Property that the recipient is not obliged to pay for or return is considered to be transferred free of charge (clause 1 of Article 572 of the Civil Code of the Russian Federation).

Transfer property valued over RUB 3,000 free of charge. commercial organizations are prohibited. As for donations to non-profit organizations and citizens, there are no such restrictions. If the transaction amount exceeds 3,000 rubles, draw up a written gift agreement. If it does not exceed, the contract can be concluded orally. This procedure follows from Articles 574 and 575 of the Civil Code of the Russian Federation.

Accounting

Income from the gratuitous transfer of goods (materials) does not arise in accounting (PBU 9/99 and PBU 5/01). Other expenses take into account the cost of transferred goods (materials), as well as expenses associated with their transfer (clause 11 of PBU 10/99).

In this case, make the following entries:

Debit 91-2 Credit 41 (10)

– reflects the cost of goods (materials) donated free of charge;

Debit 91-2 Credit 10 (60, 69, 70, 76...)

– expenses associated with the free transfer of goods (materials), for example, for delivery, are taken into account.

Legal features of gratuitous transfer operations

Such a transfer of goods is actually a donation. The legislation prohibits the transfer of goods and materials in an amount exceeding 3,000 rubles free of charge to commercial companies, but there are no restrictions on the free transfer of property to citizens and non-profit enterprises. If the cost of the transferred goods exceeds 3,000 rubles. the transaction is formalized by a gift agreement (Articles 574, 575 of the Civil Code of the Russian Federation), and up to this value level, an oral agreement will also be valid.

The fact of transfer must be documented. Typically, companies develop a form of invoice or act (as an analogue of an acceptance/transfer act), enshrining them in their accounting policies.

BASIC: income tax

The cost of goods (materials) and expenses associated with their gratuitous transfer are not taken into account when calculating income tax (Clause 16, Article 270 of the Tax Code of the Russian Federation). This also applies to accrued VAT.

Due to differences in accounting and tax accounting, a permanent difference is formed, which leads to the emergence of a permanent tax liability (clauses 4 and 7 of PBU 18/02). It must be taken into account simultaneously with the write-off in accounting of the value of property and other expenses associated with the gratuitous transfer (clause 7 of PBU 18/02).

Do the following wiring:

Debit 99 subaccount “Fixed tax liabilities” Credit 68 subaccount “Calculations for income tax”

– a permanent tax liability is reflected.

This procedure follows from the Instructions for the chart of accounts.

Results

The gratuitous transfer of fixed assets is considered a receipt of assets if the organization is their recipient. In this case, correspondence is drawn up, the result of which is the inclusion of the amount of fixed assets received in the income of the enterprise.

If, on the contrary, an organization transfers an asset to someone, then for it it will be a disposal, which will subsequently be reflected in the accounts as a loss of the organization.

Accounting for gratuitous revenues in the budgetary sector differs from accounting for other enterprises and is regulated by its own legal regulations.

Sources:

- guidelines for accounting of fixed assets, approved. by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n

- chart of accounts, approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

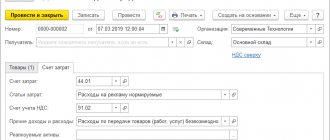

BASIS: VAT

The gratuitous transfer of goods (materials) is recognized as a sale (Clause 1, Article 39 of the Tax Code of the Russian Federation). Therefore, VAT must be charged on it (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). However, in some cases, the sale of goods (performance of work, provision of services) is not subject to VAT. For example:

- provision of free assistance in accordance with the Law of May 4, 1999 No. 95-FZ;

- transfer for advertising purposes of goods, the cost of acquisition (creation) of which, taking into account input VAT, does not exceed 100 rubles. for a unit.

For more information about this, see How to calculate VAT for the gratuitous transfer of goods, works, and services.

If the gratuitous transfer of goods (materials) is subject to VAT, make the following entry:

Debit 91-2 Credit 68 subaccount “VAT calculations”

– VAT is charged on the free transfer of goods (materials).

The amount of VAT accrued on the value of property transferred free of charge does not reduce the tax base for income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation).

Input VAT on costs associated with the transfer of goods (materials) should be deducted (clause 1 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation). Along with this, other conditions required for deduction must be met. In this case, do the wiring:

Debit 68 subaccount “VAT calculations” Credit 19

– accepted for deduction of input VAT on costs associated with the free transfer of goods (materials).

Reception and transfer of fixed assets and materials from institutions (Zernova I.)

