Such a certificate is submitted to the tax office by each enterprise. But it also has other areas of application.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

For example, when receiving a loan from a bank, you will definitely need proof of your income. In this case, 2-NDFL will need to be provided. If it is filled out incorrectly, this may cause problems. Therefore, it is important how to correctly draw up this document so that it complies with legal requirements.

general information

Filling out and submitting the 2-NDFL report is necessary so that the tax office receives information about what income this individual had and how much income tax he paid on it.

Reports are submitted for the calendar year and must be received by the tax authorities no later than April 1 of the following reporting year.

Such a certificate is submitted by a tax agent, that is, the one who is responsible by law for the transfer of this tax.

It also provides the opportunity to submit corrections to an already submitted document. The code for the type of certificate is entered in the appropriate column.

It is also possible to submit a cancellation document. There they indicate the lines that need to be removed from the original document.

As you can see, there are several options for this type of report.

In addition, when a report is submitted to the tax office, there are not only certificates for each employee, but also a register of 2-NDFL certificates is compiled.

Receipt for payment of insurance premiums to the Pension Fund in 2021: instructions and form

Insurance contributions to the Pension Fund are one of the mandatory payments that must be paid regardless of whether business activity is being conducted or not. In this article we will tell you how to generate a receipt for payment of insurance contributions to the Pension Fund for an individual entrepreneur in 2019 and provide instructions on how to pay a receipt of contributions to the Pension Fund for an individual entrepreneur in 2021 online on the tax office website.

Mandatory payments for entrepreneurs include contributions to social funds - the Pension Fund, the Compulsory Medical Insurance Fund and the Social Insurance Fund. The last type of contributions is paid if there are employees in case of temporary disability, injury and maternity. When it comes to individual entrepreneurs’ contributions for themselves, the main requirement is payment of mandatory contributions to the Pension Fund.

Late payment of mandatory contributions may result in fines and sanctions from the tax authorities. If you are afraid of missing deadlines or filling out the payment form incorrectly, entrust the work of paying insurance premiums to experienced specialists. For example, using this service.

What is 2-NDFL?

This is a specialized document. You can apply for it directly from your employer. The certificate must contain the details of the enterprise in a clearly defined form, and an original seal must be affixed. To issue an official document, you need to contact the accounting department. Tax legislation states that the period for issuing a certificate is no more than three days, and holidays and weekends are not included in the calculation.

Issuance times may be seriously delayed if the request for documentation was made orally. To protect your rights and interests, you need to submit a written application in free form to the accounting department. From the moment of its submission, a completed certificate must be provided within the established period.

Rebus Company

The contribution amount is calculated from the employee’s total income, including salary, bonuses and other incentive payments. The payment is 22% of income. If the employee’s annual income is more than 1,021 million rubles, the entrepreneur must pay 10% of the amount exceeding the established limit.

Mandatory or not?

An entrepreneur has the right to pay fixed insurance premiums at any time until the end of the current year, that is, until December 31 inclusive. You can fill out and pay a receipt for payment of insurance premiums to the Pension Fund for Individual Entrepreneurs 2021 online on the tax office website. In this case, the entrepreneur can pay the contribution in installments throughout the year or in a single payment at the end of the reporting period. Contributions from an amount exceeding the limit of 300 thousand are paid based on the results of the reporting period after January 1 of the following year.

The purpose of the barcode is to automate the process of entering reports into the Federal Tax Service Inspectorate system. All tax returns and other reporting forms have their own barcodes; all this is part of the electronic document management development program.

What does the document indicate?

There is a special form and the data and details that must be included in the document are defined. Data is provided not only for the employee, but also for the employer:

- Name of company. In this case, all registration codes in the tax register, as well as other details, are indicated;

- Employee’s passport data (taken from the first two pages);

- The amount of total income for a clearly defined period of time is indicated;

- The sum of all deductions;

- Data on standard, social and property deductions may be indicated, indicating their codes (if the employee is entitled to receive them).

What does it mean and why is it needed?

In 2015, a document form was approved, in which there is a barcode in the upper right corner. Now the 2-NDFL report is submitted on exactly these forms.

Since the tax office processes a fairly large number of documents, the use of computer processing and document accounting capabilities is relevant.

At the legislative level, it was decided that:

- enterprises with more than 25 employees are required to submit reports electronically;

- if there are 25 or fewer, it is allowed to submit them on paper.

In the first case, all processing can be carried out using computer technology. In the second case, we are talking about manual processing, which is many times slower.

