Defects in production lead to a decrease in the efficiency of resource use. Manufacturing defects are considered to be parts, components, semi-finished products, works, products:

- not meeting current standards or specifications;

- which can be used for their intended purpose only after additional costs for bringing them into compliance with standards or specifications, or cannot be used at all.

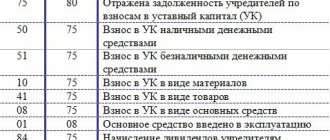

Recording of defects in production for accounting purposes is carried out on the account.

A marriage at the place of its detection can be:

- internal (directly at the enterprise);

- external (after sale to the consumer or intermediary).

If it is possible to correct the defect, it is divided into:

- correctable;

- incorrigible.

The detected defect must be documented in an act, the form of which is approved by the management of the enterprise.

Manufacturing defect: a good thing won’t be called that

In the field of production, a defect is a product or its element (it can be a semi-finished product, part, assembly), the quality of which does not fit into the norms, standards, technical conditions adopted at the enterprise, and which is impossible to use for its intended purpose or is only permissible with additional adjustments that require costs. .

FOR YOUR INFORMATION! The definition of manufacturing defects, used in modern legal acts, repeats clause 38 of the Basic Provisions for Planning, Accounting and Calculation of Costs at Industrial Enterprises, approved by the State Planning Committee of the USSR, the State Committee for Prices of the USSR, the Ministry of Finance of the USSR and the Central Statistical Office of the USSR on July 20, 1970.

What is included in financial losses as a result of marriage:

- irreparable costs for the cost of a defective product (money for raw materials, salaries to employees, payment of energy for equipment operation, etc.);

- expenses for corrective actions to bring the product to acceptable quality (this includes remuneration for workers’ labor and funds for equipment maintenance);

- funds for identifying and formulating defects (for example, creating a list of typos);

- reimbursement to the consumer of low-quality products for the expenses incurred by him (these include the cost of replacing or correcting a product whose quality did not suit the consumer, including transportation costs for its delivery).

What is the procedure for deducting from an employee’s salary for a marriage that arose through his fault?

The following are not considered a manufacturing defect:

- products for which at a particular enterprise there are special requirements that differ from the standard ones for similar products, although the quality meets the standard requirements, but does not fit into the increased ones;

- losses associated with downward transition to another type of product.

The acceptable percentage of defects is the minimum acceptable level of non-compliance with quality. Depends on the nature of production and established quality criteria. At developed enterprises it should not exceed 2-3%, up to a maximum of 5%. Excess is a reason to worry about finding the causes and influencing the detected problems.

the write-off of defective goods in accounting ?

Correctable defects

If such defects are detected, the defective items will not be written off from accounts 20 and 43. On the account 28 reflect only the costs associated with eliminating deficiencies. These include, in particular:

- The cost of additional materials, raw materials used to correct defects.

- Earnings of employees involved in eliminating deficiencies. It is accrued with appropriate deductions.

- Depreciation of machines used to eliminate deficiencies.

The costs also include indirect costs of the department (shop) in which product defects are corrected. When distributing expenses between various types of products that are manufactured in it and remade goods, when writing off defects in the postings, account 25 is closed.

When an external correctable defect is identified, transportation costs are included in the cost of eliminating defects. We are talking, in particular, about the cost of delivering low-quality products to the enterprise, to the workshop in which they will be remade, and the return transportation of already corrected objects.

Characteristics of defective products

According to the time of determination, marriage is divided into:

- internal - the product is recognized as non-compliant with standards at production, before being sent for sale or to the consumer;

- external - discovered by the consumer himself during operation or in the process of preparing for work.

If the manufacturer discovers a defect during the production process, depending on the nature of the quality discrepancies found, the following forms of defect can be distinguished:

- correctable - subject to adjustment, appropriate from the point of view of the invested funds;

- incorrigible – unsuitable for further use, a product that is irrevocably damaged.

IMPORTANT! The combination of these characteristics forms the final cost of defects made in production.

Financial losses from different types of marriage

- Internal incorrigible:

- the cost of wasted raw materials;

- labor remuneration of employees (including social charges);

- means for equipment maintenance;

- shop expenses.

- Internal fixable:

- the above expenses (direct expense items);

- direct costs for correcting defective products and bringing them up to standard.

- External incorrigible:

- cost of goods rejected by the buyer;

- reimbursement to the consumer of the amount he paid for the defective product;

- expenses for dismantling assembled products with detected defects;

- transportation costs associated with replacing the product or delivering it for repairs;

- selling expenses since the goods have already been sold.

- External fixable:

- all of the above financial losses from external defects (except for the costs of replacing goods);

- expenses for repairing defective goods from the consumer (raw materials, supplies, equipment, employee benefits, etc.).

NOTE! From the final amount of losses, you need to subtract funds that can be returned: the ability to reuse unusable products or their elements, funds collected from suppliers for substandard raw materials, monetary sanctions in the event of agreed liability for defective products.

