The obligation to pay road tax is established by Chapter. 28 of the Tax Code of the Russian Federation, according to which individuals and legal entities must transfer funds to the Federal Tax Service at a certain time. The calculation of the advance payment for transport tax for organizations is made by multiplying the base by the rate. The amount received is distributed into ¼ parts and paid in the 1st, 2nd and 3rd quarters, then the balance is transferred.

Deadline for payment of advance payment for transport tax

As mentioned earlier, the deadlines for the transfer of state contributions are set by the authorities of the constituent entities individually.

When money is transferred in different regions: Subject

| Peculiarities | |

| Adygea | Until the end of the month following the reporting period |

| Moscow region | |

| Buryatia | |

| Kalmykia | |

| Dagestan | |

| Mordovia | |

| Mari El | |

| Chuvashia | |

| Khakassia | |

| Kamchatka | |

| Stavropol | |

| Primorye | |

| Astrakhan region | |

| Amur region | |

| Vladimir | |

| Bryansk | |

| Vologda | |

| Voronezh | |

| Irkutsk | |

| Bashkortostan | For each quarter no later than the end of the last month |

| Kabardino-Balkaria | Until April 30, July 31, October 31 respectively |

| Komi | 15.05, 15.08, 15.11 – extreme dates for quarters |

| Crimea | Within 30 cal. days after the end of each quarter |

| Udmurtia | Until 10.05, 10.08, 10.11 respectively |

| Arkhangelsk | Until 05.05, 05.08 and 05.11 |

| Volgograd | Within 25 days after the end of the next quarter |

The transfer of advance payments for vehicle taxes is the obligation of all legal entities that own cars, trucks, as well as buses, air and water vehicles. The calculation of amounts is carried out by enterprise accountants independently. Before the deadlines specified in local tax legislation, the money goes to the budget of the Federal Tax Service, and a declaration must also be submitted.

Case studies

Example #1.

Introductory : The organization, for financial reasons, sold some of the cars that it owned. However, management plans to buy similar vehicles when the company's business improves. The difficulty is that the tax on the cars sold has already been paid.

Solution to the situation : A representative of a legal entity can write a statement to the Federal Tax Service so that the extra money will be taken into account next year. Returning the difference in this case is unreasonable, since the company wants to expand its fleet, so soon the size of its obligations to the state will become the same.

Example No. 2.

Introductory : The legal entity paid an advance monthly. Due to the increase in turnover and higher profits in the middle of the year, management decided to pay an advance for all remaining months.

Solution to the situation : The organization makes an advance payment for the entire year and does not deposit funds until the end. Next year, the tax is calculated based on the transport owned by the company.

An advance payment for transport tax is a convenient means of paying it, allowing you to make it not at the end of the year following the reporting year, but directly during the tax period.

This method of fulfilling fiscal responsibilities is suitable for organizations. For individuals it is less relevant. However, you need to remember the difficulties that arise when the advance has already been made and the size of the tax base has changed.

Who must pay advance payments for transport tax

Transport tax must be paid by those persons (legal entities or individuals) on whom vehicles recognized as subject to taxation by TN are registered (Article 357 of the Tax Code of the Russian Federation). At the same time, the procedure for calculating and paying tax for organizations and citizens is different: organizations calculate the tax independently, and for individuals the tax amount is calculated by the tax authority based on information from the State Traffic Safety Inspectorate (clause 1 of Article 362 of the Tax Code of the Russian Federation).

The obligation to make advance payments for transport tax can be introduced only for organizations (clauses 1, 2 of Article 362 of the Tax Code of the Russian Federation). Citizens pay tax in a lump sum on the basis of the tax notice received (clause 3 of Article 363 of the Tax Code of the Russian Federation).

ATTENTION! Starting with the tax for 2021, legal entities will also receive a tax message with the calculated amount. And they will stop submitting tax return declarations to the Federal Tax Service. However, this does not mean that they will no longer need to calculate tax. This responsibility will remain with organizations in the future. After all, they must know the amount in order to make advance payments throughout the year (if such are established in the region). And the message from the tax office is more of an informational nature, so that the company can compare its accruals with those made according to the tax authorities. And she will receive it after the deadline for paying advances (see, for example, letter of the Ministry of Finance dated June 19, 2019 No. 03-05-05-02/44672).

Read about the basic rules for calculating TN for legal entities in the material.

