Emergence of the right to compensation from the Federal Tax Service

The amount of overpaid/collected tax shall be refunded to the taxpayer. The general procedure for the refund of taxes and insurance premiums, as well as the refund deadlines, are established by Art. 78 and 79 of the Tax Code of the Russian Federation. Along with the refund of overpaid taxes, tax authorities are required to accrue and pay interest, which represents monetary compensation for the unlawful use of payers’ funds.

The right to receive interest on the amount of overpaid/collected taxes arises:

- upon the fact of excessive collection of taxes by decision of the Federal Tax Service

- if tax officials violate deadlines for returning voluntarily overpaid amounts.

The moment at which interest begins to accrue depends on the basis for the overpayment. If the overpayment occurred due to an error by the payer himself, interest is accrued from the day the Federal Tax Service Inspectorate violates the monthly deadline for tax refund.

If the tax overpaid due to the fault of the payer himself was returned by the Federal Tax Service independently (before the payer came to his senses and wrote a statement), interest is not charged on the amount of the overpayment (clause 2 of Article 78 of the Tax Code of the Russian Federation).

If the overpayment arose as a result of the collection of taxes by decision (demand) of the tax authorities, interest is accrued from the date of collection of taxes (clause 5 of Article 79 of the Tax Code of the Russian Federation).

Where to apply to collect interest from the tax office

The Tax Code of the Russian Federation does not establish a procedure for filing an application for recovery from the Federal Tax Service of interest accrued on the amount of overpaid taxes. Consequently, the procedure for filing such an application is chosen by the taxpayer himself.

For a refund of tax and interest, he can apply to the Federal Tax Service at the place of his registration (as part of filing an application for a refund of the tax itself), or he can submit the corresponding application directly to the court.

If the payer decides to act through the court, then the application must indicate the circumstances of the overpayment of tax, the emergence of the right to receive interest, and also calculate the due interest.

Interest payable to the taxpayer is accrued for each calendar day of violation of the return deadline. Interest stops accruing from the moment the overpayment is returned. The interest rate is taken equal to the refinancing rate of the Central Bank of the Russian Federation, which was in effect during the period of violation of the repayment deadline (clause 10 of Article 78 of the Tax Code of the Russian Federation).

Calculation of interest on voluntary overpayment of taxes

In cases where overpayment of taxes occurs due to the fault of the payer himself (incorrect application of the tax rate, erroneous overestimation of the taxable base, etc.), a mandatory condition for collecting interest from the Federal Tax Service is the declaration of rights to return the amount of the overpayment.

Interest in such cases begins to accrue only if there is a taxpayer’s application submitted to the Federal Tax Service for a refund of overpaid tax. Without filing such an application, the inspectorate has no obligation to refund taxes and, accordingly, pay interest on the amount of untimely returned payments.

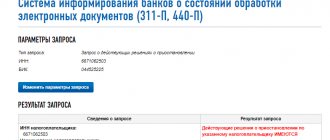

In order to receive back the overpaid tax and, possibly, monetary compensation, the payer is required to submit an application to the tax office at the place of his registration. The application form was approved by order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected] The application, among other things, indicates the details of the taxpayer’s bank account to which the tax and interest are returned, the amount of overpaid tax and the BCC for the overpaid tax.

Taxes and contributions must be returned within one month from the date the tax authority received this application. Otherwise, along with the tax, the Federal Tax Service will be obliged to return to the payer the interest accrued on the amount of untimely returned tax.

Interest is accrued not from the day the tax is paid in an inflated amount, but from the day that follows the elapsed month allotted to the tax authorities to return the overpaid amounts.

The application for a refund of overpaid tax can be submitted within three years from the date of payment.

The law does not provide for a separate application form for collecting interest on the amount of untimely returned overpayment. Moreover, payers are not required to declare such interest. Interest is calculated and accrued by the tax authorities themselves upon missing a month's deadline (Clause 10, Article 78 of the Tax Code of the Russian Federation).

