Due to lack of money, many citizens take two jobs. The second place of work is called part-time work. If the employee is officially registered, then he should be subject to all the rights and responsibilities of key employees. In terms of providing days off, there are certain features for such subordinates. Employers need to understand how vacation pay is calculated and paid to a part-time employee.

FAQ

Question No. 1: Is monetary compensation paid to a part-time worker for unused vacation?

Answer: If a part-time worker has not used his next annual leave, he has the right to receive compensation for it upon dismissal. The amount of vacation pay and compensation for part-time workers is calculated in the same way as for main employees.

Question No. 2 Is compensation due for part-time dismissal if I have worked for six months?

Answer: Upon dismissal, the organization must pay compensation to the employee for all unused vacations

Question No. 3: When applying for a part-time job, they drew up not an employment contract, but a civil law one. Worked at the company for 1 year. Under this agreement, is there compensation upon dismissal for unused vacation or not?

Answer: Under a civil contract, compensation for unused vacation is not provided by law.

The labor legislation of the Russian Federation is a rather voluminous publication, the summary of which not everyone reads. And even if he reads, he still cannot figure out some questions on his own. But such a question as compensation for vacation upon dismissal of a part-time worker remains a mystery. Let's try to popularize this topic.

Features of combination and part-time work

A part-time employee is an employee who, in one organization, in addition to his immediate obligations and functions, also performs some other work. Part-time workers also include those persons who, outside of their working hours, fulfill work obligations for another employer.

In this case, the permission of the main employer is not required, nor is information about the existence of a part-time job required. According to the law, in this case, the time allocated for combining should not exceed 4 hours a day, that is, 20 hours a week.

Combination and part-time work are actually two different concepts. When we talk about combination, we mean working in the same organization in several positions. And part-time work means working outside the main organization.

The main differences between part-time and combination:

- There are no restrictions on part-time work; persons who are not yet 18 years old are not allowed to work part-time if we are talking about the same difficult, difficult and harmful conditions as in their main place.

These are the main differences between part-time and part-time jobs. Let's take a closer look at the concept of part-time leave.

Accrual of vacation pay when combined

When combining positions, the employee is assigned additional responsibilities without leaving his permanent place of work. Unlike part-time work, it is only internal. Here the employee performs new duties during the main activity. This is important to take into account when choosing the type of activity.

Important! For example, when combined, the duties of an accountant and a cashier or a driver, a lawyer and a personnel officer are performed simultaneously.

Combining positions can be considered the assignment of a new job function or an increase in volumes. It cannot be external (only internal) and is not formalized in a separate employment contract, but is fixed as an appendix to an already signed document. Such an agreement includes the following points:

- name of the new position;

- description of additional responsibilities;

- deadline for performing duties;

- amount of remuneration.

As for the amount of payments for part-time work, it is determined by mutual agreement. The calculation is not regulated by law.

When combined, additional duties are performed at the same time as the main ones. Leave is granted under the following conditions:

- The duration is the same as for the main position.

- Payment – calculation of average earnings is carried out taking into account additional payments for part-time work.

Vacation for a part-time worker

Chapter 44 of the Labor Code regulates and describes the peculiarities of the work of part-time workers, but Art. 286 examines in detail the leave for such an employee.

An employee holding a position under any type of combination has the right to leave. It follows that an employee who has the right to leave, of course, also has the right to receive compensation for non-use when released from office.

Leave for part-time workers

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

Any employee, regardless of the length of his working day, has the right to the required 28 calendar days for rest. This figure is obtained by the following calculation: for each month worked, the employee receives 2.33 days of rest.

Art. speaks about this. 115 Labor Code, specifically part 3.

In Art. 93 of the same part of the code states that part-time work during the working day does not become a limitation for receiving full paid leave.

With a part-time job, there are no special provisions for establishing leave. At a minimum, the number of such days is 28, if, depending on the complexity and harmfulness of the conditions, as well as other factors, there are no additional days for legal rest.

In the above-mentioned Article 286, leave for a part-time worker is granted regardless of the main vacation schedule of other employees of the enterprise, simultaneously with the start of leave at the main workplace, regardless of the duration of the part-time job, even if he has worked for less than six months. In this case, according to the law, leave is provided in advance.

When the number of vacation days at the main job exceeds the number of those at a part-time job, the employee has the right to additional days of main rest, but without part-time pay.

The employee is obliged to notify his second employer about going on leave for his main activity. In this case, the employee’s absence from his place cannot be regarded as absenteeism.

Is compensation paid to internal part-time workers?

With internal part-time work, or the so-called combination, the vacation coincides with the main one. As for compensation payments, in cases where one employee performs the duties of another, for example, during maternity leave, then, of course, he has the right to receive them.

It is worth understanding that if the employment relationship is regulated by a legal employment contract, then compensation for 28 unused days is not due; the employee is obliged to use them as vacation. Cash payment is possible only if the vacation is more than 28 days.