Possible problems and nuances

Advance payments usually do not cause problems for car owners. However, difficulties may arise if during the reporting period for which the tax is paid in advance, another vehicle was purchased. It turns out that in the following months less was paid than was due, since in connection with the purchase of the car the owner had new obligations for fiscal payments.

The opposite case may also arise when an owner who has several cars sells some of them. However, the transport tax has already been paid. Under such circumstances, the law allows for excess deposits to be taken into account when paying taxes next year. This procedure is called offset of the amounts of tax paid. Money deposited in a larger amount can be returned. To use one of these methods, you need to write an application to the Federal Tax Service. However, if a taxpayer has arrears on mandatory payments, a refund is not available to him: tax officials have the right to only make a offset. In this case, part of the excess payment will be used to cover the debt.

Deadlines for payment of advance payments for transport tax

TN is a regional tax, therefore some features of its payment are determined by the authorities of the constituent entities of the Russian Federation by the relevant law (Article 356 of the Tax Code of the Russian Federation). In particular, for taxpayers-organizations, the law of the subject establishes the procedure and deadlines for paying tax, including the presence/absence of an obligation and the deadlines (if an obligation is established) for making advance payments for transport tax.

For example, an advance payment system operates in the Moscow region. In accordance with paragraph 1 of Art. 2 of the Law of the Moscow Region dated November 16, 2002 No. 129/2002-OZ, organizations pay advance payments no later than the last day of the month following the expired reporting period.

An essentially similar procedure is provided for in subsection. 1 clause 1 art. 9 of the Law of the Nizhny Novgorod Region No. 71-Z dated November 28, 2002, according to which advance payments for transport tax are made within the following terms:

- for the first quarter - April 30;

- for the second quarter - July 31;

- for the third quarter - October 31.

At the same time, the region may not introduce advance payments for transport tax.

How are such payments accounted for?

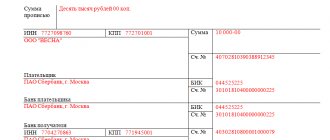

Like any other fact of the economic life of a legal entity, the payment of an advance must be reflected in the financial statements. To do this, the receipt and expense documents indicate:

- The amount of the advance payment that must be made in each month of the quarter. In this case, the debit value is written as 99 (income and expenses), and the credit value as 68 (payment of taxes and fees). The name of the subaccount will be “calculation of transport tax”;

- Reducing or increasing the amount of the advance. The debit and credit values, as well as the name of the subaccount in this case will remain the same.

Example:

Moreover, if transport tax is paid in advance for several years, then the amount of the first payment in the current year must be no less than the amount of the contribution for the last quarter of the previous one. An exception to this rule is a change in the size of the tax base.

How to reflect it in the annual declaration?

In the tax return, for entering data on advance payments, lines 023, 025, 027 are provided. There you need to enter the amounts of advances for the 1st, 2nd and 3rd quarters of the reporting year.

How to calculate an advance payment for transport tax

Advance payments for transport tax are calculated based on the results of the reporting periods. The reporting periods are the I, II and III quarters (clause 2 of Article 360 of the Tax Code of the Russian Federation).

The payment amount is determined as ¼ of the product of the tax base and the tax rate (clause 2.1 of Article 362 of the Tax Code of the Russian Federation). This takes into account the so-called ownership coefficient and the increasing coefficient for expensive cars.

In general, the calculation formula looks like this:

AP = ¼ × NB × NS × Kv × Kp,

where NB is the tax base (for a car this is the engine power in horsepower), NS is the tax rate, Kv is the ownership coefficient, Kp is the increasing coefficient.

The tax rate is also set by the constituent entity of the Russian Federation, and it can not only vary significantly by region, but also change from year to year.

We explained here what the transport tax rate depends on.

The ownership ratio is defined as the ratio of the number of full months during which the vehicle was registered to the taxpayer to the number of calendar months in the tax (reporting) period. The month in which the right to own a vehicle arose before the 15th or was lost after the 15th is considered complete (clause 3 of Article 362 of the Tax Code of the Russian Federation).

The size of the increasing coefficient depends on the average cost and age of the car. Specific values of the coefficient are fixed in clause 2 of Art. 362 of the Tax Code of the Russian Federation.

From 2021 for cars worth from 3 million to 5 million rubles. no older than 3 years, a single coefficient of 1.1 is applied ( read more in this publication ).

