- home

- OSN or simplified tax system – which system to choose?

/

In order for you to determine which taxation system is best to choose for your organization and individual entrepreneur, you need to answer several questions. But, first, let’s explain what OSN and simplified tax system are.

Tax calculator

Revenue

Expenses

| BASIC | simplified tax system | ||

| 6% | 15% | ||

| VAT | |||

| Profit | |||

| Total taxes payable | |||

Transition from OSN to simplified tax system

Art. 346.12 of the Tax Code of the Russian Federation provides for the possibility of switching to the simplified tax system if the following conditions are met:

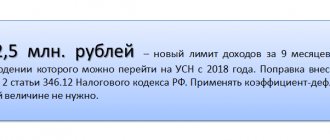

- The amount of income for 9 months of the year in which the notice of transition to the simplified tax system is submitted does not exceed 112.5 million rubles. (this rule applies only to organizations; the income of an individual entrepreneur can be any).

- The average number of employees is no more than 100 people.

To learn how to determine the average number of employees, read the material “How to calculate the average number of employees?”.

- The residual value of fixed assets as of October 1 of the year in which the organization declares its right to use the simplified tax system is no more than 150 million rubles.

IMPORTANT! For the purposes of transition to the simplified tax system, only organizations must comply with the fixed value limit. For individual entrepreneurs, this criterion does not apply at the stage of submitting an application to the simplified tax system. But entrepreneurs must comply with it while working on a simplified basis.

Read about what property is depreciable and how to account for it in this material.

- The share of participation of other organizations in the authorized capital of the enterprise is no more than 25% at the time of application. Exceptions are specified in subsection. 14 clause 3 art. 346.12 Tax Code of the Russian Federation.

- The taxpayer does not belong to the other categories of persons specified in paragraph 3 of Art. 346.12 Tax Code of the Russian Federation.

To switch to the simplified tax system, you must submit a notification to the Federal Tax Service at the place of registration before December 31 of the year preceding the transition, or within 30 days from the date of registration, if the notification is submitted by a newly created legal entity or individual entrepreneur.

IMPORTANT! When December 31 is a holiday, the deadline for submitting a notice of transition to the simplified tax system is shifted to the next working day, that is, to the first working day of January. The deadline for submitting a notice of transition to the simplified tax system from 2021 is exactly 12/31/2020, since it is a working Thursday.

A taxpayer can return to OSNO only from the next tax period, except in cases where:

- the amount of income for the reporting period exceeded 150 million rubles.

For more information about the income limit, see the material “Income limit when applying the simplified tax system .

- the taxpayer ceased to meet the requirements established by paragraphs. 3 and 4 tbsp. 316.12 and paragraph 3 of Art. 346.14 Tax Code of the Russian Federation.

When switching from the OSN to the simplified tax system, restore the VAT on the inventories and advances issued as of December 31.

If you don’t know how to do this correctly, use the recommendations from ConsultantPlus. Get trial access and access expert explanations and calculations for free.

VAT on export

As we have already said, when exporting goods, their sale is taxed at a rate of 0%. The company must justify the right to such a rate by documenting the fact of export. To do this, along with the VAT return, you must submit a package of documents to the tax office (copies of the export contract, customs declarations, transport and shipping documents with customs marks).

The VAT payer is given 180 days from the date the goods are placed under export customs procedures to submit these documents. If the necessary documents are not collected within this period, then VAT will have to be paid at a rate of 10% or 20%.

Application of UTII

If a taxpayer already combines the use of UTII and OSNO, he has the right to switch to the simplified tax system for those types of activities for which he does not apply imputation. But to determine the possibility of switching to the simplified tax system it is necessary:

- calculate the average number of employees and the residual value of fixed assets as of October 1 of the year in which the notice of transition is submitted, separately for types of activities related to UTII and OSNO;

- determine the maximum income for activities on OSNO without taking into account income from activities on UTII.

If the UTII payer decided to switch to the simplified tax system, then he can do this only from the next tax period, except for the case when the UTII was applied in parallel with the simplified tax system (letter of the Ministry of Finance of the Russian Federation dated November 24, 2014 No. 03-11-09/59636). When switching from UTII to the simplified tax system, you should check for compliance with existing limits the indicators of income, the residual value of fixed assets and the average number of employees after combining data on UTII and the simplified tax system.

NOTE! The UTII taxation regime will be abolished from 2021. See here for details.

Which is more profitable - OSNO or simplified tax system (using the example of an LLC)

It is impossible to unequivocally answer the question which taxation system is more profitable. It all depends on the scale and structure of the business, the amount of the taxpayer’s expenses, the procedure for receiving income, the region in which the taxpayer is registered, and many other factors. Each enterprise must independently assess the possible tax burden under different taxation systems and decide whether it is advisable to switch to the simplified tax system or whether it is more profitable to remain on the OSNO.

Example

The organization optimizes taxes. To do this, she is considering the possibility of switching to the simplified tax system from January 1, 2021 and compares the tax burden under different taxation systems using the example of the 3rd quarter of 2021. Below is a calculation based on the maximum possible rates for all taxes. Depending on the region or type of activity, rates may be significantly lower.

