As a general rule, in Russia all payments must be made in rubles (Article 317 of the Civil Code of the Russian Federation). However, the law makes it possible to include a condition in the contract, which in practice is called a currency clause. According to this formulation, the transaction price is determined in the conventional units required by the parties, and payment is made in rubles at the exchange rate on the date of invoice, conclusion of the contract, payment day or other time convenient for the partners (Article 317 of the Civil Code of the Russian Federation, Regulations of the Central Bank of December 22, 2014 No. 446-P, decision of the Supreme Court of the Russian Federation of October 13, 2015 No. 5-KG15-151, resolution of the East Siberian District Court of October 9, 2015 in case No. A19-11436/2014).

Most often, businessmen have to deal with indirect or direct currency clauses. The first is used when the contract currency and payment currency do not match. In this case, it is advisable to set the cost of the transaction in a reliable and stable currency, and payments in rubles. Then the payment amounts will depend on changes in the exchange rate of money relative to each other. In a contract, the wording with an indirect clause may look, for example, like this:

“...The price of goods is set in US dollars, payment is made in rubles. If the exchange rate of the US dollar to the ruble on the day of payment changes compared to the rate on the day the contract is concluded, then the contract price and the payment amount will change accordingly.”

As for the direct currency clause, it is used when the transaction currency and the payment currency are the same. In this case, a new currency is introduced into the contract - the so-called reservation currency, and the price of the agreement changes in the same proportion as the exchange rate of the reservation currency to the contract currency has changed. In this case, the contract may contain, for example, the following wording: “...The price of the goods and payment are established in Russian rubles. The currency of this clause is the United States dollar. If by the time of payment the exchange rate of the ruble against the US dollar changes compared to the rate on the day of conclusion of this Agreement, then the contract price and the payment amount will change.”

note

You should not hope that the reins of government can be taken over by the founder, who acted on behalf of the company without a power of attorney during its initial registration. The fact is that a participant who is not elected as a single individual executive in accordance with the procedure provided for by law does not have the right to do so. Only a director can represent a company without a power of attorney.

However, simply writing a currency clause in a contract is often not enough. Firstly, rates, at least slightly, change constantly, and then the clause will doom partners to countless recalculations and reconciliations even with the slightest fluctuation in the value of currencies. To avoid this, you can set a condition in which case the price will be revised: “...If by the time of payment the exchange rate of the Russian ruble against the US dollar changes by more than 2 (Two) percent, then the payment amount changes in proportion to the change in the euro exchange rate against the ruble by date of this payment."

In addition, it is in the interests of both the seller and the buyer to establish a so-called “currency corridor” (or “currency fork”), i.e. indicate below and above which indicators the applied exchange rate cannot be. In the agreement, this can be formulated, for example, as follows: “...Payments under this Agreement are made in ruble equivalent in US dollars, which is determined at the exchange rate of the Central Bank of the Russian Federation on the day of payment, but not less than 60 (Sixty) rubles and not more than 70 (Seventy) rubles for 1 (One) US dollar.”

Purpose of a currency clause and its main types

Let's look at the essence of currency clauses in a situation. Let’s say that counterparty A, located in Russia, entered into an agreement in 2021 with counterparty B, a foreign supplier, for the purchase of goods. Moreover, the main currency of the agreement is rubles, and the term of the agreement is 2 years. Total contract price: 10,000,000 rubles. Considering the situation with the ruble exchange rate, the Russian ruble can be considered an unstable currency, subject to fluctuations. Contractor-supplier B. has the following situation:

- at the time of conclusion of the agreement, the exchange rate was 62 rubles per 1 US dollar (i.e., the contract price in US dollars was conditionally 161,290 US dollars);

- at the end of the contract, in 2021, the rate was 67 rubles per 1 US dollar. The price of the contract in dollar equivalent was already 149,253 US dollars.

As you can see, the difference is quite significant - $12,037. And if counterparty B. also pays in dollars for the purchase or production of goods, which he then supplies to the Russian Federation under a contract, the losses of counterparty B. become obvious.

To avoid such losses, when concluding foreign exchange contracts, a technique called a currency clause is used. With a special clause, settlements under the contract are “linked” to a currency with a stable exchange rate, for example, the US dollar, pound sterling, euro, etc.

For example, in the situation under consideration, a sample currency clause in a contract could look like this: “The total cost of the goods is the equivalent of $161,290. Payment is made in Russian rubles at the rate in effect on the date of payment at the bank serving the buyer.” That is, if the Russian counterparty A. carried out settlements under the 2021 contract in 2021, he should have paid not 10,000,000 rubles, but about 10,806,430 (161,290 × 67).