Features of drawing up an act

The act of identifying a marriage must contain the following details:

- Name of the enterprise.

- Location address.

- Contact details.

- Title of the document.

The text contains information about the product in which the defect was detected, the reasons for the defect, and the persons responsible.

The document must be prepared in 3 copies. The first is transferred to the accounting department, the second - to the department where the low-quality product was produced, the third is received by the financially responsible employee. If an external defect is detected, a consumer claim is attached to the report.

Confirmation of the fact of detection of defects is carried out by a special commission.

Why marriage can occur

The reasons for the deviation of manufactured products from the relevant quality standards are different and relate to both objective and purely “human” ones.

- Material problems. Low-quality raw materials will not be able to produce excellent products at the output. It is necessary to control suppliers of raw materials and check each batch before starting the production cycle.

- Imperfection or breakdown of equipment. Any mechanisms tend to break down, become obsolete, wear out, and an accident may occur. To minimize defects, you need to take care of the serviceability of equipment, timely maintenance and moral compliance with the technological process.

- Production methods. Incorrectly chosen production technologies can aggravate defects (outdated, or incorrectly applied, or simply unsuccessful). The technologist solves this problem.

- Disadvantages of working conditions. Factors that can provoke marriage include:

- poor lighting of workplaces;

- non-compliance with temperature conditions;

- violation of humidity levels;

- insufficient opportunities to ensure cleanliness of hands, tools, workspace, etc.

- Human factor. Personnel directly involved in the manufacture of products are largely responsible for their quality. The causes of the problems may be:

- insufficient competence of workers;

- low level of practical skills;

- irresponsible attitude;

- low motivation of employees (undeveloped system of rewards for quality and sanctions for defects).

- Objective circumstances. It is possible, for example, a power outage, a failure in the supply of other important resources, or some other force majeure.

- Insufficiently effective quality control system. A defect that occurs for one of the above reasons should not be allowed to reach the consumer, otherwise it will turn from an internal problem into an external problem.

Mistakes in quality management

Some manufacturers are not entirely clear about the purpose of accounting for manufacturing defects. They believe that the occurrence of defective products is a natural process, without which production activities cannot occur.

Meanwhile, the creation of a competent accounting system makes it possible to timely identify the circumstances causing the appearance of defects in goods. Accordingly, based on the available data, the manager can take measures to reduce the number of defective products.

Quite often, shop managers complain about the obsolescence of equipment. This explains the appearance of defects and believes that the purchase of modern machines can improve the situation. However, not every enterprise has the funds for this. Of course, you can’t work on old equipment either. The best way out of the situation may be to modernize or rent machines.

Managers and technologists often say that identifying the causes of defects can be difficult. Of course, various situations may arise at an enterprise in which it is really problematic to determine the circumstances of the occurrence of defects. But in most cases, it is possible to identify the reasons for the production of products with defects by grouping them according to common characteristics. Usually the causes of defects are violations of technology, negligence, or oversight of responsible persons.

When grouping signs of low-quality products, correct accounting of products is of particular importance.

How to document a manufacturing defect

A detected defect, both final and subject to correction, must be documented by a special act. It is compiled by a commission that carries out quality control. The form of the act is developed by the organization independently; there are no strict requirements in this regard, except for the mandatory presence of basic office details. In addition to them, in such an act they usually cite:

- the name of the products that turned out to be defective;

- description of the identified defect, determination of the type (possibility of adjustment);

- assumption or statement of reasons;

- the place where the defect was discovered;

- quantity that does not correspond to quality (in the agreed units of measurement);

- cost of losses;

- identification of the person responsible for the marriage;

- conclusion regarding write-off or correction.

IMPORTANT! If an employee is found to be guilty of a detected defect, as reflected in the report, he must be familiarized with the report and signed.

The act serves as the basis for calculating the final amount of the marriage (calculation), which includes:

- amounts to be recovered from the perpetrators;

- irreparable financial losses;

- material claims against suppliers.

The person bearing financial responsibility delivers the registered defective products to the warehouse upon request-invoice. Subsequently, another act is formulated - for destruction (write-off) or correction of the detected defect.

VAT

In paragraph 3 of Art.

170 of the Tax Code of the Russian Federation contains a closed list of cases in which “input” VAT, previously legally accepted for deduction, is subject to restoration. Let us note that this norm does not contain such a basis for the restoration of “input” VAT as the write-off of defective products that are not suitable for further use (without identifying the guilty parties).

At the same time, according to the official authorities, the “input” VAT in the situation under consideration is subject to restoration in the period of writing off the defective one, since it will not be used to carry out operations recognized as objects of VAT taxation (see, for example, letters of the Ministry of Finance of Russia dated July 4, 2011 N 03-03-06/1/387, dated 01.11.2007 N 03-07-15/175, dated 14.08.2007 N 03-07-15/120).