When calculating compensation for unused vacation, it is often difficult to determine the calculation period for dismissal on the last day of the month. There is similar uncertainty when calculating average earnings for 3 months for the employment service. Whether or not to include the last month in the calculation depends on the specific date the employee leaves. In this consultation, we discuss dismissal on the last day of the month and calculation of compensation.

General information

Upon completion of the employment agreement, the organization is required to make all payments to the employee on the day of dismissal. The billing period and calculation of compensation for dismissal on the last day of the month most often includes:

- dismissal payments due to the reason for leaving work (by agreement of the parties, in case of layoff);

- compensation for missed vacation;

- unpaid wages;

- other dismissal payments that are provided by the enterprise.

The main point is the issue of correct calculation of the amounts that belong to the resigning employee. In addition to the Labor Code of the Russian Federation, the regulatory framework also consists of:

- letter of the Ministry of Finance dated February 12, 2021 No. 03−04−06/7535;

- letter of Rostrud dated December 19, 2014 No. 1519−6−1;

- Government Resolution No. 922 “On the implementation of order...”.

No days worked

It may be that even before the pay period, which consists entirely of excluded time, the employee did not actually have days worked (or accrued wages). In this case, take as the calculation period the days that he worked in the month of dismissal (clause 7 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

An example of how to determine the calculation period for calculating compensation for unused vacation associated with dismissal. The calculation period consists entirely of the time that needs to be excluded. Before this, the employee had no actual days worked

Economist A.S. Kondratyev has been working in the organization since January 11, 2016.

He resigns on March 23, 2021. Kondratyev is entitled to compensation for unused vacation. The duration of the period for calculating compensation is from January 11 to February 29, 2021 inclusive.

From January 11 to 31, Kondratiev was on a business trip, and from February 1 to 29, on study leave. All this time is excluded from the billing period.

Until January 11, 2021, Kondratyev did not work in the organization. Therefore, there is no period preceding the settlement period.

To calculate compensation for unused vacation, the accountant took into account the period from March 1 to March 23, 2021.

Payroll period

To calculate the debt on wages and payment of compensation for unpaid vacation, you need to determine the billing period, from which you need to start.

Thus, regarding the payment of debts related to employment during the payroll period, upon dismissal on the last day of the month, one must rely on the date of payment of wages, which is established in the internal documentation of the organization.

Taking into account the legislation of the Labor Code of the Russian Federation, the work of employees of an enterprise must be paid at least twice a month and no later than two weeks after the end of the period for which wages were accrued. Therefore, enterprises most often use a system that provides for payment of wages for the previous month at the beginning of the current month and an advance payment closer to the end of the current month.

Accordingly, in order to determine the period for calculating the salary debt, you need to know the date from which the employee decides to resign. For example, you can calculate compensation if an employee quits in the middle of the month with a specified dismissal date of the 17th, from the 1st to the 17th.

To calculate the amount of payment, you need to determine the average salary for one day of work of the resigning person by dividing the salary by the number of working days in the current month. Then, in the case under consideration, the received daily salary must be multiplied by the number of working days from the 1st to the 17th. The final salary arrears will be found by subtracting from the resulting amount the advance paid to the employee, if it was accrued before the date of leaving work.

Taxation

Any amount that is considered income is necessarily subject to taxation. 13% income tax is charged on compensation for unfulfilled vacation, both in the case of termination of the employment agreement and in the case of regular compensation. Transfers are made to the tax authorities on the final day of work of the resigning employee (Article 223, Part 2 of the Tax Code of the Russian Federation).

Tax Code of the Russian Federation N 117-FZ. Article 223. Date of actual receipt of income

Also, all insurance premiums are also transferred from the calculated amount of compensation:

- pension insurance (22%);

- social (2.9%);

- medical (5.1%);

- for injuries (from 0.8 to 8.5% depending on the type of production).

The insurance amounts must be paid by the middle of the month following the month of dismissal. For example, if the contract is terminated on March 25, contributions must be paid by April 15.

