According to the Labor Code of the Russian Federation, all employees are paid compensation for unused vacation upon dismissal. For correct accrual, it is important for employers to know the specifics of calculation, accounting entries and other nuances in order to avoid violations of the law and the application of sanctions in the event of an audit.

Types of payments upon dismissal

Labor legislation distinguishes between three methods of dismissal: at the initiative of the employer, at the request of the employee and by agreement of the parties. Even if the contract is terminated, the employer is obliged to pay the employee in full and transfer him the appropriate payments:

- salary for the period worked;

- sick leave (if dismissal is carried out during illness, or when sick leave is opened within 30 days from the date of leaving the enterprise);

- compensation for unused vacation.

If everything is clear with the calculation of wages, then questions arise with the calculation of compensation for vacation. The most common are the following:

- Is the vacation that the employee should have taken two years ago compensated?

- What is the formula for calculating compensation?

- How to reflect all payments in accounting documents?

Let's look at the answers to each of the questions in detail.

How is compensation calculated upon dismissal?

Basic calculation rules

When calculating compensation for a resigning employee, accountants should be guided by the following rules:

- If an employee’s length of service exceeds 11 months, it is rounded up to the nearest 1 year. The exception is rounding to 11 months if the length of service is, for example, 10.5: the above figure is used here.

- When rounding, you should be guided by mathematical principles: if the figure is more than half of the original, you should round up. This applies only to the accrual of funds; the rule is not suitable for calculating length of service: here it is necessary to act only in favor of the person leaving or leave everything unchanged.

- All annual leave is compensated provided that the employee has worked for more than 1 year. In other cases, you will have to calculate the number of rest days due.

- All payments must be made no later than the employee's last working day. If the company uses bank cards, the money is transferred to individual accounts. Cash is issued only by hand. If the employee does not pick them up, the funds are subsequently issued upon contacting the organization.

The number of days of unused vacation for an employee who has worked for less than 1 year is calculated using the following formula:

(OMxPO)/12, where OM is the number of months worked, PO is the number of vacation days due (for example, 28), and 12 is the number of months in a year.

For example:

The citizen worked at OOO for 10 months. By law, he is entitled to 28 days of vacation. The calculation is carried out as follows:

10x28 = 280 Divide the resulting figure by 12:

280/12 = 23.33 vacation days that must be compensated.

The compensation calculation process itself looks like this:

- The number of days of rest due is determined.

- The result obtained is multiplied by the average daily earnings.

How to calculate the average salary per day:

- We determine the amount of all payments for the billing period. For example, if we are talking about compensation for vacation for 10 months of work, then all amounts paid are taken into account. The calculation excludes business trips, sick leave, time off, additional days off, and unscheduled vacations.

- Divide the result by 12, then by 29.4 - the average number of days in a month.

Example:

The woman did not take vacation for 10 months. Her average earnings for the specified period are 300,000 rubles. 123 days worked.

300,000 /12 = 25,000 rub. 25000 /29.4 = 850 rub. – average daily earnings.

Practical calculation examples

Let's look at several full-fledged examples of calculating compensation taking into account average daily earnings.

Example 1

The citizen worked at the enterprise for 8 months. His average salary for the specified period is 350,000 rubles. He is entitled to 30 days of vacation (28 basic, 2 additional paid).

30 x 8 = 240 240/12 = 20 days of compensated vacation. 350,000/8 = 43,750 rub. – average monthly salary. 43750/29.4 = 1488.095 rub. – average earnings per day. 20 x 1488.095 = 29761.9 rubles. – the final amount of compensation.

Example 2

The woman has been working at the company for 10.5 months. As a general rule, the value is rounded up, i.e. up to 11 months. During this time she earned 200,000 rubles. The established duration of vacation is 28 calendar days.

200,000/11 = 18,181.81 rubles. – average monthly salary. 18,181.81/29.4 = 618.42 rubles. – average daily earnings. 11 x 28 = 308,308/12 = 25.66 – duration of earned vacation. 25.66 x 618.42 = 15868.65 rubles. – the amount of final payments.

Example 3

The man worked for the company for 9 months. During this time they earned 500,000 rubles. By law, he is entitled to a vacation of 28 calendar days, of which he has already used 14 days.

500000/9 = 55555.55 rub. – average monthly earnings. 55,555.55/29.4 = 1889.64 rubles. - daily salary. 9 x 28 = 252,252/12 = 21 days of vacation earned by the employee. 21 – 14 = 7 days are eventually compensated, because 14 have already been taken off.

7 x 1889.64 = 13227.48 – the final amount of accruals excluding personal income tax and other contributions.

How compensation for seasonal workers is calculated

According to Art. 295 of the Labor Code of the Russian Federation, for citizens employed under fixed-term employment contracts, vacation is calculated not in calendar days, but in working days. For each month worked, 2 days of vacation are provided. This also includes employees working under contracts for up to two months.

In both cases, the calculation is carried out using the following formula:

KM x 2 = KO, where KM is the number of months worked, 2 are working days of vacation, KO is compensation.

For example:

The citizen worked for a full 2 months under a fixed-term employment contract. They did not use their vacation. During this time they earned 150,000 rubles.

