Who is a tax resident and who is a non-resident?

Statuses are determined by the Tax Code of the Russian Federation (Chapter 23) in order to determine the percentage tax rate for individuals. “Resident” status is granted to persons who are registered and reside in the country and comply with the requirements of the law.

Citizens included in a certain list approved by the legislative bodies of the Russian Federation have “resident” status:

- citizens of Russia (having a civil passport), if they do not live abroad for more than 365 days, as well as those who have received a residence permit of another country;

- staying in another state on a study/work visa;

- foreigners who have received a residence permit;

- officially registered legal entities;

- employees of consulates and diplomatic institutions located in other states;

- municipal bodies and their constituent entities.

Non-residents are individuals/legal entities without a permanent place of residence (not residing on a permanent basis). Such citizens are those who stay less than 183 days in the country within 1 year.

It is important to understand the difference, because even having Russian citizenship, but at the same time being, for example, at work in another state, a person becomes a resident of another country.

Note! Determination of status is directly related to taxation, and also determines the portion of income that is subject to taxation. For a non-resident, the taxable part is the income that he receives in Russia.

Calculation of time spent in Russia

The period of stay in the Russian Federation (less than or more than 183 days) is counted from the day of arrival (entry) to Russia to the day of departure (departure) from it, inclusive. This calculation procedure is confirmed by regulatory agencies (letters of the Ministry of Finance of Russia dated March 21, 2011 No. 03-04-05/6-157, Federal Tax Service of Russia dated April 24, 2015 No. OA-3-17/1702).

If a person travels abroad, the countdown of 183 days until his return is interrupted.

The only exceptions are foreign trips for short-term (less than six months) treatment or training. The duration of such trips is included in the calculation of the 183 days required to obtain resident status.

This is stated in paragraph 2 of Article 207 of the Tax Code of the Russian Federation.

The purpose of the trip, the days of which are included in the calculation of 183 days, must be documented.

Situation: on the basis of what documents can you establish the time of stay in Russia in order to determine your tax status (resident or non-resident) for the purpose of calculating personal income tax?

The legislation does not contain a list of documents by which the number of days of stay in Russia can be determined to determine tax status. Consequently, these can be any documents confirming the fact that a person is in the country. Thus, the dates of entry into and exit from the Russian Federation can be determined by the marks of the Russian border service:

- in the passport;

- in a diplomatic passport;

- in the service passport;

- in the seafarer’s passport (seafarer’s identity card);

- in the migration card;

- in the refugee's travel document, etc.

Marks made on documents by border services of foreign states (including member states of the Customs Union) are not taken into account when determining tax status: they cannot confirm the duration of a person’s stay on the territory of Russia (letter of the Ministry of Finance of Russia dated April 26, 2012 No. 03-04-05/6-557).

If there is no mark in the passport (for example, a person came from Ukraine or the Republic of Belarus), then other documents can be used as proof of stay in Russia. For example, receipts for hotel accommodation, and for working citizens - time sheets or certificates from the place of work issued on the basis of these timesheets. For citizens studying in Russia, such documents may be certificates from the place of study, which confirm the actual attendance of the educational institution in the corresponding period. It should be noted that documents with a registration mark at the place of residence cannot be used as confirmation of tax status - in themselves they do not allow establishing the actual duration of stay in Russia. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated January 13, 2015 No. 03-04-05/69536, dated June 27, 2012 No. 03-04-05/6-782, Federal Tax Service of Russia dated May 25, 2011 No. AS- 3-3/1855.

Situation: how to take into account days spent on business trips and vacations abroad when determining tax status (resident or non-resident) for the purposes of calculating personal income tax?

When a person travels abroad, he leaves the territory of Russia.

When determining the tax status (non-resident or resident), only the days of the person’s actual stay in the Russian Federation are taken into account.

If over the next 12 consecutive months a person has been in Russia for 183 calendar days or more, he is recognized as a tax resident.

If during the next 12 consecutive months a person stayed in Russia for less than 183 calendar days, he is a tax non-resident.

This is stated in paragraph 2 of Article 207 of the Tax Code of the Russian Federation.

In this case, the period of stay in Russia (less than or more than 183 days) includes both the day of arrival (entry) into Russia and the day of departure (departure) from it. This calculation procedure is confirmed by the Ministry of Finance of Russia in letters dated March 21, 2011 No. 03-04-05/6-157, dated July 4, 2008 No. 03-04-06-01/187 and dated July 3, 2008 No. 03 -04-05-01/228.

If a person travels abroad, then until he returns, the countdown of 183 days is interrupted. The only exceptions are foreign trips for short-term (less than six months) treatment or training.

In all other cases (including when on a business trip or vacation abroad), the period of stay abroad is not included in the number of days of stay in Russia.

This procedure follows from paragraph 2 of Article 207 of the Tax Code of the Russian Federation. This conclusion is also confirmed by the Russian Ministry of Finance in a letter dated July 26, 2007 No. 03-04-06-01/268.

