New reporting form for employees to the Pension Fund of the Russian Federation using the SZV-M form

• Download the current version of the SZV-M form.• See sample filling below.

Starting from 2021, employers must submit monthly reports to the Pension Fund for employees using the new form SZV-M (Federal Law No. 385-FZ dated December 29, 2015). This type of reporting is intended to monitor the payment of pensions to working pensioners. But at the same time, the form is submitted to absolutely every employee.

SZV-M what kind of reporting is this?

Let's look at what SZV-M is in more detail.

This reporting form was introduced by the Pension Fund of the Russian Federation as the main source containing current information about people employed at the enterprise in the current month. The main purpose of the report is to timely inform this body whether retired citizens are working or not, since according to the new legislation, indexation of pension benefits for working pensioners is not allowed.

As soon as they stop working, indexation resumes. Therefore, the SZV-M report submitted by employers determines the month from which the pension must be recalculated. Now pensioners do not need to independently contact the Pension Fund to resume indexation.

Attention! This report also reflects not only working retirees, but also all other employees of the organization. For them, basic registration data is checked. This form is monthly and should be completed immediately after the end of the reporting period and sent to the Pension Fund.

What consequences may there be when clarifying SZV-M?

As we have already said, for untimely submission of the original (primary) SZV-M, liability is established in the form of a fine: 500 rubles for each employee about whom information was not provided. The same fine is provided for the provision of incomplete and (or) false information (Article 17 of the Federal Law of April 1, 1996 No. 27-FZ).

Note that some territorial divisions of the Pension Fund of the Russian Federation believe that policyholders who supplement or cancel SZV-M are required to submit no later than the established deadline for submitting reports for the reporting period. If you submit reports later, there will be a fine: 500 rubles for each “physicist” for whom the information was unreliable. This is reported, in particular, by the OPFR for the Tver region on the PFR website.

Let's return to our example, when the accountant submitted a supplementary form on March 20, 2018, that is, after the deadline for submitting information for February 2021 (after March 15, 2021). According to the logic of representatives of the Pension Fund of Russia, the policyholder in this case should be fined 500 rubles. But why? After all, the accountant independently discovered the error and took measures to correct it. The territorial body of the Pension Fund of Russia did not reveal any errors or inaccuracies. Why, then, should the policyholder be held accountable for such actions? There is no official explanation from the Pension Fund on this matter. However, in our opinion, in order to avoid disputes with the territorial bodies of the Pension Fund of the Russian Federation, it makes sense to submit clarifying or canceling SZV-M reports better before the deadline for submitting reports for the current month. That is, for example, it is better to clarify the February 2018 SZV-M report no later than March 15, 2021.

Read also

20.11.2017

Who should submit the SZV-M form

The new form SZV-M is submitted by all business entities if they had valid labor agreements with employees over the past month. Thus, the report must include information on all individuals on a monthly basis, and this must be done both with employment contracts and agreements for contract work.

The form is not allowed to be provided to entrepreneurs who operate independently and do not have employment contracts with third parties. Such individual entrepreneurs are not registered with the Pension Fund and Social Insurance Fund as employers.

Attention! If the organization did not conduct any activities over the past month and did not make contributions to funds for its employees, the SZV-M form must still be submitted. However, in this case, there is one exception - if the sole founder acts as a director, and an employment contract has not been concluded with him, then such a company is also exempt from submitting the form.

SNILS is missing

A person starting work for the first time in his life may not have SNILS. In this case, you, as an employer, have the obligation to issue an insurance certificate to this employee within 2 weeks from the date of conclusion of the contract (clause 9 “Instructions ...", approved by order of the Ministry of Health and Social Development of Russia dated December 14, 2009 No. 987n).

If by the time you fill out the SZV-M form, the insurance certificate of the new employee has not yet been received, then include the data of this employee in the report without indicating SNILS. But, because This document will not be accepted in electronic form with an empty SNILS, then you must write a letter to the Pension Fund explaining the reasons for the absence of SNILS. Only then, when you have SNILS in hand, fill out a new sheet of the form for this employee with the note “supplementary” in column “3. Form type."

Do I need to provide a form upon dismissal?

The law establishes that upon dismissal, an employee must receive a copy of the SZV-M report. It will confirm the fact of the employee’s work and the accrual of contributions to him, regardless of what contract was signed with him. The document must be issued in any case, even if the dismissed person worked for only one day.

