Income of an individual in the form of material benefits is taken into account when determining the tax base for personal income tax along with other income of the taxpayer (clause 1 of Article 210 of the Tax Code of the Russian Federation). The specifics of determining the tax base when receiving income in the form of material benefits are established by Article 212 of the Tax Code of the Russian Federation. So what is “material benefit”, when and in what form does it arise, what should tax agents do, and what should taxpayers who receive it do?

We will answer these and some other questions in this article. In addition, the requirements of current legislation applicable to tax agents and individual taxpayers regarding the taxation of material benefits will be considered.

What is it and when does it occur

Material benefit under a loan agreement is the amount generated when signing an agreement on an interest-free or preferential loan, calculated as the borrower saving money on interest payments. Of this, 35% is paid as personal income tax, which has been approved since the beginning of the 90s.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 110-43-85 (Moscow)

+7 (812) 317-60-09 (Saint Petersburg)

8 (800) 222-69-48 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The reason for introducing such a norm into legislation was the policy of some companies to evade paying taxes: processing salaries in the form of interest-free loans, signing loan agreements for relatives, etc.

Saving money when applying for a loan in national currency can occur when:

- interest-free loan;

- a loan with interest less than 2/3 of the bank refinancing rate in a given territory.

When borrowing in foreign currency, profit arises during an interest-free agreement and an agreement with a rate of less than 9% per annum.

Material benefits can only arise from monetary loans. In the case of a property loan, it is not determined.

To ensure that the provision of a service such as an interest-free or preferential loan does not cost the borrower more than a loan with regular interest, you need to know how the material benefit and the tax on it are calculated.

Interest-free loan in kind: taxation

An employee’s knowledge book can be issued to the company’s goods, materials, fixed assets, etc. The things transferred must be defined by generic characteristics, that is, they cannot be unique with specific characteristics that only they have. A non-monetary loan can be repaid in money or the same things. The main qualities of the transferred items should be indicated in the contract (name, grade, quantity, size, etc.) so that the borrower returns the corresponding property.

When issuing this type of work permit, the employer must take into account some taxation nuances. As for income tax, the transfer of money or things as a loan is not considered an expense (clause 12 of Article 270 of the Tax Code of the Russian Federation), and repayment of the loan is not considered income (clause 10 of Article 251 of the Tax Code of the Russian Federation). Cash loans are not subject to VAT (subclause 15, clause 3, article 149 of the Tax Code of the Russian Federation). Under a non-monetary loan agreement, the employer's property becomes the property of the employee. In paragraph 1 of Art. 39 of the Tax Code of the Russian Federation, the sale is equated to the transfer of ownership of things, and, according to subparagraph. 1 clause 1 art. 146 of the Tax Code of the Russian Federation, the sale is called an object for VAT. Therefore, the transfer of things under the BZ agreement is subject to VAT. The price of the transferred property is determined as the current market price. When calculating such VAT, the employer has the right to deduct the corresponding input VAT that he paid when purchasing valuables transferred under the BZ.

Example 2

01/01/2020 V. A. Sokolov received ceramic tiles produced at the Voskhod LLC enterprise, where he works, as a BZ. The cost of the tiles was 135,000 rubles. without VAT. The loan term is 1 year. The employer must pay VAT to the budget in the amount of 135,000 rubles. × 20% = 27,000 rub.

Calculation

Material benefits arise from the date of payment of interest on the loan (with a preferential loan). When concluding an interest-free agreement, the date of formation of the material benefit is not established by the Tax Code.

Therefore, you can choose one of the options:

- the moment of full or partial repayment of the loan;

- daily throughout the tax period;

- end date of the contract;

- last day of the tax period.

For each loan option, the amount of material benefit is calculated separately.

Calculation of material benefits for an interest-free loan

The material benefit under an interest-free loan agreement is calculated at the bank refinancing rate at the time of loan repayment. When repaying the debt in parts, this amount is calculated separately at each time the payment is made.

Formally, material benefit (MB) can be expressed as follows:

MV = PS x NW / 365 d. x SK,

Where:

PS – marginal refinancing rate (2/3); SZ – loan amount; SC – loan term, days.

It is also worth taking into account that when a loan is repaid on the last day of the contract, the material benefit arises only in the month of repayment and is accrued on the entire loan amount.

