Situations with incorrect reflection of kopecks in accounting and reporting can lead to a large number of unfavorable consequences, for example, tax authorities may refuse to accept reports, as well as make a claim for a “penny” amount. Arrears may prevent you from obtaining a certificate of no debt to the budget. If prices and costs in invoices are rounded, auditors may refuse to deduct VAT to the counterparty.

At the same time, there are several options for rounding in accordance with current legislation: it is possible to round amounts to whole rubles, but it is not advisable in primary documents; rounding cannot be done in invoices and when calculating insurance premiums; amounts must be rounded in declarations; this is required by law. In general, it turns out that an accountant needs to remember and always keep these rules in mind, which are easy to get confused about. Let's look at each of the options, drawing up a reminder of when it is possible, impossible and necessary to round pennies to the ruble.

Invoices

In invoices, rounding kopecks to whole rubles is not allowed. Papers are filled out in rubles and kopecks (letter of the Ministry of Finance of Russia dated January 29, 2014 No. 03-02-07/1/3444). The rules for issuing an invoice used in VAT calculations (approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137) in paragraph 3 indicate that all cost indicators are reflected in rubles and kopecks (US dollars and cents, euros and eurocents or in another currency).

If in the documents the organization indicates amounts in kopecks, but in the “primary” form in rubles, the company may encounter situations that will serve as a reason for the tax authority to refuse to deduct input VAT to the buyer. Conclusion: in all documents it is better to reflect the indicators in kopecks!

Since contributions are calculated in rubles and kopecks, and when paid, their amount is rounded up, arrears may arise, for example, 1,500 rubles were accrued. 42 kopecks, and 1500 rubles were paid. Such arrears do not entail liability for the organization, provided that insurance premiums are paid on time...

The buyer may have doubts about the rounding of amounts; discrepancies will be insignificant, but their presence may become a reason for business partners to constantly contact them to make corrections to the documents.

What solution is offered in this case? Add an additional clause to your accounting policy with the following wording: “Employees prepare primary documents and invoices in an accounting program. The program automatically rounds the total cost of goods to two decimal places. When calculating the final cost, the program takes VAT without rounding. In this regard, small discrepancies (up to five kopecks) between the data in the program and the amounts calculated manually are possible.”

An extract from the accounting policy presented to customers will allow you to avoid frequent corrections in primary documents.

Amount excluding VAT RUB kopecks

Ah, VAT, VAT... We can’t get away from it: whoever sells something to anyone (with some exceptions, for example, entrepreneurs who have switched to a simplified taxation system) is obliged to pay the state a fixed percentage of the transaction amount. The entire economy of the country rests on this. It is precisely some of the technical nuances of calculating value added tax that will be discussed below. In accounting documents (invoice, invoice, delivery note, etc.) we will certainly find the lines “Amount without VAT” (“Amount”, etc.), “VAT” (“including VAT”, etc. . p.), “Amount including VAT” (“Total”, etc.). In this case, the Amount with VAT is the amount that the buyer will pay, the amount of VAT is what we owe to the state, and the Amount with VAT = Amount without VAT + VAT.

Cash balance limit

The cash balance limit at the cash desk can be rounded up or down to the full ruble. On June 1, 2014, Bank of Russia Directive No. 3210-U dated March 11, 2014 came into force. This document replaced Bank of Russia Regulation No. 373-P dated October 12, 2011, which is no longer in effect. A legal entity independently determines the cash balance limit in accordance with the appendix to this Directive, based on the nature of the activity, taking into account the volume of receipts or the amount of cash issued. Individual entrepreneurs and small businesses may not set a cash balance limit.

The cash limit at the cash desk can be rounded to whole rubles according to the rules of mathematics. This was confirmed by officials (letter of the Federal Tax Service of Russia dated March 6, 2014 No. ED-4-2/4116). And primary cash documents, for example, expense orders, must be filled out with pennies.

(About rounding order...)

