The process of liquidating an LLC is very complex and affects many aspects of the financial condition of the organization. One of these is the return of authorized capital. In 2021, can the founder receive his share upon liquidation of the company?

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Upon completion of its activities, the organization is obliged to carry out important liquidation activities - to settle accounts with the founders.

That is, the remaining assets must be distributed among the participants. But the process is complicated by observing many nuances. Can the founder receive his share upon liquidation in 2020?

Authorized capital: postings

The content of the article

Authorized capital is part of the organization’s own capital, representing the amount of funds invested by the owners to ensure authorized activities recorded in its constituent documents. This value determines the minimum size of property that guarantees the interests of creditors. Depending on the organizational and legal form, the authorized capital of an organization may be called authorized capital, mutual fund, or share capital. We will talk about synthetic and analytical accounting of authorized capital in our consultation.

The credit balance of account 80 must correspond to the amount of the authorized capital recorded in the constituent documents of the organization. This means that accounting entries for account 80 are made only after appropriate changes have been made to the constituent documents.

Accounting for authorized capital and settlements with founders (account 80 and 75)

Why do you need authorized capital? It forms start-up capital, which is used in the commercial activities of the enterprise, that is, it is the basis for further activities. In addition, the founders are liable for the debts of the enterprise within the framework of their shares in the authorized capital. That is, for creditors this is the minimum amount of property that they can return, a kind of guarantee of return of funds.

But that is not all. The formation of authorized capital is a business transaction, and for each operation we must carry out accounting entries using the double entry principle. Details on how to make postings are written here. In short, from the Chart of Accounts you need to select two accounts involved in the business transaction associated with the formation of the authorized capital, and make a simultaneous entry for the debit of one and the credit of the other.

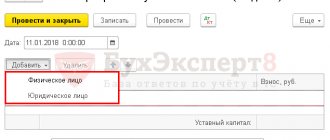

Postings 75 of the account for contributions to the authorized capital: to the current account, in the form of fixed assets and intangible assets

The fundamental procedure for creating any organization is the formation of its authorized capital. Founders and shareholders can use both cash and fixed assets (real estate, cars, equipment, etc.) as a contribution. The authorized capital is accounted for in accounting account 75. From this article you will learn how to reflect the founder’s contribution to the authorized capital in the transactions, depending on its type.

In order for an organization to be registered, it is necessary to contribute at least 50% of the authorized capital. But it should be noted that the legislation provides an exception for such an organizational and legal form as a joint-stock company. A joint stock company can obtain state registration without contributing authorized capital. But at the same time, half or more of the amount of the authorized capital must be paid for a period of no more than 3 months after state registration, the rest - no later than a year.

Accounting: cash contributions

Reflect the cash contributions received from the founders by posting:

Debit 50 (51, 52) Credit 75-1

– money was contributed as a contribution to the authorized capital.

An example of how to reflect in accounting the founder’s monetary contribution to the authorized capital of an organization

LLC "Torgovaya" was founded by LLC "Alpha" and A.S. Glebova. The authorized capital of the organization is 400,000 rubles.

Alpha owns a 60 percent share worth RUB 240,000. (400,000 rubles × 60%), Glebova – 40 percent of the share in the amount of 160,000 rubles. (RUB 400,000 × 40%).

Hermes was registered in February. Before this date, the founders paid 50 percent of their shares in the authorized capital. In March, the founders fully repaid their debt on contributions to the authorized capital.

The organization's accountant made the following entries in the accounting.

In February:

Debit 51 Credit 75-1 – 120,000 rub. (RUB 240,000 × 50%) – 50 percent of Alpha’s debt on the contribution to the authorized capital has been repaid;

Debit 50 Credit 75-1 – 80,000 rub. (RUB 160,000 × 50%) – 50 percent of Glebova’s debt on contribution to the authorized capital has been repaid.

In March:

Debit 51 Credit 75-1 – 120,000 rub. (RUB 240,000 – RUB 120,000) – Alpha’s debt on contribution to the authorized capital has been repaid;

Debit 50 Credit 75-1 – 80,000 rub. (160,000 rubles – 80,000 rubles) – Glebova’s debt on contribution to the authorized capital has been repaid.

Situation: how to take into account the difference between the currency exchange rate on the date of formation and the date of payment of the authorized capital, if the founders of the LLC pay the authorized capital in foreign currency?

