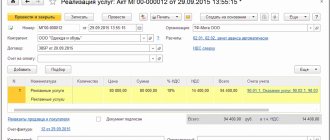

The article presents possible options for filling out an advance invoice in 1C using the example of receiving non-cash payment for upcoming deliveries.

You will learn:

- what to pay attention to when filling out an advance invoice;

- what methods are provided in 1C for issuing an advance invoice and whether they affect its completion;

- how to issue an advance invoice for specific and general items;

- Is it possible to manually fill in the name of the goods in the invoice for an advance payment?

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

What is it needed for?

A document on the basis of which the buyer of goods will be able to withhold VAT. When a retailer receives advance payment for its own goods, what should it do with it? She must issue an invoice to the consumer company. It makes no sense whether the seller shipped the goods or not. This will be considered an advance invoice.

If for any reason the seller returns the advance payment or after shipment there is a balance of the advance payment, then in both cases the buyer does not need to issue an invoice.

The peculiarities of filling out the document are associated with the fact that it will need to reflect the circumstance of receiving an advance payment. For this purpose, on the basis of which the advance was paid are recorded in the invoice

Read more about why an advance invoice is needed here.

What is an advance invoice?

What are the specifics of such a document as an advance invoice, and how does it differ from other types of invoices, in particular, “shipping” invoices that are familiar to many payers?

Upon detailed consideration of the provisions of Art. 169 of the Tax Code of the Russian Federation, which introduces invoices as a legal category, it can be stated that the legislator distinguishes 3 types of invoices.

- A document that is issued upon the actual sale of goods (performance of work, provision of services) or transfer of rights from one entity to another. The requirements for its content are specified in clause 5 of Art. 169 of the Tax Code of the Russian Federation. Unofficially, such invoices are called “shipping” invoices.

- An invoice that the supplier must issue to the buyer upon receipt of advance payment for goods or work. The requirements for its structure are contained in clause 5.1 of Art. 169 of the Tax Code of the Russian Federation. Invoices of this type are advance invoices.

- Adjustment invoice - was introduced into the Tax Code of the Russian Federation as a legal category of Law No. 245 dated July 19, 2011. It is used if the supplier has reduced the price or volume of goods - in order to clarify the relevant data.

Read more about adjustment invoices in the article “What is an adjustment invoice and when is it needed?” .

It is interesting that in the provisions contained in paragraph 1 of Art. 169 of the Tax Code of the Russian Federation, the adjustment invoice is clearly allocated to an independent category. The classification of invoices into shipping and advance invoices is carried out in the Tax Code of the Russian Federation somewhat veiledly, but in fact it is present.

Thus, the legislator provides for the following classification of invoices:

- regular invoice;

- a document drawn up by the seller upon transfer by the client of an advance payment for the goods;

- adjustment invoice.

Let's take a closer look at the purposes for which an advance invoice can be used.

Features

An advance invoice differs from an ordinary invoice in the reason for which it is issued, the period of formation and certain design elements. So it is set:

- upon receipt of funds from the consumer as a result of deliveries;

- regardless of the shipment of goods;

- without specifying individual details.

Please note that the amount of VAT must be included in it .

Reference! An advance invoice, as a rule, contains the same power as a shipping invoice, for this reason it should not be neglected.

If there was an error in the main invoice, you will need to issue a corrected invoice; if the terms of the transaction have changed, you will need to issue an adjustment invoice. As a rule, the corrected invoice has the same appearance as the original one. Even the immediate date and number in lines 1 of the original and corrected invoices are the same. And the difference between an invoice and a corrected one:

- the required details are indicated very correctly;

- line 1a is filled in, where the number and date of the correction are given.

In manual mode

There are two main ways to register ASF in the 1C program. The first one is the manual method. It is suitable when you have to register a small number of accounts. Instructions:

- In order to draw up a document in this way, you need to select the button in the documents for advance payment section: create based on. From the options that appear, select “invoice issued.”

- Once this item is selected, a separate account window will appear.

- After this, you only need to check that all the data is filled out correctly and click on the “conduct” icon, after which the document will be completed.

In what cases is it required?

It is known that an invoice is issued for a specific advance payment . Many accountants issue an invoice for the prepayment made directly in the accounting program. However, it is printed only at the request of the consumer. They feel much calmer this way. Then they strictly comply with all the requirements of the Tax Code.

