For the new form of unified calculation of insurance premiums, the Federal Tax Service developed control ratios for control and approved them by Letters of the Federal Tax Service of Russia dated December 13, 2017 No. GD-4-11/ [email protected] and dated December 29, 2017 No. GD-4-11/ [ email protected] , and they are also given in the Appendix to the Letter of the Federal Tax Service of the Russian Federation dated June 15, 2017 No. 02-09-11/04-03-13313. The standards are necessary for policyholders to check the correctness of the DAM in the new form. Let us remind you that the form for calculating contributions was approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected]

Insurance premium payments must be submitted no later than 30 calendar days from the end of the billing period. For example, for the 1st quarter - until April 30. If it is a weekend, the deadline is extended to the first working day. The completed insurance premium report looks like this:

In connection with this, the control ratios for the DAM have changed

As specialists from the Federal Tax Service of Russia noted in their letter, the current control ratios of the DAM were approved taking into account the standard rate of contributions for compulsory insurance for all employers. But in the spring of 2021, Federal Law No. 209-FZ dated July 24, 2007 “On the development of small and medium-sized businesses in the Russian Federation” was adopted, according to which, from April 1, 2020, payers of insurance premiums recognized as small or medium-sized businesses received the right to pay insurance premiums at a reduced rate of 15%:

- for compulsory pension insurance - 10%;

- for compulsory social insurance in case of temporary disability and in connection with maternity - 0%;

- for compulsory health insurance - 5%.

The new procedure applies to wages for April 2020 and subsequent months. For March, insurance premiums are charged at the regular rate.

In this regard, tax authorities clarified the control ratios in the DAM 1.84, 1.138 and 1.140, and also introduced new control ratios 1.193–1.199 and 2.8–2.10. They will help check the correctness of filling out the DAM regarding payments to employees and other individuals in the amount of more than 1 minimum wage, which are subject to reduced insurance premiums when submitting the DAM for the first half of the year (6 months) of 2021.

Online services and verification programs

In practice, it is quite difficult to manually check benchmark ratios for insurance premiums. Therefore, representatives of the Federal Tax Service recommend drawing up the form electronically, and not on paper. Let us remind you that only those insurers whose average number of employees does not exceed 24 people can report to the regulatory authorities (Federal Tax Service, Social Insurance Fund and the Russian Federation) on paper. Insurers with 25 or more employees are required to report electronically.

To prepare reports, use specialized accounting programs, free applications that you need to download and install on your work computer, or online services. All programs already have established control ratios in the report for calculating insurance premiums online, which makes the accountant’s work much easier.

New control ratios

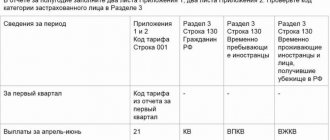

Earlier, by letter dated 02/07/2020, new control ratios were introduced for new temporary tariff codes and categories of insured persons. These are the codes:

- For reduced insurance premiums for part of payments exceeding 1 minimum wage - 20.

- For insured individuals - citizens of the Russian Federation, part of the payments from 1 minimum wage - MS.

- For foreigners and stateless persons insured in the OPS system who temporarily reside in Russia, as well as foreigners or stateless persons temporarily residing in the Russian Federation who have been granted temporary asylum - VZHMS.

- For foreigners and stateless persons who are temporarily staying in the Russian Federation (with the exception of highly qualified specialists) - VPMS.

The Federal Tax Service admits that these codes may become permanent. In this regard, additional formulas have been added to the control ratios for insurance premiums:

- for payer rate code;

- for the category code of the insured person.

Changes were approved both in the CS for calculation sections and in the inter-documentary CS. In particular, DAM data corresponds with information about the payer in the SME register at the beginning of each month. All KS are traditionally designed in the form of a table, which contains information about the KS itself, violation of the norms of the Tax Code of the Russian Federation and other laws.

