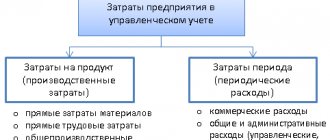

The moment of its write-off depends on whether the expense is direct or indirect. You can write off indirect expenses in the period to which they relate, and direct expenses - in the period of sales of products (goods), in the cost of which the expenses are taken into account. You can write off direct expenses without waiting for the sale of services if you provide services. The composition of direct costs in manufacturing and trade differs. You determine the specific list yourself, taking into account the general rules. Thus, direct production costs may include, in particular, costs for raw materials and materials, amounts of accrued depreciation, and labor costs. Direct costs in trade include the cost of purchasing goods and transportation costs. Indirect expenses are expenses that are not included in direct and non-operating expenses.

What expenses are considered direct?

Art. 318 of the Tax Code classifies as direct expenses:

- Costs incurred by an enterprise in the acquisition of materials and raw materials that are used in the production of goods, as well as in the implementation of work or provision of services.

- Costs incurred by an enterprise when purchasing components for installation or semi-finished products for additional processing.

- Expenses for remuneration of employees of an enterprise involved in the production of goods, provision of services or performance of work. This category also includes expenses for compulsory pension insurance, insurance in case of temporary disability, medical insurance, social insurance against occupational diseases and accidents, and financing the funded part of the pension. The listed expenses must necessarily be accrued for the wages of workers involved in the production of goods (performance of work, provision of services). Only in this case can they be taken into account when determining income tax.

- Amounts accrued for depreciation of fixed assets, if they are used in the production of goods, performance of work or provision of services.

The list of direct expenses is open. The taxpayer has the right to independently determine his own list of direct expenses, which differs from the list from Art. 318 Tax Code of the Russian Federation. At the same time, the Ministry of Finance of the Russian Federation draws attention to the fact that the list of direct expenses determined by the taxpayer must be justified by the technological process. The judges of the Arbitration Court of the Far Eastern District share the same opinion (see resolution dated August 1, 2017 No. F03-2571/2017 in case No. A04-10568/2016. By decision of the Supreme Court of the Russian Federation dated November 24, 2017 No. 303-KG17-17016, transfer was denied case No. A04-10568/2016 to the judicial panel for economic disputes of the Supreme Court of the Russian Federation for review of this decision in cassation proceedings).

IMPORTANT! When accepting expenses to reduce the tax base for income tax, it is very important to comply with the provisions of Art. 252 of the Tax Code of the Russian Federation, according to which all expenses must be documented and economically justified.

At the same time, officials emphasize that indirect costs can include costs associated with the production of goods (works, services), only if there is no real possibility of classifying these costs as direct costs (letter of the Ministry of Finance of the Russian Federation dated March 13, 2017 No. 03-03-06/1 /13785). This point of view is shared by the arbitrators (see the decisions of the Arbitration Court of the Western Siberian District dated 08/21/2017 No. F04-3174/2017 in case No. A27-19836/2016, the Arbitration Court of the Far Eastern District dated 08/01/2017 No. F03-2571/2017 in case No. A04-10568/2016, Arbitration Court of the Moscow District dated 06/05/2017 No. F05-7067/2017 in case No. A40-136716/2016).

The list of direct expenses for tax purposes must be approved in the accounting policy for tax purposes (paragraph 10, clause 1, article 318 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 02/21/2018 No. 03-07-07/11012, dated 03/13/2017 No. 03 -03-06/1/13785, dated 02/07/2011 No. 03-03-06/1/79 and Federal Tax Service of Russia for Moscow dated 02/02/2010 No. 16-12/ [email protected] ).

If you have access to ConsultantPlus, check whether you correctly divide costs into direct and indirect when calculating taxable profit. If you don't have access, get a free trial of online legal access.

See also the material “List of direct income tax expenses”.

General procedure for accounting for direct expenses

For direct income tax expenses, there is a special accounting procedure provided for by the Tax Code of the Russian Federation.