Branches of law Analytical portal

- home

- News

- Branches of law

- Articles

- Contacts

Free legal consultation by phone:

- Moscow, Moscow region +7

- St. Petersburg, Leningrad region +7

- Federal number 8 ext. 141

Calls are free. We work seven days a week

Latest news: 01/09/2019

The bill amends Art. 4 of the Federal Law of July 19, 1998 No. 115-FZ “On the peculiarities of the legal status of joint-stock companies of workers (national enterprises)”, providing for the exclusion of references to the minimum wage, according to which the par value of one share and the minimum amount of the authorized capital of the national enterprises are established in their absolute size.

31.12.2018

In order to eliminate legal uncertainty in Art. 157 of the Housing Code of the Russian Federation, it is proposed to establish provisions clarifying the procedure for calculating the payment for utility services for heating in an apartment building, according to which, if there is a common building metering device and an individual metering device, the calculation of the amount of payment for utility services for heating should be carried out on the basis of the specified metering devices.

18.12.2018

The term “jurisdiction” is excluded from procedural legislation as a principle of delimitation of powers between courts of general jurisdiction and arbitration courts. Based on this, the bill proposes clause 1 of Art. Part 11 of the Civil Code of the Russian Federation shall be stated in a new edition, indicating that the protection of violated or challenged civil rights is carried out by a court, arbitration court or arbitration tribunal in accordance with their competence.

Latest articles: Register of unscrupulous suppliers: support for unscrupulous procurement participants and the fight against them in the legislation on the contract system and the practice of its application (Tasalov F.A.)

Article posted date: 01/09/2019

Features of taxation of transactions with electronic money in the Russian Federation (Babina K.I., Babayan Z.M.)

Article posted date: 01/09/2019

Responsibility of banking organizations to depositors for violation of the provisions of the bank deposit agreement, taking into account the amendments made to the Civil Code of the Russian Federation (Katvitskaya M.Yu.)

Article posted date: 01/09/2019

All articles Reception and transfer of fixed assets and materials from institutions (Zernova I.)

Date of article posting: 06.26.2015

Most often, an educational institution receives fixed assets and inventories (hereinafter referred to as property) from institutions subordinate to one main manager of budget funds (intradepartmental transfer), as well as from institutions subordinate to different main managers of budget funds of the same budget level (interdepartmental transfer). At the same time, an educational institution can act not only as a receiving party, but also as a transmitting party. How is the transfer and acceptance process carried out? What documents should be used to document these transactions? How to reflect the receipt and transfer of property in accounting? How to calculate depreciation on an incoming fixed asset? You will find answers to these and other questions in our article.

Legality of property transfer

According to Art. 296 of the Civil Code of the Russian Federation, state (municipal) institutions use the property assigned to them under the right of operational management in accordance with the goals of their activities and the purpose of this property within the limits established by law.

Let’s find out whether institutions have the right to independently dispose of material assets assigned to them under the right of operational management.

From paragraph 4 of Art. 298 of the Civil Code of the Russian Federation it follows that state institutions do not have the right to alienate or otherwise dispose of any property without the consent of its owner.

Autonomous and budgetary institutions cannot independently dispose of real estate and especially valuable movable property assigned to them by the owner or acquired using funds allocated to them for this by the owner. The remaining property that they have under the right of operational management, these institutions have the right to dispose of independently (clause 2, article 3 of Federal Law N 174-FZ <1>, clause 10, article 9.2 of Federal Law N 7-FZ <2>).

<1> Federal Law of November 3, 2006 N 174-FZ “On Autonomous Institutions”.

<2> Federal Law of January 12, 1996 N 7-FZ “On Non-Profit Organizations”.

For your information. Movable property is especially valuable, without which the institution will be difficult to carry out its statutory activities. The procedure for classifying property as particularly valuable is established by Decree of the Government of the Russian Federation dated July 26, 2010 N 538 in accordance with the requirements of clause 11 of Art. 9.2 of Federal Law No. 7-FZ and clause 3.2 of Art. 3 of Federal Law N 174-FZ.

Thus, the transfer of certain types of property must be agreed upon by budgetary and autonomous institutions with the founders.

Documentation of transfer (receipt) of property

In order to ensure timely and reliable reflection of business transactions (transaction results) in the accounting records, the institution must generate a primary accounting document at the time of their completion, and if this is not possible, immediately after the completion of the transaction (clause 9 of Instruction No. 157n <3>).

<3> Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of Russia dated December 1, 2010 N 157n.

A business transaction for the transfer (receipt) of property (requiring agreement with the founder) must be formalized by an administrative act (order) of the founder (founders) on the transfer (receipt) of property.