Pension insurance contributions

The Federal Tax Service explained that when checking the reflection of the amount of taxable payments, payments to students must also be taken into account. They are reflected in Appendix No. 9 “Information necessary for applying the provisions of sub-clause. 1 clause 3 art. 422 of the Tax Code of the Russian Federation by organizations making payments and other rewards in favor of students in professional educational organizations, educational organizations of higher education in full-time education for activities carried out in a student detachment (included in the federal or regional register of youth and children's associations enjoying state support) according to employment contracts or under civil contracts, the subject of which is the performance of work and (or) the provision of services under section 1.”

In the DAM, line 045 has been introduced since 2021. It shows the amount of expenses for copyright orders, publishing license agreements and costs associated with intellectual property rights.

In connection with these, a new CS was created - usual for the DAM. Thus, the amount of expenses from the beginning of the billing period should be equal to the same amount for the previous period, increased by expenses for 3 months of the reporting period.

Read also

28.10.2019

Rules for submitting RSV

Employers submit this report to the Federal Tax Service at the end of the year and quarterly. The new reporting form was approved by order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/470. Its policyholders will be handed over for the first time in the first quarter of 2021. It has reduced the total number of indicators by about 30%, which means it has become easier to fill out.

Report on insurance premiums no later than the 30th day of the month following the reporting (calculation) period. In 2021, the deadlines for submitting this form look like this:

- for the first quarter - until 04/30/2020;

- 6 months before 07/30/2020;

- 9 months - until October 30, 2020;

- for 2021 - until 02/01/2021 (postponement from January 30, Saturday).

Procedure for filling out the updated form

Although there are many innovations, the new RSV has not changed that much. The Federal Tax Service did not even cancel the old form - they only made amendments to it. Thus, the Calculation of Insurance Premiums, current in 2021, is still approved by Service Order No. 7-11 / [email protected] dated September 18, 2019, as amended.

There are many sections and applications in the RSV. However, usually a company or individual entrepreneur fills out the title page, section 1, appendices 1 and 2, as well as section 3. You need to start with the title page, and then move on to section 3, then the appendices to section 1, and lastly, this one itself chapter.

Title page

We will start filling out the DAM for the 4th quarter of 2021 using the new form from the title page. Here you need to enter data into most cells, namely:

- adjustment number “000”, because we are filling out the RSV for 2021 for the first time;

- billing period code “34”, which corresponds to the year. It is contained in Appendix No. 3 to the Procedure for filling out the DAM form for 2020 from Order No. MMV-7-11 / [email protected] (hereinafter referred to as the Procedure);

- 2020 reporting year;

- your Federal Tax Service number;

- code for the place of presentation of the RSV (Appendix No. 4 to the Procedure). The code “214” is suitable for most legal entities, and entrepreneurs, as a rule, indicate “120”;

- the name of the company as in the constituent document or the last name, first name and patronymic of the individual entrepreneur;

- average number of employees (a new field that replaces the independent report);

- main activity code;

- telephone;

- number of form pages and document copies.

As with many tax forms, lines are placed in the lower left area of the cover page to verify that the information is complete and accurate.

Section 3

This section contains personal data of the insured persons, so it must be filled out for each such person. The section consists of several subsections.

Subsection 3.1 should reflect your full name, date of birth, gender, INN and SNILS codes, country code 643 (for Russia), document code (Appendix No. 6 to the Procedure) and its details. When filling out the calculation for the period for the first time, column 010 is crossed out.

Subsection 3.2 is for pension contributions. Its first part 3.2.1 reflects payments. You must indicate the amounts for the last three months of the reporting (calculation) period. In this subsection we fill in the lines:

- 130 – category code of the insured person from Appendix No. 7 to the Procedure (do not forget about the new codes, which are mentioned at the beginning of the article);

- 140 – total amount of payment to the employee;

- 150 – base for contributions;

- 160 – including paid under GPC;

- 170 – amount of contributions (base x tariff).