The essence of direct expenses is that they are taken into account only in the part attributable to goods, work, services or products after processing, sold in the current tax or reporting period (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation). This statement is explained, in addition, in letters of the Ministry of Finance of Russia dated July 20, 2017 No. 03-03-06/1/46286, dated October 31, 2016 No. 03-02-07/1/63462, dated June 9, 2009 No. 03-03- 06/1/382, dated December 8, 2006 No. 03-03-04/1/821, as well as the Federal Tax Service of Russia for Moscow dated May 18, 2010 No. 16-15/ [email protected]

It is separately stated that such expenses must be written off in the period when the products are sold, even if the funds to pay for them were received in the next tax period. Confirmation of this can be found in the resolution of the Federal Antimonopoly Service of the West Siberian District dated June 15, 2011 No. A45-12953/2010.

Direct costs and service sector

If the organization’s activities are related to the provision of services, then, according to paragraph. 3 p. 2 art. 318 of the Tax Code of the Russian Federation, such taxpayers are allowed to reduce income from sales by the entire amount of direct costs of the tax or reporting period (letters of the Ministry of Finance of Russia dated June 15, 2011 No. 03-03-06/1/348, dated August 31, 2009 No. 03-03-06/ 1/557). There are also court decisions on this matter, for example, the resolution of the Federal Antimonopoly Service of the West Siberian District dated August 27, 2013 No. A27-19013/2012. It also states that it is not necessary to establish such an accounting procedure in the accounting policy, since it is provided for by the Tax Code of the Russian Federation. However, it is better to reflect this in the appropriate document, which will avoid unnecessary explanations.

Works in accordance with clause 4 of Art. 38 of the Tax Code of the Russian Federation, like goods and products, differ from services in that they have a material expression and can be sold in the literal sense (for example, a constructed building, a completed project, etc.). Services do not have a material appearance (Clause 5, Article 38 of the Tax Code of the Russian Federation).

Example

Development of design documentation in accordance with Art. 758 of the Civil Code of the Russian Federation, should be classified as activities related to the performance of contract work. This means that income cannot be reduced at a time by the entire amount of direct expenses, but such expenses must be distributed among work in progress. This is what the letter of the Russian Ministry of Finance dated February 22, 2007 No. 03-03-06/1/114 aims at.

General construction costs, which include the maintenance of the construction site, including security of the village, cleaning the territory, renting equipment, temporary power supply, design and construction of temporary roads, standard design of residential buildings, development and approval of documentation for planning and land surveying of the territory, and other work, are an integral part of the construction costs. They should be considered as direct expenses of the construction company.

This conclusion was reached by the Arbitration Court of the Moscow District in its ruling dated June 5, 2017 No. F05-7067/2017 in case No. A40-136716/2016. By ruling of the Supreme Court of the Russian Federation dated September 27, 2017 No. 305-KG17-13063, the transfer of case No. A40-136716/2016 to the judicial panel for economic disputes of the Supreme Court of the Russian Federation for review of this decision in cassation proceedings was refused. But the audit applies, according to clause 2 of Art. 779 of the Civil Code of the Russian Federation, at your service. Therefore, an organization operating in this area has the right to reduce the income of the reporting period at a time by the entire amount of direct expenses. Confirmation of this thesis can be found in the letter of the Ministry of Finance of Russia dated June 15, 2011 No. 03-03-06/1/348.

If the taxpayer combines the provision of services with production or performance of work, then in full he has the right to attribute only those related to services to expenses of the reporting period (letter of the Ministry of Finance of Russia dated September 11, 2009 No. 03-03-06/4/77).

Let's summarize. And tips:

- Review your expenses for “direct” and “indirect”. Fix these lists in your accounting policies. References to Articles 318 and 320 of the Tax Code are not enough.

- Make a justification taking into account the specifics of the production process and technological features. It is better to involve “narrow” experts, whose opinions are difficult to challenge. Prove that the issue of cost distribution is not new to you, everything has been thought out, and taking into account and distributing costs - everything is ok!

- Conduct an examination of your contracts for the types of activities of your company - do you correctly determine the nature of the company’s activities as a service? What result of the contract do you convey to the customer? Should you leave the “work in progress” at the end of the reporting period? Once again, study the Resolution of the Administrative Court of the East Siberian District of August 27, 2018 N F02-3834/2018 in case N A19-17641/2017, which was supported by the Supreme Court.

The subject of the contract—“provision of information services”—is a broad and often abstract formulation. Please note - how is the result of the contract executed? The seismic exploration company also considered its work to be information services. But the tax authorities and the court decided otherwise: the results of the work - diagrams, designs, plans, projects, approvals - have a material expression. And these are not services.

Don't take risks. Do not ignore the division of costs into direct and indirect.

