Who must pay insurance premiums in 2021 and when?

The responsibility for calculating and transferring contributions is assigned to organizations and individual entrepreneurs if they have hired employees, as well as to individual entrepreneurs for themselves. In addition, notaries, patent attorneys, lawyers and appraisers must pay insurance premiums. A specific list of such payers is contained in Art. 419 of the Tax Code of the Russian Federation.

Insurance premiums must be transferred no later than the 15th day of the month following the month in which contributions were calculated. If the transfer deadline falls on a holiday or weekend, then contributions must be paid no later than the next business day.

What income should be taken into account to determine the right to reduced tariffs under the simplified tax system?

Payers on the simplified tax system can pay contributions at reduced rates if the following inequality is observed (clause 6 of article 427 of the Tax Code of the Russian Federation):

Income from the type of activity from paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation / Total income ≥ 70 %

Law No. 335-FZ clarified exactly what income must be taken into account when determining these indicators. Changes in paragraph 6 of Article 427 of the Tax Code of the Russian Federation came into force on November 27, 2017 and apply to legal relations that arose from January 1, 2017 (clause “c” of paragraph 76 of Article 2, Part 9 of Article 9 of Law No. 335-FZ) .

Now the Tax Code states that in total income the following must be taken into account:

- income from sales;

- non-operating income;

- income listed in Article 251 of the Tax Code of the Russian Federation (despite the fact that they do not increase the base under the simplified tax system). For example, this is targeted financing and targeted revenues.

As for income from “preferential” activities (the numerator of the formula), according to the amendments, when determining it, income related to the implementation of such activities is taken into account.

From this formulation it is not entirely clear whether it is necessary to take into account amounts not subject to the single tax? In our opinion, it is necessary.

However, it is possible that the tax authorities will think differently and will adhere to the position that amounts not subject to a single tax under the simplified tax system should be taken into account only when determining the total amount of income.

Disputes on this issue have been going on for a long time and are resolved, mainly, not in favor of the taxpayer. Until 2021, the courts sided with the regulatory authorities.

Unfortunately, Law No. 335-FZ did not solve this problem. We believe that in order to avoid claims from tax authorities, it is more advisable for payers to take into account amounts not taxed under the simplified tax system when determining only the total amount of income.

Where to send insurance premiums in 2018

Starting from 2021, the administration of insurance premiums has been transferred to the Federal Tax Service, and therefore this kind of transfers should be sent there. This point concerns contributions to pension, health and social insurance, except for contributions for injuries, which, as before, must be transferred to the Social Insurance Fund.

Important! According to paragraph 11 of Art. 431 of the Tax Code of the Russian Federation, insurance premiums must be sent to the location of either the company’s head office or its separate division.

Companies of all legal forms, as well as individual entrepreneurs, must pay the appropriate contributions to the Federal Tax Service at the place of registration for themselves and their employees. The procedure for transferring contributions also does not depend on the taxation used by business entities. In addition, if an individual entrepreneur decides to pay voluntary social contributions for himself, they must be transferred to the Social Insurance Fund, as stated in clause 5 of Art. 4.5 of the Federal Law “On Compulsory Social Insurance...” dated December 29, 2006 No. 255-FZ.

Who is obliged to accrue

Since 2021, the procedure for calculating insurance premiums is established by the Tax Code of the Russian Federation (Chapter 34, Article 426), and in terms of contributions for insurance of industrial injuries - by Federal Law of July 24, 1998 N 125-FZ.

According to the law, payers are legal entities making payments to individuals. Moreover, it does not matter at all who the payer is - LLC, JSC, PJSC or individual entrepreneur. Contributions are calculated for wages of both citizens of the Russian Federation and foreign citizens.

Persons conducting private practice (notaries, lawyers and others), despite the fact that they do not pay other individuals, are also payers.

Payroll contributions include:

- Pension insurance (PPI);

- Insurance in case of temporary disability and in connection with maternity (OSS);

- Medical insurance (CHI);

- Insurance against industrial accidents and occupational diseases (OSS NS).

How to fill out a payment order for the transfer of insurance premiums in 2021.