Form SZV-M, when sent after a month, contains data on all employees of the company. Since they are personal data, when handing over the report to the person leaving, you need to make an extract, i.e. leave him alone. There are fines for the employer for disclosing personal data.

The certificate must be issued in person on the final day of work. It should be noted that there is no penalty for SZV-M for failure to issue it. According to the Civil Code, an employee can sue the company for compensation for moral damage because he did not receive the required documents. However, in practice no one does this.

Attention! Many people do not know for what period a SZV-M must be issued when an employee is dismissed. The number of certificates handed over must be equal to the number of months that the employee has worked.

After the documents are issued, the employee must provide written confirmation of their receipt.

Deadlines for adjusting reports in 2018

Next, we will explain about the timing of updating the SZV-M in 2021. Let us recall that there are several types of SZV-M form:

- “iskhd” (initial) – a report submitted for the first time;

- “additional” (supplementary) – a report that allows you to supplement previously submitted and accepted information;

- “cancel” (cancelling) – if you need to cancel previously incorrectly submitted information.

Everything is clear with the initial forms of SZV-M (primary). In 2021, they must be submitted no later than the 15th day of the month following the reporting month. However, the legislation does not stipulate anything about the deadlines for submitting supplementary or canceling forms. But what is the timeframe for updating the SZV-M reports? Let's try to figure it out with an example.

Example.

The organization passed SZV-M for February 2021 on March 12, 2021. However, on March 19, 2021, the accountant independently discovered that the report mistakenly did not include one person who was hired at the end of February 2018 under an employment contract. In this regard, on March 20, 2021, the accountant submitted a SZV-M report with the “additional” type to the Pension Fund of Russia and supplemented the already submitted report with information in the accepted employee.

Note that there are no restrictions on the deadlines for submitting supplementary and repealing SZV-M in the legislation. That is, the accountant can submit clarifying and canceling information at any time when he deems it necessary. However, we recommend that you take into account important points related to the possible occurrence of liability.

Where to submit reports

Companies and individual entrepreneurs must send a report to the Pension Fund of Russia at the place where they are registered as an employer. This means that firms report according to their location, and entrepreneurs according to their registration.

In addition, the law establishes that individual divisions and branches must submit reports separately from their parent companies. In this situation, they indicate the TIN code of the head unit on the form, and the checkpoint code - their own.

You might be interested in:

Information on the average number of employees: sample filling, form

Where are the reports submitted?

Entrepreneurs and companies must submit the completed report to the Pension Fund body that registered them as an employer. Thus, the company must report at its location, and the individual entrepreneur must report at its registration.

Also, according to the rules, if an organization has divisions or branches, then they are required to draw up a form and send it separately from the parent companies. Moreover, when filling out the document, they enter the TIN of the parent organization, and the checkpoint code - already assigned directly to them.

Reporting methods

The SZM form can be sent to the pension authority in two forms - paper and electronically.

However, not every business entity can choose how to report to it - it all depends on the number of registered entities:

- Electronically - this is how all companies and entrepreneurs with more than 25 employees must submit. The report must be signed with a digital electronic signature and submitted to the Pension Fund via the Internet. There is a fine for incorrect delivery;

- On paper, either in person or by mail - this can only be submitted if the business entity has an average headcount of 24 people or less.

Method of submitting reports in 2018

In 2021, the following rule applies: if 25 or more “physicists” are included in the SZV-M report for the next month, then the policyholder (organization or individual entrepreneur) is obliged to transmit the reports via the Internet as an electronic document signed with an enhanced qualified electronic signature. If there are less than 25 people in the report, then the submission of a “paper” report is allowed (paragraph 3, paragraph 2, article 8 of the Federal Law of April 1, 1996 No. 27-FZ). At the same time, for electronic and paper SZV-M, the deadlines for submitting SZV-M in 2021 are the same. Information must be submitted no later than the 15th day of the month following the reporting month (regardless of the method of submission).

Deadline for submitting the SZV-M form in 2019

The law sets the deadline for submitting the SZV-M - before the fifteenth day of the month following the month of the report.

In addition, according to the generally accepted rule, if the day of the report falls on a weekend or holiday, then the deadline for transmitting the document is moved forward to the next working day.

In addition, the law does not prohibit sending a report a month before it is completed. However, it is necessary to understand that during the remaining days no employment agreement or contract should be concluded.

