Organizations can generate income from placing free funds on deposits, as well as amounts issued as loans. How to account for interest income?

- Interest on bank accounts

- Interest on loan agreements

- Legal interest

- Accounting Moment of recognition of income

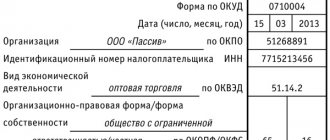

- Primary accounting documents

- Income tax

The relationship between the bank and the depositor on the account to which the deposit amount is credited is regulated by the rules on the bank account agreement (Chapter 45 of the Civil Code of the Russian Federation), unless otherwise provided by the rules on the bank deposit agreement.

Encyclopedia of solutions. Interest receivable and payable (lines 2320 and 2330)

Interest receivable and payable (lines 2320 and 2330)

Line 2320 “Interest receivable” of the Statement of Financial Results (hereinafter referred to as the Report) indicates the income due to the organization in the form of interest:

- for loans issued to other persons;

- on deposits placed in banks for the purpose of generating income;

— on bonds and other securities (for example, financial bills);

— accrued by the bank based on the balance of funds on the organization’s current account (clause 7 of PBU 9/99 “Income of the organization”, hereinafter referred to as PBU 9/99).

Such income is taken into account as part of other credit account 91 “Other income and expenses” in correspondence with account 76 “Other debtors and creditors” (when providing a loan to an employee with account 73) (clause 7 PBU 9/99, clause 34 PBU 19 /02 “Accounting for financial investments”).

Thus, line 2320 of the Report reflects the credit turnover in account 91, subaccount “Other income” in terms of accounting for interest receivable

Income in the amount of interest due is reflected on line 2320 only if it is included in the organization’s other income (clause 7 of PBU 9/99). If receiving this kind of income is one of the main activities of the organization, their amount is entered not in line 2320, but in line 2110 “Revenue” of the Report (clause 4 of PBU 9/99).

According to clause 16 of PBU 9/99, interest received for the provision of funds to an organization for use is recognized in a manner similar to that provided for in clause 12 of PBU 9/99. In turn, clause 12 of PBU 9/99 determines that income is recognized in accounting when the following conditions are met:

a) the organization has the right to receive it, arising from a specific agreement or confirmed in another appropriate manner;

b) the amount of income can be determined;

c) there is confidence that as a result of a particular transaction there will be an increase in the economic benefits of the organization. Such assurance exists when the entity has received an asset as payment or there is no uncertainty regarding receipt of the asset.

At the same time, in accounting, interest is accrued for each expired reporting period in accordance with the terms of the agreement (clause 16 of PBU 9/99).

Line 2330 “Interest payable” indicates the amount of interest that the organization must pay, in particular:

— for all types of debt obligations (loans, credits) (clause 11 of PBU 10/99 “Expenses of the organization” (hereinafter referred to as PBU 10/99);

— issued bills or bonds (clauses 15, 16 PBU 15/2008 “Accounting for expenses on loans and credits”).

The procedure for recognizing such expenses is regulated by PBU 10/99.

Expenses are recognized in accounting only if the conditions listed in clause 16 of PBU 10/99 are met, namely:

— the expense is made in accordance with a specific agreement, the requirements of legislative and regulatory acts, and business customs;

— the amount of expense can be determined;

- there is confidence that as a result of a particular transaction there will be a decrease in the economic benefits of the organization.

In this case, expenses are subject to recognition in accounting, regardless of the intention to receive revenue, other or other income and the form of expenditure (monetary, in-kind and other) (clause 17 of PBU 10/99).

In accounting, interest payable is reflected in the debit of account 91 “Other income and expenses”, subaccount “Other expenses”:

Conclusions about what a change in indicator means

If the indicator is higher than normal

Not standardized

If the indicator is below normal

Not standardized

If the indicator increases

Positive factor

If the indicator decreases

Negative factor

Notes

The indicator in the article is considered from the point of view not of accounting, but of financial management. Therefore, sometimes it can be defined differently. It depends on the author's approach.

In most cases, universities accept any definition option, since deviations according to different approaches and formulas are usually within a maximum of a few percent.

The indicator is considered in the main free online financial analysis service and some other services

If you need conclusions after calculating the indicators, please look at this article: conclusions from financial analysis

If you see any inaccuracy or typo, please also indicate this in the comment. I try to write as simply as possible, but if something is still not clear, questions and clarifications can be written in the comments to any article on the site.

Best regards, Alexander Krylov,

The financial analysis:

- Interest payable 2330 Definition Interest payable 2330 is the interest that the organization had to pay in the reporting period: interest paid on all types of borrowed obligations of the organization (in ...

