Should a private entrepreneur pay property tax? Many “out of old memory” think that an individual entrepreneur is in most cases exempt from this tax if he uses real estate in business. Today this is no longer relevant. A businessman needs to understand in which cases he can take advantage of a legal benefit, and when he needs to prepare for additional contributions to the budget.

- 2 Real estate tax for individual entrepreneurs as an individual

2.1 Tax for the inventory valuation method - 2.2 Calculation of personal property tax based on cadastral valuation

2.2.1 Table: personal property tax rates for cadastral valuation

- 5.1 Video: The Federal Tax Service provides information on property taxes

Which individual entrepreneur can avoid paying property tax?

Individual entrepreneurs are regarded as individuals and according to the same scheme they pay property tax. Starting from 2019, individual entrepreneurs make payments only for real estate that:

- already refers to the housing stock - apartments, houses, cottages, if the building has a connection with the land;

- non-residential objects - garages, parking spaces;

- any other residential and non-residential finished buildings or those that are just being rebuilt, but are already registered as property.

At the same time, entrepreneurs on imputed income, patent or agricultural tax, do not pay for the real estate that is needed for work. For example, if they rented or bought an object for equipment, a workshop or a warehouse.

Those individual entrepreneurs who work on the main taxation system are required to pay real estate tax. Tax is also paid by simplified entrepreneurs if they have a store, retail space or office, as well as premises for the provision of services, which is included in the list of cadastral real estate.

In the Russian Federation, an entrepreneur has 5 taxation options when opening an individual entrepreneur:

- general taxation system - OSN;

- patent - PSN;

- simplified - simplified tax system;

- single tax on imputed tax - UTII;

- unified agricultural tax - Unified Agricultural Tax.

If the individual entrepreneur has not submitted an application to the tax service to change the tax regime, then according to the legislation of the Russian Federation he will work under the OSN.

To understand whether or not an individual entrepreneur should pay property tax, you can follow this rule:

- There is no need to pay for real estate for work under a patent, imputation or agricultural tax. In a simplified way, you need to check whether the property belongs to the cadastral value or not. If not, then the individual entrepreneur does not pay tax; if yes, then he pays.

- Entrepreneurs who operate under the basic taxation system are required to pay property taxes to the budget. It does not matter whether the property is included in the cadastral list or not.

Therefore, the tax regime and inclusion in the cadastre are the determining parameters.

Conclusions (+ video)

In this article, we examined the question of how property tax is paid by representatives of individual entrepreneurship. The procedure for calculating the amount of payments depends on the taxation system used by a particular entity. According to the current rules, payers using the general system must pay property tax without fail. Representatives of special regimes transfer money only if a specific asset falls into the category of commercial objects. It should be taken into account that each region has its own rules regarding the procedure for making payments.

How to prove that property is used in the activities of an individual entrepreneur

An entrepreneur does not need to prove that the property is involved in business activities. The tax service itself will establish this fact during on-site inspections. To be exempt from paying tax in this case you will need:

- submit an application in free form;

- describe real estate objects that are involved in business activities;

- indicate the tax regime option used.

Entrepreneurs entitled to benefits do not need to attach supporting documents. This procedure has been in place since 2018.

Regulatory regulation of taxation

The Tax Code of the Russian Federation, Part 2 regulates the taxation of organization property

Civil Code of the Russian Federation, Part 1, Art. 130 defines objects of types of property

Decree of the Government of the Russian Federation dated January 1, 2002 N 1 determines depreciation groups of property

Order of the Federal Tax Service of Russia dated March 31, 2017 N ММВ-7-21/ [email protected] determines the form of the declaration and the procedure for filling it out

When establishing a tax, the authorities of the constituent entities of the Russian Federation determine the tax rate within the limits established by the Tax Code of the Russian Federation, the procedure and terms of payment, determine the features of determining the tax base of individual property items, and may provide for tax benefits and grounds for their use by taxpayers.

Expert of the Legal Consulting Service GARANT auditor, member of the RSA K. Zavyalov

What does the tax amount depend on?

Regions independently set the property tax rate, since the payment applies to local ones. The tax amount is affected by the price of the property; the higher it is, the greater the payment amount. The highest rate in Russia is 2%. On the tax website you can find out what percentage is set for a particular object. You will need to enter the tax type, region and year for which you plan to pay real estate taxes.

From the beginning of 2021, property taxes are calculated based on cadastral value. This price is determined not by the owner himself or the market, but by a government agency. But the cost is not much different from the market price. Recalculation of the cadastral valuation of real estate takes place every 5 years. The obtained data is published on the Rosreestr website.