The authorized capital of a Russian organization is fixed in rubles (Clause 1, Article 317 of the Civil Code of the Russian Federation). Fluctuations in foreign currency exchange rates do not affect the size of the authorized capital reflected in the accounting records of the organization’s state registration (clause 14 of PBU 3/2006).

If on the date of payment of the deposit the exchange rate has increased, then reflect the resulting difference between the ruble valuation of the authorized capital and the debt of the founder as follows:

Debit 75-1 Credit 83

– reflects the positive difference between the ruble valuation of the authorized capital and the debt of the founder.

This is stated in paragraph 14 of PBU 3/2006.

If on the date of payment of the deposit the exchange rate has decreased, then the participant (founder) needs to pay the difference. This is explained by the fact that the value of the contribution of each founder should not be less than the nominal value of his share. If this rule is violated, the company is obliged to announce either a reduction in its authorized capital or liquidation (clauses 3, 4 of Article 90, clause 4 of Article 99 of the Civil Code of the Russian Federation).

Situation: is it necessary to enter a cash receipt for the amount of the deposit received from the founder in cash?

No no need.

A cash receipt must be entered if cash was received as payment for goods sold, work performed or services provided (Clause 1, Article 2 of Law No. 54-FZ of May 22, 2003). The transfer of a contribution to the authorized capital is of an investment nature and is not recognized as a sale (subclause 4, clause 3, article 39 of the Tax Code of the Russian Federation).

Return of part of the authorized capital to the founder-individual

In the event that the value of the corresponding part of the share is returned to the company's participants, or in the event that the authorized capital is reduced in accordance with the requirements of the legislation of the Russian Federation, the amount of such reduction in the authorized capital will not be included in the tax base when calculating income tax.

As already stated above, in accordance with Art. 66 of the Civil Code of the Russian Federation, property created through the contributions of founders (participants), as well as produced and acquired by a business partnership or company in the course of its activities, belongs to it (that is, the company) by right of ownership.

conclusions

If a legal entity ceases to operate on a voluntary or compulsory basis, its participants have the right to withdraw/return their contributions (shares) from the management company.

However, they have such an opportunity only if the company’s obligations to creditors are fully repaid, and there are still some funds left on the balance sheet of the closing organization.

The write-off and distribution of capital assets in the situation of closure of a legal entity is documented and recorded in accounting.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

Capital contribution

When an enterprise is formed, as well as a change in the size of the authorized capital (registered in accordance with the law), the founders can transfer fixed assets, including motor vehicles, to the enterprise as a contribution . In accordance with clause 3.3 of PBU No. 6/01, the initial cost of fixed assets contributed to the contribution to the authorized (share capital) of the organization is recognized as their monetary value, agreed upon by the founders of the organization. In this case, the contribution can express the value of the car at the residual price, higher or lower than the original cost according to the documents of the transferring party.

In accordance with clause 2.13 of Instruction No. 37, property merged by enterprises for the purpose of joint activities is not subject to income tax. The property of legal entities united by the parties to the agreement for joint activities is accounted for on the joint balance sheet of the participant who, in accordance with the agreement, is entrusted with managing the common affairs of the parties to the agreement. This participant acts on the basis of a power of attorney signed by the other parties to the agreement.

Accounting accounts 80 and 75

First of all, with its help, start-up capital is formed for the subsequent commercial activities of the enterprise. It consists of contributions from the founders, which can be either in the form of tangible property or in cash. Each founder has his own certain share in the capital, depending on its size, he will subsequently receive the corresponding profit from the commercial activities of the enterprise (dividends). The company is responsible for its obligations within the framework of this capital, so for creditors this is a kind of guarantee of satisfaction of their interests.

Authorized capital is the initial amount of funds (start-up capital) that the founders are willing to invest to ensure the activities of the enterprise. When registering an organization with the relevant authorities, constituent documents are drawn up, which include the cost of the authorized capital.

Instructions for return of capital

Next, we will consider in detail the mechanism for returning the capital to the founders upon the dissolution of the company:

- At a general meeting, the participants decide on the termination of the company's activities.

- The results of voting on the timing of the abolition procedure and the composition of the liquidation commission are recorded in the minutes of the meeting.

- The tax office is notified of the start of the process.

