The cash accounting area is considered the most conservative among accountants. Indeed, if we look at the regulatory documents over the past forty to fifty years, we will see that the rules for conducting cash transactions have not changed much over the past time, and the synthetic accounting of cash transactions at the enterprise is still the same as before.

All changes in cash accounting can be classified into two categories. The first take into account changes in the technical equipment of modern accounting work. The latter are a consequence of the development of market relations in the country, the need to exclude shadow and corruption schemes in business activities, and in short, they are a way to increase financial discipline in the country through the establishment of strict organizational rules for conducting cash transactions at the level of individual organizations.

What is cash discipline?

This is a set of rules for processing cash transactions. They describe how you must accept, store and issue cash. It is very important in this matter not to confuse concepts such as “cash register” and “cash register”.

A cash register (cash register, cash register, online cash register) is a device that is used to accept cash from customers for goods or services. This operation is recorded for subsequent transfer to the Federal Tax Service, and the client is issued a fiscal receipt.

The enterprise cash register (operating cash desk) is a record of all actions in the company that relate to cash. Money accepted via cash register is also deposited into the organization’s general cash register. This money is then either issued for cash expenses or collected at the servicing bank for crediting to a current account. The cash desk physically stores the company's money and everything that happens to it must be confirmed by relevant documents. This is called cash discipline.

In general, when maintaining cash discipline, you need to rely on the following principles:

- All transactions with cash must be documented.

- It is important to strictly monitor compliance with the cash register limit.

- When issuing money for any needs, appropriate documents must be issued.

- The limit on cash payments between two business entities cannot be exceeded; today this amount should not exceed 100 thousand rubles per contract.

Filling

How to prepare the cash documents indicated above? Filling is carried out as follows:

- In the line “Base” the business transaction is named.

- In the “Including” column the amount of VAT is entered. It is written down in numbers. If services, goods or work are not taxed, then the line indicates “excluding VAT”.

- The “Appendix” line should list accompanying and other papers, indicating their dates and numbers.

- In the column “Loan, department code” the corresponding designation of the structural department to which the funds are allocated is entered.

Who should observe cash discipline?

All subjects of the administrative and economic sector working with cash are required to observe cash discipline. This obligation applies regardless of whether cash is accepted through a cash register or via BSO. The tax regime also does not matter.

It is worth noting that for individual entrepreneurs the rules for maintaining cash discipline are somewhat simplified. For example, this concerns the abolition of registration of receipt and expenditure orders and the cash book. They only need to be completed when issuing cash for wages to employees.

The simplification also applies to the cash balance limit. There is no need to install it for individual entrepreneurs, provided that the number of employees is less than 100 and the annual revenue is less than 800 million rubles.

A complete list of cash discipline rules can be found in the instructions of the Central Bank of the Russian Federation (Instruction No. 3210-U dated March 11, 2014).

Payment statement

It is compiled to comply with the procedure regarding the transfer of wages and other monetary payments to the company’s personnel. The document number according to OK is 0301011. The filling scheme and requirements for the document are identical to the rules for maintaining payroll records for employees.

Experts note that it is permissible to issue salaries based on the details of the expense receipt. But it is still more correct to draw up accounting statements.

The documentation is entrusted to the chief accountant, and in his absence, the head of the company handles the paperwork. It is prohibited to submit documents with errors or incorrect information.

Maintaining cash discipline for LLCs and individual entrepreneurs. List of documents

One of the requirements of cash discipline is the presence of a cashier , and his duties can be performed by the director of the enterprise or (in the case of individual entrepreneurs) by the individual entrepreneur himself. In a situation where there is more than one cashier, a senior cashier must be appointed.

In addition to the cashier, the company must have a person who is responsible for generating cash documents. Most often, this responsibility is assigned to the chief accountant. However, as in the situation with a cashier, the role of this person can be played by the cashier or directly undertaken by the individual himself. Responsibilities for generating cash documents can be delegated to an organization that maintains accounting records.