Until the end of 2021, in some areas and regions, the tax was based not on the cadastral value, but on the inventory value; it was calculated according to the degree of depreciation of the object. Now there is no such thing, and all real estate taxes in the Russian Federation are calculated in a single way - at the price indicated in the cadastre.

The tax rate for individual entrepreneurs or individuals will depend on the type of object, cadastral value and location. For example, for the Yaroslavl region for 2021:

| Type of object, cadastral value and location | Interest rate |

| Housing priced up to 2 million rubles | 0,10 |

| Housing from 2 million to 5 million rubles | 0,15 |

| Unfinished residential building | 0,15 |

| Residential buildings costing more than 5 million rubles | 0,20 |

| Non-residential outbuildings up to 50 sq.m. m. | 0,15 |

| Residential complexes, garages, parking spaces | 0,15 |

| Objects whose cadastral value exceeds 300 million rubles | 2,00 |

| Other objects | 0,50 |

No one needs to calculate how much they need to pay into the budget. The tax office sends a letter indicating both the deadline and the amount. The Federal Tax Service sends out notifications once a year, and payment must also be made in one payment before December 1 of the next year. That is, upon receipt of a letter on January 1, 2021 to pay tax for 2021, it must be paid no later than December 1, 2020. There is no need to report with a separate declaration or write a report.

How to fill out a declaration quickly and correctly

When preparing a return for the tax in question, it is recommended to adhere to the standard rules, namely:

- do not allow blots, corrections, or erasures;

- write letters and numbers legibly;

- make calculations in full rubles, do not indicate kopecks;

- follow rounding rules;

- cross out empty fields;

- use the current form;

- do not adjust the template;

The tax return in question contains 3 sections. The first - the title page - is filled out by all organizations and entrepreneurs. Here the taxpayer's data and the period for which the calculation is submitted are indicated.

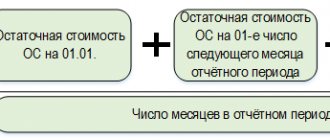

Section 1 reflects the amount of tax that must be transferred to the budget and its BCC. Section 2 shows the procedure for calculating the tax base. Here you need:

- enter the residual value of the property for each month included in the reporting period;

- indicate the average monthly cost of the preferential property;

- calculate the average annual value of property;

- indicate the rate at which the tax is calculated and its amount.

Section 3 deals with the calculation of tax in relation to real estate recorded at cadastral value. Please note that there is a separate sheet for each object.

How to calculate property tax for individual entrepreneurs

If the notification from the Federal Tax Service did not arrive until October of the current year, and the individual entrepreneur knows that he must pay property tax, then it is better to request a second notification yourself. Or at least check whether property taxes are charged or not.

If it seems that there was an error in the tax authority’s notification regarding the payment amount, then it can be double-checked on the Federal Tax Service website. For a clearer understanding of how tax is calculated, consider an example:

IP Ilkov, owns a warehouse in Moscow, in a building under cadastral number 77:09:0001015:1064. When indicating a real estate property in the form, we will select the type - another building, structure, structure. After this, we will indicate that the property is not included in the list of retail and office real estate.

The calculated cadastral value of the property is 78829968.44 rubles according to Rosreestr. The area of the facility is 2029.6 sq. m. If you own a warehouse in the amount of 1/202 of the total area for more than 12 months, zero tax deduction, no benefits and a tax rate of 2%, the tax amount will be 7805 rubles.

This way you can check any object in the Russian Federation. To find the cadastral number, use a public map, where the address will suffice.

Calculation of advance contributions and annual tax amount

We have already noted above the fact that private business entities do not need to independently make such calculations. Representatives of the tax inspectorate independently carry out calculations, after which they send appropriate notifications to businessmen. Such notifications are sent to an email address or account registered on the State Services website.

However, an entrepreneur can make all the necessary calculations, the results of which will be used for personal purposes. The amount of annual payments is determined by multiplying the tax rate by the size of the tax base. In order to calculate the amount of advance payments, you need to multiply the result by 0.25. The funds transferred as an advance payment are deducted from the total amount.

Which entrepreneurs are entitled to benefits?

The amount of property tax for individual entrepreneurs depends on the benefits that the owner is entitled to. They are provided to pensioners, disabled people, and summer residents with a plot of land up to a certain size. Each region itself supplements the federal list of beneficiaries, so it can be many times longer. For example, it may include single-parent or large families. But, in general, the state list of categories of citizens who are entitled to benefits for paying real estate taxes looks like this:

| They don't pay at all | Pay 50% |

| Heroes of the USSR | Owners of dachas up to 50 sq. m. |

| Heroes of the Russian Federation | |

| Holders of the Order of Glory of three degrees | |

| Participants and veterans of the Second World War | |

| Families of fallen soldiers | |

| Retired military personnel | |

| Disabled people from childhood and disabled people from childhood | |

| Liquidators of the Chernobyl Nuclear Power Plant | |

| Afghan warriors | |

| Pensioners by age | |

| Owners of real estate used for creative studios, libraries, museums |

If an individual entrepreneur falls under one of the preferential categories, then he can submit documents to the Federal Tax Service if the amount was incorrectly calculated for him.

