Every entrepreneur who is just starting out in the world of big business faces a reasonable question: how to choose a tax system (TSS) for their business. This choice may also arise when the individual entrepreneur is seriously thinking about changing the aid to navigation, since the current one is unprofitable.

In Russia, five tax regimes are available to individual entrepreneurs, one of which is simplified, in two versions. You can choose the taxation system yourself. In this case, it is worth taking into account the requirements for business and restrictions on the use of one or another special regime. At the start, you need to assess what fiscal burden the individual entrepreneur faces in each of the modes, so as not to pay too much.

Using the example of one entrepreneur, we will select the most favorable tax regime, which will help you save more than 100,000 rubles in mandatory payments to the budget in the first year.

What you have to pay anyway

The difference between the systems concerns the taxes that entrepreneurs pay on revenues and/or their income. All other payments for them will be the same, namely:

- Contributions for own insurance.

- Contributions for pension, social and medical insurance of employees, as well as for injuries.

- Personal income tax for employees (withheld from salaries, but the tax is transferred to the budget by the employer).

- Other special payments, if the activity requires it. For example, transport, water tax or trade tax.

Read about changes to taxation systems in 2021 here.

Insurance premiums for individual entrepreneurs

Who pays: Individual entrepreneurs are obliged to pay insurance premiums for themselves and for their employees, no matter what tax regime they apply, so let’s start with them.

How many fees to pay:

- Individual entrepreneurs pay fixed contributions for themselves for compulsory pension and health insurance - in 2021, this amount reached 36,238 rubles.

- It is also necessary to pay extra for compulsory pension insurance - 1% of annual income over 300 thousand rubles.

- For employees, the individual entrepreneur pays mandatory insurance contributions: 22% of the accrued salary for pension insurance, 2.9% for temporary disability insurance, 5.1% for medical insurance.

In general, the employer contributes more than 30% of the employee’s salary to the state budget.

You can calculate the amount of mandatory insurance contributions using an online calculator on the Tax Service website.

There are also voluntary contributions to the Social Insurance Fund - for yourself and for hired workers; individual entrepreneurs pay them at will.

Example: let’s calculate how many insurance premiums an individual entrepreneur will pay for himself in 2019 if his annual income is 1,000,000 rubles and he does not have a single employee.

- fixed amount – 36,238 rubles;

- 1% of excess income - 1% * (1,000,000 - 300,000) = 7,000 rubles.

Total contributions for this individual entrepreneur: 43,238 rubles per year.

Basic mode

The main tax regime (OSNO) has the highest tax burden, so entrepreneurs usually do not choose it of their own free will. It includes those who do not fall under the conditions of special regimes, did not have time to switch to them, or went beyond the established boundaries. Individual entrepreneur taxes on the general system are presented in the table.

| Tax | Bid | The tax base |

| VAT | Basic - 20%, preferential - 10%, export - 0% | Revenue from the sale of taxable goods and services |

| Personal income tax on individual entrepreneur income | 13% | Income reduced by documented expenses (professional deductions) |

| Property tax for individuals | 0,1-2% | Cost of property used in business |

Who chooses OSNO

Voluntary application by an entrepreneur of the basic tax system is usually associated with the deduction of VAT and is beneficial in the following cases:

- Most contractors of individual entrepreneurs are VAT payers. Buyers can claim for deduction the input tax charged to them by the entrepreneur. And he himself is the one that his suppliers provide him.

- The individual entrepreneur conducts wholesale trade with large companies. They pay VAT and do not particularly like to purchase from entities under special regimes due to the inability to claim a deduction for such transactions.

- The individual entrepreneur sells imported goods. Upon import, he must pay VAT, but can subsequently deduct it.

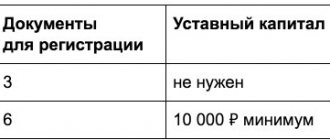

The general taxation system (OSNO) is the system installed during registration “by default”.