In order to facilitate the work, a form was created containing a barcode, which can be considered a special device.

This innovation is intended to make the work of tax officials easier when accepting such reports.

The information contained in the code does not contain specific numbers of the report, but information about the form of the document.

Mandatory or not?

The presence of a barcode is an important change that is designed to improve the work of the tax office with accepted reports.

The form is mandatory and refusal to accept if the form does not have a barcode is completely legal.

Are they all different or not?

Since the code relates to the type of form used, it will be the same for each 2-NDFL reporting form.

If the program does not put down

Of course, in some companies the accounting program puts the required barcode on 2-NDFL. But, of course, not everyone keeps up with the times. If a company uses the program, then it makes sense to update it to the latest version. Perhaps the latest changes have already been taken into account.

If you can’t solve the problem in this way, you can simply download the required form from the tax office website and fill it out. It already contains a barcode.

Will the tax certificate be accepted without it?

According to the law, if a report is accepted on the wrong form, they have every right to refuse acceptance.

If you submit reports electronically, this problem does not arise.

But if a company submits reports in paper form, then it is necessary to comply with the relevant legal requirements.

Tips and tricks

Here are some recommendations:

- When submitting such certificates, it is recommended to use high-quality paper, the density of which is no less than 80 grams per cubic centimeter.

- It is recommended not to use a stapler to avoid damaging the barcode.

- It is recommended to print the certificate only on one side of the sheet.

In order to submit reports without problems, you need to keep track of changes in legislation on time and provide accounting departments with the appropriate forms on time.

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- 8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Personal income tax (personal income tax)

Methods of data processing and comparison

Using machine technology and data center technologies, the tax office compares the information received. After this, the data verification procedure takes place, deviations, errors and shortcomings are identified. Further 2 personal income tax barcodes can be processed manually, but PDF417 technologies eliminate this need.

What are the personal income tax benefits?

The advantages of the technology are:

- saving money and time for tax inspectors;

- a simple and convenient way to record enterprises and information on their economic activities;

- increasing data processing speed.

Printing reports also has certain standards. The state obliges the use of high-quality paper, modern printers for printing and one-sided submission of information (on one side of the landscape sheet).

Since 2015, form 2-NDFL has acquired a special barcode in the upper left corner. Why do you need a barcode on the 2-NDFL certificate, is it required, and what should a tax agent do if there is no barcode on the certificate?

Administration of the Krasnoarmeysky district of the Samara region

10.08.201819:5510 August 2021 19:55:11

| chto-oznachaet-shtrikh-kod-na-spravke-2-ndfl-39908018.zip |

Tax deductions for children in 2021, personal income tax, etc. The absence of a barcode indicates that the document was filled out incorrectly. Is it possible to withdraw an organization's profits in cash? Every year, tax agents submit information about the income received by individuals and the amounts of personal income tax calculated and withheld from them for the past period. Code 503 in the 2NDFL certificate is a special form of deduction from financial assistance, which means the allocation of funds by an enterprise or employer due to the employee reaching retirement age. Previously, companies reflected labor bonuses along with salaries with code 2000. In 2021, by order of the Federal Tax Service MMV@, changes were made to the current list of codes for types of income and deductions for personal income tax. The 2NDFL certificate is not the first reporting form to which the Federal Tax Service has added a two-dimensional barcode. And those who are preparing for semi-annual reporting on contributions have new questions. To generate reporting for employees, many individual entrepreneurs and organizations use this In the 2NDFL certificate, the income code for material assistance, not counting the funds that. What is the barcode for on the 2 personal income tax certificate? Tax agents have the right to submit to the tax authority certificates in form 2NDFL for 2021, both in the form without taking into account the changes made, and in the form taking into account the changes made by order of the Federal Tax Service of Russia dated N ММВ@ information of the Federal Tax Service of Russia. 2NDFL certificate summary for filling out 2021. Situation on how to fill out section 5 of the 2NDFL certificate for someone working under a patent. Personal income tax is an abbreviation that stands for tax on income received by individuals. The barcode changes with each new approved certificate form. Income codes for 2NDFL certificate in 2021. INDIVIDUAL INCOME CERTIFICATE for 2015 1 dated 21. Indicate the amount of fixed advances on a patent by which you are reducing the tax in the line of the same name. If the directory does not contain the required code to which the income that is indicated in section 3, certificate 2 of personal income tax can be attributed, the income codes in certificate 2 of personal income tax should be attributed to other income, code 4800. Interdistrict Inspectorate of the Federal Tax Service of the Russian Federation N1 for the Belgorod Region in order to increase efficiency data entry from paper media uses new technology for processing data from accounting and tax reporting documents presented on paper with a two-dimensional barcode further 2ШК. What does the barcode mean on 2NDFL? For years now, tax officials have been conducting a campaign to encode documents under the auspices of the development of electronic document management. Sections 3 to 5 of the certificate for rate 13 are sequentially filled out, and then sections 3 and 5 of the certificate for rate 9 are filled in sequentially. The Federal Tax Service suggests sequentially filling out the data in sections 3 and 5, first for one bet, then for another. According to these documents, in a certificate of taxable income of an individual at a certain rate, you must indicate the tax code for personal income, which can be selected from the reference book in Appendix 2 to form 2NDFL. Federal Tax Service Code Tax agent 1 tax agent, 2 authorized representative

