The introduction of online cash registers led to significant changes to Law 54-FZ, the key legal act regulating the use of cash register equipment (CCT) in the Russian Federation.

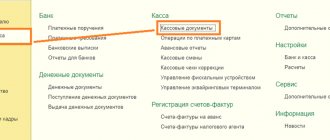

For example, the use of an online cash register by an organization or individual entrepreneur allows you to abandon a number of reporting documents and accounting registers in the cash register system.

As it turned out, however, this relaxation does not apply to the main cash documents specified in the Directive of the Central Bank of the Russian Federation No. 3210-U dated March 11, 2014, and the cash book, also mentioned in this regulatory act.

The features of maintaining and filling out a cash book (CC) by a business entity using an online cash register should be considered in more detail.

What is a Cash Book?

The cash book (hereinafter referred to as the CC) is a consolidated document that records:

- Based on data on cash receipt orders (PKO) - the amounts that were received at the enterprise's cash desk.

- Based on data on expenditure cash orders (RKO) - the amounts that were spent from the enterprise's cash register.

In turn, PKO and RKO can be formed on the basis of various supporting documents. For example, fiscal ones, that is, those that are created using cash register equipment (primarily, we are talking about receipts and expense receipts, reports). If a business entity is not obliged to use cash register equipment, then instead of fiscal documents, sales receipts and strict reporting forms can be used as primary ones when preparing orders.

In this case, the cash desk of an enterprise means not only the specially equipped place of a cashier or accountant, but also, in principle, any place where the enterprise receives or issues funds. By “cash register” it is more legitimate to understand here not an object, but a process. Incoming or outgoing transactions can be carried out at any point of the enterprise and, in principle, even outside it, both at a stationary object and in a mobile one (and even directly in motion - when calculations are carried out “on the go” in a car or “on the fly” in airplane).

CC is used both in the case of documenting transactions in which cash register is used, and in the case of cash transactions that are not subject to fiscalization (for example, this may be the issuance of funds to an employee of an enterprise on account and the acceptance of the unspent balance). Thus, with respect to QC, fiscal documents are only a special type of primary documents.

Fiscal document formats

The requirements for fiscal documents that are generated during the operation of online cash registers are set out in paragraphs 4 and 5 of Article 4.1 of the Federal Law 84 in the new edition.

Photo 2. Fiscal documentation is recorded online

To a greater extent, they relate to the details of checks and reports, as well as the storage period in the FN, which is 30 days.

Reference. Before switching to a new cash discipline, it is worth familiarizing yourself with the full list of formats of fiscal documents that are required to be used; additional details and requirements for formation and processing are reflected in the Order of the Federal Tax Service No. ММВ-7-20/229 dated 21.03. 2017.

When using an online cash register, a business entity is obliged to properly prepare the necessary fiscal documents in the form of:

- Registration report - additional details are reflected in detail in table 7 of Order No. ММВ-7-20/229;

- A report reflecting changes in registration data – table 7 and table 8;

- The report that opens the shift is actually an analogue of report-X - table 17;

- Cash receipt or reporting forms - table 19;

- Corrective checks or BSO - table 30;

- The report closing the shift is an analogue of the Z report – table 32;

- The report that is generated when closing the financial fund - table 33;

- A report confirming current calculations – table 18;

- Operator Confirmation Report - Table 34.

All fiscal documents are generated directly using the online cash register. That is, the cashier does not need to fill out the above documentation manually.

Important point! On different cash register models, fiscal reports and receipts (BSR) are generated using different algorithms.

But all models of online cash registers, approved by the Federal Tax Service and included in the register of cash register equipment, are developed to meet the requirements of Federal Law-84 and have the ability to issue the necessary fiscal documents.

For a cashier and accountant, it is important to know not so much the content of each document, since they are generated by modern cash register programs and are automatically transmitted to the Federal Tax Service, but rather the timing, frequency and basis for their execution.

All fiscal documents are stored in the memory of the Federal Tax Fund for 30 days. With a normal connection to the Internet, they are automatically transmitted from the Federal Tax Service. If the transfer of information does not occur within 30 days, the online cash register is blocked.

Photo 3. Penalties when using online cash registers are imposed on both the organization and the person in charge

Therefore, fines largely relate not to the preparation of documentation, but not to the use of online cash register systems as such, the use of faulty equipment, and for refusal to issue an electronic version of a receipt to the buyer.

Table 1. Penalties associated with the use of online cash registers

| Grounds for application of penalties | Sanctions applied to a legal entity | Sanctions applied to the person responsible |

| Non-use of online device | 75-100% of revenue | 25-50% of revenue, but not less than 10,000 rubles. |

| Repeated refusal to use online cash register systems when the amount of revenue reaches 1 million rubles. | Suspension of juice activities for up to 90 days | Prohibition on professional activities for 1–2 years |

| Using a faulty cash register | Fine – 5,000 – 10,000 rubles. | Fine – 1500 – 3000 rubles. |

| Refusal to issue an electronic payment receipt to the buyer, Federal Law | Fine – 10,000 rubles. | Fine – 2,000 rubles. |

Who needs to maintain it without fail and who can work without it

The cash book is a tool, first of all, for accounting, and therefore is necessarily used by legal entities. Individual entrepreneurs are not required to use it, but at the same time, they must use alternative summary documents to reflect the income and expenses of revenue. In general, the Income and Expense Accounting Book (KUDIR). At the same time, information in it is also collected on the basis of various primary documents - in particular, fiscal ones.