Payment orders for insurance premiums are processed in the same way as when transferring tax payments, and the following must be taken into account:

- in the column “payer status” code 01 is entered;

- in the “payee” column you must indicate the number of the tax office at the place of registration;

- in column 106, a two-digit payment code is entered as the basis for payment;

- the tax period is entered in column 107;

- columns 108 and 109 indicate the number and date of the request for payment of insurance premiums, if it is received from the Federal Tax Service and is the basis for the transfer of funds.

The range of payments within the framework of the World Cup, which are exempt from contributions, has been reduced

From 2021, payments to foreign citizens and stateless persons who took part in the preparation and holding of the FIFA World Cup are exempt from insurance premiums. But this is a general rule.

Law of October 30, 2021 No. 303-FZ shortened the wording of paragraph 7 of Art. 420 Tax Code of the Russian Federation. From January 1, 2021, there will be no contributions if these persons signed an employment or civil contract directly with FIFA.

And so payments to them are still subject to contributions if they go through:

- FIFA subsidiaries;

- organizing committee "Russia-2018";

- subsidiaries of this organizing committee.

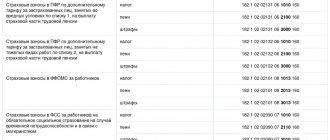

An important point is to indicate the correct BCC

A particularly important point is that the correct BCCs have been entered for payment of insurance premiums, since errors in this column will lead to the wrong direction or return of funds.

The main BCCs for insurance premiums for employees are presented in the following table:

| Payment | KBK | ||

| OPS | Compulsory medical insurance | FSS | |

| Contribution | 18210202010061010160 | 18210202101081013160 | 18210202090071010160 |

| Penya | 18210202010062110160 | 18210202101082013160 | 18210202090072110160 |

| Fine | 18210202010063010160 | 18210202101083013160 | 18210202090073010160 |

For more detailed information on various BCCs for insurance premiums, read this material.

The object of taxation of contributions in terms of intellectual property has been expanded

Insurance premiums will have to be calculated more often in 2021. Law No. 335-FZ adjusted the composition of objects subject to insurance premiums (clauses 1 and 4 of Article 420 of the Tax Code of the Russian Federation).

The amendments clarified the list of agreements on the alienation of the exclusive right to the results of intellectual activity and licensing agreements on the granting of the right to use, payments for which are subject to insurance premiums. Now the Tax Code of the Russian Federation refers to subparagraphs 1 to 12 of paragraph 1 of Art. 1225 of the Civil Code of the Russian Federation. And this:

- works of science, literature and art;

- computer programs;

- Database;

- execution;

- phonograms;

- messages on the air or via cable radio or television programs (broadcasting);

- inventions;

- utility models;

- industrial designs;

- selection achievements;

- topologies of integrated circuits;

- know-how.

Until 2021, the Ministry of Finance believed that remuneration for the alienation of the exclusive right to a computer program was not subject to insurance premiums (letter dated 06/09/2017 No. 03-15-05/36269). The explanation was this: it does not refer to works of science, literature and art, but a separately identified result of intellectual activity.

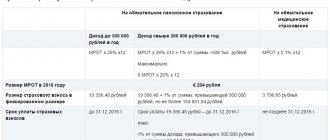

Special rules for transferring insurance premiums to individual entrepreneurs for themselves

Entrepreneurs are required to transfer contributions for mandatory health insurance and compulsory medical insurance to the tax office at the place of residence, and voluntary contributions for social insurance to the territorial department of the Social Insurance Fund at the place of registration. In this case, all contributions must be transferred to the tax office, regardless of the period for which they were calculated. The division into periods before 2021 and after 2021 is carried out based on the use of specific BCCs.

For periods after 2021, the following BCCs must be used:

| Payment | KBK | |

| OPS | Compulsory medical insurance | |

| Fixed contributions | 18210202140061110160 | 18210202103081013160 |

| Contributions in the amount of 1% on the amount of income over 300 thousand rubles. | – | |

| Penya | 18210202140062110160 | 18210202103082013160 |

| Fine | 18210202140063010160 | 18210202103083013160 |

More detailed information on the BCC for individual entrepreneurs' insurance premiums for themselves can be obtained from this article.

