- What is income coding?

- Types of income codes in the 2-NDFL certificate

Preparation of tax reporting is a labor-intensive and painstaking process that requires maximum concentration from an accounting employee. It is important to take into account the latest changes in the law and not make mistakes in the encodings: they are used in personal income tax forms to record a person’s entire earnings and required deductions.

What do personal income tax codes mean?

The Tax Code obliges tax agents to keep records of income paid to individuals, not in any form, but using special codes.

Thus, paragraph 1 of Article 230 of the Tax Code of the Russian Federation states that each tax agent must compile tax accounting registers. They need to record income paid to individuals in accordance with the codes approved by the Federal Tax Service. The current codes are given in the Federal Tax Service order No. ММВ-7-11/ [email protected] (hereinafter referred to as order No. ММВ-7-11/ [email protected] ). They are used, including for filling out certificates in form 2-NDFL. This means that incorrectly assigning a digital code to income will result in an error in the 2-NDFL certificate. This, in turn, threatens the tax agent with a fine of 500 rubles. for each incorrectly completed income certificate (Article 126.1 of the Tax Code of the Russian Federation, clause 3 of the Federal Tax Service letter No. GD-4-11/14515 dated 08/09/16).

Fill out and submit 2-NDFL via the Internet with current codes

In addition, in many accounting programs, payment codes are tied to determining the date of actual receipt of income. And it is used when filling out line 100 of section 2 of the 6-NDFL calculation. Consequently, due to an error in income coding, the tax agent may incorrectly fill out the 6-NDFL calculation. For this violation, the fine is also 500 rubles. (Article 126.1 of the Tax Code of the Russian Federation).

Finally, this same pay encoding is used in most accounting programs to calculate average earnings. Therefore, incorrect assignment of a code may cause incorrect calculations with employees for vacation pay, business trips, sick leave, etc. If the payment turns out to be underestimated, the organization may be fined in the amount of 30,000 to 50,000 rubles, an official - from 10,000 to 20,000 rubles, and an individual entrepreneur - from 1,000 to 5,000 rubles. (Part 6 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). If the employee is transferred more than is due, there may be problems with the payment of various benefits compensated from the budget.

IMPORTANT. Errors in the application of codes can lead to underestimation or overestimation of vacation pay, travel allowance, sick leave and other payments “tied” to average earnings. Therefore, it is better to calculate these payments in web services, where current codes are installed and entered into reporting automatically.

Calculate your salary, vacation pay and benefits for free in the web service

Results

All income and deductions of the taxpayer in the 2-NDFL certificate are encrypted with special codes. These codes are updated periodically. Since January 2018, 5 new codes have come into force for reflecting income and 1 for deductions.

Follow the updates in our section “Help 2-NDFL” and be the first to know about changes in legislation.

Sources:

- tax code of the Russian Federation

- letter of the Federal Tax Service of Russia dated June 26, 2012 No. ED-4-3/ [email protected]

- Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Income code 4800 with decoding

Let's start with the most universal code - 4800 “Other income”. It corresponds to any income for which there is no more suitable code in Order No. ММВ-7-11/ [email protected] (letter of the Federal Tax Service dated 07/06/16 No. BS-4-11/12127). For example, this code indicates income in the form of a one-time additional payment for vacation (letter of the Federal Tax Service dated August 16, 2017 No. ZN-4-11 / [email protected] ).

In addition, code 4800 can be used, in particular, in relation to the following income: average earnings saved for the days of medical examination; payment for downtime caused by reasons beyond the control of the parties; compensation for the delay in issuing a work book to a dismissed employee; the average salary retained for donors on the days of blood donation and on the days of rest provided to them; the amount of forgiven debt on the advance report; excess daily allowance, etc.

This code is also used for settlements with individuals who are not employees of an organization or individual entrepreneur. For example, using this cipher it is necessary to reflect the amount of winnings that a buyer or client received when participating in a lottery that was not held for the purpose of advertising goods, works or services. Also, code 4800 is used when “requalifying” interim dividends if, at the end of the year, the amount of profit turned out to be lower than the calculated one.

How are deduction data reflected in the declaration?

To correctly enter data using deduction code 620 in the reporting document in Form 3-NDFL, you first need to determine what kind of transactions are reflected under this item:

- If code 620 reflects additional total contributions to the pension in its funded part, then the data is entered in the “Social fiscal deductions” section in the tab on voluntary life insurance documents and pensions.

- If code 620 reflects the total expenses for transactions with financial transaction instruments not used in the securities market, or a negative result from economic activity with securities traded on the organized stock market, then the information in the tax return under code 4800 is reflected minus these amounts . The explanatory letters of the Federal Tax Service of Russia indicate that non-taxable income is not subject to declaration.