If the payer demands the return of the overpayment and interest through the court, bypassing the stage of filing a refund application (for example, if a three-year deadline is missed), then the court will refuse to collect the interest. This is due to the fact that in case of voluntary overpayment, interest is accrued one month from the date of filing the relevant application.

What is a penalty

On the left side of the calculator, indicate the type of ownership - individual entrepreneur or legal entity, as well as the amount of debt on which penalties were accrued. Then indicate the deadline for paying the tax or contribution (which you failed to meet) and the actual deadline for paying the arrears. Decide whether you will include the day of payment of the arrears in the calculation of penalties (we remind you that including this day in the calculations is the least risky option in terms of possible tax claims).

When can you avoid paying penalties?

In some cases, penalties are not charged. For example, when a taxpayer’s account is blocked or money is seized by court order. Or when, when calculating taxes or contributions, a businessman was guided by a court ruling.

Let us remind you that tax agents must transfer calculated and withheld personal income tax no later than the day following the day the income was paid. Personal income tax on sick leave benefits and vacation pay is transferred no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Tax Code of the Russian Federation).

How to return interest in case of excessive tax collection

According to the law, the tax authority, having established the fact of excessive tax collection, is obliged to inform the taxpayer about this within 10 days from the date of establishing this fact. The specified message is transmitted to the head of the organization, individual entrepreneur, their representatives personally against signature or in another way (clause 4 of article 79 of the Tax Code of the Russian Federation).

But on its own initiative, the Federal Tax Service is not obliged to return excessively collected tax amounts. Therefore, refund of tax and interest in such situations is also carried out in a declarative manner. To receive a refund, you will need to submit an application in the form approved. by order of the Federal Tax Service of Russia dated February 14, 2017 No. ММВ-7-8/ [email protected]

There is no need to submit a separate application for the accrual of interest on the amount of overcharged tax. The tax is refundable with interest already accrued on it.

At the same time, in contrast to a voluntary overpayment in the event of excessive collection of tax, the accrual of interest on its amount does not depend on the fact of filing an application for a refund. Interest in such cases is accrued not from the end of the month from the date of submission of the application to the Federal Tax Service, but from the moment the tax is collected.

Therefore, in principle, the taxpayer may not report the accrual and return of interest to the Federal Tax Service, but file a claim directly with the court.

When will personal income tax become overdue?

Individual entrepreneurs who do not apply special regimes, as well as notaries engaged in private practice, lawyers who have established law offices, and other persons engaged in private practice, pay personal income tax independently on the basis of a submitted tax return no later than July 15 of the year following the previous year (clause 6 Article 227 of the Tax Code of the Russian Federation). In addition, such persons must pay advance payments during the year within the time limits specified in clause 9 of Art. 227 Tax Code of the Russian Federation.

How to calculate penalties for personal income tax

Individuals who, for example, owned property for less than the maximum period and sold it in the reporting year, or received non-monetary gifts from other citizens (who are not individual entrepreneurs, family members or close relatives of recipients), as well as in some other cases specified in Art. 228 of the Tax Code of the Russian Federation, also pay personal income tax no later than July 15 of the following year based on the submitted tax return.

Procedural deadlines

An application for a refund of overpaid tax with interest accrued on its amount may be submitted to the Federal Tax Service within three years. The procedure for calculating this period depends on the basis for the overpayment.

For example, if a tax is overpaid due to the fault of the payer, the three-year period begins to be calculated from the date of payment of the tax (Clause 7, Article 78 of the Tax Code of the Russian Federation). In the case of forced payment of tax, the period for filing an application is calculated from the day when the taxpayer became aware of the fact of excessive collection of tax from him (clause 3 of Article 79 of the Tax Code of the Russian Federation).

Missing the three-year period does not deprive payers of the right to return the overpayment and interest on it. This period is established only for the return of taxes/interest through the Federal Tax Service without going to court.