This system is installed automatically for all legal entities and individuals at the time of state registration; there is no need to specifically select it.

| NOTE: The general tax system (OSNO) should be left and nothing changed only if:

This mode is quite burdensome, therefore, if there are reasons and opportunities, it is better to immediately make a choice in favor of one of the special modes. |

Simplified system

The simplified tax system or simplified tax system is good for its versatility and is therefore widespread. To apply it, an entrepreneur must have no more than 100 employees, and his annual income must not exceed 150 million rubles.

You can choose to pay using the simplified tax system:

- 6% from income;

- 15% of the difference between income and expenses.

These rates may be reduced by regional laws. In addition, for certain types of activities on the simplified tax system it is allowed to introduce tax holidays, that is, a 0% rate.

A simplified individual entrepreneur does not pay his own personal income tax, tax on “entrepreneurial” real estate, except for those assessed at cadastral value. He also does not have to pay VAT other than that incurred when importing goods. But he cannot deduct this tax.

Read about changes to the simplified tax system in 2021 here.

When is the simplified tax system beneficial and which option to choose?

The simplified system is almost always more profitable than the basic system, with the exception of import operations. Therefore, if business conditions allow, it is reasonable to switch to the simplified tax system. An important point is that the new individual entrepreneur must submit a notification of the application of this regime immediately upon registration or within 30 days after it. Otherwise, you will have to use the main system until the end of the year.

When choosing a rate, you need to proceed from the share of expenses in the business. If there are quite a lot of them, about 65-70%, then it is more profitable to use the simplified tax system at a rate of 15%. This option is usually chosen for trade and manufacturing.

The simplified tax system with a rate of 6% is a suitable option for a business with a small share of costs. It is usually used by individual entrepreneurs who provide services independently or hire a small number of employees. When calculating tax, you can take into account insurance premiums. If you have employees, you can reduce your tax by up to 50% through deductions. If the individual entrepreneur works on his own, he deducts all contributions paid. For incomes up to 650 thousand rubles per year, due to this, the tax is reduced to zero.

The advantages of the simplified tax system include the small number of reports - one declaration per year. Perhaps it will soon be canceled for those entrepreneurs who apply the simplified tax system of 6% and use online cash registers.

UTII – single tax on imputed income

Who is it suitable for: imputation is not suitable for everyone and not everywhere - UTII cannot be used in Moscow. And in those regions where this special regime operates, it is used only for certain types of business and subject to a number of conditions. So, this special mode is suitable for retail trade, but only if the sales area is no more than 150 square meters. meters. A general list of suitable types of activities with a list of conditions for business is given in Art. 346.26 Tax Code of the Russian Federation. You can compare whether you meet this list and whether you can apply UTII or not.

How to switch: you can switch to UTII at any time by notifying the tax office within 5 days from the date of such transition. However, it is worth remembering that you need to notify the tax office at the place of business, and not at the place of registration. In addition, the notification should be sent when you begin the relevant activity, not when you are just planning to begin it.

What tax to pay: the single tax on imputed income under this special regime is calculated using the formula: FP * BD * K1 * K2 * Rate 15%.

- where FP is a physical indicator of a specific business: number of employees, sales floor area, number of vending machines;

- DB – basic profitability: in Art. 346.29 of the Tax Code of the Russian Federation specifies the standard for how much income different types of businesses can generate per employee or per sq.m. store area;

- K1 – a deflator coefficient common to all, in 2021 – 1.915;

- K2 – regional coefficient for certain types of activities, different areas and categories of business;

- Regional authorities have the right to set the UTII rate in the range from 7.5 to 15%.

Tax calculation depends on the location and type of activity, so the amount of UTII payable for a hairdressing salon with two employees in the Moscow region and in the Far East can vary greatly. Look for all the missing data in local regulations - they are posted on the official website of the Federal Tax Service in the corresponding section about the use of UTII in the regions, there you only need to select your subject of the Russian Federation and municipality.

Example:

To begin with, let’s collect all the values for the indicators from the formula for calculating UTII:

- FP for a car service is the number of employees, and the individual entrepreneur himself is also considered. In our example there are no employees, so FP = 1;

- the basic profitability for this type of activity according to the Tax Code is 12,000 rubles per month, respectively, 144,000 rubles per year;

- K1 coefficient this year is 1.915;

- the K2 coefficient for car repairs in the Moscow region city of Kolomna is 1 (this value is from the corresponding decision of the city council of deputies);

- UTII rate is basic, 15%.