The direct transfer (receipt) of property by the transferring and receiving institution is formalized:

— act of acceptance and transfer of fixed assets (except for buildings, structures) (f. 0306001) (not issued for library collection objects);

— act of acceptance and transfer of groups of fixed assets (except for buildings, structures) (f. 0306031);

— act of acceptance and transfer of a building (structure) (f. 0306030) with the attachment, in cases specified by the legislation of the Russian Federation, of documents on state registration of rights to real estate or their copies, certified in the prescribed manner;

— act of acceptance of materials (f. 0315004);

— shipping documents, other primary accounting documents confirming the transfer (receipt) of material assets.

The transfer of the value of the property and the amount of accrued depreciation (if any) is formalized by a notice (f. 0504805), drawn up in two copies. One copy of the notice with the institution’s mark on receipt of the property is returned to the transferring institution.

Accounting for transactions involving the transfer (receipt) of Property

When transferring (receiving) a fixed asset in accounting:

- the transferring institution - you need to write off the book value of the fixed assets and the amount of previously accrued depreciation (clause 29 of Instruction No. 157n);

- the receiving institution - you need to register the fixed asset at the transferred book value and reflect in the accounting the amount of previously accrued depreciation.

The transferring party's inventories will be written off in accordance with the method adopted within the accounting policy for determining their value upon disposal, and the receiving party will take them into account at this cost.

We present in the table the main transactions for the transfer (receipt) of property.

| When transferring | Upon receipt | |||

| Debit | Credit | Debit | Credit | |

| State institutions | ||||

| Write-off (acceptance for accounting) of an object of fixed assets at a previously formed value received (transferred): | ||||

| a) from an institution subordinate to one main manager of budget funds (intradepartmental transfer): | ||||

| — on the book value of the fixed asset; | 1 304 04 310 | 1 101 xx 410 | 1 101 xx 310 | 1 304 04 310 |

| - the amount of accrued depreciation | 1 104 xx 410 | 1 304 04 310 | 1 304 04 310 | 1 104 xx 410 |

| b) from an institution subordinate to another main manager of budgetary funds of the same budget level (interdepartmental transfer): | ||||

| — on the book value of the fixed asset; | 1 401 20 241 | 1 101 xx 410 | 1 101 xx 310 | 1 401 10 180 |

| - the amount of accrued depreciation | 1 104 xx 410 | 1 401 20 241 | 1 401 10 180 | 1 104 xx 410 |

| Write-off (acceptance for accounting) of inventories written off (received): | ||||

| - from institutions subordinate to one main manager of budget funds; | 1 304 04 340 | 1 105 xx 440 | 1 105 xx 340 | 1 304 04 340 |

| - from institutions subordinate to different main managers of budgetary funds of the same budget level | 1 401 20 241 | 1 105 xx 440 | 0 105 xx 340 | 0 401 10 180 |

| Budget institutions | ||||

| Deregistration (acceptance for accounting) of an object of fixed assets at a previously formed value received (transferred) from state (municipal) institutions: | ||||

| — on the book value of the fixed asset; | 0 401 20 241 | 0 101 xx 410 | 0 101 xx 310 | 0 401 10 180 |

| - the amount of accrued depreciation | 0 104 xx 410 | 0 401 20 241 | 0 401 10 180 | 0 104 xx 410 |

| Termination (consolidation) of the right to operational management of material reserves upon their transfer (receipt) | 0 401 20 241 | 0 105 xx 440 | 0 105 xx 340 | 0 401 10 180 0 210 06 660 |

| Autonomous institutions | ||||

| Deregistration (acceptance for accounting) of an object of fixed assets at a previously formed value received (transferred) from state (municipal) institutions: | ||||

| — on the book value of the fixed asset; | 0 401 20 241 | 0 101 xx 000 | 0 101 xx 000 | 0 401 10 180 |

| - the amount of accrued depreciation | 0 104 xx 000 | 0 401 20 241 | 0 401 10 180 | 0 104 xx 000 |

| Termination (consolidation) of the right to operational management of material reserves upon their transfer (receipt) | 0 401 20 241 | 0 105 xx 000 | 0 105 xx 000 | 0 401 10 180 |

Example 1. On the basis of an administrative act between budgetary educational institutions subordinate to one main manager of budgetary funds, the acceptance and transfer of equipment purchased previously using targeted subsidies with a book value of 180,000 rubles was carried out. (especially valuable movable property). It is subject to depreciation in the amount of RUB 26,000. A notice and an equipment acceptance certificate have been drawn up. The equipment has been accepted for accounting. The host institution's equipment will be used to fulfill government assignments.