Contributions for SMEs should be calculated according to two tariffs: basic tariffs are applied to payments within the minimum wage, and preferential tariffs are applied to payments above the minimum wage. Accordingly, if the payment in the company exceeds the minimum, there will be 2 subsections 3.2.1 for each insured person. The first is filled in regarding payments up to the minimum wage. The amount of 12,130 rubles is prescribed, the amount of contributions is 2,688.6 rubles (this is 22% of the minimum wage), and the code “NR” is also entered.

The second time, subsection 3.2.1 should be completed in relation to payments above the minimum wage and use the code “MS”. A 10% contribution rate will apply to this portion. If the payment is not more than the minimum, then there will be only one subsection 3.2.1.

Let's give an example for filling out the DAM for the 4th quarter of 2021. Let the employee’s salary be 65,000 rubles per month. In this case, we will fill out the subsection separately for the amount of 12,130 (22% contribution rate) and for the amount of 65,000 - 12,130 = 52,870 (10% rate).

When calculating contributions at an additional tariff, you must fill out subsection 3.2.2.

Appendix 1 to section 1

This application calculates pension and medical contributions. It is filled out in terms of tariffs, so SMEs create two attachments 1. The first time in column 001 you need to indicate the tariff code “01”, which means the basic tariff applied to payment within the minimum wage. The second time Appendix 1 is filled out regarding part of the payments above the minimum wage with code “20”.

Subsection 1.1 reflects the number of insured persons, including those from whose payments deductions are made. Payment amounts should be reflected on a cumulative basis from the beginning of the billing period, as well as for the last 3 months separately.

For example, the company employs only a director who receives a salary of 65,000 rubles per month. For 2021, he was paid 780,000 rubles. The basic tariff base will be:

- for January-March – 65,000 * 3 = 195,000 rubles;

- payment within the minimum wage for April-December – 12,130 * 9 = 109,170 rubles;

- the base at the 22% tariff is equal to 195,000 + 109,170 = 304,170 rubles.

Thus, the amount of contributions at the 22% tariff will be 66,917.4 rubles.

Payments to the manager for April-December exceeding the minimum wage are taxed at a 10% rate: (65,000 – 12,130) * 9 = 475,830 rubles. The amount of contributions at the 10% tariff will be 47,583 rubles.

Further, in subsection 1.1 you should indicate: the amounts of payments that are not subject to contributions, the amounts that are subject to deduction, the calculated base and the amount of contributions from it (separately from the base within the limit and above).

Medical contributions are calculated according to the same principle - subsection 1.2 of Appendix 1 is intended for them. More detailed calculations can be seen in the sample of filling out the DAM for the 4th quarter of 2021.

Appendix 2 to section 1

Appendix 2 calculates contributions for temporary disability and in connection with maternity. The filling principle is similar, but there are important nuances:

- in column 002 you should enter the payment indicator (direct payments or offset system);

- on the second page you need to reflect the costs of paying insurance coverage and the amounts received from the Social Insurance Fund.

Section 1

The calculation results are entered in section 1. If the employer has made payments to employees in the last three months, then code “1” is entered in column 001. Line 010 indicates the OKTMO code.

Below for each type of insurance deductions you need to reflect:

- budget classification code;

- the amount of contributions for the reporting period;

- monthly contribution amounts.

That's all, the DAM form for 2021 (KND form 1151111) is completed. The deadline for submitting calculations has not changed - the last day of the month following the end of the reporting period. We would like to add that the calculation of insurance premiums for 2021 should be sent to the Federal Tax Service no later than February 1, 2021.

Why are control ratios needed?

Control ratios for any reporting form are a method of mathematical data verification that reflects the correctness of the information entered into the report by comparing certain indicators. Data is compared both within the form itself and with other reports.

Tax officials create and supplement a table comparing the indicators of the insurance premium calculation form and send it to the territorial offices so that the territorial Federal Tax Service Inspectors check the correctness of the data specified in the payers’ documents. The information is not kept secret: the policyholders themselves have the right to use the developed indicators for self-checking before submitting the calculation. Previously, the Federal Tax Service of Russia has already published a memo for payers of insurance premiums, which contains sufficient information on the procedure for their calculation and payment.

