According to statistics from tax authorities, VAT ranks second in terms of revenue. Any enterprise (or individual entrepreneur) using the general taxation system is required to transfer to the federal treasury a set percentage of the amount added to the original price of the goods by the seller.

In other words, when selling goods (products or services), the seller must pay the state the difference between the VAT received from buyers and the tax incoming from suppliers.

Is optimization always necessary?

VAT exemption affects whether it is convenient to work with you.

If you, as the seller, do not charge VAT, then the buyer will not be able to recover the tax. Therefore, if you work mainly with large companies, then without VAT you are less competitive. Losing one or two key customers can be much worse than paying a large VAT. On the other hand, if you pay VAT, then it is beneficial for you to work with suppliers who pay this tax. It is worth working with non-payers if they give a discount comparable to the VAT rate.

One more point: in business there can be both VAT-taxable and non-VAT-taxable areas. Then, to apply tax benefits, you will have to keep separate records. But if the preferential direction is insignificant compared to the entire volume of business, separate accounting may cost more than saving on VAT.

Therefore, when applying optimization schemes, take into account the risks, benefits and reactions of counterparties.

What are the risks of using schemes?

Tax evasion schemes can be legal or illegal. Although even legal methods can be used in such a way that people will become interested in the company. Experts offer optimization, citing successful court decisions, but are silent about losses.

The scheme may work, or it may cause trouble. Of course, in this case, experts promise to solve problems with the Federal Tax Service for additional money, but there are no guarantees.

There is an opinion that tax authorities turn a blind eye to minor offenses and come at the hour when the business reaches large turnover. But it is not exactly. Either way, do you need the extra worry?

Still, the Federal Tax Service is one of the most automated and advanced services in Russia. The tricks of entrepreneurs there are well known.

Working in special mode

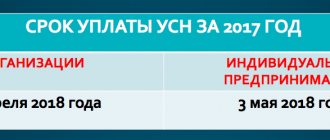

The last resort is not to pay VAT at all. This is possible if you apply a special tax regime: simplified tax system, PSN, unified agricultural tax or UTII (cancelled from 2021). Special regimes also exempt from taxes on property and profits. Instead of several taxes, you pay one and usually at a lower rate. Compare your tax burden across different taxation systems using our free calculator.

Each special regime has its own set of conditions that the business must meet: revenue, cost of fixed assets, participation of other companies in the authorized capital, number of employees.

Some special modes can be combined with OSNO: PSN, UST, UTII. They can also be combined with each other: simplified tax system + UTII, simplified tax system + PSN, simplified tax system + ESKHN. You will have to maintain separate accounting and reporting for each mode.

Sometimes a business is divided into several legal entities or individual entrepreneurs, so that each part operates under its own tax regime. But this method of optimization is dangerous: tax authorities may consider this a fragmentation of the business, recognize the entire direction as a single company operating on OSNO and charge additional taxes (and also impose fines and penalties). And if the arrears exceed 5 million rubles, the tax office may initiate a criminal case under Art. 199 of the Criminal Code of the Russian Federation.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Game of bets

An absolutely legal way to reduce VAT is prescribed in Article 164 of the Tax Code. Its first paragraph lists goods, works and services that are taxed at a rate of 0%, and the second - at a rate of 10%. Paradoxically, not all taxpayers know about this. Another option is to purchase raw materials with VAT of 18% and manufacture final products from them, taxed at a reduced or zero rate. If you want to pay less VAT, engage in activities that are taxed at a preferential rate, and sleep well!

VAT exemption

Businesses can be exempt from paying VAT on certain transactions or types of activities (Article 145 of the Tax Code of the Russian Federation). This is a privilege; it is given for up to a year to companies without import operations. Also, you cannot trade excisable goods. To obtain this right, you must submit an application.

It is important that during this period the enterprise’s revenue excluding VAT for three consecutive calendar months does not exceed 2 million rubles. Otherwise, the right to the privilege is lost.

And for certain types of goods and services there is an exemption from VAT (Article 149 of the Tax Code of the Russian Federation). These are, for example, medicine, child and disabled care, arts services, financial services, and research.

Consumer cooperative

Sometimes companies that have a small number of product buyers, for example, a dozen small wholesalers, use a scheme of working through a consumer cooperative to optimize VAT. The main goal of creating a consumer cooperative is to satisfy the needs of its shareholders, which can be expressed in money or property. In this case, this need is property, that is, the company’s goods. All buyers become shareholders, pay fees and receive the goods they need. In accordance with subparagraph 4 of paragraph 3 of Article 39 of the Tax Code of the Russian Federation, such an operation is not a sale and therefore is not subject to VAT. But in order for this mechanism to work without failures, it is important to think it through carefully and correctly formalize it from a legal point of view.

Advance payments

Work with advances usually begins at the end of the quarter. The optimization scheme works if the company receives an advance for goods or services in one quarter and sells them in the next. It consists of the following: the organization receives an advance from the buyer and transfers funds to its supplier for another product, which receives an advance and transfers funds to its supplier, and so on. The tax is paid by the participant in the chain who did not manage to make an advance payment to their supplier.

Keep in mind that the tax office is well aware of this scheme and does not welcome it. If you regularly use advances to defer VAT payment, you may receive an unscheduled tax audit.

