Deadlines for submitting transport tax reports for 2021

According to paragraph 17 of Art. are canceled from January 1, 2021 . Moreover, this also applies to transport tax reporting for 2020 .

This means that the transport tax declaration for 2021 was the last. And you don’t need to fill it out anymore (unless any clarifications are required for previous periods).

Filling out the declaration: step-by-step instructions

Let us use a specific example to examine the procedure for filling out a transport tax return, which was in effect until 2021 inclusive.

Vesna LLC is registered in St. Petersburg, is engaged in the wholesale trade of flour and pasta, and owns one Scania R420 truck - it has been owned for 6 years. Local law in St. Petersburg establishes advance payments for this tax. In our case, the amounts of advances do not play a role, since they are not taken into account when paying tax on trucks (see letter of the Ministry of Finance of the Russian Federation No. 03-05-05-04/3747 dated January 26, 2017).

Step 1. Title page

Filling procedure:

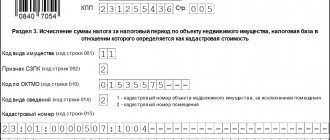

- at the top of the page we will indicate the company’s tax identification number and checkpoint, then they are automatically duplicated on each sheet of the declaration;

- adjustment number when submitting the declaration for the first time - 000;

- tax period code for the calendar year - 34. For the last tax period upon liquidation - 50;

- reporting year - 2019;

- The tax office to which the declaration is submitted has a unique four-digit code, find it out by contacting the Federal Tax Service or on the Federal Tax Service website: the first 2 digits are the region code, the second 2 digits are the code of the inspection itself. The declaration is submitted to the Federal Tax Service at the location of the vehicles, which the organization usually registers at its location. Or at the location of a separate subdivision - when registering vehicles (TS) with the subdivision. For example, Federal Tax Service Code No. 9 of the Central District of St. Petersburg;

- the taxpayer enters a code at the place of registration, which depends on his status. Codes - in Appendix No. 3 to the filling procedure:

| 213 | At the place of registration of the organization - the largest taxpayer |

| 216 | At the place of registration of the legal successor of the largest taxpayer |

| 260 | At the location of the vehicle |

Vesna LLC is a Russian company that is not a major taxpayer. Enter code 260. Fill in the rest like this:

- We enter the title in the longest field of the title page, skipping one cell between the words;

- We check OKVED using the classifier. Vesna LLC sells wholesale flour and pasta: OKVED code 46.38.23;

- phone number;

- number of pages in the declaration. Vesna LLC submits a declaration for this tax for 2021 on three sheets;

- We will write your full name at the bottom of the title page. taxpayer (director) or his representative, we will put the filing date and signature.

Step 2. Section 2 for each vehicle separately

Line by line:

- 020 - OKTMO code in the territory of which the car is registered. Find the code on the Federal Tax Service website;

- 030 - code of the type of vehicle, which are listed in Appendix No. 5 to the procedure for filling out the declaration. In the example for Vesna LLC, 520 01 is indicated for a truck. The table shows the most commonly used codes:

| Code | Vehicle name |

| Aircraft | |

| Aircraft | |

| 411 12 | passenger airplanes |

| 411 13 | cargo planes |

| Helicopters | |

| 412 12 | passenger helicopters |

| 412 13 | cargo helicopters |

| Water vehicles | |

| Sea and inland navigation vessels | |

| 420 10 | passenger and cargo sea and river self-propelled vessels (except those included under code 421 00) |

| 420 13 | sea and river self-propelled cargo vessels (except those included under code 421 00) |

| 420 30 | sports, tourist and pleasure boats |

| 420 32 | self-propelled sports, tourist and pleasure craft (except those included under codes 422 00, 423 00–426 00) |

| 422 00 | yachts |

| 423 00 | boats |

| 424 00 | jet skis |

| 425 00 | motor boats |

| Ground vehicles | |

| 510 00 | passenger cars |

| 520 01 | trucks (except those included under code 570 00) |

| Tractors, combines and special vehicles | |

| 530 01 | agricultural tractors |

| 530 03 | self-propelled combines |

Next line by line:

- 040 - VIN - vehicle identification number;

- 050 - brand - indicate Scania R420;

- 060 - state registration number assigned to the car;

- 070 — the field is intended to indicate the date of registration of the vehicle according to the documents;

- 080 - line is filled in in case of deregistration. It is important to use registration documents;

- 090 - tax base for transport tax. Define it as follows: if the vehicle has an engine, then indicate the power in horsepower. In our example, this indicator is used, and the sample declaration itself indicates 420 liters. With.;

- When filling out a report for an aircraft, enter the nameplate static thrust of the jet engine (the total thrust of all engines) at takeoff in kilograms of force or the power of the vehicle engine in hp. With. Owners of non-self-propelled (towed) water vehicles indicate the gross capacity in registered tons, and owners of self-propelled vehicles indicate the engine power in hp. With.;