And all payments for unused vacation are accrued upon dismissal of the employee. Even if the accountant for some reason did not accrue and pay for these days on the day of dismissal, such calculation must still be made later than the deadline.

Payments of compensation to a part-time worker

Any employee who has worked at the enterprise for more than two weeks, upon dismissal from the workplace, main or combined, must receive compensation for unused vacation in proportion to the days worked.

Compensation due for unused vacation is paid on the last working day, in monetary terms. Art. 140 of the Labor Code of the Russian Federation also describes the full calculation that is due when dismissing an employee:

- arrears of wages accrued on the day of dismissal

- payments related to non-vacation leave

- in some cases, such payments include severance pay

- other payments, bonuses and compensation, if any are specified in the agreement between the employee and his employer

If the employee was not at work on the day of his dismissal, then the employee must receive all his payments on the next or another day.

Calculation of compensation in connection with the dismissal of a part-time worker

Regardless of whether an employee works in a main or part-time position, the calculation of all compensation payments for unused legal vacation days is carried out in the same way. The formula for this calculation is as follows:

The number of days remaining unpaid multiplied by wages, calculated as the average daily wage.

To calculate the number of vacation days that were not used, it is necessary to multiply the number of days that the employee should receive for rest for each month of work by the number of days worked and subtract from this product those days that have already been used for rest. If in the last month he worked more than 15 days, then these days are counted as a whole month.

In other words, to obtain unused days, it is necessary to subtract from the allotted days those that have already been used.

According to the calculation methodology of the Ministry of Health and Social Development, all non-integer numbers are rounded to whole numbers in favor of the employee. These days do not include:

- absenteeism

- vacations that were not payable beyond 14 days

- child care days

To calculate compensation, you also need to know the average daily wage. It is calculated as follows: the amount of total earnings for 12 months / 351.6.

We multiply the resulting value by the already calculated number of days of unused vacation and get the monetary compensation that the employee should receive upon dismissal in addition to other payments. Total earnings include not only salary, but also all allowances, bonuses and other additional payments and payments to the employee for the last year.

What position (main, part-time or part-time) the employee works in does not matter when calculating vacation pay, as well as for receiving the amount of his compensation. Internal and external combinations are considered by labor legislation in the same order as the main job.

Labor relations, due to their diversity, often create difficulties for those who implement them. Many questions traditionally arise when regulating the activities of part-time workers.

Let's consider what guarantees are provided in terms of compensation for unused vacation upon dismissal of an employee employed under such conditions. Vacation compensation upon dismissal of a part-time worker

Mandatory taxes due to combination

The law obliges ordinary tax deductions to be made on payments for combining positions:

- personal income tax – the required 13% (subtracted from the accrued amount);

- contributions to insurance funds – 30% (paid at the expense of the employer).

Calculation of surcharge

The procedure for determining the amount of additional remuneration in cases of replacement can be stipulated in a collective agreement or a special document, or can be decided directly between the employer and employee, and reflected in the order.

IMPORTANT! The additional payment cannot be less than the established wage standards, otherwise the employer risks administrative liability.

Factors influencing the amount of surcharge:

- the complexity of the additional responsibilities assumed;

- amount of additional work;

- a fixed amount or percentage depending on the results of work;

- employment mode of the substitute (full or part-time, free or strict schedule, etc.).

When regulating the calculation of such additional payments, internal regulations may include specific amounts or percentages of existing salaries.

Calculation example

The salary of economist G.M. Petrovsky, who is going on vacation in August, is 35,000 rubles. per month, and the salary of R.T. Lukyantsev, also an economist, is 32 thousand rubles. per month. R.T. Lukyantsev was appointed to combine his duties and the duties of G.M. Petrovsky. during a 20-day vacation.

According to the provisions of the collective agreement, an additional payment of 70% is required for such a combination. Let's calculate how much money Lukyantsev will receive in August:

- 32,000 rub. – own salary;

- 70% from 35,000 rub. – 24,500 rub. – required additional payment for a full month;

- since the combination did not take place for the entire month, but only for 20 days, the additional payment is due for 2/3 of the required 70%: 16,333 rubles;

- in total, Lukyantsev was entitled to 32,000 + 16,333 = 48,333 rubles;

- Personal income tax must be deducted from this amount: 13% of 48,333 = 6,283 rubles;

- Insurance premiums must be calculated on this amount: 30% of 48,333 = 14,499.90 (not deducted from the salary, the employer transfers from his own funds);

- total in hand: 48,333 – 6,283 = 42,050 rubles.

Features of granting leave to a part-time worker

A part-time worker is a person who, along with the main labor functions, performs other work in the same organization (enterprise, institution, individual entrepreneur) or for another employer beyond the established working day. The duration of part-time work cannot exceed 4 hours a day and, accordingly, 20 hours a week. Employment does not require consent or information from the manager at the main location.