Note! Many course options for “binding” are allowed. This could be the Bank of Russia, the national bank of the supplier’s country, or the internal exchange rate of the bank of one of the partners - this condition is determined only by the parties to the transaction.

Based on the range of risks covered by the currency clause, as well as the individual characteristics of the transactions being executed, we can highlight:

- direct and indirect reservations;

- unilateral and bilateral reservations;

- other clauses sometimes applied by the contracting parties.

Settlements with suppliers in conventional units: exchange rate differences

Published 07/16/2019 00:26 Author: Administrator The situation when a Russian supplier issues invoices in foreign currency, and payments are made in rubles, is becoming more and more common. This is mainly due to the risks arising from suppliers and manufacturers who have foreign economic relations. For most accountants, this section of accounting involves certain difficulties, and the issue of correct reflection of such transactions is becoming increasingly relevant. In this article we will look at a practical example of accounting for transactions with exchange rate differences in the 1C: Enterprise Accounting program, edition 3.0.

The legal side of this aspect is covered in paragraph 2 of Art. 317 Civil Code of the Russian Federation, PBU 3/2006 and art. 316 Tax Code of the Russian Federation. First, let's look at the theoretical component of this issue. Article 317 of the Civil Code of the Russian Federation talks about the possibility of paying for a transaction in rubles, equivalent to the amount established in foreign currency or in conventional monetary units. At the same time, the Federal Law “On Accounting” provides for the obligation of taxpayers to reflect all business transactions in the currency: Russian ruble. Accounting for contracts in conventional units is carried out on the basis of PBU 3/2006 “Accounting for assets and liabilities, the value of which is expressed in conventional units.” As a result, we receive the obligation to recalculate liabilities on the day of settlement, on the date of capitalization of assets, as well as on each reporting date.

Accounting for mutual settlements with the supplier in conventional units is carried out on subaccounts 60.31 - payment with deferred payment and 60.32 - prepayment. If the prepayment is 100%, then exchange rate differences do not arise and the accounting entries look as follows (to simplify the example, we exclude VAT entries):

Let's assume that we purchase a product worth $20 at the rate of 60 rubles

Dt 60.32 Kt 51 1200 rub. – 100% prepayment has been made

Dt 41 Kt 60.31 1200 rub. – capitalization of inventory items

Dt 60.31 Kt 60.32 1200 rub. – advance payment

In the case when the buyer makes full payment after receipt of inventory items, the amount in rubles is calculated based on the exchange rate on the day of payment, and the capitalization of inventory items is reflected at the rate on the date of shipping documents. It is in this situation that exchange rate differences arise. To simplify calculations, the exchange rate on the date of payment will be considered equal to 65 rubles, and on the date of shipment 60 rubles:

Dt 41 Kt 60.31 1200 rub. ($20) – capitalization of inventory items

Dt 60.31 Kt 51 1300 rub. ($20) – paid for previously received goods and materials

Dt 91.02 Kt 60.31 100 rub. (1300 – 1200) – negative exchange rate difference

If the exchange rate at the time of payment is less than the rate on the date of shipment, then a positive exchange rate difference arises and is reflected by posting Dt 60.31 Kt 91.01.

And I saved the trickiest part for dessert: payments are made in parts at different exchange rates, and shipping documents are drawn up in the middle of the transaction cycle. Let’s assume that a partial prepayment of 50% was made at the rate of 65 rubles, capitalization of inventory items at the rate of 60 rubles and the final payment at 63 rubles per dollar. Under these conditions, we will receive the following postings:

Dt 60.32 Kt 51,650 rub. ($10) – advance payment of 50%

Dt 41 Kt 60.31 1250 rub. ($20) – capitalization of inventory items

Dt 60.31 Kt 60.32 650 rub. ($10) – advance payment credit

Dt 60.31 Kt 51,630 rub. ($10) – surcharge of 50%

Dt 91.02 Kt 60.31 30 rub. – negative exchange rate difference

Let's figure out how the exchange rate difference was calculated? We paid for the goods: 650 rubles. + 630 rub. = 1280 rub. Inventory and materials were capitalized for a total amount of 1250 rubles. The difference between 1280 and 1250 is our exchange rate difference of 30 rubles.

Accounting for exchange rate differences in 1C: Accounting

Now let’s look at how to reflect the listed transactions in the 1C Accounting 8 edition 3.0 program. We will consider the most complex example with partial payments and shipment in the middle of the transaction cycle. To begin with, in order for accounts 60.31 and 60.32 to appear in the transactions, you need to set up an Agreement with the supplier, indicating in it “Price in USD” and “Payment in rubles”. An agreement can be created from the counterparty card by clicking on the “Agreements” link. The “Counterparties” directory is located in the “Directories” section.

