Write-off of administrative and commercial expenses to cost price

Write-off of administrative and commercial expenses occurs through the 90th account as follows:

- Dt 90 subaccount “Administrative expenses” Kt 26;

- Dt 90 subaccount “Business expenses” Kt 44.

Let's dwell on the choice of method for writing off expenses from the 26th account.

An organization can choose and record in its accounting policy one of 2 methods of writing off to the following accounts:

- 20 (23, 29);

- 90.

With method 1, general business expenses participate in the formation of the full cost of finished products, ending up in cost accounts in full at the end of the month. They can be distributed between main, auxiliary and service industries, as well as between types of products. In the future, from the 20th (23rd, 29th) account, these expenses will go to the finished product accounts and will be written off in proportion to the volume of products sold to the cost price.

With the 2nd method, the financial result includes the entire amount of general business expenses incurred during the month, without being distributed between the products sold and those remaining in the warehouse. The 2nd method makes it much easier to write off expenses from the 26th account, and also increases expenses, reducing profits. The organization must describe the choice of method for writing off general business expenses in its accounting policy.

The chart of accounts does not allow you to choose which account to write off sales expenses to - only to the 90th one. However, the organization can choose whether to write them off completely or partially. Partial write-off implies a monthly distribution between goods sold and those remaining in the warehouse:

- for manufacturing companies - packaging and delivery costs;

- for trading companies - delivery costs.

Other items of selling expenses are written off in full.

Read about the distribution of delivery costs in the article “How to correctly calculate transport costs (nuances)?”

We launch the “closing the month” procedure

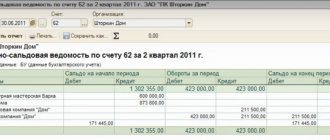

Let's see how our turnover has changed.

I'll comment a little

.

Look, account 26 at the end of the month was “closed” - it became 0. This is good. Here's a log of the wiring showing how it happened.

As we can see, expense accounts “transfer” their accumulated amounts from their Credit to Debit account to the financial result account.

Remember the financial result formula? What accounts are involved?

So, Debit 90 and 91 accounts collect the expenses of our company for the current month. Now we can calculate the financial result for each of them. Calculating the financial result is some kind of action on 90, 91 accounts. As you remember, accounts 90 and 91 after summing up the financial result should be equal to 0. And the final result of financial activity will be on account 99.

Zero balances for accounts 90 and 91 should be for the account as a whole. Sub-accounts of these accounts will have balances until December 31, pending the procedure - balance reformation. But more on that later.

This is how the situation looks in our SALT for accounts 90, 91 and 99. This situation arises after the “transfer” of expenses to account 90, BUT

until closing 90, 91.

Look, I have highlighted key accounts from the entire SALT to show the intermediate stage of “closing the month”. We see that account 26 has been closed: its balances are zero. And, in our case, the amount of account 26 was displayed in the Debit of account 90.

In our example, the company has only account 26. If there were an account 44, it would also be closed and the amount from it would go to the Debit of account 90.

Thus, Debit 90 of account collects amounts from the company’s expense accounts, plus accumulates the cost of goods sold and products. Cost, as you understand, is available to manufacturing and trading companies. For us, only accumulated expenses from account 26.

Now we see that on accounts 90 and 91 different amounts were formed for Debit Turnover (DO) and Credit Turnover (CR). It turns out that for each of these accounts there is a final balance: 1705778.54 and 11374.53.

Now it doesn’t make much difference for us where this balance is - in Debit or Credit. Only one thing is important to us:

Closing accounts 90 and 91 implies such actions so that the balance turns to zero. Those. we must make such entries for each account in correspondence with 99 so that our numbers - 1705778.54 and 11374.53 - go away. Those. the remainder would become zero. This is the rule for closing a total of 90 and 91 accounts - the balance on them should be zero.

And in order for the balances to become zero, we must transfer the existing differences between DO and KO (these are final balances) by posting to account 99. In other words, for account 90 we will “add” 1705778.54 to Debit. — for 91 accounts we will “add” 11374.53 to the Credit

The following report shows how we “add the necessary numbers” through postings, thereby closing accounts 90 and 91. The closure of these accounts will be correct if, after that, their balances at the end of the period (month) become 0.

