Subordinate to the account “Other income and expenses” (91).

Account type: Passive.

Account type:

- Quantitative

- Tax

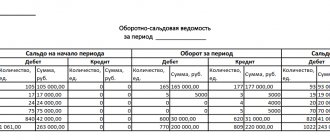

Analytics for account “91.01”:

| Subconto | RPM only | Total accounting | Accounting in currency |

| Other income and expenses | Yes | Yes | Yes |

| Assets being sold | Yes | Yes | Yes |

What does the entry Debit 91 and Credit 91 reflect?

91 accounting account is an account on which the organization’s income and expenses are recorded that are not directly related to its main activities (Order of the Ministry of Finance dated October 31, 2000 No. 94n (hereinafter referred to as the Chart of Accounts).

The following sub-accounts can be opened to it:

- 91.1 “Other income”;

- 91.2 “Other expenses”;

- 91.9 “Balance of other income and expenses.”

Income received by the organization (account 91.1) can be classified as other if they represent:

- income from the rental of its property;

- profit under a simple partnership agreement;

- income from the sale of fixed assets and other assets of the company;

- interest received under loan agreements;

- fines, penalties, and forfeit amounts transferred in favor of this organization due to violation of contract terms by counterparties;

- resulting positive exchange rate differences;

- profit of previous periods;

- expired accounts payable;

- other income other than core activities.

Such receipts are reflected in the credit of account 91.

In the debit of account 91 (subaccount 91.2) other expenses are recorded:

- losses associated with the sale of company property;

- interest paid on loans and credits;

- expenses for banking services for servicing accounts with credit institutions;

- fines and penalties paid by the organization;

- recognized losses of previous years;

- accounts receivable that are impossible to collect;

- negative exchange rate differences;

- other expenses listed in the instructions to the Chart of Accounts.

Subaccount 91.9 reflects the final balance for the reporting period for other income and expenses, determined by comparing the turnover in accounts 91.1 and 91.2.

Find out what expenses are considered other in tax accounting and how they are taken into account for income tax in the Ready-made solution from ConsultantPlus. Trial access to the legal system is free.

Example of rental income on account 91.01

JSC "Musson", which conducts its main activities in the field of retail trade, rents out premises in one of the industrial buildings. The tenant of Breeze LLC pays monthly .350 rubles, VAT 4.325 rubles. according to the concluded agreement. The amount of expenses incurred by Musson JSC for maintenance of the premises is:

- depreciation charges - 1,380 rubles;

- payments to service personnel - 8,430 rubles;

- social benefits for salaries - 1,880 rubles;

- utilities, maintenance and other services - RUB 2,770.

At the end of August, the accountant of Musson JSC made the following entries:

| Dt | CT | Description | Sum | Document |

| 76 | 91.01 | Calculation of rent for August 2015 | .350 rub. | Certificate of completion |

| 91.02 | 68 VAT | Calculation of VAT on rental services in August 2015 | 4.325 rub. | Invoice |

| 91.02 | 02 (, 69, 23…) | Reflection of expenses for the maintenance and servicing of premises leased (RUB 1,380 + RUB 8,430 + RUB 1,880 + RUB 2,770) | RUR 14,460 | Receipts, invoices, acts, etc. |

| 76 | Crediting funds received from Breeze LLC as payment for rental services | .350 rub. | Bank statement |

How does the posting Debit 91 Credit 91 correspond with other accounts

When generating other income or expenses of the organization, the sources of their occurrence are taken into account:

- Dt 91 Kt 51 - if expenses arise in connection with banking services (commissions associated with account transactions).

- Dt 91 Kt 60 - attributing the shortage to other expenses after acceptance of goods from the supplier, charging penalties in favor of the supplier.

- Dt 91 Kt 01 - loss from the sale of fixed assets.

- Dt 60 Kt 91 - recognition of accounts payable (including unclaimed or expired) as income of the organization.

- Dt 76 Kt 91 - reflection of unclaimed amounts deposited for wages as income.

- Dt 10 Kt 91 - free receipt of materials.