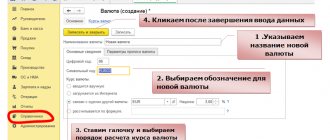

It is also important that the Currencies directory is filled with up-to-date data. To check, you need to select the “Currencies” directory in the “Directories” section. If it does not contain the currency we need, then it should be added using the “Create” - “By classifier” button and select the one you need from the list of all currencies. Next, if you have an Internet connection, click on the “Download exchange rates” button. After that, the current courses are downloaded automatically.

If there is no Internet connection, you can enter exchange rates manually. To do this, you need to go to foreign currency and at the top of the window that opens, click on the “Currency rates” link. Using the “Create” button, you should enter rates for the dates of payments and shipments, as well as for the last days of months, if transactions occur in more than one month.

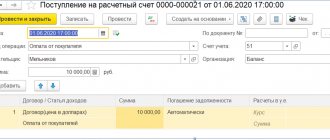

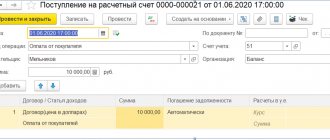

Next, we will look at filling out the document “Write-off from the current account.” It can be opened from the menu “Bank and cash desk” - “Bank statements”. In this document, for the correct formation of accounting entries, the important details are: Agreement, Amount in rubles, Settlement rate and settlement amount.

If “Write-off from current account” is filled out correctly, then the posted document will generate the following transactions:

Let's move on to capitalization of goods and materials: open the documents "Receipts (acts, invoices)" from the "Purchases" section and create "Receipt (Goods, invoice)". The posting date of the document must coincide with the entering date of the document, otherwise the exchange rate will be determined incorrectly. After selecting the agreement we created, the settlement accounts should be determined automatically: 60.31 and 60.32. We indicate the price of the goods in foreign currency and post the document.

We check the result of the document:

And finally, we will make an additional payment for the goods received. In the created “Write-off from the current account”, we check the completion of the lines: Amount in rubles, Agreement, Settlement rate and Settlement amount. The completed document is presented below.

If the document is filled out correctly, the postings will be as follows:

It should also be noted that exchange rate differences when applying the general taxation system in accounting and tax accounting are calculated in the same way and, according to clause 11 of Art. 250 of the Tax Code of the Russian Federation are reflected in non-operating income (expenses). Have you encountered difficulties in reflecting such transactions?

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #20 Alina Kalendzhan 01/24/2021 19:43 I quote Irina:

I quote Alina Kalendzhan: I quote Olga: How is it possible on a topic related to the purchase of goods from a supplier in the Russian Federation. The contract stipulates the cost of the goods in dollars. The invoice was issued in rubles (at the exchange rate on the day of shipment), and payment was made in rubles later at the exchange rate on the day of payment. In accounting everything is clear: 91/60 and the exchange rate difference is written off. What about the NU, given that the buyer is on the simplified tax system? It turns out that we paid the supplier 100 rubles, but we can only put 95 in the invoice book? There are many answers on the forums on accounting and OSN. But what to do on the simplified tax system when paying postpaid... After all, the ruble amount in the invoice is less than ruble payments..

Good afternoon.

Under the simplified tax system, revaluation of currency values and claims (obligations), the value of which is expressed in foreign currency, is not carried out (clause 5 of Article 346.17 of the Tax Code of the Russian Federation). That is, exchange rate differences are not reflected in tax accounting. Hello. And where to write off the resulting difference? Firstly, it hangs on account 60. Secondly, for us, this difference is presented to us in the reconciliation report by the supplier, thereby reducing our debt to him. And then the question arises about writing off the purchased materials as expenses for the amount of the exchange rate difference, they were not paid (since this difference reduces our creditor) What should we do? Good afternoon. The difference is written off in accounting to account 91. Quote 0 #19 Irina 01/21/2021 22:12 I quote Alina Kalendzhan:

I quote Olga: How can you do this on a topic related to the purchase of goods from a supplier in the Russian Federation. The contract stipulates the cost of the goods in dollars. The invoice was issued in rubles (at the exchange rate on the day of shipment), and payment was made in rubles later at the exchange rate on the day of payment. In accounting everything is clear: 91/60 and the exchange rate difference is written off. What about the NU, given that the buyer is on the simplified tax system? It turns out that we paid the supplier 100 rubles, but we can only put 95 in the invoice book? There are many answers on the forums on accounting and OSN. But what to do on the simplified tax system when paying postpaid... After all, the ruble amount in the invoice is less than ruble payments..

Good afternoon.