Therefore, if the payer has not applied to the inspectorate for a refund of taxes and interest within three years, he may demand their collection in court. In this case, the general rules for calculating the limitation period apply - within three years from the day the person learned or should have learned about the violation of his right (Articles 196 and 200 of the Civil Code of the Russian Federation).

The moment from which the payer must become aware of a violation of his right to a refund of taxes and interest is determined by the courts in different ways. It all depends on the reasons why the taxpayer overpays the tax, as well as on whether the payer has the ability to correctly calculate the tax.

Often, the courts recognize this moment not as the day of payment of the tax, but as the day of receipt of a certificate from the tax authority on the status of settlements with the budget (Resolution of the Administration of the Ural District dated March 14, 2017 No. A76-12783/2016, Resolution of the Administration of the Ural District dated June 17, 2016 No. F09-6580/ 16).

If the payer decides to collect tax and interest by challenging the actions or decisions of the Federal Tax Service (decision to refuse a refund), then the statute of limitations established in clause 4 of Art. 198 Arbitration Procedure Code of the Russian Federation. This period is only three months from the day the taxpayer became aware of a violation of his rights.

Calculation of penalties for late personal income tax return in 2021

11.10.2019

As a general rule, if a tax agent does not withhold and/or transfer personal income tax from the taxpayer’s income, or does not fully withhold and/or does not fully transfer the tax, then a fine in the amount of 20% of the amount that was required to be withheld may be collected from the tax agent. transfer to the budget (Article 123 of the Tax Code of the Russian Federation).

True, only in the case where the agent had the opportunity to withhold personal income tax from the income of an individual. After all, if a citizen was paid income, for example, only in kind, then tax cannot be withheld from him (clauses 4, 5 of Article 226 of the Tax Code of the Russian Federation, clause 21 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57).

And in such a situation, the fine is not applicable to the tax agent.

The obligation to pay personal income tax may lie with the taxpayer himself - an individual, including individual entrepreneurs, or with the tax agent paying income subject to personal income tax to individuals (clause 1 of article 227, clause 2 of article 214, clause 1 of article 228, Clause 1 of Article 226 of the Tax Code of the Russian Federation). There are penalties for non-payment of tax or late payment.

Kbk for payment of penalties for personal income tax for 2021

Currently, personal income tax is charged on income taxed at a rate of 13%, in accordance with clause 3 of Art. 226 of the Tax Code of the Russian Federation, occurs on the date of receipt of income, and its transfer to the budget is no later than the next day after payment (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Late submission of reports in accordance with clause 1.2 of Art. 126 of the Tax Code of the Russian Federation is fraught for the employer with a fine of 1000 rubles. for each month (for form 6-NDFL), 200 rubles. for each 2-NDFL certificate. Transfer of incorrect information, in accordance with paragraph 1 of Art. 126.1 of the Tax Code of the Russian Federation will entail liability in the amount of 500 rubles. for each incorrectly completed report.

What are the fines for non-payment of personal income tax in 2021?

- paying personal income tax in advance, before receiving income;

- transfer of tax to the budget before payment of wages to employees;

- transfer of funds to the NFS of the head office instead of the inspectorate supervising the branch;

- non-payment of tax, since the acquisition was made from extra-budgetary funds.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

Penalties for late personal income tax returns in 2021

- The most important thing The first (and most important!) is to buy or build.

- Article 214, paragraph 2 of the Tax Code of the Russian Federation regulates interest tax.

- Dear readers, good afternoon! Today I will provide you with a sample sample.

- Many of us do not know what happens when we sell property.

The actual damage caused by the developer includes, in particular, the amount of actual expenses of an individual for a rented apartment during the period of violation of the deadline for transfer of the shared construction project. It follows from this: the amounts of actual damage compensated on the basis of a settlement agreement approved by the court do not form an economic benefit for an individual.

Consequently, they are not income of the taxpayer and are not taken into account when determining the tax base for personal income tax.