When entering school, many already knew numbers... In elementary school, they became familiar with fractions... Then they learned to round them (it’s not difficult)...

For reference

When rounding a number to the Nth digit, if the next digit after N:

— < 5, then the Nth sign does not change,

— >= 5, then the Nth digit is increased by 1.

For example , the number “pi” = 3.14159 when rounded to hundredths is equal to 3.14. And the number “e” = 2.71828 when rounded to the nearest hundredth is equal to 2.72.

So, in our material we will talk about rounding indicators in accounting and tax accounting, as well as in reporting.

We will dwell only on some points related to rounding.

Note that when we talk about rounding, for example, to the second decimal place, we mean rounding to hundredths (XXX,XX).

Taxes and fees

First of all, it is necessary to separate the concepts: taxes and fees, since regulatory regulation on these issues is established by different legislative acts. In the words of experts, a tax in a real tax mechanism is an irrevocable and urgent form of forced collection from taxpayers in accordance with the tax code of a part of their income in order to satisfy socially necessary needs, and the fee is a targeted contribution aimed at covering state expenses.

Timing and procedure for paying VAT in 2017

By Order of the Ministry of Finance of Russia dated March 17, 2005 N 40n. <28> Approved by Order of the Ministry of Finance of Russia dated January 31, 2006 N 19n. <29> Procedure for filling out a tax return, approved. By Order of the Ministry of Finance of Russia dated January 31, 2006 N 19n. <30> Approved by Resolution of the FSS of the Russian Federation dated December 22, 2004 N 111. <31> Approved by Resolution of the FSS of the Russian Federation dated April 25, 2003 N 46. <32> Approved by Resolution of the FSS of the Russian Federation dated February 10, 2006 N 9. <33> Letter of the FSS of the Russian Federation dated 06.04 .2006 N 02-18/05-3253. <34> Approved by Order of the Federal Tax Service of Russia dated November 25, 2005 N SAE-3-04/ [email protected] <35> Approved by Order of the Ministry of Finance of Russia dated December 23, 2005 N 153n. <36> Clause 4 of Art. 225 Tax Code of the Russian Federation; The procedure for filling out the Tax Card, approved. By order of the Ministry of Taxes and Taxes of Russia dated October 31, 2003 N BG-3-04/583; section I Recommendations, approved. By order of the Federal Tax Service of Russia dated November 25, 2005 N SAE-3-04/ [email protected] ; clause 2 section I Order, approved. By Order of the Ministry of Finance of Russia dated December 23, 2005 N 153n. <37> Approved by Order of the Ministry of Finance of Russia dated May 19, 2005 N 66n. <38> Approved by Order of the Ministry of Finance of Russia dated September 23, 2005 N 124n. <39> Subparagraphs 18, 22, paragraph 13 of the Recommendations, approved. By Order of the Ministry of Finance of Russia dated May 19, 2005 N 66n. <40> Subparagraphs 18, 22, paragraph 13 of the Recommendations, approved. By Order of the Ministry of Finance of Russia dated May 19, 2005 N 66n; pp. 20, 24 clause 13 of the Procedure, approved. By Order of the Ministry of Finance of Russia dated September 23, 2005 N 124n. <41> Clause 3 of Art. 362 of the Tax Code of the Russian Federation. <42> Clause 1 of Art. 122 of the Tax Code of the Russian Federation. <43> Article 15.11 of the Code of Administrative Offenses of the Russian Federation; Art. 5 of the Federal Law of June 19, 2000 N 82-FZ “On the minimum wage”.

N.A.Sidorova

Lawyer

Declarations and payment orders

In tax returns and payments, amounts are indicated in whole rubles.

Paragraph 6 of Article 52 of the Tax Code establishes the main rule for calculating taxes: their amount must be reflected in full rubles. The Ministry of Finance in letter dated March 5, 2014 No. 03-07-15/9519 explained that this article of the code regulates the procedure for calculating the amounts of taxes payable to the budget, which are reflected in declarations.