The main differences between part-time and combination

Important! Part-time work should not be confused with combination. Sometimes distinctions are made depending on the place of work. If additional employment is with the same employer, then this is a combination. If the other has a part-time job. This definition is incorrect. Part-time work can also be internal, i.e. with one employer. The differences lie in the work schedule - when combining, additional functions are performed during normal working hours, and when part-time, additional work is carried out outside of the working day.

Unlike part-time work, part-time work is carried out in excess of the established working hours

The specifics of regulating the labor of part-time workers have been defined. Article 286. Leave when working part-time

If the duration of vacation from the part-time employer is shorter than the main one, at the employee’s request, he is provided with additional days of rest without payment in accordance with the duration of rest at the main place. The employer does not have the right to refuse additional rest to a part-time worker under such circumstances.

Position of the Supreme Court. A part-time employee who has notified the manager of the need to grant him leave in connection with a vacation at the main place of work has the right not to appear at the workplace. Absence from work under such circumstances cannot be considered as absenteeism (para.

"d". P.

39 Resolution of the Plenum of March 17, 2004 No. 2).

No specific features have been established when determining the duration of leave for a part-time employee. The minimum paid vacation is 28 calendar days.

Additional leave for harmful conditions, special character, etc. is provided according to general rules. The exception is additional leave for irregular working hours.

Part-time work does not imply the possibility of an irregular schedule. Calculation of compensation for unused vacation

For what positions and professions is it possible?

The Labor Code of the Russian Federation does not limit the right to combine positions.

Unlike part-time work, in which there is a clear list of specialties and positions that do not allow additional employment, combination work is allowed for all professions and positions.

Restrictions

Additional work of the employee is limited to:

- One employer.

- Time of the working day (shift).

- The capabilities and qualifications of the employee admitted to combining duties.

The established combination procedure must be fixed in internal labor regulations.

Registration of combining positions or professions, even for an indefinite period, can be terminated at the request of either party.

In matters of part-time work, there are many uncertainties that are eliminated by judicial practice, the decisions of which are precedents.

For example, questions arise regarding whether the payment corresponds to the duties performed, the lack of employee consent, and the calculation of northern coefficients for additional payments.

The initiator of assigning additional responsibilities to an employee can be the employer or the employee.

Registration of a combination of employees is carried out on the basis of voluntarily expressed written consent:

- An employee, if the initiative to expand responsibilities comes from the employer. The manager draws up a memo on which the employee expresses consent.

- The employer, if the initiative for combination comes from the employee. On the application submitted to the employer, the manager provides a written opinion.

Both forms of appeal have legal force and are valid for drawing up an order only after approval.

Documentation

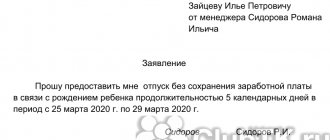

When documenting the operation, the employee submits an application to the employer.

The form of the paper is arbitrary, with the inclusion of data in the text:

- name of the enterprise, full name of the manager;

- employee data – full name and position;

- the name of the combined position;

- descriptions of responsibilities when expanding the range of tasks.

The employer also has the right to develop and contact the employee with a proposal for combination.

The written appeal in the form of a memo shall indicate:

- enterprise and division data;

- position for which a combination of duties is required;

- a brief description of responsibilities and scope of work;

- additional payment provided to a person.

Example of an employee's application for combining positions

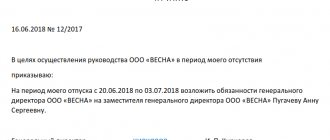

After the parties have reached agreement on the procedure for performing duties and the amount of remuneration, the combination must be formalized on the basis of an application from the employee or instructions from the employer.

We invite you to familiarize yourself with: Tax deduction and maternity capital when buying an apartment with a mortgage: is a refund of 13 percent of personal income tax due for a purchase using Moscow time, who is reimbursed?

The HR department produces:

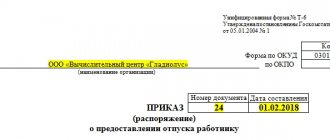

- Issuance of an order on combining work by an employee. The order specifies the urgent or indefinite performance of duties and the payment procedure. The order must be signed by the employer and employee.

- Drawing up an additional agreement to the contract. The additional agreement is drawn up in 2 copies having equal legal force. One document is given to the employee, the second is kept by the employer along with the main employment contract.

Sample order on combining positions

Additional agreement to the employment contract (combining)

If additional responsibilities are provided for at the stage of drawing up the main contract, they can be included in the conditions in the case of an open-ended nature of the combination of work.

Termination of the combination of duties and changes in conditions are formalized by an additional agreement based on an application and order.

Expanding the range of responsibilities within production and within working hours does not require the execution of a new contract.

