Accounting account 60 “Settlements with suppliers and contractors” is intended to generate data on settlements made by the enterprise with contractors for purchased values, services, and work performed. Thanks to the double entry system and correspondence of account 60, information on accepted deliveries and transactions for which documents are not yet available (for uninvoiced transactions) is reflected here. Let's consider the order in which records are kept for the posting of property or services/work - posting to the account. 60 you will find below.

What does Debit 10 - Credit 10 mean?

Account 10, on which data on the organization’s inventory is generated, is classified as active. Receipts and disposals of materials are reflected in Debit 10 - Credit 10, respectively. Postings for Debit 10 - Credit 10 in accordance with the two-level analytics used on account 10 give an idea of the change in the composition and location (storage) of inventories. They can also be used to judge the direction of expenses.

Receipt of inventories from suppliers is reflected in the following entry:

- Dt 10 Kt 60 - cost of purchasing materials excluding VAT.

If the organization’s accounting policy provides for capitalization at accounting prices, then upon receipt of goods and materials, the following entries will appear:

- Dt 15 Kt 60 - materials purchased from the supplier;

- Dt 10 Kt 15 - acceptance of inventories at discount prices;

- Dt 15 Kt 16 (Dt 16 Kt 15) - deviation of accounting prices from cost.

It is possible that materials will be received by the organization not as a result of procurement, but as a consequence of the dismantling of property, fixed assets, and also as a contribution to the management company by the founders. In some cases, MPP can be obtained free of charge. The postings will be as follows:

- Dt 10 Kt 91 - capitalization of inventories free of charge or as a result of dismantling fixed assets, disassembling property;

- Dt 10 Kt 75 - materials are capitalized as a contribution of the founders to the organization’s management company;

- Dt 10 Kt 71 - purchase of materials and equipment by accountable persons.

The decrease in inventories in an organization occurs mainly in connection with the needs of production or their use for management purposes. The following operations appear:

- Dt 20 (23, 25, 26) Kt 10 - materials (raw materials) released for production needs;

- Dt 44 (45, 76) Kt 10 - inventories are written off as necessary costs for the sale of goods or other needs of the organization.

If materials are supplied for sale, and are also transferred to third parties free of charge, then the following entry appears in the accounting records:

- Dt 91 Kt 10 - reflects the cost of retired materials.

For other information on how you can track the movement of inventory, see the material “Features of the balance sheet for account 10.”

I propose to consider the main standard transactions for account 10.

- Materials received from supplier D-10 K-60/76

- VAT is reflected on received materials D-10 K-60/76.

- Materials were received from the accountable person D-10 K-71.

- The materials contributed as a contribution to the authorized capital of D-10 K-75 have been capitalized.

- During the inventory, unaccounted materials were identified D-10 K-91

- Materials received as a result of the liquidation of fixed assets D-10 K-91 were capitalized

- Received materials donated by another organization D-10 K-98.

- Materials were written off for non-production needs (improving working conditions) - D-91 K-10.

- Materials from the production of D-10 K-20 have been returned.

- Materials for the construction of fixed assets D-08 K-10 were written off.

- Materials were written off for the main production of D-20 K-10.

- Materials were written off for auxiliary production D-23 K-10.

- The cost of materials is included in the cost of selling D-44 K-10.

- The cost of materials for victims of emergency situations (fire) was written off - D-99 K-10.

An enterprise has the right to write off materials for production using the following valuation methods:

- at the cost of each unit;

- at average cost;

- at the cost of the first purchases (FIFO method);

- at the cost of the most recent purchases (LIFO method - not used since 2008).

The method must be selected and prescribed in the accounting policy.

Let’s solve a small problem to reinforce the topic:

A furniture production plant purchased 7 boards at a price of 100 rubles per m, excluding VAT. Charged for delivery of boards is 150 rubles, excluding VAT. The payment for materials and delivery was paid from the bank account. For the production of the cabinet, 3 boards were written off at the average cost.

Make postings.

Solution:

- Let's calculate VAT on boards = 700 * 0.18 = 126 rubles.

- Let's calculate VAT on transport costs = 150 * 0.18 = 27 rubles.

- Transport costs are evenly distributed among the boards.

- Let's calculate the amount of written-off boards using the average cost method: 850/7*3 = 364.29 rubles.

Let's make the wiring:

- Materials from the supplier D-10 K-60 were capitalized - 700 rubles.

- VAT is reflected on purchased materials D-19 K-60 - 126 rubles.

- Transport costs are reflected - D-10 K - 60 - 150 rubles.

- VAT is reflected on transport costs – D-19 K-60 – 27 rubles.

- Materials D-20 K-10 were written off for production - 364.29 rubles.

Using posting Debit 10 - Credit 10

Within the organization itself, both the movement of materials and a change in their value can occur (for example, after the distribution of delivery and procurement costs). In such cases, wiring Dt 10 Kt 10 is used. This entry may mean:

- internal movement of inventory - then the posting of Debit 10 - Credit 10 is carried out in the context of warehouse analytics (for example, Dt 10 / Warehouse of the semi-finished products workshop - Kt 10 / Main warehouse of the inventory);

- reflection of misgrading, including those discovered based on the results of the inventory - in this case, the posting of Debit 10 - Credit 10 is done in the context of the item (for example, Dt 10 / Nails - Kt 10 / Screws);

You will learn more about how to reflect the completed inventory in warehouses from the material “Unified Form No. INV-3 - Form and Sample.”