Attention! If changes occur, then it will be necessary to send a corrective report, and if this is not done, then fines may be imposed on the business entity for submitting false information. Therefore, it is better to submit the form at the end of the month.

SZV-M deadlines for 2021 are as follows:

| Period | Due dates |

| -for December 2021 | 15.01.2018 |

| -for January 2021 | 15.02.2018 |

| -for February 2021 | 15.03.2018 |

| -for March 2021 | 16.04.2018 |

| -for April 2021 | 15.05.2018 |

| -for May 2021 | 15.06.2018 |

| -for June 2021 | 16.07.2018 |

| -for July 2021 | 15.08.2018 |

| -for August 2021 | 17.09.2018 |

| -for September 2021 | 15.10.2018 |

| -for October 2021 | 15.11.2018 |

| -for November 2021 | 17.12.2018 |

| -for December 2021 | 15.01.2019 |

Due dates

It must be submitted monthly no later than the 15th of the next month. The due dates for 2021 are as follows:

- December 2021 — From January 1 to January 15, 2018

- January 2021 - From 1 to 15 February 2018

- February 2021 — From March 1 to March 15, 2018

- March 2021 - From April 1 to April 16, 2018

- April 2021 — From May 1 to May 15, 2018

- May 2021 - From 1 to 15 June 2018

- June 2021 — From July 1 to July 16, 2018

- July 2021 - From 1 to 15 August 2018

- August 2021 — From 1 to 17 September 2018

- September 2021 - From 1 to 15 October 2018

- October 2021 - From 1 to 15 November 2018

- November 2021 — From December 1 to December 17, 2018

- December 2021 — From January 1 to January 15, 2019

The fine for failure to submit reports is 500 rubles (for each employee).

The fine for providing false information is 500 rubles (1 document).

Who exactly submits this form? These reports are submitted by those who are registered with the Pension Fund as an employer. An organization (including a foreign one operating in the Russian Federation) or an individual entrepreneur becomes an employer when an individual. the person has concluded at least one employment or civil law contract (GPC). It is important to remember that:

1) If an employee was hired on the last day of the reporting month, he must also be included in the SZV-M.

2) The report also includes those who are on leave without pay or to care for a child, provided that the previously concluded employment contract continues to be in force with these persons.

IMPORTANT POINT: if there are employees, but wages for the reporting month were not paid to anyone, the SZV-M form still needs to be submitted. Section 4 of the form itself (in small print) states that it includes employees with whom in the reporting month they were contracted, continue to work, or were terminated:

- employment contracts; civil law contracts (GPC), the subject of which is the performance of work and provision of services;

- copyright contracts;

- agreements on the alienation of exclusive rights to works of science, literature, and art;

- publishing licensing agreements;

- licensing agreements granting the right to use works of science, literature, and art.

Sample of filling out the SZV-M form

To fill out the form, you can use special computer programs or online reporting services.

The SZV-M form includes four sections.

Section 1

All information about the subject who sends the form to the authority is recorded here. Here you need to enter the registration number of the company or entrepreneur in the Pension Fund, full name or full name. according to the constituent documents, assigned TIN and KPP codes (the entrepreneur does not have a KPP code).

Section 2

This section is small - here you need to enter the reporting period code and the four-digit year number. Both of these fields are required. The period number is the serial number of the month in the year. Just in case, there is a hint on this issue below on the form.

Section 3

This section contains a column in which you need to determine the type of form.

It can take one of three values:

- ISHD - initial, a report with data is submitted to the Pension Fund for the first time;

- Additional information - supplementary, contains new information that must be added to the previously submitted original form. This status must be used if, for example, some employee’s data from the original report needs to be corrected, or another “forgotten” employee needs to be added. In the latter case, the form sent must contain information only on it alone.

- OTMN - canceling; this status must be assigned if information on a certain employee needs to be removed from the original report. The document includes only rows with those employees that need to be canceled.

Section 4

It includes a four-column table. The first column of the table contains the row number in order. In the second - full name. employee. The third and fourth are the TIN and SNILS codes of this employee.

The filling rules stipulate that if any of these codes are unknown, then the field can be left blank without striking through.

Attention! This table must include all employees with whom the business entity had valid employment agreements in a given month, including those who were hired, fired, were on vacation or took sick leave during this period. Also here you need to record those who entered into a contract, from the price of which the business entity calculated and sent contributions.