Rounding to whole rubles is not allowed in invoices. The legislation obliges companies to fill out these documents in rubles and kopecks.

The amount is calculated in full rubles: what is less than 50 kopecks is discarded, what is more is rounded up, says the well-known rule, which is enshrined in Article 52 of the Tax Code. However, there are exceptions to this rule that should not be forgotten. In the form of any declaration, you can see that not only the final data is rounded, but also the intermediate figures on each sheet. Therefore, if the amount of tax that the accountant reflects in the declaration, he also indicates in the payment order, there will be no discrepancies.

VAT calculator online

And about the calculation of VAT: “The amount of tax reflected in lines 010 and 020 in column 5 of section 3 of the declaration when applying tax rates of 18 and 10 percent is calculated by multiplying the amount reflected in column 3 of section 3 of the declaration, respectively, by 18 or 10 and dividing by 100." That is, judging by the rule for filling out a tax return, then method 1 is used.

Important

But here we are talking only about the amount of tax for the year, and we are interested in the amounts for each sale, those that are printed in receipt and expense documents. In fact, in our country, most enterprises use 1C for accounting.

As far as I found out by rummaging on the Internet, in this software product, in the standard configuration for calculating VAT, method 2 is used: first we calculate the amount excluding VAT for each product, then we summarize the results.

Insurance premiums

Insurance contributions for compulsory pension, medical and social insurance in case of temporary disability and in connection with maternity are charged for each employee separately (Part 6, Article 15 of the Federal Law of July 24, 2009 No. 212-FZ). In this case, the amount of any of these types of contributions, payable for the organization as a whole, is determined in full rubles (Part 7, Article 15 of Law No. 212-FZ). Thus, an amount of less than 50 kopecks is discarded, and an amount of 50 kopecks or more is rounded up to the full ruble. Thus, the specified insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund must be calculated in kopecks, but paid in full rubles. Information on accrued and paid contributions is reflected in the corresponding calculations (Part 9, Article 15 of Law No. 212-FZ).

Since contributions are calculated in rubles and kopecks, and when paid, their amount is rounded up, arrears may arise (for example, 1,500 rubles 42 kopecks were accrued, but 1,500 rubles were paid in accordance with the rounding rules). Please note that such arrears arising as a result of the application of rounding rules do not entail liability for the organization, provided that insurance premiums are transferred on time (letter of the Ministry of Labor of Russia dated February 14, 2013 No. 17-4/264).

In another situation, if the organization does not follow the rounding rules, arrears are also possible (for example, 1500 rubles 76 kopecks were paid instead of 1501 rubles). In these cases, claims by officials and demands for payment of arrears, penalties and fines are possible (Article 22 of Law No. 212-FZ).

As for insurance contributions for compulsory social insurance against industrial accidents and occupational diseases, the procedure for their payment is regulated by Federal Law No. 125-FZ of July 24, 1998. This law does not contain requirements to round up the amounts of contributions when paying. Thus, in contrast to contributions for compulsory pension, medical and social insurance in case of temporary disability and in connection with maternity, contributions for “injuries” are paid in rubles and kopecks.

Insurance premiums can also be paid in whole rubles (clause 7, article 15 of the Federal Law of July 24, 2009 No. 212-FZ). But if amounts are rounded in tax returns, then insurance premiums are not reported in reporting. Indicators in forms RSV-1 PFR and 4-FSS are indicated in rubles and kopecks. Therefore, small discrepancies may arise between the data in the reporting and in the payments.

Tatiana Lesina

, accountant, for the magazine "Calculation"

Guide for the simplified tax system

With this e-book, you will easily understand all the intricacies of the simplified taxation system, competently draw up a balance sheet and financial statements. You will receive the electronic edition immediately after payment to your email. Find out more about the publication >>

If you have a question, ask it here >>

Pennies in calculations: to round or not?