- The liquidator publishes a publication in the media about the beginning of the procedure and accepts claims from lenders.

- The liquidator creates a register of claims from lenders.

- Payment of arrears of taxes, wages and other obligatory payments is carried out.

- The remaining amount of profit is distributed among the founders.

- The assets of the enterprise are distributed among the owners depending on their share in the company's capital.

Until the end of the abolition process and full repayment of debts to creditors, employees and the tax service, none of the owners can receive their shares.

During bankruptcy proceedings, the company's capital is fully used to satisfy all claims against the organization. Further, the funds are used to pay expenses associated with organizing court proceedings (state fees, manager’s fees and other costs).

According to the Civil Code of the Russian Federation, all founders of an organization after its liquidation have the right to withdraw their part of the capital. But they can implement it only after final settlement with all creditors who managed to present their claims to the legal entity. If the financial savings in the company’s accounts are not enough, then in order to repay debts to creditors, the organization’s property will be sold.

After all necessary payments to creditors have been made, the remaining property is divided between the founders. This is done in the following order:

- First of all, they are calculated based on existing profits.

- The property that remains is distributed among the participants depending on the shares they contributed to the capital.

Money is returned to depositors either through the bank (using a payment order), or through the cash desk of the enterprise itself.

Before returning capital, the founder must pay off all creditors

If the liquidation of an LLC occurs through sale, the capital goes to citizens in the following order (the same applies to joint-stock companies, municipal unitary enterprises, etc.):

- Persons with injuries of varying severity, if the enterprise is at fault.

- Employees who must be paid all outstanding wages and benefits.

- State structures and funds.

- Creditors.

- Founders (participants) of the organization.

Chapter 2

Thus, it is up to the court to determine whether a company’s violation of its registration procedure is gross or irreparable. Therefore, the requirements of Article 20 of Law No. 14-FZ themselves cannot serve as an automatic basis for the liquidation of the company. Whether the company is liquidated or not will be decided by the court, taking into account the nature of the violations committed by the company and the consequences caused by them.

There are also intangible assets for which it is impossible to determine their useful life. Then this period is taken equal to 20 years (but, of course, not more than the life of the company itself). Let us immediately draw the attention of readers to the fact that for tax accounting purposes for the same intangible assets, the useful life is set within 10 years (and also no more than the period of activity of the taxpayer himself). This is stated in paragraph 2 of Article 258 of the Tax Code of the Russian Federation.

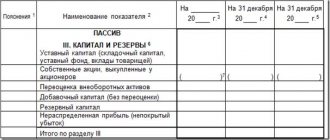

Formation of authorized capital: accounting entries

The authorized capital is the amount that the founders contribute after registering the company. It is displayed in the liability side of the balance sheet, since it is the source of the formation of assets. The founders can make contributions in the form of cash, non-cash funds, materials, fixed assets. The activities of the enterprise are financed from the funds of the management company.

How is the formation of authorized capital reflected in accounting? Postings depend on the sources of funds. To account for the authorized capital, accounts 80 and 75 are used. Receipts of funds are reflected in credit 75, and write-offs are shown in debit 75. The entry drawn up when forming the authorized capital in joint-stock companies looks like this: DT75 KT80 - the debt of the founders is reflected in the Criminal Code. Each owner must contribute to the capital in accordance with his share. Profits will then be distributed in the same ratio.

How to write off - write-off postings

In order to correctly write off the capital company during the liquidation of a legal entity, you can use the accounting entries provided for two typical situations:

- The liquidation balance turned out to be positive. The corresponding profit of the LLC is recorded in the debit of account 99 and the credit of account 84. The increase in capital is reflected in the debit of account 84 and the credit of account 80.

- The liquidation balance turned out to be negative. The write-off of the capital is reflected in the debit of account 80 and the credit of account 84. The distribution of the remaining funds between the participants is shown on the debit of the 80-account and the credit of the 75-account. The amounts of refundable contributions (shares) for each co-owner are fixed on the debit of account 75 and the credit of account 51(50).