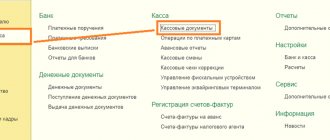

Documents that need to be completed for cash transactions:

- A cash receipt order (PKO) is issued for each receipt of cash at the cash desk. When cash is accepted using a cash register or BSO, then one such order can be issued for the total amount per shift.

- An expense cash order (RKO) is issued for each expense transaction, i.e. for any withdrawal of money from the cash register. It is imperative to check the correctness of filling out such orders and verify the identity of the employee to whom the money is issued.

- Cash book (form KO-4) – records of all income and expense transactions are kept here, i.e. the data of each PKO and RKO must be reflected in it. The cashier's responsibilities include daily reconciliation of cash amounts with balances on cash documents. This may not be done if there were no operations during the shift.

- The accounting book (form KO-5) must be filled out if the enterprise has more than one cashier. This book reflects all movements of money between cashiers and the senior cashier. They must be certified with personal signatures.

- Payroll and payroll must be prepared and signed by employees when payments are made to them.

Maintaining cash documents is acceptable both in paper and electronic form

When completed manually, documents must be certified by original signatures.

Documents in electronic form are drawn up using a computer (other equipment) ensuring their protection from unauthorized access and signed with electronic signatures.

Important! Cash discipline does not include books of income and expenses, BSO, as well as the report and journal of the cashier-operator.

Maintaining a cash book in a separate department

The responsibility for maintaining a cash book is assigned to all separate divisions of the organization in which cash transactions are carried out. Such clarifications were given by the cash circulation department of the Bank of Russia in letter dated May 4, 2012 No. 29-1-1-6/3255. The Federal Tax Service of Russia adheres to a similar position in its letter dated May 17, 2013 No. AS-4-2/8827.

What is a cash balance limit?

The cash register limit or carryover balance is the maximum possible amount of cash that can be left in the cash register at the end of the shift. Anything in excess of this amount must be deposited in the bank. True, small deviations are acceptable on days when a large amount of cash is expected to be issued (paydays) or on holidays.

Setting a cash register limit should be approached extremely responsibly, since if the limit is not set at the end of the work shift, there should not be a single ruble in the cash register. Otherwise, there will be a violation for which administrative liability and a fine are provided.

An order to set a cash limit.

The limit must be calculated and fixed in an internal order, which can set a limit both for a specific period of time and for an unlimited period, i.e. until a new order is issued.

Simplified procedure.

For small enterprises (less than 100 employees and revenue for the previous year less than 800 million rubles) and individual entrepreneurs, from June 1, 2014, establishing a cash balance limit is not mandatory. However, to cancel it, it is necessary to issue an appropriate order based on the Directive of the Bank of Russia dated March 11, 2014 No. 3210-U, which must certainly contain the following wording: “Keep cash in the cash register without setting a limit on the cash balance.”

Operator's log

This document is necessary to account for cash flow and receipts for each cash register of the enterprise. The log also acts as a control and registration report of meter readings. This document is laced, numbered and sealed with signatures. accountant, company manager, and tax inspector. The magazine is also certified by the seal of the enterprise. All entries are made by the operator every day. The procedure for preparing cash documents does not allow erasures or blots in the journal. All corrections made must be approved and certified by the signatures of authorized persons. If the readings coincide, they are entered into the log for the current shift at the beginning of work. This data must be certified by the signatures of the duty administrator and cashier. Line 15 indicates the amounts entered on checks returned by clients. Information for this is taken from the relevant act. In the same column indicate the number of zero checks printed during the shift. At the end of the working day, the operator generates a final report for the shift and submits the received revenue with it. At the same time, a receipt order is drawn up. After the meter readings are taken, the actual amount of receipts is checked, and a corresponding entry is made in the journal. It is confirmed by the signatures of the manager (duty administrator), senior cashier and operator. If discrepancies are identified between the amounts indicated on the control tape and the volume of revenue, the reason for the resulting difference is identified. Detected surpluses or shortages are recorded in the appropriate journal lines.