Learn from other people's mistakes and be careful.

How to correctly distribute direct costs for products sold

To accurately determine the part of direct expenses that must be attributed to sold products, you should isolate the direct expenses for the month attributable to:

- For the remains of unfinished production.

- Remains of products shipped but not sold at the end of the month.

- Remaining products in warehouse.

The amounts of direct expenses that occurred in the current period on all these balances do not need to be taken into account in reducing the tax base for this period.

EXAMPLE of calculating WIP balances when producing products from ConsultantPlus: For tax purposes, the accounting policy of Legprom LLC states: “1. Direct costs are: the cost of raw materials and basic materials used in the production of products; remuneration of key production workers; insurance premiums from the wages of key production workers; depreciation of production equipment. The remaining costs are indirect. 2. To distribute direct costs to the balance of work in progress, it is determined... View the full example of the calculation.

If an organization decides to change the list of direct expenses, then it must make a change to the accounting policy from the beginning of the new tax period (paragraph 6 of Article 313, paragraph 10 of paragraph 1 of Article 318 of the Tax Code of the Russian Federation).

About the situation when the tax inspectorate may challenge the list of direct and indirect costs given in the accounting policy, read the material “Rent of industrial premises may not be recognized as an indirect expense .

As a result, from the beginning of a new reporting or tax period, certain income tax expenses will move from the category of direct to the category of indirect expenses.

However, at the end of the last tax period, direct costs attributable to unsold products and work in progress were not taken into account. The Ministry of Finance of Russia in letters dated 09.15.2010 No. 03-03-06/1/588, dated 05.20.2010 No. 03-03-06/1/336 recommends that they be taken into account in the new tax period as goods or work are sold. It will now be possible to recognize at a time only those expenses that have been incurred since the beginning of the new period.

However, in judicial practice there is also a different opinion. As an example, we can cite the situation that was considered by the FAS of the East Siberian District (resolution dated 02/03/2011 No. A78-901/2010). The essence of the matter is that in the first quarter, when calculating the income tax base, the organization took into account expenses that had previously been classified as direct in full.

Tax inspectors perceived this action as a violation, indicating in the inspection report that since the expenses were incurred in the previous tax period, they should be attributed to them. And the taxpayer had no right to write them off as indirect expenses at a time. Nevertheless, the arbitration court sided with the organization and recognized the one-time inclusion of these costs in the income tax base as legitimate. A similar position of the court is contained in the decisions of the Federal Antimonopoly Service of the Far Eastern District dated May 27, 2011 No. F03-1824/2011 and dated December 25, 2009 No. A27-671/2009.

Indirect income tax expenses: list

In accounting, indirect expenses include general production and general business expenses, i.e., expenses associated with the production of different types of products that support the activities of the organization as a whole. In this regard, when calculating the cost, they need to be distributed. The basis for the distribution of indirect costs in accounting is established by the organization independently in its accounting policies.

How to reflect indirect costs in accounting policies, see the article “Reflection of indirect costs in accounting policies - sample.”

List of indirect costs

The list of indirect costs of the company is recorded in the accounting policy and consists of costs that could not be defined as direct or non-operating. They are taken into account in the cost of the finished product according to a pre-approved proportion. The list of indirect costs includes:

- costs of selling goods;

- payment for services of third-party firms - accounting, consulting, legal, etc.;

- rent for general business premises;

- deductions for depreciation and repair of fixed assets intended for general economic and administrative needs.

Indirect expenses: what applies to them in tax accounting

In Art. 318 of the Tax Code, indirect expenses include all expenses except direct and non-operating ones. That is, if direct costs, the list of which must be given in the accounting policy, are excluded from production and sales costs, then indirect costs for income tax remain, the list of which is open. Indirect costs include costs for repairs, development of natural resources, R&D, property insurance, as well as other costs associated with production and sales. The composition of indirect costs for each organization will depend on the operations performed. Indirect expenses should be classified as expenses of the current tax or reporting period. This is the aim of the letter of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/182, based, in turn, on the provisions of paragraph 2 of Art. 318 Tax Code of the Russian Federation.

Example

The company has a confectionery shop, which allows it to produce and sell relevant products. If the products are not sold, then, according to the contract, they are returned and processed as raw materials. In such circumstances, direct costs of processing confectionery products should be recognized in the period in which the finished products made from processed raw materials are sold.

