Current transport declaration form for 2017

For 2021 reporting, transport tax returns must be submitted on new forms. A new declaration form approved by order of the Federal Tax Service of Russia dated December 5, 2021 No. ММВ-7-21/668. Let us explain in the table what has changed in it:

| Declaration indicators | New form | Old form |

| Title page | There is no print field | There is a printable field |

| Section 2 “Calculation of the tax amount for each vehicle” | Added lines: – 070 – vehicle registration date; – 080 – date of termination of registration of the vehicle (deregistration); – 130 – year of manufacture of the vehicle. | In the previous form there were no such lines |

| Lines have appeared for deductions that are used by payers of contributions to the Platon system (owners of vehicles weighing over 12 tons). Line 280 shows the deduction code, and line 290 shows the deduction amount. |

.

Section 1

This section can be completed only after section No. 2 has been completed.

In line 010, write down the BCC of the tax (for transport tax in 2019–2020 - 182 1 0600 110).

Line 020 OKTMO code assigned by statistics, according to which the amount of transport tax is payable.

Line 021 duplicates the amount from line 300 of section No. 2. Here the taxpayer indicates the calculated tax amount.

Advance payments, if you are required to pay them, are written in cells 023–027. Keep in mind that you need to report accrued advances, not paid advances.

The total amount payable minus advances is reflected in line 030 (line 021 - line 023 - line 025 - line 027). If the calculation results in a negative value, it means there has been an overpayment; it is reflected in line 040.

What are the deadlines for submitting the transport declaration for 2021?

Article 363.1 of the Tax Code of the Russian Federation regulates the deadlines for submitting a transport tax return. Organizations submit reports on vehicles once a year. The deadline is February 1 of the following year. If the last day of the deadline falls on a weekend, it is shifted to the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). However, since February 1st falls on a Thursday in 2021, the dates will not be postponed. The declaration must be submitted to the Federal Tax Service no later than February 1, 2021.

Please note that the specified deadline for submitting a transport tax return is the same for all companies. There are no special rules or exceptions regarding when a transport tax return is submitted in the Tax Code of the Russian Federation. It is very convenient that the procedure for filling out a tax return for transport tax allows companies to choose how to submit it:

- personally or through a representative;

- by mail with a description of the attachment or by sending an electronic report.

If you choose postal services, the declaration is considered submitted on the day the postal item is sent. And when transmitted via TKS - the date the file was sent.

Submit your transport tax declaration to the same inspectorate where you pay the tax. That is, according to the location of vehicles (clause 1 of article 363, clause 1 of article 363.1 of the Tax Code of the Russian Federation).

Lines 230−240 Tax rate reduction

If the organization has a benefit in the form of a reduced tax rate, fill out lines 230 and 240.

To do this, on the left side of line 230, enter the tax benefit code - 20230 (Appendix 7 to the Procedure approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11/99).

Fill out the right part of line 230 according to the same rules as the right part of line 190 <here from the words: On the left side of the indicator on line 190, indicate the benefit code: 20210 - if the benefit is established by regional legislation, >.

On line 240, calculate and indicate the amount of the tax benefit, taking into account the coefficient of use of the benefit Kl and the increasing coefficient Kp. If a fixed reduced rate is established, calculate the amount of the benefit using the formula:

| Page 240 | = | Page 070 | × | Page 140 – Reduced rate | : | 100 | × | Page 120 | × | Page 150 | × | Page 180 |

Such rules are established by paragraphs 5.21–5.22 of the Procedure approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11/99, letter of the Federal Tax Service of Russia dated November 13, 2012 No. BS-4-11/19074.

An example of reflecting a benefit in the form of a reduction in the transport tax rate in a declaration

The Alpha organization is a housing and communal services organization and operates on the territory of the Republic of Mari El. It has a special vehicle - a Gianni Ferrari Turbo 4 sidewalk sweeper with an engine power of 36 hp. With.

According to paragraph 2 of Article 7 of the Law of the Republic of Mari El dated October 27, 2011 No. 59-Z, in relation to special transport, Alpha applies a reduction factor of 0.4 to the transport tax rate established by Article 5 of this law.