Income code 2000 with decoding

The next most common code is 2000. According to Order No. ММВ-7-11 / [email protected] , this code corresponds to “remuneration received by the taxpayer for the performance of labor or other duties.”

Typically, the use of this code does not cause difficulties - everything that is reflected in the employer’s accounting as a salary accrued under an employment contract for the daily performance of job duties “passes” under code 2000. The same value is assigned to the average earnings saved for the period of a business trip, since it also is a salary (letter of the Ministry of Finance dated November 12, 2007 No. 03-04-06-01/383).

Automatically calculate the salary of a posted worker according to current rules Calculate for free

Income codes 2002 and 2003 with decoding

But bonuses for the purpose of coding income as wages are not recognized, although they are named in Article 129 of the Labor Code of the Russian Federation as part of remuneration. Moreover, bonuses are reflected in tax registers and in 2-NDFL certificates in three different codes.

The main code is 2002. It is used for awards that simultaneously satisfy three conditions:

- the payment is not made at the expense of profits, earmarked proceeds or special-purpose funds;

- the payment is provided for by law, labor or collective agreement;

- the basis for payment is certain production results or other similar indicators (i.e. indicators related to the employee’s performance of his or her job duties). This circumstance must be confirmed by an order for payment of the bonus.

Code 2003 reflects bonuses (regardless of the criteria for their assignment) and other remunerations (including additional payments for complexity, intensity, secrecy, etc., which are not bonuses), which are paid from special-purpose funds, targeted revenues or profits organizations.

For other bonuses, code 4800 must be used.

Also see: “Taxes on premiums: we calculate personal income tax and contributions, take them into account in expenses, and reflect them in reporting.”

Provision of information by the tax agent to the Federal Tax Service

All organizations and individual entrepreneurs with employees become tax agents for personal income tax. What are their responsibilities? First, income taxes must be withheld on all income paid by an employer to an individual. Secondly, the withheld amounts must be transferred to the account of the Federal Tax Service within the time limits specified by law. Thirdly, after the end of the calendar year (which is the tax period for personal income tax), the agent is obliged to provide data to the inspectorate about all amounts of income tax withheld and transferred for each employee. The employer provides a certificate for each employee in Form 2-NDFL within the time limits specified in the Tax Code of the Russian Federation.

Late or missing submission of a certificate will result in penalties. The codes in 2-NDFL in 2021 were slightly different from the current ones.

Income codes 2012 and 2013 with explanation

The 2012 code corresponds to the amount of vacation pay, that is, the average earnings retained by the employee during the vacation period. This code is used to make payments both for regular vacations and for additional ones, including educational ones.

Code 2012 can only be applied to vacation pay that is paid to existing employees. If the employer transfers compensation to the dismissed employee for unused vacation, this income must be assigned code 2013.

ATTENTION. The Labor Code allows for the provision of leave followed by dismissal (Part 2 of Article 127 of the Labor Code of the Russian Federation). In this case, the employee receives the final payment and work book before the vacation, and does not return to the previous employer after the vacation. However, from the point of view of labor legislation, the transferred amounts are vacation pay, and not compensation for unused vacation. Therefore, the code 2012 must be applied to such a payment.

Also see: “An employee is ill or recalled from vacation: what to do with personal income tax, contributions and reporting?”

Why was the deduction code 620 introduced?

Other income that reduces the base for fiscal taxation based on the provisions of Chapter. 23 of the Tax Code of the Russian Federation are recorded in the citizen’s personal certificate using deduction code 620. These amounts include:

- additionally paid insurance contributions for the labor pension, or rather for its funded part;

- total costs of financial transactions with derivatives instruments not put into circulation on the stock market;

- the amount of a negative result formed in the reporting period on transactions with securities put into circulation on the organized securities market.

Income code 2300 with decoding

Using code 2300 in personal income tax reporting, temporary disability benefits are indicated. This code must be assigned not only to the benefit that is paid in case of illness of the employee himself, but also to those amounts that are transferred in the case of caring for sick children or other family members.

REFERENCE. Formally, maternity benefits also fall under this code, since the basis for its accrual is sick leave. But since maternity benefits are not subject to personal income tax (clause 1 of article 217 of the Tax Code of the Russian Federation), this payment may not be recorded at all in the registers and certificate 2-NDFL (clause 1 of article 230 of the Tax Code of the Russian Federation, letter of the Ministry of Finance dated April 2, 2019 No. 03- 04-05/22860).

Create electronic registers and submit them to the Social Insurance Fund via the Internet

What amounts should definitely not be included in code 4800

Only amounts subject to taxation are included in the income certificate. Even if they are partially exempt from tax. Payments that are not subject to personal income tax at all do not need to be included in this report. So, for example, you will never see maternity benefits in 2-NDFL. After all, the entire amount of this payment is completely exempt from taxation.