It is no secret that even minor discrepancies between accrued and paid taxes or insurance premiums can become a reason for inspectors to demand payment of arrears. How to avoid “penny” mistakes?

Situations with incorrect reflection of kopecks in accounting and reporting can lead to a large number of unfavorable consequences, for example, tax authorities may refuse to accept reports, as well as make a claim for a “penny” amount. Arrears may prevent you from obtaining a certificate of no debt to the budget. If prices and costs in invoices are rounded, auditors may refuse to deduct VAT to the counterparty.

At the same time, there are several options for rounding in accordance with current legislation: it is possible to round amounts to whole rubles, but it is not advisable in primary documents; rounding cannot be done in invoices and when calculating insurance premiums; amounts must be rounded in declarations; this is required by law. In general, it turns out that an accountant needs to remember and always keep these rules in mind, which are easy to get confused about. Let's look at each of the options, drawing up a reminder of when it is possible, impossible and necessary to round pennies to the ruble.

Source documents

In the “primary” calculation, rounding of indicators to whole rubles is allowed. Accounting for property, liabilities and business transactions can be kept in amounts rounded to whole rubles. The amount differences arising in this case are attributed to the financial results of a commercial organization or an increase in income (reduction of expenses) (clause 25 of the Regulations, approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n).

Invoices

In invoices, rounding kopecks to whole rubles is not allowed. Papers are filled out in rubles and kopecks (letter of the Ministry of Finance of Russia dated January 29, 2014 No. 03-02-07/1/3444). The rules for issuing an invoice used in VAT calculations (approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137) in paragraph 3 indicate that all cost indicators are reflected in rubles and kopecks (US dollars and cents, euros and eurocents or in another currency).

If in the documents the organization indicates amounts in kopecks, but in the “primary” form in rubles, the company may encounter situations that will serve as a reason for the tax authority to refuse to deduct input VAT to the buyer. Conclusion: in all documents it is better to reflect the indicators in kopecks!

The buyer may have doubts about the rounding of amounts; discrepancies will be insignificant, but their presence may become a reason for business partners to constantly contact them to make corrections to the documents.

Rounding to whole rubles is not allowed in invoices. The legislation obliges companies to fill out these documents in rubles and kopecks. This rule follows from the Letter of the Ministry of Finance dated January 29, 2014 No. 03-02-07/1/3444.

What solution is offered in this case? Add an additional clause to your accounting policy with the following wording: “Employees prepare primary documents and invoices in an accounting program. The program automatically rounds the total cost of goods to two decimal places. When calculating the final cost, the program takes VAT without rounding. In this regard, small discrepancies (up to five kopecks) between the data in the program and the amounts calculated manually are possible.”

An extract from the accounting policy presented to customers will allow you to avoid frequent corrections in primary documents.

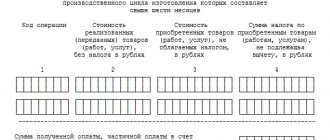

Purchase book, sales book

In the purchase book and sales book, cost indicators are also indicated in rubles and kopecks. The Russian Ministry of Finance clarified that when filling out these documents, VAT amounts are not rounded (letter dated April 1, 2014 No. 03-07-RZ/14417). This means that taxes in the sales book are reflected to the second decimal place (exactly as they are indicated in the invoice issued to the buyer).

Cash balance limit

The cash balance limit at the cash desk can be rounded up or down to the full ruble. On June 1, 2014, Bank of Russia Directive No. 3210-U dated March 11, 2014 came into force. This document replaced Bank of Russia Regulation No. 373-P dated October 12, 2011, which is no longer in effect. A legal entity independently determines the cash balance limit in accordance with the appendix to this Directive, based on the nature of the activity, taking into account the volume of receipts or the amount of cash issued. Individual entrepreneurs and small businesses may not set a cash balance limit.