Having decided to terminate the contract, the employee has the right to receive payment for unfulfilled rest days. It is calculated by analogy with regular vacation pay. Compensation is due not only for regular, but also for unrealized vacation in the form of additional days. The person being fired must receive the money on his final day of work.

Vacation not taken

When determining compensation for unpaid leave upon dismissal on the last day of the month, the calculation period is made up of those days that are due to the employee on the date of dismissal.

To determine them, an organization can use one of the methods. The first method is to calculate the period (vacation days that the employee did not use) using the formula: RP=(Mo*Ko)/12, where:

- RP - number of settlement days;

- Ko - the due vacation days of the resigning employee;

- Mo - the number of months worked since the last leave;

- 12 is the number of months in a year.

This method is also used by the courts if it is necessary to calculate the vacation days due to the employee on the date of dismissal.

The other method is a little imperfect, but is used by many businesses.

This method consists of determining the number of vacation days accrued by an employee for each month. In this case, the month that is worked less than half does not take part in the calculations, and the month that is worked more than half is rounded up to the full month. Taking into account this method, during a standard vacation of 28 days, the employee receives 2.33 days each month towards the upcoming vacation (28 days/12 months). But when dividing 28 by 12, there are 2 integers and 3 in the period, so Rostrud decided to round this figure to 2.33.

Therefore, due to a slight error, calculations in some cases lead to incorrect results. For example, 6 months of work allows you to take 14 vacation days, but when calculated using this method it comes out to 13.98. As a result of this, the Ministry of Health and Social Development, in letter No. 4334−17, recommended that all errors be transferred in favor of resigning workers.

Determine the start and end date of the period

The general rules for calculating deadlines are established in Article 14 of the Labor Code. The period of time associated with the termination of employment relations begins the next day after the calendar date that determines their end (Part 2 of Article 14 of the Labor Code of the Russian Federation).

The period must begin counting from the day following the day of dismissal. But the main difficulty is determining the end date.

If severance pay is paid monthly. The algorithm for determining the boundaries of the paid period depends on what date the period begins.

A month that begins on the first day ends on its last calendar day, such as September 30, February 28, or October 31.

But the start date of the period does not always coincide with the first day of the calendar month. In this case, it is convenient to set the last day of the period in this way.

Step 1. Determine the month in which the last day of the period will be. This must be the month following the month in which the last day of work occurred. For example, an employee was fired on September 30, 2013. This means that the desired date will definitely fall in October.

Step 2. Subtract one from the number that indicates the first day of the required period. For example, an employee was fired on August 23, 2013. The period for which severance pay is calculated begins on August 24, 2013. Subtract one, we get September 23, 2013 (24 - 1).

Step 3. We combine the results of step 1 and step 2. We get the end date of the period. For example, an employee was fired on October 18, 2013. The first date of the period for which severance pay is paid is October 19, and the last date falls in November, namely the 18th (18 - 1) - November 18, 2013.

If severance pay is paid in two weeks. In this case, the algorithm proposed above is not applicable. Since the number of calendar days in a month can vary, but two weeks always have 14 calendar days. But this fact makes the accountant’s task easier.

The start date of the period is also determined. This is the day following the day of dismissal. And the last day will always be the 14th (regardless of the number of calendar days in the month of dismissal).

Example 1. O. I. Ivanenko was dismissed due to conscription into the army on April 29, 2013, E. D. Romanenko - on May 29, 2013. Each of them is entitled to severance pay in the amount of two weeks' average earnings. It is necessary to determine the beginning and end of the two-week periods for each conscript.

Solution. The two-week period after the dismissal of O.I. Ivanenko began on April 30 and ended on May 13, 2013.

The two-week period after the dismissal of E.D. Romanenko began on May 30 and ended on June 12, 2013.

Average wages

Along with determining the period that is used to calculate the amount for unpaid vacation, the method of calculating the average salary of an employee, as another component in calculating the final amount of compensation, is of no small importance . The Labor Code of the Russian Federation regulates the basic requirements for calculating average payment (Article 139):

- Use in calculations of information about the amounts earned for one year that preceded the month the calculations were performed.