As for the deadlines for paying insurance premiums for individual entrepreneurs for themselves within an income of 300 thousand rubles, the deadline is December 31 of the same year. If this day falls on a holiday or weekend, funds must be transferred on the next first business day. In this case, this amount can be paid in a one-time payment or divided into several parts (up to 1 month). Contributions in the amount of 1% on the excess income of 300 thousand rubles. must be paid no later than July 1 of the following year.

When an entrepreneur ceases to operate, contributions must be transferred no later than 15 days from the date of registration of the closure of the individual entrepreneur.

For simplified people - new preferential activities

The Tax Code of the Russian Federation provides for reduced rates for a number of categories of taxpayers. The changes affected simplifiers who were entitled to apply preferential rates.

The list of activities from this paragraph has undergone changes to bring it into compliance with the new directory of OKVED-2 codes. The state did not seek to cut the benefit, but some taxpayers risked losing the right to lower tariffs due to clarification of the name of the type of activity.

New reasons to reject RSV

From January 1, 2021, the reasons for refusal are the following: errors in the amount of payments and other remunerations, errors in the base for calculating “pension” contributions within the limit, errors in the base for calculating “pension” contributions for additional tariffs, as well as errors in the amount of the “pension” contributions themselves. pension" contributions ("regular" and at additional tariffs). The condition for data discrepancy looks like this: a discrepancy between the amounts of the same indicators for all individuals and the same indicators for the payer as a whole. As for inaccurate personal data, they will also remain on the list of reasons for non-acceptance of payment of contributions.

As before, tax authorities are required to notify the policyholder of an unsubmitted calculation. The notification period will remain: no later than the day following the day of receipt of the calculation in electronic form (or 10 days following the day of receipt of the calculation in paper form). The policyholder, in turn, must correct the violations and submit a new calculation within five days from the date of sending the notice in electronic form (or within 10 days from the date of sending the “paper” notice). If these deadlines are met, the date of submission will be considered the day the initial calculation is submitted.

Calculation upon acquisition or loss of individual entrepreneur status

By law, an entrepreneur must begin paying insurance premiums from the moment the individual entrepreneur was registered. The need to make payments disappears simultaneously with the loss of individual entrepreneur status.

Example. IP Nosov was officially registered and included in the Unified State Register of Legal Entities on March 18, 2021. But on October 20 of the same year, Nosov stopped carrying out commercial activities and lost his status as an individual entrepreneur. During operation, the enterprise's income amounted to 900,000 rubles. Let's calculate the amount of insurance premiums.

When calculating the amount of insurance premiums, the days of obtaining and losing the status of an individual entrepreneur are not taken into account. Therefore, insurance will be calculated for the period from March 19 to October 19.

First of all, let's calculate the amount of pension and health insurance for 1 calendar month. To do this, we will divide the annual fee into 12 months.

Pension 26,454 / 12 = 2,212 rubles

Medicine 5,840 / 12 = 486

In our example, the enterprise operated for 6 full months. For them the businessman must pay:

Pension 2,212 * 6 = 13,272 rubles

Medicine 486 * 6 = 2,916 rubles

In total, Nosov must transfer 16,188 rubles for 6 full months.

In addition, the individual entrepreneur worked for 2 incomplete months - March and October.

In March there were 31 days, of which the individual entrepreneur worked for 12 days. Contributions for this month will be calculated as follows:

Pension insurance: 2,212 / 31 * 12 = 856 rubles

Medical insurance: 486 / 31 * 12 = 188 rubles

In total, Nosov needs to transfer 1,044 rubles for March.

There were also 31 days in October, of which the entrepreneur worked for 19 days.

Pension insurance: 2,212 / 31 * 19 = 1,356 rubles

Medical insurance: 486 / 31 * 19 = 298 rubles

For October, the merchant must deposit 1,654 rubles

In 2021, the amount of insurance premiums will be:

Pension insurance: 13,272 + 856 + 1,356 = 15,484

The income of IP Nosov for 2021 exceeded three hundred thousand rubles. Therefore, the entrepreneur needs to pay extra (900,000 – 300,000) * 1% = 6,000 rubles.

The total amount of pension contributions for the accounting year is 21,484 rubles. This amount does not exceed the maximum payment towards a future pension of 212,360 rubles.

Medical insurance: 2,916 + 188 + 298 = 3,402

In total, IP Nosov will have to pay 21,484 + 3,402 = 24,886 rubles for insurance.