The list of expensive cars must be published annually by the Ministry of Industry and Trade.

The amount of advance payments for transport tax accrued for the tax period 2021 inclusive is reflected in the declaration submitted for the year as an amount that reduces the total amount of tax accrued for the tax period to the amount intended for payment for the last period of the year. At the end of the reporting periods, no reports are submitted.

This material will introduce you to the transport tax return .

Starting from the 2021 tax period, the declaration of transport tax for legal entities has been cancelled.

Results

Only organizations have the obligation to make advance payments for transport tax (individuals pay the tax in one amount). The procedure and terms for payment of advances are established by regional legislation.

The payment amount is determined as ¼ of the product of the tax base and the tax rate, taking into account the ownership coefficient and the increasing coefficient for expensive cars.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to calculate an advance payment for transport tax

The calculation of advance payments and transport tax is determined by Art. 362 of the Tax Code of the Russian Federation. It states that taxpayers-organizations make their own calculations, and individuals pay tax on the basis of a notification from the tax authority.

The tax is calculated for the calendar year for each vehicle separately. The calculation method is the product of the tax rate and the tax base. Advance payment for transport tax is ¼ of the tax amount. It is calculated for 1st, 2nd, 3rd quarters. The tax at the end of the year is paid in the form of the difference between the calculated tax amount and advances paid to the budget.

The tax base is what the tax is collected from. For transport tax, the base is the technical characteristics of vehicles, for example, the power of the car. The entire list of technical characteristics involved in tax calculation is indicated in Art. 359 of the Tax Code of the Russian Federation.

Rates for tax calculation are set by regions. When developing them, the latter should be guided by the rates of the Tax Code named in Art. 361 Tax Code of the Russian Federation. The main requirement is that regional rates should not exceed NK rates by more than 10 times. The appropriate service of the Federal Tax Service allows you to determine the rate correctly.

Example of calculating advance payment for transport tax

The organization has owned a passenger car since 2013. The car is registered in the Moscow region. Tax base – 152 horsepower. Tax rate – 49 rubles per hp.

Tax amount for 2015:

152 hp x 49 rubles = 7448 rubles.

Advance payment amount in 2015:

152 hp x 49 rubles x 1/4 = 1862 rubles.

Based on the results of the calculation, the organization will pay advances of 1,862 rubles each for the 1st, 2nd, 3rd quarters of 2015. The tax amount for the year will be 1862 rubles.

The timing of payment of advances and taxes will depend on the law of the subject of the Russian Federation. For example, in Moscow, organizations are not provided for the payment of advance payments for transport tax (Clause 1, Article 3 of Moscow Law No. 33 of 07/09/2008 “On Transport Tax”), the tax is transferred until February 5 following the year, according to which it is paid. In St. Petersburg, organizations transfer advance payments to the budget until April 30, July 31, October 30 (Clause 2, Article 3 of the Law of St. Petersburg dated November 4, 2002 No. 487-53 “On Transport Tax”), the tax is transferred until February 10 , following the year in which it is paid.

Object of taxation and tax base

The objects of taxation are vehicles (vehicles) registered in the prescribed manner in accordance with the legislation of the Russian Federation, listed in paragraph 1 of Art. 358 of the Tax Code of the Russian Federation: cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) and other water and air vehicles.

For your information: the list of vehicles that are not subject to taxation is given in paragraph 2 of Art. 358 Tax Code of the Russian Federation.

The procedure for determining the transport tax base is established in Art. 359 of the Tax Code of the Russian Federation.

According to paragraph 1 of this article, the tax base is determined separately for each vehicle :

- in relation to vehicles with engines - as the vehicle engine power in horsepower (clause 1);

- in relation to air vehicles for which the thrust of a jet engine is determined - as the nameplate static thrust of a jet engine at take-off mode in terrestrial conditions in kilograms of force (clause 1.1);

- in relation to waterborne non-self-propelled (towed) vehicles, for which the gross tonnage is determined - as the gross tonnage in registered tons (clause 2).

In addition, the tax base for water and air vehicles not listed above is determined separately - as a vehicle unit (clause 3).

Main changes in transport tax for 2021

There are very few changes in transport tax legislation this year. Among the main ones, we can note the abolition of benefits for users of the Platon and the introduction of a common tax payment date for legal entities for the Russian Federation until March 1 of the year following the reporting period.