Accordingly, amounts from which income does not arise will never fall into the lines with code 4800.

Please note: amounts that are not taxed only up to a certain threshold are safer to include in the certificate in any case. If you do not do this, you can distort the real picture of income in relation to a specific individual.

Revenue codes 2762 and 2760 with decoding

Using code 2762 in tax registers and 2-NDFL certificates, you must indicate the entire amount of financial assistance issued to the employee at the birth of a child. Let us remind you that such financial assistance is not subject to personal income tax up to 50 thousand rubles. for each child, provided that the payment is transferred no later than one year after his birth (clause 8 of article 217 of the Tax Code of the Russian Federation).

When paying employees of other types of financial assistance, the code 2760 is used. In this case, the basis for the transfer of money does not matter. So, if the company decides to issue financial aid for vacation, then this amount must be separated from the main “vacation pay” and reflected with code 2760. This code must also be assigned to financial aid paid to former retired employees. Let us remind you that such income is not subject to personal income tax up to 4,000 rubles. per year (clause 28 of article 217 of the Tax Code of the Russian Federation).

Income on which personal income tax is calculated

Personal income tax is charged on all types of income of individuals. They include:

- Salary based on the main position and part-time position.

- Premium payments.

- Payment of basic and additional vacations.

- Payment of sick leave.

- Gifts and winnings.

- Royalties received for intellectual activity.

- Insurance payments.

- Payment for work under civil contracts.

- Proceeds from the sale of property.

- Income of the lessor under the lease agreement.

- Other income of the taxpayer.

For the correct calculation of personal income tax, the citizenship of an individual does not matter, the only important thing is whether he is a resident or not. This is determined by how many days this person spends in a year (the calendar year is the tax period for personal income tax) within the borders of Russia. If a person stays in the country for more than 183 days, he is considered a resident; otherwise, he is considered a non-resident. A resident individual is subject to taxation on all income in accordance with the law. A non-resident pays only on the income he received from a Russian-based source.

The tax base for the income tax of an individual consists of all income issued to him in financial or in kind form, with the exception of amounts that, in accordance with the Tax Code of the Russian Federation, are free from taxation and various types of deductions.

Income code 2720 with explanation

Code 2720 is used in personal income tax reporting to include the cost of gifts for employees. In particular, it should be used for gifts for the New Year, birthday, etc.

ATTENTION. According to the rules of paragraph 28 of Article 217 of the Tax Code of the Russian Federation, gifts worth no more than 4,000 rubles are exempt from personal income tax. in a year. This income must be reflected in the tax registers, regardless of the amount of the gift. But in the 2-NDFL certificates the cost of gifts does not exceed 4,000 rubles. for a year, you don’t have to show it (letters from the Federal Tax Service dated 07/02/15 No. BS-4-11/ [email protected] and dated 01/19/17 No. BS-4-11/ [email protected] ).

Also see: “Tax accounting for gifts and bonuses, or what an accountant should do after February 23 and March 8.”

Taxation of daily allowances on business trips

Most often, code 4800 is used to reflect an employee’s income in the form of daily allowances paid while on a business trip. The amount of travel expenses is determined in the “Regulations on Business Travel”, which is an annex to the collective agreement. This is an optional document; you can specify all the necessary points in the “Internal Rules” or in the order of the manager. But many organizations accept the Regulations; it can be created in personnel management programs with automated accounting. The amount of daily allowance is set by decision of management and is not limited by an upper limit. It must be remembered that Article 217 specifies the maximum amounts of daily allowance that are not subject to income tax:

- On business trips within Russia – 700 rubles.

- On business trips abroad – 2500 rubles.

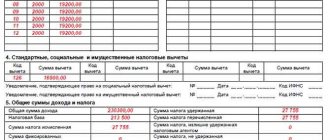

Daily allowances exceeding this limit are subject to 2-personal income tax. For example, if the daily allowance for an internal business trip is 1,000 rubles, the employee traveled for five days, he is credited with 5,000 rubles. Of these, 700 x 5 = 3500 rubles. are not subject to personal income tax. Amount 1500 rub. must be included in the 2-NDFL certificate in the month when the daily allowance was accrued and issued, with income code 4800.

The situation is similar with the amount of travel expenses for accommodation. The organization has the right to provide in its Regulations for full reimbursement of living expenses based on the documents provided. In the absence of documents, the employee may be reimbursed in a fixed amount. In Article 217, the maximum amounts of non-taxable compensation for accommodation without supporting documents are:

- On business trips within Russia – 700 rubles.

- On business trips abroad – 2500 rubles.

