211607090060000140 for late submission of a report to the Pension Fund, then this code is contained in the section “Other fines, penalties, penalties paid in accordance with the law or agreement in case of non-fulfillment or improper fulfillment of obligations before the Pension Fund of the Russian Federation" of the KBK list. The basis for accrual is Art. 17 of Law No. 27-FZ of 04/01/1996 (as amended on 07/20/2020).

Payer status - individual

From October 1, 2021, innovations are also being introduced when filling out payment receipts for individuals who pay taxes, fees, insurance and other payments administered by the tax authorities. This field 101 is the payer status.

Until October 1, 2021, when filling out field 101 by individuals, the following values are allowed:

- “09” - individual entrepreneur;

- “10” – a notary engaged in private practice;

- “11” - lawyer who established a law office;

- “12” - head of a peasant (farm) enterprise;

- “13” is an “ordinary” individual.

Starting from October 2021, only the value “13” remains, the same for all individuals. This is also provided for by Order of the Ministry of Finance No. 199n.

Payment algorithm

The order of payment according to the writ of execution to bailiffs

Payment of the fine based on the decision of the Federal Tax Service in 2021 is as follows:

- A person receives a demand from the tax office.

- The offender draws up a payment order to a banking organization to transfer funds to the Federal Tax Service account.

From 2021, third parties can pay fines. To do this, the document must indicate the payer status, INN and KPP of the person for whom the payment is being made. Individuals can pay fines through an online account on the website of the Russian Tax Service.

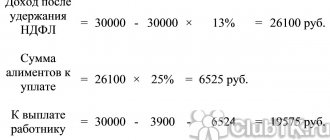

When to pay

Payment of the tax must be made no later than one working day following the day the income is issued (Clause 6, Article 226 of the Tax Code of the Russian Federation). An exception is made for vacation pay and sick leave: tax on them must be paid no later than the last day of the month in which the employee was given the appropriate funds.

Therefore, if on the same day you transfer personal income tax from the salary for the previous month and from vacation pay for the current month, then you need to fill out your payment order for both salary and vacation pay (letter of the Federal Tax Service dated July 12, 2016 No. ZN-4-1/ [ email protected] ).

KBK 18211603010016000140: what is the 200 ruble fine for and what is the tax in 2021

So, KBK 18211603010016000140 - transcript 2021 - what tax is the fine paid with it? Please indicate this code only when transferring penalties in 2021 for the following violations:

- For late submission of an application for tax registration or generally working without registration with the Federal Tax Service (Article 116 of the Tax Code of the Russian Federation).

- Failure to comply with the method of submitting a tax return (Article 119.1 of the Tax Code of the Russian Federation) is for which a fine of 200 rubles is imposed under KBK 18211603010016000140.

We will explain in what form you need to submit tax returns in the article “Procedure for submitting tax reports via the Internet.”

- When the managing partner submits financial statements of the partnership with unreliable data (Article 119.2 of the Tax Code of the Russian Federation).

- Gross violation of tax accounting rules is grounds for a fine under Art. 120 (clauses 1 and 2) of the Tax Code of the Russian Federation.

The article “How to maintain tax accounting registers (sample)” will tell you how to organize accounting of income and expenses for tax purposes without errors.

- Violation of the procedure for using pledged or seized property (Article 125 of the Tax Code of the Russian Federation).

- Failure to provide information necessary for tax control (Article 126 of the Tax Code of the Russian Federation). If, for example, you do not provide the primary information during a counter-inspection of the counterparty by the tax authorities, then you will face a fine of 200 rubles. for each document not presented (clause 1). And if the tax agent does not submit a personal income tax calculation on time (clause 1.2), then this is also a reason for a fine (that’s why the fine is 1000 rubles according to KBK 18211603010016000140).

For more information on how tax authorities should conduct a counter audit, read the article “Features of conducting a counter tax audit.”

- Submission by a tax agent of documents with false information (Article 126.1 of the Tax Code of the Russian Federation).

- Failure to appear at a tax violation case as a witness (Article 128 of the Tax Code of the Russian Federation).

- Refusal to assist in conducting a tax audit or issuing a knowingly false conclusion, being an expert in any field or a translator (Article 129 of the Tax Code of the Russian Federation).

- Silencing important information, provided that you have information that you should have reported to the tax authorities (Article 129.1 of the Tax Code of the Russian Federation).

- Failure to submit information about controlled transactions or submitting them with incorrect data (Article 129.4 of the Tax Code of the Russian Federation).

- Violations that banking organizations can commit: opening a current account for a businessman or company without the necessary documents, violation of deadlines for the execution of payment orders for the payment of taxes, illegal continuation of transactions on the taxpayer's current account, failure to fulfill the obligation to submit account statements to the tax authority, violation of the rules for working with electronic money (Articles 132, 133, 134, 135, 135.1, 135.2 of the Tax Code of the Russian Federation).

For each of these articles, the Tax Code of the Russian Federation provides for different amounts of fines for the taxpayer. The smallest fine is 200 rubles. - this is a penalty for violations under Art. 119.1 of the Tax Code of the Russian Federation and 126 (clause 1).