The additional agreement is an integral part of the main employment contract and is subject to signature by both parties and registration in the journal.

An entry about the combination is not made in the work book.

Obligations performed under one contract do not require additional documentation.

Work execution is not included in the timesheet.

The employee is listed at his main place of employment, including when combining work with a vacant position.

The average salary for establishing the amount of vacation pay provided to a part-time employee is calculated according to the same rules as for main employees.

If a person is an internal part-time worker, then the determination of the salary amount for calculating vacation benefits is carried out for each place of work separately.

As you can see, it is possible to say whether vacation is paid, and if so, in what amount (or rather, for what period), only if you take into account all the nuances of a person’s work.

The main thing you should remember is that if you work part-time, no one has the right to deprive you of vacation. And this is strictly prohibited by labor law.

Its duration and time of provision in general cases should coincide with leave from the main job.

Compensation for unused vacation at a part-time job

In accordance with Art. 140 of the Labor Code of the Russian Federation, upon dismissal, an employee receives a full payment on the last day of employment, including:

- unpaid wages for hours actually worked;

- compensation for missed vacation;

- individual compensations in accordance with an employment or collective agreement;

- severance pay in specified cases, etc.

Article 140. Terms of payment upon dismissal

For your information! The issue of compensation for unused time off has not been clearly resolved. To avoid disputes, it is recommended to use all accumulated rest days before dismissal. Otherwise, on a voluntary basis, the employer most likely will not compensate for the remaining days, and the court will not always come to the employee’s defense.

An additional basis for the dismissal of a part-time employee is the hiring of a permanent employee for the position he occupies. Upon dismissal for any reason, compensation for unused vacation is carried out on a general basis, regardless of the type of part-time job (external or internal).

The amount is determined as the product of the number of unused vacation days and the current average daily salary:

Comp. = Number of unused days x Wed. daily salary Formula for calculating compensation for unused vacation

Calculation of vacation days not taken off

In general, the number of non-vacation days is determined as the product of the total number of vacation days per month of work (28 days/12 months = 2.33 days for each month) and the number of months actually worked part-time. Vacation days used are subtracted from the resulting product.

When determining the number of months worked, the Rules approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169 apply. According to clause 35 of the Rules, less than half a month worked is not counted as vacation time, and more than half is counted as fully worked. P. 35 of the People's Commissariat of Labor of the USSR 04/30/1930 No. 169

Days not taken into account in accordance with Art. 121 TK :

- days of absenteeism;

- maternity leave;

- unpaid leave beyond 14 days per year.

Article 121. Calculation of length of service giving the right to annual paid leave

Example. Part-time worker Ippolit worked for 1 year 8 months 16 days at an additional job in a store as a cleaner, of which he missed 3 days, for which he was fired. Before dismissal, the employee was provided with 14 days of paid leave.

The vacation period is 20 months (12 + 8), since absenteeism is deducted from the length of service, and the number of days in an incomplete month without taking them into account is less than 15.

The number of days off is:

2.33 x 20 – 14 = 32.6

Applying the rounding rules, we get 33 full days of unused vacation, which will be taken into account when calculating compensation. Missed days are deducted from vacation time

Instead of calculating months and days yourself, you can use a convenient online calculator .

Calculator for calculating compensation for unused vacation upon dismissal

Calculation of average daily earnings

The procedure for determining the average salary is established by Art. 139 TK . When calculating, all existing income from the employer is taken into account, regardless of the grounds and source (general provisions on bonuses, individual bonuses, extra-budgetary payments, etc.):

- salary;

- premium;

- allowances and surcharges, etc.

Article 139. Calculation of average wages

In order to determine the amount of compensation for vacation not taken, income for the previous 12 months is taken into account. The resulting amount is divided by 12. The average number of days in a month for the purposes of calculating wages is taken to be 29.3 (taking into account the alternating length of the months and the short February).

Compensation calculation

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

The result of our calculations is the amount to be paid to the unlucky truant Hippolytus as compensation for unused vacation:

Comp. = 33 x 136.5 = 4504.5 rub.

Ippolit should receive the specified amount upon dismissal, along with the salary due for days worked minus days of absenteeism, instead of receiving 4,000 rubles monthly. for tireless work and have free access to expired products. Formula for calculating compensation for unused vacation upon dismissal

If part-time leave was provided in advance, the days of leave that the employee actually earned are calculated in a similar manner. The result obtained is subtracted from the days actually provided. Based on the average daily earnings, the amount of deductions is determined, which is deducted in the final calculation.

According to the norms of current legislation, upon dismissal, every employee has the right to count on compensation for unused vacation if he worked at the enterprise for more than 2 weeks. Time and working conditions do not affect the employee’s right to claim the same rights and guarantees that other company employees have, even in the case of combining positions or professions.

Let's find out what kind of vacation compensation a part-time worker is entitled to.