Postings Kt 91 Dt 91 also record the results of other income and expenses:

- Dt 91 Kt 99 - profit on other income and expenses is reflected;

- Dt 99 Kt 91 - a loss was received on other income and expenses.

Features of annual closure

According to the accounting rules, every month it is necessary to close exclusively the synthetic level of the account, without taking into account subaccounts. They accumulate analytical data all year long:

- By type of income/expenses.

- By cost item.

- By department.

At the end of the year, the accounting department must reform the balance sheet. This means that when closing 91 accounts, transactions must reset all analytical subaccounts that are subject to such an operation:

- Dt 91.01 Kt 91.09 – the accumulated balance in the subaccount is reset to zero;

- Dt 91.09 Kt 91.2 – accumulated expenses are closed.

The resulting result as of September 91 closes at 99 “Profits and Losses”, depending on the financial result of the company.

What does the entry Debit 91 Credit 94 mean?

In cases where losses of valuables that have occurred in an organization or shortages identified as a result of an inventory cannot be compensated at the expense of the guilty parties, the resulting expenses are charged to account 91: Dt 91 Kt 94 - writing off shortages and losses as other expenses.

Important to consider! Recommendation from ConsultantPlus: When writing off shortages of valuables or their damage in excess of the norms of natural loss, confirmation of the validity of such write-off is necessary. They must be confirmed by the following documents... For more details, see K+. Trial access is free.

And when transferring property and materials free of charge to third parties, the following entries are made: Debit 91 Credit 10 or Dt 91 Kt 41.

For additional information on establishing the facts of shortages, see the article “Accounting for losses from theft if the culprit is not identified.”

How can 1C help an accountant?

Automation of final operations significantly saves time when compiling reports. Therefore, 1C.8 versions 2.0 and 3.0 provide for a whole cycle of regulatory operations. They must be carried out gradually, strictly in the sequence in which they were conceived.

Important point! Violation of the sequence of routine operations leads to incorrect data in analytical reports. We must remember that some of the operations are interconnected. It is impossible to calculate profit if cost accounts are not reset.

Regular operations are located in the “Accounting, Taxes and Reporting” menu, “Period Closing” section, “Month Closing” subsection. Here in the third stage you can see “Closing 90, 91 accounts”.

This processing deals with zeroing the required account. 91, just like other accounts, is not closed if there are errors. Incomplete cost items and other analytical sub-contos may result in the transaction being rejected. You can learn more about how the operation works from the video:

Empty subcontos form negative balances in analytics, which confuse the balance sheet, leading movements into chaos. Therefore, it is necessary to fill out the analytics very carefully and thoughtfully, entering primary operations in the program.

Results

Earning income and expenses not related to the main activities of the company are recorded in account 91. This includes income from the sale of property, penalties, results of writing off overdue debts, etc. Accounts Kt 91 Dt 91 are also used to reflect shortages or receipt of property free of charge .

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Industry nuances of material write-off

The methods for writing off inventories described in the previous section are the same for all companies, regardless of their industry. However, industry specifics still influence the order of write-off of materials.

Let's look at the industry-specific nuances of writing off inventories using the example of industries such as construction and agriculture.

Construction

A specific nuance of this industry is the variety of materials written off and the primary documents drawn up.

To document the write-off of materials in construction, a whole set of documents is required:

- monthly reports on the consumption of materials and materials in construction (in comparison with standard consumption);

- estimates (local and site) indicating the estimated consumption of materials by type of work;

- material reports of materially responsible persons (foremen, foremen or site managers);

- production standards for the consumption of basic building materials approved by the head of the construction company;

- logs of work performed for each construction project.

In addition, construction specifics include the need for a monthly assessment of spent open storage materials: crushed stone, sand, gravel and other bulk materials. Their consumption during the month is not documented, and to determine the actual consumption, the remaining materials must be inventoried. Based on the results of such an inventory, inventories are written off.

If you have access to K+, see the Typical situation “How to write off materials in construction.” If you don’t have access, sign up for a free trial access to K+ and study the recommendations.

Agriculture

To write off materials by an agricultural enterprise, specific primary documents are also required (along with universally applicable requirements, such as invoices and limit cards).