Let's multiply all these indicators and reduce the resulting amount by the amount of insurance premiums to get UTII payable: (1 * 12,000 rubles * 12 months * 1,915 * 1 * 15%) - 43,238 rubles. = 41,364 – 43,238 rub. Since the amount of tax does not even exceed the amount of insurance premiums, this entrepreneur will not have to pay tax at all under UTII.

Patent

The patent taxation system (PTS) is a regime created specifically for individual entrepreneurs and the easiest to account for. The entrepreneur chooses the type of activity and the validity period of the patent, acquires it and begins to work. The main thing is to pay the cost of the patent on time. It depends on the direction of the business and the place where it is conducted.

The restrictions for the use of PSN are as follows:

- the regime must be valid in a specific region and for the activity chosen by the individual entrepreneur;

- number of employees - no more than 15 people;

- income - no more than 60 million rubles from the beginning of the year. Moreover, if an entrepreneur combines a patent and the simplified tax system, then income under both tax systems is taken into account;

- from 2021 not available for sale of labeled goods.

Pros and cons of buying a patent

The PSN tax does not depend on income. The cost of a patent can be calculated in advance on the Federal Tax Service website specifically for your business and location. That is, an individual entrepreneur can plan his tax expenses. No reporting is required.

Another important advantage is that the patent is suitable for seasonal activities, since it can be purchased for several months. It is also convenient that an individual entrepreneur can purchase the patents he needs in different regions.

But the system is not without its disadvantages:

- The price of a patent is often quite high. This depends on the potential income of the entrepreneur in this area, and it is set by the authorities and can be overestimated.

- Entrepreneurs cannot reduce the cost of a patent for insurance premiums either for employees or for themselves. True, the Ministry of Finance is going to fix this - the change is included in the main directions of tax policy, which are being considered by the State Duma. If individual entrepreneurs on PSN are allowed to deduct contributions, this will make the regime more attractive.

Please note that from 2021 the patent tax system will change significantly. Read about the new working conditions here.

Is it possible to change it

According to the law, an individual entrepreneur must monitor whether the criteria for his activities correspond to the chosen taxation system. If you do not switch to another mode in time, the Federal Tax Service will recalculate and impose a fine.

To switch to another form of tax payment, you need:

- Select a new mode that corresponds to the activity parameters.

- Fill out an application (for PSN and UTII) or notification (for simplified tax system). The document is drawn up on a computer or by hand. An important condition is that it should not contain corrected errors or typos.

- Take the application to the tax office in person or send it electronically on the Federal Tax Service website.

- Prepare reporting documents and their copies: declaration of profit, certificates of the number of personnel, residual value, share of the individual entrepreneur’s capital in other companies.

- Wait for approval and confirmation. Typically, the tax office reviews applications within 5 days.

- Make sure the mode is changed. When switching to PSN, a patent is issued. If the businessman is now on UTII, he receives a notification. There is no confirmation form for the simplified tax system, but the entrepreneur has the right to request a letter.

The tax office has the right to refuse an entrepreneur if his activities do not meet the requirements of the chosen regime. In this case, it is recommended to reconsider the decision and opt for a different form of calculating tax payments.

Unified agricultural tax

The single agricultural tax is intended for agricultural producers. A detailed description of all entities that are recognized as such can be found in Article 346.27 of the Tax Code of the Russian Federation. Here we just mention that if an individual entrepreneur processes agricultural or fishery products, but does not produce them (does not grow them), then he cannot apply this regime.

The Unified Agricultural Tax has a low tax rate - 6% of the difference between income and expenses. Moreover, the constituent entities of the Russian Federation have the right to reduce this rate to 0. The tax is paid twice a year, and the declaration is submitted only once.