Under the simplified tax system, revaluation of currency values and claims (obligations), the value of which is expressed in foreign currency, is not carried out (clause 5 of Article 346.17 of the Tax Code of the Russian Federation). That is, exchange rate differences are not reflected in tax accounting. Hello. And where to write off the resulting difference? Firstly, it hangs on account 60. Secondly, for us, this difference is presented to us in the reconciliation report by the supplier, thereby reducing our debt to him. And then the question arises about writing off the purchased materials as expenses for the amount of the exchange rate difference, they were not paid (since this difference reduces our creditor) What should we do? Quote 0 #18 Alina Kalendzhan 11/27/2020 03:39 Quoting Alisa:

Good afternoon Tell me how to do the wiring. An organization, a resident of the Russian Federation, shipped goods on October 10, 2020 to a non-resident of the Russian Federation for 1000 euros. A non-resident will pay 11/01/20 1000 euros. The bank converted euros into rubles. What kind of wiring will there be? Shipment of Dt62 Kt90. And what should we do next with currency and exchange rate differences? Spasbo

Good afternoon.

When you receive payment, you need to indicate that the payment is for a currency transaction, and then account 62.31 will be closed for the currency. If the exchange rate on the date of payment is higher than on the date of shipment, then a positive exchange rate difference will arise D 62 K 91. If it is the other way around, then it will be negative. Quote 0 #17 Alina Kalendzhan 11/27/2020 03:31 Quote Maria:

Good afternoon, Alina. Help me please. According to the agreement, the price of the goods is set in dollars. USA. Payment is made in Russian. rub. at the dollar exchange rate US, equal to the exchange rate on the day of shipment. 21.07. goods were shipped for 350,000 USD, exchange rate 71.9628, for 2,518,698 rubles. 15.10 paid 2,518,698 rubles. How to reflect this operation in 1C. Is it possible to reflect only in Russia? rub.? Thank you

Good afternoon.

Yes. Both documents must be entered in rubles. There will be no exchange rate differences here. Quote 0 #16 Alina Kalendzhan 11/27/2020 03:30 I quote Maria:

Good afternoon Please tell me, the contract with the buyer is in USD... The implementation included a setting not to pay off the advance payment, and now the contract in foreign currency is closed, and the exchange rate differences still work out in favor of the Buyer... Tell me how can I fix this?

Good afternoon.

If there was an advance, then an offset must be made. If the document cannot be corrected, then do it using the “Debt Adjustment” document. Quote 0 #15 Alisa 11.26.2020 18:07 Good afternoon! Tell me how to do the wiring. An organization, a resident of the Russian Federation, shipped goods on October 10, 2020 to a non-resident of the Russian Federation for 1000 euros. A non-resident will pay 11/01/20 1000 euros. The bank converted euros into rubles. What kind of wiring will there be? Shipment of Dt62 Kt90. And what should we do next with currency and exchange rate differences? Spasbo

Quote

0 #14 Maria 11.26.2020 15:04 Good afternoon, Alina. Help me please. According to the agreement, the price of the goods is set in dollars. USA. Payment is made in Russian. rub. at the dollar exchange rate US, equal to the exchange rate on the day of shipment. 21.07. goods were shipped for 350,000 USD, exchange rate 71.9628, for 2,518,698 rubles. 15.10 paid 2,518,698 rubles. How to reflect this operation in 1C. Is it possible to reflect only in Russia? rub.? Thank you

Quote

0 #13 Maria 11.24.2020 15:09 Good afternoon! Please tell me, the contract with the buyer is in USD... The implementation included a setting not to pay off the advance payment, and now the contract in foreign currency is closed, and the exchange rate differences still work out in favor of the Buyer... Tell me how can I fix this?

Quote

0 #12 Alina Kalendzhan 11/19/2020 02:53 I quote Alevtina:

Alina, please help me sort out the delivery. We had an advance of 50% - Dt60.32 Kt51 54.441-00 USD (3077.88*63.6016)+(17121.04*63.4536)+(17121.04*63.7698)+(17121.04* 63.7413)=3.465.272.05 Delivery issued in rubles. supplier from 01.07 in the amount of 7.300.448-64, the exchange rate on the day of delivery was 70.4413. The program makes entries Dt60.31 Kt60.32 for the advance amount of 3,465,272.85, but then, as I understand it, the remaining part should be capitalized at the rate of 70.4413, but the program receives delivery in the amount of 6,930,826.05 Subsequent payments were 02.08, 03.07,30.07

Good afternoon.