Fine for late payment of personal income tax in 2021

Please note that a fine can only be avoided if the errors are corrected before the Federal Tax Service inspectors find out about them. For example, until the moment when the Federal Tax Service issued a demand for payment of arrears and tax penalties. Or before scheduling a desk audit by the Federal Tax Service for the corresponding period.

If the taxpayer is in an employment or civil law relationship, then the obligation to pay personal income tax is delegated to the employer - the tax agent (Article 226 of the Tax Code of the Russian Federation). It is the tax agent who must withhold tax from the income paid.

Non-payment of personal income tax in 2021: fine for tax agents

Remember: timely identification of financial obligations to the budget and compliance with legal regulations will allow you to avoid fines for non-payment of personal income tax. This will prevent additional losses and litigation.

A fine under Article 123 of the Tax Code of the Russian Federation can be avoided if the organization proves that it did not have the opportunity to withhold personal income tax from an employee (clause 21 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57).

At the same time, the tax agent is not obliged to transfer personal income tax to the budget at his own expense (clause 9 of Article 226 of the Tax Code of the Russian Federation). If it is impossible to deduct tax from the employee’s income, then the organization is obliged to notify the inspectorate of the unwithheld amount.

This must be done no later than March 1 of the year following the expired tax period (subclause 2, clause 3, article 24 and clause 5, article 226 of the Tax Code of the Russian Federation).

Free and simple online calculator for calculating personal income tax penalties - instructions, examples and formulas for calculation

- The amount of personal income tax debt is the amount of income tax not paid on time (the first field of the calculator).

- The number of days overdue is counted from the day following the payment due date to the day before the debt is repaid (second field of the calculator).

- Refinancing rate - the current value in percentage is taken, valid at the time of the arrears (third field of the calculator).

- for an advance payment for the first half of the month - not paid, since the tax is transferred in full along with personal income tax from the salary for the second half of the month;

- for wages for the second half of the month - the next day after the day of payment (if wages are paid on the 10th, then the deadline for payment is the 11th; if it is a day off, then it is postponed to the next closest working day);

- for vacation pay – the last day of the current month;

- for sick leave – the last day of the current month;

- payment upon dismissal – next after the day of dismissal.

Personal income tax penalties in 2021

According to Art. 223 of the Tax Code of the Russian Federation, income for the purpose of calculating personal income tax arises, as a rule, at the time of its receipt. However, there are other situations: when approving an employee’s advance report, when issuing borrowed funds to him with savings on interest, income is considered received on the last day of the month (subclauses 6–7, clause 1, article 223 of the Tax Code of the Russian Federation).

Currently, personal income tax is charged on income taxed at a rate of 13%, in accordance with clause 3 of Art. 226 of the Tax Code of the Russian Federation, occurs on the date of receipt of income, and its transfer to the budget is no later than the next day after payment (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Fine for late payment of personal income tax

After this, the tax payment order is sent to the person by mail. You can track the status of debt for any taxes, including personal income tax fines, on the official website of the tax service. In addition, the site automatically sends registered users a personal email notification of tax debt.

Personal income tax is a direct tax on the income of citizens, regulated by Ch. 23 of the Tax Code of Russia. According to Art. 41 of the Tax Code of the Russian Federation, any monetary benefit is recognized as income, including expensive gifts and lottery winnings. Timely payment of taxes is the responsibility of every citizen.

Amount of fines for late submission of 6-NDFL and errors in the report

The amount of the fine for late submission of 6-NDFL is 1000 rubles. for all months that have passed since the legally defined deadline for delivery, counting complete and incomplete. Based on Article 6 of the Tax Code of the Russian Federation, the countdown of delay begins the next day after the event that marked its beginning.

A tax agent who delays submitting the form even by one day is required to pay a fine for failure to submit 6-NDFL.

The qualification of a violation does not depend on the number of days, weeks or months of delay in reporting the withheld and transferred income tax.

