The Social Insurance Fund may not accept benefits for credit. An entrepreneur cannot ignore this decision of the authorities. He must correctly take into account expenses not taken into account and make corrective entries.

Question: Based on the results of a desk audit, the Federal Social Insurance Fund of the Russian Federation did not accept the amount of benefits for credit due to an incorrectly issued sick leave. The amount of benefits was not collected from the employee. Is it necessary and how to make adjustments to the calculation of insurance premiums? View answer

For what reason may the FSS of Russia refuse compensation?

Employees of the Federal Social Insurance Fund of Russia have the right to refuse to reimburse an organization for the costs of benefits. This is possible if the benefit is paid:

- in violation of the legislation on compulsory social insurance in case of temporary disability and in connection with maternity. For example, the organization violated the procedure for accruing (calculating) benefits;

- without supporting documents. For example, without a sick leave certificate, a child’s birth certificate, etc.;

- on the basis of documents that were incorrectly executed or issued in violation of the established procedure. For example, the medical organization that issued the sick leave does not have a license (clause 2 of the Procedure approved by order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n).

This follows from paragraph 4 of part 1 of article 4.2, part 4 of article 4.6 and part 4 of article 4.7 of the Law of December 29, 2006 No. 255-FZ.

In addition, the Federal Social Insurance Fund of Russia will refuse to allocate funds for the payment of benefits if the money in the organization’s bank accounts is not enough to satisfy all the requirements presented to them (Part 3.1, Article 4.6 of the Law of December 29, 2006 No. 255-FZ).

That is, if, after studying the documents submitted by the organization, the territorial branch finds out that the balance in the account is not enough to pay off all the claims made against it in order of priority, it will not transfer the money for the payment of benefits.

Situation: can the Federal Social Insurance Fund of Russia refuse to reimburse maternity benefits on the grounds that the employee does not have the necessary qualifications to work in her specialty?

Yes, it can, if the FSS of Russia manages to prove the fictitiousness of the labor relationship.

As a general rule, the Russian Federal Social Insurance Fund may refuse to reimburse benefits if they were accrued in violation of the law. During the audit, fund employees have the right to check any documents related to the accrual of payments to the fund, as well as confirming expenses incurred by organizations for the purposes of compulsory social insurance (including expenses for the payment of maternity benefits).

This procedure follows from Part 7 of Article 34, Part 22 of Article 35 and Article 37 of the Law of July 24, 2009 No. 212-FZ, Part 4 of Article 4.6 and Part 4 of Article 4.7 of the Law of December 29, 2006 No. 255-FZ.

The legislation does not contain specific lists of documents to be verified, as well as grounds for refusal to reimburse maternity benefits.

Employees of the Federal Social Insurance Fund of Russia may refuse to reimburse an organization for benefits if there are circumstances that indicate the deliberate creation of an artificial situation for the purpose of unlawfully receiving funds from the fund (inflating the amount of benefits). The practice of inspections shows that one of these grounds may be the employee’s lack of necessary qualifications to work in her position (that is, the woman was hired not to actually perform her job functions, but only to receive maternity benefits).

Arbitration courts confirm the legality of the actions of the FSS of Russia in such situations if, in addition to the insufficient qualifications of the employee, there are other facts that together indicate the fictitious nature of the labor relationship and employment only for the purpose of receiving benefits. Such facts may be family relationships with the head of the employing organization, an unreasonably inflated salary, hiring shortly before maternity leave, etc. (see, for example, the ruling of the Supreme Court of the Russian Federation dated October 26, 2015 No. 304-KG15 -13356, resolution of the Arbitration Court of the West Siberian District dated July 3, 2015 No. F04-21153/2015, East Siberian District dated September 18, 2014 No. A19-16413/2013, FAS Ural District dated June 16, 2011 No. F09-3014/11-S2).

At the same time, the inspectors’ conclusion that the employee does not have sufficient qualifications to work in her position cannot in itself be grounds for refusing compensation for benefits. To win a case in court, employees of the FSS of Russia must provide irrefutable evidence that the level of education and work experience of this specialist really does not allow him to perform the assigned work. And if the inspectors’ arguments do not convince the judges, the organization will be able to defend its right to reimbursement of benefits. But for this it is necessary to submit to the court documents confirming:

- the existence of actual labor relations between the employee and the employing organization (including an employment contract, time sheets, pay slips);

- actual performance of the employee’s job duties;

- the need and justification for hiring this specialist;

- the fact of the occurrence of an insured event and the payment of maternity benefits (including a correctly executed sick leave certificate).

There are examples from arbitration practice that confirm the right of organizations to reimbursement of benefits from the FSS of Russia in similar situations (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated November 1, 2013 No. VAS-11916/13, the resolution of the FAS of the East Siberian District dated July 11 2013 No. A33-19621/2011, West Siberian District dated September 26, 2011 No. A27-17239/2010, Ural District dated September 14, 2011 No. F09-5130/11).

Refund of Social Insurance Fund expenses in 2021 with direct payments

But the period for transferring funds by Social Insurance is strictly limited by law. The FSS is obliged to return the money before the expiration of 10 days from the date of receipt of the application. However, if an inspection is ordered, the period is extended.

How to offset excess FSS expenses in 2021

- sick leave;

- children's birth certificates;

- certificates from medical institutions;

- payroll statements;

- orders for admission;

- certificates of earnings from previous places of work;

- other documents confirming the legitimacy of the application for compensation of expenses, as well as confirming the settlement amounts.

- At the expense of the employer with subsequent reimbursement. This method is used in all regions, with the exception of participants in the FSS pilot project (point 2).

- Directly from the fund. We are talking about the “Direct Payments” project, which is carried out in some regions of Russia (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

What to do if you have received a refusal from the FSS of Russia

The territorial branch of the FSS of Russia will inform you in a reasoned decision that your organization has been denied reimbursement of expenses. Fund employees will send such a document to you within three working days from the date the decision was made (Part 5, Article 4.6 of the Law of December 29, 2006 No. 255-FZ). The form of such a decision was approved by order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1014n. If you do not agree with the fund’s decision, you can appeal it to the regional branch of the FSS of Russia or in court (Part 6, Article 4.6 of the Law of December 29, 2006 No. 255-FZ).

If there are no objections on your part, then you can follow one of the following paths:

- ask the employee to voluntarily return the overpayment (to the cash desk or to the organization’s bank account);

- withhold money from the salary with the consent of the employee;

- recover the overpayment through the court.

In addition, the employer may not withhold (collect) from the employee an erroneously paid benefit or what was given to him in excess of what was due (Article 240 of the Labor Code of the Russian Federation). Then, in accounting, include the costs of such payments as other expenses. But in tax accounting, do not take into account amounts erroneously paid to an employee and not returned by him (not collected from him).

It is also possible that, by decision of the head of the organization, the employee is partially, and not fully, recovered. This is what Article 240 of the Labor Code of the Russian Federation allows. Then in accounting, include in other expenses only the part that could not be recovered from the employee. You will withhold the rest from the employee's salary.

Accounting for benefits if the employee has not returned them

The benefit amount cannot be forcibly returned if the failure is a consequence of a violation of laws by the accountant. Collection of funds is a right, not an obligation of the employer. That is, he may not collect benefits, even if there are grounds for this (the grounds are Article 240 of the Labor Code of the Russian Federation).

If the employee has not returned the benefit, the following entries are made:

- DT69 KT70. Reversal of accrued benefit.