The amount of revenue should be determined as the advance amount (in rubles) + balance * exchange rate on the day of delivery. The first thing I would advise you to do is check what rate is in the posting document. The second is to click on the “Print” button in the receipt and select the “Ruble amounts in a currency document” form. From it you will understand how the program calculated these amounts. Quote 0 #11 Alevtina 10/31/2020 02:16 Alina, please help me sort out the delivery. We had an advance of 50% - Dt60.32 Kt51 54.441-00 USD (3077.88*63.6016)+(17121.04*63.4536)+(17121.04*63.7698)+(17121.04* 63.7413)=3.465.272.05 Delivery issued in rubles. supplier from 01.07 in the amount of 7.300.448-64, the exchange rate on the day of delivery was 70.4413. The program makes entries Dt60.31 Kt60.32 for the advance amount of 3,465,272.85, but then, as I understand it, the remaining part should be capitalized at the rate of 70.4413, but the program receives delivery in the amount of 6,930,826.05 Subsequent payments were 02.08, 03.07.30. 07

Quote

0 #10 Alina Kalendzhan 10.30.2020 14:43 I quote Alevtina:

Good afternoon Why is the product received at the rate of 63, if the rate on the date of receipt on July 6 is 60?

Good afternoon.

When you make an advance payment, you thus fix the rate at the time of payment. Then, when making a purchase, the advance payment is offset and that rate goes into the purchase. But only for the amount of the advance payment. In our example, there was an advance payment - 600 at the rate of 60, and a purchase for 1000 of which 600 was calculated at 60, and 400 at 63. Quote 0 Alevtina 10/30/2020 03:08 Good afternoon! Why is the product received at the rate of 63, if the rate on the date of receipt on July 6 is 60?

Quote

0 Alina Kalendzhan 09/07/2020 13:30 I quote Elena:

Good afternoon Please tell me at what rate to calculate sales under the following conditions: 08/20/2020 50% prepayment 08/26/2020 partial delivery (11% of total delivery) 08/27/2020 approx. payment for partial delivery. The first question is: at what rate should partial implementation be considered? according to mixed, i.e. ruble amount = 50% of the amount of partial sales in monetary units. * for the course 08/20/2020 (prepayment) + 50% of partial sales in USD * rate 08/26/2020 or you can calculate everything at the rate as of 08/20/2020 because This advance completely covers partial implementation.

Good afternoon.

When registering and selling fully paid goods, the exchange rate is taken from the prepayment. In your case, the entire delivery was paid for, even though it is partial. Therefore, the rate will be on 08/20/2020. Quote 0 Alina Kalendzhan 09/07/2020 13:27 I quote Evgeny Yudin:

Good afternoon I am faced with the problem of how to prove to the supplier that the capitalization of inventory items is reflected at the exchange rate on the date of shipping documents? The supplier issued a ruble invoice at the exchange rate on the date of signing the specification.

Good afternoon.

The conditions for converting foreign currency into rubles must be fixed in an agreement. Perhaps, according to your contract, the moment of translation is actually the issuance of specifications. Quote 0 Elena 09/04/2020 18:30 Good afternoon! Please tell me at what rate to calculate sales under the following conditions: 08/20/2020 50% prepayment 08/26/2020 partial delivery (11% of total delivery) 08/27/2020 approx. payment for partial delivery. The first question is: at what rate should partial implementation be considered? according to mixed, i.e. ruble amount = 50% of the amount of partial sales in monetary units. * for the course 08/20/2020 (prepayment) + 50% of partial sales in USD * rate 08/26/2020 or you can calculate everything at the rate as of 08/20/2020 because This advance completely covers partial implementation.

Quote

0 Evgeniya Yudina 07/16/2020 15:06 Good afternoon! I am faced with the problem of how to prove to the supplier that the capitalization of inventory items is reflected at the exchange rate on the date of shipping documents? The supplier issued a ruble invoice at the exchange rate on the date of signing the specification.

Quote

0 Maria 06/30/2020 16:53 Hello, please help me with solving the problem, preferably with transactions and amounts. The organization entered into an agreement for the supply of goods as a buyer with a foreign supplier. According to the terms of the contract, the cost of the goods is 10 thousand euros. The contract provides for the following conditions: - delivery of goods on the terms of 50% prepayment, - goods are supplied by the supplier in accordance with the rules of Incoterms 2010 on EXW terms, - transfer of ownership of the goods is carried out on the date of the customs declaration. Foreign exchange rates (conditionally): - on the date of prepayment - 70 rubles. for 1 euro (March 15, 2021), - on the date of shipment from the manufacturer - 72 rubles. for 1 euro (March 30, 2018), - on the date of the customs declaration “Issue permitted” - 71 rubles. for 1 euro. (April 15, 2021), - as of March 31, 2021 - 73 rubles. for 1 euro, - as of April 30, 2021 - 69 rubles. for 1 euro. What value of the goods should the organization reflect when registering them? Provide accounting records for March and April 2021 indicating dates and amounts.

