All private entrepreneurs and organizations that engage in entrepreneurial activities in one way or another face the need to pay insurance premiums. These could be pension, health or social insurance contributions. The insured is always the employer and it is he who ensures the timely and correct transfer of funds to the insurance fund by filling out payment documents. What role does KBK 39210202101081011160 play in this process? Let’s try to figure it out below.

Services

News by section:02/10/2012KBC for payment of insurance premiums since 2012

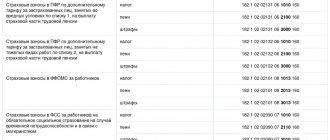

| Code | Name of KBK |

| 39210202010061000160 | insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the insurance part of the labor pension |

| 39210202010062000160 | penalties on insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the insurance part of the labor pension |

| 39210202010063000160 | fines on insurance contributions for compulsory pension insurance, credited to the Pension Fund for payment of the insurance part of the labor pension |

| 39210202020061000160 | insurance premiums for compulsory insurance in the Russian Federation, credited to the Pension Fund for the payment of the funded part of the labor pension |

| 39210202020062000160 | penalties on insurance premiums for compulsory insurance in the Russian Federation, credited to the Pension Fund for the payment of the funded part of the labor pension |

| 39210202020063000160 | fines on insurance premiums for compulsory insurance in the Russian Federation, credited to the Pension Fund for the payment of the funded part of the labor pension |

| for individuals | |

| 39210202100061000160 | insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year for payment of the insurance part of the labor pension |

| 39210202100062000160 | penalties on insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year for payment of the insurance part of the labor pension |

| 39210202110061000160 | insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year for the payment of the funded part of the labor pension |

| 39210202110062000160 | penalties on insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year for the payment of the funded part of the labor pension |

| for legal entities and individuals | |

| 39210202101081011160 | insurance premiums for compulsory health insurance of the working population received from payers |

| 39210202101082011160 | penalties on insurance premiums for compulsory health insurance of the working population received from payers |

Budget classification codes for payment of insurance premiums since 2010

PENSION FUND

| Saffron | Phone Address: Pskov, Yan Fabritsius st. 3 | |||||

| I. Legal entities | |

| Code | Name of KBK |

| 39210202010061000160 | insurance premiums |

| 39210202010062000160 | penalties |

| 39210202010063000160 | fines for compulsory pension insurance, credited to the Pension Fund for payment of the insurance part of the labor pension |

| 39210202020061000160 | insurance premiums |

| 39210202020062000160 | penalties |

| 39210202020063000160 | fines for compulsory pension insurance in the Russian Federation, credited to the Pension Fund for payment of the funded part of the labor pension |

| 39210202080061000160 | insurance premiums |

| 39210202080062000160 | penalties |

| 39210202080063000160 | fines for organizations using the labor of flight crew members of civil aviation aircraft to pay supplements to pensions |

| 39210202041061000160 | Additional contributions to the funded part of the labor pension and employer contributions in favor of insured persons paying additional insurance contributions |

| II. |

Health insurance premiums in 2020

The changes that have occurred with medical insurance premiums for 2021 are as follows:

- A single rate has been established for everyone, equal to 5.1%

- There are no payment thresholds, which means that everyone will be required to pay the contribution

- Medical insurance premiums are transferred to the Federal Tax Service, and payment details will change accordingly.

- Reporting on insurance premiums will also be submitted to the Federal Tax Service on a quarterly basis.

Also, in 2021, the amount of penalties will increase if this contribution is overdue. If the delay period is up to 30 days, then the rate will be equal to 1/300 of the Central Bank refinancing rates. Already starting from 31 days, the rate will be used in the amount of 1/150 of the CBR rate.

