Each tax agent (individual entrepreneurs, enterprises and organizations) annually submits to the Federal Tax Service at the place of registration or residence a report on the accrued and paid tax on the income of individuals (hired employees). He also provides Form 2-NDFL to the employee upon his request. It serves as proof of income for applying for a loan from a bank and other authorities.

In the report that the tax agent submits to the Federal Tax Service, and in the certificate for the employee, it is necessary to indicate income codes. They are approved by the Federal Tax Service of the Russian Federation. As of 2021, new income codes have been introduced. Let's look at this topic in more detail.

Changes and innovations

In each 2-NDFL certificate, income and deduction codes must be entered. This is required by paragraph 1 of Art. 230 Tax Code of the Russian Federation. In this matter, tax agents are required to rely on the order of the Russian Tax Service dated September 10, 2015 No. ММВ-7-11/387. Its Appendix No. 1 contains income codes, and Appendix No. 2 contains codes for types of deductions. Tax authorities periodically review the composition of codes and supplement them with new codes. So, for example, last year the Federal Tax Service already made changes to the codes (order dated November 22, 2016 No. ММВ-7-11/). Codes were added to the list: 2002 – for bonuses that are included in wages; 2003 – for non-labor bonuses from profits and earmarked funds. In addition, child deduction codes have been changed. See “Table with breakdown of income codes in 2021.”

This time the amendments were made by order of the Federal Tax Service dated October 24, 2017 No. ММВ-7-11/820. It was officially published on December 21, 2021. Taking into account this date, the amendments are effective from January 1, 2021. Therefore, income codes in 2-NDFL for 2021 must be entered taking into account all changes and new income codes.

The commented Order of the Federal Tax Service adds new income codes for the generation of 2-NDFL certificates in 2021. Here is a table with the new codes.

Table of new income codes with decoding from 2018

| Code | Decoding |

| 2013 | Compensation for unused vacation |

| 2014 | Severance pay in the form of average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in the amount exceeding in general three times the average salary (or six times for organizations in the Far North) |

| 2301 | Fines and penalties paid by an organization on the basis of a court decision for failure to voluntarily meet consumer demands in accordance with the law on the protection of consumer rights; |

| 2611 | The amount of bad debt written off in accordance with the established procedure from the organization’s balance sheet |

| 3021 | The amount of income in the form of interest (coupon) on circulating bonds of Russian organizations denominated in rubles. |

Such additions were required so that the accountant would know what amounts the employees’ incomes consist of. Previously, such payments were coded in 2-NDFL certificates under a single code 4800 “Other income”. Since 2021, there are more codes - they have become more accurate.

We take into account above-limit daily allowances in the 1c program

Dear readers!

We continue the conversation about how to implement the features of accrual and payment of various amounts in 1C programs. This time we will talk about withholding personal income tax from amounts exceeding the daily allowance. The accountant uses two programs in his work - “1C: Salary and Human Resources Management” (release 8.2) and “1C: Accounting” (release 8.2).

When uploading data from the 1C: Salary and Personnel Management program to the 1C: Accounting program, the amount of daily allowance paid in excess of the limit is doubled in the 1C: Accounting program.

In addition, the said amount is due to the employee to be paid in person, although he has already received the daily allowance.

How to make adjustments in the 1C program to get rid of doubling the amount?

This question came from our reader via email from Zarplata magazine.

All income codes for 2021

Summarizing the above, below is a table with a breakdown of income codes that may appear on income certificates in 2018. It combines new and old codes. Use this table when generating 2-NDFL certificates.

| Revenue code | Name of income |

| 1010 | Dividends |

| 1011 | Interest (except for interest on mortgage-backed bonds issued before 01/01/2007, income in the form of interest received on bank deposits, and income received upon redemption of a bill of exchange), including discount received on a debt obligation of any type |

| 1110 | Interest on mortgage-backed bonds issued before 01/01/2007 |

| 1120 | Income of the founders of the trust management of mortgage coverage received on the basis of the acquisition of mortgage participation certificates issued by the mortgage coverage manager before 01/01/2007 |

| 1200 | Income received in the form of other insurance payments under insurance contracts |

| 1201 | Income received in the form of insurance payments under insurance contracts in the form of payment for the cost of sanatorium and resort vouchers |