Quote

0 Alina Kalendzhan 06/04/2020 00:52 I quote Olga:

How can you do this on a topic related to the purchase of goods from a supplier in the Russian Federation? The contract stipulates the cost of the goods in dollars. The invoice was issued in rubles (at the exchange rate on the day of shipment), and payment was made in rubles later at the exchange rate on the day of payment. In accounting everything is clear: 91/60 and the exchange rate difference is written off. What about the NU, given that the buyer is on the simplified tax system? It turns out that we paid the supplier 100 rubles, but we can only put 95 in the invoice book? There are many answers on the forums on accounting and OSN. But what to do on the simplified tax system when paying postpaid... After all, the ruble amount in the invoice is less than ruble payments..

Good afternoon.

Under the simplified tax system, revaluation of currency values and claims (obligations), the value of which is expressed in foreign currency, is not carried out (clause 5 of Article 346.17 of the Tax Code of the Russian Federation). That is, exchange rate differences are not reflected in tax accounting. Quote 0 Olga 05/27/2020 19:44 How can you do this on a topic related to the purchase of goods from a supplier in the Russian Federation. The contract stipulates the cost of the goods in dollars. The invoice was issued in rubles (at the exchange rate on the day of shipment), and payment was made in rubles later at the exchange rate on the day of payment. In accounting everything is clear: 91/60 and the exchange rate difference is written off. What about the NU, given that the buyer is on the simplified tax system? It turns out that we paid the supplier 100 rubles, but we can only put 95 in the invoice book? There are many answers on the forums on accounting and OSN. But what to do on the simplified tax system when paying postpaid... After all, the ruble amount in the invoice is less than ruble payments..

Quote

0 Ekaterina Orekhova 02/18/2020 22:00 Thank you very much. I chose everything correctly and the contract is settled in euros and paid in rubles. but nothing slammed shut. I read the article, I immediately understood and automatically rolled up the score 60.21 60.22 instead of 60.31 and 60.32

Quote

Update list of comments

JComments

What are direct and indirect currency clauses

The above example is an example of an indirect currency clause. Conditions are classified as indirect when payments under the contract occur in the national currency of one of the parties, and the price of the product is fixed in one of the stable currencies common in international payments.

With a direct clause, both the price of the goods and the currency of payment are expressed in one, relatively stable currency. However, to be on the safe side, a condition is included in the contract according to which the payment can be adjusted if the contract currency exchange rate changes significantly in relation to another stable currency.

Example

Currency clause: “The price of the goods under the contract is 250,000 USD. Settlements under the contract are carried out in USD. If on the date of payment the USD to GBP (pound sterling) rate on the New York Currency Exchange is lower than the USD to GBP rate on the date of conclusion of the contract, then the price of the goods and the payment amount in USD must be recalculated to increase, compensating for the corresponding change in the rate USD to GBP".

This means that if there is, say, 100,000 USD left to pay under the contract and on the day of the next payment the USD exchange rate against GBP has decreased, for example, from 1.3000 USD per GBP (on the date of conclusion of the contract) to 1.2350 USD per GBP, then :

- the contract price in USD for settlements will become: 100,000 + 100,000 × ([1.3000 – 1.2350] / 1.3000) = 105,000 USD;

- additional payment - 105,000 USD.

Important to consider! Recommendation from ConsultantPlus: Currency corridor. To protect yourself from losses caused by sharp fluctuations in the exchange rate, we recommend stipulating in the agreement a currency corridor - the minimum and/or maximum rate at which the payment will be made. For an example of how to do this, see K+.

What are unilateral and bilateral currency clauses?

The reservations we discussed above are so-called unilateral reservations. They insure only one party - the recipient of funds under the contract. In fact, a change in the exchange rate, of course, affects the one who pays under the contract. For example, in the example given at the beginning of the article, buyer A also cares whether he pays 10,000,000 or 10,800,000 rubles. Therefore, a clause in a contract can be drawn up in such a way as to take into account the interests of both parties - both the one who pays and the one who receives the funds. For example, a “fork” of rates may be provided, within which prices and payments under the contract are automatically recalculated, and if the rate jumps beyond the established values, another mechanism is used to level out negative impacts, for example, revising the terms of the contract by a separate agreement.

Example

A direct clause, tailored to the interests of both parties, may look something like this: “If on the date of payment the USD to GBP exchange rate on the New York Currency Exchange changes in relation to the USD to GBP rate on the date of conclusion of the contract by an amount established within 5% in any direction, then the price of the goods and the amount of payment in USD must be recalculated, compensating for the corresponding change in the USD to GBP exchange rate. In other cases of fluctuations in the USD to GBP exchange rate (in excess of the 5% established by this paragraph), the contract price and further payments are subject to revision and additional agreement by the parties.”