The base rate established by Article 5 of the Law of the Republic of Mari El dated October 27, 2011 No. 59-Z is 25 rubles. with every horsepower. The benefit was used throughout the year, so the benefit utilization coefficient Kl = 1.

The accountant calculated the amount of the benefit: 25 rubles/l. With. × 36 l. With. × (1 – 0.4) × 1 = 540 rub.

He reflected the tax benefit code and amount in the transport tax return:

Who exactly should report for 2017 in 2021

Legal entities (Article 363.1 of the Tax Code of the Russian Federation) on which vehicles are registered (Article 357 of the Tax Code of the Russian Federation) are required to submit a transport tax return for 2021. And not just any, but those that are recognized as taxable objects: cars, motorcycles, buses, yachts, boats, motor boats, etc. (see Article 358 of the Tax Code of the Russian Federation).

The same article provides a list of items whose registered rights do not oblige you to fill out a transport declaration for 2017, since these are not taxable items. For example, a stolen car or agricultural transport.

Reorganization

If the declaration is submitted by the successor organization for the reorganized organization, then fill out the title page of the declaration as follows.

At the top, indicate the TIN and KPP of the successor organization.

In the Tax period line, enter code “50”.

In the line at the location (accounting) indicate the code:

- 260 – if you submit a declaration on the location of vehicles;

- 216 – if the assignee is the largest taxpayer and submits a declaration at its location.

In the taxpayer line, indicate the full name of the reorganized organization.

In the line Form of reorganization (liquidation) put the code:

- 1 – if the reorganization was in the form of transformation;

- 2 – if the reorganization was in the form of a merger;

- 3 – if the reorganization was in the form of division;

- 5 – if the reorganization was in the form of a merger;

- 6 – if the reorganization was in the form of division with simultaneous merger.

In the TIN/KPP line of the reorganized organization, put the TIN and KPP of the old organization. Take this data from the registration certificate issued by the Federal Tax Service.

OKTMO code in sections 1 and 2 indicate the municipality in whose territory the reorganized organization or its separate divisions were located.

Fill out the remaining indicators of the reorganized organization in the general manner prescribed for filling out a transport tax return.

Such rules are established in clauses 2.9 and 3.2.1, appendices 1 and 2 to the Procedure approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11/99.

Should “physicists” report?

Unlike legal entities, a tax return for transport tax by individuals is not filled out and submitted (Clause 1, Article 362 of the Tax Code of the Russian Federation). Tax authorities themselves will calculate this tax to be paid based on data from the traffic police. Thus, for ordinary citizens, a transport tax declaration for individuals is replaced by a notification from the Federal Tax Service for the payment of transport tax. There is no need to download the transport tax return. By the way, you can check whether the inspectorate calculated the transport tax correctly using a special service on the official website of the Federal Tax Service. Exact link.

As for individual entrepreneurs, they are fully subject to the rules of reporting and payment of transport tax that apply to ordinary individuals. Even if the merchant uses the vehicle to make a profit. Thus, individual entrepreneurs do not submit a transport tax return for 2021, but pay the tax based on a notification from the Federal Tax Service.

Lines 210−220 Tax reduction

If the organization has the right to reduce tax, fill out lines 210 and 220.

To do this, on the left side of line 210, enter the tax benefit code - 20220 (Appendix 7 to the Procedure approved by Order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11/99).

Fill out the right side of line 210 similarly to the right side of line 190.

On line 220, calculate and indicate the amount of the tax benefit, taking into account the coefficient of use of the benefit Kl and the increasing coefficient Kp.

Such rules are established by clauses 5.19–5.20 of the Procedure approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11/99 (letter of the Federal Tax Service of Russia dated November 13, 2012 No. BS-4-11/19074).

An example of reflecting a benefit in the form of a reduction in the amount of transport tax in a declaration

The Alpha organization is engaged in international road transport and is registered in the Sverdlovsk region. It has transport for international transport - an IVECO Stralis AT440S42T truck tractor with a 420 hp engine. With.

According to paragraph 2 of Article 4 of the Law of the Sverdlovsk Region of November 29, 2002 No. 43-OZ, “Alpha” applies a benefit for such transport - pays a tax in the amount of 40 percent of the calculated amount.