150000/2 = 75000 75000/29.4 = 2,551.02 rub. – average daily earnings. He is entitled to 2 x 2 = 4 days of vacation. 4 x 2,551.02 = 10,204.08 rub. – amount of compensation.

Second example:

According to the contract, the woman worked at the enterprise for 3 months and earned 100,000 rubles. She also used 2 days of vacation.

100000/3 = 33333.33 rubles. – average monthly earnings. 33333.33/29.4 = 1133.78 rubles. – average salary per day. 2 x 3 = 6 days of statutory holiday. 6 – 2 = 4 days of rest, taking into account the two already used. 4 x 1133.78 = 4535.12 rubles. = total amount of accruals.

YuA Optimist

Leave for the second and subsequent years of work can be granted at any time of the working year in accordance with the order of provision of annual paid leave established in a given organization (Article 122 of the Labor Code of the Russian Federation). Read more about granting vacations and their registration here. An employee's vacation pay should be calculated according to the general rules established in Article 139 of the Labor Code of the Russian Federation. Without dwelling in detail on the rules for calculating average earnings for vacation pay, we will only note that in accordance with the new edition of the Labor Code of the Russian Federation, a new procedure for its calculation is being established from October 6, 2006. The billing period will be 12 calendar months preceding the vacation (now three), and the average monthly number of working days will be 29.4 (now 29.6). 12 calendar months (Article 139 of the Labor Code of the Russian Federation) preceding the vacation calculation period will be taken before the 1st day of the month of going on vacation.

There are two points of view on the issue of calculating the unified social tax for the amount of the returned vacation advance. Each of them is associated with a direct interpretation of the term “withholding” (as in the situation with personal income tax). That is, the choice of the accountant will depend on what decision he makes in the dilemma: what income or payment the employee received - in the full amount or truncated by deductions. So, two options to choose from:

Accounting reports

According to the established Classification of Operations of the General Government Sector (KOSGU), payments falling under subsection 211 include wages for night work, overtime work, temporary disability benefits (the first 3 days), as well as compensation for unused vacation days. This rule applies to employees of government agencies.

If the employer is a legal entity, the payment of compensation must be included in a reserve: this refers to the recognition of its future obligations to employees with an indefinite period of fulfillment.

For individual entrepreneurs, creating a reserve is not necessary.

Accrual and issue are reflected in transactions as follows:

| Accrued | Issued as a result | ||

| Debit 20 | Credit 70 | Debit 70 | Credit 50 (51) |

Decor

According to the law, the amount of the withholding amount must be written off only after all taxes and fees provided by law have been removed from the salary.

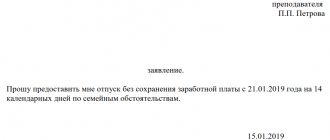

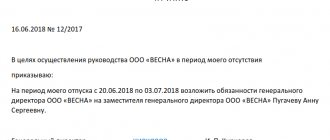

Documentation is an order written by the manager. There is no unified form for this. Usually it is subject to simple rules of internal regulatory documentation.

Mandatory information in the document:

1. Full name of the resigning employee.

2. Number of extra vacation days.

3. Specific amount of withholding.

4. From where it will be withheld.

There should also be a line where the resigning employee will sign and agree to return the required funds. In addition to the painting, there must be written consent to this deduction .

Taxes and insurance premiums

Some people mistakenly believe that compensation for unused vacation is not subject to taxation and insurance premiums are not paid from it. But in reality this is not so: this type of payment is subject to personal income tax on the same basis as wages.

What contributions are withheld from compensation:

| Personal income tax | 13% |

| Pension compulsory insurance | 22% |

| Compulsory medical insurance | 2,2% |

| FSS | 2,2% |

How is the calculation carried out (point by point):

- All types of accruals paid to the employee based on the total are calculated: salary, compensation, etc.

- Personal income tax and other payments are withheld from the amount received.

- No later than the next day after receiving the salary, contributions are transferred to the state budget.

Note! The employer is a tax agent, and therefore undertakes to withhold and pay personal income tax on the employee’s income independently. Insurance premiums are transferred to them from their own budget, and not from staff salaries.

How everything is calculated:

A citizen resigns from the enterprise, the salary for the period worked is 30,000 rubles, and compensation for vacations not taken is 15,000 rubles. It is logical to add these amounts together and calculate government payments:

30,000 + 15,000 = 45,000 rub. – accrued based on the total. 45000 x 13% = 5850 rub. – Personal income tax deducted from salary. 45000 x 22% = 9900 rub. – pension contribution. 45000 x 2.2% = 990 rub. – contribution to compulsory medical insurance. 45000 x 2.9% = 1305 rub. – payment to the Social Insurance Fund.

As a result, the employee receives:

45,000 – 5,850 (personal income tax) = 39,150 rubles. in your arms.

The employer pays for the resigning employee:

9900 + 990 + 1305 = 12195 rub.

If it is difficult to do the calculations yourself, it is recommended to use an online calculator for convenience. With its help, you can calculate not only the amount of compensation due, but also the amount of contributions to various funds by the employer.