Amounts in excess of those specified in article 217 are subject to income tax and are displayed with income code 4800. The decoding of all amounts that relate to this code must be kept in the accounting department in order to avoid misunderstandings during tax audits.

Income codes 2400 and 1400 with decoding

To indicate rental income, you need to choose one of two codes (depending on the object that is transferred under the contract). Thus, income from the rental of any cars, as well as sea, river and aircraft, is reflected in personal income tax reporting using a special code 2400. It is necessary to show the fee for the rental of these types of transport, even if it is paid to the employee (including h. to the manager). The same code also covers income from other uses of vehicles. Therefore, it includes income from contracts for the provision of services for driving your own car, rental agreements with a crew, etc.

REFERENCE. Compensation for the use of a personal car, paid under an employment contract in the amount established by its parties, is not subject to personal income tax. There is no income code for this payment, and it does not need to be indicated in personal income tax reporting.

Also see: “How to more profitably register an employee’s use of his car (new edition).”

Draw up and print a vehicle rental agreement for free using a ready-made template

In addition, code 2400 applies to rental payments for fiber-optic and (or) wireless communication lines, and other means of communication, including computer networks.

Income from the rental of any other property (including real estate, including residential) must be reflected using code 1400. It does not matter who exactly receives this income from an organization or individual entrepreneur: a manager, an ordinary employee or an outsider.

What other income could there be?

An organization in need of qualified personnel is ready to hire specialists living in other areas. At the same time, managers often even pay candidates for the position travel to the interview and other expenses associated with it. An employee's move to a new place of work is not subject to tax. But the candidate is not an employee, so the reimbursement for the presented travel documents and hotel bill is taxable income. There is no code for it in the list, so the amount should be displayed in the certificate as other income under code 4800. The organization is obliged to withhold and remit income tax on other income. There are two options here:

- The candidate himself bought travel tickets, paid for accommodation, and submitted documents to the organization for reimbursement.

- Travel tickets were purchased and the hotel was paid for by the organization itself.

In the first case, there should be no problems: having calculated the compensation, the accountant will withhold personal income tax from it and transfer it to the budget. In the second case, there is nothing to withhold tax from. Although income has undoubtedly been received, it is in such a form that deduction is impossible. In this case, no later than February of the next year, the organization, based on the requirements of the Tax Code, must notify the inspectorate of the obstacle to tax withholding.

There are situations when, during a tax audit, inspectors assign certain amounts to code 4800. This is income that should not be included in the taxable base in accordance with Article 217, but due to the absence or incorrect execution of relevant documents (no agreement, no certificates confirming taxpayer status, etc.) are not accepted by inspectors in this capacity. They can be classified as other income (income code for 2-NDFL - 4800) and tax withheld, as well as a penalty or fine.

The base on which income tax is calculated is very diverse. It includes many different accruals, rewards, benefits, compensation, payments, etc. In order to correctly classify all this variety by income codes, thoughtfulness and attention are needed. The correctness of tax calculation will ultimately depend on these qualities.

Revenue code 2001 with decoding

Code 2001 is used for remuneration paid to directors on the board of directors and other members of the organization's collegial governing body.

ATTENTION. The salary of an executive under code 2001 is not “posted”, even if the corresponding position is called “director”. However, if the manager is a member of the board of directors (board, other collegial body) and receives additional remuneration for this, then this amount must be separated from the salary and reflected for personal income tax purposes using code 2001.

This might also be useful:

- Personal income tax for individual entrepreneurs on different taxation systems in 2021

- simplified tax system for individual entrepreneurs in 2021

- Tax system: what to choose?

- New KBK for 2021

- What taxes does the individual entrepreneur pay?

- Calculation of income tax from salary

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Income code 2014 with explanation

The amounts of severance pay, as well as the average monthly earnings saved for the period of employment, are reflected in personal income tax reporting with the code 2014. This code applies only to that part of the payments that is subject to personal income tax (in total, it exceeds three times the average salary, and for “northerners” - sixfold). The income tax-free amount of severance pay and average earnings for the period of employment for personal income tax purposes is not fixed or coded.

Also see: “Payments when laying off an employee in 2019‑2020.”

Calculate a “complex” salary with coefficients and bonuses for a large number of employees Try for free

What conclusion can be drawn

The employer acts as an intermediary between the tax authorities and employees. Therefore, it is his responsibility to fill out a certain number of accounting papers relating to the fate of employees.

In the process of filling out the 2-NDFL paper, it is necessary to ensure that the income codes are indicated correctly, because these parameters determine the sources of their income, and also contribute to the competent and fair withdrawal of taxes from the payers’ accounts.

Code 2760 reflects financial assistance received by current and former employees. To ensure that it is not subject to taxation, the amount per year should not exceed 4,000 rubles.

Accounting for financial assistance in 1C is presented in the video.