Authorized capital: postings

- Cash:

- cash;

- non-cash;

- Inventory assets:

- equipment (Deb. 01);

- vehicles (Deb. 01);

- goods (Deb. 10);

- materials (Deb. 10);

- Intangible assets:

- patents (Deb. 08.5);

- know-how (Deb. 08.5);

- licenses (Deb. 08.5);

- franchises (Deb. 08.5);

- agreement on assignment of rights (Deb. 08.5);

- shares, bonds of third legal entities. (Deb. 58);

Account No. 80 is inactive, but passive. Account 80 is necessary to summarize information about the movement and general condition of the organization's management company. Account balance 80 should be equal to the capital specified in the organization’s charter. Any movements in the MC account occur when a MC is created or changed (increased or decreased).

Reasons for liquidation

Considering that a company can be liquidated on a voluntary basis and forcibly, the reasons for these two types differ. If an organization ceases its activities based on an internal decision of the constituent meeting, then the reasons for this may be the following:

- The enterprise becomes unprofitable or its profit is very small.

- Contradictions arise between participants that cannot be resolved in any other way.

- Upon the departure of all founders, if they no longer want to engage in the type of commercial activity that the liquidated structure is oriented towards.

- The purpose for which the organization was created has been fully achieved.

- The time frame for which the opening of a legal entity was aimed has ended (for example, the license has expired).

The liquidation process can be initiated either by the owner himself or by the state. authority when detecting violations

Provided that liquidation occurs as a result of a court decision or order of authorized government bodies, the reasons for this may be the following:

- The company was initially opened in violation of the law.

- A legal entity carries out illegal activities or activities that are not stated in the organization’s Charter.

- The work of the enterprise is not supported by the availability of the necessary permits (certificates, licenses, etc.).

- Bankruptcy.

- Tax evasion.

There are a number of other reasons that are difficult to classify:

- Force majeure circumstances. This could be a natural disaster or an act of terrorism, i.e. something that could lead to damage to property, but does not depend on the will of the participants in the enterprise.

- An organization can be closed simply because its founders lose interest in its further activities.

Basic entries used for authorized capital

The authorized capital is created through founders' contributions, expressed in the form of cash or any property assets. There are often cases when founders invest not just money, but fixed assets or tangible assets that can be used in the production and economic process. In this regard, contributions to the authorized capital must be correctly allocated to accounting accounts.

When funds or property are transferred by participants for the purpose of contributing to the authorized capital, this action must necessarily be reflected in the accounting accounts. In other words, after the shares themselves have been reflected as a credit of 80 and a debit of 75, we show the components of the shares. Examples of correspondence regarding cash and material property include the following postings:

During liquidation there is no money to return the authorized capital

Basic information ↑

The authorized capital of an organization is the initial reserve created by the participants of the company to ensure the possibility of carrying out activities.

From a legal point of view, the charter capital is a value indicator of the property assets that the organization owns and within the limits of which it is liable to potential creditors.

From the economic side, this is the minimum amount of funds required to start a business activity, the type of which is determined by the Charter.

The composition of the authorized capital is the funds of the founders of the company. When forming the authorized capital, the share of each participant is determined. Within the period specified by law, participants are required to contribute the value of their share to the authorized capital account.

The total amount of the capital is determined in monetary terms, and the size of the share is determined as a percentage or fraction of the entire amount of capital. Each share has a nominal value.

Participants can pay for the share of the management company with money, property or property rights. A non-monetary form of payment requires a monetary valuation, which makes it possible to establish the value of the share.

As the company develops, the amount of authorized capital can increase due to profits and additional contributions from participants. Sometimes the size of the authorized capital decreases. In this case, the value of each participant’s share is recalculated.

One of the main functions of the share of the authorized capital is to determine the percentage of profit that the owner can receive. Although the contribution is transferred to the benefit of the organization, the right to it remains with the participant.

Consequently, upon liquidation of the organization, the founders have the right to count on the return of the authorized capital. At the same time, the authorized capital is a guarantee of creditor interests.

If the organization has creditor obligations upon liquidation, debts are paid precisely from the amount of the capital. The founders can only claim the amount remaining after paying all accounts payable, tax and other debts.

At the very last stage of liquidation, the remainder of the authorized capital is divided among the founders in proportion to their share.

Required terms

Authorized capital is the funds of the organization necessary to start a business activity. It consists of contributions from company participants and is valued in cash.

The main functions of the authorized capital are to ensure the interests of the founders and possible creditors. A share of the authorized capital is the amount of money or property that a participant contributed to the management company.

The size of the share in the authorized capital determines the number of votes that the founder has at the general meeting and the part of the profit received by the participant from the activities of the organization.