- DT91/2 KT70. Attribution of expenses to other expenses.

- DT91/2 KT69. Calculation of insurance premiums for the amount.

- DT70 KT68. Withholding personal income tax from payments. The exception is disability benefits.

- DT91/2 KT69 (special account “Penies, fines”). Penalties for contributions paid late due to a deficiency.

- DT91/2 KT68 (special account “Fees and Fines”). Penalty for personal income tax paid late.

- DT69/68 KT51. Transfer of insurance premiums and personal income tax to the state treasury.

Personal income tax will be withheld from the employee. If an employee quits, the Federal Tax Service must be informed about the impossibility of withholding tax.

Insurance premiums

Situation: is it necessary to charge insurance premiums for erroneously paid disability benefits (for pregnancy and childbirth, etc.) if the Federal Social Insurance Fund of Russia refused to reimburse the costs?

Yes, it is necessary if it was not possible to withhold the erroneously paid amounts from the employee or, by decision of management, they did not collect them.

In general, social insurance benefits are included in the list of payments not subject to insurance contributions (Article 9 of the Law of July 24, 2009 No. 212-FZ, Article 20.2 of the Law of July 24, 1998 No. 125-FZ). However, if during the inspection, specialists from the territorial branch of the FSS of Russia discovered that the benefit was paid with violations, and therefore did not accept it for credit, then the payment is considered accrued within the framework of labor relations. That is, it should be subject to insurance premiums on a general basis, as provided for in Part 1 of Art. 7 of the Law of July 24, 2009 No. 212-FZ and paragraph 1 of Article 20.1 of the Law of July 24, 1998 No. 125-FZ.

But here it also matters whether it was possible to recover the wrongfully paid benefits from the employee. If yes, then there is no need to charge contributions. After all, the money was returned, which means that there was no payment as such in the end. And therefore there is no object of taxation with insurance premiums. It does not matter whether the employee returned the money voluntarily or whether the organization forcibly collected it from him.

Was it not possible to withhold the erroneously paid amounts from the employee or, by decision of management, did they not begin to collect them? Then there is a fact of payment. Accordingly, insurance premiums will have to be calculated.

Such clarifications are in letters of the Ministry of Labor of Russia dated September 3, 2014 No. 17-3/OOG-732, Ministry of Health and Social Development of Russia dated August 30, 2011 No. 3035-19.

Advice: if you are ready to argue with the inspectors, then you do not have to charge insurance premiums on the amounts of benefits not accepted by the Federal Social Insurance Fund of Russia for offset, even if the employee has not returned the money. The following arguments will help you.

When the territorial branches of the FSS of Russia do not accept benefits accrued by the organization, the social orientation of these payments remains the same. Typically, the fund’s refusal to compensate expenses means that the policyholder paid benefits based on incorrectly executed documents. And if the employee was really sick or injured, then the benefit retains its character of material support in case of loss of ability to work. Benefits are not related to wages, are not incentive payments and are not provided for in employment contracts. Therefore, regardless of their reimbursement from the budget of the Social Insurance Fund of Russia, such payments are subject to paragraph 1 of part 1 of Article 9 of the Law of July 24, 2009 No. 212-FZ and subparagraph 1 of paragraph 1 of Article 20.2 of the Law of July 24, 1998 No. 125-FZ. This means that insurance premiums are not assessed. The legality of this approach is confirmed by judges (see, for example, the ruling of the Supreme Court of the Russian Federation dated November 23, 2015 No. 304-KG15-14441, the resolution of the Arbitration Court of the West Siberian District dated July 10, 2015 No. F04-20221/2015, FAS Ural District dated May 8, 2014 No. F09-2608/14).

Regardless of whether the employee returned the benefit or not, the organization will have arrears in insurance premiums. After all, the amount of expenses accepted for deduction when calculating the monthly payment to the Federal Social Insurance Fund of Russia was overestimated. The specialists of the territorial branch of the fund will send a request for compensation for such arrears to the organization along with a decision that the costs of paying insurance coverage are not accepted for offset. The request will indicate the amount and repayment period of the arrears (Parts 4 and 5 of Article 4.7 of the Law of December 29, 2006 No. 255-FZ). The organization is obliged to fulfill it in a timely manner (clause 5, part 2, article 4.1 of the Law of December 29, 2006 No. 255-FZ).

Situation: is it possible to fine an organization for non-payment (not full payment) of insurance premiums if the Federal Social Insurance Fund of Russia refused to reimburse the social benefits paid to the employee?

Yes, it is possible if such arrears arose due to unlawful actions of the organization. In particular, these are:

- incorrect definition of insurance period;

- errors in calculating benefits;

- payment of benefits in the absence of documents confirming the employee’s right to it, etc.

Is the refusal to reimburse benefits due to the employee’s unlawful actions (for example, did he falsify documents)? Then there is no reason to fine the organization.

Such conclusions are in the letter of the Ministry of Health and Social Development of Russia dated August 30, 2011 No. 3035-19.

In addition, you will have to adjust the amount of previously accrued contributions and be sure to submit an updated calculation to the territorial branch of the FSS of Russia (Part 1, Article 17 of Law No. 212-FZ of July 24, 2009).

How to reflect a contribution taxable benefit that has not been credited to the Social Insurance Fund: policyholder reporting

4-FSS

The procedure for correction depends on the year in which the uncredited benefit was paid. If this is 2021 or earlier, then first of all the data in table 2 is corrected: the policyholder excludes social payments not accepted by the fund from the corresponding lines and columns of the table. Accordingly, the indicators for the lines “Expenditures for the purposes of compulsory social insurance” and “Debt owed to the territorial body of the Social Insurance Fund at the end of the reporting (calculation) period” are reduced. And the accountant will record the amount of the benefit not accepted by social insurance in the same line 5 of Table 1.

As a general rule, the policyholder will also need to adjust lines 1–4 of Table 3 and lines 1–3 of Table 6 (in terms of the total amount of payments and rewards in favor of individuals and the distribution of these amounts into taxable and non-taxable insurance premiums). Lines 2 of Table 1 and Table 7 “Accrued for payment of insurance premiums” are adjusted for the amount of additionally accrued insurance premiums - if the arrears were discovered in the same year in which the benefits were initially paid. Accordingly, amendments are made to the lines recording the debt owed by the policyholder at the end of the reporting period.

If 4-FSS is adjusted for the periods of 2021, then there are no tables for calculating contributions and payments for VNiM. The basis for calculating contributions for injuries, the total amount of payments and rewards in favor of individuals, the amount of accrued contributions and the debt owed to the policyholder at the end of the period are subject to correction.

RSV-1

For periods before 2021, personalized information should be specified using the SZV-KORR form (Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p). In this form, you provide the employee’s personal data, corrected amounts of payments in his favor and calculated contribution amounts. In case of incomplete reflection of insurance premiums in the reporting for any reporting periods, the amounts of additional accruals are reflected on an accrual basis in the 120th line and in section 4 of the annual form RSV-1 on a separate line for each period.

ERSV

Policyholders submit new calculations for insurance premiums for periods starting from 2021. The general principle for adjusting the calculation in the event of a FSS refusal to reimburse or offset is the same as when correcting Form 4-FSS for 2021: it is necessary to exclude uncredited benefits from Appendix 3, as well as adjust the base for calculating each type of insurance premium and the total amount of payments and rewards in favor of individuals. The lines containing information on the amount of accrued insurance premiums and the amounts on lines 070 and 090 of Appendix 2 are also adjusted.