- Income from participation in other organizations 2310 Definition Income from participation in other organizations 2310 is income from participation in the authorized capitals of other organizations: income associated with participation in the authorized capitals...

- Other liabilities 1450 Definition Other liabilities 1450 are other liabilities of the organization, the maturity of which exceeds 12 months, which are not included in other groups of the 4th section of the balance sheet. Their presence...

- Profitable investments in material assets 1160 Definition Profitable investments in material assets 1160 - investments of an organization in property, buildings, premises, equipment and other material assets provided by the organization for a fee for a temporary...

- Profit (loss) from sales 2200 Definition Profit (loss) from sales 2200 is the gross profit (loss) of the enterprise minus selling expenses and general business expenses. This indicator reflects the effect obtained...

- Deferred tax liability 1420 Definition Deferred tax liability 1420 is a liability in the form of a portion of deferred income taxes that will result in an increase in income taxes in one or...

- Estimated liabilities 1430 Definition Estimated liabilities 1430 are estimated liabilities, the expected fulfillment period of which exceeds 12 months. Despite not the simplest definition, in fact, estimated liabilities are...

- Revaluation of non-current assets 1340 Definition Revaluation of non-current assets 1340 is the added value of non-current assets discovered by revaluation. In fact, this is a re-determination of the value of non-current assets, which, if this ...

- Deferred tax assets 1180 Definition Deferred tax assets 1180 are an asset that will reduce income taxes in future periods, thereby increasing after-tax profits. The presence of such an asset...

- BALANCE 1600 Definition BALANCE 1600 is the sum of indicators on lines 1100 and 1200, that is, the sum of non-current and current assets. These are all the assets that a company uses...

Conditions affecting loan accounting

A loan is a transfer of funds (or other means of payment) on debt that occurs between individuals or legal entities, as well as between a legal entity and an individual. A credit institution never participates in this procedure, since operations with its participation, despite the same nature of the relationship, have different names: loan and deposit (for an individual) or deposit (for a legal entity).

Accounting entries arise only for legal entities that can both borrow funds from legal entities or individuals and give them to the same entities, but the nature of the accounting entries does not depend on with whom exactly (a legal entity or individual) the borrowing agreement was concluded. At the same time, there are points that affect the correspondence of accounts used in these records.

Interest on a loan issued - postings

Funds issued as a loan, subject to the accrual of interest on them by the transferring party, are always taken into account as part of financial investments, i.e. in account 58. The issue is recorded by posting Dt 58 Kt 51 (50, 52).

IMPORTANT! An interest-free loan will not be shown on account 58, since it does not correspond to the very idea of financial investments (to generate income). Its amount should be shown on account 76 (Dt 76 Kt 51 (50, 52)).

At the same time, in transactions for calculating interest on a loan issued, another account will be used - 76. Its use will lead to the appearance of a transaction - interest accrued on a loan issued - with correspondence Dt 76 Kt 91 (90). The choice of account in the credit part of this record will determine which types of activities for the lender include issuing a loan: other (in which case account 91 will be used) or ordinary (in this case account 90 will be used).

Interest calculations by organizations are carried out monthly on the last date of this period (clauses 12, 16 of PBU 9/99, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n).

Neither the loan amount itself nor the interest on it are subject to VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation), i.e., there will be no postings regarding this tax on the debit of account 91 (90). If the lender has any costs associated with issuing a loan (for example, a fee to the bank for funds transfer services), then during the period of their implementation they will be debited to account 91 (90).

The receipt of interest payments will be expressed by posting Dt 51 (50, 52) Kt 76.

How to calculate the profitability of a deposit with simple interest calculation?

Simple compounding is the calculation of the annual interest rate based only on the amount originally invested.

The simplest and most understandable way. The calculation periods here may vary: you can accrue interest once a year or once a month, but the total amount will be the same.

Let's consider this using the example of placing 50 thousand rubles in a bank at 8 percent per annum, without capitalization, replenishment or early withdrawal:

- When interest is calculated at the end of the deposit period, the owner of the funds will receive 54 thousand rubles.

However, interest is usually calculated monthly. This method gives the investor more confidence; he knows that his deposit has already grown.

Interest is calculated based on the total rate, depending on the number of days in each month. In relation to the selected amount, the calculation for January will be as follows:

- 50,000 * (0.08 / 365 * 31) = 340 rubles;

the total amount belonging to the investor is 50 thousand 340 rubles.