A clause in the contract or bank insurance?

Enterprises can protect themselves from currency risks not only with the help of currency clauses in the contract, but also with the help of banking instruments such as hedging.

To understand the essence of a hedging transaction, let's look at an example again.

Example

A Japanese company entered into a 6-month contract to supply goods to the United States. Let's say payment under the contract - 1,000,000 USD - should also be received in 6 months, in USD. In case of fluctuations in the ratio of JPY to USD during the contract period, the selling company entered into an agreement with its bank that after 6 months the company would sell the bank, and the bank would purchase 1,000,000 USD at the rate of 0.0087 USD per 1 JPY (market average for day of conclusion of the contract). Even if the JPY exchange rate changes in a way that is unfavorable for the Japanese supplier in 6 months, its risks will be offset by an agreement with the bank, under which the bank will still buy the proceeds in USD at 0.0087.

Thus, bank insurance in relation to currency risks is the ability of a party to a contract to use banking instruments instead of introducing a clause into the contract. What to choose depends on each specific transaction and the general economic situation. For example, in Russia such operations are practically not common, but the rules for the repatriation of foreign currency earnings are in force (established by Article 19 of the Law of December 10, 2003 No. 173-FZ “On Currency Regulation”). That is, for Russian participants in foreign trade relations, the only option left is with a clause in the contract: it will not be possible to arrange hedging in Russia or receive proceeds into an account in a foreign bank where hedging is possible.

Of course, there may also be an option with “regular” insurance issued by an insurance company. If, of course, it is possible to insure currency risks against unstable currencies within the framework of an insurance contract.

Significant change in circumstances

Change or termination of a contract due to a significant change in circumstances (clausula rebus sic stantibus, clause on the materiality of circumstances) is an extraordinary basis for changing (terminating) a contract, which is extremely rarely used. The courts did not apply it in Russia either during the period of default in 1998, when the ruble exchange rate fell 4 times, or during the comparatively milder financial crisis of 2008. The reason is that the clause on the materiality of the circumstances is an exception to the rule on the inviolability of the contract (pacta sunt servanda). If the contract could be easily changed and terminated, citing the fact that the circumstances that took place at its conclusion had changed, then its strength could be forgotten. Circumstances are constantly changing, and contracts must be respected.

Therefore, amendment or termination of the contract is possible not with any change in the circumstances from which the parties proceeded when concluding it, but only with a significant one. A change in circumstances is considered significant when they have changed so much that, if the parties could have reasonably foreseen them, the contract would not have been concluded by them or would have been concluded on significantly different terms. A significant change in circumstances is an evaluative concept. It depends on the specific case. Therefore, to identify it, the following additional conditions (criteria) have been established, which must be met in total:

1) at the time of concluding the contract, the parties assumed that such a change in circumstances would not occur. In relation to the currency clause, it is impossible to believe that the US dollar/ruble exchange rate will not increase significantly. History of Russia in the 20th and 21st centuries. shows that significant depreciation of the national currency occurred regularly: in 1917 - 1921, 1929 - 1933, 1941 - 1945, 1959 - 1960, 1989 - 1991, 1998 - 1999, 2008 - 2009. In such circumstances, the parties to the lease agreement should have assumed that a significant increase in the exchange rate of the US dollar against the ruble was not only predictable, but highly probable. The court agreed with this in its decision in the case;

2) the change in circumstances was caused by reasons that the interested party could not overcome after their occurrence with the degree of care and prudence that was required of it by the nature of the contract and the conditions of turnover;

3) execution of the contract without changing its terms would so violate the relationship of property interests of the parties corresponding to the contract and would entail such damage for the interested party that it would largely lose what it had the right to count on when concluding the contract;

4) it does not follow from customs or the essence of the contract that the risk of changes in circumstances is borne by the interested party. PJSC "Vympel-Communications" - the tenant under the agreement, is a commercial organization and independently bears the risk of an increase in the exchange rate of the US dollar to the ruble. It is responsible regardless of guilt (clause 3 of Article 401 of the Civil Code of the Russian Federation), which means it takes upon itself the consequences of accidental losses. In relation to the relations between the parties to the contract, the increase in the tenant's payments refers to such accidental losses.

The state's change in its financial policy, which led to the weakening of the ruble, is a business risk that commercial organizations must bear. At the same time, it does not apply to circumstances of force majeure (force majeure), since it does not have the property of extremeness and unpreventability (clause 1 of Article 202 of the Civil Code of the Russian Federation).