- if we are talking about water and air vehicles not specified in subparagraphs 1, 1.1 and 2 of paragraph 1 of Art. 359 of the Tax Code of the Russian Federation, the tax base is defined as a vehicle unit, and in line 090 they put 1;

- 170 is the tax rate determined at the level of the subject of the Federation. To determine regional rates, use the Federal Tax Service service. In St. Petersburg, the rate is for trucks with a capacity of more than 250 hp. p., from the year of issue of which more than 5 years have passed, is 85 rubles (see Article 2 of the Law of St. Petersburg No. 487-53 dated November 4, 2002, as amended on June 21, 2016);

- 180 - the increasing Kp coefficient is indicated when owning a passenger car with an average cost of 3,000,000 rubles and depends on its year of manufacture (the coefficient varies from 1.1 to 3). Such machines are included in a special list (information from the Ministry of Industry and Trade of Russia dated February 26, 2016). In other cases, put dashes;

- 190 is the amount of tax calculated for the truck. Formula for calculation:

or by lines

Line 190 = page 090 × page 170 × page 150 × page 160 × page 180.

Let's calculate the tax amount for our example:

Let's continue filling:

- 200–270 - these lines are filled in if there are tax benefits. Vesna LLC does not have benefits, so we put dashes. See the table for codes:

| Code | Name | Base |

| 20200 | Transport tax benefits established by the laws of the constituent entities of the Russian Federation, of which: | Art. 356 Tax Code of the Russian Federation |

| 20210 |

| |

| 20220 |

| |

| 20230 |

| |

| 30200 | Benefits (exemptions) for transport tax provided for by international treaties of the Russian Federation | Art. 7 Tax Code of the Russian Federation |

- 280 - field for organizations that have heavy vehicles registered in the Platon system. It contains the deduction code - 40200. If the declaration is filled out for a passenger car, dashes are added;

- 290 - here we indicate the amount that the organization deposited into the account of the Platon system operator. If for some reason you do not remember how much money you paid for damages, make a request for each vehicle through your personal account in the system. Vesna LLC paid a fee of 10,000 rubles;

- 300 - if there are no benefits or deductions, the indicator from field 190 is transferred to this line. In our case, it is necessary to calculate the final amount. These are indicators from page 190 - data from page 290. In numbers, this is 25,700 rubles.

If the organization owns a car, the declaration must be filled out in the same way, but with minor differences. Note:

- vehicle type code - passenger car - 51000;

- the number of years that have passed since the year of manufacture does not need to be filled in, since rates for passenger cars in St. Petersburg are not differentiated depending on the age of the car.

Deadlines for payment of transport tax in 2021

Starting from January 1, 2021, uniform deadlines for payment of transport tax and advance payments on it for all Regional authorities, as before, determine tax rates and the procedure for transferring taxes (advances during the year), but regions no longer have the right to change or set other payment deadlines for the tax period (different from the uniform ones) .

Now all organizations must pay transport tax for the past year before March 1 . And if the regions provide for advances, then they must be paid before the last day of the month following the billing period. That is:

- for the 1st quarter - the advance is paid until April 30;

- for the second – until July 31 ;

- for the third – until October 31 .

deklaraciya_transportnyy_nalog_4.jpg

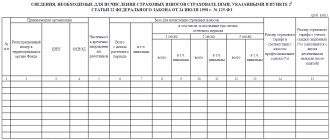

Let's check the control ratios:

| page 021 section 1 15992 | = | sum page 300 of all sections 2 585 + 15407 |

| page 030 5135 | = | page 021 – (page 023 + page 025 + page 027) 15992 – (585 + 5136 + 5136) The result is positive |

The equalities are fulfilled, the declaration is drawn up correctly.

Who calculates the tax

Organizations, as before, in 2021, calculate transport tax independently and pay advance payments based on these calculations.

The Federal Tax Service, in turn, does the same thing and first sends each taxpayer a special message with a tax calculation, followed by a requirement to pay transport tax.

If the organization has not received the demand before the established payment deadline, the obligation to pay the tax on time remains. And she must pay it according to her calculations.

Companies that have transport tax benefits are not required to declare the benefits to the Federal Tax Service, but take them into account in their calculations.

If in the tax payment request from the Federal Tax Service the amount of transport tax does not coincide has the right to file objections within 10 working days , confirming them with relevant documents. The inspectors, having examined the documents, will decide to clarify their calculations or make a demand for repayment of the arrears.

Read also

03.08.2020

Purpose of lines 070 and 080

On pages 070-080, indicate the dates of registration and deregistration of the vehicle

Using this information, tax authorities will be able to check whether you are correct:

- calculated the number of full months of vehicle ownership;

- took into account the “15th” rule.

This rule is described in paragraph 3 of Art. 362 of the Tax Code of the Russian Federation and is associated with the calculation of the vehicle ownership coefficient.

Find out from our publications whether you need to pay tax if you owned a vehicle:

- 1 day;

- less than a month.