For February the situation will be like this:

- 50,000 * (0.08 / 365 * 28) = 307 rubles;

the total amount belonging to the investor is 50 thousand 647 rubles.

The calculation table for the year will be as follows:

Deposit calculation table

| Months | Principal deposit amount, rub. | Accrued interest, rub. | Total deposit amount, rub. |

| January | 50 000 | 340 | 50 340 |

| February | 50 000 | 307 | 50 647 |

| March | 50 000 | 340 | 50 986 |

| April | 50 000 | 329 | 51 315 |

| May | 50 000 | 340 | 51 655 |

| June | 50 000 | 329 | 51 984 |

| July | 50 000 | 340 | 52 323 |

| August | 50 000 | 340 | 52 663 |

| September | 50 000 | 329 | 52 992 |

| October | 50 000 | 340 | 53 332 |

| November | 50 000 | 329 | 53 660 |

| December | 50 000 | 340 | 54 000 |

It can be seen that at the end of the year the investor will receive exactly as much as would have been obtained by calculating interest at the end of the year. That is 54 thousand rubles.

Now most banks take into account the interests of depositors and charge interest monthly. When withdrawing a deposit early, a recalculation is made based on the number of days the deposit was placed. However, this does not always happen; it is better to clarify the settlement conditions for different withdrawal options when concluding a deposit agreement.

How to calculate a contribution with capitalization?

Capitalization is the addition of interest accrued on the initial investment amount to the total amount, and further calculation at the same rate, but on the total amount.

The benefit of capitalization is not obvious without an accurate calculation. Bank advertising offers usually focus on simple numbers: either a high annual rate or the amount of capital appreciation. By the way, the latter is a more reliable indicator of investment return.

To find out how capitalization works, let's take the same example with 50 thousand rubles and 8%. Let's place the funds on an annual deposit again, but with monthly capitalization.

The formula for calculating interest on a deposit with capitalization in the first month (January) will remain the same:

- 50,000 * (0.08 / 365 * 31) = 340 rubles;

the total amount belonging to the investor is 50 thousand 340 rubles.

But for February, the initial data and the result will change:

- 50,340 * (0.08 / 365 * 28) = 318 rubles;

the total amount belonging to the investor is 50 thousand 657 rubles.

An increase of 10 rubles will seem small, but in the following periods the amount will increase:

Deposit calculation table

| Months | Principal deposit amount, rub. | Accrued interest, rub. | Total deposit amount, rub. |

| January | 50 000 | 340 | 50 340 |

| February | 50 340 | 318 | 50 657 |

| March | 50 657 | 354 | 51 011 |

| April | 51 011 | 345 | 51 356 |

| May | 51 356 | 359 | 51 715 |

| June | 51 715 | 350 | 52 065 |

| July | 52 065 | 364 | 52 428 |

| August | 52 428 | 366 | 52 794 |

| September | 52 794 | 357 | 53 151 |

| October | 53 151 | 371 | 53 523 |

| November | 53 523 | 362 | 53 885 |

| December | 53 885 | 376 | 54 261 |

The difference between the options with and without capitalization at the end of the year will be 261 rubles. This is a little more than half a percent of the total amount, as if the investment was made not at 8% per annum, but at a rate of 8.522%. If you calculate the contribution with capitalization, under the same conditions, but for 3 years, then the difference with simple accrual will already be 1 thousand 903 rubles. And this is for 50 thousand, for 500 the result will already be 19 thousand 30 rubles.

“A good increase in pension” and, what is important, completely legal and safe.

The effect of such capitalization makes it possible to replenish the deposit with recalculation of interest to a new amount. The calculation will be similar to the above, but using the amounts of specific top-ups. An even better result is provided by a combination of deposit replenishment and frequent capitalization.

How to independently calculate the annual interest on a deposit?

To calculate interest on deposits, they usually use calculator programs, which are abundant on financial and non-financial portals. Banks also have programs for calculating interest on their own deposits on their websites.

Welcome deposit online from TransCapitalBank

Design

A special advantage of online calculators is that they calculate not only “ideal data”, as we did above, but real banking products under real conditions. Inflation rates, taxes on income from financial investments, etc. may be taken into account.

However, for greater confidence, it is useful to calculate the interest on a deposit using a calculator and a piece of paper. It's long and boring, but it promises understanding of processes. Having mentally gone through all the stages of calculation, it is more difficult to make a mistake in reality; the skill appears to quickly, intuitively decide what is true and what is not.

Author: Mainfin.ru Team

Interest accrued on the loan received - postings

The recipient of the borrowed funds will have their receipt recorded either in account 66 (if the loan is short-term - up to a year) or in account 67 (if the funds are taken for a period exceeding 12 months). The wiring will be as follows: Dt 51 (50, 52) Kt 66 (67).