The period of time elapsed between the established Tax Code of the Russian Federation and the actual date of submission of the form has a significant impact on the amount of penalties.

Payment of penalties for personal income tax

Every day of debt, the fine grows, until the debt is paid in full and at once. When paying tax with an existing debt, penalties are not removed from the debtor, and also continue to be calculated from the original monthly tax amount.

The amount of the fine is established and is the same for all citizens.

For the first month of personal income tax debt, an unscrupulous payer will be charged daily penalties in the amount of 1/300 of the refinancing rate; after 31 days of delay, a fine of 1/150 of the refinancing rate will be applied.

Moreover, you can receive a fine, but in a fixed amount, for late submission of reports on taxes and debts.

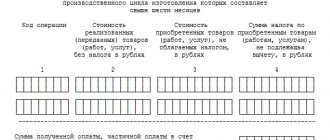

The amount of tax is calculated using the tax rate.

From the income of an individual, in this case it will be the tax base, the percentage of the tax rate imposed on a specific payer is calculated and thus the amount of the monthly tax is calculated.

The Tax Code of the Russian Federation provides for 5 types of tax rates. They differ in relation to the types of income on which the tax is levied, as well as in relation to the various taxpayers.

Rates:

Penalties for personal income tax postings in 2021

Let's take a closer look at an example. delayed the payment of personal income tax for 10 days in the amount of 50,000 rubles. The company calculated the penalty and paid it along with the amount of the debt. The refinancing rate on the day of delay is 7.75%. Therefore, the amount of the penalty will be:

Failure to pay or not pay in full personal income tax, which arose due to an understatement of the tax base, may be punished in the form of a penalty.

Collection in this case is possible in the amount of 20% of the debt amount or 40% if the taxpayer committed these actions intentionally.

An understatement of the tax base is possible if the taxpayer indicates in the declaration those deductions that he is not entitled to apply.

Penalties for non-payment of personal income tax and contributions in 2021

Penalties will be calculated as follows (and if the arrears arose from October 1, 2021, then this formula only applies to debts within a period of up to 30 days; if the delay is over 30 days, the calculation scheme is more complex - details below):

Along with the arrears, penalties were transferred to the budget, which the accountant calculated from April 26 to May 3 (8 days). During this period, the refinancing rate was 7.75 percent. The amount of penalties was: RUB 360,000. × 7.75% : 300 × 8 days. = 744 rub.

Simple taxes

Source: https://exjurist.ru/konsultatsiya/raschet-peni-za-nesvoevremennyj-vozvrat-ndfl-v-2019-godu

Pre-trial settlement

Claims for the recovery of interest accrued on the amount of untimely returned/collected taxes are of a property nature. Therefore, these requirements are not subject to the procedure for pre-trial settlement of disputes with tax authorities established by Art. 138 Tax Code of the Russian Federation.

Let us recall that, according to this article, acts of tax authorities of a non-normative nature, actions or inactions of their officials can be appealed in court only after they have been appealed to a higher tax authority.

Therefore, if the payer makes a demand to collect interest from the Federal Tax Service, there is no question of appealing the decisions and actions of the tax authorities. Therefore, there is no need to appeal to a higher tax authority the refusal of the Federal Tax Service to return overpaid tax and interest. It is enough for the payer to file a claim in court to recover the appropriate amounts from the Federal Tax Service.

The Supreme Court of the Russian Federation in its Ruling dated June 20, 2016 No. 304-KG16-3143 directly stated that such judicial methods of protecting the rights of taxpayers as challenging non-normative legal acts of tax authorities and claiming excessively collected tax/interest are independent.

The norms of the Tax Code of the Russian Federation do not contain special requirements for a mandatory pre-trial procedure for resolving disputes regarding the return (reimbursement) of taxes, penalties, fines and interest. The taxpayer may submit these property claims to the court regardless of challenging non-normative legal acts of the tax authorities.