.

As I understand it, the code is the same, I think that you can take it from the Excel version of the consultant’s document at the link above, convert it into an image and use it. The Federal Tax Service of the Russian Federation has developed an effective and convenient method for processing and recording information that is displayed on paper. Do I need to indicate December payments in the new 6NDFL calculation? Natalya Lensmaster is the author of the question. Two innovations have changed: income codes and deduction codes. Form of arrows for the eyes photo MTS power of attorney form from a legal entity The world around us 2nd grade test work in the Churakov test form answers Is it possible to apply for divorce Consent to registration from the owner sample notary

krasnoarmeysky.ru

What does a barcode look like?

When creating a control barcode, standard EAN symbology is used, which is always placed in the upper left corner of the document. Each form of tax and accounting certificate has a specific code, which is used to identify the data.

In various fields of activity, the EAN linear barcode is used, which can encode up to two hundred and fifty-six characters. This set of characters is not enough to express these documents and declarations, so the state uses two-dimensional coding, which allows you to display all the necessary information about a particular certificate.

Deadline for submitting personal income tax certificate 2

A two-dimensional barcode is expressed in PDF417 symbology, which provides encoding of two thousand seventy ten characters. PDF417 technology is used in the following areas of activity:

- digital personal identification;

- accounting of commercial products;

- accounting of documentation and information.

The most common errors in the 2-NDFL certificate

There is a standard form with mandatory fields to fill out. A document may be declared invalid or erroneous in a number of cases. If required fields were omitted, if errors or typos were made, strikethroughs were made. When such errors occur, it is best to fill out a new form. You can use already developed standard templates, which will help eliminate common errors.

Often the reason for declaring a document invalid is the incorrect date indication. In accordance with the requirements, the date must be indicated exclusively in numbers. Writing the date in words is not acceptable and is a serious error. A document can only be stamped in a clearly defined location. That is, it is placed at the bottom of the page in the left corner, there is an indication there - M.P. It is imperative to ensure that the seal imprint is clear and bright, without any scuffs or washouts.

Accounting employees who fill out such documents must carefully check the data entered into the certificate. Any errors or inaccuracies in the numbers can become the basis for serious problems in the future. When receiving a certificate, a person must check for the accountant’s signature - a mandatory element. The standard assumes that the signature is written with a ballpoint pen, exclusively in blue ink. It must be clear and precise. The quality of the stamp is also checked.

Changes in certificate 2-NDFL

In 2021, new changes were made that affected only certain sections of this document. So, in the second section you will need to indicate not only all the data about the individual, but also the TIN. This field must be filled in for those employees who are not residents of the country, but are officially employed. A new list of taxpayer statuses has appeared in the section. The following positions appeared:

- Immigrants from foreign countries are voluntary and are compatriots;

- Foreign employees who have refugee status;

- Foreign persons who have received temporary asylum on the territory of the Russian Federation;

- Employees who work on the basis of a patent.

Purposes of using PDF417 in the field of taxation

In the field of accounting and taxes, the barcode for 2 personal income tax is used to achieve the following goals:

- simplification of the procedure for entering data on the activities of enterprises;

- increasing the level of database performance;

- reduction of errors when entering and processing information about taxpayers.

Accounting is carried out using standardized rules for placing codes on the pages of reports and declarations. Each document and its page corresponds to a specific two-dimensional code. Well-established classification helps to get rid of unnecessary difficulties and errors during accounting and audits.

The data with the declaration completed by the tax agent is sent to an electronic file, which collects the most necessary information. The electronic format file is processed using a single printing module, the system sends the received data to a specific tax authority template. After this, from the database system, tax inspectors can print out any data that is necessary for control and accounting of enterprises and organizations. After completing the necessary activities, the tax agent sends a report to the place of registration and accounting.