This is for 2021. For the KBK for these violations for 2020, see the next section.

When filling out a payment order, you must correctly indicate the KBK code. It is important to use the current code that is valid in the year the fine debt is repaid. The BCC for current payments to pay off tax obligations and for transfers of penalties will be different. For example, in 2021:

- when filling out a payment slip for income tax for the billing period, enter code 18210102010011000110;

- when paying a fine for personal income tax, the BCC has the form 18210102010013000110;

- if the fine is assigned to an individual entrepreneur applying the general taxation regime, the code will be 18210102020013000110.

A complete list of current BCCs in 2021, including fines, can be found in this article.

We invite you to familiarize yourself with: Deduction from transport tax Platon individual

Refund

To avoid situations where tax arrears arise, you need to submit an application to the Federal Tax Service to clarify the payment. A copy of the payment slip must be attached to the document. If the status is indicated incorrectly, the funds will still go to the budget and to the correct current account. But for the Federal Tax Service, this amount will reflect the repayment of another tax. Only on the basis of an application can it be transferred to pay off real debt.

Before redistributing funds, the Federal Tax Service will reconcile the calculations of enterprises with the budget. If a positive decision is made, the inspectorate will cancel the accrued penalties. The taxpayer will be informed about the decision within 5 days. You can do it differently:

- remit the tax using the correct details in the payment slip;

- then refund the overpaid tax.

In this case, the company will only avoid the accrual of fines. The penalty will still have to be paid. Let's look at a sample application.

STATEMENT

about a mistake made

Irkutsk 07/16/2016

In accordance with paragraph 7 of Art. 45 NC OJSC "Organization" asks to clarify the payment. In detail “101” of receipt No. 416 dated July 16, 2021 for the transfer of VAT (specify KBK) in the amount of 6,000 (six thousand) rubles, the status “01” was incorrectly indicated. The correct status is “02”. This error resulted in non-transfer of tax to the budget of the Russian Federation to the treasury account. Please clarify the payment and recalculate the penalties.

Taxable period

In field 107, indicate:

- when transferring insurance premiums – value “0” (clause 5 of Appendix 4 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n);

- when transferring taxes - a 10-digit tax period code (clause 8 of Appendix 2 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

The first two characters of the code characterize the frequency of tax payment. For example, when paying taxes monthly, the first two digits will be “MS”. The fourth and fifth digits are the tax period number. For example, if the tax is paid for May, enter “05”. The seventh to tenth signs indicate the year in which the tax period includes. For example, 2021. These three groups of signs are separated by dots. Thus, when transferring, for example, the mineral extraction tax for May 2021, in field 107 you need to indicate “MS.05.2016”.

For more information on generating tax period codes when filling out payment orders, see the table.

If the annual payment has more than one payment deadline and specific dates for paying the tax (fee) are established for each deadline, then indicate these dates in the tax period indicator. In addition, a specific date must be indicated when repaying the debt, for example “09/04/2016”. Depending on the basis of payment, dates may vary:

| Payment basis code (field 106) | What date should I enter in field 107? |

| TR | The payment deadline established in the tax inspectorate’s request for tax payment |

| RS | The date of payment of part of the installment tax amount in accordance with the established installment schedule |

| FROM | Deferment end date |

| RT | Date of payment of part of the restructured debt in accordance with the restructuring schedule |

| PB | Date of completion of the procedure applied in the bankruptcy case |

| ETC | End date of suspension of collection |

| IN | Date of payment of part of the investment tax credit |

If the debt is repaid under an act (ground of payment AP) or an executive document (ground of payment AR), enter zero (“0”) in field 107.

If you are paying your tax early, indicate the first upcoming tax period for which payment is due.

An example of indicating the basis for payment for early payment of tax

In June 2021, Alpha transferred VAT to the budget for the second quarter of 2021 ahead of schedule. In the payment order, the Alpha accountant indicated the tax period code:

KV.02.2016.

If the tax arrears are identified independently, in the payment order for the transfer of the arrears, indicate the period for which the additional tax is paid.

An example of indicating the basis for payment when independently identifying arrears

In April 2021, an Alpha accountant independently identified an underpayment of VAT for the second quarter of 2015. The accountant transferred the amount of debt in the same month. In the payment order, the accountant indicated the tax period code:

KV.02.2015.

Results

The rules for filling out payment order details for paying fines are listed in Appendix 2 to Order No. 107n of the Ministry of Finance of the Russian Federation. The payment for the fine must be filled out correctly, otherwise the bank may not accept it. And in case of errors in the details that are significant for crediting the payment, the Federal Tax Service may classify it as unclear.

If you doubt the correctness of filling out the details of the payment order, then remember that the Tax Code of the Russian Federation in paragraph 6 of Art. 32 obligated the tax authorities to provide all the necessary information to fill out orders for the purpose of paying taxes, fees, penalties and fines. Therefore, you can request all the necessary information from your tax office.

If penalties are due

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office in 2021.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties on them to the Social Insurance Fund, fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document” are entered as 0 (paragraphs