Transport tax rates by region in 2021

| Region | Rate RUR for 1 hp | 0-100 | 100-150 | 150-200 | 200-250 | 251+ |

| Adygea, republic | 10 | 20 | 40 | 70 | 130 |

| Altai region | 10 | 20 | 25 | 60 | 120 |

| Altai, republic | 10 | 14 | 20 | 45 | 120 |

| Amur region | 15 | 21 | 30 | 75 | 150 |

| Arhangelsk region | 14 | 24 | 50 | 75 | 150 |

| Astrakhan region | 14 | 27 | 48 | 71 | 102 |

| Bashkiria, republic | 25 | 35 | 50 | 75 | 150 |

| Belgorod region | 15 | 25 | 50 | 75 | 150 |

| Bryansk region | 10 | 18 | 40 | 75 | 130 |

| Buryatia, republic | 9.5 | 17.9 | 25.5 | 38.3 | 76.5 |

| Vladimir region | 20 | 30 | 40 | 75 | 150 |

| Volgograd region | 9 | 20 | 40 | 75 | 150 |

| Vologda Region | 25 | 35 | 50 | 75 | 150 |

| Voronezh region | 25 | 35 | 50 | 75 | 150 |

| Dagestan, republic | 8 | 10 | 35 | 50 | 105 |

| Jewish Autonomous Region | 8 | 16 | 40 | 60 | 95 |

| Transbaikal region | 7 | 10 | 20 | 33 | 65 |

| Ivanovo region | 10 | 20 | 35 | 60 | 120 |

| Ingushetia, republic | 5 | 7 | 10 | 30 | 40 |

| Irkutsk region | 10.5 | 14.5 | 35 | 52.5 | 105 |

| Kabardino-Balkaria, republic | 7 | 15 | 35 | 65 | 130 |

| Kaliningrad region | 2.5 | 15 | 35 | 66 | 147 |

| Kalmykia, republic | 11 | 22 | 47 | 75 | 150 |

| Kaluga region | 10 | 25 | 50 | 75 | 150 |

| Kamchatka Krai | 9 | 24 | 40 | 68 | 130 |

| Karachay-Cherkessia, republic | 7 | 14 | 25 | 35 | 95 |

| Karelia, republic | 6 | 30 | 50 | 75 | 150 |

| Kemerovo region | 8 | 14 | 45 | 68 | 135 |

| Kirov region | 20 | 30 | 44 | 60 | 120 |

| Komi Republic | 15 | 20 | 50 | 75 | 150 |

| Kostroma region | 14 | 26.8 | 38 | 60 | 120 |

| Krasnodar region | 12 | 25 | 50 | 75 | 150 |

| Krasnoyarsk region | 5 | 14.5 | 29 | 51 | 102 |

| Crimea, republic | 5 | 7 | 15 | 20 | 50 |

| Kurgan region | 10 | 27 | 50 | 75 | 150 |

| Kursk region | 15 | 22 | 40 | 70 | 150 |

| Leningrad region | 18 | 35 | 50 | 75 | 150 |

| Lipetsk region | 15 | 28 | 50 | 75 | 150 |

| Magadan Region | 6 | 8 | 12 | 18 | 36 |

| Mari El, republic | 25 | 35 | 50 | 90 | |

| Moscow, city | 12 | 35 | 50 | 75 | 150 |

| Mordovia, republic | 17.3 | 25.9 | 37.9 | 75 | 150 |

| Moscow region | 10 | 34 | 49 | 75 | 150 |

| Murmansk region | 10 | 15 | 25 | 40 | 80 |

| Nenets Autonomous Okrug | 0 | 25 | 50 | ||

| Nizhny Novgorod Region | 22.5 | 31.5 | 45 | 75 | 150 |

| Novosibirsk region | 6 | 10 | 30 | 60 | 150 |

| Omsk region | 7 | 15 | 30 | 45 | 90 |

| Orenburg region | 0 | 15 | 50 | 75 | 150 |

| Oryol Region | 15 | 35 | 50 | 75 | 150 |

| Penza region | 15 / 21 | 30 | 45 | 75 | 150 |

| Perm region | 25 | 30 | 50 | 58 | |

| Primorsky Krai | 18 | 26 | 43 | 75 | 150 |

| Pskov region | 13 / 15 | 25 | 50 | 75 | 150 |

| Rostov region | 12 | 15 | 45 | 75 | 150 |

| Ryazan Oblast | 10 | 20 | 45 | 75 | 150 |

| Samara Region | 16 | 20 | 45 | 75 | 150 |

| Saint Petersburg, city | 24 | 35 | 50 | 75 | 150 |

| Saratov region | 14 | 30 | 50 | 75 | 150 |

| Sakhalin region | 10 | 21 | 35 | 75 | 150 |

| Sverdlovsk region | 2.5 | 9.4 | 32.7 | 49.6 | 99.2 |

| North Ossetia, republic | 7 | 15 | 20 | 45 | 90 |

| Sevastopol, city | 5 | 7 | 25 | 75 | 100 |

| Smolensk region | 10 | 20 | 40 | 60 | 100 |

| Stavropol region | 7 | 15 | 36 | 75 | 120 |

| Tambov Region | 20 | 30 | 50 | 75 | 150 |

| Tatarstan, republic | 25 | 35 | 50 | 75 | 150 |