How to fill out a receipt for payment of insurance premiums for individual entrepreneurs in 2021

To create and fill out a receipt for payment of insurance premiums to the Pension Fund in 2021 for individual entrepreneurs, you need to use the intuitive prompts in the menu. All the data to fill out the form is either in the tax database or the taxpayer has. When you click the “Next” button to complete the creation of a receipt for payment of insurance premiums for individual entrepreneurs in 2019, you must provide the following information:

- taxpayer status - for an entrepreneur, code 09 is indicated;

- basis for payment - in the absence of fines and penalties, the TP code (current payments) is indicated;

- tax period - for fixed contributions you need to select “annual payment” from the menu;

- contribution amount.

An example of correctly filling out the details when issuing a tax receipt for an individual entrepreneur in 2021:

How to pay a tax receipt to an individual entrepreneur's pension fund

To pay a payment order through a bank cash desk, you need to use the “Generate payment document” function and print the already completed payment order. That is, when printing a document in PDF format, the entrepreneur receives a ready-made payment slip that can be paid at any bank.

Only individuals and entrepreneurs who have opened a “Bank-Client” in one of the available systems can pay contributions to the Pension Fund for individual entrepreneurs using receipt 2021 on the tax website.

In most cases, you can pay the receipt using a bank card. To carry out non-cash payment of insurance premium receipts to the Pension Fund of the Russian Federation in 2021 for individual entrepreneurs, the taxpayer’s INN must be indicated in the entrepreneur’s personal account. When making a payment on the tax website, the individual entrepreneur receives a receipt confirming that the payment was made electronically. To save reporting documents, you can save it to a computer or any electronic storage medium, and print it if necessary.

Why do you need a 2-NDFL certificate?

The completed form 2-NDFL is an official document confirming the income received by an individual. In some cases, when a citizen applies for a large bank loan, 2-NDFL may be required to prove not only solvency, but also a stable place of work.

Who will need an income certificate and why?

- Tax agents, i.e. employers who use the labor of employees and make payments to them are required to submit Form 2-NDFL for each of their employees. Based on the amounts paid, the corresponding tax is calculated and paid to the budget.

- A citizen has the right to request a certificate from the employer to confirm his income. This is necessary in the following cases:

- when applying for a large loan, mortgage loan, car loan in the case where the lending institution requires this document;

- to prepare a tax return when using social deductions for purchased housing, education for yourself or your child, for your treatment;

- upon dismissal, to submit 2-NDFL at the new place of work;

- other situations.

If an employee needs such a certificate, he will need to contact the employer with an application. If the employee has already been dismissed, he applies to the accounting department at his previous place of work with an application, presenting his passport and work book.

New form 2-NDFL in 2021

Let us indicate the differences in the forms of certificates of the previous sample with the new one.

The barcode of the document has been changed - 3990 9015.

- In section 1, containing information about the tax agent, fields have been added that are filled in by the legal successor in the event of liquidation (reorganization) of a legal entity.

- The name and details of the legal successor of the organization - the tax agent - have been entered.

- Information about the registration address of an individual in section 2 has been excluded.

- Section 4 excludes the amounts of investment deductions.

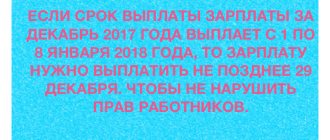

If we talk about the deadlines within which employers are required to submit 2-NDFL to the tax authorities, these are the dates of the year following the tax period:

- April 1 in most cases;

- March 1, if it is not possible to withhold the calculated tax during the tax period.

Legal grounds

The form of the certificate, as well as the procedure for its execution, are approved by the relevant order of the Tax Service No. ММВ-7-11/485, issued on October 30, 2021. The basis for the development of this document is paragraph 5 of Article 226, paragraph 4 of Article 31, as well as Article 230 of the Tax Code.

In accordance with these regulations, it is approved:

- form of providing information about the income of certain individuals;

- the procedure for completing the form of information on the profits of individuals;

- the format in which information on the profits of individuals should be submitted electronically;

- the form in which a notice of impossibility of withholding taxes must be submitted, as well as the amount of income of the individual from whom it was not possible to withhold tax, and the total amount not withheld.

In addition, in accordance with this order, Tax Service Order No. ММВ-7-3/611 was completely neutralized, in accordance with which the previously existing form for submitting data on the income of individuals was adopted.