New KBK for 2015: listing and decoding

Individuals

CodeName KBK39210202030061000160insurance premiums39210202030062000160penalties39210202030063000160finesin the form of a fixed payment, credited to the Pension Fund for payment of the insurance part of the labor pension39210202040061000160insurance premiums39210202040062000160penalties39210202040063000160fines

in the form of a fixed payment, credited to the Pension Fund for payment of the funded part of the labor pension39210202100061000160insurance premiums39210202100062000160penalties39210202100063000160fines

for compulsory pension insurance in the amount determined based on the cost of the insurance year for payment of the insurance part of the labor pension39210202110061000160insurance premiums39210202110062000160penalties39210202110063000160fines

for compulsory pension insurance in the amount determined based on the cost of the insurance year, penalties, fines for the payment of the funded part of the labor pension39210202041061000160Additional contributions to the funded part of the labor pension and employer contributions in favor of insured persons paying additional payments. insurance premiumsIII. Legal entities and individualsCodeName KBK 39210202100081000160insurance premiums39210202100082000160penalties39210202100083000160fines

for compulsory health insurance in the federal budget of the Compulsory Medical Insurance Fund39210202110091000160insurance premiums39210202110092000160penalties39210202110093000160fines

for compulsory health insurance, to the budgets of territorial compulsory health insurance fundsIV. Penalties, fines CodeName KBK 39211620010060000140Fines

for violation of the legislation of the Russian Federation on state extra-budgetary funds and on specific types of compulsory social insurance, budget legislation39211620050010000140Fines

, imposed by the Pension Fund of the Russian Federation and its territorial ones in accordance with Articles 48-51 of the Federal Law “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds”

SOCIAL INSURANCE FUND

| Contributions to compulsory social insurance in case of temporary disability and in connection with maternity | |

| 393 1 0200 160 | insurance premiums |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

| Contributions for compulsory social insurance against accidents at work and occupational diseases | |

| 393 1 0200 160 | insurance premiums |

| 393 1 0200 160 | penalties |

| 393 1 0200 160 | fines |

Already from the beginning of 2021, new BCC values are in effect when calculating accrued insurance premiums. Let's consider which BCF values have undergone changes. Each accountant is required to know the latest information related to any innovations in the values of budget classification codes in order to avoid errors when transferring contributions to the Funds, which can lead to delays, and, consequently, fines and even major proceedings at the enterprise.

Contributions intended for transfer to the Social Insurance Fund

1. Insurance premiums that are accrued to an employee due to temporary disability and related to maternity:

- contributions - 39310202090071000160;

- penalties - 39310202090072000160;

- fines - 39310202090073000160.

2. Insurance contributions charged for compulsory social insurance in connection with accidents and occupational diseases:

- contributions - 39310202050071000160;

- penalties - 39310202050072000160;

- fines - 39310202050073000160.

Contributions for compulsory health insurance

Imperfect payments

Naturally, since entrepreneurs are required by law to pay fees, there is a possibility that the entrepreneur may be held accountable for non-payment. So, for example, a fine may be imposed for non-payment of contributions - this goes without saying. But few people know that the unpaid amount of the insurance premium, if government authorities believe that the entrepreneur should have paid it, is subject to another type of material penalty, called a penalty.

At the same time, many entrepreneurs, due to inattention or ignorance, transfer the penalty according to the BCC, which is used for the contribution. It is clear that, as in all cases where an incorrect KBK is indicated, the money not only does not flow in the required direction, but also seems to “hang” in the air. Of course, with the help of an application, you can then send the transferred amount towards the next installment, but the penalty still needs to be paid.

To do this, you need to find the correct KBK. There will be a different BCC for each form of payment. Payment details can be:

- Directly upon payment

- When a fine is assessed

- When calculating penalties

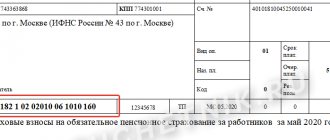

KBC payment of contributions for compulsory pension insurance for legal entities

Contributions to the Federal Compulsory Medical Insurance Fund accrued to the working population:

- contributions – 39210202101081011160;

- penalties – 39210202101082011160;

- fines – 39210202101083011160.

2. Contributions credited until 2012 to the TFOMS, accrued to the working population:

- contributions – 39210202101081012160;

- penalties – 39210202101082012160;

- fines – 39210202101083012160.