How, according to the rules of cash discipline, money is issued to accountable persons

Accountable money is cash given to an employee to pay for business expenses, travel expenses and other needs of the enterprise.

To issue such money, an application from the employee receiving the money is required, in which it is necessary to indicate the full amount, period and purpose of receiving it. The application must have the signature of the manager.

If business or other expenses of the enterprise are paid with the employee’s own funds, they are also subject to reimbursement on the basis of an application, which must indicate that “the employee has no debt on previously issued advances.” This is a legal requirement that an employee must fully account for previously received advances before receiving accountable money.

To provide a report on spent funds, the employee is given 3 working days from the expiration of the period for which the funds were issued, or from the date of return to work. Expenses are confirmed by appropriate receipts, which are attached to the expense report. This is necessary to accept them as expenses and to correctly calculate the tax base. In addition, for funds spent without supporting documents, it is necessary to pay insurance premiums and withhold personal income tax.

Restriction on the issuance of money according to the rules

You should also pay close attention to cash payments between business entities. This does not apply to settlements with individuals. Legal entities and individual entrepreneurs can make cash payments among themselves, but not more than 100 thousand rubles within the limits of one agreement.

This restriction also does not apply when issuing from the payroll office to employees accountable funds to an individual employee, if this money is not planned to be used to pay for goods and services on behalf of the organization on the basis of a power of attorney.

Who and when can take money from the cash register for personal needs?

Any income of the organization belongs directly to the organization. Therefore, payment for the personal needs of the founders, even if there is only one, cannot be made from the cash desk of the enterprise.

This does not apply to individual entrepreneurs, who can use money both from the cash register and from the current account in any quantity, provided there are no arrears in paying insurance and tax contributions.

If an individual entrepreneur does not have an order to cancel the maintenance of cash documents, in order to receive cash from the cash register, an expense order must be drawn up containing the following wording: “Issuing funds to the entrepreneur for his own needs” or “Transferring income from current activities to the entrepreneur.”

Important nuances

Details that relate to foreign currency (page 1a on the front and columns 6 and 8 on the back) must be filled out only if the accountable person receives funds not in rubles. After the inspection, the advance report must be approved by the head of the enterprise or his authorized person. Only after this is it accepted for accounting. If the advance has not been used in full, the accountable person returns the balance back to the cashier. At the same time, a receipt order is filled out. In accordance with the information in the approved report, funds are written off.

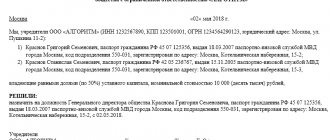

What do tax authorities pay attention to during an audit?

Previously, banks were authorized to verify compliance with cash discipline rules. However, since 2012, this competence has been transferred to representatives of the Federal Tax Service, who, during an on-site inspection, can control:

- correct accounting of cash in the cash register;

- information recorded on the fiscal memory of the cash register by printing reports;

- any documents related to the execution of cash transactions (receipt and expense orders, cash register reports, cash book);

- timely issuance of cash receipts to customers.

Withdrawal slip

An expense cash transaction order is abbreviated as RKO. According to the General Classifier, it is assigned the number 0310002. The purpose of maintaining cash and register management is to document the expenditure of money on the company’s balance sheet and record this procedure.

Transferring cash requires the cashier to ask and verify a receipt from the person receiving the funds and proof of their identity. Wherein:

- the receipt is filled out by hand by the recipient;

- the amount of rubles to be issued is indicated in words, and if it includes kopecks, then kopecks are written in numbers;

- if the issuance of funds is carried out by power of attorney, then the cashier must indicate the full name of the authorized person in the cash register.