As you can see, the closure of accounts 90 and 91 goes through their internal subaccounts 90.9 and 91.9 in correspondence with account 99. Where 90.9 (91.9) will appear in the Debit or Credit entry depends on where there are not enough amounts so that the account at the end of the period gives 0.

Conclusion

Now we have looked at the very, very, very simple option of what “turnover” looks like and the principle of “closing the month” for companies providing services.

For trading organizations, SALT looks somewhat different. For example

, we will see 41 and 44 counts. For production ones it will be 20, 25, 40, 43, 44.

All businesses can have 76 and 73 accounts.

In addition, many enterprises have 01 accounts with their own 02 and 08 auxiliary accounts.

All this diversity is not as complicated as it seems at first glance.

Whatever accounting accounts you have to deal with in accounting, everything will come into “turnover”, where it will be necessary to take the amounts from all accounting accounts of Expenses and “move” them to accounts 90 and 91. Then from accounts 90 and 91, move the resulting balances to account 99. And so on every month until December. In December, there will be another operation called “balance sheet reform” at the “closing of the month.”

For the “closing the month” process, there is some more basic knowledge that affects the rules for transferring amounts to account 90. We look at all this in practical classes and learn how to solve such accounting situations from the event to the end of the month.

Addition

The article raised questions, which was expected. Accounting is not a difficult subject, but all its numbers and rules make it difficult, confusing and confusing. The first questions showed that more clarification should be given to this article. The following article answers two important questions: - should more details be given in the SALT - in the SALT for account 26 there are different amounts - is this an error in the article?

Account 90 is a special account used to reflect and analyze the amounts of income received and expenses incurred by the enterprise. Based on the balances in this account, the financial result of the organization’s activities is determined. In the article we will look at the basic operations on account 90 in examples and postings.

Account 90 is used to determine and analyze the amounts and volumes of sales for main activities, in particular:

- industrial/non-industrial work;

- construction, design, survey work;

- rental services;

- supply of goods (including products of own production);

- granting rights to intellectual property.

Accounting for goods at sales prices

Organizations working with retail can keep records of goods at sales prices (clause 13 of PBU 5/01 “Accounting for inventories”, approved by order of the Ministry of Finance of the Russian Federation dated 06/09/2001 No. 44n). With this method there are some features of reflecting cost. Let's look at them with an example.

From 2021, PBU 5/01 will no longer be in force. To replace it, officials approved FSBU 5/2019 “Inventories,” which introduced a number of amendments to the procedure for accounting for goods. Get free demo access to K+ and go to the Ready Solution to learn all the nuances of inventory accounting according to the new standard.

Example

The store purchased 50 kg of one type of sweets at a price of 472 rubles. per kg, including VAT 20%. Goods are accounted for at sales prices. The selling price of sweets is 500 rubles. per kg. Let's assume that there were no leftovers of such candies at the beginning of the month.

Dt 41.1 Kt 60 - 20,000 rub. — sweets have arrived at purchase prices;

Dt 19 Kt 60 - 4,000 rub. — reflected incoming VAT;

Dt 41.2 Kt 41.1 — 20,000 rub. — candies sold at retail;

Dt 41.2 Kt 42 - 5,000 rub. (500 × 50 – 20,000) - reflects the trade margin.

Within a month, all the candies were sold:

Dt 50 Kt 90.1 - 25,000 rub. — revenue is reflected;

Dt 90.3 Kt 68 - 5,000 rub. — VAT is charged on the sale;

Dt 90.2 Kt 41.2 - 25,000 rub. — the cost of sweets is written off at sales prices;

Reversal Dt 90.2 Kt 42 - 5,000 rub. — the trade margin has been written off.

Check whether you are taking into account the financial result correctly, with the help of explanations from ConsultantPlus experts. If you do not have access to the K+ system, get a trial online access for free.

Accounting entries

Let's look at what transactions the sales account 90 takes part in.