Liquidation is the process of officially ending the activities of an organization. A distinction is made between voluntary and forced liquidation.

The decision on voluntary liquidation is made by the general meeting of participants if further activities are unwilling or impossible. Forced liquidation is carried out by court decision.

Reasons for closing the organization

An organization may close for various reasons. The basis for voluntary liquidation is the decision of the participants.

For example, the founders do not want to continue their business activities, or insurmountable differences have arisen between the participants that do not allow them to continue working.

Another reason may be to reduce the amount of authorized capital below the minimum established by law. The minimum authorized capital of an LLC must be ten thousand rubles.

For which entries reflect the contribution to the authorized capital to the current account, see the article: entries for the authorized capital. Why you need a certificate of payment of the authorized capital of a joint-stock company, read here.

If, based on the results of the second and subsequent years, the value of the organization’s net assets is less than the possible minimum, then the organization must be liquidated.

When it comes to forced liquidation, there is bankruptcy of the organization. That is, the company is not able to pay off its accounts payable.

An organization can admit its insolvency independently and go to court to confirm bankruptcy. Creditors may also file a claim.

In this case, the court, after considering the facts, may decide on the need for forced liquidation and settlement with creditors.

Legal regulation

In the Russian Federation, the legal regulation of authorized capital, as in most developed countries, is aimed at protecting the interests of society, founders and creditors.

When establishing requirements regarding the Criminal Code, legislation pursues the following goals:

- actual formation of the authorized capital;

- maintaining the organization’s property at a level not lower than the predetermined minimum of the Criminal Code.

Regulatory regulation of the authorized capital is carried out on the basis of:

- Civil Code.

- Federal Law No. 14 “On LLC”.

- Federal Law No. 208 concerning the activities of joint-stock companies.

- Other regulations.

In accordance with Article 58 of Federal Law No. 14, after the completion of settlements with creditors in the process of liquidation of the organization, the remaining property is divided between the participants.

In this case, the distributed profit is paid first, and then the property is divided in proportion to the size of the shares.

Authorized capital upon liquidation

When the tax authority decides to suspend transactions on the accounts of a liquidated company, the rights of participants to register ownership of the received property are limited. In this case, they have the opportunity to go to court (Resolution of the Federal Antimonopoly Service of the Moscow Region dated April 28, 2011 No. KG-A40/3403-11, Resolution of the Federal Antimonopoly Service of the East Siberian District dated March 23, 2009 No. A69-4315/08-F02-1027/09). If the founders, in violation of the procedure established by law, take away the property before full settlement with creditors, then such property can be demanded from them.

If it is impossible to return the property in kind, its value is claimed.

- All property is subject to distribution if the legal entity has no obligations to creditors. In this case, compliance with two basic conditions is mandatory. Firstly, the period for receiving claims from creditors is two months. The period must be counted from the date of publication of the liquidation record in the Bulletin. Secondly, the compiled interim liquidation balance sheet must reflect all settlements with creditors.

- Only the part of the property remaining after full settlement of debts will be distributed. The remaining funds must be entered into the liquidation balance sheet.

- The property is not distributed or transferred to the company's participants, since it is not available after settlements with creditors. Such information is also entered into the balance sheet.

After its creation, the liquidation commission develops and approves a plan for the liquidation of the enterprise, which begins with a complete inventory. In accordance with subparagraph 27 of the Order, an inventory is required of a legal entity at the beginning of the liquidation procedure. All positions of assets and liabilities are subject to inventory. If discrepancies are identified between accounting data and the actual availability of property, they must be reflected in the accounting accounts. 100% of the authorized capital of a Russian LLC that is in the process of liquidation belongs to another Russian organization. In 2011, the LLC acquired a stake in the authorized capital of an organization that is a resident of the Republic of Belarus; the cost of the contribution to the authorized capital was determined in US dollars; as payment for the share in the authorized capital, the company transferred an object of fixed assets.

This financial investment has not been revalued by the organization. The LLC applies a general taxation system. What is the procedure for accounting and tax accounting (profit tax) for a liquidated organization of the transaction of transferring to the sole participant a contribution to the authorized capital of a Belarusian organization? Let us recall that in accordance with the Instructions for the application of the Chart of Accounts for accounting the financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, information on the availability and movement of financial investments is reflected in account 58 “Financial investments”, and all settlements with LLC participants are reflected in account 75 “Settlements with founders (see also the letter of the Ministry of Finance of Russia dated 03.07. 2007 N 07-05-12/06). In accordance with Part 3 of Art. 62 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), after approval of the decision to liquidate a legal entity, a liquidation commission is to be formed, whose task is to conduct the liquidation procedure and determine its terms.