- Use during calculations of all payments that made up the organization’s remuneration system and received by the employee.

The average salary is calculated using the formula: UZ =D/12/29.3. In which UDS is the average salary, D is the employee’s income for one year before calculation, 12 is the number of months in a year, 29.3 is working days in one month.

Taking into account Resolution No. 922, if in the period that was taken for calculation, the employee did not work all the required days, then the determination is made using the formula UZ = D / (29.3 * Mn + Mn), where:

- UZ - average salary;

- D - amount of payments for the past year;

- 29.3 - working days in a month;

- Mn - the number of days worked in partial months;

- MP - the number of days that are fully worked by the employee.

So, knowing the size of the employee’s average salary, you can calculate the amount of compensation for unused vacation by multiplying this figure by the number of vacation days due to the employee.

Compensation calculation

The amount of vacation pay directly depends on two main components:

- Average earnings. The latter is calculated in accordance with Post. Proceedings No. 922 dated December 24, 2007 and Article 139 of the Labor Code of the Russian Federation.

- Duration of vacation.

Average earnings

The articles of Decree No. 922 indicate which payments are used to calculate average earnings, and what must be excluded from this list. The payment system under which this or that employee works does not affect the calculated values.

What payments are used to calculate average earnings

It is necessary to take the following types of earnings to calculate the average wage:

- accrual of actually worked time in accordance with the established salary;

- remuneration related to the implementation of the volume of piecework;

- payments depending on the revenue received as a percentage;

- remuneration in the form of cash for hours worked in state and municipal institutions, including teachers of schools, universities, and colleges;

- various types of fees, as well as royalties awarded to media workers and artists;

To calculate the average amount of remuneration, various types of royalties are used, as well as royalties accrued to media workers

- various additional payments, calculated either as a percentage or as a constant value to both tariff rates and salaries. These may be charges:

- For achieving a certain level of professionalism and skill, for example, assigning the appropriate category to the teaching staff.

- For confirmation of class, for example, among truck drivers.

- For the number of years worked in a specific production. The amount of service for certain professions depends on the established level of service, for example, 10 years or 15 years.

- For maintaining commercial or state secrets.

- All types of combinations of any profession, for example, school teachers, in addition to teaching lessons, often combine classroom management.

- For performing work under special conditions: harmful and dangerous.

- For performing work outside of normal working hours: night hours, work on holidays and weekends.

- Bonuses and individual or professional allowances.

- bonuses paid monthly or quarterly;

- annual bonus accruals.

The amount of vacation pay directly depends on the main components

The following social payments cannot be included in the calculation of average earnings:

- any financial assistance;

- paid travel;

- monetary compensation for food, for the provision of utilities;

- tuition fees.

Note! If the contract is terminated on the last day (calendar), this reporting period is included in the calculation of payments for compensation of vacation days. If the final day of work in a month is the last working day, but not a calendar day, then such a period is not taken into account for calculations.

If the final day of work in a month is the last working day, but not a calendar day, then such a period is not taken into account for calculations

For example, an employee worked his last day on June 28. It is the final working day of the month, but not a calendar one. Therefore, May will be used as the last month for calculations.

Amount of days

The calculation of vacation pay includes all payments for the year preceding the accrual period. In this case, a calendar month is a full month, including 30 or 31 days. The exception is February, in which the number of days corresponds to 28 or 29.

The calculation of vacation pay includes all payments for the year preceding the accrual period.

From the selected 12 months, when calculating vacation compensation, the following time must be excluded:

- sick days, including sick leave for pregnancy and childbirth;

- the time that the employee was on temporary work;

- any downtime that occurred through no fault of the employee or employer;

- additional paid days provided to care for a disabled child;

- release from work for any reason, either with or without full retention of earnings;

- the vacation itself.

Important! If the work activity in the company is less than a year, then the actual number of hours worked, starting from the month of his employment, is used for calculation.