The cashier writes down the details of the expense order. The chief accountant certifies the document, and the manager signs the document. The required elements of the cash settlement structure completely coincide with the details of the order for incoming transactions.

Fines for violation of cash discipline

Cash discipline obliges business entities to comply with the rules and provides for serious liability for their violation. A set of possible violations of cash discipline is contained in Art. 14.5 and 15.1 of the Code of the Russian Federation on Administrative Offences.

Not using CCT

According to Article 14.5 of the Code of Administrative Offenses, this is a violation and provides for liability in the form of a fine:

- for officials - from 3,000 to 4,000 rubles;

- for legal entities - from 30,000 to 40,000 rubles.

As practice shows, a fine for such violations is imposed on the entire organization, although only one employee can really be at fault.

Of course, companies are interested in having only the employee fined, since the amount of the fine (according to Article 14.5 of the Code of Administrative Offenses of the Russian Federation) is much lower. However, it should be borne in mind that when seeking to impose a fine on an official, you can end up with two. Since the law allows for the imposition of a fine on both the person who committed the violation and the organization in which it was committed.

Exceeding the cash limit

Based on Article 15.1 of the Code of the Russian Federation on Administrative Offences, for violating cash register limits you can receive a fine of 40,000 to 50,000 rubles. Cash discipline since 2021 obliges these limits to be strictly observed. If the company's revenue was less than 800 million rubles, and the number of employees is less than 100 people, the company can immediately cancel the cash balance limit from mid-2015, classifying itself as a small enterprise.

Non-receipt of cash proceeds

Funds not properly received in the cash register in accordance with Art. 15.1 of the Code of the Russian Federation on Administrative Offences, are the basis for significant fines (up to 50,000 rubles).

Exceeding the cash payment limit

Taking into account the limit of 100,000 rubles, questions arise regarding the calculation of these amounts, for example, if the agreement is not drawn up on paper or if similar contracts are drawn up for different amounts that are less than the established limit

For non-compliance with the procedure for handling cash, fines are provided, according to Art. 15.1 Code of Administrative Offenses of the Russian Federation:

- from 40 to 50 thousand rubles. for legal entities persons (organizations);

- from 4 to 5 thousand rubles. for officials and individual entrepreneurs.

Cases related to non-compliance with the Directives of the Central Bank of the Russian Federation are within the competence of the tax authorities (Article 23.5 of the Code of Administrative Offenses of the Russian Federation).

Data on cash register counter readings and revenue

They are used to generate a summary report for the current shift. This data acts as an appendix to the operator’s certificate, compiled daily. Information about indications and revenue is generated in one copy. Together with expenditure and receipt orders, certificates and reports from the operator, they are transferred to the accounting department of the enterprise until the next shift. A sample of cash documents, in accordance with meter readings, at the beginning and end of the working day for each cash register includes a calculation of revenue. In this case, among other things, its distribution among departments is indicated. The latter must be confirmed by the signatures of the managers. At the end of the completed table, the results are displayed based on the meter readings of all cash registers, and the company’s revenue is also summed up with the distribution of funds by department. In accordance with the acts, the total amount of money that was issued to clients for the checks they returned is indicated. The company's total revenue decreases by this amount. The information must be signed by the senior cashier and the head of the enterprise.

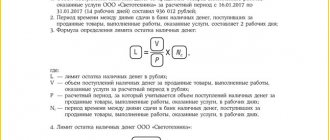

Example of cash limit calculation

In Alpha and Omega LLC for the period from June 1 to June 30 (30th day) revenue was 3,000,000 rubles. Collection of money to the bank occurs once every 3 days. The cash register limit is:

3000000 / 30 days * 3 days = 300,000 rub.

Based on the calculations made, an order from the manager regarding the cash balance limit is formed.

Important! If the balance limit is not set by order, then it is considered equal to 0.