| Tax system | BASIC | simplified tax system "income" | Simplified tax system “income minus expenses” |

| Income | RUB 1,000,000, including VAT RUB 166,667. | 1,000,000 rub. | 1,000,000 rub. |

| Total expenses, including: | |||

| Depreciation (taken into account only as expenses when determining income tax (OSNO), under the simplified tax system “Income minus expenses”, the costs of acquiring depreciable property are taken into account entirely in the tax period in which they were paid and taken into account) | 52,000 rub. | ||

| Rent | 30,000 rub. (including VAT 5000 rub.) | 30,000 rub. | |

| Salary | 200,000 rub. | 200,000 rub. | |

| Insurance premiums | 61,800 rub. | 61,800 rub. | |

| Total tax burden (excluding taxes that are the same for all taxation systems and property tax), including: | 322 374 | 91 800 | 168 030 |

| Income tax | (833 333 – 52 000 –25 000 – 200 000 – 61 800) × 20% = 98 907 | ||

| VAT | 166 667 – 5000 = 161 667 | ||

| Single tax under the simplified tax system | 1,000,000 × 6% – 30,000 (half of the tax received, since the limitation does not allow reducing the tax on the entire amount of insurance premiums) = 30,000 | (1 000 000 – 30 000 – 200 000 – 61 800) × 15% = 106 230 |

The table shows that with a given cost structure, the taxation system in the form of the simplified tax system with the “income” base will be the most profitable for the organization. But if an enterprise operates at a loss with a large number of expenses including VAT, then there is a possibility that staying on OSNO will be more correct, since even an unprofitable enterprise on the simplified tax system “income minus expenses” is required to pay 1% of income, and on the simplified tax system “income » – 6% (depending on the region, the rate may be lower), but on OSNO both income tax and VAT can be zero.

There are other nuances that affect the tax burden. For example, enterprises on the simplified tax system pay property tax on the cadastral value of individual real estate, and enterprises on the OSNO pay property tax on the book value of all real estate listed on their balance sheet, including those taxed at the average annual rate. If there is taxable property, the tax on it should also be taken into account when comparing different taxation systems.

For information on choosing an object of taxation, see the material “Which object under the simplified tax system is more profitable - “income” or “income minus expenses”?” .

Simplified taxation system

To determine the most favorable tax regime, it is first necessary to compare the tax burden indicators when applying different regimes and give preference to the regime with the lowest tax burden. The main factors of the tax burden when applying the simplified tax system and the general taxation regime for comparative analysis are given in the table below.

Thus, if expenses are less than 60% of the income level, it is preferable to use the first option, but if expenses are more than 60% of the income level, then it is necessary to further analyze the impact of the amount of accrued insurance contributions to the Pension Fund and the amount of temporary disability benefits paid (“sick leave”) by the amount of the single tax.

It is necessary to take into account that the object of taxation in the form of income is appropriate in situations where the taxpayer will have minimal costs (non-production sphere, advertising and other services). If the taxpayer expects significant documented expenses (this applies, first of all, to production), it is advisable to choose the object of taxation in the form of income reduced by the amount of expenses.

In general, the taxation system in the form of a single tax on imputed income is quite convenient and beneficial for the taxpayer, since: a) it frees him from the obligation to keep full accounting records (to submit balance sheets and other accounting reports). b) provides for the replacement of general taxes (VAT, income tax, property tax and unified social tax) with one fixed payment that does not depend on the results of activity (income) of the taxpayer. The fixed payment is determined depending on the objective indicators of the taxpayer’s activities (number of employees, retail space, area of the sales floor or customer service area).

Differences between OSNO and simplified tax system

The main differences between the simplified tax system and the OSNO can be considered:

- Under the simplified tax system, organizations do not have the obligation to pay income tax (except for certain transactions), VAT (except for certain transactions), property tax (except for tax on “cadastral” real estate); Individual entrepreneurs using the simplified tax system do not have to pay personal income tax (in relation to income from activities for which the simplified tax system is applied), property tax for individuals (in relation to objects used in business activities), VAT with the exception of certain transactions).

Read about when a “simplified” person will have to pay VAT in this article .

- Using the simplified tax system, you can choose the object of taxation: “income” or “income minus expenses.”

- There is no need to prepare invoices (except in certain cases).

- There is no need to maintain income tax registers (only a book of income and expenses).

For information about the features of different tax systems, see the material “How can an organization choose a tax regime: OSN, simplified tax system or UTII?” .

To make the right decision on choosing the optimal tax system, we recommend studying several opinions. Get free trial access to ConsultantPlus and see expert opinion.

Tax systems in Belarus

Almost all business entities today face the choice of an optimal taxation regime, regardless of whether they are just starting their activities or have been working for a long time. Due to the fact that the seriousness of this issue is undeniable, it is necessary to approach its solution with the same seriousness and thoughtfulness. After all, a lot depends on the chosen tax regime: how to keep accounting records, what the tax burden of the enterprise will be, as well as what kind of accounting reporting is provided and how often it must be submitted. Therefore, it is best to seek advice from a specialized company providing accounting services. Highly qualified specialists from such a company will be able to analyze the activities of a company or individual entrepreneur and choose the most optimal tax return system from the point of view of the tax burden and accounting.

3% of revenue - for firms and individual entrepreneurs that are engaged in retail trade and are not registered as VAT payers, provided that the number of their employees from the beginning of the year to the reporting period on average did not exceed 15 people, and for individual entrepreneurs also revenue from the beginning of the year for the reporting period did not exceed 4100000000 Belarusian rubles.

Results

The simplified tax system, in comparison with OSNO, has both advantages and disadvantages. In order to understand whether it makes sense to switch from one taxation system to another, you should study the legislation in force in the region where the taxpayer is registered, and then compare the tax burden.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Mandatory taxes and fees

Regardless of the chosen tax regime, the following taxes and fees are paid:

- Excise taxes (Tax Code, Chapter 22)

- State duty (Tax Code, Chapter 25.3)

- Customs duty (Customs Code, Art. 318-319)

- Transport tax (Tax Code, Chapter 28. Local laws on transport tax)

- Land tax (Tax Code, Chapter 31. Local laws on land tax)

- Fees for the use of fauna and for the use of aquatic biological resources (Tax Code, Chapter 25.1)

- Water tax (Tax Code, Chapter 25.2)

- Mineral extraction tax (Tax Code, Chapter 26)