Tax nuances of vacation advance forgiveness

The debt forgiveness agreement signed by the parties automatically triggers the tax adjustments associated with this event.

For the employee, recalculation of tax obligations does not lead to material losses - the tax on his income in the form of a forgiven debt has already been withheld when he was paid vacation pay. Changing the status of the amount received from vacation pay to a bonus from the employer (debt forgiveness) does not have an impact on personal income tax obligations.

What to do with personal income tax if an employee voluntarily repays the debt on advance vacation pay, see the material “Personal income tax on unearned vacation pay is subject to return .

The employer's situation is different. In connection with the “act of goodwill” in relation to the employee, the income tax will have to be recalculated. In this case, it becomes necessary to exclude from expenses the amount of unearned vacation pay (clause 1 of Article 252, clause 49 of Article 270 of the Tax Code of the Russian Federation). Tax officials consider such expenses to be economically unjustified (letter from the Federal Tax Service for the city of Moscow dated June 30, 2008 No. 20-12/061148).

With regard to the amount of unearned vacation insurance premiums accrued, it should be noted that there are no grounds for their recalculation - they were accrued within the framework of the labor relationship. The legality of their inclusion in tax expenses is not disputed by officials of the Ministry of Finance (letter dated April 23, 2010 No. 03-03-05/85).

Payment of compensation without dismissal

If desired, and if a number of conditions are met, citizens may not use vacation days, receiving compensation in return. However, there are a number of limitations:

- By law, employees are required to be provided with 28 calendar days of basic leave and 7 days of additional leave (in some cases). They must be fully utilized. Only the part exceeding the minimum duration of rest is compensated. For example, if an employee is employed in the judicial apparatus, a municipal body, a pedagogical or other organization, where the duration of vacations is never less than 30 days.

- Under no circumstances may pregnant women, minors employed in enterprises with dangerous or harmful conditions, or customs officials receive compensation for continued employment.

According to Art. 126, compensation is carried out at the request of the employee with the consent of the employer. If this expense item is included in the budget, payments will be made on the next salary.

Results

Deduction for unworked vacation upon dismissal is made from the final payment amounts received by the employee. In certain legally established cases, such deductions are not permitted or limited.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The procedure for settlement with an employee upon dismissal

The process for terminating an employment relationship depends on the reason. Let's look at the example of an employee leaving at his own request:

- The citizen submits a letter of resignation. If necessary, the employer assigns two weeks of work in order to have time to find a replacement.

- On the last working day, the employee visits the HR department, picks up the completed work book and education documents. On the same day, all payments are transferred to him after deduction of government contributions to the budget.

- The person resigning from the accounting department is given a certificate of income, 2-NDFL and a document on the status of an individual personal account with the Pension Fund of the Russian Federation, reflecting the amount of insurance pension contributions.

The specifics of paying compensation for unused vacation are regulated by the Labor Code of the Russian Federation, instructions of Rostrud, taking into account the norms of the Tax Code of the Russian Federation, according to which payments are subject to taxation. All calculations are carried out by the employer or accountant and are reflected in the reporting documentation.

What to do if an employee takes his vacation in advance?

Situations when an employee takes his vacation in advance occur quite often. The vacation schedule is formed based on the fact that in his working year the employee takes off all 28 or more days allotted to him.

Article 137 of the Labor Code of the Russian Federation includes the case of vacation taken in advance in possible deductions from wages to compensate for the employer’s expenses. There are exceptions. It is impossible to withhold the amount of vacation pay for unworked days in the event of such dismissals:

- in connection with the refusal to transfer to another job for medical reasons (clause 8, part 1, article 77 of the Labor Code of the Russian Federation);

- in connection with the liquidation of an enterprise (deregistration of individual entrepreneurs) (clause 1, part 1, article 81 of the Labor Code of the Russian Federation);

- in connection with the reduction (clause 2, part 1, article 81 of the Labor Code of the Russian Federation);

- in connection with the dismissal of the manager, his deputies or the chief accountant due to a change in the owner of the organization (clause 4, part 1, article 81 of the Labor Code of the Russian Federation);

- in connection with conscription into the army (clause 1 of article 83 of the Labor Code of the Russian Federation);

- in connection with the reinstatement of the predecessor who held the position of the dismissed person (clause 2 of Article 83 of the Labor Code of the Russian Federation);

- in connection with a medical report about the inability to hold a position (clause 5 of Article 83 of the Labor Code of the Russian Federation);

- in connection with death (clause 6 of article 83 of the Labor Code of the Russian Federation);

- due to the occurrence of emergency circumstances (clause 7 of article 83 of the Labor Code of the Russian Federation).

Please note that if the accrued wages before dismissal are not enough to pay off the debt for unearned vacation, the employee cannot be required to return this amount; the return can only be voluntary. This is indicated by Part 4 of Art. 137 Labor Code of the Russian Federation. Moreover, if more than 20% of the salary is collected from an employee without his consent, claims may arise against the employer. After all, according to the norms prescribed in Art. 138 of the Labor Code of the Russian Federation is exactly such a limit on deductions from wages.