An example of determining a person’s tax status (resident or non-resident) for personal income tax purposes. During the year, the person repeatedly went on business trips abroad

The work of Moldovan citizen A.S. Kondratieva is associated with business trips. During 2015 (365 days), he was sent on business trips abroad three times for periods of 100, 20 and 40 days (excluding the day of departure from Russia and return to Russia). The total duration of official business trips abroad was 160 days.

In addition, Kondratiev went on vacation abroad for 24 days (excluding the day of departure from Russia and return to Russia).

In total, over the past 12 months, Kondratiev has carried out:

- abroad – 184 days (160 days + 24 days);

- on the territory of Russia 181 days (365 days - 184 days), that is, less than 183 days.

Kondratiev is recognized as a tax non-resident.

Situation: is the 12-month period interrupted when determining the tax status of a foreigner who, due to the expiration of his residence permit in Russia, leaves the country? Next year he will enter the Russian Federation again.

No, it is not interrupted.

The legislation establishes a uniform procedure by which a person’s tax status is determined when calculating personal income tax for non-residents.

If over the next 12 consecutive months a person has been in Russia for 183 calendar days or more, he is recognized as a tax resident.

If during the next 12 consecutive months a person stayed in Russia for less than 183 calendar days, he is a tax non-resident.

This follows from the provisions of paragraph 2 of Article 207 of the Tax Code of the Russian Federation. A similar point of view is reflected in the letter of the Ministry of Finance of Russia dated May 5, 2008 No. 03-04-06-01/115.

The use of a 12-month period to determine the tax status of a personal income tax payer is mandatory. Moreover, if a person pays personal income tax on his own income, then the 12-month period is equal to the calendar year in which the income was received (Clause 2 of Article 207, Articles 216 and 228 of the Tax Code of the Russian Federation). Interruption of this period is not provided for by law (including for reasons, for example, termination or re-conclusion of an employment contract, departure and re-entry into the territory of Russia). At the same time, the number of days a person stays in Russia (less than or more than 183 days) during a 12-month period may be interrupted. This is confirmed by the provisions of paragraph 2 of Article 207 of the Tax Code of the Russian Federation.

If a person traveled abroad for treatment or study (for a period of no more than six months), then the 12-month period is not interrupted. The duration of trips is included in the calculation of 183 days (clause 2 of article 207 of the Tax Code of the Russian Federation). In this case, the purpose of the trip must be confirmed documented (for example, when undergoing treatment - an agreement with a medical institution, a certificate indicating the time of its implementation and a copy of the passport with a border control stamp) (letter of the Ministry of Finance of Russia dated June 26, 2008 No. 03-04-06- 01/182).

If a person left the Russian Federation for other reasons (including in connection with the renewal of migration documents, termination of an employment contract), then the 12-month period by which the person’s tax status is determined is also not interrupted. However, days spent abroad must be excluded from the calculation of 183 days (letter of the Ministry of Finance of Russia dated May 26, 2011 No. 03-04-06/6-123).

The main differences between residents and non-residents

For individuals and legal entities recognized as residents, the tax rate is 13% (for individuals) and 20% (for legal entities). Non-residents pay tax at a rate of 30%. For some categories it may be reduced:

- 13% of personal income tax is for persons with the status of refugees, migrants, highly qualified specialists, as well as for crew members of sea vessels, workers who have issued a labor patent;

- 15% on income received from investment activities.

The main differences are as follows:

- different bet sizes;

- list of objects subject to taxation;

- different procedures for determining the tax base;

- the difference in the possibilities for providing deductions and calculating taxes.

Resident status obliges you to declare, and therefore pay, all types of income, while a non-resident pays taxes only on the income he received in the country.

How is personal income tax collected from foreigners in 2021?

However, it is worth considering that certain categories of migrant workers are not considered residents, but pay taxes under special conditions. This:

- highly qualified specialists;

- citizens of other countries working under a patent;

- individuals from the EAEU countries - Belarus, Armenia, Kazakhstan;

- refugees.

In accordance with the Tax Code of the Russian Federation, tax residents include people who have been on its territory for more than 183 days over the past 12 months. If a foreigner has received this status, then taxes are withheld from him in the same amounts as from Russian citizens. Thus, personal income tax from a temporarily residing foreigner in 2021 is withheld in the same way as from a non-resident.

How to become a tax resident with a residence permit?

The conditions for recognizing an individual as a tax resident are specified in paragraph 2 of Article No. 207 of the Tax Code of Russia. Obtaining a residence permit does not automatically change the status from non-resident to tax resident. In order to obtain a certificate of receipt of this status, you need to contact the appropriate department at the place of registration or registration.

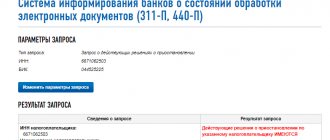

In order to have the necessary documents, you need to submit an application to the Interregional Inspectorate of the Federal Tax Service of the Data Center (centralized data processing) of the Russian Federation.