Tax rate from January 1 to December 31, 2021 for trucks with a capacity of over 250 hp. With. is 56.2 rub./l. With. (clause 19 of the appendix to the Law of the Sverdlovsk Region of November 29, 2002 No. 43-OZ). The benefit was used throughout the year, so the benefit utilization coefficient Kl = 1.

The accountant calculated the amount of the benefit: 56.2 rubles/l. With. × 420 l. With. × (100% – 40%) × 1 = RUB 14,162.4

He reflected the tax benefit code and amount in the transport tax return:

Composition of the new transport declaration in 2018

The new transport tax return for 2021 for legal entities consists of a title page and two sections.

As we have already said, in the second section of the declaration for 2021. in which the tax amount for each vehicle is indicated, five lines appeared:

- in lines 070 and 080 you can now indicate when the vehicle was registered (with the State Traffic Inspectorate, Gostekhnadzor, etc.) and when it was deregistered;

- on line 130 – year of manufacture;

- lines 280 and 290 - code and deduction amount are filled in by payers of fees in the Platon system (owners of vehicles weighing over 12 tons).

Data about the car - identification number (VIN), make, registration number, registration date, year of manufacture, take from the title or registration certificate. Indicate the registration termination date (line 080) only for cars that you deregistered in the reporting year.

Lines 190−200 Tax exemption

If the organization is completely exempt from vehicle tax, fill out lines 190 and 200.

On the left side of the indicator on line 190, indicate the benefit code: 20210 - if the benefit is established by regional legislation, 30200 - if the benefit is provided for by international treaties of the Russian Federation (Appendix 7 to the Procedure approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11/ 99).

On the right side of the indicator on line 190, indicate sequentially the numbers: article, paragraph, subparagraph of the regulatory legal act approved by local authorities, in accordance with which the benefit is provided.

On the right side of the indicator on line 190, indicate the numbers in sequence:

1) article, 2) paragraph, 3) subparagraph

a regulatory legal act approved by local authorities, in accordance with which the benefit is provided.

For each of these three positions, four cells are allocated. Fill out this part of the indicator from left to right - article, paragraph, subparagraph. Moreover, if the attribute has less than four characters, fill the empty spaces to the left of the value with zeros.

For example, if the benefit is established by paragraph 4 of Article 6 of the Law of the Republic of Tatarstan dated November 29, 2002 No. 24-ZRT, fill out line 170 this way.

In line 200, enter the amount exempt from tax using the formula:

| Page 200 | = | Page 070 | × | Page 140 | × | Page 120 | × | Page 150 | × | Page 180 |

Such rules are established by clauses 5.17–5.18 of the Procedure approved by order of the Federal Tax Service of Russia dated February 20, 2012 No. ММВ-7-11/99, letter of the Federal Tax Service of Russia dated October 26, 2012 No. BS-4-11/18200.

Filling out a new declaration form: examples and samples

Below we provide examples and images of filling out a transport tax return for 2021.

Title page of the declaration

On the title page, indicate basic information about the organization and the declaration.

TIN and checkpoint

Please include these codes at the top of the title. If you are reporting on the location of a separate unit, indicate its checkpoint.

Correction number

Please indicate here:

- if you are submitting a report for the first time – “0–”;

- if you are clarifying something that has already been submitted, the serial number of the report with corrections (“1–”, “2–”, etc.).

Taxable period

Enter code “34” in your transport tax return.

Reporting year

In this case, 2017 is the year for which reporting is submitted.

Next, mark with codes which inspection you are submitting the declaration to:

- In the “Submitted to the tax authority” field, enter the Federal Tax Service code;

- in the line “at the location (registration) (code)” put 260 if you are submitting a declaration at the place of registration of the organization, division, or vehicles. Code 213 means the largest taxpayers, and code 216 their legal successors.

Taxpayer

Here record the full name of the organization in accordance with the constituent documents.

OKVED

In this field, enter the code according to the All-Russian Classifier of Types of Economic Activities (OKVED) OK 029-2014 (NACE revision 2).