Excluding days when calculating vacation compensation

The number of days in a month that was not fully worked out is calculated in accordance with the formula:

Kdm = 29.3 / duration of the reporting period according to the calendar * actual days of work.

For example, in April an employee was sick for a week. The amount of actual work per month was 23 days. The number of days in April that will be used to recalculate vacation pay will be:

Kdm = 29.3 / 30 * (30 - 7) = 22.4 days = 23 days.

Important! If after calculations the result is not a whole value, then it should always be rounded, but not according to the rules of mathematics, but always upward (Letter of the Ministry of Health and Social Development No. 4334-17 dated 07/12/2005). Thus, rounding is carried out in favor of the employee.

“Letter” of the Ministry of Health and Social Development of the Russian Federation “On the procedure for determining the number of calendar days of unused vacation”

Number of days for vacation recalculation = number of full months * 29.3 + Kdm.

If for the example given earlier the remaining months are considered fully worked, then the number of days will be:

11 * 29.3 + 23 = 345 days.

Use the calculator to calculate the amount upon dismissal, as required wages and for unused vacation pay.

All earnings for the year in question should be divided by the days obtained as a result of the calculation.

| Possible situations | Billing period |

| The employee has been working for the company for more than a year | 12 months before the month of vacation registration |

| The employee was hired by the company less than a year ago | Since employment |

| The employee has been with the company for a long time, but over the last 12 months his salary has not been calculated. | For the earlier 12 months when earnings were accrued |

Important! If the resigning employee worked for more than half a month (from 15 days) and did not complete the full reporting period, then the whole month is taken into account for the calculation. If the work at the enterprise was less than half of the reporting period, then no payment is due.

Calculation of additional Leave associated with harmful conditions is carried out only according to the time of actual work in such conditions.

Harmful working conditions 1st degree

Last day of the month

If the application for resignation is dated on the last day of the month, then when calculating the average salary of the resigning employee, the question often arises of including in the calculated compensation the month in which the employment contract is terminated.

The Labor Code does not precisely regulate this situation, defining only that dates from the 1st to the 30th or 31st are considered a calendar month. Rostrud explains this situation in letter No. 2184−6−1, taking into account whether the last day is a weekend or a working day.

If the deadline is a working day (for example, May 31, 2021), then it must be included in the calculation of the employee’s average salary. This is due to the fact that the day the employment agreement ends is considered the employee’s last working day - and, accordingly, the month has been fully worked and there is no reason not to include it in the calculations.

Another situation occurs if an employee is dismissed on the last non-working day of the month. For example, in 2021 this day may be March 29th. As Rostrud explains, despite the fact that the dismissal occurs on the last day, and the month itself ends later (in the described example - March 31, that is, 2 days later), it turns out that the month has not been fully worked out and therefore it can not be counted during calculating the average salary of an employee for the past year.

The procedure for payments upon termination of employment

Upon dismissal, an employee is entitled to several types of payments:

- salary for the last calendar month before dismissal;

- compensation for unused vacation in the current working period;

- issuance of average earnings, the amount of which is calculated depending on the reason for dismissal (downsizing, refusal to transfer, conscription, etc.);

- other compensation provided for by a specific employer, for example, in a collective agreement.

All types of payments must be transferred to the former employee no later than the day of dismissal. An exception may be a bonus if the employer’s internal regulations establish the procedure for its payment after the period for which it is due.

For example, an employee quits in the middle of the month, and according to the collective agreement he is entitled to a bonus. The same document establishes that it is calculated and paid based on the results of meeting planned targets for the month and is issued the following month. In this case, it will be transferred to the former employee after the date of dismissal.

If the employee’s dismissal date falls on a weekend, then he must receive all the money on the last working day.

Example: at the request of the employee, the employment relationship is terminated on December 12. According to the calendar, this day falls on Saturday and is a day off. This means that all payments must be transferred on the last working day, i.e. December 11.

If compensation and salary payments are paid later than the date of dismissal, then this situation may become a reason for a complaint to the court. For the organization from which the employee left, this is fraught with fines and additional costs.