| Tver region | 10 | 21 | 30 | 45 | 90 |

| Tomsk region | 5 | 8 | 20 | 30 | 75 |

| Tula region | 10 | 25.4 | 50 | 75 | 150 |

| Tyva, republic | 7 | 11 | 20 | 30 | 70 |

| Tyumen region | 10 | 30 | 34 | 40 | 66 |

| Udmurtia, republic | 8 | 20 | 50 | 75 | 100 |

| Ulyanovsk region | 12 | 30 | 45 | 65 | 115 |

| Khabarovsk region | 12 | 16 | 30 | 60 | 150 |

| Khanty-Mansi Autonomous Okrug | 5 | 7 | 40 | 60 | 120 |

| Khakassia, republic | 6 | 15 | 25 | 40 | 75 |

| Chelyabinsk region | 7.7 | 20 | 50 | 75 | 150 |

| Chechnya, republic | 7 | 11 | 24 | 48 | 91 |

| Chuvashia, republic | 13 | 23 | 50 | 75 | 150 |

| Chukotka Autonomous Okrug | 5 | 7 | 10 | 15 | 30 |

| Yakutia, republic | 8 | 13 | 17 | 30 | 60 |

| Yamalo-Nenets Autonomous Okrug | 15 | 24.5 | 25 | 37.5 | 75 |

| Yaroslavl region | 15.8 | 28.1 | 45 | 68 | 145 |

The amount of tax depends on many factors. Among them are the type of vehicle, its service life, engine power, and the availability of benefits. In addition, the base rate in different regions of Russia may differ significantly, and for expensive cars an increasing coefficient is applied. The rate for each region and separately for vehicles can be viewed on the official website of the Federal Tax Service, or use one of the calculators offered by numerous specialized sites.

Calculation of advance payments for transport tax upon the emergence/termination of ownership

If a vehicle is acquired or is removed from ownership in the year for which the tax is calculated, then the coefficient for the number of full months of vehicle ownership is applied.

| Base | date | Accounting for calculations |

| Vehicle registration | inclusive until the 15th of the month | taken into account |

| after the 15th of the month | not taken into account | |

| Deregistration of a vehicle | inclusive until the 15th of the month | not taken into account |

| after the 15th of the month | taken into account |

Example of calculating advance payment for transport tax

The organization is the owner of a truck whose engine power is 204 hp. The place of registration of the vehicle is Rostov region. The tax rate is 35 rubles. The car was sold on October 16, 2015.

Since the car has been sold, the ownership period factor must be used. For 1st, 2nd, 3rd quarters, the tax is calculated in full, that is, the coefficient is not applied. At the end of the year, the coefficient will be 10/12 (October is included in the calculation).

Tax amount for 2015:

204 hp x 35 rubles x 10/12 = 5950 rubles.

Advance payment amount in 2015:

204 hp x 35 rubles x 1/4 = 1785 rubles.

For the 1st, 2nd, 3rd quarters, the organization will pay advances of 1,785 rubles for each quarter. The amount of transport tax will be 595 rubles in addition to the listed advances to the budget.

Special transport

There are special types of transport for which TN and, accordingly, AP are calculated differently.

Such transport includes:

- transport that is considered expensive;

- weighing more than 12 tons.

For expensive cars, when calculating the transport tax, a special increase indicator is used. It depends on the year of manufacture and price. In order to find out which car requires an increased tax, you should familiarize yourself with the list of cars on the website of the Ministry of Industry and Trade.