You might be interested in:

SZV-STAZH: who should take it, in what time frame, sample filling

The completed document is signed by the head of the company or the entrepreneur personally, indicating the position of the person and the date of registration. Also, if there is a seal, it is necessary to put its imprint.

Based on the fact that the document does not provide space for information about the submission of the report by a representative, it can only be submitted personally by the manager.

What to pay attention to when generating a report for September 2021

Let us explain a number of points that usually cause difficulties for employers:

- In SZV-M for September 2021, include only those persons whose payments are subject to pension insurance. If, for example, an organization enters into a contract for the sale or lease of property with an individual, then there is no need to enter this person’s data into SZV-M.

- The design of the form is based specifically on the contracts in force in September 2018. The presence of payments on them in the same period does not matter. It also does not matter how many days during September the contract was in force. Even if we are talking about only one day, the employee must still be included in the report. But if in the reporting period there were only payments, and the agreement has already ceased to be valid, then there is no need to include the payee in the SZV-M.

- If employees are absent from work for any reason (long business trip, vacation, maternity leave), but contracts with them are valid in the month of September, information about such persons should also be entered into the form.

- The zero SZV-M form is not taken. If an individual (individual entrepreneur, lawyer, notary) does not have employees and does not enter into civil agreements with other individuals, then he has no obligation to provide this report. A more interesting situation arises if a legal entity consists of one employee who is both a director and a founder. What to do in this case - we will consider further.

Should I submit zero reporting?

Very often, responsible persons have a question: is it necessary to submit a zero form. In fact, the answer to this lies in the very concept of form. It is submitted if the company or entrepreneur has concluded employment agreements.

In this case, the key word is “concluded”, because even if an individual entrepreneur or company does not operate and does not pay wages to employees, but they themselves have employees with valid contracts, they do not cease to be insured persons.

On the other hand, if an entrepreneur has no hired employees at all, and the company has no concluded contracts, including with the director, then they are generally exempt from filing a report.

Attention! Thus, SZV-M cannot be zero at all - either contracts have been concluded and the report is filled out, regardless of payment/non-payment of wages, or there are no contracts and the subject is exempt from completing the report.

Non-profit (NPO) and public organizations without employees - should they take the SZV-M?

If there are no persons in labor relations in NPOs or public organizations, then you need to submit a report to SZV-M with information on their managers (chairmen). This position was expressed on the Pension Fund website: The FSS also gave a similar comment in its Letter No. 02-09-05/06-06-4615 dated March 14, 2016, in response to question No. 8. They were talking about the chairman of the board of SNT, here is an excerpt:

“...In accordance with Article 17 of the Labor Code of the Russian Federation, labor relations arise as a result of election to a position if election to a position requires the employee to perform a certain labor function.

Thus, since Article 23 of Law N 66-FZ entrusts the chairman of the board of a horticultural, gardening or dacha non-profit association with performing certain functions in this elective position, his activities can be classified as the labor activities of an individual.

In this regard, payments accrued to the chairman of the board of a horticultural, gardening or dacha non-profit association, in particular SNT, for the performance of labor duties are subject to insurance premiums in the generally established manner.”

FAQ

Are reports submitted if the individual entrepreneur has no employees?

The legislation establishes that this form of reporting is submitted only in relation to employees, or people engaged under civil contracts, when contributions must be calculated for payments in respect of them.

Therefore, if an entrepreneur works independently, without involving employees, then he does not need to draw up and submit a SZV-M report, including a zero one. This does not need to be done, even if in the previous month there were employees who terminated their contracts.

In the next period, they do not need to be shown in the report, which means there is no need to submit the report itself. However, in this case, it is recommended to send a letter to the Pension Fund with appropriate explanations.

Attention! An individual entrepreneur does not prepare this type of reporting for himself personally.

Should I submit a report if the company is being liquidated?

The process of liquidating a company takes quite a long period.

Until all employees are fired, a SZV-M report on them must be submitted to the Pension Fund.

In the future, it all depends on who the liquidator is and whether a liquidation commission has been created.

The legislation establishes that the owners of a closed company can, during the liquidation process, involve specialists under civil contracts who will deal with this process.

Since accruals and payments of remuneration will be carried out in relation to them, the SZV-M report will need to be submitted until the very moment when an entry about the closure of the enterprise is made in the register. Information is submitted to the liquidator, as well as to each member of the liquidation commission.