Read more about the procedure for clarifying personalized information in the ERSV here.

Personal income tax

Whether or not to withhold personal income tax from an erroneously paid benefit depends on the type of benefit and whether the employee returned the money (voluntarily or forcibly, it does not matter). Four options are possible.

Option 1: the employee returned or was charged erroneously paid sick leave benefits

Once an employee has returned an erroneously paid allowance to the organization, there is no income for personal income tax purposes. This means that such payments are not subject to personal income tax. This follows from the provisions of paragraph 1 of Article 209, paragraph 1 of Article 210 of the Tax Code of the Russian Federation.

But when paying sick leave benefits, you withheld personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation). Therefore, as a result of the return, there will be an overpayment of tax in the amount previously withheld (clause 1 of Article 217, clause 1 of Article 209 of the Tax Code of the Russian Federation).

For information on how to return (offset) the overpayment that has arisen, see How to return an overpayment for personal income tax.

Option 2: the employee returned or was charged the benefit, which is fully financed by the Federal Social Insurance Fund of Russia

Benefits that are fully reimbursed by the fund (maternity benefits, child care benefits, etc.) are exempt from personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation). Since personal income tax was not withheld when paying them, no tax adjustments will have to be made when returning such amounts.

Option 3: the employee did not return the sick leave benefit, and the organization did not collect from him

In this case everything is simple. When paying benefits, you have already withheld personal income tax. So the employee no longer has income in the sense of Article 41 of the Tax Code of the Russian Federation. Of course, there is no need to calculate additional taxes.

Option 4: the employee did not return the benefit, which was fully paid at the expense of the Russian Social Insurance Fund, and the organization did not collect the money

The fund refused to accept benefits that are not subject to personal income tax, for example, for pregnancy and childbirth, and the employee did not return it? This amount will already have to be included in the personal income tax base. After all, such a payment will no longer be considered a benefit. So the organization must fulfill the duties of a tax agent: calculate the tax, withhold it and transfer it to the budget.

How to reflect a contribution taxable benefit not credited to the Social Insurance Fund: tax agent reporting

If the fund refused to count or reimburse the benefit, then it is necessary to make adjustments to a number of reporting documentation of the tax agent:

| Reporting | The benefit was initially subject to personal income tax, the employee returned it | The benefit was initially subject to personal income tax, the employee did not return it | The benefit was initially not subject to personal income tax, the employee returned it | The benefit was initially not subject to personal income tax, the employee did not return it |

| 2-NDFL | Exclude the benefit amount from 2-NDFL and submit a corrective certificate | Submit corrective 2-NDFL for the employee, replace sick leave code 2300 with code 4800 | There is no need to correct anything in 2-NDFL | The employee has income that should be reflected in 2-NDFL under code 4800 and income tax withheld. If at the time of discovery of a benefit that has not been credited by the fund, the employee has already quit, then 2-NDFL should be submitted with sign 2 |

| 6-NDFL (if uncredited benefits are discovered in 2021 and later) | Submit the corrective 6-NDFL for the period of illegal payment of benefits, as well as for previous periods - since section 1 of the 6-NDFL form is filled out on an accrual basis from the beginning of the year | There is no need to correct anything in 6-NDFL | The employee now has income, submit the corrective 6-NDFL for the period of unlawful payment of benefits, as well as for previous periods | |

Read more about adjusting the quarterly personal income tax calculation here.

How to correct an erroneous payment in accounting

If you do not intend to challenge the decision of the territorial branch of the fund in court, then all transactions related to the calculation and payment of such benefits will be erroneous. This means that such errors must be corrected in accounting and financial statements (clause 4 of PBU 22/2010). It does not matter whether the employee returned the overpayment or not. For information on how to make corrections in accounting, see How to correct errors in accounting and financial reporting.

Transfer the amount of hospital benefits (benefits related to the birth of a child), the reimbursement of expenses for which the Federal Social Insurance Fund of Russia refused, to account 73 “Settlements with personnel for other operations” (76 “Settlements with various debtors and creditors”, if the person has already quit):

Debit 73 (76) Credit 70

– the employee’s debt in the amount of the erroneously paid benefit (overpayment) was transferred.

A special situation with funeral benefits. There is no need to make any additional entries for the amount of the erroneously issued benefit (overpayment). The fact is that this benefit is initially taken into account in account 73 or 76. So continue to take into account the amount of the mistakenly paid funeral benefit (overpayment) in account 73 (76) until the money is returned or written off as expenses.

The organization withholds money from the employee: accounting

The amount of benefits overpaid can be withheld from the employee’s salary or subsequent benefit amounts in the following cases:

- the overpayment occurred as a result of a counting error. This is understood as an error made during arithmetic calculations (letter of Rostrud dated October 1, 2012 No. 1286-6-1, ruling of the Supreme Court of the Russian Federation dated January 20, 2012 No. 59-B11-17);

- dishonest actions of an employee (for example, he submitted documents with incorrect information or forged ones).

But first, get the written consent of the employee (letter from the Federal Social Insurance Fund of Russia dated August 20, 2007 No. 02-13/07-7922). At the same time, no more than 20 percent of the amount due to him can be withheld from the employee’s monthly salary (benefits). This is stated in Article 138 of the Labor Code of the Russian Federation, Part 4 of Article 15 of the Law of December 29, 2005 No. 255-FZ and Article 19 of the Law of May 19, 1995 No. 81-FZ.

When you make your next salary (benefits) payment, make an entry in your accounting records:

Debit 70 Credit 73 (76)

– the amount of erroneously paid benefits (overpayment) is withheld from the employee’s salary;

Debit 70 Credit 50 (51)

– the salary was issued from the cash register (the salary was transferred to the employee’s bank card) minus the withheld amount of the erroneously paid benefit (overpayment).

For more information about the cases and procedure for deductions from an employee’s salary, see How to make deductions from salaries at the initiative of the organization.

Situation: how to formalize an employee’s consent to deduct social benefits from his salary. FSS of Russia refused to reimburse benefits?

Ask the employee to write a statement.

Withholding from an employee’s salary can only be done with his written consent and only in cases provided for by law (letter of the Federal Social Insurance Fund of Russia dated August 20, 2007 No. 02-13/07-7922).

Labor legislation does not answer the question in what form the employee’s consent should be obtained to deduct overpaid amounts from his salary - verbally or in writing. But in order to avoid misunderstandings in the future (for example, the employee first agreed verbally and then began to make claims), it is better to record the consent in writing - let the person write a statement. This conclusion follows from the provisions of Article 137 of the Labor Code of the Russian Federation.

The employee received a writ of execution: accounting

If an employee has received a writ of execution, that is, the organization is recovering the amount of an erroneously paid benefit in court, then the amounts specified in this document must be withheld from earnings. For more information about this, see How to make deductions from wages based on executive documents.

Make a note in your accounting:

Debit 70 Credit 73 (76)

– the amount of erroneously paid benefits (overpayment) under the writ of execution was withheld from the employee’s salary;

Debit 70 Credit 50 (51)

– the salary was issued from the cash register (the salary was transferred to the employee’s bank card) minus the withheld amount of the erroneously paid benefit (overpayment) according to the writ of execution.

The employee returned the money: income tax

Whether the return of an erroneous benefit will affect your income tax calculation depends on what benefit the fund refused to refund. There are two possible options.