For a loan with a preferential interest rate

Determining the material benefit for a loan with a preferential interest rate (below two-thirds of the refinancing rate) is carried out almost in the same way as for an interest-free loan, only the difference of 2/3 of the bank’s rate with the contract rate (SD) is taken as interest:

MV = (PS-SD) x SZ / 365 d. x SK

On an interest-bearing loan at an enterprise

The company has the right to issue loans to its employees at interest rates that are lower than bank interest rates.

If the organization’s interest rate is less than two-thirds of the refinancing rate, then the resulting difference is a material benefit for the borrower, which must be subject to personal income tax - 35% of the benefit amount. Most often it is deducted from your salary.

Results

Material benefit is the income of an individual, subject to personal income tax in a special manner, using special tax rates.

Tax must be calculated on each last day of the month. This is done by the tax agent. He also transfers the tax to the budget or informs the taxpayer and tax authorities about the impossibility of withholding. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Material benefit from a loan in foreign currency

When the interest rate on a foreign currency loan is below 9% per annum, the resulting difference is a material benefit. According to the law, income in foreign currency must be converted into rubles at the rate at which this income was received. That is, on the day the loan or part thereof is repaid.

To calculate the material benefit of a foreign currency loan, you must have data on:

- loan amount;

- interest rate;

- days (actual) of use of borrowed money;

- tax period;

- exchange rate of the Bank of Russia on the date of receipt of income.

Calculation of material benefits under a loan agreement can be calculated using the formula:

MV = SZ x CV x (9%-PZ) / 365 d. x SK,

Where:

MB – material benefit; SZ – loan amount; KV – exchange rate on the date of receipt of the benefit; PZ – loan interest; SC – loan term, days.

With an interest-free loan, the formula will be almost the same:

MV = SZ x CV x 9% / 365 d. x SK

That is, personal income tax should be paid at 9% per annum of the loan amount on the date of partial or full repayment.

The classification of government loans can be seen in the table in the article: classification of government loans. How to apply for a loan on a card instantly, around the clock and without refusal, read here.

An interest-free loan was issued: accounting

Let's consider what entries an accountant should make for an interest-free loan to an employee. For settlements of loans to employees, the chart of accounts approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 200 No. 94n provides for account 73.

| Description | Dt | CT | Documentation |

| Posting for issuing an interest-free loan to an employee in cash | 73.1 | 50 (51) | Expenditure cash order (payment order, bank statement) |

| Posting for repayment of cash balance by employee | 50 (51) | 73.1 | Receipt cash order (payment order, bank statement) |

The financial investment account is not used in transactions for interest-free loans issued to employees; this is indicated in the instructions for the chart of accounts for account 58. It is also necessary to pay attention to the reflection of transactions for personal income tax, which must be paid if the employer does not charge interest on the loan. Read more about personal income tax in the following sections.

| Description | Dt | CT | Documentation |

| Personal income tax withheld from income from non-payment of interest on the loan | 70 | 68 | Tax registers |

| Personal income tax is transferred to the budget | 68 | 51 | Payment order, bank statement |

Buying a home

In Art. 212 of the Tax Code of the Russian Federation defines the concept of material benefit and cases of its accrual, the exception of which is interest savings on a loan issued for the construction or purchase of housing, acquisition of land, etc.

In other words, the financial benefit from a home loan is not subject to taxation.

But the borrower must have an approved document that will indicate his right to deduct property. This form is approved by law and is mandatory.

Without this document, a loan is considered simply a cash loan and income tax will be charged on it.

From the date the lender provides the property right, no material benefit will arise, therefore the tax will not need to be paid according to the rules of an interest-free or preferential loan.

But organizations are recommended to withhold tax until receiving a notification from the borrower, since the start of the benefits is the day when he submits documents to the tax office, and it takes 30 days to issue a notification.

Therefore, in order not to submit an application for a tax refund from the budget, you should not rush to deduct it.

Deadlines for payment of personal income tax by a tax agent

Next, we will note when a tax agent should pay personal income tax in 2021 in the most common situations.

- Advance and salary for the second half of the month - the day following the day of payment of salary for the second half of the month.

- Bonus – the day following the day of its payment.

- Vacation pay is the last day of the month in which they are paid.

- Sick leave is the last day of the month in which they are paid.

- Payments upon dismissal, including compensation for unused vacation and salary - the day following the last day of work.

- LLC dividends – the day following the day of their payment.

- Payments under GPC agreements (contract, provision of services) - the day following the day of payment of any income under the agreement, including advance payment.

- Material assistance and other cash income - the day following the day of payment.

- The material benefit from saving on interest is the day following the next cash payment after calculating the personal income tax from the financial benefit.