Read about in what cases and when an advance invoice is issued here.

If there is an agreement

At the time of receipt of goods directly subject to VAT at various rates (10% or 18%) on account of the completed shipment, the procedure for filling out column No. 1 of the invoice depends on the terms of the existing agreement. And if the data contained in the contract makes it possible to divide the volumes, as well as the cost of goods directly subject to VAT, they will need to be separated into separate items in the invoice.

If such a distribution is unrealistic, indicate in the invoice the direct name of the goods , and also the VAT rate of 18/118. At the time of issuing an invoice for prepayment (incomplete payment) under contracts that take into account various delivery times for goods, the funds for the advance payment (incomplete payment) are not required to be divided.

If there is no contract

An invoice must be issued for prepayment, even if an agreement with the consumer has not been concluded or if the agreement does not require the transfer of an advance payment. Whenever funds are received related to further supplies of goods, the seller is obliged to generate an invoice and present it to the buyer.

Otherwise, the seller may be held liable for taxation for severe non-compliance with the laws of accounting for profits and objects of taxation, which led to a direct understatement of the tax base. The direct buyer, if there is no provision in the contract for the direct transfer of the advance payment, the seller will need to prove in court his right to tax deduction of VAT from the advance invoice.

Registration options

When registering an account in the 1C program, there are several ways to register it.

- Always register when receiving an advance. If you select this option, all advance invoices received will be recorded automatically for each accrued amount, with the exception of advances that were offset on the day of receipt.

- Do not register credits within 5 days. In this case, invoices will be created only for those amounts that were not credited within five days from the date of receipt. This method helps to implement the requirement in the Tax Code to register accounts within 5 days (Article 168).

- Amounts credited before the end of the month are not recorded. This registration option is not suitable for all cases (otherwise you may receive a fine for late registration).

You need to choose it only in situations where the supply of goods or services occurs continuously in relation to the same person.It is suitable for advance payment for Internet access, communication, electricity services, as well as in other similar situations.

The fact that such a practice is not a violation was clarified in a letter from the Ministry of Finance dated March 6, 2009. In this case, invoices of this kind must be issued no later than the 5th day of the month following the month of transfer of the advance.

For example, the services of an Internet provider were paid in advance for July. In such a situation, the advance invoice will need to be issued no later than July 5 of the same year.

- Do not register accounts offset until the end of the tax period. The use of this clause is quite controversial and may cause disagreements with the tax authorities. It should be used only by those companies that are ready to defend their position.

The ability to choose this option is due to the following: there is an opinion that the name “advance payment” should not apply to payments accrued in the same period in which the shipment occurs, since then they do not correspond to the very concept of “advance payment”.And if so, then there is no need to prepare advance accounts for the current period. However, it should be said once again that if you choose this option, disputes with the tax service will be ensured.

- Do not register incoming payments as advance payments at all. It is suitable only for organizations designated in the Tax Code in Article 167. These include companies with a long production cycle of final products exceeding 6 months.

Decor

The invoice must be issued on a special form , which is confirmed by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. The invoice must include:

- number, date of the document (in the case of using the 1C program, the prefix A is added to the number);

- imprint of your company;

- output information of your counterparty;

- information about the act under which the advance was transferred.

If on 1 day there were a number of transfers from the 1st buyer, then the following will need to be entered in the invoice:

- all payments;

- payment currency, its code;

- required payment amount;

- name of the product for which the advance is transferred (from the existing contract);

- the amount of VAT on a particular product in the format 18/118, 10/110;

- direct VAT amount.

Purpose of advance invoices

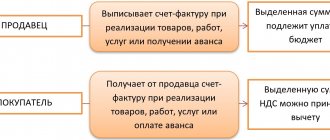

An invoice is a source that serves as a legal basis for the company purchasing a product (work, service) to accept the amount of VAT included in the structure of the selling price as a deduction provided for by law. The legislator in paragraph 3 of Art. 168 of the Tax Code of the Russian Federation directly instructs the seller to send this document to the buyer upon receipt of advance payment for the delivered goods (work or service), as well as when the supplier actually fulfills its obligations.

Having an advance invoice in hand, the purchasing organization can, as if it had a shipping document, exercise the right to deduct VAT (clause 12 of Article 171 of the Tax Code of the Russian Federation).