The accrued interest will be credited to these same accounts, separating them in the accounting analytics from the amount of the principal debt. That is, in the entry for calculating interest on a loan received in the credit part there will be an account 66 or 67. The choice of the account that falls into its debit part will determine the fact of use or non-use of the funds received when creating an investment asset (clause 7 of PBU 15/2008, approved by order of the Ministry of Finance of Russia dated October 6, 2008 No. 107n).

Interest amounts on a loan that is not related to the creation of an asset regarded as an investment (it has a long period of creation and high cost) should always be taken into account in other expenses - Dt 91 Kt 66 (67), accruing the corresponding amounts monthly (clause 6 of PBU 15/2008).

If borrowed funds are involved in expensive long-term investments, then the interest on them will form the cost of property (fixed assets or intangible assets) created with the participation of the corresponding investments: Dt 08 Kt 66 (67). During a long (more than 3 months) break that arose in the process of making investments, and upon completion of investments in the object, the continuing accrual of interest on the loan should be included in other expenses (clauses 11, 13 of PBU 15/2008).

Features of lending

A credit agreement or loan agreement is a bilateral agreement that stipulates the conditions for one party to provide a specific type of assets (money, property, intangible assets, etc.) that belong to this party for temporary use by the second party (organization, individual entrepreneur or employee).

Let us remind you that a loan can only be issued by a specialized organization that has the appropriate license. But borrowed funds can be obtained from a company, individual entrepreneur or individual. In addition, lending is carried out exclusively in money, that is, in cash. While loans can also be obtained in material form, for example, in the form of products, fixed assets, raw materials or any other property of the company.

Some companies can provide borrowed funds free of charge, that is, there is no need to pay additional fees for the use of borrowed assets (Clause 1, Article 809 of the Civil Code of the Russian Federation). However, most companies provide lending for a specific fee - they calculate interest on the loan, and the accrual entries reflect the occurrence of the borrower's debt to the lender.

The provision of borrowed funds in the accounting of the borrower and the lender differ significantly.

Definition

Interest receivable

– income received in connection with the provision of debt financing to third parties, namely:

interest due to the organization on loans issued by it;

interest and discount receivable on securities (for example, bonds, bills);

interest on commercial loans provided by transfer of advance payment, prepayment, deposit;

interest paid by the bank for the use of funds located in the organization’s current account, etc.

Interest receivable is (clause 4 of PBU 9/99):

an independent type of income – if, in accordance with the company’s activities, such income is classified as other;

component of sales revenue, if, in accordance with the company’s activities, such income is recognized as income from ordinary activities.

What it is?

This document represents the main form of financial statements. It describes the financial results of the company for a certain period, which is called the reporting period. The main information contained in it is the organization’s income and expenses , as well as direct financial results , which are reflected on an accrual basis.

This document reflects the costs of producing the products sold, along with commercial and administrative expenses.

At the same time, you can see the value of the proceeds from sales and the amount of tax that is imposed on the profit.

It is important to understand that this type of report is almost the main source that allows you to see the detailed information necessary to analyze the profitability of the company’s activities, products sold, production, and so on. In addition, it allows you to determine the following indicators:

- The amount of net profit.

- Return on assets.

- Dynamics of indicators of the reporting period compared to the previous one.

- All key indicators related to the company’s activities, etc.

You can get more detailed information about this document from the following video:

How is interest receivable calculated?

Interest receivable is recognized as income in accordance with the terms of the agreements on the basis of which financing was provided to third parties, and the terms of the issue of securities (clause 16 of PBU 9/99).

Interest receivable is taken into account (Instructions for using the Chart of Accounts):

on the credit of account 91 “Other income and expenses”, subaccount “Other income” in correspondence with account 76 “Settlements with various debtors and creditors” - if, in accordance with the areas of the company’s activities, such income is classified as other;

on the credit of account 90 “Sales”, subaccount “Revenue” in correspondence with account 76 “Settlements with various debtors and creditors” - if, in accordance with the areas of the company’s activities, such income is recognized as income from ordinary activities.

Taxation

Income tax

Interest received under loan agreements, bank account agreements, bank deposit agreements is reflected in the tax accounting of the organization as part of non-operating income (clause 6 of Article 250 of the Tax Code of the Russian Federation).

By virtue of clause 6 of Art. 271 of the Tax Code of the Russian Federation under loan agreements or other similar agreements (including debt obligations issued by securities), the validity of which falls on more than one reporting (tax) period, income is recognized as received and is included in the corresponding income at the end of each month of the corresponding reporting month ( tax) period, regardless of the date (terms) of its payment stipulated by the agreement.