Agricultural producers on the Unified Agricultural Tax do not pay personal income tax and property tax if it is used in business. But from 2021 they started paying VAT. However, with small incomes, you can apply the rule from Article 145 of the Tax Code of the Russian Federation and receive an exemption from this tax. If the activities of an individual entrepreneur meet the requirements of the Unified Agricultural Tax, then using this system will most likely be profitable.

How to request information from the Tax Inspectorate

Contacting the Tax Inspectorate is perhaps the most effective, fastest and reliable way to obtain the necessary information about the taxation system. You can contact the inspector personally with your passport and Taxpayer Identification Number (TIN) and explain the situation.

You can also generate a request for confirmation of the fact that the simplified tax system is applied, as if the notification of the transition was not submitted. If it was indeed sent and the system is applied, the Federal Tax Service of the Russian Federation must respond to this request with a confirmation letter in form No. 26.2.-7. There is also the opportunity to request Form 39, a certificate of debt; this form will reflect the tax line for which the entrepreneur is obliged to report and pay tax. If the individual entrepreneur sent a notification about the transition to the simplified tax system, then he will find the corresponding line in the certificate.

New NAP regime

Since 2021, as an experiment, a new regime based on the payment of professional income tax (NPT) has been introduced in certain regions of Russia. It is designed for self-employed individuals and entrepreneurs.

The advantages of NPD are as follows:

- Low tax rates - 4% on income received from transactions with individuals, and 6% on transactions with legal entities and individual entrepreneurs. Expenses are not taken into account.

- This is the only regime that allows individual entrepreneurs not to pay their pension contributions. Medical contributions will be included in the tax amount. If an entrepreneur wants his insurance period to accumulate, he can pay contributions to the pension voluntarily.

- No need to purchase an online cash register. Receipts are generated through a special “My Tax” application.

- You don’t have to think about reporting and tax calculations. The Federal Tax Service itself will calculate everything and send you a monthly payment.

But there are also limitations:

- You can't hire workers.

- You can only engage in services or sell products of your own production, but you cannot resell goods.

- An entrepreneur's income is limited to 2.4 million rubles per year.

- This mode cannot be combined with others.

The NAP regime is valid in all regions of the country.

The use of NPD can be beneficial for those individual entrepreneurs who have small incomes and do not yet have plans for expansion. Their business is based on working with their hands or their heads, and their clients are predominantly individuals. However, it is quite possible that in this case, more benefits can be obtained from simplification, which allows you to reduce the tax to zero due to insurance premiums.

When to choose a form of taxation

After registration, an individual entrepreneur is automatically placed on the general tax payment system. If he believes that the tax burden on OSNO is too high, which will cause his business to suffer losses, the businessman can choose a regime in which he will have to make the least number of payments.

Important! Paying the minimum tax for the purpose of business development is the legal right of an entrepreneur.

To switch from OSNO to another mode, you must meet the requirements and criteria and assess business opportunities in advance. If, having switched to the simplified tax system or a patent, an individual entrepreneur exceeds the permissible limits of annual profit or the number of hired workers, as a punishment he will immediately be transferred to OSNO. The reason for fines is also the incorrect form or untimely filing of reports, which is also worth considering when choosing a tax system.

Comparison by example

To figure out which taxation system is better for an individual entrepreneur, let’s calculate how much taxes he needs to pay for them.

Let's take an entrepreneur from the town of Chekhov near Moscow with services for sewing curtains to order. With an average bill of 4.5 thousand rubles and 5 clients per day, the expected monthly income will be 675 thousand rubles. Number of employees - 5. Total cost per month in accordance with the business plan - 370 thousand rubles, including wages - 150 thousand, insurance premiums for employees - 45 thousand, for individual entrepreneurs - 3.02 thousand rubles .

| ✏ Let's calculate the simplified tax system 6%. The tax will be: 675 * 6% = 40.5 thousand rubles. It can be reduced by contributions, but not by more than half, since the individual entrepreneur has employees. In total, on the “income” simplified tax system, the tax will be equal to 40.5 / 2 = 20.25 thousand rubles. |

| ✏ We will calculate the simplified tax system of 15%. The tax base is: 675 - 370 = 305 thousand, tax amount: 305 * 15% = 45.75 thousand rubles. |

| ✏ Let's calculate PSN. We will do the calculation using a calculator from the Federal Tax Service website. It turns out that in a year an individual entrepreneur must pay 67.729 thousand for a patent, or approximately 5.65 thousand per month. |

We will not take into account other tax regimes, since our entrepreneur does not fit their conditions. It turns out that the most profitable is the simplified tax system Income. But do not forget that this is a special case with very approximate figures. If you slightly change the conditions of the problem, you may get completely different conclusions.