Among them, for example, are:

- act of consumption of seeds and planting material (drawn up by agronomists or other specialists after sowing or planting crops);

- feed record sheet (maintained to record the daily distribution of feed on the farm in accordance with the animal feeding plan and the approved diet);

- act for the disposal of animals and poultry (issued in case of death, forced slaughter or slaughter of animals).

However, simply filling out an act or statement is not enough. A professional justification for this or that event is necessary. For example, in the event of the death of animals, writing off their value will be justified if the act objectively and comprehensively discloses the reasons for the disposal of animals and indicates the diagnosis. Moreover, if an animal died due to the fault of an employee of an agricultural enterprise, its value is reflected in accounting in the form of the debt of this employee (with an additional valuation to the market price) and is recovered from him in the prescribed manner.

For information on the specifics of writing off inventories, see the article “The procedure for writing off materials in accounting (nuances).”

How to confirm expenses for restoring damaged documents

Due to emergency circumstances, not only property, but also documents are damaged. The latter cannot be sold, but they are also of great value. If accounting or tax documentation was lost (for example, it burned down), you need to restore it. Restoring papers is important if they were not verified as part of a tax audit. This procedure is divided into these stages:

- Inventory of documents, the need for which is specified in paragraph 2 of Article 12 of Federal Law No. 129.

- The company organizes a commission that should establish the reasons for the loss of documents. The corresponding instruction is given in paragraph 6.8 of the Regulation “On document flow in accounting” No. 105, approved by the Ministry of Finance on July 29, 1983. Sometimes the commission’s activities involve interaction with the Ministry of Emergency Situations.

- The results of the commission’s activities are recorded in the act. It states the fact of damage to documents. The act must be approved by the manager.

- Attached to the document is a certificate of emergency issued by authorized bodies, and a list of papers that were lost.

- A person responsible for the restoration of papers is appointed. Usually this is the chief accountant.

- You can contact an intermediary company to restore documents. After the restoration is completed, a work acceptance certificate is created.

- It is on the basis of the act that related expenses are recorded in accounting.

Expenses for the restoration of documents (as part of accounting) are recognized as part of other expenses. Within the framework of tax accounting, they will be reflected in the structure of non-operating expenses on the basis of subparagraph 6 of paragraph 2 of Article 265 of the Tax Code of the Russian Federation. Expenses are taken into account in the standard manner.

What subaccounts are used?

The following subaccounts can be created for account 10:

- 10/1 “Raw materials and materials” - it records raw materials and the main types of materials that form the basis for the production of main products. Here you can also keep records of materials for auxiliary and technological purposes, as well as agricultural products intended for processing.

- 10/2 “Purchased semi-finished products and components, structures and parts” - this takes into account the cost of semi-finished products and components that are purchased for the production of products and require further refinement.

- 10/3 “Fuel” – this takes into account the availability and movement of fuel and lubricants for the company’s vehicles and equipment.

- 10/4 “Containers and packaging materials” - here all types of containers are recorded, as well as materials for their manufacture or repair.

- 10/5 “Spare parts” - here the accounting of spare parts intended for the repair of existing equipment, vehicles and other mechanical means is made;

- 10/6 “Other materials” - production waste, trimmings, shavings, etc. are taken into account here. Materials that were formed during the liquidation of the OS can also be taken into account here. The main thing is that the materials accounted for in this subaccount are not used as basic materials, fuel, spare parts, etc.

- 10/7 “Materials transferred for processing to third parties” - this takes into account materials that were transferred to third parties for the manufacture of products from them;

- 10/8 “Building materials” - the subaccount is used in developer organizations to account for materials used during construction and installation;

- 10/9 “Inventory and household supplies” – the account records the cost of tools, inventory, and household supplies;

- 10/10 “Special equipment and special clothing in the warehouse” - is intended to account for special equipment, equipment, special clothing, etc., which are stored in the warehouse.

- 10/11 “Special equipment and special clothing in operation, etc.” – designed to account for special equipment, equipment, workwear, etc., which are used in production.

Attention! An organization can open other sub-accounts necessary for proper accounting. Analytical accounting can be carried out by types, types, sizes, grades of materials, etc.