Recommendations for filling

When preparing cash documents, you must adhere to the procedure established by laws and other regulations. In addition, there are several fairly simple rules, the observance of which will allow you to avoid inaccuracies when filling out papers:

- Amount in words should always be capitalized. In this case, kopecks can be written in numbers. For example: Eighteen thousand rubles 10 kopecks.

- Papers can be filled out either by hand or using technical means (computer, for example).

- Regulatory acts allow information to be corrected in cash documents. However, a number of requirements must be met. An incorrect entry should be carefully crossed out with one line. The correct information is indicated next to or (if possible) above it. Here you should make a postscript: “Believe what is corrected,” “What is crossed out is invalid,” or “True.” Next to this entry there should be signatures. accountant and head of an organization (or individual entrepreneur).

- If there are blots, erasures, erasures, or other similar methods of correction, the document is considered invalid.

How to issue a check to a buyer

To understand how to use an online cash register, an employee needs to understand the algorithm for issuing a receipt to a buyer:

- The cashier scans the item, thereby opening a receipt

- The buyer hands over the payment to the cashier

- After receiving the funds, the cashier completes the sales process by generating a cash receipt

If necessary, an electronic version of the cash receipt is sent to the buyer’s e-mail or phone number.

In order to simplify the process of entering personal data, the developers have created a Federal Tax Service application with which the buyer can transfer his personal data to the cashier via a QR code.

When paying for a purchase, you may need to deposit funds in different ways. For example, if the buyer does not have enough money on the card, he can pay the remaining amount in cash. In this case, the cashier generates one check. In which both payment methods are recorded, indicating the amount of each of them.

Operations for which a receipt must be generated include:

- Sale. The check is issued after the cashier receives the funds or after the funds are written off from the client’s payment card.

- Return. A refund receipt is issued if a refund was issued to the buyer based on the return of the goods to the store. The return receipt must be accompanied by a return application, which indicates the buyer’s passport details, date and reason for returning the goods.

- Making adjustments. An adjustment is necessary if the sale was made at an incorrect price or without using an online cash register (for example, when there was a power outage). In this case, a correction check is issued.

- Making an advance payment. A check is issued when the buyer makes an advance payment.

- Making an advance payment. The difference from an advance payment is that an advance payment is made for a specific specific product, while an advance payment is a payment for an unspecified product (for example, the purchase of a gift certificate).

- Issue of goods on credit/installments. The algorithm for generating and issuing a check in this case will be the same as for a regular sale, the differences lie in the absence of the fact of transfer of funds to the cashier and the indication of the payment method indicated in the check.

Calculation sign

A payment attribute is a cash receipt detail indicating the reason for the receipt/disbursement of funds to/from the organization's cash desk.

The calculation attribute can be specified in four options:

- “Receipt” - will contain a sales receipt. For example, when a buyer purchases household appliances in a store.

- “Return of receipt” will be indicated on the return receipt. For example, if household appliances turned out to be of inadequate quality, and the buyer decided to return the goods.

- “Expense” - will be indicated in the receipt upon receipt of the goods on a paid basis. For example, a point for accepting scrap metal - issuing money when accepting metal;

- “Refund of expenses” - will be present on the receipt if the operation involves returning the goods to the client. For example, a customer returns money to pick up an item.

From January 1, 2019 , the requirements to update the FDF to version 1.05 come into force. In the new version, such details will appear as “Attribute of the subject of payment, indicating a specific subject of payment, for example, “lottery winning”, “excise goods”, “service”, prepayment, advance payment, etc.

Payment method indicator

The payment method attribute indicates how the payment was made.