So, we looked at all possible modes, their strengths and weaknesses. It is impossible to say unequivocally which taxation system to choose for individual entrepreneurs in order to get the greatest benefit. It all depends on a combination of factors - the type of business, the place of its introduction, the share of expenses in relation to income, the planned scale of activity, the number of employees and others. The best option is to calculate the tax burden under several regimes and compare the results.

Changes for individual entrepreneurs

Individual entrepreneurs and employees will have new responsibilities:

- If there are more than 10 employees, then reporting for them must be submitted only electronically. Currently, this obligation is established only for those with more than 25 employees.

- With each personnel change (hiring, dismissal, transfer), new reporting must be submitted to the Pension Fund of Russia in the SZV-TD form. The change was introduced in connection with the transfer of work books to electronic format.

- The employee's salary must be no less than the minimum wage. In 2021, the all-Russian minimum wage is set at 12,130 rubles, and if there is a regional minimum wage, you need to focus on it.

- The deadline for submitting 2-NDFL and 6-NDFL for the year has been postponed by one month, so instead of April 1, have time to report no later than March 1, 2021. And the calculation of contributions, starting from the 1st quarter of 2021, must be submitted using a new form (order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11 / [email protected] ).

- The maximum base for calculating contributions for employees has increased. This means that employers will have to pay more for insurance for individuals.

Taxation for individual entrepreneurs: what types exist, their conditions

In accordance with the provisions prescribed in Article 227 of the Tax Code of the Russian Federation, private owners are required to independently calculate the amount of taxes on the income of individuals from business and pay within the specified period. But if a businessman-entrepreneur, on his own initiative, switches to a simplified system, he is no longer required by law to pay income tax. As an exception, there is a single category of fees, which is established for profit in accordance with paragraphs 2, 4 and 5 of Art. 224.

Private entrepreneurs pay the state the approved amount of non-tax accruals for 12 months. In this case, the direct amount of income received does not matter. The base and object of taxation in this case are also not determined. When calculating the amount of contributions, the cost of the insurance period equal to one year is taken as a basis. In such a situation, it is important to understand that the use of reduced tariffs and the absence of personal income tax payments can arouse increased interest on the part of the inspection authorities. Which is quite reasonable, suddenly a private owner makes a large profit, but does not contribute enough to the state treasury.

If the competent authorities begin to become interested in the compliance of the income received and the taxes paid, it is time to turn to tax optimization with the help of an experienced tax lawyer. This is the only way to avoid conflict and at the same time talk about the economic benefits of the enterprise.

Do you want to implement “Store 15”? Get all the necessary information from a specialist.

Thank you!

Thank you, your application has been accepted.

Conclusion!

So, how can an individual entrepreneur decide on the tax system? You can follow this algorithm:

- Determine your types of activities and the tax regimes that you can apply;

- Study the restrictions that may prevent you from switching to one mode or another: the number of employees, the amount of income/expenses, other indicators;

- Find out whether this regime applies in the territory where you are going to operate (just contact your tax office, they will tell you everything in detail);

- Determine for yourself: is VAT important to you or your partners, is it important for you to use CCA, is the possibility of reducing taxes on insurance premiums and other similar points important to you;

- Calculate approximate values of the tax burden under possible tax regimes.

- The final choice must be made based on the smallest amount of tax payable.

We also recommend that you keep accounting and tax records in online accounting services, because many calculations are done automatically, you will never forget about paying taxes and mandatory payments, all documentation for reports is generated automatically, which simplifies your work 100%. You don’t even need to go to the tax office! By the way, the site already has an article about one of these services: “How to do online accounting yourself.”