Not all services are equally “free”

When using the new online service for reconciling insurance premium reports, be vigilant. Some sites offer a free test - a one-time reporting reconciliation. Further control of the forms will be paid.

For example, if the site requires you to enter a phone number or card, then most likely money will be debited from your accounts. But reporting control services may not be provided. Fraudsters have come up with a number of tricks. For example, during an online check, the site produces a new error that the accountant has not encountered before. But the service does not provide explanations for the shortcomings, but requires payment. Be carefull!

We recommend working with official services and applications. For example, download software for reporting insurance premiums on the Federal Tax Service website.

Control ratios in the report: calculation of insurance premiums

The data for verification is presented in the form of a voluminous table. It contains more than 300 internal control relationships within the calculation and two inter-document ones. In particular, the control ratios of 6-NDFL and the calculation of insurance premiums 2021. For example, the first of them sounds like this: “the obligation to provide a calculation of insurance premiums in the case of providing 6-NDFL.” This means that all employers who are required to report under 6-NDFL are also required to report on insurance premiums. Even if the calculation turns out to be zero.

We will dwell in more detail on a small part of it, inter-document relationships, in order to understand how to use it. So, these indicators look like this:

| Document | № | KS | Violation | Actions of the Federal Tax Service | |

| RSV. 6-NDFL (in relation to the parent organization) | 2.1 | It is necessary to provide RSV in case of submitting 6-NDFL | Request for reporting | ||

| RSV. 6-NDFL (for taxpayers without separate sections, not for individual entrepreneurs on a patent and UTII) | 2.2 | Art. 020 rub. 1 6-NDFL - art. 025 rub. 1 6-NDFL >= art. 050 gr. 1 other 1.1 rub. 1 RSV | The amount of accrued income of the taxpayer is less than the base for calculating insurance premiums | Request for explanation or correction | |

| RSV, information from the FSS of Russia | 2.3-2.5 | Gr. 3-5 tbsp. 80 applications 2 r. 1 RSV = the amount of funds allocated by the Social Insurance Fund for reimbursement of expenses for insurance payments in 1-3 months of the reporting period | The amount of reimbursed expenses is more than the allocated amount | Same | |

It is not difficult to understand what the first line in this table means; this has already been discussed above. But the second line already contains a real comparative indicator, and we will dwell on it in more detail. So, tax authorities argue that the difference between line 20 of section 1 and line 25 of section 1 in the 6-NDFL declaration must be greater than or equal to the data reflected in line 50 of group 1 of subsection 1.1 of the calculation of insurance premiums. What's in these form fields:

- page 20 rub. 1 is the amount of accrued income;

- page 25 rub. 1 - these are accrued dividends, which are included in the amount of income.

Obviously, since insurance premiums are not charged on the amount of dividends, it is deducted in order to obtain the taxable base for them, which is indicated on page 050 gr. 1 other 1.1 RSV. If the data does not match, it means the payer made a mistake and will be sent a request for clarification. But this is not the only option. If discrepancies are identified in the document, tax authorities have the right to immediately draw up an act of violation in accordance with the provisions of Article 100 of the Tax Code of the Russian Federation and hold the payer accountable. If the payer himself discovers the error after the payment has been submitted, he has the right to submit an updated form.

How to work with online resources

The report verification algorithm depends on the selected software type. In general, the operating procedure is as follows:

- Prepare the report electronically. For example, use specialized accounting programs or applications from the official website of the Federal Tax Service.

- Check the finished report using internal control. Such actions provide standard settings for accounting programs.

- If the program does not support intra-form control, then you can check the RSV like this:

- download the report in XML format—this is a special reporting format;

- upload the report file to the application for verification;

- or upload reports to the website;

- follow the recommended software actions;

- correct errors identified by the check;

- submit reports to the Federal Tax Service.

Advice! If you submit reports via secure communication channels and use specialized software, then most likely the program for sending reports provides for mandatory forms of control. For example, PP "SBIS" will check the report for arithmetic errors, and will also point out discrepancies with 6-NDFL.