To correctly calculate all payments, first determine the period for which they are due and the time period for calculating average earnings.

Additional rest

Taking into account current legislation, some workers have the right to additional days of rest earned for some features of the profession. Additional days may be added:

- for the special specifics of work activity;

- hazardous production;

- work in the North;

- irregular working hours.

In addition, additional vacation days can be regulated by the local documentation of the enterprise as a way of awarding bonuses for work.

As the Labor Code of the Russian Federation states, upon completion of the employment agreement, the employee is provided with compensation for all vacation days not taken off. This means that additional leave not taken must also be compensated. In this case, there is no need to separately calculate the amount of payment specifically for additional leave. In this case, during calculations, you can take into account the total duration of the allotted vacation for the resigning employee and use any of the calculation methods described above. In other words, the total amount of dismissal compensation can be calculated simultaneously for all vacations.

Concept of the term

When an employee is dismissed, there are several types of compensation.

- Benefits and compensation for employees who have been laid off. This type of compensation is paid only if the employee’s dismissal was not his own decision, did not depend on his desire and was not a consequence of a disciplinary sanction. Otherwise, when an employee independently violates the terms of the contract he signed, benefits will not be paid. The amount of this benefit is equal to the employee’s average monthly salary or two weeks’ salary (in some situations).

- Payment of the average monthly salary while looking for another job. Just as in the first paragraph, this compensation payment is made only on the condition that the employee was dismissed due to reduction, and not at his own request. This compensation is paid in the second or third month of dismissal.

- Payment for days worked after the last payments. This payment is not affected by the reason why the employee quit, and it does not matter whether it was his own decision or forced. In any case, the employer is obliged to make this payment for the days worked by the employee.

- Compensation for unfulfilled vacation. This compensation is paid to employees who are planning to leave the company without having time to use the accumulated vacation days for any reason.

Other payments that do not fall into one of these categories are made only when this has been agreed upon in advance in the employment contract. They are regulated by local regulations.

Benefit due

In certain non-standard cases, calculations of compensation upon dismissal for vacation days cause difficulties. Typically, the following situations occur:

- If a short-term employment agreement lasting no more than 2 months is signed with an employee, then the calculation of the vacation pay period is made according to Art. 291 of the Labor Code, taking into account which a worker is entitled to 2 days of vacation for one month of work. But if an open-ended employment agreement is terminated before two months, then this rule does not apply.

- Working employees under a civil law agreement do not have the right to compensation for leave during dismissal, since the Labor Code does not apply in this case. But certain payments may be provided for by the organization’s local documents.

- Severance pay for leave is paid to the employee regardless of the reasons for which he quits, in particular during the cancellation of the employment agreement during the probationary period or due to the employee’s misconduct. This is regulated by Rostrud letter No. 1917−6−1. If the employee has not worked for the company for 6 months, then compensation is calculated in proportion to the time worked. If a specialist has worked at the enterprise for less than two weeks, then according to the law, compensation for vacation upon dismissal is not provided.

- During their work, seasonal employees receive 2 days of vacation per month (Article 295). Taking into account this norm, leave upon dismissal for this employee should be calculated.

What are the consequences of non-payment or delay of salary upon dismissal?

For non-payment or untimely payment of settlement and salary upon dismissal, the employer and officials face administrative and, in some cases, criminal penalties. Let's look at them in more detail.

Administrative liability under clause 6 and clause 7 of Article 5.27 of the Code of Administrative Offenses threatens for untimely or incomplete payment of wages and compensation, provided that there is no criminal offense. The size of the sanctions will be:

- from 10 to 20 thousand rubles. for officials;

- from 30 to 50 thousand rubles. for legal entities.

- from 50 to 100 thousand rubles. for legal entities for repeated violation.

Criminal liability is provided for in Art. 145.1 of the Criminal Code of the Russian Federation, if the employer does not pay wages for more than 2 months (from 100 to 500 thousand rubles), or does not pay the balance of wages for more than 3 months (up to 120 thousand rubles). This article also provides for deprivation of the right to hold certain positions or engage in certain activities for a period of up to 1 year.