Contributions in 2021 to the Pension Fund

The most extensive article concerns contributions to the Pension Insurance Fund, therefore, the changes there will be the most extensive:

1. Compulsory insurance contributions for the payment of the insurance and funded parts of the pension:

- contributions – 39210202010061000160;

- penalties – 39210202010062000160;

- fines – 39210202010063000160.

2. Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for payment of the insurance part of the labor pension (for billing periods expired before January 1, 2013):

- contributions – 39210202100061000160;

- penalties – 39210202100062000160;

- fines – 39210202100063000160.

3. Insurance contributions for compulsory pension insurance in the amount determined based on the cost of the insurance year, credited to the Pension Fund for the payment of the funded part of the labor pension (for billing periods expired before January 1, 2013):

- contributions – 39210202110061000160;

- penalties – 39210202110062000160;

- fines – 39210202110063000160.

4. Insurance contributions for compulsory pension insurance in a fixed amount, credited to the Pension Fund for the payment of the insurance and funded part of the labor pension:

- contributions – 39210202140061000160;

- penalties – 39210202140062000160;

- fines – 39210202140063000160.

Decoding income items for the estimate

| Decoding of income items for 2018-2019. | ||||||||||||

| Nn/n | Name of income | price (rub, kopecks) per unit area | Amount per month (RUB) | Period | Amount per year (RUB) | |||||||

| 1. | Maintenance of housing per sq.m. | |||||||||||

| * 33341.6 sq.m. x 12.93 rub. | 12,93 | 431 107 | 12 months | 5 173 283 | ||||||||

| 2. | Current repairs with sq.m.. | |||||||||||

| * 33341.6 sq.m. x 5.07 rub. | 5,07 | 169 042 | 12 months | 2 028 503 | ||||||||

| 3. | Payment for HOA services for the maintenance of common property and management of apartment buildings under an agreement with ZAO NZhS-2 (block 5 of the housing section), including: | 94 502 | 12 months | 1 134 027 | ||||||||

| 3.1 | Housing maintenance | 82 744 | 12 months | 992 926 | ||||||||

| 3.2 | Maintenance | 11 758 | 12 months | 141 102 | ||||||||

| 4. | Income from leasing MKD structures for advertising | 500 | 66 600 | 12 months | 796 254 | |||||||

| 5. | Other income | 311 053 | 4 535 428 | |||||||||

| 5.1 | Income from leasing structures and space for placing telecommunications equipment and HVAC: 1) Zap-SibTranstelecom CJSC - 3250.00; 2) JSC "Teleconnect" - 1200.00; 3) MegaCom LLC - 3000.00; 4) Novotelecom LLC - 2200.00; 5) PJSC Rostelecom - 4000.00 | 13 650 | 12 months | 163 800 | ||||||||

| 5.2.1 | 33341.6 sq.m x 2.09 rub. | 2,09 | 69 726 | 12 months | 836 712 | |||||||

| 5.2.2 | Territory control post services paid for by JSC NZhS-2 5 block section - 5682.6 sq.m x 2.09 rub. | 2,09 | 11 877 | 12 months | 142 524 | |||||||

| 5.3 | Maintenance and operation of elevators per sq.m. (33341.6 sq.m. x 1.31 rub.) | 1,31 | 43 677 | 12 months | 524 124 | |||||||

| 5.4.1 | Payment for services for maintaining a watch - 24753.4 sq.m x 5.80 rubles. | 5,80 | 143 570 | 12 months | 1 722 836 | |||||||

| 5.4.2 | Payment for watch maintenance services (video surveillance) - 4636 sq.m x 2.85 rubles (3rd and 4th entrances) | 2,85 | 13 213 | 12 months | 158 556 | |||||||

| 5.5 | Solid waste removal - 39024.5 sq.m x 1.36 rubles | 1,36 | 53 073 | 12 months | 636 876 | |||||||

| 5.6 | Other income penalties, bank interest, etc. | 29 167 | 12 months | 350 000 | ||||||||

| * area of premises excluding the area of apartments in the 5th block section (6th entrance, property of JSC NZhS-2″) | ||||||||||||

| 13 667 495 | ||||||||||||

| Chief accountant Gustova L.Yu. | ||||||||||||

| 03.09.2018 | ||||||||||||