- Is vacation compensation paid to a part-time worker?

- How long is the vacation for part-time workers?

- Is vacation compensation due to a part-time worker replacing an employee who has gone on maternity leave?

- Leave at the main place of work and part-time work

- When is vacation compensation paid to a part-time employee upon dismissal?

- How to determine the vacation period of a part-time worker

- How is vacation compensation calculated for a part-time worker?

- How is the number of vacation days calculated?

- How to calculate average daily earnings and vacation compensation

- Legislative acts on the topic

- Common mistakes

- Answers to common questions about how much vacation compensation a part-time worker is entitled to

- ? Video tips. How is compensation paid for unused vacation?

Average earnings for temporary disability benefits

The calculation of average earnings, on the basis of which benefits are calculated, includes all types of payments and other remuneration in favor of the insured person, for which insurance contributions to the Federal Social Insurance Fund of the Russian Federation are calculated. This is stated in Part 1 of Article 14 of the Federal Law of December 29, 2006 No. 255-FZ (hereinafter referred to as Law No. 255-FZ).

| Average daily earnings | = | The amount of payments taken into account for two calendar years preceding the year of occurrence of the insured event | : | 730 |

ExampleEmployee of Buttercup LLC O.L. Lysenko was ill from January 19 to January 22, 2015. The employee's insurance period is 7 years 7 months. It is necessary to calculate the amount of temporary disability benefits for 4 calendar days if it is known that the following payments were accrued to the employee during the billing period.

| Name of payment | 2013, rub. | 2014, rub. |

| Salary according to salary | 253 500 | 363 000 |

| Monthly bonus | 38 500 | 44 000 |

| Additional payment for combination | 58 500 | 66 500 |

| Financial assistance for vacation | 3000 | 5000 |

| Vacation pay | 17 500 | 30 500 |

| TOTAL | 371 000 | 509 000 |

When calculating average earnings, you should take into account the full amount of salary accrual, monthly bonus, vacation pay and additional payment for part-time work. Financial assistance paid to O.L. Lysenko for vacation, we will take into account only in the amount of the taxable amount, that is, in an amount in excess of 4,000 rubles. Financial assistance accrued in 2013 will not be included in the counted payments, but accrued in 2014 will be taken into account in the amount of 1000 rubles. (5000 rubles – 4000 rubles).

For 2013, we will take into account 368,000 rubles. (253,500 rubles. 38,500 rubles. 58,500 rubles. 17,500 rubles), and for 2014 - 505,000 rubles. (363,000 rub. 44,000 rub. 66,500 rub. (5,000 rub. – 4,000 rub.) 30,500 rub.).

The maximum base for calculating insurance premiums for 2013 is 568,000 rubles, for 2014 - 624,000 rubles. These amounts do not exceed the maximum tax base for calculating insurance premiums for the corresponding years.

The average daily earnings is 1195.89 rubles. ((RUB 368,000 RUB 505,000) : 730).

The employee's insurance experience is more than 5, but less than 8 years, so the benefit should be paid to him based on 80% of average earnings.

Let's calculate the amount of daily allowance. It is equal to 956.71 rubles. (RUB 1,195.89 × 80%).

The amount of benefit for 4 days of illness will be 3826.84 rubles. (956.71 rubles × 4 calendar days). When paying benefits, personal income tax in the amount of 497 rubles must be withheld from it. (RUB 3,826.84 × 13%). The amount of the allowance to be issued in person will be 3329.84 rubles. (3826.84 rubles – 497 rubles).

The procedure for calculating average earnings for vacation pay is established by Article 139 of the Labor Code and the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 (hereinafter referred to as the Regulations on Average Earnings).

Additional payment for combining professions (positions) is taken into account when calculating vacation pay (subparagraph “k”, paragraph 2 of the Regulations on Average Earnings).

| Average daily earnings | = | Amount of accounted payments accrued in the billing period | : | 12 | : | 29,3 |

where 12 is the number of fully worked months of the billing period; 29.3 is the average monthly number of calendar days.

Example: Employee of Vladimir Fabrics LLC I.V. Sviridova wrote an application for leave from January 30 to February 9, 2015 (11 calendar days). In the billing period, the employee received a salary of 300,000 rubles, an additional payment for combining professions in the amount of 16,400 rubles, and an additional payment for keeping a child in kindergarten - 12,000 rubles. The calculation period for calculating vacation pay is 12 months. It has been completely worked out.

The employee’s earnings for the billing period will be 300,000 rubles. (300,000 rubles. 16,400 rubles = 316,400 rubles). We do not take into account the additional payment for keeping a child in kindergarten. This payment is of a social nature, is not payment for labor, and is not included in the remuneration system (clause 3 of the Regulations on Average Earnings).

The average daily earnings is 899.89 rubles. (RUB 316,400: 12 months: 29.4).

The amount of vacation pay is 9898.79 rubles. (RUB 899.89 × 11 calendar days).

We invite you to familiarize yourself with: Calculation of rent for engineering and public utility facilities example

The amount of personal income tax withheld from vacation pay is 1,287 rubles. (RUB 9,898.79 × 13%).

The amount in hand will be 8611.79 rubles. (9865.13 rubles – 1287 rubles).

Is vacation compensation paid to a part-time worker?

By law, employees of enterprises who work part-time have similar rights to employees who are employed at their main place of work. Accordingly, unused vacations must also be compensated for part-time workers, as full-time employees working at their main place of work.

Compensation payments for vacation that did not take place will be calculated for all days when the part-time employee should have rested, but worked. That is, the part-time worker is entitled to compensation for vacation, and it is paid on a general basis.

Payment amount

The amount of vacation pay for part-time workers is equal to the benefits of main employees, since the employer in all cases is obliged to pay one hundred percent of the employee’s average salary.

Accounting will calculate the average income of an employee based on the salary he received in the billing period (during the year or from the date of conclusion of the contract, if the employee works less than the period established by law).

Once it is possible to calculate the average salary for one day, the resulting value is multiplied by the number of vacation days that the employee decided to take.

Is vacation compensation due to a part-time worker replacing an employee who has gone on maternity leave?

It happens that a part-time employee becomes a part-time employee at the request of the employer to replace an employee who has gone on maternity leave or child care leave.

Since this type of combination of positions or professions is no different from other cases of part-time work, the part-time worker is still entitled to compensation for unused vacation. The law assumes that external and internal part-time workers will have equal rights.

Leave at the main place of work and part-time work

It often happens that a part-time worker did not go on vacation when he was given the opportunity to take an annual vacation at his main place of work. Here it is impossible to immediately say whether part-time leave will be compensated or not.

Labor legislation allows an employee to do what he thinks is necessary during the vacation period - rest or work. It turns out that he can work part-time even when he is supposed to rest at his main place of work.

However, the law also indicates that vacation at an enterprise where an employee works part-time must be provided simultaneously with vacation at the main place of work. But most often it happens that the employer does not even know that his employee is employed somewhere else, since the employee is not obliged to provide him with such data - this is his personal business, and this should not affect the relationship with his superiors.

Or the employer may know about part-time work, but do not have information about the rest time at the employee’s main place of work.

How to determine the vacation period of a part-time worker

In order to correctly calculate the amount of compensation upon dismissal, you must first determine the employee’s vacation period. To do this, you need to know what the law allows for a part-time worker:

- a part-time worker may ask the employer to provide him with additional days of rest at his own expense if the vacation at his main place of work is longer than at the part-time place;

- a part-time worker has the right not to appear at work when vacation has begun at his main place of work, and the employer at his part-time job refuses to let him go on vacation (this will not be considered absenteeism).

The vacation period does not include the time while the employee rested at his own expense (on additional days of rest), but not more than 2 weeks. Missing work days due to the fact that the employer did not allow him to go on vacation cannot be counted as absenteeism. These days must be included in the vacation period.

How is vacation compensation calculated for a part-time worker?

To calculate the amount of compensation for unused vacation for a part-time employee upon dismissal, you need to focus on the general rules for calculating compensation for employees employed at their main place of work. You can use the following formula:

RKO = (OCDEO - FIDO) x SDZ,

where RKO is the amount of compensation for unused vacation;

OCHDEO - the total number of days of annual leave due to the employee;

FIDO - actually used vacation days;

SDZ is the employee’s average daily earnings.

If a part-time worker, like employees at their main place of work, has the right to additional rest, for example, for working in hazardous conditions, he has the right to receive compensation for it. The number of days of additional leave depends on the number of days spent at work in hazardous conditions.

How is the number of vacation days calculated?

Each employee of the enterprise is entitled to rest for 28 days of annual basic leave. Based on this, it can be argued that for each month of work he is entitled to (28 days / 12 months) = 2.33 days of vacation. You also need to consider the following rules:

- Fractional numbers involved in calculating the number of days of rest are rounded in favor of the employee.

- If an employee worked for more than half a month, he is counted as a full month. If less than half a month is worked, it is excluded from the calculation.

- Vacation days on which the employee managed to rest are excluded from the calculation of compensation.

Legislative acts on the topic

| Part 2 Art. 287 Labor Code of the Russian Federation | That employees employed part-time have the same rights as employees employed at their main place of work |

| Part 1 Art. 115 Labor Code of the Russian Federation | About the duration of annual leave |

| Letter of Rostrud dated 05/08/2009 No. 1248-6-1 | On granting annual paid leave to a part-time worker simultaneously with rest at the main place of work |

| subp. “d”, paragraph 39 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 No. 2 | On the right of a part-time employee not to appear at the workplace if vacation at the main place of work has begun, without fear of absenteeism |

How is part-time work different?