Dismissal of a part-time worker

According to the Labor Code, part-time workers have the same rights as full-time employees. They have the same guarantees for compensation during dismissal. The rights of part-time workers include:

- payment of compensation upon dismissal, which consists of the same parts as the dismissal payment to the main employee, it is calculated according to uniform rules regulated for determining these indicators;

- payment of vacation days taking into account those received at part-time work;

- annual leave (at least two weeks).

That is, when calculating compensation for a part-time employee upon dismissal, you need to find out the period for calculations and determine the total wage debt in accordance with the Labor Code.

It is important to correctly calculate the amount of compensation for unpaid vacation, find out the billing period, taking into account the rules on regular and additional vacations. Moreover, it is necessary to take into account vacation payments that were provided in advance, which is not uncommon for part-time workers.

Calculate other payments that are related to the reason for leaving a part-time job (for example, due to layoffs), or specified by the company’s internal documentation.

Calculating compensation upon dismissal of an employee is an important element of the process of completing an employment contract. Moreover, the procedure for calculation during dismissal, despite detailed instructions in labor legislation, requires a careful approach, taking into account all the accompanying obligations of the organization, which are important for calculating the total amount of payment.

Payment terms and package of documents

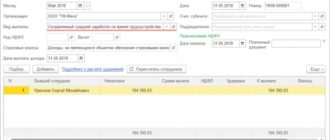

In order to calculate and pay all amounts due to an employee, the following documents must be completed:

- dismissal order;

- settlement note upon termination of an employment agreement (contract) with an employee;

- certificate 182n about income.

A special place among these documents is occupied by the so-called settlement note. Compose it in any form or use the unified form T-61, approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 N 1. This form is quite easy to fill out; it consists of two pages.

Section 1. Title page, on which you should indicate all the data about the person, the period of his work, the date and reasons for dismissal.

Section 2. Calculation of vacation pay (reverse side). The entire period of work for which vacation was not used is calculated here.

Section 3. Wages. Salary calculations are made indicating all deductions:

Please note that the title page is signed by a human resources specialist, and the reverse side is signed by the accountant of the organization who made the calculation.

Is it possible to check online?

Currently, there are many online calculators with which you can make all the necessary calculations, even those related to certain economic tasks. You can also calculate compensation payments yourself using the Internet.

There are a huge number of popular sites where you only need to enter the main requested indicators - average salary, unused vacation days, dismissal day, days worked, etc., taking into account all possible features, and the program will automatically process the data and calculate the size of future payments

The most famous online sites for calculating compensation:

- Main book;

- Simple accounting;

- Planetcalc.

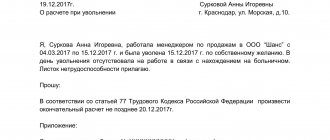

Dismissal after maternity leave

Many people are concerned about the question of whether payment is due to an employee who quit immediately after the end of maternity leave or maternity leave. The period of time during which a woman is at home with her child will not be taken into account when calculating her work experience. In other words, the days you are at home with your child are not taken into account the legal days of rest that you did not have time to take off. In this case, the billing period is taken to be 12 months before the employee goes on maternity leave.

Typically, employees who decide to quit must work for the company for an additional 2 weeks. This rule does not apply to women who were on maternity leave if the employee warned her employer in advance of her dismissal.

Calculation example:

- Economist N. G. Arefieva, having worked for the company for 5 years, resigned on January 15, 2021.

- The calculation period for determining compensation for unused vacation in this case is from January 5, 2021 to January 4, 2017.

- During the billing period, there were times when Arefieva did not work due to maternity leave and child care leave - from August 20, 2014 to December 25, 2014 and from December 25, 2014 to January 15, 2021. This time was excluded from the calculation period.

- Then, to calculate compensation for unused vacation, you can take the period from September 1, 2013 to August 1, 2014.