The cash limit at the cash desk can be rounded to whole rubles according to the rules of mathematics. This was confirmed by officials (letter of the Federal Tax Service of Russia dated March 6, 2014 No. ED-4-2/4116). And primary cash documents, for example, expense orders, must be filled out with pennies.

Taxes and fees

First of all, it is necessary to separate the concepts: taxes and fees, since regulatory regulation on these issues is established by different legislative acts. In the words of experts, a tax in a real tax mechanism is an irrevocable and urgent form of forced collection from taxpayers in accordance with the tax code of a part of their income in order to satisfy socially necessary needs, and the fee is a targeted contribution aimed at covering state expenses.

Declarations and payment orders

In tax returns and payments, amounts are indicated in whole rubles.

Paragraph 6 of Article 52 of the Tax Code establishes the main rule for calculating taxes: their amount must be reflected in full rubles. The Ministry of Finance in letter dated March 5, 2014 No. 03-07-15/9519 explained that this article of the code regulates the procedure for calculating the amounts of taxes payable to the budget, which are reflected in declarations.

Since contributions are calculated in rubles and kopecks, and when paid, their amount is rounded up, arrears may arise, for example, 1,500 rubles were accrued. 42 kopecks, and 1500 rubles were paid. Such arrears do not entail liability for the organization, provided that insurance premiums are paid on time.

The amount is calculated in full rubles: what is less than 50 kopecks is discarded, what is more is rounded up, says the well-known rule, which is enshrined in Article 52 of the Tax Code. However, there are exceptions to this rule that should not be forgotten. In the form of any declaration, you can see that not only the final data is rounded, but also the intermediate figures on each sheet. Therefore, if the amount of tax that the accountant reflects in the declaration, he also indicates in the payment order, there will be no discrepancies.

Insurance premiums

Insurance contributions for compulsory pension, medical and social insurance in case of temporary disability and in connection with maternity are charged for each employee separately (Part 6, Article 15 of the Federal Law of July 24, 2009 No. 212-FZ). In this case, the amount of any of these types of contributions, payable for the organization as a whole, is determined in full rubles (Part 7, Article 15 of Law No. 212-FZ). Thus, an amount of less than 50 kopecks is discarded, and an amount of 50 kopecks or more is rounded up to the full ruble. Thus, the specified insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund must be calculated in kopecks, but paid in full rubles. Information on accrued and paid contributions is reflected in the corresponding calculations (Part 9, Article 15 of Law No. 212-FZ).

Since contributions are calculated in rubles and kopecks, and when paid, their amount is rounded up, arrears may arise (for example, 1,500 rubles 42 kopecks were accrued, but 1,500 rubles were paid in accordance with the rounding rules). Please note that such arrears arising as a result of the application of rounding rules do not entail liability for the organization, provided that insurance premiums are transferred on time (letter of the Ministry of Labor of Russia dated February 14, 2013 No. 17-4/264).

In another situation, if the organization does not follow the rounding rules, arrears are also possible (for example, 1500 rubles 76 kopecks were paid instead of 1501 rubles). In these cases, claims by officials and demands for payment of arrears, penalties and fines are possible (Article 22 of Law No. 212-FZ).

As for insurance contributions for compulsory social insurance against industrial accidents and occupational diseases, the procedure for their payment is regulated by Federal Law No. 125-FZ of July 24, 1998. This law does not contain requirements to round up the amounts of contributions when paying. Thus, in contrast to contributions for compulsory pension, medical and social insurance in case of temporary disability and in connection with maternity, contributions for “injuries” are paid in rubles and kopecks.

Insurance premiums can also be paid in whole rubles (clause 7, article 15 of the Federal Law of July 24, 2009 No. 212-FZ). But if amounts are rounded in tax returns, then insurance premiums are not reported in reporting. Indicators in forms RSV-1 PFR and 4-FSS are indicated in rubles and kopecks. Therefore, small discrepancies may arise between the data in the reporting and in the payments.

Date of publication: January 13, 2015, 13:37

— + 0

Tweet