Option 1: the fund refused to reimburse the benefit, which is fully financed by the Russian Social Insurance Fund

Benefits for which the FSS of Russia refused to reimburse expenses and which were returned by employees do not affect the calculation of income tax. We are talking about benefits for pregnancy and childbirth, child care, etc. Since the benefit was supposed to be reimbursed by the fund, then you did not take these amounts into account in expenses. This means that the return of money in case of refusal to reimburse the benefit does not affect the organization’s income. There is no economic benefit in the sense of Article 41 of the Tax Code of the Russian Federation. There is no need to adjust the tax base for income tax. There is no arrears for this tax.

Option 2: the fund refused to reimburse sick leave benefits when an employee of the organization suffered an illness or injury

If the fund refuses to reimburse the sick leave benefit, then the taxable income will have to be adjusted by the amount of the benefit for the first three days of the employee’s illness. After all, the organization paid for these days at its own expense.

Since this error resulted in an understatement of the tax base and incomplete payment of income tax to the budget, submit an updated tax return. An amendment must be submitted for the period in which the organization unlawfully took into account part of the sick leave benefit as expenses for the purpose of calculating income tax.

All these conclusions follow from the provisions of paragraph 1 of Article 81, paragraph 1 of Article 54, subparagraph 48.1 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, paragraph 1 of part 2 of Article 3 of the Law of December 29, 2006 No. 255-FZ.

Since there is arrears in income tax, the organization will have to pay penalties and possibly a fine (Articles 75, 122 of the Tax Code of the Russian Federation).

An example of how to take into account the return of sick leave benefits by an employee when the Federal Social Insurance Fund of Russia refuses to reimburse the amounts paid. General organization

Alpha LLC applies a general taxation system (accrual method); it pays income tax monthly based on actual profit.

Employee of the organization A.I. Ivanov (worker) was ill from June 1 to June 5. The employee's incapacity for work was confirmed by a sick leave certificate. Ivanov’s insurance experience exceeds eight years. He has the right to a benefit in the amount of 100 percent of average earnings calculated for two calendar years preceding the year of the insured event.

Sick leave benefits for the first three days of an employee’s illness are paid by the organization at its own expense. From the fourth day of illness, the amount of the organization’s benefit is reimbursed by the FSS of Russia. Ivanov’s average daily earnings are 500 rubles/day.

Alpha's accountant calculated the benefit as follows.

At the expense of the organization you need to pay: 500 rubles/day. × 3 days = 1500 rub.

At the expense of the Social Insurance Fund of Russia they pay: 500 rubles/day. × 2 days = 1000 rub.

Ivanov received the benefit on July 1. The amount of sick leave benefits increased the personal income tax base. The employee does not have the right to tax deductions. The tax amount was: (1500 rubles + 1000 rubles) × 13% = 325 rubles.

Ivanov was paid: 2500 rubles. – 325 rub. = 2175 rub.

Alpha's accountant transferred personal income tax to the budget on July 1.

The following entries were made in accounting:

Debit 20 Credit 70 – 1500 rub. – a benefit paid at the expense of the organization has been accrued;

Debit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” Credit 70 - 1000 rubles. – benefits paid at the expense of the Federal Social Insurance Fund of Russia have been accrued;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 325 rubles. – personal income tax is withheld from the benefit amount;

Debit 70 Credit 50 – 2175 rub. – a benefit was issued to the employee;

Debit 68 subaccount “Personal Income Tax Payments” Credit 51 – 325 rub. – personal income tax is listed.

The accountant included the amount of benefits paid at the expense of the organization (1,500 rubles) as income tax expenses. By the amount accrued at the expense of the Federal Social Insurance Fund of Russia (1000 rubles), the accountant reduced the amount of insurance contributions that he had to pay to this fund. The accountant transferred insurance premiums from payments to citizens to the budget on July 15.

On July 27, the Federal Social Insurance Fund of Russia made a decision to refuse to reimburse the amount of benefits due to the fictitiousness of the sick leave. The employee confirmed that the sick leave was not issued by the medical organization and agreed to return the benefit amount.

The following entries were made in accounting:

Debit 20 Credit 70 – 1500 rub. – the benefit amount paid at the expense of the organization is reversed;

Debit 69 subaccount “Settlements with the Social Insurance Fund for social insurance contributions” Credit 70 - 1000 rubles. – the amount of benefits paid at the expense of the Russian Social Insurance Fund has been reversed;

Debit 70 Credit 68 subaccount “Personal Income Tax Payments” – 325 rubles. – the amount of withheld personal income tax is reversed;

Debit 73 Credit 70 – 2175 rub. – the employee’s debt in the amount of the erroneously paid benefit (overpayment) was transferred;

Debit 50 Credit 73 – 2175 rub. – the employee returned the amount of the benefit to the organization’s cash desk.

The Alpha accountant transferred the income tax to the budget on July 28 with an increase in the amount of the tax base by 1,500 rubles. The reporting was prepared taking into account the correction of the error.

Alpha's accountant completed an updated Form 4-FSS. The organization had an arrears in terms of contributions to the Social Insurance Fund of Russia, for which the inspectors assessed penalties.

We take into account the amounts of benefits that the FSS refused to offset

No company is insured against the fact that the Social Insurance Fund refuses to take into account the costs of paying benefits.

How to take into account such amounts and report on the correction of the violation, read the article prepared by our colleagues from the magazine “Salary” 09.21.2012 magazine “Glavbukh”

According to paragraph 4 of part 1 of article 4.2 and part 4 of article 4.7 of the Federal Law of December 29, 2006 No. 255- Federal Law “On compulsory social insurance in case of temporary disability and in connection with maternity” (hereinafter referred to as Law No. 255-FZ), the bodies of the Federal Social Insurance Fund of the Russian Federation have the right not to take into account expenses for the payment of benefits for state social insurance if they are made:

- on the basis of documents that were incorrectly executed or issued in violation of the established procedure;

— in violation of the legislation of the Russian Federation on social insurance;

- without supporting documents.

Let's figure out what the employer should do in this case.

Is it possible to recover benefits from an employee that were not accepted by the fund?

According to the general rule established by Part 4 of Article 15 of Law No. 255-FZ, amounts of social benefits paid to an employee in excess cannot be recovered from him.

There are two exceptions to this rule:

— counting error;

— dishonesty on the part of the employee, for example, submission of documents with deliberately incorrect information affecting the receipt of benefits and its amount.

In these cases, the overpaid benefit can be withheld in accordance with the norms of Part 4 of Article 137 of the Labor Code and Part 4 of Article 15 of Law No. 255-FZ. Withholding is made for each payment in an amount not exceeding 20% of the amounts due to the employee (Part 1 of Article 138 of the Labor Code of the Russian Federation). If payments are stopped, the remaining debt can be collected in court (Part 4, Article 15 of Law No. 255-FZ).

Thus, in other cases, the good will of the recipient is required to return the amount of benefits not accepted by the fund. However, voluntary contribution is rare in practice. As a rule, these amounts have to be written off at the expense of the organization’s own funds, corrections must be made in accounting and tax accounting, and the reporting forms already submitted must be adjusted.

How to avoid such cases? Read about this in the article: “Four situations when the Social Insurance Fund may recalculate maternity benefits or not reimburse them at all”

Corrective entries in accounting

The fact of the fund’s refusal to reimburse the benefit amounts paid is reflected in the Decision on not accepting for offset the costs of paying insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity in the form 28-FSS, approved by order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1014n.