If a loan agreement or other similar agreement (including debt obligations issued by securities) stipulates that the fulfillment of an obligation under such an agreement depends on the value (or other value) of the underlying asset with the accrual of a fixed interest rate during the validity period of the agreement, income accrued on the basis of this fixed rate are recognized on the last day of each month of the corresponding reporting (tax) period, and income actually received based on the current value (or other value) of the underlying asset is recognized on the date of fulfillment of the obligation under this agreement.

Upon termination of the agreement (repayment of a debt obligation) within a calendar month, income is recognized as received. Accordingly, it is included in the relevant income on the date of termination of the agreement (repayment of the debt obligation).

Tax accounting of income in the form of interest under loan agreements, credit, bank account, bank deposit is carried out in accordance with Art. 328 Tax Code of the Russian Federation. The amount of income in the form of interest on debt obligations is determined based on the established yield and the validity period of such debt obligations in the reporting period. The date of receipt of interest paid by the bank under the bank account agreement, using the accrual method, is recognized as the last day of the reporting month. The basis for recognizing income is a bank statement.

A taxpayer who determines income using the accrual method must calculate the amount of income received (or to be received) in the reporting period in the form of interest on each type of debt obligation, based on the profitability established by the terms of the agreement and the validity period of such debt obligation in the reporting period, taking into account the provisions of paragraph 4 tbsp. 328 Tax Code of the Russian Federation. Recognition of such income is carried out monthly, regardless of the deadline for their payment, stipulated by the agreement, under which its validity period falls on more than one reporting (tax) period.

In analytical accounting, based on the data in the certificate drawn up by the accountant (or other responsible person entrusted with keeping records of income on debt obligations), the amount of interest determined in the manner established by clause 6 of Art. 271 Tax Code of the Russian Federation.

Interest income is reflected in non-operating income throughout the entire term of the agreement at the end of each month of use of the provided funds. In this case, it does not matter what exact conditions are specified in the agreement regarding the date of settlements for the amounts accrued during the period of use of interest (Letters of the Ministry of Finance of Russia dated 08/07/2015 N 03-03-06/2/45657, dated 02/02/2015 N 03- 03-06/1/3928, etc.).

If the taxpayer determines income and expenses using the cash method, then interest is recognized as received on the date of receipt of funds. The basis for recognizing such amounts as interest income is a bank statement on the flow of funds on the account.

Reflection of interest receivable in financial statements

Interest receivable is reflected:

on line 2320 “Interest receivable” of the Statement of Financial Results - if, in accordance with the areas of the company’s activities, such income is classified as other;

on line 2110 “Revenue” of the Statement of Financial Results - if, in accordance with the areas of the company’s activities, such income is recognized as income from ordinary activities.

Still have questions about accounting and taxes? Ask them on the accounting forum.

Interest.

If you are given a number B which is P percent of the number A and you need to find the value of the number A, then A = B · 100%P Formula for calculating the percentage of one number from another. If two numbers A and B are given and it is necessary to determine what percentage the number B is of the number A, then P = B · 100%A Formula for calculating a number that is greater than the original number by a given percentage. If a number A is given and you need to find a number B that is P percent greater than the number A, then B = A(1 + P)100% Formula for calculating a number that is less than the original number by a given percentage.

If a number A is given and it is necessary to find a number B that is P percent less than the number A, then B = A(1 - P)100% The formula for calculating the original number from the value of the number that is greater than the original by a given percentage. If

3.2.8.1. What is related to interest receivable?

Interest receivable by the organization includes (clause 7 of PBU 9/99, Instructions for the use of the Chart of Accounts):

- interest due to the organization on loans issued by it;

— interest and discount receivable on securities (for example, bonds, bills);

— interest on commercial loans provided by transferring an advance, prepayment, or deposit;

— interest paid by the bank for the use of funds located in the organization’s current account.

Interest is recognized as income for the expired reporting period in accordance with the terms of contracts (clause 16 of PBU 9/99).

Interest capitalization

With a regular deposit, the bank pays the accrued interest to the depositor monthly (or at other intervals stipulated by the terms of the agreement). This is called "simple interest." A deposit with capitalization (or “compound interest”) is a condition under which accrued interest is not paid, but is added to the deposit amount, thereby increasing it. The total income from the deposit in this case will be higher.

Using a deposit calculator, you can compare the results of calculating two identical deposits (with and without capitalization) and see the difference.