| 1202 | Income received in the form of insurance payments under voluntary life insurance contracts (except for voluntary pension insurance contracts) in the case of payments related to the survival of the insured person to a certain age or period, or in the event of the occurrence of another event (except for early termination of contracts), in part of the excess of the amounts of insurance premiums paid by the taxpayer, increased by the amount calculated by sequentially summing the products of the amounts of insurance premiums paid from the date of conclusion of the insurance contract to the day of the end of each year of validity of such a voluntary life insurance contract (inclusive), and the average annual refinancing rate in force in the corresponding year Central Bank of the Russian Federation |

| 1203 | Income received in the form of insurance payments under voluntary property insurance contracts (including civil liability insurance for damage to the property of third parties and (or) civil liability insurance of vehicle owners) in terms of excess of the market value of the insured property in the event of loss or destruction of the insured property, or expenses necessary to carry out repairs (restoration) of this property (if repairs were not carried out), or the cost of repairs (restoration) of this property (if repairs were carried out), increased by the amount of insurance premiums paid to insure this property |

| 1211 | Income received in the form of amounts of insurance premiums under insurance contracts, if these amounts are paid for individuals from the funds of employers or from the funds of organizations or individual entrepreneurs who are not employers in relation to those individuals for whom they make insurance premiums |

| 1212 | Income in the form of cash (redemption) amounts paid under voluntary life insurance contracts, subject to payment in accordance with the insurance rules and terms of the contracts upon early termination of voluntary life insurance contracts |

| 1213 | Income in the form of cash (redemption) amounts paid under voluntary pension insurance contracts and subject to payment in accordance with the insurance rules and terms of the contracts upon early termination of voluntary pension insurance contracts |

| 1215 | Income in the form of cash (redemption) amounts paid under non-state pension agreements and subject to payment in accordance with the insurance rules and terms of the agreements upon early termination of non-state pension agreements |

| 1219 | Amounts of insurance contributions in respect of which the taxpayer was provided with a social tax deduction provided for in subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation, taken into account in the event of termination of the voluntary pension insurance agreement |

| 1220 | Amounts of insurance contributions in respect of which the taxpayer was provided with a social tax deduction provided for in subparagraph 4 of paragraph 1 of Article 219 of the Tax Code of the Russian Federation, taken into account in the event of termination of non-state pension provision |

| 1240 | Amounts of pensions paid under non-state pension agreements concluded by organizations and other employers with Russian non-state pension funds, as well as amounts of pensions paid under non-state pension agreements concluded by individuals with Russian non-state funds in favor of other persons |

| 1300 | Income received from the use of copyright or other related rights |

| 1301 | Income received from the alienation of copyright or other related rights |

| 1400 | Income received from the rental or other use of property (except for similar income from the rental of any vehicles and communications equipment, computer networks) |

| 1530 | Income received from transactions with securities traded on the organized securities market |

| 1531 | Income from transactions with securities not traded on the organized securities market |

| 1532 | Income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices |

| 1533 | Income from transactions with derivative financial instruments not traded on an organized market |

| 1535 | Income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is not securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices |

| 1536 | Income received from transactions with securities not traded on the organized securities market, which at the time of their acquisition met the requirements for traded securities |

| 1537 | Income in the form of interest on a loan received from a set of repo transactions |

| 1538 | Income in the form of interest received in the tax period under a set of loan agreements |

| 1539 | Income from operations related to the opening of a short position that is the object of repo operations |

| 1540 | Income received from the sale of participation shares in the authorized capital of organizations |

| 1541 | Income received as a result of the exchange of securities transferred under the first part of the repo |

| 1542 | Income in the form of the actual value of a share in the authorized capital of an organization, paid when a participant leaves the organization |

| 1544 | income received from transactions with securities traded on the organized securities market, accounted for in an individual investment account |

| 1545 | income from transactions with securities not traded on the organized securities market, accounted for in an individual investment account |

| 1546 | income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is securities, stock indices or other derivative financial instruments, the underlying asset of which is securities or stock indices accounted for in an individual investment account |

| 1547 | income from transactions with derivative financial instruments not traded on the organized securities market, accounted for in an individual investment account |

| 1548 | income from transactions with derivative financial instruments that are traded on an organized market and the underlying asset of which is not securities, stock indices or other financial instruments of futures transactions, the underlying asset of which is securities or stock indices accounted for in an individual investment account |

| 1549 | income received from transactions with securities not traded on the organized securities market, which at the time of their acquisition met the requirements for traded securities accounted for in an individual investment account |

| 1550 | Income received by a taxpayer upon assignment of rights of claim under an agreement for participation in shared construction (an investment agreement for shared construction or under another agreement related to shared construction) |