Reversal of accrued benefits. On the basis of this document, the insurer reverses the entries on the accrual of the amounts of expenses not accepted for offset for the payment of benefits for temporary disability and in connection with maternity as of the date of the decision (clauses 2 and 4 of PBU 22/2010).

The former benefit was from one’s own funds. Amounts recovered from the debit of account 69 cannot be written off as expenses, such as wages. They should be included in the reduction of the policyholder's own funds.

Since they are not recognized when calculating income tax, a permanent difference and a corresponding permanent tax liability arise in accounting.

Personal income tax. Note that temporary disability benefits are subject to personal income tax due to the direct indication in paragraph 1 of Article 217 of the Tax Code (letter of the Ministry of Finance of Russia dated February 22, 2008 No. 03-04-05-01/42). Since we are talking about a case where the employee did not voluntarily return the amount of the benefit that was not accepted by the fund (he received income), there is no need to reverse the amount of personal income tax withheld from him.

If the fund has not accepted a tax-free allowance for offset, this amount should be included in the taxable base for personal income tax.

Let's look at the example of accounting records for correcting a violation.

Example 1

At Amur Chickens CJSC in February 2012, employees were paid:

— temporary disability benefits due to an industrial accident in the amount of RUB 26,827.33;

— a one-time benefit for women registered in medical institutions in the early stages of pregnancy in the amount of 465.2 rubles. (Article 3 of the Federal Law of May 19, 1995 No. 81-FZ “On state benefits for citizens with children”).

However, according to the results of a desk audit conducted by the fund in August, expenses for the payment of benefits were not accepted due to incorrect execution of the submitted documents.

Corrective entries need to be made.

Solution. In August 2012, the accountant of Amur Chickens CJSC made the following entries:

DEBIT 69 subaccount “Settlements with the Federal Social Insurance Fund of the Russian Federation for insurance premiums in case of injury” CREDIT 70

RUB 26,827.33 — the amount of temporary disability benefits due to an industrial accident that was not accepted for credit was reversed;

DEBIT 69 subaccount “Settlements with the Federal Social Insurance Fund of the Russian Federation for insurance premiums in case of temporary disability and in connection with maternity” CREDIT 70

465.2 rub. — the amount of a one-time benefit for women registered in medical institutions in the early stages of pregnancy, which was not accepted for credit, was reversed;

DEBIT 76 CREDIT 70

RUB 27,292.53 (RUB 26,827.33 + RUB 465.2) - amounts of benefits not accepted for offset paid to employees are reflected in the account of settlements with various debtors and creditors;

DEBIT 69 subaccounts of settlements with the Federal Social Insurance Fund of the Russian Federation for two types of social insurance CREDIT 51

RUB 27,292.53 (26,827.33 rubles + 465.2 rubles) - the amounts of the insured's debt to the fund that arose in connection with the fund's refusal to accept the benefit amounts for offset are listed in the FSS of the Russian Federation;

DEBIT 84 CREDIT 76

RUB 27,292.53 (26,827.33 rubles + 465.2 rubles) - the amounts of benefits paid to employees that were not accepted by the fund for offset were attributed to the insurer’s own funds;

DEBIT 70 CREDIT 68 subaccount “Settlements with the budget for personal income tax”

60 rub. (465.2 rubles × 13%) - personal income tax was withheld from the amount of a one-time benefit for women registered in medical institutions in the early stages of pregnancy, which was not accepted for credit;

DEBIT 99 CREDIT 68 subaccount “Calculations with the budget for income tax”

RUB 5,458.51 [(RUB 26,827.33 + RUB 465.2) × 20%] - reflects a permanent tax liability.

Note that if we are talking about a regular temporary disability benefit, then the accrual of benefits for the first three days of temporary disability to expense accounts (20, 23, 25, 26, 29, 44) should also be reversed.

Consequences of non-payment of insurance premiums for benefits not accepted by the fund

In connection with the refusal of the territorial branch of the fund to accept the benefit for offset, the question arises of underestimating the amount of payments subject to insurance premiums.

Additional calculation of insurance premiums

For now, the payment was considered a benefit. At the time the benefit is assigned, it is considered lawfully accrued and is not subject to insurance premiums (clause 1, part 1, article 9 of Federal Law No. 212-FZ of July 24, 2009, hereinafter referred to as Law No. 212-FZ, and subclause 1, clause 1 of Art. 20.2 of the Federal Law of July 24, 1998 No. 125-FZ, hereinafter referred to as Law No. 125-FZ).

When a violation is detected. At the time the decision is made not to offset the costs of paying out insurance coverage, the amounts paid lose the status of insurance coverage for compulsory social insurance. Thus, they should be excluded from the list of payments not subject to insurance contributions and insurance premiums should be charged on them (letter of the Ministry of Health and Social Development of Russia dated August 30, 2011 No. 3035-19).

The violation was committed this year. If the fund has not taken into account benefits paid in the current year, additional assessments of insurance premiums are made in the reporting period when the error was identified (clause 5 of PBU 22/2010).

Violation of past periods. If we are talking about the results of an on-site audit, the depth of which also covers previous periods, the procedure for additional calculation of insurance premiums depends on the moment the error was discovered, whether it is significant, whether the reporting of the previous year was approved, etc.

Example 2

Let's use the conditions of example 1, supplementing them. CJSC Amur Chickens does not have the right to apply reduced insurance premium rates. The main activity of Amur Chickens CJSC belongs to the VII class of professional risk. It corresponds to the rate of insurance premiums in case of injury - 0.8%.

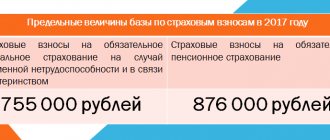

Recipients of unaccepted benefit amounts were born after 1967. The amount of their income subject to insurance premiums, together with the amounts of benefits not accepted for offset, in August did not exceed the maximum taxable base - 512,000 rubles.

How to charge additional insurance premiums from unaccepted benefit amounts?

Solution. In August 2012, the accountant of Amur Chickens CJSC made the following entries:

DEBIT 20 CREDIT 69 subaccount “Settlements with the Pension Fund of the Russian Federation for insurance premiums for the insurance part of the labor pension”

4366.8 rub. [(26,827.33 rubles + 465.2 rubles) × 16%] - additional insurance contributions to the Pension Fund for the insurance part of the labor pension were accrued;

DEBIT 20 CREDIT 69 subaccount “Settlements with the Pension Fund of the Russian Federation for insurance contributions for the funded part of the labor pension”

1637.55 rub. [(26,827.33 rubles + 465.2 rubles) × 6%] - additional insurance contributions to the Pension Fund for the funded part of the labor pension have been accrued;

DEBIT 20 CREDIT 69 subaccount “Settlements with the Federal Social Insurance Fund of the Russian Federation for insurance premiums in case of temporary disability and in connection with maternity”

RUB 791.48 [(26,827.33 rubles + 465.2 rubles) × 2.9%] - additional insurance contributions to the Federal Social Insurance Fund of the Russian Federation in case of temporary disability and in connection with maternity;

DEBIT 20 CREDIT 69 subaccount “Settlements with the Federal Social Insurance Fund of the Russian Federation for insurance premiums in case of injury”

RUB 218.34 [(26,827.33 rubles + 465.2 rubles) × 0.8%] - additional insurance contributions to the Social Insurance Fund of the Russian Federation in case of injury;

DEBIT 20 CREDIT 69 subaccount “Settlements with FFOMS”

RUB 1,391.92 [(26,827.33 rubles + 465.2 rubles) × 5.1%] - additional insurance contributions to the Federal Compulsory Medical Insurance Fund.