One of the practical aspects of using cash register is ensuring compliance with the cash limit at the enterprise. Based on the results of each cash transaction—receipt or expense—a cash balance is formed at the cash register. Its value should not exceed the maximum specified by law - the limit. And if it exceeds, then the excess must be transferred for placement to a bank with which the business entity enters into an agreement on servicing monetary transactions.

Individual entrepreneurs also have preferences regarding the limit - they simply are not obliged to comply with it. But they may well establish it: for this purpose, a private enterprise issues a separate local standard. By the way, standards similar in purpose should be adopted by those business entities that are obliged to set and comply with the limit.

The cash book is not used for the purpose of documenting financial transactions within the framework of acquiring - receiving (transferring) funds using bank cards (and alternative electronic means of payment), despite the fact that online cash desks carry out fiscalization of such transactions. Acquiring revenue is transferred to the company's current account. It does not remain at the cash register and does not affect the limit.

Entities that are required to maintain a Cash Book (or wish to maintain one) must do so in accordance with certain rules.

Changes regarding cash documentation

Federal Law No. 54 “On the use of CCP” dated May 22, 2003 was updated. It became the basis for changes regarding the list of cash documentation. In particular, a number of documents have changed that must complement the work with the cash register. Federal Law No. 54 introduced Article 1. It lists the acts that must be followed when using cash registers. These are the following documents:

- Federal Law No. 54.

- Acts adopted on the basis of this Federal Law.

Now it is not necessary to use the documents listed in Resolution No. 132 of December 25, 1998. In particular, this is an act on the return of funds to consumers, on checking money at the CTT and many other documents. However, documents related to cash register transactions remain mandatory. They are listed in the Central Bank instruction No. 3210-U dated March 11, 2014:

- Orders accompanying receipts and expenditures.

- KK.

What does this all mean? The question of the need to maintain a cash register in the presence of an online cash register arose when a number of papers became optional with the update of Federal Law No. 54. However, despite all the updates, maintaining QC is still a mandatory item.

Rules for maintaining the Cash Book

The form of the Cash Book was approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88 (LINK). An enterprise can also use the form that it has developed on its own. But the one proposed by Goskomstat is quite convenient and widely used. As a rule, there is no point in abandoning it.

The cash book in Excel format can be found HERE.

The Cash Book can be maintained on paper or electronically. The second option involves the use of an electronic signature. The general procedure for maintaining the Cash Book is enshrined in the order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n (LINK).

It is highly advisable to include a reference to this normative act in the job description of an accountant or cashier who, due to their job responsibilities, will work with the Cash Book.

The key rules for working with the Cash Book are as follows:

- The CC is filled out only on those days on which cash transactions were carried out - for receiving or issuing cash (acquiring, as we already know, does not count).

- At the end of the day in which the receipt or expenditure of cash was recorded, the employee who maintains the cash register fills it out using PKO or RKO (which, in turn, can be filled out on the basis of fiscal documents - receipts or expenditure checks, reports, alternative them documents - sales receipts or BSO). Afterwards, it is submitted to the chief accountant for certification.

- Each order records the total amount of revenue (expenses) for the day, regardless of the number of individual transactions.

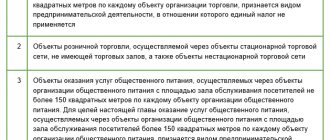

At the same time, it is possible to create several types of orders depending on the type of specific operation. For example, cash receipt transactions carried out at online cash desks are classified into several types - in particular, operations corresponding to:

- regular (full) payment for the goods;

- partial payment for the goods (while the remaining part is issued on credit);

- prepayment (which can be represented by the purchase of a gift card).

For each group of operations, a separate cash receipt order is thus drawn up.

- An individual entrepreneur (his employee at the cash register), who does not use PKO or RKO, “directly” fills out the Book of Income and Expenses - indicating the date on which the calculations were made, in accordance with fiscal documents (or sales receipts or BSO replacing them).

- In cases provided for by law, when forming RKO and PKO, details of various auxiliary documents are used - certifying the legality of drawing up the order.

For example, an identification document of an individual receiving funds through cash settlement services (an employee who goes on a business trip, a buyer who returns goods).

It must be borne in mind that, by default, only the head of the company (or the individual entrepreneur himself, if he has put the relevant cash documents into circulation) and the chief accountant of the organization (in some cases, persons who report to him) have the authority to work with the Cash Book and orders.

In order to delegate authority to work with the Cash Book, the most important accounting document, the head of the company must issue separate local regulations. It is necessary to pay sufficient attention to detailing the procedure for applying the CC, the rights and responsibilities of the employees responsible for its maintenance - in the job descriptions of such employees.

What unified forms can be abandoned?