In accounting, these transactions will be reflected as follows.

| Debit | Credit | Amount, rub. | |

| In the records of the transferring institution | |||

| The following write-offs are reflected in the accounting records: | |||

| — book value of equipment; | 4 401 20 241 | 4 101 24 410 <*> | 180 000 |

| — accrued depreciation | 4 104 24 410 | 4 401 20 241 | 26 000 |

| In the records of the receiving institution | |||

| Acceptance of equipment reflected in accounting: | |||

| — by the amount of book value; | 4 101 24 310 | 4 401 10 180 | 180 000 |

| - the amount of accrued depreciation | 4 401 10 180 | 4 104 24 410 | 26 000 |

<*> Equipment paid for using targeted subsidies is accepted for accounting according to activity type code 4.

The transfer (receipt) of property can also occur between the head institution and its separate division, which is on an independent balance sheet. Depending on the type of institution, standard postings will look like this.

| When transferring | Upon receipt | |||

| Debit | Credit | Debit | Credit | |

| Transfer (receipt) between the head office and a separate division: | ||||

| a) basic funds: | ||||

| — on the book value of the fixed asset; | 0 304 04 310 | 0 101 xx 410 (000) <*> | 0 101 xx 310 (000) | 0 304 04 310 |

| - the amount of accrued depreciation | 0 104 xx 410 (000) | 0 304 04 310 | 0 304 04 310 | 0 104 xx 410 (000) |

| b) inventories | 0 304 04 340 | 0 105 xx 440 (000) | 0 105 xx 340 (000) | 0 304 04 340 |

<*> (000) - in the accounting of autonomous institutions.

Example 2. A branch of an autonomous institution received a notice of the transfer from the head institution of material reserves (referring to other material reserves - other movable property) acquired using funds from income-generating activities. The branch is vested with the powers of a legal entity and maintains an independent balance sheet. Attached to the notice was an acceptance certificate for materials in the amount of 48,000 rubles. Inventories are intended for use in income-generating activities.

In accounting, the transfer (receipt) of inventories will be reflected in the following entries:

Documents required for registration

When going to a notary to conclude one of these types of contracts, representatives of organizations need to prepare the following documents:

ATTENTION! Check the list of documents that will be needed in your particular case: the list may differ from one notary to another, and for some categories of gifts, special papers are sometimes required.

How to register the transfer of goods between your own legal entities

Although, this raises a large number of disputes and various issues in the field of taxation, including the collection of VAT.

There is a widespread belief that gifts between legal entities are prohibited. This statement is not entirely correct. Subp. 4 paragraphs 1 art. 575 of the Civil Code of the Russian Federation (hereinafter referred to as the Code) contains a provision that donations between commercial organizations are prohibited.

If the acceptance rules and deadlines are violated, trade organizations are deprived of the opportunity to make claims to suppliers or transport organizations in the event of a shortage or reduction in the quality of goods.

The ban in question is explained by the fact that the main purpose of the activities of commercial organizations in accordance with paragraph 1 of Art. 50 of the Code is profit-making. The gratuitous alienation of the property of a legal entity is directly opposite to this goal and excludes the receipt of any income.

Acceptance of goods at the supplier's warehouse is carried out by the financially responsible person by proxy. If the goods are in undamaged containers, then acceptance can be carried out by the number of pieces, gross weight or by the number of trade units and markings on the container. If the actual presence of the goods in the container is not checked, then it is necessary to make a note about this in the accompanying document.

It is expected that the production of a new type of product will begin. In this regard, it is planned to provide our own customers with samples of new products on a non-refundable basis. VAT is paid on this transaction. The cost of the transferred products can be more than 3,000 rubles.

What can be donated?

Objects for gratuitous transfer may be:

- securities;

- intangible assets of the organization;

- goods;

- finished products;

- materials, raw materials;

- equipment, tools;

- real estate objects or the right to use them;

- vehicles;

- money in cash or non-cash form, as well as repayment of the financial obligations of the recipient.

IMPORTANT! If taking possession of the transferred property involves registration, for example, we are talking about a car or real estate, then the recipient party must register this property for themselves, and only then will a change of owner occur.

Accounting for exhibition samples

Samples are usually used during exhibitions. Let's consider all the wiring that is used when exhibiting products at exhibitions:

- DT41-5 KT41-1. Transfer of products for display at the exhibition. Primary document (hereinafter referred to as PD): invoice.

- DT41-1 KT41-5. Transfer of samples to the warehouse after the end of the exhibition. PD: invoice.

- DT91-2 KT14. Formation of a reserve to reduce the cost of the demonstration model. PD: product assessment report, order to reduce the cost, certificate of calculation.

- DT62 KT90-1. Recognition of sales revenue. PD: waybill.

- DT90-3 KT68. VAT accrual on sales. PD: invoice.

- DT90-2 KT41-1. Write-off of actual cost. Basis: accounting certificate.

- DT14 KT91-1. Reinstatement of the reserve for depreciation. Reason: reference-calculation.

Selling samples is the most reasonable solution, as it allows the company to reduce costs.