The tax base of the transport tax is one of the components of the formula for calculating this type of state duty. It largely determines the amount of tax. If individuals do not have to worry about finding transport tax, then with organizations and enterprises things are somewhat different.

Legal entities bear full responsibility not only for the timely payment of the state duty, but also for its accurate calculation.

Often, some of them have questions regarding the formula for finding the tax. This article will examine in more detail such a component of this formula as the transport tax base.

Tax base for transport tax

The tax base is considered as the main component of the formula used to establish the size of the fiscal payment.

The tax system reflects different concepts, including base and object. Citizens often use incorrect meanings of these terms. It is important to distinguish between them, since the base is the main element for finding the tax amount. For many types of property, market value is used as a basis. The object must be understood as the property for which the tax is paid. In the case of transport fees, the objects are vehicles. Depending on the type of car, a base is installed.

It is important to note that the car must be registered to a specific citizen. When setting the base, the power of the motor is taken into account. The measurement is in horsepower.

Nuances of the tax period for legal entities

The Tax Code as a whole contains for legal entities exactly the same procedure for calculating the tax period as for ordinary citizens. However, the law provides for a number of cases when it can be reduced. This happens when a company is created after January 1, as well as when it is liquidated or reorganized during the year.

The procedure for calculating the period for which you will have to report is established by Article 55 of the Tax Code.

Shortened tax period

Here's how to calculate the shortened forty payments for a car when registering, reorganizing and liquidating a legal entity in the middle of the year:

- If a company was registered from January 1 to November 30 , then it will have to report for the period of time from the moment of its creation to December 31 of the year of its creation;

- If a legal entity was created at the end of the year , in December, then the time for calculating the contribution to the budget for it is from the date of registration until the end of December;

- When reorganizing or liquidating a company, tax reporting is submitted from the beginning of the calendar year until the date of termination of its existence;

- If an organization is registered later than January 1 , and then immediately reorganized or liquidated before the end of the year, the calculation period is the period of time between the establishment and the entry of liquidation into the register of legal entities.

How is the tax base for transport tax determined?

Not in all cases, engine power affects the determination of the base for fiscal payments. This indicates the need to take into account other indicators. Most often, there is no need to calculate the value in question. This is due to the fact that at car manufacturing plants, the documentation initially indicates the parameters that are important when determining the base.

Vehicle with engine

The motor is the main indicator of the category

The main group are those that have a motor. In this regard, the basis for them is established based on an assessment of the power of a given unit. It is important to note that the measurement is only in horsepower. Other indicators cannot be used.

This category includes:

- passenger cars;

- motorbike;

- bus and so on.

The exceptions are devices used to move in airspace. These funds are classified in another group.

Air vehicles

The next category is represented by aircraft. In their design, a motor is a mandatory element. However, when setting the size of the base, the thrust of the jet motor is used. This value has a static expression.

The measurement of the indicator in question occurs during takeoffs. It is set as kilograms of force. This group will include helicopters and other vehicles moving in the airspace.

Water towed vehicles

Another group is represented by water vehicles. They cannot be classified as self-propelled vehicles. When establishing the base, gross tonnage is used. The indicated figure is determined in tons. You can find the value in the technical documentation for a specific type of product. In this case, the category is not important.

Unclassified vehicles

There are funds that cannot be classified into a certain category. Their device may or may not have a motor. To establish the base, a unit of such funds is taken into account.

For which vehicles do you not need to pay tax?

Wheelchairs are not taxed

It is important to take into account that there are devices for the use of which you do not need to make fiscal payments. This suggests that establishing a tax base will also not be required. These include:

- devices that are used to move through water and are not equipped with motors or are not equipped with them (the power limit is set to no more than 5 horses);

- passenger cars with a capacity not exceeding 100 units;

- means of transportation for the disabled;

- machines used for the purpose of passenger transportation.

In addition, this includes devices used in agricultural activities. If the car is stolen, then the fiscal payment will not be charged. Also included in this category are cars used in military units.