The commission will carry out its activities at all stages of liquidation of a legal entity, including taking part in the distribution of property between the founders. If a company has been active and functioning at all stages of its existence, it is possible that it may accumulate debts. Debt settlement is an integral part of the liquidation procedure and the further distribution of property between the company's participants.

simplified tax system

Organizations applying the simplification do not include founders' contributions as taxable income. This is explained by the fact that when calculating the tax base of simplified organizations, they do not take into account the income listed in Article 251 of the Tax Code of the Russian Federation (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). And it also mentions income in the form of contributions to the authorized capital (subclause 3, clause 1, article 251 of the Tax Code of the Russian Federation).

This rule applies to all organizations applying the simplification, regardless of the chosen object of taxation.

Organizations that pay a single tax on the difference between income and expenses cannot include the cost of contributed property as expenses. Such requirements are imposed by regulatory agencies (see, for example, letters of the Ministry of Finance of Russia dated February 3, 2010 No. 03-11-06/2/14, dated September 26, 2007 No. 03-11-04/2/236). They believe that when receiving property as a contribution to the authorized capital, the organization does not incur any expenses. Therefore, it is impossible to reduce taxable income by the value of the deposit.

An example of how to take into account the value of property contributed by the founder to the authorized capital of the company. The organization applies simplification

Alpha LLC uses simplification. Accounting is carried out in full.

In March, the founder of Alpha made a copying machine as a contribution to the authorized capital of the organization. The founder owns 20 percent of the shares in the authorized capital or 160,000 rubles. The valuation of the copier, agreed upon by the participants and confirmed by an independent appraiser, amounted to 142,000 rubles.

That same month, the copier was handed over to the accounting department, where it began to be used. Alpha set the useful life of the copier to 37 months.

The organization's accountant made the following entries in the accounting.

In March:

Debit 08 Credit 75-1 – 142,000 rubles. – the photocopier was received as a contribution to the authorized capital;

Debit 01 Credit 08 – 142,000 rub. – the copy machine was put into operation.

Monthly starting from April until the end of the useful life of the property (37 months):

Debit 26 Credit 02 – 3838 rub. (RUB 142,000: 37 months) – depreciation has been accrued on the copier for the current month.

Operations related to the receipt and operation of a copy machine do not affect the calculation of the single tax.

What to do with the authorized capital upon liquidation of an LLC

All savings that remain after settlements with creditors are divided between the founders in the shares that were contributed when drawing up the authorized capital. The accountant's task is to determine the market value of the property and the actually paid shares. If the price of the former is higher than the initial contribution of the founder, then the difference is written off as assets received free of charge.

If the amounts are equal, then the amount written off is not taxable. If losses occur, the value of the contribution made to the management company is also not subject to taxation.

- organize a general meeting of founders;

- approve the decision to liquidate the LLC and form a liquidation commission;

- notify the tax office of the upcoming liquidation;

- submit an announcement to the media (specialized magazine “Bulletin of State Registration”) about the closure of the enterprise and the acceptance of claims from creditors;

- determine the amount of accounts payable by forming an interim liquidation balance sheet;

- make settlements with creditors, employees and other authorities;

- pay profit to the founder;

- approve the liquidation balance sheet (final);

- Submit an application for registration of liquidation, a liquidation balance sheet, and a receipt for payment of the state duty to the registering authority.

5. Appeal the actions or inaction of the Company to the Federal Service for Supervision in the Sphere of Communications, Information Technology and Mass Communications or in court if a citizen believes that LLC Legal Company “Start” is processing his personal data in violation of the requirements of Federal Law No. 152 -FZ “On personal data or otherwise violates his rights and freedoms. Processing of personal data is any action (operation) or set of actions (operations) performed using automation tools or without the use of such means with personal data, including collection, recording, systematization, accumulation, storage, clarification (updating, changing), extraction, use, transfer (distribution, provision, access), depersonalization, blocking, deletion, destruction of personal data;7) Personal data is stored in a form that allows you to identify the subject of personal data no longer than required by the purposes of processing personal data, unless the period for storing personal data is established by federal law, an agreement to which the subject of personal data is a party, beneficiary or guarantor. The processed personal data is subject to destruction or depersonalization upon achievement of the processing goals or in the event of loss of the need to achieve these goals, unless otherwise provided by federal law.