| 1551 | income in the form of interest on a loan received from a set of repo transactions accounted for in an individual investment account |

| 1552 | income in the form of interest received in the tax period on a set of loan agreements accounted for in an individual investment account |

| 1553 | income from operations related to the opening of a short position, which is the object of repo transactions, accounted for in an individual investment account |

| 1554 | income received as a result of the exchange of securities transferred under the first part of the repo, accounted for in an individual investment account |

| 2201 | Author's fees (rewards) for the creation of literary works, including for theatre, cinema, stage and circus |

| 2000 | Remuneration received by a taxpayer for performing labor or other duties; salary and other taxable payments to military personnel and equivalent categories of individuals (except for payments under civil contracts) |

| 2001 | Directors' remuneration and other similar payments received by members of the organization's governing body (board of directors or other similar body) |

| 2002 | Amounts of bonuses paid for production results and other similar indicators provided for by the laws of the Russian Federation, employment agreements (contracts) and (or) collective agreements (paid not at the expense of the organization’s profits, not at the expense of special-purpose funds or targeted revenues) |

| 2003 | Amounts of remuneration paid from the organization’s profits, special-purpose funds or targeted revenues |

| 2010 | Payments under civil contracts (except for royalties) |

| 2012 | Amounts of vacation payments |

| 2013 | Compensation for missed vacation |

| 2014 | Severance pay amount |

| 2201 | Author's fees (rewards) for the creation of literary works, including for theatre, cinema, stage and circus |

| 2202 | Author's fees (rewards) for the creation of artistic and graphic works, photographic works for printing, works of architecture and design |

| 2203 | Author's fees (rewards) for the creation of works of sculpture, monumental decorative painting, decorative and applied and design art, easel painting, theatrical and film set art and graphics, made in various techniques |

| 2204 | Copyright royalties (rewards) for the creation of audiovisual works (video, television and cinema films) |

| 2205 | Author's fees (rewards) for the creation of musical works: musical stage works (operas, ballets, musical comedies), symphonic, choral, chamber works, works for brass band, original music for cinema, television and video films and theatrical productions |

| 2206 | Copyright royalties (rewards) for the creation of other musical works, including those prepared for publication |

| 2207 | Author's fees (rewards) for the performance of works of literature and art |

| 2208 | Copyrights (rewards) for the creation of scientific works and developments |

| 2209 | Royalties for discoveries, inventions, utility models, industrial designs |

| 2210 | Remuneration paid to the heirs (legal successors) of the authors of works of science, literature, art, as well as discoveries, inventions and industrial designs |

| 2300 | Temporary disability benefit |

| 2400 | Income received from the rental or other use of any vehicles, including sea, river, aircraft and motor vehicles, in connection with transportation, as well as fines and other sanctions for idle time (delay) of such vehicles at loading (unloading) points ); income received from the rental or other use of pipelines, power lines (power lines), fiber-optic and (or) wireless communication lines, and other means of communication, including computer networks |

| 2510 | Payment for the taxpayer by organizations or individual entrepreneurs for goods (work, services) or property rights, including utilities, food, recreation, training in the interests of the taxpayer |

| 2520 | Income received by a taxpayer in kind, in the form of full or partial payment for goods, work performed in the interests of the taxpayer, services rendered in the interests of the taxpayer |

| 2530 | Payment in kind |

| 2610 | Material benefit received from savings on interest for the taxpayer’s use of borrowed (credit) funds received from organizations or individual entrepreneurs |

| 2611 | A forgiven debt that was written off the balance sheet |

| 2630 | Material benefit received from the acquisition of goods (work, services) in accordance with a civil contract from individuals, organizations and individual entrepreneurs who are interdependent in relation to the taxpayer |

| 2640 | Material benefit received from the acquisition of securities |

| 2641 | Material benefit received from the acquisition of derivative financial instruments |

| 2710 | Financial assistance (with the exception of financial assistance provided by employers to their employees, as well as to their former employees who resigned due to retirement due to disability or age, financial assistance provided to disabled people by public organizations of disabled people, and one-time financial assistance provided by employers to employees ( parents, adoptive parents, guardians) at the birth (adoption) of a child) |

| 2720 | Cost of gifts |

| 2730 | The cost of prizes in cash and in kind received at competitions and competitions held in accordance with decisions of the Government of the Russian Federation, legislative (representative) bodies of state power or representative bodies of local government |

| 2740 | The cost of winnings and prizes received in competitions, games and other events for the purpose of advertising goods, works and services |