Why might a 2-NDFL certificate be required?

Most often, such a document is required when applying for a loan from banking organizations. The certificate allows you to see that the person actually has official employment and is solvent. Based on accurate data on income received, bank employees can make the right decision on the issue of providing credit funds. In essence, the certificate is a reflection of the client’s level of solvency and allows you to determine what limit of loan funds can be provided.

2-NDFL may also be requested in the following cases:

- When the process of registration is carried out, as well as receiving the due tax deductions;

- When applying for various social benefits and benefits. For example, such a document may be required if a person expects a refund for a child’s paid education;

- In certain lawsuits, controversial situations and proceedings, a certificate may often be required as a document determining the availability of a permanent and official place of work and the amount of income received;

- When calculating a future old-age pension, providing such a certificate is necessary (on its basis the main elements of the calculation are made);

- When registering guardianship or adoption, a mandatory condition is confirmation of the status of a working citizen;

- It is recommended to issue a certificate upon dismissal, since in the future new employers often require the provision of data on wages and taxes;

- When applying for a foreign visa, bank statements about the accrual of wages on the card are most often requested; a certificate of permanent employment may also be required. But, in some cases, the consulate may require the provision of 2-NDFL;

- When calculating unemployment benefits, data on wages for the last six months is usually used (data from the last place of work is taken into account). Accordingly, in such situations, providing a document in 2-NDFL format is mandatory, otherwise the employment center may refuse to accrue a specialized benefit.

Certificate 2-NDFL on maternity leave or on sick leave

There are situations when a pregnant woman or an employee on maternity leave needs to apply for a special monetary benefit in social structures. This benefit is assigned in the form of compensation for child care. Benefits are calculated based on accurate salary data. When a woman goes on maternity leave, payments in the amount of one hundred percent of the average earnings from her place of work are required. The calculation is influenced solely by the amount of earnings; other factors, such as length of service, cannot affect the amount of the benefit. In order to correctly and competently determine the amount of cash benefits, it is necessary to be guided by salary data. By law, data from the last two years is taken into account. The current employer must obtain a 2-NDFL certificate from the previous place of employment if the woman has been on the payroll for less than two years; this is the only way to make a correct and legal calculation.

In 2010, changes were introduced that determined that a certificate of this format is the main source for calculating payments for sick leave. In the calculation process, the accountant must use data on the employee’s average salary for the last two years. Certificate 2 Personal income tax is used in various cases, acts as a legally significant document, and is considered an official source of data on the income received by an individual.

Rules for filling out 2-NDFL

When drawing up a document form, a unified form is used. It is contained in all accounting programs that calculate wages and taxes on amounts accrued to individuals.

- All information contained in the certificate must correspond to the tax registers. Accrual in one period (calendar year) of amounts to an individual that are taxed at different tax rates requires filling out the relevant sections of the certificate (3-5) separately for each rate.

- If the form does not fit on one sheet, then a multi-page document is generated. Each sheet is signed by the manager or authorized representative and the chief accountant. No stamp required.

- The document consists of five sections; we will consider filling out each section in more detail.

Should there be or not

The main purpose of barcodes is to provide automation of reporting for the tax service. Each tax and other forms have certain markings, and all this as a whole represents a separate element of the development of electronic document management in our country.

If reporting is submitted in paper rather than electronic form, tax officials need to independently transfer all the necessary information into their programs.

A barcode, which is read using special equipment, makes it possible to completely eliminate the need for manual data entry, which also eliminates inevitable errors. To prevent this field from being damaged, it is highly not recommended to staple several sheets of paper with a standard stapler during the documentation process.

It must be included on the 2-NDFL certificate, that is, with a barcode already placed, and therefore a certain form of the certificate has been approved. If it is missing, then the tax authorities will simply not accept the information on profit, and will indicate as a basis for refusal that the submitted certificates do not comply with accepted standards.

If profit certificates are filled out using specialized accounting utilities, then in this case there should not be any difficulties with affixing barcodes to 2-NDFL, since the program automatically downloads current forms.

If for some reason this format is not used, then you can manually fill out all the necessary documents and submit reports in paper form, but this is only allowed if the average number of employees in the organization is less than 25 people.

If the average number of employees of the company is larger, then in this case you can use a special program posted on the official website of the tax service, which helps prepare data on Form 2-NDFL for any number of employees for the purpose of their further submission in the form of tax reporting.