After the transition to “smart” cash registers, maintaining primary documentation has become much easier. The usual unified forms and accounting journals, previously drawn up on the basis of the requirements of Goskomstat Resolution No. 132 of December 25, 1998 and Federal Law-402 “On Accounting,” after the repeal of Government Resolution No. 470 from July 1, 2021, became optional for use.

The Ministry of Finance came to this conclusion, as reflected in its Letters No. 03-01-15/54413 (September 16, 2021), No. 03-01-15/28914 (May 12, 2017), No. 03-01-15/ 3482 (25 January 2021), No. 03-01-15/19821 (04 April 2021).

However, the opinion of officials is advisory in nature. Therefore, the entrepreneur has the right to use online cash registers and old-style cash documents or can completely abandon the following forms:

- Form KM-1 - an act used when resetting KKM counters;

- Form KM-2 - the act required to take readings when repairing the cash register and returning it to work;

- Form KM-3 - the act that was filled out when returning cash;

- Forms KM-4 - a journal filled out by the cashier;

- Form KM-5 - a special journal designed to record data when using cash registers that operate without a cashier-operator;

- Forms KM-6 – certificate-report for the cashier-operator;

- Forms KM-7 - a document recording CCT readings.

From July 2021, businesses that have switched to online checkouts can legally refuse to fill out such forms.

Note. After switching to a new cash discipline, a business entity has the right to voluntarily maintain the old document flow. In this case, optional documents are filled out in any form.

Administrative responsibility

Violation of the rules for maintaining a cash book or its absence is an administrative offense; liability for it is provided for in Article 15.1 of the Code of Administrative Offenses of the Russian Federation, as for violation of the handling of cash. For such an offense, the Federal Tax Service may impose an administrative fine:

- in the amount of 40 thousand to 50 thousand rubles for the organization itself;

- in the amount of 4 thousand to 5 thousand rubles per manager or chief accountant.

Cash book, form in Word

in Excel

The essence of the process of implementing online cash registers

From 07/01/2017, cash registers of a new type - online cash registers, characterized by:

- a higher degree of security for sales data generated on them;

- the ability to transmit this data in real time to the Federal Tax Service.

At the same time, a number of changes were introduced:

- to the list of persons obliged to use CCP;

- procedure for registering and using cash registers;

- register of mandatory details of documents generated by the cash desk.

To learn how the change in the list of persons required to use cash registers affected the stages of implementation of online devices, read the article “Who should switch to online cash registers from July 1, 2019?”

However, despite a fairly wide range of changes in working with cash register systems, the essence of these changes boils down to the fact that cash registers of a technically higher level began to be used for cash payments. And it was precisely this circumstance that caused most of the changes in the procedure for working with them. These changes did not affect the rules for accounting for revenue received through cash register systems, despite a number of innovations in the documentation of some cash transactions. Therefore, the question of how to keep records at online cash registers has only one answer: in the same order as before. There are no innovations in it.

Some businesses, usually online stores, prefer to use cloud services instead of cash registers. A cloud online cash register is a service through which an online store connects to a remote online machine located in the service’s data center. All information about calculations is carried out through this device, which is transmitted through the fiscal data operator to the tax office. And the cloud service ensures the connection of cash registers to the online store website, setting up online cash registers and uninterrupted access to them.

The cloud service allows you to rent several cash registers without a cash register and register them with the tax office.

Equipment accounting

Online cash registers themselves can relate to material and production costs or fixed assets. The criterion is the cost of the device. If it is within 40 thousand rubles, the expenses can be classified as MPZ. The same applies to situations where an organization has a limit on the value of assets.

When registering an online cash register in accounting through the Inventory, the following operations must be reflected:

- Expenses for purchasing the device and putting it into operation.

- “Input” VAT for this product.

- Offset of tax in the form of entry into settlements with the budget.

- Putting cash register into operation.

- Payment of debt to the equipment seller.

When a cash register is included in the category of fixed assets, transactions through the online cash register will include the same list of operations.

Equipment maintenance

When accounting for online cash registers, the costs of equipment maintenance and repair are included in expenses. This applies to expenses for routine repairs, the purchase and replacement of components, and payments for central service centers. Such costs are reflected in the entry Dt 44 - KT 60 for the amount of repairs performed. The same posting applies to payments for monthly maintenance.

When making an advance payment for the period specified in the agreement, costs are written off in equal parts over the duration of the agreement. For the amount of the advance payment, the posting DT 60 - KT 51 is made, for monthly write-off - DT 44 (20, 26) - KT 60.

Important! The useful life of cash register equipment is indicated in the documentation supplied with the device.

Registration of money acceptance

The accountant's records will depend on the form of receipt of money: cash or electronic payments:

- Cash receipts are recorded as Dt 50 – KT 90.

- Payment by bank plastic for acquiring – DT 57 – Kt 90.

- Other settlements with consumers – Dt 76 (60) – Kt 50 (51).

- When returning money – Dt 50 (57) – Kt 76 (60).

Important! Payment of remunerations and winnings under an agency agreement, payment for recyclable materials received from citizens are included in other calculations.