Purchasing goods from individuals is not such a rare occurrence. Often, companies buy something they need from their founders, managers or other employees. But sometimes it is profitable to purchase a car, a computer, the necessary equipment, spare parts, building materials, etc. from some third parties. And some organizations cooperate with individuals regularly. Take, for example, buyers of agricultural products - most of them are shops, catering establishments and food manufacturers. What are the features of such transactions?

Convenient purchasing act

In accordance with subparagraph 1 of paragraph 1 of Article 161 of the Civil Code of the Russian Federation, transactions of companies with citizens must be made in simple written form.

For many, the best option is a procurement act, which simultaneously performs the functions of a purchase and sale agreement and a transfer and acceptance certificate. The Russian Ministry of Finance has nothing against it. But then the procurement act must contain all the terms of the transaction: name and quantity of products, unit of measurement, price and total amount, place of purchase, position and surname of the organization’s representative, information about the seller (passport details and residential address). This is emphasized in the letter dated August 4, 2014 No. 03-04-06/38361.

Paragraph 4 of Article 9 of Federal Law No. 402-FZ of December 6, 2011 allows an enterprise to develop the form of a procurement act independently. You can rely on form No. OP-5, approved by Resolution No. 132 of the State Statistics Committee of Russia dated December 25, 1998. As a rule, companies take it as a basis and modify it to suit themselves, deleting unnecessary columns, adding necessary ones, renaming the column “Agricultural products” (if they buy something else), etc. The main thing is that the document contains the mandatory details specified in paragraph 2 of Article 9 of Law No. 402-FZ. Then it will record the relationship between the parties and serve as the basis for recording assets in the accounting and tax accounting of the organization. No further paperwork is required (resolutions of the Federal Antimonopoly Service of the East Siberian District dated June 10, 2004 No. A74-438/03-K2-F02-1999/04-S1 and dated December 15, 2010 No. A78-7669/2009).

The purchase act is drawn up in two copies and endorsed by the parties at the time of purchase of the products. One copy is given to the seller, the second copy is kept by the company. Let us note that in form No. OP-5 there is a line “Income tax withheld in the amount, rubles.” However, the company should not withhold personal income tax in this case. More on this a little later.

The parties have the right to take an alternative route - to draw up a purchase and sale agreement (the general provisions on it are spelled out in Articles 454-491 of the Civil Code of the Russian Federation), and record the transfer of goods in a separate act. In this case, all the terms of the transaction are fixed in the contract, while the act is simplified (referring to the contract in it). A third option is also possible - the parties stipulate in the contract that the property is transferred to the buyer upon conclusion of the contract. Then it is not necessary to draw up a separate act.

Cases of application of the company's mentioned documents should be discussed in the accounting policy.

The tax base

When selling goods (works, services), the tax base for VAT is revenue. Determine the amount of revenue based on all the organization’s income related to payments for these goods (works, services) (clause 2 of Article 153 of the Tax Code of the Russian Federation). For more information about this, see How to calculate VAT on calculations related to payment for goods, works, and services sold.

In general, calculate revenue from the sale of goods (works and services) based on the prices established in the agreement with the buyer (customer). It is believed that these prices correspond to market prices (clauses 1 and 3 of Article 105.3 of the Tax Code of the Russian Federation). However, in some cases, tax inspectors can check whether the prices specified in the contract correspond to market prices. For more information, see How a tax audit of controlled transactions is carried out.

In some cases, the tax base for VAT is determined in a special manner (Article 154 of the Tax Code of the Russian Federation). This applies to the following situations:

- sales of goods (works, services) through commodity exchange (barter) transactions;

- sale of goods (works, services) free of charge;

- sale of property that was previously accounted for VAT;

- sales of agricultural products and processed products purchased from citizens;

- sales of cars previously purchased from citizens for resale;

- production of goods from customer-supplied raw materials;

- realization of property rights;

- implementation of intermediary services;

- sales of other goods (works, services) listed in Article 154 of the Tax Code of the Russian Federation.

An example of reflecting in accounting the accrual of VAT on the sale of goods (works, services)

In January of this year, Alpha LLC (seller) shipped Torgovaya LLC (buyer) a batch of finished products, subject to VAT at a rate of 18 percent. The cost of this batch, according to Alpha’s accounting and tax records, is 80,000 rubles.

The price of finished products (excluding VAT), according to the concluded agreement, is 100,000 rubles. This price corresponds to the market level.

Thus, the amount of VAT charged by the seller (“Alpha”) to the buyer (“Hermes”) is: RUB 100,000. × 18% = 18,000 rub.

The price of a batch of finished products, including VAT, is: 100,000 rubles. + 18,000 rub. = 118,000 rub.

Based on the results of this transaction, in the first quarter of this year, Alpha’s accountant must charge VAT in the amount of 18,000 rubles.

The seller did not receive any advances from the buyer for the upcoming delivery.

In the accounting of the seller (“Alpha”), the sale of finished products was reflected as follows:

Debit 62 Credit 90-1 – 118,000 rub. – revenue from the sale of a batch of finished products is reflected;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 18,000 rubles. – VAT is charged on sales proceeds;

Debit 90-2 Credit 43 – 80,000 rub. – the cost of finished products sold is written off.

Situation: how to calculate VAT when selling a building along with a land plot. Is the cost of each object not highlighted in the contract?

Calculate VAT based on the book value of each object (building and plot) taking into account the correction factor.

In the situation under consideration, the procedure provided for in Article 158 of the Tax Code of the Russian Federation should be applied. That is, the VAT tax base must be determined separately for each type of property (land and building).

To do this, you need to calculate the cost of each object using the formula:

| Cost of land (building) | = | Book value of land plot (building) | × | Correction factor |

Calculate the correction factor as follows:

| Correction factor | = | Selling price of a single object | : | Combined book value of building and land |

Since the sale of land plots is not subject to VAT, the tax must be charged only on the cost of the building.

Calculate VAT on the cost of the building using the formula:

| VAT = Cost of building: 18/118 |

The sale of the plot together with the building located on it will be issued with a consolidated invoice. In it, indicate the cost of each object separately. In this case, in the final line in column 9 “Cost of goods (work, services), property rights with tax - total,” indicate the total cost of the site with the building. Since the sale of a land plot is not subject to VAT, put dashes in columns 7 “Tax rate” and 8 “Tax amount” on the line where the cost of the land plot is indicated. Attach inventory acts to the consolidated invoice indicating the book value of each of the objects (clause 4 of article 158 of the Tax Code of the Russian Federation).

This is what the Russian Ministry of Finance recommends in letter dated March 27, 2012 No. 03-07-11/86.

Example: how to calculate VAT when selling a building along with land

Alpha LLC is selling the land plot along with the warehouse building located on it. The total selling price is RUB 160,000,000.

The book value of the land plot is 45,000,000 rubles, the warehouse building is 72,000,000 rubles.

To determine the tax base, the accountant calculated the correction factor:

160,000,000 rub.: (45,000,000 rub. + 72,000,000 rub.) = 1.36752137

The tax base for the warehouse building is equal to:

72,000,000 rub. × 1.36752137 = 98,461,538 rubles.

The accountant charged VAT on this amount at a rate of 18/118 percent.

RUB 98,461,539 × 18/118 = 15,019,557 rub.

The price of a land plot is:

45,000,000 rub. × 1.36752137 = 61,538,462 rubles.

Since the sale of land plots is not subject to VAT, the accountant did not charge tax on it.

In the consolidated invoice, the accountant reflected the cost of each item. At the same time, the accountant put dashes in columns 7 and 8 of the invoice for the land plot.

The accountant issued a consolidated invoice for the cost of the sold plot with the building located on it.

We take goods for resale: hello, KKT!

The parties have the right to choose the payment method themselves and specify it in the contract (purchase act). For example, indicate that the goods are paid for by bank transfer to an individual’s bank card, and provide details for transferring money. Or negotiate that the company pays the seller in cash.

In the first case, the fact of transfer of funds is confirmed by a payment receipt and a bank account statement of the purchasing company. And in the second, that is, when paying the seller money from the cash register, the company draws up a consumable document in form No. KO-2 (approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88).

Does a company need to punch a cash receipt? Financial department specialists have repeatedly noted: in general, when an enterprise pays money to an individual for goods, there is no need to use cash registers and issue a check (letters dated December 11, 2021 No. 03-01-15/89828, dated August 10, 2021 No. 03- 01-15/56554). At the same time, officials emphasize that citizens do not use cash register equipment in any case, since clause 1 of Art. 1.2 of Federal Law No. 54-FZ of May 22, 2003 imposes such an obligation exclusively on organizations and entrepreneurs.

But there is one exception to this rule. If a company purchases goods from individuals (including through accountable persons) for resale, then it is obliged to run a cash receipt. The Tax Service instructs to do this in a letter dated August 14, 2021 No. AC-4-20/15707.

If a company purchases goods from individuals (including through accountables) for resale, then it is obliged to run a cash receipt. The Tax Service instructs to do this in a letter dated August 14, 2021 No. AC-4-20/15707. Moreover, this applies to payments both in cash and by bank transfer (Article 1.1, paragraph 1 of Article 1.2 of Law No. 54-FZ, letter of the Ministry of Finance of Russia dated June 15, 2021 No. 03-01-15/41171).

It is important that the 100,000 limit for cash payments does not apply to amounts paid by companies to individuals (clause 5 of Bank of Russia Directive No. 3073-U dated October 7, 2013, Resolution of the Moscow District Administrative Board dated January 10, 2021 No. F05-9223 /2018).

We do not withhold personal income tax, we do not submit certificates

Citizens who sell property that belongs to them by right of ownership independently calculate personal income tax on the income from such a transaction and pay it to the budget. This follows from the provisions of Articles 226 and 228 of the Tax Code of the Russian Federation. The purchasing company in this case is not a tax agent, and therefore should not withhold anything. Officials have drawn attention to this more than once (letters from the Ministry of Finance of Russia dated April 11, 2012 No. 03-04-05/3-484 and dated March 12, 2008 No. 03-04-06-01/55, Federal Tax Service of Russia dated August 1, 2012 No. ED-4-3/ [email protected] ). The servants of Themis have an identical point of view (see resolutions of the FAS Central District dated February 17, 2011 No. A35-7103/2009, FAS Volga District dated May 15, 2009 No. A65-6772/2008 and the West Siberian District dated March 27, 2007 No. F04-1746/2007 (32835-A03-7), left in force by the Determination of the Supreme Arbitration Court of the Russian Federation dated July 26, 2007 No. 8910/07).

Thus, such transactions will not affect Form 6-NDFL in any way. Moreover, the organization should not provide the fiscal authorities with information on income paid to citizen sellers (that is, 2-NDFL certificates). After all, Art. 230 of the Tax Code of the Russian Federation establishes this obligation only for tax agents. Officials also think so (letters from the Ministry of Finance of Russia dated March 7, 2014 No. 03-04-06/10185 and dated February 27, 2013 No. 03-04-06/5607, Federal Tax Service of Russia dated May 19, 2008 No. 3-5 -04/19), and judges (resolutions of the Supreme Court of the Russian Federation dated December 6, 2005 No. 72-ad05-3, FAS Moscow District dated June 21, 2010 No. KA-A40/6150-10 and Volga District dated May 18, 2009 No. A12-16391/2008, upheld by the decision of the Supreme Arbitration Court of the Russian Federation dated July 21, 2009 No. VAS-8842/09).

note

If a company bought a car from a citizen and used it for some time in its activities, then when selling such a car, the VAT base is determined in the usual manner. There will be no benefits when selling a car received from an individual as compensation.

Sales under a contract in foreign currency

The tax base for VAT under contracts in foreign currency is determined taking into account the specifics. They are due to the fact that the buyer can make payments both in foreign currency and in rubles.

If revenue is received in foreign currency , it must be converted into rubles at the official exchange rate of the Bank of Russia on the date the tax base is determined. In this case, the tax base for export is recalculated into rubles on the date of shipment (transfer) of goods (work, services). Such rules are provided for in paragraph 3 of Article 153 of the Tax Code of the Russian Federation.

There are cases when the price in the contract is indicated in foreign currency, and the buyer pays in rubles . There are two options.

First: goods (work, services) are paid for after they are shipped. Then the proceeds from sales must be converted into rubles at the Bank of Russia exchange rate on the date of shipment of goods (work, services). Such rules are established by paragraph 4 of Article 153 of the Tax Code of the Russian Federation.

Second: the buyer made payment in advance. In this case, the tax base must be determined twice: on the date of receipt of the prepayment and on the date of shipment of goods (work, services) (Clause 1, 14, Article 167 of the Tax Code of the Russian Federation). Moreover, if 100 percent prepayment is received, then there is no need to recalculate the tax base determined upon receipt of the advance at the Bank of Russia exchange rate on the date of shipment of goods (performance of work, provision of services). If partial prepayment is received, the tax base is determined as the sum of two quantities:

- the amount of the received advance payment;

- the cost of shipped goods (work, services) at the Bank of Russia exchange rate on the date of shipment minus the received prepayment.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated January 17, 2012 No. 03-07-11/13.

Situation: how to calculate VAT on revenue if goods are sold in Russia and their value is expressed in foreign currency? They pay for the goods in foreign currency in two stages: partially in advance, partially after shipment.

Calculate VAT in rubles at the Bank of Russia exchange rate on the date of shipment of goods.

In accounting and tax accounting, revenue from sales under contracts denominated in foreign currency is defined as the sum of two quantities: the received advance and the receivables outstanding on the date of shipment. This is explained by the fact that advances received under contracts, the value of which is expressed in foreign currency, are not recalculated either on the reporting date, or on the date of shipment, or on the date of final settlements with the buyer (clauses 9, 10 PBU 3/2006, para. 3 Article 316 of the Tax Code of the Russian Federation).

However, for VAT purposes these rules do not apply. When making advance payments, the VAT tax base is determined twice:

- first, the seller charges VAT at the rate of the Bank of Russia on the date of receipt of the advance (according to the settlement rate);

- then the seller charges VAT on the cost of the shipped goods at the Bank of Russia exchange rate on the date of shipment (at a direct rate), and takes the amount of VAT accrued on the advance payment (at the rate in effect on the date of receipt of the advance payment) for deduction.

This procedure follows from the provisions of paragraph 3 of Article 153, paragraphs 1 and 14 of Article 167, paragraph 8 of Article 171 and paragraph 6 of Article 172 of the Tax Code of the Russian Federation and is confirmed by letters of the Ministry of Finance of Russia dated September 7, 2015 No. 03-07-11/51456, dated October 4, 2012 No. 03-07-15/130 and the Federal Tax Service of Russia dated September 24, 2012 No. ED-4-3/15921.

An example of reflection in accounting and taxation of proceeds from the sale of goods, the cost of which is expressed in foreign currency. The goods are sold to a representative office of a foreign organization located in Russia (payment for the goods is made in foreign currency). The contract provides for partial prepayment, final payment is made after shipment

Torgovaya LLC entered into an agreement for the supply of goods with a representative office of a foreign organization located in Russia for the amount of USD 11,800 (including VAT - USD 1,800). Cost of goods sold – 200,000 rubles.

On October 14, 2015, the representative office transferred an advance payment in the amount of $5,000 to Hermes. On October 26, 2015, Hermes shipped the entire consignment of goods to the buyer. The final payment is due on November 25, 2015. Title to the goods passes to the buyer on the date of shipment (26 October). Hermes applies a general taxation system and pays income tax quarterly.

The conventional US dollar exchange rate is:

- on October 14 – 29.40 rubles/USD;

- on October 26 – 29.70 rubles/USD;

- on November 25 – 30.00 RUB/USD.

In accounting, the Hermes accountant reflected the received advance and subsequent shipment of goods with the following entries.

October 14:

Debit 52 Credit 62 subaccount “Settlements on advances received” – 147,000 rubles. (5000 USD × 29.40 rubles/USD) – an advance was received to pay for goods;

Debit 76 subaccount “Calculations for VAT on advances received” Credit 68 subaccount “Calculations for VAT” - 22,424 rubles. (RUB 147,000 × 18/118) – VAT is charged on the advance received.

October 26:

Debit 62 subaccount “Settlements for shipped goods” Credit 90-1 – 348,960 rubles. (RUB 147,000 + USD 6,800 × RUB 29.70/USD) – revenue from the sale of goods is reflected;

Debit 62 subaccount “Settlements for advances received” Credit 62 subaccount “Settlements for shipped goods” - 147,000 rubles. – the received advance is counted towards payment;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 53,460 rubles. ((10,000 USD × 29.70 rubles/USD) × 18%) – VAT is charged on proceeds from the sale of goods;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances received” – 22,424 rubles. – accepted for deduction of VAT on advance payment;

Debit 90-2 Credit 41 – 200,000 rub. – the cost of goods sold is written off.

The same amount (200,000 rubles) is included in expenses that reduce the tax base for income tax.

Due to the fact that the contract provides for partial prepayment, and the final payment to the organization is made after shipment, an exchange rate difference arises in accounting. It appears only in relation to the subsequent (second) part of the payment - USD 6,800 (including VAT - USD 1,037). The advance payment is not recalculated.

The exchange rate difference is reflected in accounting on the date of receipt of final payment.

November 25:

Debit 52 Credit 62 subaccount “Settlements for shipped goods” – 204,000 rubles. (6800 USD × 30.00 rubles/USD) – final payment for the goods has been received;

Debit 62 subaccount “Settlements for shipped goods” Credit 91-1 – 2040 rubles. (6800 USD × (30.00 rub./USD – 29.70 rub./USD)) – reflects the positive exchange rate difference on the date of final settlement.

When calculating VAT, the resulting exchange rate difference is not taken into account.

In the VAT return for the fourth quarter of 2015, in line 010 (section 3), the Hermes accountant indicated (as part of the general indicators) revenue in the amount of 297,000 rubles. (10,000 USD × 29.70 rubles/USD) and the amount of VAT accrued in the amount of 53,460 rubles. (RUB 297,000 × 18%).

To calculate income tax, the accountant calculated the proceeds as follows: – regarding the advance: 5,000 USD × 29.40 rubles/USD = 147,000 rubles; – regarding subsequent payment: 6800 USD × 29.70 rubles/USD = 201,960 rubles.

The resulting revenue figure includes VAT. However, for the purposes of income tax, revenue is accepted without taking into account the taxes imposed (clause 1 of Article 248 of the Tax Code of the Russian Federation). The VAT charged upon shipment is considered to be presented. Therefore, when determining the amount of revenue for profit tax purposes, the accountant subtracted from the resulting indicator the amount of VAT, converted into rubles at the exchange rate on the date of shipment. Total revenue amounted to:

147,000 rub. + 201,960 rub. – 1800 USD × 29.70 rubles/USD = 295,500 rubles.

When determining the tax base for income tax, the accountant included:

- included in income from sales is revenue in the amount of RUB 295,500;

- non-operating income includes a positive exchange rate difference in the amount of 2040 rubles.

Thus, with the advance form of settlements for transactions denominated in foreign currency, the indicators of sales revenue (excluding VAT) in accounting and tax accounting are the same (295,500 rubles), but differ from the tax base for VAT (297,000 rubles) .

Situation: how to calculate VAT on the sale of goods (work, services) under an agreement concluded in foreign currency or conventional units linked to foreign currency? Settlements under the agreement are carried out in rubles.

Charge VAT depending on whether the terms of the contract provide for the transfer by the buyer (customer) of advance payment towards the upcoming delivery of goods (performance of work, provision of services).

If the transfer of prepayment is not provided for in the contract, calculate VAT in rubles at the foreign currency exchange rate (cu) in effect on the date of shipment of goods (performance of work, provision of services). In the future, when receiving payment from the buyer (customer), do not recalculate VAT. Exchange differences that arise upon receipt of payment should be included either in non-operating income (positive difference) or in non-operating expenses (negative difference) (clause 11 of article 250, subclause 5 of clause 1 of article 265 of the Tax Code of the Russian Federation). The same explanations are in letters of the Ministry of Finance of Russia dated December 23, 2015 No. 03-07-11/75467, dated January 17, 2012 No. 03-07-11/13.

According to the terms of the agreement, e. may represent the equivalent of foreign currency at the Bank of Russia exchange rate, adjusted by a certain percentage. In this case, when calculating the tax base, use only the official rate without any adjustments. Differences arising due to the adjustment percentage do not increase (decrease) the VAT tax base. They are taken into account only when taxing profits. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated February 21, 2012 No. 03-07-11/51.

An example of calculating the tax base for VAT when selling goods under an agreement concluded in e. A conventional unit is the equivalent of a foreign currency adjusted by a certain percentage. Payment for goods is received in rubles

LLC "Torgovaya" entered into an agreement for the supply of goods, the cost of which is 11,800 USD. e. (including VAT – 1800 USD). According to the terms of the agreement 1 cu. e. equal to 1 US dollar at the Bank of Russia exchange rate, increased by 5 percent.

Hermes shipped the goods on July 1 and received payment for them on July 15 of the current year.

The dollar exchange rate established by the Bank of Russia is:

- on July 1 – 32 rubles/USD;

- as of July 15 – 32.5 rubles/USD.

The value of i.e., according to the terms of the contract, it is equal to:

- as of July 1 – 33.6 rubles. (32 RUB/USD × 1.05);

- as of July 15 – 34,125 rubles. (32.5 rubles/USD × 1.05).

The following entries were made in the accounting records of Hermes:

July 1:

Debit 62 Credit 90-1 – RUB 396,480. (11,800 cu × 33.6 rubles) – revenue from the sale of goods is reflected;

Debit 90-3 Credit 68 subaccount “Calculations for VAT” – 57,600 rubles. (10,000 cu × 18% × 32 rubles/USD) – VAT is charged on the amount of proceeds from the sale of goods.

July 15:

Debit 51 Credit 62 – 402,675 rub. (11,800 cu × 34,125 rubles) – payment received from the buyer;

Debit 62 Credit 91-1 – 6195 rub. (RUB 402,675 – RUB 396,480) – reflects the positive difference in settlements with the buyer.

On July 15, upon receipt of payment, Hermes does not recalculate the VAT tax base. The VAT return for the third quarter will reflect a base of 320,000 rubles.

If the terms of the contract provide for the transfer of an advance payment, the procedure for calculating VAT depends on its amount.

When you receive a 100% advance payment, calculate VAT based on the amount of the advance payment received in rubles. In this case, no recalculation of the tax base is required - neither at the contractual rate, nor at the rate of the Bank of Russia on the date of shipment. That is, on the date of receipt of the advance payment, the final tax base for VAT is formed. When shipping goods against the received advance payment, please indicate in the invoice:

- in column 5 - the cost of goods (excluding VAT) in rubles based on 100 percent prepayment (without recalculation at the Bank of Russia exchange rate on the day of shipment);

- in column 8 - the amount of VAT from the tax base reflected in column 5.

This is stated in the letter of the Federal Tax Service of Russia dated July 21, 2015 No. ED-4-3/12813.

If the agreement provides for partial payment, charge VAT in the following order. Upon receipt of payment, calculate VAT on the amount of the advance payment received in rubles. When shipping goods (performing work, providing services), determine the tax base using the formula:

| Tax base for VAT upon shipment of goods (performance of work, provision of services) | = | Advance amount in rubles | + | Cost of the unpaid part of goods (work, services) in rubles at the Bank of Russia exchange rate valid on the date of shipment (performance of work, provision of services) |

The contractual exchange rate (cu) is not used when calculating VAT. There is no need to recalculate the amount of VAT accrued on the advance payment at the Bank of Russia exchange rate in effect on the date of shipment.

When calculating income tax, the differences that are formed when subsequent payments are received, include either in non-operating income (positive differences) or in non-operating expenses (negative differences) (clause 11, article 250, subclause 5, clause 1, art. 265 of the Tax Code of the Russian Federation).

This procedure for calculating VAT under contracts in foreign currency (cu) with settlements in rubles follows from the provisions of paragraph 4 of Article 153, paragraph 14 of Article 167 of the Tax Code of the Russian Federation and letters of the Ministry of Finance of Russia dated December 23, 2015 No. 03-07- 11/75467, dated January 17, 2012 No. 03-07-11/13.

On the date of shipment of goods (performance of work, provision of services), draw up an invoice. When filling out an invoice, take into account the specifics of the formation of the tax base. So, in column 5 of the invoice you need to indicate:

- the cost of goods (work, services) equal to the amount of the advance payment received in rubles on the date of receipt of the advance - if there was an advance payment of 100 percent;

- the cost of goods (work, services) equal to the amount of the advance in rubles on the date of receipt of the advance and the cost of the remaining part of the goods (work, services) in rubles at the exchange rate on the date of shipment of goods (performance of work, provision of services) - if there was a partial prepayment.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated February 15, 2012 No. 03-07-11/46.

Indicators in columns 4, 7, 8 and 9 are formed based on the tax base indicated in column 5 and the tax rate provided for the sale of the relevant goods (works, services).

See Examples of reflection in accounting and taxation of sales of goods under a contract in foreign currency.

Vegetables, fruits, parsley

As already noted, companies often buy vegetables, fruits, meat, fish, etc. from the population. Let's talk about this in a little more detail.

It is important that agricultural products are the property of citizens running private farms. This follows from paragraph 2 of Article 38 of the Tax Code of the Russian Federation, articles 128 and 130 of the Civil Code of the Russian Federation, paragraph 3 of Article 2 of the Federal Law of July 7, 2003 No. 112-FZ.

The same applies to berries, nuts, mushrooms, etc. collected by individuals, caught fish, wild animals caught (Article 20, paragraph 1 of Article 11, paragraph 2 of Article 34 of the Forest Code, Article 221 of the Civil Code of the Russian Federation ). This means that all of the above is completely true when purchasing such products from citizens.

Keep in mind that Article 21 of the Law of the Russian Federation of May 14, 1993 No. 4979-1 prohibits the sale and use of a number of products for food purposes if they have not been subjected to veterinary and sanitary examination.

We are talking about meat, milk, eggs, feed, etc. Therefore, be sure to ask the donors for the appropriate documents (veterinary certificates, etc.). So be sure to ask the donors for the appropriate documents (veterinary certificates, etc.).

Mushrooms - special attention. As is known, they can cause severe poisoning. If you are dealing with such gifts of nature, strictly follow the instructions of the “mushroom” Sanitary Rules SP 2.3.4.009-93 (approved by Resolution of the State Committee for Sanitary and Epidemiological Supervision of the Russian Federation dated August 20, 1993 No. 10). In particular, it is prohibited to buy processed mushrooms from the population (letter of the Ministry of Finance of Russia dated December 12, 2007 No. 03-04-06-01/437).

The organization can inform sellers that they have the right not to pay personal income tax on income:

- from the sale of livestock and crop products grown on private farms (Clause 13, Article 217 of the Tax Code of the Russian Federation). True, this is only possible if several conditions, also listed in this Code norm, are simultaneously met. Otherwise, taxation is carried out in the usual manner (letter of the Ministry of Finance of Russia dated February 18, 2013 No. 03-04-05/6-111);

- sales of wild fruits, berries, nuts, mushrooms, etc. (clause 15 of article 217 of the Tax Code of the Russian Federation);

- sales of furs, wild animal meat and other products obtained as a result of amateur and sport hunting (clause 17 of article 217 of the Code). But for this, the conditions established by paragraph 11 of Art. 1 of the Federal Law of July 24, 2009 No. 209-FZ (letter of the Ministry of Finance of Russia dated August 4, 2014 No. 03-04-06/38361).

However, the use of these concessions, including compliance with the requirements necessary for this, is entirely the concern of citizen suppliers.

The company has nothing to do with it anyway. Her business is the side.

Important

Citizens who sell property that belongs to them by right of ownership independently calculate personal income tax on the income from such a transaction and pay it to the budget. Thus, such transactions will not affect Form 6-NDFL in any way. Moreover, the organization should not provide the fiscal authorities with information on income paid to citizen sellers (that is, 2-NDFL certificates).

Hunting for quasi-entrepreneurs (freelancers)

Everything changed dramatically in 2015. More precisely, two letters from the Federal Tax Service :

- dated July 17, 2015 No. SA-4-7/ [email protected] ,

- dated December 24, 2015 No. SA-4-7/ [email protected] .

Among other things, they reported that leasing commercial real estate is aimed at obtaining funds, which are income from business . And, referring to the Supreme and Constitutional Courts, the Federal Tax Service notified citizens that they could be charged VAT and penalties for receiving such profits.

By that time, in different regions of Russia, city and district courts had already considered several cases related to the collection of tax debts from landlords.

Situation one.

Someone P. acquired ownership of a share of an unfinished residential building. Thus, she wanted to invest her savings without the goal of making a profit. In 2004, P. bought shares from other owners and transferred the entire house to the status of non-residential premises . In 2005, the facility passed state registration as a medical building.

From 2010 to 2012 offices were rented to a legal entity. At the same time, P. regularly paid personal income tax . The tenant LLC "***" as a tax agent withheld from the landlord and transferred 13% tax to the budget.

The tax office considered that P. was conducting commercial activities and was obliged to pay VAT , fines and penalties. By decision of the MIFTS dated February 25, 2014 No. 12-13/5, the quasi-entrepreneur was charged additional VAT, as well as a fine and penalties.

P. appealed the decision to the regional Department of the Federal Tax Service and the city court, the complaints were left unsatisfied.

Decision of May 13, 2014 in case No. 2-1291/2014 (attached to this article)

Situation two.

Defendant K., while married, purchased a building in his name in the center of the village to restore it after a fire - at the request of the district administration. After the renovation, while wondering what to do with the building, the defendant’s wife decided to start a private business. I had to enter into a gratuitous rental (the tax office demanded this, otherwise refusing to register my wife as an entrepreneur).

The wife’s trading did not improve in 2010 and 2011. The building began to be rented out to trade and catering enterprises under short-term contracts. K. submitted personal income tax , where he indicated in detail these sources of income, and paid tax.

In 2013, K. was charged VAT for 2010 and 2011, penalties and fines. He refused to pay. Later, by decision of the head of the regional Federal Tax Service, the amount of VAT and penalties was reduced - taking into account mitigating circumstances (committing such a violation for the first time, the taxpayer’s honest misconception regarding the nature of his activity, the presence of a son).

The court decided to collect from K. the VAT for 2010 - 2011, penalties and tax sanctions, as well as state duty for the district budget.

Decision of January 28, 2014 in case No. 2-25/2014 (in the appendix to this article)

Situation three.

T. rented out part of the premises in a residential building and an office for three years (from 2009 to 2011). However, he was not registered as an individual entrepreneur, but considered himself a law-abiding taxpayer, calculating and conscientiously paying personal income tax . In 2013, he decided to register an individual business. And during the paperwork, he notified the tax office that he owned residential and non-residential premises, which he used for rent. The tax authorities did not take into account the fact that the citizen paid tax in the indicated years and charged him additional VAT with penalties and fines. The judges decided the dispute in favor of the Federal Tax Service.

Determination of the Armed Forces of the Russian Federation No. 306-KG15-11736

Situation four.

In 2004, a certain M. acquired two non-residential premises under a joint activity agreement. Ten years later he sold them without even making a profit. He duly declared the transaction amount and paid personal income tax .

During all of the above operations, M. was not an individual entrepreneur. He decided to register his commercial activity after selling real estate in 2014. The Federal Tax Service charged M. VAT and penalties. In court, tax officials were able to prove that the premises were not intended for household, family or personal needs. And when M. explained that he did not make a profit from the sale of real estate, he was told that entrepreneurship is not always profitable. As a result, the courts again sided with the Federal Tax Service and forced the former owner of the property to pay more than 8 million rubles (including VAT ).

Determination of the Armed Forces of the Russian Federation No. 304-KG17-10687

Situation five.

Sh. has been processing non-ferrous metal since September 2012. And I submitted documents for registration as an individual entrepreneur only in November. The entrepreneur received a license for his type of activity in 2013. Tax officials calculated how much income Sh. received from September to November and assessed him an additional 2 million rubles - for VAT, single tax and personal income tax with penalties and fines. And for working without a license until 2013, a criminal case was opened against him and, as a result, he was punished with a fine of 150 thousand rubles.

The court of first instance canceled the obligation to pay personal income tax, but subsequent courts returned this requirement. Result: payment of more than 2 million rubles and a criminal record for the entrepreneur.

Determination of the RF Armed Forces No. 307-KG17-7696

As we can see, it is not only lease transactions that attract the interest of the tax authorities. By owning real estate and selling it, citizens can, from the point of view of the Federal Tax Service, be considered as entrepreneurs hiding their activities. Quasi-entrepreneurs who have other sources of income may also be targeted: private traders, online store , freelancers - if they are not registered as individual entrepreneurs.

It is worth understanding why the courts in most cases side with the tax authorities.

1. This is entrepreneurship.

Leasing of non-residential space contains such signs of commercial activity as the systematic receipt of profit when transferring the right to use these premises. In addition, all real estate was not purchased for personal use. And the activities of lessors are included in OKVED (70.20 according to the old version and 68.20 according to the new one). Another sign of entrepreneurship is the risky nature of the activity. Rante will bear the risk if his property is damaged or he does not receive income from the tenant.

2. These are commercial real estate transactions.

These premises are purchased and intended not for family, personal, or household needs. In most cases, they are used for retail or catering outlets.

But not everything in judicial practice is so clear-cut. Some quasi-entrepreneurs, with the help of competent lawyers, manage to prove their case in court - in whole or in part. Let's look at two cases where, after numerous trials, cases were sent “to the second round” and as a result, the courts took the side of individuals who were unfairly charged VAT .

Situation six.

From the beginning of 2011 to mid-2013, someone E. rented out premises to legal entities - for banks and retail outlets. From the income received, he faithfully paid personal income tax (for the entire period the amount amounted to more than 1.4 million rubles). Later, E., continuing to engage in this type of activity, registered an individual entrepreneur. Then the tax authorities became interested in his previous income, and based on the results of the audit, they assessed additional VAT (more than 1.9 million rubles), penalties (more than 550 thousand rubles), and fines totaling about 600 thousand rubles.

It is important that E.’s income as a lessor amounted to 4,376,000 rubles for 2011, 4,376,000 rubles for 2012, and 2,140,200 rubles for 2013. At the same time, for each three previous consecutive calendar months, revenue did not exceed 2 million rubles.

The entrepreneur appealed to the Arbitration Court and lost the case. The appeal yielded nothing. Judges of further instances also sided with the Federal Tax Service, noting that the premises owned by E. are not intended for personal use and are in fact non-residential.

And after many years of litigation, he won... an individual entrepreneur (who had previously rented out premises without registering an individual entrepreneur).

The fact is that in 2015 E. used his right to be exempt from VAT, which he notified the inspectorate about. But she did not take any retaliatory action. Only at the beginning of 2021, the tax authority again went to court with an application to collect the tax debt.

In 2021, the Arbitration Court refused to collect payments from the tax authorities: due to the exemption under Article 145 of the Tax Code of the Russian Federation and the missed deadline for accrued fines. The Court of Appeal upheld this decision.

Decision of the CA dated April 26, 2018 in case No. A55-1489/2018.

Resolution of the AAS dated August 21, 2018 in case No. A55-1489/2018.

Situation seven.

In 2008, M. bought a share in the premises, which are non-residential. For five years, he rented out this property, paying tax to the state as an individual. In 2009, he registered an individual entrepreneur in his name (main activity – furniture trade, simplified tax system, “income minus expenses”). In 2014, he sold the property for 2.8 million rubles. The tax authorities considered the amount received to be commercial income. As a result, M. was charged an additional 280 thousand rubles under the simplified tax system, almost 45 thousand rubles in penalties and 28 thousand rubles. fine

Challenging this decision, the individual entrepreneur lost the proceedings of 3 instances. But the Supreme Court came to an unexpected conclusion: since the tenants (tax agents) withheld and paid the tax, the entrepreneur had the right to expect a tax deduction.

Also, the tax authority knew for what kind of income the personal income tax , but the tax authorities did not express any doubts about the correctness of these payments, the declarations were accepted without questions.

Taxpayers have the right to assume that the tax office does not doubt the correctness of this payment if it does not contact them for clarification.

The Supreme Court concluded that the legality of the additional assessment depends on whether the tax authority had full information at the time the property was delivered and whether it used this information to invite the taxpayer to contribute the correct percentage.

The acts of the previous proceedings were canceled, and the case was sent for a second round. Rostov judges this time supported the IP.

Ruling of the Supreme Court of the Russian Federation dated March 6, 2018 in case No. A53-18839/2016

Resolution of the AAS of the Rostov region dated November 5, 2021 in case No. A53-18839/2016

Conclusion

By purchasing, selling and leasing commercial real estate, private individuals risk coming to the attention of the tax authorities and receiving not only a fine for illegal business , but also an additional 18 (and now 20) percent VAT with penalties. The same applies to everyone who runs online stores and engages in freelancing without registering as an individual entrepreneur or LLC. If earlier it was possible to get off with a fine, now the tax office will conduct a detailed audit, determine the duration of the activity, the turnover (and not just the income) from it and assign 13% personal income tax and 18% VAT.

If you are already on the list of debtors, the examples given in this text show that you have a chance to defend your position by entrusting your defense to smart lawyers.

Share on social media networks

Sales worker

In terms of insurance premiums, everything is also smooth: payments under civil contracts under which ownership of property is transferred are exempt from them (clause 4 of Article 420 of the Tax Code of the Russian Federation). The picture is similar with contributions for injury (clause 1, article 20.1 of the Federal Law of July 24, 1998 No. 125-FZ).

But keep in mind: if an organization buys agricultural products from its employees, fiscal officials may well suspect it of paying unofficial wages in this way. With all the consequences regarding personal income tax and contributions.

However, if the company proves that the transactions were real and its actions pursued reasonable economic goals, the arbitrators will most likely support the enterprise. A good example is Resolution of the Federal Antimonopoly Service of the Central District dated February 17, 2011 No. A35-7103/2009. In it, the court stated: the presented papers confirm the reality of the transactions and their reasonable business and economic purposes. Milk was bought from workers for fattening animals, and other products - meat, fish, sugar, grain, flour - for cooking in the canteen. Even the defects in the preparation of documents for the acceptance of agricultural products did not work against the company.

According to the judges, the presence of these errors does not refute the actual availability of these goods.

"Profitable" dangers

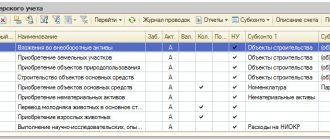

The purchase of goods, raw materials, supplies, and fixed assets from individuals is reflected in tax accounting in the same manner as the purchase of these valuables from an organization. In this case, the primary equipment must be in perfect condition, and the costs must be economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation). Otherwise the company will have problems.

Make sure that procurement documents contain complete and accurate information. If it turns out, for example, that individuals did not live at the listed addresses, and passports with the data specified in the acts were not issued to sellers, the company may well pay (see Resolution of the Federal Antimonopoly Service of the Far Eastern District dated October 11, 2006, October 4, 2006 No. F03- A73/06-2/3360).

Verify the seller's identity. A case from life - in the primary application for purchasing products from a private person, there was information from the passport of a completely different citizen, which he had lost several years ago. Moreover, this man himself was serving a sentence in a correctional colony at the time of the transaction and denied his involvement in these business operations. As a result, the company lost expenses, despite the fact that the goods were actually purchased by it, capitalized and subsequently sold (Resolution of the Federal Antimonopoly Service of the Volga Region dated August 9, 2012 No. A12-22472/2011, upheld by the Determination of the Supreme Arbitration Court of the Russian Federation dated December 19, 2012 No. VAS-16290/12).