Attention! The founders may not involve third-party specialists, but take over the entire process of closing the legal entity. If they do not pay themselves remuneration during liquidation, which is subject to insurance premiums, then SZV-M does not need to be handed over.

Should I rent it out to new organizations if there is no bank account and no director?

The Pension Fund of the Russian Federation has issued letters on this issue with explanations, according to which if the only founder is a director and he does not pay himself remuneration, the company does not carry out activities, and the bank account has not yet been opened, then there is no need to submit a SZV-M report.

What to do if the only employee is the director and founder?

Sometimes a situation arises in which the only “employee” of the company is the founder, who serves as director. As a rule, no activity is carried out.

Until 2021, Rostrud and the Pension Fund of the Russian Federation gave conflicting explanations on this matter. Thus, Rostrud, in a letter dated March 6, 2013 No. 177-6-1, indicated that in this case it is not possible to conclude an employment contract. And since there is no agreement, there is no basis for inclusion in the report.

However, the Pension Fund in letter dated 05/06/2016 No. 08-22/6356 says the opposite - that the founder in this case is the insured person and must be included in the SZV-M.

Many “cautious” payers, in order to avoid disputes, previously included information on such persons in the report. Now the situation has become clear - the Ministry of Labor of the Russian Federation agreed with the position of the Pension Fund. The letter dated March 16, 2018 No. 17-4/10/B-1846 provides a reference to Art. 16 of the Labor Code of the Russian Federation, according to which labor relations arise upon the actual admission of the employee to work. On this basis, officials recognize the sole founder - the director - as an insured person subject to inclusion in the SZV-M report.

Thus, the changes in SZV-M from April 2021 are that the report must clearly include the only founder who manages the company.

Let's summarize briefly:

- The SZV-M report is needed for operational personalized accounting of working pensioners.

- It is submitted to the Pension Fund authorities monthly until the 15th.

- Beginning in April 2021, this form must include information about the sole founder of the firm, who is its director.

A sample of filling out the SVZ-M for March 2021 can be downloaded here.

Read also

20.11.2017

Penalty for failure to submit reports

The law establishes that the completed report must be sent to the regulatory authority within a strictly specified time frame. If it is violated, a fine will be imposed on the subject for late submission of the SZV-M.

Currently it is 500 rubles. for each employee who needed to be included in the report. Since the amount of the penalty is calculated based on the number of employees in the month for which the report was not sent, for large firms with large staff, it can be quite significant.

A similar amount of fine is determined for business entities that submitted a form with incomplete or incorrect information. The amount of punishment in this case will be determined based on the number of people for whom information was not submitted or distorted.

Attention! Another type of penalty is for those who file the report incorrectly. Thus, an entity with more than 25 people must report only electronically. If the form is provided on paper, a penalty of 1000 rubles will be imposed.

Violation of deadlines: responsibility

What will be the penalty for violating the deadlines for the delivery of SZV-M in 2021? Are there any penalties for failure to submit monthly reports by the 15th day following the reporting month? Yes, there is responsibility. For failure to submit within the prescribed period or submission of incomplete and (or) unreliable information as part of the SZV-M report, financial sanctions in the amount of 500 rubles are applied to such policyholder in the amount of 500 rubles in relation to each insured person (Article 17 of the Federal Law of 01.04.1996 No. 27-FZ).

Accordingly, if you are late in submitting the SZV-M, for example, for February 2021 by at least one day, and the report includes 85 people, then the fine for lateness will be 42,500 rubles (85 × 500).

There is also a fine for violating the procedure for submitting information - 1000 rubles (Article 17 of the Federal Law of April 1, 1996 No. 27-FZ). That is, if in 2021 you violate the method of submitting SZV-M and submit, for example, a paper report instead of an electronic file, then inspectors from the Pension Fund of the Russian Federation may additionally fine the organization or individual entrepreneur.

When can you avoid fines?

Despite the fact that policyholders have been submitting a report on the SZV-M form for several years now, many disputes over fines due to errors in this form are resolved only in court. And often in favor of policyholders. Here are a few court decisions that will help fight off a fine or significantly reduce its size:

- A technical typo in SZV-M cannot serve as a basis for a fine (Determination of the RF Armed Forces dated September 28, 2018 No. 309-KG18-14482).

