The introduction of new cash register equipment (hereinafter referred to as CCT) by Federal Law No. 54-FZ makes it easier for entrepreneurs to interact with the tax service and facilitates reporting and internal accounting. In our article we will talk about the legal requirements for cash registers in 2021, cash discipline and machine models for individual entrepreneurs.

Online cash registers for individual entrepreneurs. We will install and register in 1 day.

Leave a request and receive a consultation within 5 minutes.

How to simplify cash management using cash discipline

For some categories of entrepreneurs, the law provides for a simplified procedure for maintaining cash records.

According to the decree of the Central Bank of the Russian Federation, issued in March 2014, businessmen who own enterprises classified as small or micro businesses, as well as individual entrepreneurs, may not set a cash limit.

Individual entrepreneurs, in addition, may not draw up PKO and RKO (receipt and expense cash order), and also have the opportunity to refuse the cash book.

However, these privileges do not replace the obligation to create payroll records when paying wages and benefits to employees.

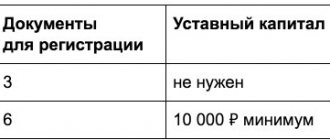

The category of small businesses includes organizations that fall under the conditions of Law No. 209-FZ (clause 1 of Directive No. 3210-U). They can be briefly summarized as follows:

- The organization is classified as consumer cooperatives or organizations equivalent to commercial ones (except for municipal and federal state unitary enterprises);

- The number of such enterprises should vary from 16 to 100 employees;

- Income for the year should not exceed 400 million rubles.

- If the enterprise employs up to 15 people inclusive, and the revenue for the previous year, according to reporting, did not exceed 60 million rubles, this enterprise will be classified as a micro-business.

Important!

The share of state ownership in such enterprises should not exceed 25%.

Despite the obvious conveniences, a businessman must understand that if the receipt of funds is not confirmed by a cash receipt order, the cash may simply not reach the company’s cash desk, remaining with an unscrupulous employee.

In this connection, we can conclude that simplified management of cash discipline will primarily be convenient for entrepreneurs who do not have hired employees.

Strengthening windows and doors

The door must be made of materials whose strength is considered sufficient to be used as a countermeasure to human physical forces and cannot be broken open with simple equipment (for example, a crowbar). It must comply with the requirements of GOST 6629-88, 24698-81, 24584-81, 14624-84:

- All doors must be in good condition, without gaps in the closed and open positions, with a thickness of at least 4 cm, and equipped with at least two locks (not mortise).

- The outer door is reinforced with sheet steel and equipped with a chain lock and a peephole.

- If necessary, the door is strengthened with additional locks, safety linings, strong canopies, and end hooks.

- The internal door is duplicated with a grill of the appropriate size or sliding metal doors with lugs for a padlock. The lattice door is framed with a steel profile; the cells between the welding points of the lattice do not exceed a size of 15 by 15 cm.

A window intended for carrying out financial transactions with clients (company employees) must have specially established dimensions (20 by 30 cm). If it is impossible to comply with this parameter, the outer side of the window is framed with a special grille. The requirements for the door on which the window is located correspond to the conditions for strengthening the external entrance to the cash register room.

All window openings (and vents) have securely fixed glazing. Opening windows are equipped with working locks (latches).

On the inside (or between the frames) window openings are reinforced with bars, which can have a decorative and strengthening character.

For large window sizes, a double, opening grille is installed, which is connected using a padlock threaded through welded metal ears.

For rooms classified as the highest degree of fortification, the inside of the window is equipped with an iron shield.

Important rules about the cash register on video:

What you should not spend cash on

Quite often, store owners or accountants have a question about what expense items can be spent on cash proceeds from the cash register.

First, let's look at what an entrepreneur has the right to spend cash proceeds on:

- Payment of wages to employees;

- Expenses for scholarships;

- Issuance of travel expenses to accountable persons;

- Any other payments to persons who are accountable;

- Expenses on goods or services (except for payment for securities);

- Insurance payments;

- Payment for returned goods;

- Issuance of funds for services/work not provided;

- Issuance of funds for the consumer needs of the owner of the organization, if these needs are classified as personal;

- Payments to the paying agent when carrying out banking transactions.

The list of expense items on which an entrepreneur cannot spend cash from the enterprise’s cash desk includes much fewer items, but their compliance is strictly mandatory:

- Rent;

- Interest on loans, as well as the issuance or repayment of the loans themselves;

- Any manipulation with securities;

- Costs of organizing games from the gambling category.

If an entrepreneur needs to make one of the above payments, the funds will need to be withdrawn from the organization’s current account.

Penalties for violations committed

The main government body exercising control over compliance with the proper regime for conducting cash transactions is the Federal Tax Service. It is authorized to conduct scheduled and unscheduled inspections of business entities, send requests, verify documentation, and, if violations are identified, apply administrative and criminal penalties.

Important! If an enterprise (IP) fails to comply with the legal norms for conducting cash transactions, the guilty employees of the business entity and its officials may be held accountable.