Responsibility for understating the tax base for insurance premiums

If expenses for payment of benefits have not been accepted, the organization has arrears in insurance premiums. The arrears are collected with penalties and are subject to a fine for underestimating the taxable base.

Late fees. According to Part 5 of Article 25 of Law No. 212-FZ, penalties are calculated as a percentage of the unpaid amount of insurance premiums for each calendar day of delay in payment of insurance premiums. Note that the day of repayment of overdue debt on insurance premiums is not included in the period of delay (clause 1, part 5, article 18 of Law No. 212-FZ). The interest rate is taken equal to 1/300 of the current refinancing rate of the Central Bank of the Russian Federation. Penalties are paid simultaneously with the payment of insurance premiums or after payment of such amounts in full. This is provided for in parts 5, 6 and 7 of Art. 25 of Law No. 212-FZ.

In accordance with paragraph 4 of Article 22 of Law No. 125-FZ, the amounts of insurance premiums in case of injury are transferred monthly within the period established for receiving funds to pay wages for the past month.

Penalties for late payment of insurance premiums in case of injury are accrued from the day following the established day for payment of insurance premiums until the day of their payment (collection) inclusive (clauses 1 and 2 of Article 22.1 of Law No. 125-FZ). Penalties are determined as a percentage of the arrears.

The interest rate is also equal to 1/300 of the refinancing rate of the Central Bank of the Russian Federation in force at the time of the arrears. If it changes, the calculation is made based on the new rate from the day following the day of change (clause 4, article 22.1 of Law No. 125-FZ).

Fine. For understating the taxable base, the organization may be fined in the amount of 20% of the unpaid amount of contributions, and in the case of deliberate actions on the part of the policyholder - in the amount of 40% (parts 1 and 2 of Article 47 of Law No. 212-FZ and Article 19 of Law No. 125- Federal Law).

Specialists from the Ministry of Health and Social Development of Russia, in a letter dated August 30, 2011 No. 3035-19, recommend holding the insured accountable selectively. The company will be fined if incomplete payment of insurance premiums arose as a result of:

— incorrect determination of the employee’s insurance period;

— incorrect calculation of the amount of benefits;

— lack of documents confirming the right of the insured person to receive state benefits, etc.

Accounting and tax accounting of penalties and fines. In the situation under consideration, the amount of penalties and fines in accounting refers to other expenses (clause 11 of PBU 10/99).

An organization cannot take into account the amount of accrued penalties and fines in tax accounting (clause 2 of Article 270 of the Tax Code of the Russian Federation and letter of the Ministry of Finance of Russia dated March 12, 2010 No. 03-03-06/1/127), therefore a permanent tax liability is formed in accounting (p 7 PBU 18/02).

We will show with an example how to calculate penalties and fines in cases where benefits are not accepted for offset.

Example 3

Let us supplement the conditions of examples 1 and 2. The policyholder paid the additional accrued amounts of insurance premiums from the amounts of benefits not accepted for offset, as well as the overdue debt in the amount of unaccepted benefits on August 20, 2012. It is necessary to calculate and reflect in accounting the amount of penalties payable to the Federal Social Insurance Fund of the Russian Federation, the Pension Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund, the amount of fines in the amount of 20% of the unpaid amount of insurance contributions to extra-budgetary funds. The salary issuance date is the 15th.

Solution. Based on the results of the audit, it turned out that the organization did not transfer insurance premiums for February in the amount of benefits not accepted for offset, as well as in the amount of under-accrued3 insurance premiums from the unaccepted amounts.

Insurance premiums established by Law No. 212-FZ should have been paid no later than March 15, 2012; from March 16, the delay in payment began.

Let us determine the duration of the period of delay - 157 calendar days. The refinancing rate of the Central Bank of the Russian Federation since December 26, 2011 is 8% per annum (Instruction of the Bank of Russia dated December 23, 2011 No. 2758-U).

The amount of penalties for late payment of insurance premiums, calculated according to the rules of Article 25 of Law No. 212-FZ, will be 362.27 rubles. [(465.2 rub. + + 4366.8 rub. + 1637.55 rub. + 791.48 rub. + 1391.92 rub.) × 1/300 × 8% × × 157 calendar. days].

The delay in payment of insurance premiums in case of injury was 158 calendar days. The amount of penalties amounted to 1139.52 rubles. [(RUB 26,827.33 + RUB 218.34) × 1/300 × 8% × 158 calendar. days].

In August, the accountant of Amur Chickens CJSC made the following entries:

DEBIT 91-2 CREDIT 69 subaccount “Settlements with the Federal Social Insurance Fund of the Russian Federation, Pension Fund of the Russian Federation, FFOMS”

RUB 362.27 — penalties were accrued for late payment of insurance premiums established by Law No. 212-FZ;

DEBIT 91-2 CREDIT 69 subaccount “Settlements with the Federal Social Insurance Fund of the Russian Federation for insurance premiums in case of injury”

RUB 1,139.52 — penalties were accrued for late payment of insurance premiums established by Law No. 125-FZ;

DEBIT 91-2 CREDIT 69

7139.72 rub. [(RUB 26,827.33 + RUB 465.2 + RUB 4,366.8 + RUB 1,637.55 + RUB 791.48 + RUB 1,391.92 + RUB 218.34) × 20%] — a fine was accrued from the amount of unpaid contributions for understating the taxable base;

DEBIT 69 subaccount “Penalties, fines” CREDIT 51

8641.51 rub. (RUB 362.27 + RUB 1,139.52 + RUB 7,139.72) — penalties and fines have been paid;

DEBIT 99 subaccount “PNO” CREDIT 68 subaccount “Calculations for income tax”

1728.3 rub. (RUB 8,641.51 × 20%) - reflects a permanent tax liability.

Clarification of previously submitted calculations for insurance premiums

If an organization has underestimated the taxable base, it, in accordance with Part 1 of Article 17 of Law No. 212-FZ, is obliged to submit updated calculations for accrued and paid insurance premiums (Form-4 FSS and Form RSV-1 PFR).

If the base is underestimated in the current year. An updated calculation must be submitted for the period of the reporting year in which the violation was committed. For example, if an organization paid benefits in February 2012, and the fund did not accept these amounts in August 2012, you need to submit an updated calculation only for the first quarter of 2012.

Please note that current practice shows that the “clarification” submitted after the end of reporting is used for reference purposes. Its indicators do not change the picture of the “closed” reporting period. Fund specialists will take into account the correction of the violation based on the calculation for the period when the violation was identified and actually corrected (9 months).

The base was lowered last year. If a violation was identified that was committed in the previous reporting period, an updated calculation (also for reference) must be submitted for that year, and the actual corrections must be reflected in lines 4 and 5 of tables 1 and 7 of the calculation for the period when the violation was identified and corrected. The updated calculation must be submitted on the old form (Part 5, Section 17 of Law No. 212-FZ).

When submitting the simplified form, you must enter 001, 002, etc. in the “Adjustment number” field.

Let's look at an example of how to reflect identified violations in FSS Form-4 and correct them.

Example 4

Let's use the conditions and results of solutions to Examples 1-3. It is necessary to determine which indicators of the previously submitted calculation for the first quarter of 2012 are subject to adjustment in the updated calculation and how the calculation indicators for 9 months of 2012 will change.

