Transport tax rates in Moscow

For a year

| Name of taxable object | Rate (RUB) for 2021 |

| Passenger cars | |

| up to 100 hp (up to 73.55 kW) inclusive | 12 |

| over 100 hp up to 125 hp (over 73.55 kW to 91.94 kW) inclusive | 25 |

| over 125 hp up to 150 hp (over 91.94 kW to 110.33 kW) inclusive | 35 |

| over 150 hp up to 175 hp (over 110.33 kW to 128.7 kW) inclusive | 45 |

| over 175 hp up to 200 hp (over 128.7 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 225 hp (over 147.1 kW to 165.5 kW) inclusive | 65 |

| over 225 hp up to 250 hp (over 165.5 kW to 183.9 kW) inclusive | 75 |

| over 250 hp (over 183.9 kW) | 150 |

| Motorcycles and scooters | |

| up to 20 hp (up to 14.7 kW) inclusive | 7 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 15 |

| over 35 hp (over 25.74 kW) | 50 |

| Buses | |

| up to 110 hp (up to 80.9 kW) inclusive | 15 |

| over 110 hp up to 200 hp (over 80.9 kW to 147.1 kW) inclusive | 26 |

| over 200 hp (over 147.1 kW) | 55 |

| Trucks | |

| up to 100 hp (up to 73.55 kW) inclusive | 15 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 26 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 38 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 55 |

| over 250 hp (over 183.9 kW) | 70 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms | 25 |

| Snowmobiles, motor sleighs | |

| up to 50 hp (up to 36.77 kW) inclusive | 25 |

| over 50 hp (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles | |

| up to 100 hp (up to 73.55 kW) inclusive | 100 |

| over 100 hp (over 73.55 kW) | 200 |

| Yachts and other motor-sailing vessels | |

| up to 100 hp (up to 73.55 kW) inclusive | 200 |

| over 100 hp (over 73.55 kW) | 400 |

| Jet skis | |

| up to 100 hp (up to 73.55 kW) inclusive | 250 |

| over 100 hp (over 73.55 kW) | 500 |

| Non-self-propelled (towed) ships for which gross tonnage is determined (from each registered ton of gross tonnage) | 200 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 250 |

| Airplanes with jet engines (per kilogram of thrust) | 200 |

| Other water and air vehicles without engines (per vehicle unit) | 2000 |

FILES

Note to the table: the values are given in Moscow for 2021, 2021, 2021, 2021, 2021, 2021. To select rates for a specific year, use the selector.

The capital of Russia is the largest subject of the Russian Federation in terms of the amount of collected transport tax. More than 27 billion rubles are brought in annually by 2.9 million payers, subject to the requirements of Moscow City Law No. 33 of July 9, 2008.

Types of transport subject to tax

According to Art. 358 of the Tax Code of the Russian Federation recognizes a large list of types of automobile and motorcycle transport registered in the Russian Federation, motor air and water transport as objects of taxation, and also defines a list of categories of vehicles (10 items) not subject to taxation. For example, the legislator excludes from taxation such categories as cars listed as stolen, cars converted for disabled people, and agricultural machinery. Taxpayers are the persons to whom such vehicles are registered. Payment of the state fee must be made within strictly established deadlines, otherwise vehicle owners will face penalties.

Tax calculation and payment deadlines for organizations

Most regions of Russia provide for the need to make advance payments for payers from among legal entities. In Moscow there is no such obligation - legal entities pay tax in full at the end of the year. The last date by which funds can be transferred to pay off obligations is February 5.

The enterprise calculates the amount independently, taking into account the following factors:

- bid;

- the tax base;

- the share in the right;

- increasing the coefficient;

- holding period (number of months/12);

- benefit provided.

Payment is made without taking into account fractional shares of the ruble, using mathematical rounding rules.

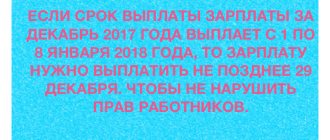

Deadline for payment of transport tax for legal entities in 2021:

- for 2021 - no later than February 5, 2020

- for 2021 - no later than February 5, 2021

How to calculate the number of complete months of car ownership?

If a vehicle is delivered or deregistered during the year, then the transport tax is calculated with a certain coefficient. This coefficient is defined as the ratio of the number of full months during which a given vehicle was registered to the number of calendar months in a year.

The procedure for determining the number of full months of car ownership is calculated in accordance with paragraph 3 of Art. . Month of registration

It is considered complete if the vehicle

is registered

before the 15th day inclusive.

The month of deregistration is considered complete if the car is deregistered

after the 15th day. For example, if a car was registered after the 15th, then this month is not complete and is not taken into account when calculating the car tax.

Rules and deadlines for paying taxes for individuals

Residents of the Moscow region may not calculate the tax amount themselves. It is enough to wait for the tax notification from the Federal Tax Service. This document represents a breakdown of charges for each vehicle owned by the payer in the past year.

You can check the correctness of the specified information using the multiplication formula with the same factors that were listed for legal entities.

The tax payment deadline for citizens is December 1. If funds are not credited on time, penalties will be charged on the entire amount daily.