When the price of a vehicle is 3 million rubles

Separate conditions for determining the amount of tax are established for transport, the cost of which is 3 million rubles. The calculation of the tax base in this case is carried out taking into account the increasing coefficients of clause 2 of Art. 362 of the Tax Code of the Russian Federation for each group of equipment. The size of the coefficients is set taking into account the average cost and service life of transport. The average cost, as well as the list of expensive cars, is approved by law and is contained in the list of regulatory act No. 316 dated February 28, 2014. This list is updated annually with car models, irrelevant information is excluded from it, and to accurately determine the tax base, you should check the current list on the website Ministry at: minpromtorg.gov.ru.

| applied coefficient | Average cost of a vehicle unit | Number of years preceding the year of issue |

| 1,1 | from 3 million to 5 million rubles. inclusive | from 2 to 3 years |

| 1,3 | from 1 year to 2 years | |

| 1,5 | no more than 1 year | |

| 2 | from 5 million to 10 million rubles. inclusive | no more than 5 years |

| 3 | from 10 million to 15 million rubles. inclusive | no more than 10 years |

| 3 | from 15 million rubles | no more than 20 years |

Other conditions for calculating tax and advance payments on equipment remain similar to those used in determining the tax base for ordinary movable property.

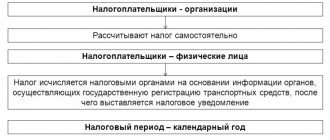

Payers of transport tax and the basic principles of its calculation

Transport payments - regional fees

The fiscal tax is classified as regional. The obligation to pay falls on citizens and organizations. The main condition is the existence of legal ownership of the transport. Company representatives have the obligation to independently calculate and make these payments. For citizens, settlement transactions are carried out by employees of fiscal authorities. The receipt is generated on the basis of data provided by the registration authorities.

The principles include:

- when calculating the tax payment, the base multiplied by the rate is taken into account (other rules are sometimes reflected in the Tax Code of the Russian Federation);

- advance payments are determined every reporting period (a quarter of the base is taken and multiplied by the rate);

- if a tax calculation is necessary for an enterprise, then it is enough to calculate the difference between the amount established for the year and the advance payments made (the law does not provide that citizens must make such contributions);

- Organizations have the right not to pay advance payments for cars that have a permissible weight of more than 12 tons.

In addition, if the vehicle has a high cost, the total amount is calculated taking into account multiplying factors. It is determined based on the price of the car and the number of years that have passed since the car was produced.

Recognition of the amount of tax payable, calculation conditions

The tax base, like the tax itself, is calculated for each piece of equipment separately. To calculate the tax amount you need to take into account:

- Length of equipment ownership period in months;

- Power of the vehicle object (in units of measurement established for each type of equipment);

- Age of the vehicle (lifetime).

The final amount of the amount payable is determined as the product of the indicators:

STN = NB x TsN, namely

STN – amount of transport tax payable;

NB – tax base (engine power, etc.);

ТсН – tariff tax rate.

Advance payments for legal entities are calculated and paid quarterly and amount to ¼ of the total tax for the reporting period. The final amount for calculating this tax according to the Tax Code of the Russian Federation is rounded to full rubles in this way: if the kopecks amounted to less than 50, then they are discarded. And when the value of kopecks is more than 50, rounding is carried out upward.

For equipment owners who are individuals, the tax amount is calculated by tax officials. In such cases, reporting is not required. For legal entities, the deadlines are determined by law according to the Tax Code, but regions have the right to set their own dates for payment and reporting.

Object and tax rate

Payment object - vehicle

An object is understood as a vehicle that has undergone the registration process and at the same time complies with the requirements reflected in legal acts. For example, if the car is registered to the father, and the son drives it, the father is obliged to pay. When the right of ownership is with the organization, and the car is used for the personal purposes of the manager, the company pays.

Local authorities are in charge of approving rates in specific regions. They change depending on certain indicators. Including:

- motor power;

- the period during which the product is used;

- its gross tonnage;

- vehicle categories.

It is permissible to adjust the rate no more than 10 times. This ratio is related to the indicator reflected in the Tax Code of the Russian Federation.

Privileges

All organizations that own vehicles are required to pay for their ownership. As with all rules, there was an exception to this. It became FIFA - a football organization, as well as its subsidiaries.

In 2021, the world football championship was organized in Russia, and the companies involved in its organization were exempt from the tax burden:

- "Russia-2018" is the organizing body;

- national level football companies.