Thus, advance and shipping documents have the same legal significance. The legislator has established the form in which they must be drawn up - its structure is given in Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

You can download the invoice form on our website.

In turn, a special form is also established for the adjustment invoice - in Appendix 2 to Resolution No. 1137.

You can download the adjustment invoice form on our website.

There are 2 main criteria for distinguishing between advance and shipping invoices:

- moment of preparation (an advance document is drawn up upon receipt of an advance payment by the seller, a shipping document upon the fact of the sale of goods or completion of work);

- completeness of filling out (information in some of the points of the advance invoice cannot always be entered for objective reasons - and the legislator takes this into account).

Let us study the specifics of both of these criteria in more detail.

Features of prepayment recording

- When issuing invoices, either the name itself or the general name of a group of goods is written in the column “name of the product...”, without requiring advance payment, contracts, or invoices.

- In column No. 1, the name of the goods must correspond to the name confirmed in the agreement for the supply of goods. If such a name is general (for example, petroleum products, confectionery products). In addition to the name of the goods, the invoice must indicate the details of the agreement for the fulfillment of which an advance (partial payment) was received.

- The “prepayment” entry in the advance invoice is created automatically.

If there is no data for advance invoices, then proceed differently . Individual entrepreneurs often have conditions that do not fall under a single procedure. Let us analyze special cases associated with the registration of a business transaction.

This will make it possible to understand how to deal with the account directly in the purchase book. To record actions and control them, these documents are recorded in a special journal specialized for account registration.

What to do if the contract is terminated

If before the day the buyer decided to terminate the contract with the seller, he made an advance payment, and the amount that needs to be returned does not exceed what was received, then there is no need to reconcile mutual settlements and it is possible to disperse in a few days.

If during the current contract the seller shipped goods against the transferred amount, and only an advance payment not covered by the products is required, then it is recommended to sign a reconciliation report.

It is also required when the advance payment was received into a bank account in several payments or the amount was received not from the buyer, but from his representative with a power of attorney.

Most often, reconciliation is required if the initiator of the break in legal relations is the buyer.

There are 2 ways to terminate the contract: sending a letter of offer or drawing up a new document that the parties sign. In the first case, you will need to send a response letter after returning the advance. Documentation is kept in the archives of the enterprise for 75 years, or until the company ceases to exist.

Rules for filling out the document: step-by-step instructions

First, let's fill in the rows , they are located in front of the tabular part:

- Line No. 1 – serial number (taken from the list of documents), date.

- Line 2, 2a, 2b – location and details of the seller.

- Line 4 – write the location of the final recipient, if the final addressee is also a consumer of the product, then put a dash.

- Line 5 – here we write the number and date of the document. When issuing an invoice based on several payments at once, all payments without exception are indicated. If the advance payment for the goods was not made in cash, only then a dash is added in column 5. Thus, an invoice can be issued only upon receipt of payment.

- Line 6, 6a, 6b – location and details of the buyer.

- Line 7 is the code of the monetary unit, if it is the ruble, then 643.

- Line 8 – suppliers under a government contract show the code of such an agreement.

Now let's start filling out the tabular part of the form. In this part of the form, only sections 1, 7, 8 and 9 are filled out, and dashes are added in the others.

- Column 1 must indicate:

- Product Name;

presentation of work performed, services provided, property rights.

- Columns 2, 3, 4 (unit of measurement, number, price per piece of measurement) do not need to be filled out. In addition, the data in columns 10 and 11 (country of origin of the goods, customs declaration number) is not indicated. They need to have dashes. When calculating VAT specifically on the prepayment amount, the estimated tax amount is used.

- Section 7 – the estimated tax rate is indicated . It is possible to make a note in the act, say, accepted from such and such.

Will it be possible to write the phrase “Advance payment” instead of the product name? In another column, it is possible to write the phrase “Advance payment under the agreement...” without providing the name of the goods (works, services). Such wording in an “advance” invoice is quite possible. In such a case, in column 1 we advise you to write the phrase “Advance payment for... (name of product required) under the contract...”.

If the seller clearly understands for which goods (works, services) payment was received from the consumer, it is possible to indicate their direct names in column 1 of the invoice. In this case, it is necessary to make an integral note that the amount of tax is calculated directly from the amount of the purchased prepayment.