With a part-time job, as opposed to a part-time job, the employee performs additional duties in his free time. The Labor Code limits the duration of overtime work to no more than four hours a day.

There are two types of part-time work:

- external – if different employers;

- internal – if there is only one employer.

A separate employment contract is drawn up with the part-time worker. The text indicates that this work is not the main one. It is concluded both for a specific period and indefinitely.

It is not necessary to make an entry in the work book; this can be done at the request of the employee. If an external part-time job is registered, the employee presents a certificate, a copy of the order or contract to the place of his main job to mark it.

Part-time workers have the same rights as the main employees of the enterprise. Calculation and payment of labor are carried out in accordance with the terms of the employment contract. When attracting part-time workers in regions where regional coefficients are provided, they are reflected in the amount of payments.

Payment may be charged:

- for working hours;

- for completed tasks;

- on other terms.

Common mistakes

Error: The employer did not pay compensation for unused vacation to a part-time worker, since this employee is not an external, but an internal part-time worker and performs the duties of a woman who went on maternity leave.

Comment: Internal part-time workers, like external part-time workers, have the right to compensation for unused vacation.

Error: A part-time employee demands that the employer provide him with a longer vacation while maintaining his salary on the basis that the vacation at his main job is longer.

Comment: An employee does have the right to demand additional days of rest, but at his own expense.

Example

Let's look at an example of a part-time worker going on vacation. Ivan T. has been working at the museum as a research assistant for two years; for the last six months he has been combining his main job with a part-time job in another department.

In this case, he will be granted standard leave of twenty-eight days for both jobs.

The calculation of vacation pay will be carried out separately, in the first case for a full year, and in the second - only for six months worked.

Answers to common questions about how much vacation compensation a part-time worker is entitled to

Question No. 1: The employer for whom I am employed part-time does not allow me to go on vacation at the same time as the start of my vacation at my main place of work, on the grounds that I did not notify him about the combination at the time of employment. Is he right?

Answer: No, the employer is wrong. You are not obligated to inform him that you are taking a part-time job if this does not prevent you from conscientiously performing your job duties.

Expert opinion

Gusev Pavel Petrovich

Lawyer with 8 years of experience. Specialization: family law. Has experience in defense in court.

Question No. 2: The boss does not want to let me go on vacation, while the vacation at my main place of work has already begun. But I'm afraid not to show up at work because he threatens to fire me.

Answer: You have the right not to go to work, even if your employer does not allow you. The main thing is to notify him according to all the rules about the vacation time at his main job. If you are fired, you will be reinstated to your job by court decision.

Rules for registration of combination

If an employee decides to earn a little extra money, then he can make a request to be assigned the duties of a temporarily absent employee.

All changes in job functions must be documented. At the enterprise, an additional agreement is concluded with the employee, which stipulates the amount of additional payment, the replacement period, and also signs.

The next point is that an order to combine work is issued, certain points are indicated:

- for what reason did it become necessary to take over someone else’s work, for example, sick leave;

- the period during which it will be necessary to replace an absent colleague;

- list of transferred job responsibilities.

? Video tips. How is compensation paid for unused vacation?

The video reveals information about how compensation for unused vacation after dismissal is calculated⇓

Whether vacation compensation is paid upon dismissal of a part-time worker depends on the passage of the contract termination regulations through the entire chain. To pay for unused vacation, you need to familiarize yourself with the rules for calculating rest days at the place of additional work and methods for calculating the average salary.

It is also useful to find out about other benefits in connection with the termination of a part-time job.

- Circumstances of dismissal from additional work

- Regulations on vacation accrual

- Procedure for granting rest

- Features for part-time workers

- Calculation of average for vacation pay

- Compensation upon termination of the contract

Legislation

The duration of leave and the amount of benefits paid are regulated by several regulations. First of all, this is the Labor Code of the Russian Federation, which defines all the basic rights and obligations of all parties to the labor process, including the provision of social guarantees on the part of the employer.

It is necessary to pay attention to the Decree of the Government of the Russian Federation No. 922, which concerns the specifics of calculating the average salary and duration of vacation for certain categories of citizens.

Another legal act that affects the amount of benefits is the Tax Code of the Russian Federation, which determines what contributions must be paid from vacation pay to the state.

Circumstances of dismissal from additional work

In accordance with the law, every worker, regardless of working conditions and duration, has equal rights and guarantees with others, including leave and sick pay. The procedure for dismissing part-time workers is no different from the general regulations set out in the Labor Code.

There are three main reasons for dismissal:

- the employee’s own desire;

- agreement of the parties to the contract;

- initiative of the employer, including staff reduction and liquidation of the enterprise.