| 2750 | The cost of prizes in cash and in kind received at competitions and competitions held not in accordance with decisions of the Government of the Russian Federation, legislative (representative) bodies of state power or representative bodies of local government and not for the purpose of advertising goods (works and services) |

| 2760 | Financial assistance provided by employers to their employees, as well as to their former employees who quit due to retirement due to disability or age |

| 2761 | Financial assistance provided to disabled people by public organizations of disabled people |

| 2762 | Amounts of one-time financial assistance provided by employers to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child |

| 2770 | Reimbursement (payment) by employers to their employees, their spouses, parents and children, their former employees (age pensioners), as well as disabled people for the cost of medications purchased by them (for them), prescribed to them by their attending physician |

| 2780 | Reimbursement (payment) of the cost of medications purchased by the taxpayer (for the taxpayer), prescribed by the attending physician, in other cases not falling under paragraph 28 of Article 217 of the Tax Code of the Russian Federation |

| 2790 | The amount of assistance (in cash and in kind), as well as the value of gifts received by veterans of the Great Patriotic War, disabled people of the Great Patriotic War, widows of military personnel who died during the war with Finland, the Great Patriotic War, the war with Japan, widows of deceased disabled people of the Great Patriotic War and former prisoners of Nazi concentration camps, prisons and ghettos, as well as former minor prisoners of concentration camps, ghettos and other places of forced detention created by the Nazis and their allies during the Second World War |

| 2800 | Interest (discount) received upon payment of a bill presented for payment |

| 2900 | Income received from transactions with foreign currency |

| 3010 | Income in the form of winnings received in the bookmaker's office and betting |

| 3020 | Income in the form of interest received on bank deposits |

| 3021 | Interest on outstanding bonds of Russian companies |

| 3022 | Income in the form of fees for the use of funds of members of a consumer credit cooperative (shareholders), interest for the use by an agricultural credit consumer cooperative of funds raised in the form of loans from members of an agricultural credit consumer cooperative or associated members of an agricultural credit consumer cooperative |

| 4800 | Other income |

Is the cost of travel subject to personal income tax?

Art. 168 prescribes that the employing company is obliged to compensate the employee for the cost of travel to the destination. In Art. 217 of the Tax Code of the Russian Federation states that income tax is not provided for the following types of expenses:

- cost of round trip tickets;

- baggage fee;

- travel to the airport (station), to the destination in the city where the specialist was sent;

- commission fees;

- payment for airport services.

Important! The only condition for exempting compensation paid to an employee from personal income tax is documentary evidence of the expenses incurred.

For example, if a specialist traveled by train, he presents a ticket to the hiring company. If the business trip involved air travel, you can attach an electronic ticket receipt and a scan of your passport with border crossing marks to the advance report. To confirm expenses for taxis and airport services, you need to save receipts.

The employer’s obligation to charge tax on travel expenses arises in a situation where the specialist was unable to document them, but compensation was paid. The accountant calculates the tax in the month when the advance report was approved and deducts it from the specialist’s next salary.

The question of whether compensation for VIP lounge services is subject to personal income tax deserves special attention. Current legislation does not contain any restrictions prohibiting the classification of this type of expense as transportation costs. In practice, questions and claims from regulatory authorities are not excluded, so it is better for the company to have an explanation why the employee needed VIP service at the airport. For example, the manager was holding negotiations there and preparing an urgent presentation. Rules regarding such costs can be specified in the enterprise's collective agreement.

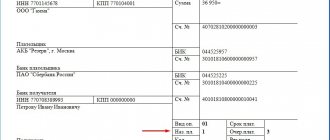

Submission of 2-NDFL certificates for 2021: new form and new codes

2-NDFL certificates for 2021 must be submitted to the inspectorate no later than April 2, 2021. But employees can also ask for the document at any time. The document must be filled out separately for each employee, coding all income and deductions in them with the appropriate codes. Apply new codes from January 1, 2021. New codes cannot be used in 2021.

If it is impossible to withhold personal income tax from the taxpayer during 2021, the tax agent must submit to his tax office, and also transfer 2-NDFL certificates to the individual himself no later than 03/01/2018, indicating in the certificates the sign “2” (clause 5 of Article 226 of the Tax Code RF). At the same time, submitting a certificate with attribute “2” does not relieve the tax agent from the obligation to submit a 2-NDFL certificate for the same persons with code “1”. And this will need to be done within the general time frame - no later than 04/02/2018.