Sale of products, works, services:

| Debit | Credit | Description |

| 62/1 | 90/1 | The goods have been shipped to the buyer |

| 76 | 90/1 | Sales to other debtors reflected |

| 90/2 | 41, 43 | The cost of goods sold was written off |

| 90/3 | 68 | VAT on sales has been calculated |

| 50, 51 | 62/1 | Money for the goods is transferred by the buyer |

How to close account 90 at the end of the year:

| Debit | Credit | Description |

| 90/1 | 90/9 | Write-off of revenue from core activities |

| 90/9 | 90/2 | Write-off of costs for core activities |

| 90/9 | 90/3 | Write-off of accrued VAT amounts |

| 90/9 | 90/4 | Write-off of accrued excise taxes |

| 90/9 | 99 | The profit received was written off when closing the account 90 |

| 99 | 90/9 | The resulting loss was written off when closing the account 90 |

Determination of financial results for core activities

Postings to subaccounts of the 90th account are made throughout the year, accumulating the amounts of income and expenses. This approach makes it easy to generate the appropriate lines in the income statement. To obtain information about the organization's performance for the month, the accountant calculates expenses (turnover on the debit of the 90th account) and income (turnover on the credit of the 90th account). The difference between these values is profit or loss for the month; this value is reflected by posting Dt 90.9 Kt 99 when making a profit or Dt 99 Kt 90.9 when receiving a loss.

As a result, by the end of the year, a final balance will be formed on all subaccounts used by the organization, which must be reset to zero. For subaccounts with a debit balance, an entry for its full amount is made on the credit of this subaccount and the debit of subaccount 90.9, for subaccounts with a credit balance - vice versa:

Dt 90.1 Kt 90.9

Dt 90.9 Kt 90.2

Dt 90.9 Kt 90.3, etc.

Sales analysis is one of the main aspects that must be taken into account when developing an organization's marketing policy. Therefore, it is important to set up the correct analytics for account 90. Most often, sales analysis is carried out by type of product, by geographic location, by counterparty, by structural division of the organization, etc. Analytical accounting is organized depending on the needs of users for accounting information.

Account correspondence

From the debit of account 90, entries can be made to the credit of the following accounts:

- Account 11 - for the cost of sold animals that were fattened;

- Account 20 - for the cost of work and services sold;

- Account 21 - for the cost of semi-finished products sold externally;

- Account 23 - for the cost of work and services provided by auxiliary production;

- Account 26 - for accumulated general business expenses in their conditionally constant part (without distribution by type of main production);

- Account 29 - for the cost of work and services provided by service industries;

- Account 40 - for the deviation of the actual cost of production over the planned one;

- Account 41 - for the cost of purchased goods sold;

- Account 42 - for the amount of trade margin;

- Account 43 - for the cost of sold own products;

- Account 44 - for the accumulated amount of expenses associated with the sale of goods;

- Account 45 - for the amount of the cost of goods for which revenue was recognized;

- Account 58 - for the amount of redeemed or sold securities;

- Account 68 - for the amount of accrued taxes and fees;

- Account 79 - for the amount of costs for on-farm settlements;

- Account 99 - for the amount of profit received when closing account 90.

You might be interested in:

Account 71 in accounting: what is it used for, correspondence, subaccounts, main entries

From the credit of account 90, entries can be made to the debit of the following accounts:

- Invoice 45 - for the cost of the stages of work accepted by the customer;

- Account 50 - for the amount of cash revenue received for the reporting period;

- Account 51 – for the amount of revenue received to the current account for the reporting period;

- Account 52 – for the amount of revenue received in foreign currency for the reporting period;

- Account 57 – for the amount of revenue received from receipts, transfers, etc. during the reporting period;

- Account 62 - for the amount of goods shipped to the buyer;

- Account 76 - for the amount of work and services provided to other creditors;

- Account 79 – for the amount of revenue from on-farm settlements;

- Account 98 - upon the arrival of the moment of recognition of income previously allocated to future periods;

- Account 99 – for the amount of loss received when closing account 90.

Results

Account 90 is necessary to collect data on income and expenses for activities that the company considers normal for itself.

Income is recorded on the credit side of the account, and expenses are recorded on the debit side. The company can independently enter subaccounts to the 90th account - depending on business conditions and the accounting data used. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.