The basis for recalculating the amount of property tax may be:

- incorrect information about the owner;

- the billed tax amount, which does not take into account benefits.

When an entrepreneur justifies a mistake, the tax inspectorate:

- will reset the amount and penalties that contained the error;

- will generate a new notification and place it in the taxpayer’s personal account.

If the individual entrepreneur does not use the taxpayer’s personal account as an individual, then he will receive a new notification by mail. According to the legislation, the Federal Tax Service can issue an invoice for payment of property tax to individual taxpayers, if for some reason the payer has not been involved in it earlier, within 3 years. In addition, the tax for the same tax period can be recalculated both downward and upward according to the Tax Code of the Russian Federation.

Calculation of tax payments using the simplified tax system Income minus expenses

For those simplifiers who have chosen this object of taxation, the procedure for reducing tax is different. Insurance premiums paid for oneself do not reduce the calculated tax, but are simply taken into account along with other expenses of the individual entrepreneur.

For example, let’s take an entrepreneur who opened a small retail outlet. His expenses are already significant: purchasing goods, renting premises, transportation costs, etc. The tax rate is standard - 15%.

In the table we will record the income and expenses of individual entrepreneurs by quarter. Contributions paid for yourself quarterly will be indicated separately.

Period

| Income | Expenses, no fees | Paid fees | |

| 1 sq. | 320 000 | 243 000 | 6 500 |

| 2 sq. | 382 000 | 196 000 | 10 000 |

| 3 sq. | 158 000 | 84 000 | 3 000 |

| 4 sq. | 570 000 | 310 000 | 12 885 |

| Total | 1 430 000 | 833 000 | 32 385 |

We calculate advance payments payable:

- for the first quarter – (320,000 – 243,000 – 6,500) * 15% = 10,575 rubles

- for the second quarter – (382,000 – 196,000 – 10,000) * 15% = 26,400 rubles

- for the third quarter – (158,000 – 84,000 – 3,000) * 15% = 10,650 rubles

The calculated taxes for individual entrepreneurs in 2021 from our example will be (1,430,000 – 833,000 – 32,385) * 15% = 84,692 rubles, but of this amount 47,625 rubles have already been paid in advance. You need to pay an additional 37,067 rubles.

But the calculation of the additional insurance premium, which will be paid next year, is based on all income without taking into account expenses, i.e. (1,430,000 – 300,000) * 1% = 11,300 rubles. The injustice of this approach has already been noted by the Supreme Court, but the necessary changes to the Tax Code of the Russian Federation have not yet been made.

Which individual entrepreneurs are required to pay property tax?

An entrepreneur is required to pay tax if two conditions are met:

- He is the owner of the property. If the property is used under a lease agreement, the tenant does not have to pay property taxes.

- The property is located on the territory of the Russian Federation. If the object is located in another country and the individual entrepreneur legally owns it in that state, then he is not obliged to pay tax to the budget of the Russian Federation.

At the same time, an individual entrepreneur pays tax if he works according to OSNO, regardless of the use of property - for personal or business purposes. If the objects are leased, the owner-entrepreneur must also pay tax for them if he works for OSNO, and not the tenant. And even if an entrepreneur gives the property for free use, he will still pay property taxes.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

What types of real estate are eligible for tax deduction?

Private entrepreneurs, like other citizens, can receive a tax deduction for the following types of expenses:

- Standard. They are available to needy citizens upon application or submission of a declaration.

- Social. Given for education or medical services. Sometimes this is compensation for insurance and pension payments.

- Investment. In the form of a financial payment to the account upon the sale of securities that were owned by the individual entrepreneur for more than three years. In this case, there are restrictions on the amount.

- Professional. Related to the receipt of income of an entrepreneur or individual in the amount of documented expenses.

- If it is impossible to confirm expenses, you can exercise your right to a deduction in the amount of 20% of the total amount of income from business activities. This can only be done by persons officially registered as individual entrepreneurs.

- Property. They can be obtained by selling real estate, land and other property.

Individuals can use a professional deduction if the property compensation amount is less and it is possible to confirm expenses.

Tax office: paperwork

Difficulties with processing tax deductions may arise in the following situations: In the absence of documents confirming expenses; Payment made by another person. Using the services of organizations that do not have a license.

In these cases, the possibility of obtaining deductions is minimal.

Comments: 0

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya