A special tax regime for entrepreneurs appeared in Russia in 2013. Chapter 26.5 of the Tax Code of the Russian Federation established the rules for transferring to the system, rates, terms and procedure for settlements with the budget. Businessmen were completely exempted from reporting. At the same time, the regulations did not stipulate how to keep an individual entrepreneur’s accounting. Businessmen have to deal with aspects of patent accounting on their own.

Patent tax system

The purpose of the patent regime is to help small and medium-sized businesses in our country.

This leads to restrictions on its use:

- Available exclusively to individuals who have received the status of Individual Entrepreneur;

- Limitation on the number of employees that a businessman can hire. At the moment, the upper limit corresponds to 15 employees;

- If you have your own shop, cafe or restaurant, then the area of the premises that you use for the above purposes should not exceed 50 square meters;

- Payment of taxes under the patent system is available only for 63 types of activities, including: repair services, tailoring, knitting of clothing and other textile products; shoe repair and sewing services; hairdressing activities; provision of cosmetic services; educational services; furniture repair services, retail trade; design services. You can find a general list of permitted activities in the Tax Code of the Russian Federation, Article 346.43, paragraph 2.

- For each patent, the entrepreneur is required to keep an income book; this book must be kept by the individual entrepreneur for 4 years after the patent regime was adopted. We will talk in more detail about this document a little later;

- Convenient patent payment system depending on the period of its application.

- The company's annual turnover is limited to 60 million rubles;

- The cost of a patent is not reduced by insurance payments.

There are quite a lot of restrictions and disadvantages, but the patent system also has its advantages, for which 3.5% of Russian entrepreneurs choose it:

- Significantly eases the tax burden for a businessman. You transfer to the state only 6% of the potential income from your type of activity. Potential income is established by the authorities of the constituent entity of the Russian Federation;

- You can choose the validity period yourself;

- You are exempt from filing a tax return;

- The only extra-budgetary fund to which you will have to make payments is the Russian Pension Fund. Payments will be 20%;

- If you are on the patent system's list of eligible activities, you will remain on it until the end of your life. The authorities do not have the right to reduce this list;

You can use the Patent cost calculator.

Procedure and terms of payment for a patent

The timing and procedure for paying for a patent depend on the period during which the patent will be valid. If the patent is issued for a period of up to 6 months, then it is paid in one amount until the expiration of its validity period.

A patent with a validity period of 6-12 months is paid in two amounts:

- The amount of the first payment is one third of the tax amount. It is paid within 90 days from the date of receipt of the patent;

- the remaining amount must be paid before the patent expires.

You can generate a payment document on the Federal Tax Service website. To do this, you need to find out KBK - a twenty-digit budget classification code. KBK for payment of a patent in Moscow, St. Petersburg and Sevastopol - 18210504030021000110.

Fill out payments in the web service for individual entrepreneurs for free

Book of accounting of income and expenses (KUDiR)

KUDiR is a reporting document of a private businessman. Under the patent regime, the ledger takes the form of a journal in which only the receipt of funds must be recorded. Keeping a journal is a must.

The document is intended to record the income of businessmen, which in the future will be taken into account to calculate potential income for the entire business area. However, these books do not directly affect the amount of tax payments of a particular entrepreneur.

The book has a form approved by the Ministry of Finance of the Russian Federation. The absence of a document is punishable by law: for this you will have to pay a fine of 200 rubles. It’s not much, but you shouldn’t risk it, because it could harm your reputation.

Keeping a book is simple: your task is to enter official income in chronological order. Please note that only those transactions that are confirmed in the form of an accounting document are entered into the report.

The book must be filled out within one tax period (the period for which the patent was purchased). After the expiration of the period, a new accounting journal is started.

KUDiR is presented in two formats: paper and virtual. You can buy a paper version at a printing house and fill it out manually. The electronic version is presented in the form of a program and online services for accounting.

If you chose a virtual form, then at the end of the reporting period, the completed document must be printed, certified by the regulatory authority and stored in the organization for the next 4 years.

Structure:

- Title page . The personal data of the business owner is displayed here: first name, last name, patronymic, place of registration, current account, identification number and start date of the tax period;

- The first section is “Income and Expenses” . This part of KUDiR contains four tables, one for each quarter. Each table is divided into four columns: date of entry, name of the document, its number and date, income and expenses. Patent owners do not need the “Expenses” column, so we will not analyze it. The income column is divided into five more columns: record contents, sales income, non-operating income, other income, notes. The lines must be completed in chronological order.

- The second, third and fourth sections are not needed by entrepreneurs operating under the patent regime . They are intended to calculate the amount of future tax. We won't dwell on them.

Rules for filling out the journal:

- Pages must be numbered;

- The pages must be bound;

- Transactions are recorded in chronological order;

- The last page of the journal must contain the stamp and a numerical value of the number of pages that make up the document.

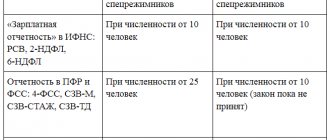

Reporting when combining special modes

An individual entrepreneur can work not only according to one chosen tax regime, but also by combining several that are most convenient for him.

PSN applies to a limited list of types of economic activities; the rest are subject to other regimes, as a rule these are:

- STS (simplified system).

- UTII (single tax on imputed income).

The likelihood of using regular accounting as an individual entrepreneur is minimal, since it requires the participation of a professional accountant, which is beyond the means of most businessmen.

We recommend you study! Follow the link:

How can an individual entrepreneur with or without employees switch to a patent form of taxation?

If there is a need to use three types of tax systems PSN, UTII and simplified tax system, a businessman must understand that this requires separate accounting of income and expenses for all three systems and types of activities. This requires time and basic knowledge and skills.

In addition, using the simplified tax system and UTII, all actions with property, money and loans are subject to accounting.

The number of income and expense accounting books is equal to the number of accounting systems used, plus a separate book is kept for each type of patent.

The combination of the simplified tax system and the special taxation system (including in the case of a transition from the simplified tax system to the special tax system during a calendar year) entails the need to submit a tax return under the simplified tax system. In this case, personal income tax is transferred in the following order: for employees working in the field that is on the simplified tax system to the inspectorate at the place of residence of the individual entrepreneur, and for activities on the PSN at the place of its jurisdiction.

In a situation where the application of the PSN is unlawful, the individual entrepreneur is obliged to pay taxes and contributions under the general taxation system for the entire period of the unlawful use of the patent.

From the moment of deregistration as a PSN payer, a private owner can apply the simplified tax system to these types of work and services.

Reporting and payments to individual entrepreneurs in a patent system without employees

If you carry out business activities without hiring personnel, then the number of tax fees for you will be significantly reduced. And reporting in this case is not provided at all. However, you will still have to keep a book of income.

Here is a list of taxes required to be paid for individual entrepreneurs in the patent regime without employees:

- Contributions towards your own compulsory health insurance;

- Contributions to the pension fund for yourself.

- Payment for the patent itself.

Results

Entrepreneurs using PSN submit a minimum of reports to government agencies in the general case. If they simultaneously conduct activities that do not fall under the PSN, or have hired employees, their reporting work increases.

You can study other nuances of conducting individual entrepreneur activities within the framework of the PSN in the “PSN” section.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reporting and payments of individual entrepreneurs with PSN with employees

If you involve employees in your business, the tax burden and the number of reports will increase significantly.

Particular difficulties for entrepreneurs are caused by the need to annually confirm the type of activity with the Federal Insurance Service (FSS). Every entrepreneur is required to do this by April 15 after the end of the current year.

For a more accurate schedule, see the tax calendar.

| Frequency of presentation | Document submission deadlines | Place of delivery | |

| Income Journal | Once per period | At the end of the period | Tax |

| Information on the number of employees on staff | Once a year | Until January 20 | At the place of residence of the entrepreneur Tax |

| Help 2-NDFL | Once a year | Until April 1 | At the place of registration of the businessman Tax |

| Help 6-NDFL | Every quarter | Until 30.04 (Q1) Until 31.07 (1st half of the year) Until 31.10. (9 months) Until 31.01 (reporting year) | At the place of registration of the businessman Tax |

| Form 4-FSS | Quarterly | Until the 20th day of the month following the reporting quarter | Social Insurance Fund |

| Form SZV-M | Monthly | Until the 15th day of the month following the reporting month | Pension Fund |

| Calculation of insurance premiums | Quarterly | Until 30.04 (Q1) Until 31.07. (1st half of the year) Until 31.10. (9 months) Until 30.01 (reporting year) | At the place of registration of the businessman Tax |

| SZV-STAZH | Annually | Until March 1 of the year following the reporting year | Pension Fund |

In addition, immediately after the first employee appears in your company, you need to register with the Social Insurance Fund (you are given 10 days to do this) and the pension fund (you can visit the Pension Fund within 30 days).

As for payments, the entrepreneur and his employees must pay personal income tax and contributions to the Pension Fund and Social Insurance Fund. Personal income tax is paid monthly. In addition, immediately after the first employee appears in your company, you need to register with the Social Insurance Fund (you are given 10 days to do this) and the pension fund (you can visit the Pension Fund within 30 days). Also, reporting required to be submitted to the Pension Fund of Russia includes forms RSV-1, ADV-6-5 and SZV 6-4. They are rented quarterly.

In this case, information about employee income and withheld personal income tax must be provided to the Federal Tax Service at the place of registration of the individual entrepreneur. This information must be provided once a year by April 1st.

Independent accounting

The patent holder can organize tax accounting without a qualified employee. In practice, there are no difficulties with recording income in the journal. The merchant will be required to be attentive and responsible in preparing documents. The basis will be statements from the current account and cash register reports.

If the activity is gaining momentum, it makes sense to think about setting up a simplified accounting system. Even minimal accounting reporting will significantly improve the quality of control over the movement of material assets and cash. The main directions will be:

- Salary. In this area, you will need to deal with calculating staff remuneration, withholding personal income tax, and calculating insurance premiums. Systematization of data will facilitate the calculation of vacation pay and streamline the reimbursement of travel expenses.

- Stock. Recording the remaining raw materials, finished products and materials will help optimize production processes. It will become easier for suppliers to submit requests. Regular inventory will eliminate the risk of theft and other abuses.

- Fixed assets. The entrepreneur cannot put the property on the balance sheet. The law does not separate the status of a commercial entity and an individual. However, it is quite possible to calculate the initial cost, control wear and tear and create reserves in case of major repairs.

- Accounts receivable and accounts payable. Regular analysis of the relationship between obligations and rights allows you to maintain the financial stability of your business. Availability of accounting information helps in planning.

Separate areas of accounting may include cash register, non-cash payments, government procurement, etc. The basis for independent construction of accounting becomes Law No. 402-FZ of 12/06/11 and the current rules. Numerous standards and regulations are presented in reference and legal systems. The provisions of regulations should be applied taking into account the entrepreneurial status.

Reporting methods

As you may have noticed, an individual entrepreneur with employees on staff must submit a fairly large number of documents to various regulatory authorities. But a businessman does not have to deal with these issues himself and waste his time.

At the moment, an entrepreneur can choose one of four ways to submit tax reports and financial statements:

As we said above, the most convenient way is online accounting.

- Self-submission of documents is the easiest, in terms of execution, but the most time-consuming and labor-intensive method;

- Executing a power of attorney for another person . A representative of an individual entrepreneur can submit reports for him if he issues a notarized power of attorney;

- Sending reports by mail . Please note that the date of submission of the report in this case will be considered the date of sending the letter to the regulatory authority. The envelope must contain an inventory of the document signed by the accountant and manager. Experts advise enclosing two copies of the inventory. We recommend sending reports by registered or certified mail. This way you will be absolutely sure that they will reach the addressee;

- Sending reports via the Internet . To do this, you need to go to the website of the Federal Tax Service of Russia. There you need to get a subscriber ID, install the PC program “Taxpayer Yul”, it is needed to generate documents. Or send reports through special communication operators accredited by tax inspectorates. You also need to issue a power of attorney to submit reports.