If not provided

It often happens that tax agents use the latest versions of specialized accounting programs, with the help of which the tax agent completely gets rid of putting 2-NDFL barcodes on his documentation, since instead this procedure will be completely automatically carried out by the program used. Ultimately, this utility will issue certificates already filled out in the appropriate form, which will immediately contain all the necessary barcodes.

If, for one reason or another, the utility you are using does not provide barcodes during its operation, then in this case you can act depending on how many employees the company submits reports for to government agencies.

To avoid any misunderstandings associated with the use of new forms, from which some equipment cannot read information or does not carry out this procedure correctly, then in this case you can adhere to certain recommendations.

First of all, it is best to avoid joining multiple papers using staples or paper clips, as they can damage the barcodes being used.

If any adjustments need to be made to the already completed certificate in the future, the responsible person will have to re-format the documents used, as well as print them out, if such a need really arises.

Form 2-NDFL is required to submit information about income paid to individuals to the tax authority.

In this article you will find a sample of filling out financial assistance in the 2-NDFL report.

A sample of filling out form 2-NDFL can be downloaded.

The personal income tax stamp may not be affixed, but there is a barcode on it, without which the document will be considered invalid. You cannot create a certificate yourself. It is issued by an accountant who fills out the form in a special program and is based on information from personal accounts. In addition to the bank, you may be required to provide a certificate from:

- When calculating alimony.

- When drawing up form 3-NDFL for tax deduction crediting to the Federal Tax Service.

- When adopting a child from an orphanage or baby home, as well as establishing guardianship.

- To the Pension Fund for recalculation of pension payments.

- To consider labor disputes in court.

Paper Features

The need to print such documents with specialized barcodes has been fixed for more than two years, and a strict place on the document is provided for the placement of this element - they must be placed in the upper left corner of the generated document. This marking is mandatory today, since it significantly simplifies reporting processing.

By using this marking, the data from the certificate will be taken into account and recorded directly in the INFS database, thanks to which tax officers will be able to save a huge amount of time.

In this regard, if you need to issue a certificate in form 2-NDFL, it must have a unique barcode, and if reporting is submitted in a multi-sheet version, then in this case it is highly not recommended to combine pages with a stapler, so how this can lead to damage to two-dimensional elements that help optimize electronic document management.

If the certificates used do not have barcodes, then tax officials have every right to refuse to accept this documentation, since their execution differs significantly from the form accepted by law.

Of course, if you order the appropriate forms in advance, then in this case you will receive papers drawn up in the correct order, but in any case, it is better to check the barcodes in this situation.

As mentioned above, the only solution to the situation when there is no marking on a document is to file reports in paper form, if the company has an average number of employees of 25 people, since accountants of such organizations are given the opportunity to submit reports filled out by hand, and that is quite enough obtain ready-made forms. For everyone else, the only option left is to use the “Legal Taxpayer” program, located on the official website of the tax service.

Example of a barcode on a 2-NDFL certificate

If the program does not put a barcode in 2-NDFL

Accounting programs contain current forms of all mandatory reports, which are updated in accordance with the requirements of current legislation. During the preparation of declarations, calculations and certificates, the responsible employee of the company receives the required document format without unnecessary hassle.

But in some situations, the system does not automatically enter a code, and forms are printed without two-dimensional symbols. What needs to be done in this case? The algorithm of actions depends on the size of the enterprise/individual entrepreneur:

- Less than 25 people in a company - such tax agents are allowed to submit Form 2-NDFL certificates on paper. In order to fill out the correct form, you need to download the latest version of the form, then enter information on income, deductions and withholdings (for each taxpayer separately), put down the correct sign (1 or 2) and send the reports to the Federal Tax Service by mail by a certified letter or by personal visits to the inspection site at the place of registration.

- More than 25 people in a company - such tax agents cannot report on paper forms; 2-NDFL certificates are accepted only in electronic format. To fill out the forms, you will need to find a special Legal Entity Taxpayer program on the official website of the Federal Tax Service of the Russian Federation, download and install it on your computer, after which you can prepare all the necessary reports. This program is very easy to use and is accessible even to people who are little familiar with computer nuances.

Note! No matter how you fill out the reports, it is important to correctly enter all the information - from the details of the enterprise/individual entrepreneur to information about the taxable base, the amounts of deductions and charges. Errors and inaccuracies in documents can lead to penalties, arrears and penalties for tax payments and fees.

If you find an error, please select a piece of text and press Ctrl+Enter.

Such a certificate is submitted to the tax office by each enterprise. But it also has other areas of application.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (Saint Petersburg)