- It is impossible to fine a branch for being late with SZV-M (Resolution of the Supreme Court of the Russian Federation dated December 10, 2018 No. 308-KG18-19977).

- An error in the SZV-M (for example, in the designation of the reporting period), corrected after the reporting deadline, but before its discovery by the Pension Fund, is not grounds for a fine (determination of the RF Armed Forces dated November 29, 2018 No. 310-KG18-19510).

- The company in the original SZV-M did not indicate information about 248 employees and only a year later supplemented the missing information. The Pension Fund of the Russian Federation fined the policyholder for this after an inspection, but the court considered the prosecution illegal: in the interim, the fund itself did not discover the error (resolution of the Volga-Vyatka District Court of October 29, 2018 in case No. A82-1008/2018).

- SZV-M was submitted late due to the accountant’s illness ─ the court reduced the fine 11 times, recognizing the accountant’s incapacity for work as a mitigating circumstance (decision of the RF Supreme Court dated July 4, 2018 No. 303-KG18-8663).

- The insured submitted the SZV-M 1 day late for an objective reason (on the last day of submitting the report, the power was turned off) ─ the judges sided with the insured, disagreeing with the fine (resolution of the Volgo-Vyatka District Court of July 17, 2017 No. A28-11249/2016 ).

The reasons why SZV-M does not get from the policyholder to the Pension Fund on time can be different. No one is immune from technical errors, typos, inaccuracies when registering the SZV-M or omissions of information in it. If the pension fund is trying to fine you a substantial amount, and you have mitigating circumstances, you can try to challenge the fine or reduce its size in court.

If you find an error, please select a piece of text and press Ctrl+Enter.

What is contained in the document and why is it needed?

The official name of the document is “Information about the insured persons”. Its main function is to transmit information to regulatory authorities about hired specialists, for whom the organization transfers insurance contributions to all extra-budgetary funds.

Such reporting helps government officials track citizens who have reached retirement age but continue to work. Current legislation establishes that the pensions of such persons are not subject to indexation, which is annual for other pensioners.

The SZV-M form displays the data of all insured persons; by law, they include all persons for whom the employer makes the transfer of pension contributions. It does not matter how they were hired (based on the Labor or Civil Code), or what age they are.

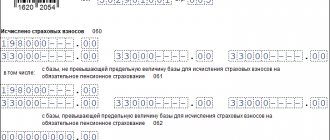

The BCC for paying individual entrepreneurs' contributions to pension insurance for themselves has not changed in 2020; you can use the old codes. You can see an example of calculating insurance premiums in 2021 here.

The SZV-M form has a clearly established structure, enshrined in Resolution of the Pension Fund No. 83p, which was issued in 2020.

This regulatory act establishes that the report consists of four sections that are required to be completed:

| First section | Enter the details of the employing company:

|

| Second section | The period for which the form is being compiled is indicated. The numbers indicate the month number and the year. |

| Third section | The type of report being submitted is indicated, it can be:

|

| Fourth section | This contains information about the insured person who works in the organization on the basis of any contractual relationship. The report must include the person's full name (abbreviations are not allowed); SNILS number and individual tax number. |

The last detail raises the most questions: due to the fact that it is not mandatory, the Pension Fund is obliged to accept the SZV-M report without it. But experts predict that in the near future it will acquire the status of an indispensable one, and therefore the employer needs to initiate the receipt of a TIN by its employees.

Information about the company's employees is compiled into a table, in which each person has his own row. At the very end of the form, all completed sections are signed by the director of the company or other authorized person. In this case, the person’s position and his full name, as well as the date and wet seal of the company must be indicated.

Sample of filling out the SZV-M form for a legal entity

Possible fines

For violations of the procedure for generating a report or the deadline for submitting it, a fine of 500 rubles may be imposed on the policyholder. for each insured person (Article 17 of Law No. 27-FZ). Thus, large companies with a large staff can suffer very significant financial losses if violations occur.

The system for imposing fines for errors in SZV-M has changed since October 1, 2018 ─ Instructions on the procedure for maintaining personalized records dated December 21, 2016 No. 766n were corrected by PFR Order No. 385n dated June 14, 2018.

The updated instructions establish conditions under which a fine can be avoided:

- Errors subject to correction were made in relation to persons included in the SZV-M with the “Initial” type.

- Errors were discovered and corrected by the policyholder himself or within 5 working days from the date of receipt of the notification from the Pension Fund.