Thus, at least two of the four conditions necessary to amend or terminate the contract due to a significant change in circumstances are not met. The other two conditions must be proven by the person requesting modification and termination of the contract. In particular, under the second condition, the tenant had to prove that he could not increase the profitability of his business to cover the increased rental costs. According to the third, the costs of increased rent will significantly reduce the profitability of his business.

According to paragraph 4 of Art. 451 of the Civil Code of the Russian Federation, amendment of a contract due to a significant change in circumstances is permitted by a court decision in exceptional cases when termination of the contract is contrary to the public interests or will entail damage for the parties that significantly exceeds the costs necessary to execute the contract on the terms changed by the court. Termination of a lease agreement between two commercial organizations is unlikely to be contrary to the public interest, and the tenant is unlikely to experience significant damage, especially given the fact that there are now quite a lot of offers on the rental market for non-residential premises.

Obviously, it is impossible to talk about the presence of all four conditions in total for recognizing a significant change in circumstances in the case of PJSC Vimpel-Communications versus PJSC Tizpribor, as well as for choosing to change the contract instead of terminating it. That is why the court refused to change the agreement on the basis of Art. 451 of the Civil Code of the Russian Federation, taking into account the exceptional nature of such a change. There is no point in changing the approach that has developed in practice, especially since in much more seriously changed conditions (for example, during the default of 1998–1999), the courts refused to apply Art. 451 Civil Code of the Russian Federation.

Nuances: multi-currency clauses, “gold” clauses and clauses in the loan agreement

We examined the main types of clauses on currency risks. Other clauses that may occur in practice are derived from the main ones.

Examples of the most common clauses include:

- Multicurrency - when, instead of the rate of one stable currency, a certain settlement rate for a group of currencies (basket) is taken as a “peg”.

- “Gold” - the price of gold is used as a “peg”: the established value of the contract is expressed in gold equivalent. For example, the exchange value of 1 troy ounce of gold accepted by the parties as of January 25, 2017 is 1,196.00 USD. The cost of goods under the contract concluded on the same day is 1,000,000 USD. Then the contract price under the clause will be 836.12 troy ounces. If the exchange price of gold changes, contract settlements will change in accordance with it.

As a separate nuance, one can also highlight the clauses included in loan agreements. For example, in similar agreements between residents of the Russian Federation you can often find a condition that the ruble amount in the agreement must be calculated based on “conventional units”. The role of such units is usually the same stable currency. Simply, due to the current currency restrictions in the Russian Federation on foreign exchange transactions between residents, the parties prefer to avoid concluding loan agreements directly in foreign currency.

An interesting point in such agreements is that the currency clause in this case insures the parties not so much against the risk of currency exchange rate fluctuations on the international market, but rather against a decrease in the purchasing power of the ruble within the country, which is expected during the course of the loan agreement itself. That is, if a resident lender of the Russian Federation lends 70,000 rubles and knows that today he could buy a new iPhone with this money, then he wants to be sure that at least he will be able to buy an iPhone on the day he receives his money back from borrower.

Results

A currency clause is a way to offset the losses of the parties to a foreign exchange contract from fluctuations in exchange rates. For these purposes, a certain basic unit is introduced into the contract as a separate clause, by which the parties are guided when making calculations. Such a unit can be the rate of one stable currency, the average rate of a basket of currencies, or even the exchange price of precious metals. The clause may protect the interests of only one party to the contract or both parties. The characteristics of the clause in each specific case depend only on the agreements between the parties to the contract.

Read more about the peculiarities of working under foreign exchange contracts in the Russian Federation:

- “Currency transactions between residents and non-residents”;

- “Repatriation of foreign currency to the Russian Federation by residents is...”;

- “What is the essence of currency control in customs authorities?”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

The ruble exchange rate in the agreement is tied to the official exchange rate of the Central Bank of the Russian Federation

Let's consider a situation where the rate in the contract is tied to the official rate of the Central Bank of the Russian Federation. In this case, everything is simple: the exchange rate is taken by the official Central Bank of the Russian Federation on the date of prepayment in the case of prepayment, on the date of shipment in the case of postpayment:

- with 100% prepayment, VAT and income tax are calculated at the rate of the Central Bank of the Russian Federation on the date of prepayment;

- in case of partial payment, VAT and profit tax on prepayment are calculated at the rate of the Central Bank of the Russian Federation on the date of prepayment, VAT and profit tax on postpayment - at the rate of the Central Bank of the Russian Federation on the date of shipment (performance of work, provision of services);

- for postpayment - VAT and income tax on postpayment - at the rate of the Central Bank of the Russian Federation on the date of shipment (performance of work, provision of services).