Let us remind you that the current form of the 2-NDFL certificate was approved by order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/485. However, a new form of certificate 2-NDFL has been prepared, which must be used when submitting certificates for 2017 to the Federal Tax Service. The old form will not pass format and logical control or will not be accepted by the inspector. Download the new form 2-NDFL in 2018.

The need to change the 2-NDFL certificate and the procedure for filling it out, as follows from the explanations to the project, is due to the fact that the “old” form of the certificate did not allow the submission of information about the income of individuals for a tax agent by his legal successors. Below are the main changes in the new 2-NDFL form for 2021:

- in section 1 “Data about the tax agent” of the certificate, a new field “Form of reorganization (liquidation)” will appear, where the corresponding code (from 0 to 6) will be indicated, as well as the field “TIN/KPP of the reorganized organization”.

- amendments to the procedure for filling out the form provide that the legal successor of the tax agent indicates the OKTMO code at the location of the reorganized organization or a separate division of the reorganized organization;

- if the Certificate is submitted by the legal successor of the reorganized organization, the name of the reorganized organization or a separate division of the reorganized organization is indicated in the “Tax Agent” field;

- from Section 2 “Data about an individual – recipient of income”, fields related to the address of residence are excluded;

- in section 4 of the 2-NDFL certificate, investment deductions are excluded from tax deductions.

Read also

10.01.2018

What happens when data is uploaded

So, on the day the advance report is approved, the excess daily allowance must be registered in the employee’s personal income tax base in the 1C: Salary and Personnel Management program.

The program must calculate the tax and generate transactions.

At the same time, if in the payroll calculation program, in addition to transactions for withholding personal income tax, transactions are generated for accrual of the amounts of excess daily allowances themselves, when uploading data from this program to the 1C: Accounting program, the amount of daily allowance will be doubled precisely in terms of accrual of daily allowances exceeding the limit ( that is, the excess amount will double).

In addition, the amount of daily allowance payable to the employee will double (since the posting will be unloaded, which will turn out to be superfluous).

Online magazine for accountants

According to the new order, organizations will use code 2002 for bonuses. We are talking about payments for production and other similar indicators provided for by: - the norms of the legislation of the Russian Federation; — employment agreements or contracts; - collective agreements. We believe that the code 2003 will need to indicate, for example, a bonus for a holiday at the expense of the profit of a legal entity. Accountants will need new codes when issuing a 2-NDFL certificate. The current list of income codes does not contain separate codes for bonuses. Therefore, now, depending on the type of bonus, the accountant uses the following codes: - 2000 - mainly for rewards for performing labor or other duties. For example, for performance bonuses; - 4800 - for bonuses, the payment of which is not related to the performance of job duties. For example, a bonus for a holiday. This code is also used for income that does not have a code in the list.

Reference

The document contains the following data:

- information about the tax payer;

- information about the enterprise or individual entrepreneur who paid the tax;

- the tax base on the basis of which the accrual of tax payments was calculated is indicated;

- shows what tax was paid;

- all incomes are divided by their types in order to more fully control the accuracy of calculations;

- if deductions were made, it is written down what specific types and in what amounts.

Such a certificate can be obtained from the accounting department of your company. The period of issue is regulated by current legislation. It is three days.

Why it might be needed

Proof of income is often necessary when applying to a bank to obtain a loan. He wants to be sure that the borrower will be able to repay the loan with appropriate interest. Of course, such a certificate alone cannot guarantee that, say, the borrower will definitely not lose his job while the loan is being repaid. However, this is one of the important arguments when deciding to issue a loan.

Sometimes a person, having left one job for various reasons, finds a new place. Often, upon admission there, he is required to provide such a certificate from his previous job. In some cases, you need to apply for it separately, and often it is issued during the dismissal process.

This certificate reflects the tax deductions used, if any. On the other hand, in some cases the very fact of their provision is based on a 2-NDFL certificate. One example could be a deduction related to a child’s education at a paid university. There are also many other situations when this document cannot be avoided. It will be needed when:

- pension calculation;

- in the process of registering the adoption of a child;

- when it is necessary to calculate the amount of alimony payments;

- sometimes when applying for a visa;

- in some legal proceedings.

In order to understand what exactly is written in the certificate issued to the employee, you need to understand the rules by which this document is filled out. They should be studied carefully.

This certificate may be the basis for recognizing a family as low-income. This is determined quite simply. To do this, you need to divide the income indicated here by the number of family members and dependents. The average amount per person will show the level of income. It is compared with the living wage established for the region. If the amount is less than this, the family has the right to additional social benefits.