Machines directly involved in the preparation and holding of the 2021 football championship were exempt from tax deductions.

In addition to football, benefits are given to vehicles that are allowed to transport cargo weighing more than 12 tons. The calculated advance payments are not paid for them. Such vehicles are forced to pay for travel on the highways, so they were charged double payment for damage to the roadway.

They also do not pay tax on stolen cars - only this will have to be documented annually. Plus, they will stop calculating tax from the day when the payer - no matter whether an individual or a legal entity - submitted a corresponding application and a certificate from the Ministry of Internal Affairs to the Federal Tax Service, and not from the moment of the fact of theft.

The following are not subject to taxation:

- boats with less than 5 liters. With.;

- passenger vehicles owned by disabled people;

- agricultural machinery;

- vehicles of executive authorities, where legislation provides for the deployment of military service or an equivalent unit.

The procedure for providing tax breaks to socially vulnerable and other categories of citizens is determined at the local level, but with an eye to federal legislation.

Often they include heroes of military or labor glory, pensioners and people with disabilities. They may have their property tax completely abolished or the rate reduced.

How can you reduce transport tax?

Local authorities have the power to reduce the amount of tax payment. This is expressed in different behaviors:

- the company pays tax in an amount similar to that of citizens (the Supreme Arbitration Court explained in this situation that calculations are made depending on the properties of the car, and not the owner);

- to reduce the size of the fiscal payment, it is permissible to purchase a vehicle with less power;

- register in the entity where a lower rate is used.

In addition, the payment amount can be reduced if the owner is a person under the age of majority.

Tax benefits

Citizens can receive tax benefits

From the beginning of 2021, companies owning vehicles are required to submit to the fiscal authority an application for the use of benefits in the area in question. They will also need to document their eligibility to use the exemptions.

If such papers are not submitted, employees of the fiscal authority independently make inquiries and confirm the information reflected in the application.

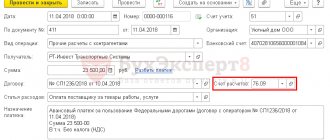

Procedure for calculating and paying tax

Regional authorities are establishing periods and procedures for making tax payments. This is due to the fact that the tax in question falls within their competence. The federal law reflects that such a period cannot be set earlier than the beginning of February of the year following the previous tax period.

Enterprises are responsible for independently calculating the payment amount. Firms submit declarations to the tax authorities, based on which a conclusion is drawn about the correctness of the contributions paid. Starting from 2021, this obligation will be abolished and there will be no need to submit declarations.

If the cost of the car exceeds three million, then a multiplying factor is used in the calculations.

Who determines the amount of deductions

There is a Tax Code (abbreviated as TC) of the Russian Federation, it states who is responsible for replenishing the public treasury. Among the many types of deductions, money is collected from citizens who own vehicles for damage to the road surface or, if we are talking, for example, about ships, for harm to the ecology of the aquatic environment, etc. The owner will have to add a special coefficient to the payment amount if he owns a very expensive vehicle classified as a luxury item. There are rules that are common to everyone and apply at the federal level.

There are “local” subjects of the Russian Federation - at the level of regional authorities they decide:

- what will be the tax rate by type and capacity of transport;

- when the tax must be paid;

- how payment is made;

- who has tax benefits and how they are applied.

The Federal Tax Code dictates rules to the regions regarding the size of the rate - it cannot diverge by more than 10 times from the specified national level.

After the end of the billing period, a calculation is made. Each category has its own time limits - from one month to a longer period - a year. There have been no changes in the calculation of transport tax for a long time. The tax period is one year, determined by the calendar.

At the general level, there is a tax period for transport tax - federal legislation is the same for each region. All information about the measures taken can be found on the local Internet resource. As a rule, regions also prescribe for what period the transport tax is paid, but they must adhere to the general laws of the Russian Federation.

The differences lie in advance payments - they must be paid for the first three quarters, and then payments for them are deducted from the final tax amount. From a legal point of view, regional legislation must follow the standards prescribed at the federal level. The region has the right to shift the payment acceptance deadlines, but not downwards. When conducting accounting, it is necessary to look at what is prescribed in regional legislation.

Payments of this kind are calculated where the company that owns the transport is registered or where its divisions are located.