- if one of the LLC participants has not been paid his part of the profit, division of the authorized capital (hereinafter referred to as the authorized capital) may only be possible after all payments have been made;

- in the event that the liquidation balance indicator is negative, then first it is repaid at the expense of the authorized capital, and then the property is divided between the participants of the LLC;

- If a company declares itself bankrupt, debts are covered from the authorized capital, and then the remaining amount is divided among the participants.

What documents are needed?

The liquidation process is accompanied at all stages by the need to draw up all kinds of documents. It looks like this:

- Minutes that record the decision on liquidation adopted at the general meeting.

- Notice of impending liquidation to the Tax Office (must be sent within 3 working days after the meeting).

- Information letter on the formation of the liquidation commission.

- An interim liquidation balance sheet, in which all debts should be displayed, as well as a list of all tangible property of the company and the amount of monetary assets. This document is drawn up no earlier than 2 months after the publication of information about the beginning of liquidation, so that all creditors have time to present their claims. After completing work on the document, it must be certified by a notary and sent to the Tax Service.

- An act on the distribution of remaining funds, which must be signed by all founders and members of the liquidation commission.

- The final liquidation balance sheet is drawn up only after all debts to creditors, government agencies and employees of the enterprise have been repaid.

- A receipt confirming the fact of payment of the state duty.

In addition, all primary documentation, accounting reports for the entire life of the enterprise, correspondence with funds and government agencies must be submitted to the archive.

The liquidation process must be accompanied by a variety of documentation

Systematization of accounting

The main goal of any business enterprise is to earn a profit in the amount necessary to ensure normal functioning, including investing in assets and using the profits for consumption. At the same time...Lyudmila Dmitrievna is simply burning! Of course they are... is. yes, after all, he may not take part in management, and be the founder of 5 companies at once - at the same time, for him, everything brings profit and is an object of investment. Securities can be divided into debt and equity. Debt securities are all types of securities that give their owner the right to return

by a certain date the amount lent to them and a fixed income. Debt securities...If there are securities, there is a market, there are no securities and there is no market.

That's the whole secret. Well, I don't think it's a difficult question. Go to the websites of investment companies, or just search on the Internet. Shares, bonds, derivatives market and how you can use it... when closing an LLC after repaying all debts, the authorized capital

and the remaining property is divided between the founders according to the Charter (becomes property). After this, you can safely register an individual entrepreneur.

Individual entrepreneur has authorized capital

no, so nothing...maybe just issue an invoice for all the goods for 1p... Sell in installments, and after

liquidation

pay off the debt. Listen to STELLA until she says “But this option is possible... Because if you show the implementation (within OSNO), you will have to pay VAT...ed. Federal Law of December 28, 2002 N 185-FZ) A share is an issue-grade security that secures the rights of its owner (shareholder) to receive part of the profit of a joint-stock company in the form of dividends, to participate in the management of a joint-stock company... you need an economic dictionary Zhanna... here is a link to the library everything is there. SHARES (from the Dutch actie, German aktie) securities issued by joint-stock companies, companies, commercial banks, without... In contrast to compulsory motor liability insurance (damage insurance), under CASCO (that is, under a voluntary insurance agreement) there may be certain problems.

However, with the revocation of the license, the insurer’s responsibilities do not cease. He is obliged to settle everything within six months... Compensation payments are provided only by the law on compulsory motor liability insurance; as for CASCO, there is no one to present losses to. I’ve already had a lawsuit with this company, if you’re interested, write to the soap also via Casco. No way. To the court and to the RSA. To receive...The joint stock company issues exclusively issue-grade securities, which by their definition cannot but be registered, so Yuri’s answer is incorrect.

A joint stock company has the right to issue shares and bonds. Since the bonds... are registered, the owner of which must be registered in the appropriate register. When reselling registered shares, the coordinates of the new owners must be entered. Most often, these shares are used to analyze the shareholder structure, with the aim of... During liquidation, there is no money to return the authorized capital