The completed form must be signed by the head of the company and its chief accountant , or in the absence of the latter, the responsible person.

You will find a detailed procedure for filling out the ASF here.

Seller mistakes

When issuing advance invoices

No later than five calendar days from the date of receipt of the advance payment, the supplier must provide the buyer with VAT. The invoice is drawn up in two copies: one is given to the buyer, and the second is registered in the sales book (clause 3 of article 168 of the Tax Code of the Russian Federation). When deciding whether to issue an invoice, accountants make mistakes in two cases.

- When the same buyer (customer) repeatedly transfers prepayment amounts for one or more transactions during a tax period, a single invoice is issued at the end of the month (quarter), which is illegal in such a situation. For each amount received, an invoice must be issued within the specified deadline.

- Let's say that during the quarter you received an advance payment, and then in the same quarter you shipped the goods (transferred work, services). More than five days passed between prepayment and shipment. You must first issue an advance invoice, and then an invoice for the sale of prepaid goods (works, services). This is required by the provisions of paragraph. 2 clause 1, clause 3 art. 168, paragraph 3 of Art. 169 of the Tax Code of the Russian Federation, if there are no circumstances provided for in paragraph. 3 clause 17 of the Rules for maintaining purchase books (hereinafter in the article we refer to the Rules for maintaining purchase books and sales books, filling out invoices, approved by Decree of the Government of the Russian Federation No. 1137 of December 26, 2011).

The Ministry of Finance allows you not to issue an invoice if you received an advance payment for an upcoming delivery and, within five calendar days from the date of receipt, shipped the goods, performed the work, provided the service (letters dated October 12, 2011 No. 03-07-14/99, dated 03/06/2009 No. 03-07-15/39, clause 1). However, we still recommend that in this case, issue two invoices: both for the amount of the prepayment received and for shipment. Since this is the opinion of the Federal Tax Service, and it is this agency that will check your declaration (letters dated March 10, 2011 No. KE-4-3/3790, dated February 15, 2011 No. KE-3-3/ [email protected] ).

Please note that in order to deduct VAT paid on an advance payment, the seller must register an advance invoice in the purchase book, which was previously reflected in the sales book (clause 22 of the Rules for maintaining the purchase book). Thus, an advance invoice is the basis for a deduction not only from the buyer, but also from the seller (clause 1 of Article 169, clause 9 of Article 172 of the Tax Code of the Russian Federation).

Recommendations for the application of Art. 54.1 of the Tax Code of the Russian Federation, nuances of due diligence. See the analysis of these and other topics in the recordings of Kontur.Conference-2018.

Watch recording

In the details of advance invoices

Errors that the seller (supplier) makes when filling out the details in the advance invoice can be critical for the buyer if he decides to exercise the right to deduction (clauses 1 and 5–6 of Article 169 of the Tax Code of the Russian Federation). In the advance invoice, as in a regular one, the following details must be filled in (clause 5.1 of Article 169 of the Tax Code of the Russian Federation):

- serial number of the invoice, while advance invoices are numbered in general chronological order with shipping invoices (letter of the Ministry of Finance dated October 16, 2012 No. 03-07-11/427);

- invoice date;

- name, address, INN and KPP of the seller and buyer in accordance with the constituent documents. You can indicate both full and abbreviated names.

In addition, advance invoices must include:

- on line 5: number and date of the payment document for which the advance was received. If the advance was received in non-monetary form, a dash is added. Since the tax authorities conduct cross-checks of accruals and deductions, it is important that both the buyer and the seller correctly indicate this detail in the books of purchases and sales;

- on line 7: name and code of the currency in which the advance was received (according to OKV). If the price is determined in foreign currency (cu), but payment is made in rubles, indicate the name of the currency “Russian ruble” and its code “643” (letter of the Federal Tax Service dated July 21, 2015 No. ED-4-3/12813).

Particular attention should be paid to filling out the tabular part of the document.

In column 1, the name of the goods (description of work performed or services provided), for the delivery of which advance payment was received, is reflected as it is specified in the contract. If the buyer made an advance payment not for a specific product, but in general for the range of products and a specific specification or application will be drawn up after payment, it is permissible to indicate in the advance invoice the general name of the goods: petroleum products, stationery (confectionery), etc.