It is also necessary to ensure that all procurement documents contain the signatures of sellers. Of course, there are examples of court decisions in which companies, in the absence of such autographs, still managed to prove the fact of purchase of products (Resolution of the Federal Antimonopoly Service of the Volga District of August 7, 2009 No. A57-14214/2008, etc.).

However, wasting time, energy and tempting fate is not a pleasant experience.

We immediately warn against forging sellers’ signatures in such a situation. The deception may well be revealed with the help of a handwriting examination, and then - goodbye to expenses (Resolutions of the Federal Antimonopoly Service of the North-Western District dated June 15, 2009 No. A52-5063/2008, FAS North Caucasus District dated May 6, 2009 No. A53-17846 /2008).

The auditors will certainly suspect something is wrong even if the volume of products purchased from “physicists” goes beyond all reasonable limits.

For example, the Federal Antimonopoly Service of the Volga-Vyatka District, in Resolution No. A31-9242/2005-15 dated May 14, 2007, came to the conclusion that the procurement acts contained unreliable information. After all, the company purchased an unrealistic amount of mushrooms from four individuals every day - from 2.5 to 10 tons. As a result, the company lost its “profitable” expenses.

Without VAT deduction, but with concessions

Individuals are not VAT payers (clause 1 of Article 143 of the Tax Code of the Russian Federation), and therefore do not present tax to the purchasing organization, which it could take as a deduction.

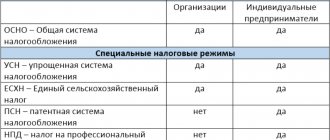

For companies on OSN, this is a definite minus. The same cannot be said about the “income simplifiers,” for whom such a deduction is unnecessary (unlike, by the way, their “income-expenditure” colleagues, who write off “input” VAT as expenses (subclause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation)) .

Keep in mind: it is impossible to determine the tax by calculation method in order to subsequently accept it as a deduction for such purchases (Resolution of the Federal Antimonopoly Service of the North Caucasus District dated May 29, 2007 No. F08-2109/2007-875A).

If the company subsequently sells this property, it will have to charge VAT on its sale price (subclause 1, clause 1, article 146, clause 1, article 154 of the Code). However, there are two exceptions to this rule, when a company calculates tax on the inter-price difference (that is, on the sales price of products including VAT minus the price of its purchase from citizens) using calculated rates - 10/110 or 20/120. Thanks to such a preference, the organization will pay much less tax.

The first case is the sale of agricultural products and products of their processing (except for excisable goods) purchased from “physicists” from the List approved by Decree of the Government of the Russian Federation of May 16, 2001 No. 383 (clause 4 of Article 154 of the Tax Code of the Russian Federation).

note

Purchases from entrepreneurs with special regimes are not subject to this provision of the Code (see letter of the financial department dated December 7, 2006 No. 03-04-11/234, Resolution of the Federal Antimonopoly Service of the Volga District dated December 3, 2013 No. A12-6633/2013) .

Please note - according to financiers, this benefit is applicable only when the company resells the mentioned products.

If a company purchases it, then processes it, and then sells the finished product, then the tax base is determined based on the full cost of what is sold, that is, in the usual manner (letter of the Ministry of Finance of Russia dated July 11, 2021 No. 03-07-14/43942).

Some judges also think the same (see decisions of the Federal Antimonopoly Service of the West Siberian District dated June 8, 2009 No. F04-2975/2009 (6522-A03-42), Central District dated October 8, 2008 No. A36-528/2008) . However, the majority of arbitrators have a different point of view - they allow processors of raw materials to use the benefit (resolutions of the Administrative Court of the East Siberian District dated July 30, 2015 No. 02-3273/2015, FAS Ural District dated May 8, 2009 No. F09-2751/09 -C2, as well as determinations of the Supreme Arbitration Court of the Russian Federation dated December 11, 2007 No. 15613/07 and August 9, 2007 No. 8061/07). So the company’s chances of defending its position are very good.

Important

If a company purchases products from citizens of one locality, it is impossible to combine all these purchases in a single document, according to lawyers.

After all, each such transaction is bilateral, which means that separate contracts (purchase acts) must be drawn up with all sellers. Example 1. VAT on the purchase and sale of agricultural products

The company purchased 145 kg of potatoes from an individual at a price of 15 rubles. per kg, after which she sold it at a price of 27 rubles. per kg including tax. Potatoes are named in List No. 383. Thus, when selling these products, the tax base is equal to 1,740 rubles. ((27 rub. – 15 rub.) × 145 kg). The amount of VAT payable, based on the provisions of sub-clause. 1 clause 2 and clause 4 art. 164 of the Tax Code of the Russian Federation, amounted to 158.18 rubles. (RUB 1,740 × 10/110).

Background

Since the 90s of the twentieth century, the tax service began to actively campaign citizens, motivating them to pay taxes. The advertising slogan invented in those years: “Pay your taxes and sleep well” is still remembered by many Russians. And such advertising had a very strong response - people registered their income en masse and diligently paid the required 13 percent of personal income tax to the treasury.

One of the most popular types of passive income in our country is renting out residential and non-residential premises . By becoming the owners of such real estate and receiving rentier status, citizens provided themselves with at least some kind of financial stability. They profitably rented out their premises for long periods of time as offices, shops, warehouses and had a constant and reliable income. individuals on the rent received .

Many enlightened people understood that having received the status of private entrepreneurs (later changing their name to individual entrepreneurs or individual entrepreneurs), they would spend less by notifying the tax authorities about the transition from OSNO, where you need to pay VAT , to the “simplified tax” and reducing the tax to 6%. But the bureaucratic “bonus” in the form of constant reporting for all regulatory authorities attracted few people. And the notorious personal income tax was included in the rental price and was not burdensome for the rante itself.