In the first two cases, the part-time worker simply writes an application to terminate the contract, and the manager issues a dismissal order, which may be accompanied by an entry in the work book, if it previously contained a note about hiring. The notification procedure for an employee of the administration is 2 weeks in writing, and the employee is notified of the layoff by management 2 months in advance.

It is unacceptable to fire a part-time employee while he is on vacation or temporarily incapacitated due to illness.

The date of termination of the contract should not coincide with a holiday or weekend: it is on the last shift that the accounting department makes the final settlement with the dismissed person, and the personnel department issues him a work book.

From what salary is it calculated?

The accountant needs to have information on which salary to calculate the additional payment. Typically, replacement occurs in positions of equal value, in this case the payment is calculated from the basic salary of the acting employee.

An employee replacing an absentee will be given a higher tariff rate if he is assigned the duties of an employee with a different qualification. For example, the deputy head of a department will agree to perform certain work while the head of the department is on vacation.

Supplement during vacation

Most often, the main reason for assigning and receiving additional payment is the vacation of one of the employees.

As in other cases, you will need:

- enter into an additional agreement;

- issue an order for the enterprise on combining positions.

The documents specify what duties are assigned to the employee temporarily performing the work of an absent colleague.

The duration of the vacation period is known in advance, so the replacement period is immediately indicated in all documents drawn up. The compensatory additional payment is calculated in proportion to the days actually worked, if the entire month is not worked.

Regulations on vacation accrual

Part-time workers within the enterprise and at external work have the right to annual rest. The procedure for provision is regulated by provisions common to all categories of workers, but with features inherent in additional activities.

It is also worth considering whether a part-time employee is entitled to compensation for unused vacation upon dismissal and the procedure for calculating it.

Procedure for granting rest

Art. 115 of the Labor Code of the Russian Federation establishes the duration of the main vacation provided to workers every year at 28 days.

The circumstance that an employee is employed at the place of activity part-time is not a basis for reducing rest. When calculating the break in the labor process due to a citizen, the following rules apply:

- for each month worked, 2.33 days of vacation are accrued: 28/12;

- fractional numbers are rounded to a whole value in favor of those sent on vacation - the figure 2.4 is converted to 3;

- Periods when the amount of time served by an employee in a month is less than half, for example, 13 days, are excluded from the calculation; or add up to a whole number if the number is 16 or more.

Leave is provided to employees according to a schedule approved by the manager, which does not coincide in the location of the main enterprise and the additional one. But the Labor Code establishes that a part-time worker is provided with paid leave for his main activity and at the same time for his secondary work.

For the first working year, vacation is due after 6 months. If the time for rest has not come due to additional service, days can be taken in advance.

Features for part-time workers

The Labor Code provides for restrictions in providing guarantees to workers involved in the production process at the second and third enterprises. Exclusively only at the main place of activity, a part-time worker receives preferences, as an employee of a company in the Far North region and when combining work with education.

Other features include the following:

- During the vacation time provided by law, a part-time worker can continue to engage in work activities - the code does not prohibit this.

- The synchronicity of the provision of rest for main and additional work is provided for in Art. 286 of the Labor Code, but the employer of a secondary enterprise may not know about leave at a permanent place. And the head of the main company does not always know about the employee’s third-party activities. Judicial practice shows that vacations for the main job and part-time work may not coincide in time.

- The shortage of rest days for a secondary organization relative to the main enterprise is covered by submitting an application to the head of the additional place of work for vacation time without pay. If you refuse, the part-time worker may not go on shift, and missed days will not be considered absenteeism.

The rules for calculating rest are prescribed in Art. 120 of the Labor Code, they also apply to compensation for unused part-time leave. Holidays and non-working days are excluded from the defined period.

There is no maximum limit on the duration of the combined main and additional rest time.

Other types of leave for part-time employees

In addition to annual rest days, which the employer must pay on time, Russian labor legislation contains instructions for other types of leave, both for persons combining two positions and for key employees.

The first type of leave is maternity leave. It cannot be transferred to another period, therefore it is provided simultaneously at all places of employment.

It is issued on the basis of a sick leave certificate, which confirms the fact of pregnancy and its duration.

The employer is obliged to allow the employee to go on maternity leave at the thirtieth week.

At the same time, payments that are due to an employee in connection with pregnancy and at the birth of a baby can only be processed by one of the employers.

To receive maternity payments, you must provide the employer with a certificate of two years of earnings in the place from which this money will be transferred to the employee.

The second type of leave is educational. According to the norms of Russian labor legislation, only the main employer is obliged to provide days of rest for the session.

The employee must continue to work at the additional job.

Otherwise, he can take leave at his own expense in a combined position.

Payment for training time is carried out by the employer for the main job.

If at an additional place of employment there are difficulties with attending classes, the employee can:

- take unpaid leave for several days;

- study on your days off or free hours;

- study according to a special schedule by agreement with the employer and the dean’s office of the educational institution.