Please take into account: in accordance with paragraph 7 of Art. 6.1. Tax Code of the Russian Federation, if the last day of the period falls on a weekend, then the day of expiration of the period is considered to be the next working day following it.

Tax notice in 2021

After calculating the transport tax, the Federal Tax Service sends a tax notice to the address of residence, which contains information about the amount of tax, the deadline for its payment, etc.

Tax notices in 2021 will be sent to residents of Russia between April and September

. You can find out information on the planned deadlines for sending notifications to a specific tax authority on this page.

If erroneous data

in the notification, you must write an application to the tax service (the application form is sent along with the notification). After confirming this data, the tax amount will be recalculated and a new notification will be sent to the taxpayer.

The tax notice did not arrive

Many vehicle owners mistakenly believe that if they have not received a notification from the tax service, then they do not need to pay transport tax. This is wrong

.

On January 1, 2015, a law came into force according to which taxpayers, in the event of non-receipt of tax notices, are required to independently report

to the Federal Tax Service about the availability of real estate assets, as well as vehicles.

The above message, accompanied by copies of title documents, must be submitted to the Federal Tax Service in respect of each taxable object once before December 31 of the following year. For example, if a car was purchased in 2021, but no notifications were received regarding it, then information must be provided to the Federal Tax Service by December 31, 2021.

Therefore, if you do not receive a notification, the Federal Tax Service recommends taking the initiative and contacting the inspectorate in person (you can use this service to make an appointment online).

If a citizen independently reports that he has a vehicle for which tax has not been assessed, the payment will be calculated for the year in which the specified report was submitted. However, this condition only applies if the tax office did not have information about the reported object. If the payment notice was not sent for other reasons (for example, the taxpayer’s address was incorrectly indicated, or it was lost in the mail), then the calculation will be made for all three years.

For failure to submit such a message within the prescribed period, the citizen will be held accountable under clause 3 of Art. 129.1 and was fined in the amount of 20% of the unpaid tax amount for the object for which he did not submit a report.

note

, due to the postponement of the deadline for payment of property taxes (no later than December 1), tax notices for 2021 will be generated and sent, including posted in the “Taxpayer’s Personal Account for Individuals,” no later than October 18, 2017. If the user of his personal account wishes, as before, to receive paper notifications, he must notify the tax authority about this. As for individuals who do not have access to the electronic account, notifications will continue to be sent to them in paper form by mail.

Benefits for individuals

Citizens registered in Moscow also have the right to receive preferential conditions for paying transport tax, subject to belonging to the following groups:

- Heroes of the USSR, Russian Federation, full holders of the Order of Glory;

- veterans;

- disabled people of I, II disability groups;

- former minor prisoners of the fascist regime;

- guardians in large families or families with a disabled child (one parent can take advantage of the benefit);

- citizens whose health was damaged as a result of exposure to radiation during the Chernobyl accident, at the Mayak production facility, as well as during nuclear weapons testing in Semipalatinsk.

FILESOpen the table of transport tax benefits in Moscow

Changes 2021

Changes in transport tax 2021 can be represented by three points:

- The declaration form was slightly changed - five new lines were added to it.

- The size of the increasing coefficient for expensive cars has been reduced.

- The procedure for providing benefits to citizens has been simplified.

We reviewed all the changes that have occurred in more detail in the article Transport Tax (2018): changes.

Federal benefits for vehicles

Federal benefits include those that were prescribed in Article 358 of the country’s Tax Code. It also contains types of transport for which you do not have to pay taxes, namely:

- river or sea vessels that carry out fishing;

- rowing boats;

- passenger cars that are specially equipped for use by disabled people;

- passenger and cargo ships that are used to transport people by sea or river;

- A vehicle that belongs to executive authorities and is used in operational work;

- special agricultural machinery;

- stolen or wanted vehicles.

Increasing factor

In 2014, increasing coefficients were introduced for expensive cars. They are still used today. In 2021 their values are as follows:

| Car cost | Car age | Odds size |

| From 3 to 5 million rubles | Up to 3 years | 1,1 |

| From 5 to 10 million rubles | Up to 5 years | 2 |

| From 10 to 15 million rubles | Up to 10 years | 3 |

| More than 15 million rubles | Up to 20 years | 3 |

Until the beginning of 2021, cars costing from 3 to 5 million rubles were differentiated by age. There were three different coefficients:

- Age up to one year – 1.5;

- Age from one to two years – 1.3;

- Age from two to three years – 1.1.

Now a single coefficient of 1.1 is applied, regardless of the age of the car.

Tax return

A transport tax declaration is a reporting document that must be generated and submitted to the tax office by legal entities and private businessmen who own transport facilities recognized as taxable objects. Individuals do not need to prepare a declaration on their own; the tax authorities do it for them.

Since this year, the declaration form has been slightly changed:

- A field for affixing a company seal has been added.

- The following lines have been added:

- 070 – date of registration of the vehicle with the traffic police;

- 080 – date of deregistration of the transport facility with the traffic police;

- 130 – year of manufacture of the vehicle;

- 280 – code value of the deduction according to the Platon system;

- 290 – the amount of deduction according to the Platon system.

We discussed the declaration in more detail in the article Declaration of transport tax. Also, in this article you can find the current transport tax declaration form, rules and a sample for filling it out .