Tax from a foreign citizen with a temporary residence permit

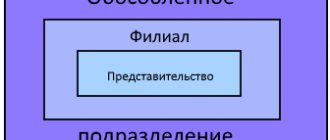

Otherwise, both when hiring foreigners with temporary residence permits and temporary residence permits, and with reporting on them, taxation, and insurance contributions, persons with temporary residence permits and permanent residence permits do not differ from citizens of the Russian Federation. Clause 8 of Article 13 of the Federal Law No. 115 obliges the employer or customer of work (services), who attracts and uses a FOREIGN CITIZEN to carry out labor activities, to notify the FMS within 3 days about the conclusion and termination of the TD, which contradicts the above

They acquire a special document - a patent, which represents payment of income tax in advance. This gives them the right to get hired by individuals and companies in a certain region of Russia. In the case of a patent, personal income tax from foreigners in 2021 is paid at a rate of 13%.

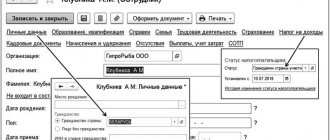

How to fill out an application?

The taxpayer submits an application of a certain sample to the authorized tax authority. You can submit it in person or through the Internet service of the Federal Tax Service.

Important! Pay attention to the “code” column. When applying in person, you must enter four zeros (0000), if you are sending an application by mail, tax authority code 9965.

The application must be filled out on a computer or manually (in black ink). All fields to be filled out must be written in clear, legible handwriting, without corrections or erasures.

To obtain resident status with a residence permit, the following documents are provided:

- copies of civil passport pages. It must be accompanied by a notarized translation;

- documents that can confirm that the individual was in the country during the period for which he wants to receive the document. A residence permit can serve as such a document; in addition, you can provide a foreign passport with marks of entry into the territory of the Russian Federation;

- certificates confirming income (copy of work book/contract, bank or accounting statement, etc.);

- rights to own real estate, payment of dividends, cash or payment checks, etc.

The application has the following form:

When submitting an application to an authorized person, it may be necessary to certify with the signature and seal of the tax authorities the form that is accepted in a foreign country. In this case, this form is adjusted to the above package of documents.

Hiring a foreigner with temporary residence permit in 2021

An employer can issue SNILS for an employee when he is employed for the first time. If a new employee does not have a Russian (or Soviet) standard labor record, then one is created in the personnel department of the organization. The employer also has the right to enter into agreements with a specific medical organization to provide paid services to foreign workers.

In fact, the main documents when employing a foreigner with a temporary residence permit are the temporary residence permit itself, a policy and a personal passport. The rest are presented at the request of the employer and within the framework of Art. 65 Labor Code of the Russian Federation. There is no need to present military registration documents.

Where and how to obtain a document confirming the status of a resident of the Russian Federation?

The applicant can indicate the most convenient way to receive a document confirming receipt of resident status under a residence permit: in person, at the specified postal address, or by email.

One of the main goals of obtaining this status is to avoid double taxation. Documents are issued for 1 year, the one indicated in the application, but you can request data for previous years.

Important! If you need several copies of a document, please indicate the required number in the letter attached to your application.

The time period and procedure for considering the application are regulated by the Order. Confirmation of the status “tax resident of the Russian Federation” is issued no later than forty days after submitting the documents. In the case of a negative decision, when the resident status is not confirmed, the applicant receives a written notification indicating the reason for the negative decision.

For help and legal advice, you can contact the Legal Agency https://migron.ru/. Phone: +7 495 118-33-74.

Get a free consultation with a migration lawyer. Write your question in the form, and a migration law specialist will call you back and advise you.

Notification for a foreigner with a temporary residence permit sample

What documents will be needed to confirm a temporary residence permit in 2021 What is the notification procedure? As practice shows, most citizens do not fully understand migration terminology. To avoid inaccuracies, let’s dot all the i’s. Russian legislation provides for two procedures regarding temporary residence: obtaining it; annual notification of stay within Russia.

Who should be notified when hiring a foreigner with a temporary residence permit? When accepting a citizen with a temporary residence permit, do you need to notify the FMS about the admission, and do you need to notify the tax and pension fund? About hiring a foreigner with a temporary residence permit, you must notify the territorial body of the Main Directorate for Migration Issues of the Ministry of Internal Affairs of Russia, in whose territory the foreigner works.

How to hire a foreigner with a temporary residence permit

Contributions for health insurance Insurance premiums for compulsory health insurance are allocated to payments to foreigners (except for highly qualified specialists) who have the status of permanent or temporary residents in Russia. Do not charge compulsory health insurance contributions for payments to foreigners who have the status of temporarily staying in Russia. This procedure follows from the provisions of paragraph 15 of part 1 of article 9 of the Law of July 24, 2009 No. 212-FZ.

In turn, an employer hiring a temporarily resident foreigner does not need to obtain permission to hire foreign labor. At the same time, the migration service must be notified about the employment of temporarily residing foreigners. This follows from paragraph 8 of Article 13 of the Law of July 25, 2002 No. 115-FZ*.