Section 1 of the declaration

After completing the title page, skip Section 1 and begin completing Section 2. Based on the information in this section, then complete Section 1.

Let us explain the features of filling out some lines in section 1 of the declaration for 2021.

Line 120

Fill out line 120 only if the tax rate depends on the number of years from the year of manufacture of the car.

Line 140 and 160

In line 140, indicate the number of full months of car ownership during the year, and in line 160 - the coefficient Kv. If you owned the car all year, put 12 in line 140, and 1 in line 160.

Enter the number of months of 2021 during which your organization owns a specific vehicle in line 140. Please note that full months include those in which the vehicle was registered before the 15th day (inclusive) and deregistered after the 15th day. Months in which the vehicle was owned for less than half a month are not taken into account. Divide the number of complete months of vehicle ownership by 12 to obtain the ownership coefficient, which is reported on line 160. This coefficient is rounded to four decimal places.

Line 150

In line 150, put 1/1 if the owner is the only one. Otherwise, it is indicated as a fraction (1/2, 1/3, etc.).

Line 180

Indicate the Kp coefficient (line 180) only for expensive cars.

Lines 190 and 300

In lines 190 and 300, indicate the calculated tax for the year.

Enter the amount of calculated tax on line 190. To do this, calculate it using the formula:

| Page 190 | = | Page 090 | × | Page 170 | × | Page 150 | × | Page 160 | × | Page 180 |

Tax payable on line 300 is calculated using the formula:

| Page 300 | = | Page 190 | – | Page 250 | – | Page 270 | – | Page 290 |

For vehicles that are completely exempt from tax, put a dash in line 300.

Lines 200 – 290

These lines are filled in by “beneficiaries”. Subjects of the Russian Federation have the right to exempt an organization from transport tax or reduce it for some vehicles. In this case, fill out lines 200-270.

When a vehicle falls under the benefit, line 200 indicates the number of full months of use of the benefit in 2017. To calculate the coefficient of use of the Kl benefit (line 210), the data on line 200 is divided by 12 months. The coefficient is rounded to four decimal places. The type of benefit and amount are deciphered in the lines:

- 220-230 – complete tax exemption;

- 240–250 – reduction of the tax amount;

- 260–270 – reduced tax rate.

If vehicle benefits are not established, dashes are placed in lines 220–270.

Section 1 of the declaration

By filling out section 2 for all vehicles, go to section. 1.

If you do not pay advance payments, in lines 021 and 030, indicate the total tax amount for all cars.

If you pay, indicate advance payments in lines 023 - 027, and in line 030 - tax payable at the end of the year.

Next, we will look at filling out the main sections of the declaration using an example.

The car has an engine power of 105 hp. With. was sold and deregistered on December 13, 2017. The car was produced in 2015 and registered on 10/21/2015. In the region there are advance payments, the tax rate is 35 rubles/l. With.

- During the year, the organization owned the car for 11 months from January to November.

- Advance payments for the 1st, 2nd and 3rd quarters – 919 rubles each. (1/4 x 105 hp x 35 RUR/hp).

- The coefficient Kv for calculating tax for the year is 0.9167 (11 months / 12 months).

- The calculated tax amount for 2021 is RUB 3,369. (105 hp x 35 rub/hp x 0.9167).

- The amount of tax payable for the year is 612 rubles. (3,369 rubles – 919 rubles – 919 rubles – 919 rubles).

You can also, which will be handed over no later than February 1, 2018.

Read also

21.12.2018

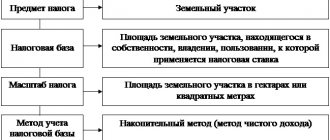

How to calculate tax

The basis for calculating car tax is engine power. For other transport, other units of measurement are established, which are specified in Art. 359 of the Tax Code of the Russian Federation.

Tax rates depend on the power of the machine and regional legislation. Before calculating your tax, check the applicable rate in your area.

Example. Mak LLC has a registered car with a capacity of 102 hp. With. The rate in the region is 2.5 rubles. Increasing factors are not applied. The company owns the car for a full year. At the end of the year, you will have to pay tax to the Federal Tax Service in the amount of 255 rubles (102 x 2.5).