In tax accounting, indirect expenses are not distributed. But there is an exception to this rule: the distribution of indirect costs is made if they relate to several reporting periods. At the same time, there are indirect income tax expenses, the list of which is given below and which in tax accounting are attributed to the reduction of the tax base not at the time of occurrence, but according to a special algorithm. Such expenses, in particular, include:

- R&D expenses (Article 262 of the Tax Code of the Russian Federation);

- insurance costs (clause 6 of Article 272 of the Tax Code of the Russian Federation);

- entertainment expenses (clause 2 of article 264 of the Tax Code of the Russian Federation);

- advertising expenses (clause 4 of article 264 of the Tax Code of the Russian Federation).

ConsultantPlus has a test, by answering the questions of which you will refresh your knowledge on the topic and be able to reasonably defend the correctness of income tax calculations in the event of disputes with tax authorities. Get trial access to the K+ system and start testing for free.

Are you sure you don’t need to split the costs?

The issue of dividing costs into direct and indirect ones was also raised in the case in which the Supreme Court ruled on December 21, 2021 No. 302-KG18-21175.

During the audit, the tax authorities reduced the loss and assessed additional income tax due to the lack of division of expenses into direct and indirect. But there was another problem in this case - the re-qualification of the nature of the company's activities.

The essence of the dispute: The company performing seismic survey work regarded its activities as the provision of services. And all expenses - for profit tax purposes - were recognized immediately - in the period when they arose.

The tax office insisted on reclassifying the nature of the activity as “work”), highlighting direct and indirect expenses.

In accordance with paragraph 4 of Article 38 of the Tax Code, work for tax purposes is recognized as activity whose results have a material expression and can be implemented to meet the needs of an organization and (or) individuals. A service is recognized as an activity, the results of which do not have material expression, are sold and consumed in the process of carrying out this activity (clause 5 of Article 38 of the Tax Code.

The court agreed with the tax authorities' arguments:

Tax legislation does not contain an exact list of activities that are classified as works and which are classified as services. The decisive factor is the achievement of results in material terms.

From the controversial contracts for seismic exploration work and acceptance certificates, it was clear that the contractor transferred to the customer the result of seismic exploration work, which consisted of seismograms, 3D diagrams and reports on paper and electronic media.

The courts have recognized that the result of seismic exploration has a material expression, since it is transferred to the customer in paper and electronic form. The purpose of concluding contracts is for the customer to obtain a result, expressed in the transfer of relevant documentation.

Therefore, the controversial activity is recognized as work. This is not a service. And recognizing expenses in full for profit tax purposes—without taking into account “incomplete”—is illegal.

From the definition of the Supreme Court and the decisions it reviewed, it is indicative: the courts support the approach of tax authorities to the distribution of costs into direct and indirect. And they confirm the reclassification of the nature of the activity into “work”.

Results

The taxpayer determines the list of direct expenses independently based on the specifics of his technological process. Costs related to production and sales are classified as indirect costs only if there is no real possibility of classifying them as direct costs.

Errors in the distribution of expenses between direct and indirect lead to distortion (most often understatement) of the tax base, the accrual of fines and penalties.

Therefore, any expense for the purpose of calculating income tax must not only be tested for compliance with Art. 252 of the Tax Code of the Russian Federation, but also to classify correctly. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Filling your budget in any way

The tax office faces the task of replenishing the budget. And in recent years, tax authorities have succeeded in many ways. The information resource of the Federal Tax Service – on gaps and inconsistencies – catches “fly-by-night” documents, paper VAT, and unrealistic transactions. Schemes with business fragmentation are revealed along the tree of connections.

By and large, all these inept optimization techniques lie on the surface and are easily read by the Federal Tax Service algorithms.

And even if you don’t work with one-day businesses, have eliminated paper VAT and don’t split your business, this does not mean that you are “in the dark” and are not afraid of an audit. Of course, you are a great fellow if you abandoned vicious schemes.

But the treasury must be filled. And the tax office will be looking for new ways to do this. Using an in-depth dive into tax law. And not only tax. And due to the ambiguities of legal norms. And due to mistakes.

It is possible that accountants “clicking a button” will have to study the methodology for calculating taxes, study the Tax Code and dig up judicial practice.

One of the illustrative issues that will require delving into the accounting methodology is the distribution of expenses into direct and indirect.