You must also pay VAT on advances received. And the seller can enter into a supply agreement at the end of the quarter, and, by agreement with the buyer, transfer the advance payment to the beginning of the next quarter. Then the seller will pay tax three months later.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

You can defer VAT payment by more than a quarter using borrowed funds. Then the seller takes a loan from the buyer in the amount of the advance. And after shipment, they offset the debts on the loan and for the goods sold. The issuance of a loan is not subject to VAT, so tax is charged only upon sale. Although this scheme does not violate the law, the tax authorities are displeased with it, so it is not suitable for regular use.

It is important to consider the interests of the buyer when working with advances. When the buyer makes an advance payment, but uses it to deduct VAT on this amount. So it is not profitable for him to postpone the payment deadline or work with the loan.

Is it possible to reduce the tax amount?

When they talk about reducing VAT, the first thing that comes to mind is illegal and less than legal methods of cashing out money through shell companies or offshore zones. There are quite reliable schemes, but they also pose a threat to such violators. But besides all this, there are also quite official ways to reduce VAT. They:

- Less effective than fraud.

- But if used systematically and correctly, they can significantly reduce payments to the budget.

A diagram of how you can legally reduce the accrued VAT payable to the budget (optimization) is discussed below.

Schemes for legal VAT reduction are reviewed by a specialist in this video:

Include shipping costs in the product price

If you sell goods at a VAT rate of 10%, it is beneficial for you to include the costs of transporting goods to the buyer in the price of the goods and not allocate the delivery amount. In this case, you will pay 10% of the entire amount of the goods, and for the services of transport companies you will deduct 20%. To do this, write down in your accounting policy a provision that the cost of the goods includes delivery costs, and in the contract with the buyer indicate that the cost of the goods includes delivery.

Work with VAT in the Kontur.Accounting web service. The system makes it easy to keep records, pay salaries, and report online. The service will help you optimize VAT and tell you how to reduce your payment. The first two weeks of operation are free for all new users.

Involvement of “gray” intermediaries

The most commonplace and at the same time dangerous scheme is the involvement of intermediaries to create artificial expenses and VAT deductions. And although companies try to carefully cover their tracks, this is not always possible. Today there is a lot of talk about working with fly-by-night companies and being careful when choosing counterparties. And sometimes, trying to bring criminals to light, tax authorities act like seasoned detectives.

Thus, trying to prove the receipt of an unjustified tax benefit by a taxpayer from the North Caucasus, representatives of the Federal Tax Service did a great job:

- We studied all the company's counterparties, including the second and third links, to see if they exhibited “gray” signs.

- They inspected the transport on which the cargo was allegedly transported (tax officials considered the operation fictitious) and checked the speedometer readings. It turned out that on the day of delivery the cars traveled a distance 2 times less than to the buyer’s location.

- We asked the traffic police for data and found out that the cars indicated in the transport documents were not recorded on the route from the seller to the buyer.

All these facts, according to tax authorities, clearly confirm the fictitiousness of the transaction, which the judges agreed with (Resolution of the Administrative Court of the North Caucasus District dated February 15, 2017 No. F08-219/2017 in case No. A63-4622/2015).

Point 2. Loopback and automation

VAT is a battle of algorithms. There are programmers who write and constantly modify the VAT ASK. There are programmers who constantly modify software to combat ASK VAT.

Above we touched upon such an important factor as the number of counterparties in the ASC chain.

Now imagine that from the 7th leg there is a loop of invoices to the 4th leg. In parallel, companies from the tree still exchange thousands of sf among themselves. All amounts in sf up to 100 thousand rubles. Each shop ends up with several hundred thousand. Sounds unreal. But it is so. And it’s done in a second, with a sufficient level of automation.

At the moment, the Federal Tax Service does not have ways to combat this technique. And they will appear very soon, because... writing an algorithm that could analyze and deal with such a flow of data is a gigantic task. Its implementation also takes a long time.

Clause 4. Reissue of digital signature

The favorite tax method now is to disable the EDS of counterparties.

I will not describe the ways in which tax authorities achieve this. It's just a fact.

Digital signatures can be cut off many times. That is, companies from the chain that a paper VAT professional provides to you are forced to constantly check the functionality of the digital signature. And if there is a rally somewhere, you need to immediately reissue the digital signature. This can also be achieved only by automating the monitoring of digital signature performance. Doing this by hand is almost impossible. It is necessary to be able to re-issue digital signatures over and over again in the shortest possible time. The record for the number of attempts to disable the digital signature that I have heard about is 5 times. Then the tax authorities, apparently, simply got tired of it, due to the futility of their attempts.

Point 7. Quality of shops in the chain

We are not talking about the classic gasket on the first link, multi-year, with taxes, 100% turnover, bold payroll, etc.

It would be good if these were shops with accounts and turnover on them. With minimal one-day criteria. You can post part of the amount to your accounts as an advance payment. The main thing is that lawyers can go to the inspection from these shops. And be available to the director. The registration period is preferably more than a year. Invite the person providing the VAT service to pay for his services by bank transfer. And it’s convenient for you: the wiring has been done. And in this way he will show that the shop is alive and under his control.

But further, at all shops in the chain, it is extremely important to comply with the minimum risks in the ASK VAT RMS. Remember that if the director is massive, the shop lights up red. Mass address with signs of unreliability - red. Work off from cash, thrown after a block under 115-FZ and on the list 550p - red. Therefore, 1-2 shops for each director is what, ideally, the entire chain consists of. All 140 companies. If your contractor cannot provide the quality of the tools he uses, this greatly increases your risks. Feel free to find out all the details, because you are paying a lot of money. And the risks are even higher.