If personal income tax payment deadlines are violated in 2021, penalties will be charged for each day of delay. To avoid such costs, it is important to be aware of payment dates and adhere to them. See the table for the deadlines for paying personal income tax on different types of income of individuals: wages, vacation pay, sick leave benefits and other payments.

Material benefit is a benefit in monetary or in-kind form that can be assessed and defined as income in accordance with the tax legislation of the Russian Federation.

Material benefits are generated when receiving loans (credits) from individual entrepreneurs and organizations at a low interest rate, when purchasing goods (works, services) under civil contracts from individuals, individual entrepreneurs and organizations that are interdependent in relation to the purchasing organization, as well as when purchasing securities at prices below market prices.

Thus, a material benefit arises in situations where an individual acquires ownership of something on more favorable terms than the established conditions for all other buyers or consumers.

Material benefits are subject to personal income tax.

Loan to an employee, individual

An organization that issues a loan to its employee without interest or on preferential terms becomes his tax agent. It calculates the material benefit to the borrower, withholds personal income tax on it and transfers this money to the budget.

The employee receives a material benefit with each loan payment and can be either once a month or one-time when the entire amount of the debt is repaid.

If during one tax period (1 year) there were no loan payments, then no material benefit arose.

The lending company most often withholds personal income tax from the employee’s salary, but this amount should not exceed 50% of the payment amount.

As a tax agent, the lending organization keeps records of the funds issued in the employee’s tax register, and also provides it to the tax authorities within the period established by law.

The only difference when issuing a loan to an employee and an individual who is not an employee of the company is that personal income tax can be withheld and paid to the budget only from the employee. This is also shown differently in accounting.

The issuance of a loan to an employee is carried out in account 73: debit 73-1 credit 50 (51), and return - vice versa. Interest on the loan is indicated in the credit account 91-1. A loan to an individual is a financial investment, since it brings economic profit to the enterprise, therefore it should be recorded in subaccount 58-3.

Interest on the loan is posted through debit 76 credit 91-1. Interest-free loans are not investments, so they are shown in account 76.

Deadline for payment of personal income tax on wages in 2021

Personal income tax should be withheld from your salary when it is actually paid. On the same day you can pay personal income tax to the budget. The deadline for paying personal income tax in 2021 on wages is the day following the day of payment of wages (clause 6 of Article 226 of the Tax Code of the Russian Federation).

As a general rule, there is no need to withhold and pay tax on advance payments to the budget in 2019 (letter of the Ministry of Finance of Russia dated July 22, 2015 No. 03-04-06/42063 and the Federal Tax Service of the Russian Federation dated January 15, 2016 No. BS-4-11/320). But there is an exception. If the advance was issued on the last day of the month, then you must pay personal income tax on the advance no later than the next day. Then, when the second part of the salary is paid, the remaining tax for the month worked should be transferred. The Supreme Court came to this conclusion in its ruling dated May 11, 2016 No. 309-KG16-1804.

Between legal entities

If an interest-free loan agreement is concluded between legal entities, then the borrowing organization does not pay tax, since it does not have a material benefit.

This comes out of ch. 25 of the Tax Code of the Russian Federation, which indicates all types of income subject to taxation, among which there is no material benefit when concluding an interest-free or preferential loan agreement. Therefore, the borrower does not need to pay interest.

When a legal entity is a UTII, its taxation is determined by local authorities, which can tax certain areas of activity. But even in this case, the material benefit from the loan cannot be subject to taxation.

The lending organization, according to the law, is not subject to VAT when issuing a loan, as specified in Art. 149 of the Tax Code of the Russian Federation. All funds given or received from the loan account are not taken into account as expenses or income of the lender, and therefore are not subject to tax.

The interest that the borrower pays for using the loan is considered non-operating income of the organization. Each loan must be accounted for separately, and the interest on it is included in the list of monthly income.

If the debt is repaid ahead of schedule or upon expiration of the contract, income is taken into account on the date of repayment.

When the loan is returned to the company's cash desk, interest income is accrued immediately.

Interest-free loan: basic provisions

The issuance of interest-free loans to employees is regulated by the Civil Code, namely the 1st paragraph of Chapter 42. The subject of the loan can be both money and things. In this case, an agreement must be concluded in writing between the employer and the employee (Article 808 of the Civil Code of the Russian Federation). The contract must state that the loan is interest-free. Otherwise, the default interest rate will be equal to the refinancing rate (Article 809 of the Civil Code of the Russian Federation). However, there are exceptions. If the agreement of the parties does not contain a word about interest, then the loan will be considered interest-free when:

- the agreement was concluded between citizens for an amount less than or equal to 50 minimum wages, not for business purposes;

- Things are given on loan.