Solution. The violation was committed and corrected within one year. Let us determine the list of adjustments to the calculation indicators for the first quarter of 2012, which the accountant must make in the updated calculation. Let us say right away that the updated calculation for the first quarter of 2012 should ultimately reflect settlements with the fund in such a way as if there had been no violation. To do this, a number of primary calculation indicators for the first quarter of 2012 should be reduced (increased) by the unaccepted benefit amounts.

The amount of the unaccepted one-time benefit for women who registered in the early stages of pregnancy (465.2 rubles) should be reduced (-):

— indicator of line 15 “Expenditures for the purposes of compulsory social insurance” of table 1. The decrease should be reflected in column 1 (“2nd month” and “for the last three months of the reporting period”), in column 3 of line 15 of table 1;

— columns 3, line 18 “Total (sum of lines 12 + 15 + 16 + 17)” of table 1;

— column 4, line 5 “One-time benefit for women registered in the early stages of pregnancy” of table 2;

— columns 3, line 12 “Total (sum of lines 1 + 3 + 5 + 6 + 7 + 10 + 11)” of table 2.

At the same time, by the amount of the unaccepted one-time benefit for women who registered in the early stages of pregnancy (465.2 rubles), the indicator in column 3 of line 19 “Debt due to the policyholder at the end of the reporting (calculation) period” of Table 1 should be increased (+).

By the amount of benefits not accepted for offset, the indicators reflecting the value of the taxable base for both types of insurance should be increased (+):

— column 5 and 3 lines 1 “Amount of payments and other remuneration accrued in favor of individuals in accordance with Article 7 of the Federal Law of July 24, 2009 No. 212-FZ” of table 3;

— column 5 and 3 lines 4 “Total base for calculating insurance premiums (page 1 – page 2 – page 3)” of table 3;

— column 3 “Payments and other remuneration in favor of employees for whom insurance premiums are calculated” lines 4, 2 and 1 of table 6.

The following indicators should be increased (+) by the amount of additionally accrued insurance premiums in case of temporary disability and in connection with maternity (RUB 791.48) from the amounts of unaccepted benefits:

— line 2 “Accrued for payment of insurance premiums” of table 1. The increase should be reflected in columns 1 and 3 (“2nd month” and “for the last three months of the reporting period”);

— columns 3, line 8 “Total (sum of lines 1 + 2 + 3 + 4 + 5 + 6 + 7)” of table 1;

— columns 3, line 19 “Debt owed by the policyholder at the end of the reporting (calculation) period” of table 1.

By the amount of the unaccepted temporary disability benefit due to an industrial accident (RUB 26,827.33), you need to reduce (-) the following indicators:

— line 11 “Expenses for compulsory social insurance” of table 7. The decrease should be reflected in column 1 (“2nd month” and “for the last three months”), in column 3 of line 11 of table 7;

— columns 3, line 14 “Total (sum of lines 10 + 11 + 12 + 13)” of table 7;

— column 4 of line 1 “Benefits for temporary disability due to an industrial accident, total” of table 8;

— columns 3, line 10 “Total expenses (sum of lines 1 + 4 + 7 + 9)” of table 8.

By the amount of the unaccepted temporary disability benefit due to an industrial accident (RUB 26,827.33), the indicator in column 3 of line 15 “Debt owed by the policyholder at the end of the reporting period” of Table 7 should be increased (+).

By the amount of additional accrued contributions in case of injury (RUB 218.34) from the amounts of unaccepted benefits, the following indicators of Section II of Form-4 of the Social Insurance Fund, dedicated to insurance premiums in case of injury, should be increased (+):

— column 1 and 3 of line 2 “Accrued for payment of insurance premiums” of table 7 (“2nd month” and “for the last three months of the reporting period”);

— columns 3, line 8 “Total (sum of lines 1 + 2 + 3 + 4 + 5 + 6 + 7)” of table 7;

— columns 3, line 15 “Debt owed by the policyholder at the end of the reporting (calculation) period” of table 7.

In addition to adjusting cost indicators, it is necessary to correct natural indicators reflecting the number of benefits issued (column 3, line 5 of table 2), days of temporary disability (column 3, line 1 of table 8), and the number of victims (column 3, line 1 of table 9).

Let us remind you that the submitted “clarification” for the first quarter is used only for reference purposes, therefore the actual correction of the violation must be reflected when preparing the calculation for 9 months, namely:

— increase in the tax base for both types of social insurance (26,827.33 rubles + 465.2 rubles);

— actual additional accrual of insurance contributions for two types of social insurance (791.48 rubles and 218.34 rubles) from the amount of benefits not accepted for offset and not collected from recipients;

— payment of amounts of benefits not accepted for offset and additional accrued insurance contributions for both types of social insurance.

Adjustment of personalized reporting

In connection with changes in the tax base for insurance pension contributions, individual information submitted for benefit recipients for the first quarter of 2012 should be adjusted.

SZV-6-1 (SZV-6-2). For recipients of unaccepted benefits, corrective forms of individual information should be prepared in the form SZV-6-1 or SZV-6-2 for the reporting period in which the benefits not accepted by the fund were accrued. Corrective information is presented together with the original information of personalized accounting for the reporting period in which the violation was detected.

ADV-6-2. Also, in the ADV-6-2 form, which accompanies the initial individual information for the reporting period in which the violation was detected, data on corrective individual information should be reflected (section “Information on corrective (cancelling) information” of the ADV-6-2 form). It must indicate the amount of additional accrued insurance premiums. It should be equal to the amount of additionally accrued insurance premiums indicated in line 120 of the RSV-1 Pension Fund. Such recommendations are given in the letter of the Pension Fund of Russia dated May 18, 2011 No. 08-26/5304.

The article was prepared based on materials

our colleagues from the magazine “Salary”.

Post:

Comments

Lyudmila

September 25, 2012 at 12:26 pm

Very useful article! There will be fewer questions for the FSS, and we will save time on disassembly. This is a must-read article for both beginners and experienced accountants.

The employee returned the money: USN

Whether the return of an erroneous benefit will affect the calculation of tax on the simplified tax system depends on what benefit the fund refused to reimburse. There are two possible options.

Option 1: the fund refused to reimburse the benefit, which is fully financed by the Russian Social Insurance Fund

Benefits for pregnancy and childbirth, child care, etc., for which the FSS of Russia refused to reimburse expenses and which were returned by employees, do not affect the calculation of the single tax. It does not matter which object of taxation the organization has chosen - “income” or “income reduced by expenses”. Since the benefit was supposed to be fully reimbursed by the Federal Social Insurance Fund of Russia, then you did not take these amounts into account in expenses and did not apply a deduction under the object “income” for them. Therefore, the return of money in case of refusal to reimburse the benefit does not affect the company’s income. There is no economic benefit in the sense of Article 41 of the Tax Code of the Russian Federation. There is no arrears for this tax. After all, simplified organizations do not take into account the amount of such benefits when calculating the single tax (clause 2 of Article 346.16, clause 3 of Article 346.21 of the Tax Code of the Russian Federation).

Option 2: the fund refused to reimburse sick leave benefits when an employee of the organization suffered an illness or injury

Regardless of the chosen object of taxation, if the fund refuses to reimburse the hospital benefit, either the tax base for the single tax or the tax itself will have to be adjusted to the amount of the benefit paid at its own expense.

Since, due to an error, the organization did not pay additional single tax, submit an updated tax return. It must be drawn up for the period in which the organization unlawfully reduced the single tax (included in expenses) by the amount of benefits paid at its own expense. That is, for the first three days of the employee’s illness.