The sign of the payment method can be indicated both in the form of a code word and in the form of a digital designation:

- Code ADVANCE PAYMENT 100% (or 1 in the digital version) - indicates that the seller has received an advance payment for the goods in the amount of 100%;

- Code ADVANCE PAYMENT (or 2) - the buyer made a partial advance payment for the goods;

- ADVANCE code (or 3) - receiving an advance for an item that has not been defined. For example, if a buyer purchases a gift certificate, the seller cannot find out in advance which product will be purchased, in this case the payment method is indicated as “advance”;

- Code FULL PAYMENT (or 4) - indicated when the buyer pays in full and immediately receives all of his goods;

- Code PARTIAL SETTLEMENT AND CREDIT (or 5) - this can include the situation when the buyer purchases goods on credit, while paying a down payment, i.e. the goods will be partially paid for, and the remaining amount will be issued as a loan;

- TRANSFER ON CREDIT (or 6) - here the payment method will be to purchase the goods on credit in full without a down payment, and the goods in this case are transferred to the buyer immediately;

- LOAN PAYMENT (or 7) - is indicated when the buyer makes a payment to repay the loan, and it does not matter whether the next payment is made or the payment is made in full.

Cashier's report

This reporting is prepared by the cashier-operator. He enters information about the cash register readings and revenue for the day. Cashiers must prepare such a report every day. After drawing up the report, it is signed and, together with all the proceeds, it is handed over to the manager of the company.

If the company is small, cashiers hand over money to collectors. When transferring funds, the appropriate bank documents must be drawn up.

More complete information about the cashier's report can be found in the article.

Features of the design of individual CDs

The nuances of documenting cash flow in an enterprise:

- Cash book . It must be stitched, numbered and sealed. The numbering of cash documents must be present on each sheet. At the end of the book, the number of sheets is indicated and the signature of the responsible person is affixed. The books must have a tear-off part - the cashier's report at the end of the day. It comes off after all operations are completed.

- KVD . It is appropriate to fill it out if the staffing table includes more than one cashier position.

- Stamps for RKO/PKO . The Central Bank does not separately stipulate the format of the stamp imprint. The stamp “Paid” is affixed to the tear-off receipt for the PKO. “Repaid” is stamped on payslips. It is used when the “Paid” stamp is lost/missing.

If several tax systems are combined

The law provides for the possibility for business entities to apply several tax regimes simultaneously. In order to save money, it is allowed to generate fiscal documents on one cash register, if the following conditions are met:

- During the first launch, the owner of the cash register entered data on all applicable taxation systems (hereinafter referred to as SNO). In this case, you should read the instructions for using the cash register.

- When selling goods or services, the user creates separate receipts for each tax regime.

We must not forget that if an economic entity combines two or more SNOs, separate records should be kept for each mode.

Applying a correction check

A correction check is created by the cashier if payments were made without using an online cash register:

- Inability to use online cash register due to breakdown

- Inability to use the cash register due to a power outage

- The occurrence of surpluses or shortages in the cash register due to the inattention of the cashier

In any of these situations, the cashier will have to generate a correction check. The differences from a regular check with a correction check are quite significant:

- Firstly, it is impossible to indicate the list of goods that were purchased on the correction receipt. This is due to the fact that in almost every situation in which the formation of this fiscal document is necessary, there is no possibility of establishing which specific goods were purchased. As an example, we can take the formation of such a check when a shortage is detected at the end of a work shift.

- Secondly, it is worth paying attention to such details as a sign of calculation. When generating a fiscal document for correction, this detail can be of only two types:

- “arrival” when surplus is detected

- "expense" when a shortage is detected

The correction check must always be accompanied by an explanatory note detailing the reason for the correction. The explanatory note will be useful in the event of a tax audit, because Federal Tax Service employees pay special attention to correction checks.

Most often, correction checks are confused with refund checks. A refund receipt is generated when the cashier needs to correct an operation that has already been completed. For example, when a cashier mistakenly punches out an extra item. In this case, it is necessary to cancel the operation by generating a new fiscal document with a settlement attribute, which will indicate “return of income”. The check must also contain the amount of the erroneously issued check. Additionally, a new receipt is generated indicating the correct purchase amount.