In addition, the contract must specify the return period. If such a date is not specified, the borrower must be prepared to repay the debt within 30 days after receiving a request to do so. Also, at his discretion, an employee can repay an interest-free loan (hereinafter referred to as the LO) ahead of schedule.

Personal income tax

The calculation of personal income tax for material benefits from saving money on interest on a loan is determined by Art. 212 of the Tax Code of the Russian Federation.

This income is taxed at the rate:

- 35% when the borrower is a tax resident of the Russian Federation;

- 30% when the borrower is not a tax resident of the Russian Federation.

A tax resident is considered to be an individual who stays in Russia for at least 183 consecutive days per year.

When a loan is issued by an organization to its employee, the amount of personal income tax from the material benefit received is automatically withheld from each salary and transferred to the budget.

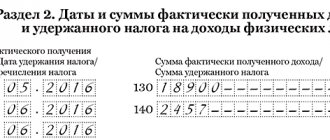

But this amount should not be more than 50% of the payment itself (salary). In the 2-NDFL certificate, this tax from material benefit is carried out through code 2610. The certificate is submitted to the Federal Tax Service within the time limits established by law.

When providing a loan to a non-employee of the organization, a 2-NDFL certificate is drawn up without deduction of funds and transferred to the Federal Tax Service and the borrower.

In this case, you need to notify the tax authority in advance that personal income tax is not collected from the borrower, and the borrower that he needs to pay tax.

Personal income tax can be calculated using the formula: personal income tax = financial benefit x tax percentage. If the debt is forgiven, then this amount is fully included in the individual’s income and is taxed at 13%.

Also, material benefits in some cases are not taxed, as indicated in Art. 212 of the Tax Code of the Russian Federation. This always applies when issuing a loan to a legal entity.

Material benefits from a loan to an individual are not subject to personal income tax in the following cases:

- for housing construction;

- for the purchase of a residential property or part of it (house, apartment, room, etc.);

- for the full or partial acquisition of land for the construction of a residential property;

- for the purchase of a plot with a residential building;

- for refinancing loans that were issued for the construction or purchase of a residential property, land for building a house, land with a house, shares in construction, etc. In this case, the bank providing the initial loan must be located on the territory of the Russian Federation.

In order to confirm the purpose of his loan, the borrower must provide the lender with a document certifying his right to a tax deduction in connection with the purchase of housing or a plot for its construction.

Until this moment, the organization withholds tax on its material profits. As soon as the borrower contacts the tax service to obtain an identification document, he must inform the lender about this, since personal income tax ceases to be calculated from the moment of application. The document itself is issued only 30 days after application.

The financial benefit of a loan is the amount of money that the borrower saves on interest payments. With an interest-free loan, it is equal to two-thirds of the refinancing rate of the Bank of Russia, and with a preferential loan, it is equal to the difference between these 2/3 and the interest on the loan (if it is lower).

A loan in foreign currency implies a material benefit if the interest on it is less than 9% per annum, and when calculating the benefit, the amount received is converted into rubles at the current exchange rate at that time.

If a loan is issued to a legal entity, there is no material benefit from it. In other cases, personal income tax is withheld from the amount of economic benefit in the amount of 35%.

If a loan was issued by an organization to its employee, then personal income tax is deducted from the salary, and when a loan is issued to another individual, he must pay the tax himself.

What is the possible maximum amount for an interest-free loan between legal entities is described in the article: interest-free loan between legal entities. To draw up a subordinated loan agreement without errors, see the sample.

Find out about the agreement to terminate the loan agreement on the page.

Responsibilities of taxpayers.

If an individual taxpayer receives material benefits in the form of:

- Savings on interest

- Related to the acquisition of goods (works, services) from interdependent persons,

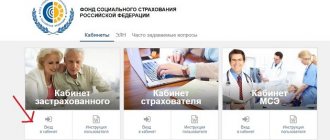

in the process of relations with credit organizations of which he is not an employee, such credit organization, no later than one month from the end of the year in which the material benefit was received, reports in writing:

- To the taxpayer,

about the impossibility of withholding tax and the amount of tax in accordance with clause 5 of Article 226 of the Tax Code of the Russian Federation.

Accordingly, the taxpayer must independently fill out and submit to the Federal Tax Service at the place of residence (place of registration) a declaration in form 3-NDFL.