This follows from the provisions of paragraph 1 of Article 81, paragraph 1 of Article 54, subparagraph 7 of paragraph 1 of Article 346.16, paragraph 3.1 of Article 346.21 of the Tax Code of the Russian Federation, paragraph 1 of part 2 of Article 3 of the Law of December 29, 2006 No. 255-FZ.

Once arrears have arisen regarding the single tax (advance payments thereon), the organization will have to pay penalties, and possibly a fine (Articles 75, 122 of the Tax Code of the Russian Federation).

An example of how to reflect when taxing an employee’s return of maternity benefits when the Federal Social Insurance Fund of Russia refuses to reimburse the amounts paid. The organization applies a simplification with the object of taxation “income”

Alpha LLC applies a simplified taxation system (taxable object “income”). Contributions to the Pension Fund of Russia, the Social Insurance Fund of Russia and the Federal Compulsory Medical Insurance Fund are calculated by Alpha at the regular rate.

From November 1 A.S. Dezhneva was hired by the organization as a part-time accountant. The employee presented a sick leave certificate to the accounting department, on the basis of which she was granted maternity leave from May 13 (for 140 calendar days). The amount of maternity benefit was 110,000 rubles.

Dezhneva received benefits on May 12.

By the amount accrued at the expense of the Federal Social Insurance Fund of Russia (RUB 110,000), the accountant reduced the amount of insurance premiums that the organization had to transfer to this fund. The accountant transferred insurance premiums from payments to citizens to the budget on June 15.

On September 24, the Federal Social Insurance Fund of Russia made a decision to refuse to reimburse the amount of the benefit. Dezhneva should have received benefits at her main place of work. The employee agreed to return the amounts previously paid.

Alpha's accountant completed an updated Form 4-FSS. The organization had an arrears in terms of contributions to the Social Insurance Fund of Russia, for which the inspectors assessed penalties and fines.

The fund refused to reimburse the benefit, which is fully compensated by the Russian Social Insurance Fund. Therefore, the accountant did not adjust the single tax during simplification.

An example of how to reflect when taxing an employee’s return of benefits for the birth of a child if the Federal Social Insurance Fund of Russia refuses to reimburse the amounts paid. The organization applies a simplification with the object of taxation “income reduced by the amount of expenses”

Alpha LLC applies a simplified taxation system (taxable object “income reduced by the amount of expenses”). The organization applies a reduced rate of insurance contributions: in the Pension Fund of Russia - 20 percent, in the Federal Social Insurance Fund of Russia - 0, in the Federal Compulsory Medical Insurance Fund - 0.

Employee of the organization A.I. Ivanov applied to the accounting department for payment of a one-time benefit for the birth of a child, despite the fact that his marriage with the child’s mother was dissolved and the child lives with the mother.

Benefit in the amount of RUB 14,497.80. was paid to the employee on January 19 (at the expense of the Russian Social Insurance Fund).

On March 24, the Federal Social Insurance Fund of Russia made a decision to refuse to reimburse the amount of benefits due to the fact that the employee did not have the right to payment (clause 27 of the Procedure approved by order of the Ministry of Health and Social Development of Russia dated December 23, 2009 No. 1012n). The employee agreed to return the amounts previously received.

The organization did not have any arrears in taxes and contributions and the accountant did not submit updated declarations (calculations).

What you need to know

To avoid penalties from various types of funds, it is necessary to familiarize yourself in as much detail as possible with all the information regarding both the calculation of insurance premiums and additional charges.

Moreover, some points are especially important:

- Basic information;

- who pays the fees;

- legal grounds.

Knowledge of current legislative acts that relate to all kinds of insurance premiums allows you to carry out accruals and additional accruals in the correct manner.

Using up-to-date information about laws from trusted sources is necessary for the work of any individual entrepreneur or enterprise.

Basic information

All employers who enter into employment contracts with their employees in the prescribed form are required to make appropriate transfers to the Russian Pension Fund.

This structure is a financial administrator that distributes funds, which subsequently go to:

- for the payment of pensions upon reaching a certain age;

- to pay for services provided to citizens of the Russian Federation under the compulsory health insurance system.

Payment of insurance premiums is carried out in the following order:

| Until the 15th day of each month following the reporting month | If this date falls on a non-working day, then the last reporting day is the next working day. |

| 22% | Pension insurance contribution rate |

| The rate increases by 10% | If the employer’s insurance contribution base is more than a certain amount |

| 5.1% | Contribution rate to the compulsory medical insurance system |

There is a certain category of employers who are exempt from paying insurance premiums. They are also not subject to the increased tariff rate of 10%.

Decree of the Government of the Russian Federation No. 1316 dated December 4, 2014 states that in 2021 the base from which insurance premiums are paid is 711 thousand rubles.

In 2021, payment of contributions of the type in question must be made at the indicated rates for all amounts. The only exceptions are the payments listed in Article No. 9 of Federal Law No. 212-FZ.

It should also be remembered that the taxable contribution base is calculated in relation to each employee separately.

Who pays the fees

The following categories of employers are required to pay insurance premiums:

- All kinds of organizations with employees who are paid wages or working with contractors who are individuals.

- Individual entrepreneurs who work with hired employees or individual contractors.

- Individuals who do not have the status of an individual entrepreneur, but enter into employment contracts with other individuals and contractors.

- Individual entrepreneurs working under the patent system and conducting private practice - this category includes all kinds of notaries, lawyers, as well as other individuals.

Sometimes it happens that an employer simultaneously falls into several categories that are required to make appropriate contributions to extra-budgetary funds. In this case, it is necessary to make transfers on all grounds.

Thus, if an individual entrepreneur conducts private practice and has entered into employment contracts with individuals, then he is obliged to make transfers both for himself and for his employees.

It must be remembered that the employer is obliged to generate quarterly reports, which are subsequently transferred to the Pension Fund of Russia.

Moreover, if the total number of employees is more than 50 people, then this must be done only electronically.

At the same time, individual entrepreneurs carrying out work without employees should not submit any reports.

Legal grounds

The very existence of various extra-budgetary funds, as well as the mandatory transfer of contributions to them, is enshrined at the legislative level.

What the authorities monitoring the payment of insurance premiums do as part of an on-site inspection, see the article: authorities monitoring the payment of insurance premiums.

What methods are used to calculate insurance premiums in 2019?

The main document that you need to focus on is Federal Law No. 212-FZ of 2407.09, as amended on July 13, 2015.

It covers in as much detail as possible all the important points related to the following institutions:

- Pension Fund of Russia.

- Social Insurance Fund.

- Mandatory health insurance fund.

Also, all payers need to remember the following legal grounds:

| Clause 3, Art. No. 5 of Federal Law No. 406-FZ - from 01.01.15 | It is necessary to transfer contributions from all payments that are included in the tax base |

| Clause 2, Article No. 346.43 of the Tax Code of the Russian Federation | All rules and exceptions relating to individuals/legal entities who are exempt or, conversely, are required to make contributions are indicated |

| Clause 3, Art. No. 58.2 of Law No. 212-FZ | All aspects relating to the payment of contributions by foreign citizens are covered in as much detail as possible. |

| Article No. 2 of Law No. 179-FZ | Covers the procedure for applying reduced tariffs |

| Article No. 9 of Law No. 212-FZ | All payments under employment contracts are indicated, from which there is no need to make deductions in favor of extra-budgetary funds |