About the features of cash transactions in the video:

The procedure for maintaining cash discipline

As for measures aimed at maintaining cash discipline at online cash registers, the company develops them independently.

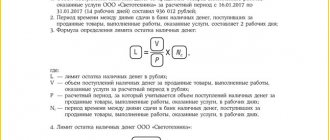

Cash limit at the cash desk

The organization determines it for itself independently. When calculating, the company’s field of activity, the approximate amount of daily revenue, etc. are taken into account. All cash in excess of the established limit must be collected into the bank.

Cash payment limit

The maximum permissible limit for cash payments between organizations or individual entrepreneurs cannot exceed 100,000 rubles within the framework of one agreement. Moreover, this limit will remain in effect even after the expiration of the contract.

For example, a lease agreement was concluded between IP Volga and IP Berkut. After the expiration of the contract, IP "Berkut" still had a debt to IP "Volga" in the amount of 300 thousand rubles. Of the total debt of IP Berkut, only 100 thousand rubles. will be able to pay in cash.

Cash acceptance

If the organization does not belong to the category of small or micro business, cash is received through a cash receipt order (PKO). The employee accepting the document must check whether it contains:

- signatures of an accountant or manager;

- indicating the amount in accordance with the amount of cash actually transferred;

- availability of supporting documents, if such are indicated in the PQS.

Cash is counted piece by piece in the presence of the person transferring it. If the amount declared in the PKO coincides with the actual amount of cash, the cashier stamps and signs the receipt for the cash receipt order, and then hands it over to the person from whom the funds were received.

Cash withdrawal

When dispensing cash from the cash register, the cashier must check the cash receipt order (RKO) for the presence of:

- signatures of an accountant or manager;

- correspondence of the amount indicated in words with the amount indicated in the document in numbers.

In order to issue the cashier, the cashier must identify the recipient using an identification document (passport). The recipient, in turn, must sign the cash register, thereby confirming the receipt of funds.

Cash desk requirements in 2021

Now new cash register machines (hereinafter referred to as KKM) must comply with law 54-FZ. Requirements for devices are specified in Article 4. 54-FZ.

According to the rules, the online cash register must:

- have constant access to the Internet;

- print new paper checks and create electronic ones that can be sent to the client by email or mobile phone;

- send documents to the fiscal data operator (FDO) - a company that deals with subsequent interaction with the tax office;

- generate reports on the status of calculations and notify about incorrect operation;

- meet the specified physical characteristics (have a fiscal drive (FN), a clock, a printing mechanism, etc.).

All cash register models that comply with legal requirements are presented in a special register of the Federal Tax Service on the official website. The same list has been developed for fiscal storage units and fiscal data operators.

We'll tell you which cash register from our catalog is suitable for your business.

Leave a request and receive a consultation within 5 minutes.

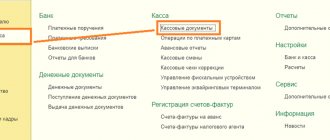

Procedure for preparing cash documents

The main documents that are involved in the process of maintaining cash discipline at an online checkout are PKO and RKO.

Receipt cash order

Records the fact of receipt of cash at the cash desk. The document contains the following information:

- household operation;

- receipt amount;

- tax on the amount deposited;

- documents attached to the PQS;

- code of the department in which the funds will be capitalized.

Account cash warrant

This document, according to its name, records the expenditure of cash. Mandatory information in this case is:

- expenditure;

- amount of expense;

- recipient;

- documents attached to the RKO. All specified documents are also registered in the PKO/RKO journal.

This might also be useful:

- How can an individual entrepreneur keep accounting records?

- Audit: let's look into the details

- Submitting reports electronically - using innovations

- New procedure for conducting cash transactions in 2021

- How much taxes does an individual entrepreneur pay in 2021?

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

How is cash discipline checked?

Cash discipline is checked as part of on-site activities of the tax service.

The main aspects that the Federal Tax Service pays attention to:

- Algorithm for posting revenue, availability of uncapitalized funds;

- Compliance with the cash limit;

- Condition, serviceability and availability in the state. online cash register register;

- Compliance of cash documents with actual amounts;

- The fact of issuance/non-issuance of cash receipts to customers;

- The presence of large amounts issued on account for unreasonably long periods, etc.

KKT: features of purpose

Cash register equipment is used in most cases of issuance and receipt of cash (non-cash) funds by the cash desk of an organization (enterprise). The main purpose of the cash register is to document the directions of cash flows for further reporting to management, tax authorities and other interested parties (for example, police officers, prosecutors, auditors, etc.).

The presented technique allows the entrepreneur (the head of the organization) to exercise control over the amount of working capital and predict changes in the overall balance.

Order for setting a cash limit

After you calculate the cash balance limit for the cash register, you must issue an internal order approving the limit amount. In the order, you can indicate the validity period of the limit, for example, 2017 (sample order).

The law does not provide for the obligation to reset the limit every year, so if the validity period is not specified in the order, then the established indicators can be applied both in 2021 and further until you issue a new order.