In a situation where contracts are concluded that provide for the performance of work (provision of services) simultaneously with the delivery of goods, in column 1 it is necessary to provide both the name of the goods supplied and a description of the work performed (services provided), see letter of the Ministry of Finance dated July 26, 2011 No. 03- 07-09/22.

Further in the tabular part in columns 7, 8, 9 indicate: estimated tax rate - 18/118 or 10/110 (clause 4 of article 164 of the Tax Code of the Russian Federation); the amount of calculated VAT; the amount of the advance received. In the remaining columns 2–6, 10–11 and lines 3 and 4, put dashes (clause 4 of the Rules for filling out an invoice).

Invoices for prepayment when exempt from VAT are not drawn up in accordance with the provisions of Art. 145 and 149 of the Tax Code of the Russian Federation. The same applies when receiving an advance:

- on account of the future supply of goods (works, services), the duration of the production cycle of which is more than six months (paragraph 3, paragraph 1, article 154 of the Tax Code of the Russian Federation);

- for transactions that are subject to VAT at a rate of 0% (paragraph 4, clause 1, article 154 of the Tax Code of the Russian Federation);

- for transactions that are not subject to VAT.

VAT+ will check the correctness of filling in the buyer’s details in advance invoices and help avoid double taxation for this advance transaction with the counterparty.

To learn more

When filling out the sales book

The issued advance invoice, including for non-cash payments, must be registered by the seller in the sales book for the quarter in which the date of receipt of the advance falls (clause 17 of the Rules for maintaining the sales book). It is important to fill out the book correctly:

- the number of the payment and settlement document for which the advance was received is reflected in column 11;

- columns 4–6, 14–16, 19 are not filled in;

- The operation is reflected by code 02.

When filling out the purchase book

If the shipment is made simultaneously with the registration in the sales book of the invoice that was issued during this operation, the invoice that was issued upon receipt of the advance is registered in the purchase book (clause 8 of Article 171 and clause 6 of Article 172 of the Tax Code of the Russian Federation, p. 22 Rules for maintaining a purchase book).

The seller will deduct VAT from the advance payment in the amount corresponding to that part of it that is offset according to the terms of the contract as payment for goods shipped (work performed, services rendered) and transferred property rights. Advance VAT can only be deducted in the quarter in which the conditions for it are met. This deduction cannot be transferred to later quarters (letters from the Ministry of Finance dated 07/21/2015 No. 03-07-11/41908, dated 04/09/2015 No. 03-07-11/20290).

In the purchase book, transaction code 22 is indicated, and in column 7 - details of the payment order for the advance received. Information about the payment order is also indicated in the shipping document on line 5. And in the sales book, column 11 must be filled in for it. Therefore, if the details are filled out correctly, the tax office can automatically check everything and will not make claims.

Recording an advance payment in accounting

The buyer, by virtue of Article 171 of the Tax Code of the Russian Federation (clause 12), accepts the existing advance VAT for deduction if:- there is a correctly approved invoice;

- there is an act certifying payment;

- The agreement stipulates the possibility of prepayment.

- Having transferred the advance payment, the buyer makes the following entries:

- Dt 60 Kt 51 - advance payment is transferred.

- Dt 68 Kt 76 - deposit VAT taken for deduction.

- Enters VAT withholding from advances in the purchase book with the invoice number directly issued by the seller.

- Reflects deposit VAT on line 130 of the VAT return.

- Then it restores advance VAT at the time of sale: Dt 76 Kt 68.

- Reflects VAT recovery directly in the sales book.

- Next, it reflects in the declaration VAT on advances on line 090 of section 3.

You can find out how to issue and register an invoice for an advance payment from a supplier in a separate article.

Automatically

In a situation where there are a lot of incoming invoices, registering them manually becomes inconvenient and time-consuming. In this case, it is better to set automatic registration. Instructions:

- To do this, you need to go to the “banks and cash desks” subsection, where you can find “advance accounts.” After selecting this item, a window will appear in which you should select the period for which documents will be generated.

- Then you need to click the “fill in” button and select all unregistered accounts. At the same time, the list can be easily adjusted and, if necessary, delete unnecessary ones or add new documents.

- When all the necessary advance invoices from the supplier have been selected, all that remains is to click on the “execute” button, after which they will be processed - this way all the rules of ASF offset will be observed. The list of all completed documents can be opened at any time by clicking on the link: “ open a list of advance accounts."