- distribution of transportation and procurement costs (TPR) - in the event that TPR are first taken into account in a subaccount to account 10 and they need to be distributed when capitalizing several types of inventory that arrived on one vehicle.

Without dwelling in detail on the distribution method (it has its own nuances), let's look at an example.

Example:

Dry cement, expanded clay and crushed stone were brought to the construction plant by one train. The total cost of transportation was 250,000 rubles, it was distributed in proportion to the tonnage of the cargo: cement - 150,000 rubles, expanded clay - 70,000 rubles, crushed stone - 30,000 rubles. The total cost of delivery was first taken into account in the subaccount 10.11/TZR. According to the accounting policy adopted at the plant, fuel and equipment are distributed according to the cost of the materials themselves:

D 10 / Cement - Kt 10.11 / TZR - 150,000 rub.

Dt 10 / Expanded clay - Kt 10.11 / TZR - 70,000 rub.

Dt 10 / Crushed stone - Kt 10.11 / TZR - 30,000 rub.

In which subaccount is the railway tariff taken into account?

Note: 50 rubles VAT cannot be presented to the budget, since the amount difference of 250 rubles on equipment installed before the moment of its determination cannot be attributed to account 01 “Fixed assets”, but is reflected in the debit of account 91/2 “Other income and expenses" subaccount "Other expenses".

The total difference reflected on account 16 “Deviation in the cost of material assets” in the amount of 500 rubles is equally divided between the balance of equipment for installation, taken into account on account 07 “Equipment for installation” and already installed. Important

Debit 07 Credit 16 - 250 rub. — the amount difference is written off; Debit 91.2 “Other expenses” Credit 16 - 250 rub. — the amount difference is written off. In this case, a positive total difference was formed.

If the ruble exchange rate on the day of payment for goods were higher than on the day of capitalization, then the amount difference would be negative.

Attention

In fact, it makes no sense to declare, say, a picture hanging in the office or a flower pot standing there as a means of labor. With the entry into force on January 1, 2001 of the Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, small business enterprises can be classified as working capital only if their service life does not exceed 12 months or the normal operating cycle if it exceeds 12 months.

These objects are reflected in account 10 “Materials” under subaccount 9 “Inventory and household supplies”. 2) refusal to reflect the revaluation of current assets in accounting on a special account. In the preamble to Section II of the Instructions for the Application of the Chart of Accounts, the provision according to which the accounts of this section are used to account for transactions related to the revaluation of material assets is removed, since the regulatory documents do not provide for the revaluation of working capital.

If, not being the consignor and consignee according to the transportation documents, the taxpayer makes payments for the transportation of goods, for other work and services provided by the carrier, for shift escort and security along the route of goods, to confirm the specified expenses for the purposes of clause 1 of Art.

252 of the Tax Code of the Russian Federation, a contract for the provision of the above services and a service acceptance certificate are required. Explanations from the Ministry of Finance are given regarding the confirmation of expenses for income tax purposes. However, we believe that regarding the issue of the availability of a primary document to confirm the right to deduct the oversubmitted VAT, the opinion of the financial department will not change - in addition to the overissued invoice, you must have a primary document. Conclusions What conclusion did the reader come to after reading the article? Are there ways to resolve the issue? As you can see, there are two of them.

Info

What to do when the purchase price of materials is burdened with transportation and procurement costs? We will answer the fourth question this way: if accounting prices are not used, then the materials are received at the actual purchase price. At some enterprises, accounting also includes transportation and other expenses included in the cost price in the purchase price.

This is a lot of work that we do not recommend doing. Since several types of materials are usually indicated in one accompanying document, the question always arises: how to distribute these general costs between individual types of materials? There are many answers to this question: proportional to cost, proportional to weight, transportation distance, proportional to production significance (according to special conditional and predetermined coefficients), etc.

etc. etc.

Taking into account the discount provided for exceeding the purchase volume, the cost of material assets purchased under the agreement of ZAO Petrostroy amounted to 1,140,000 rubles. The following entries will be made in accounting: Debit 10 Credit 60 - 950,000 rubles.

(2,500 x 200 - 2,500 x 200 x 10% 1,000 x 500) - material assets received; Debit 19 Credit 60 - 190,000 rub. (950,000 x 20%) - VAT on received material assets is taken into account; Debit 60 Credit 51 - 480,000 rub. — transferred to the supplier for materials; Debit 60 Credit 91.1 - 40,000 rub. (400,000 x 10%) - discounts provided by the supplier on payment terms are taken into account;

When animals culled from the main herd are delivered to livestock procurement organizations without being fattened, the sale is reflected directly from the credit of account 01 “Fixed assets” to the debit of account 91 “Other income and expenses.” The cost of dead and forced slaughtered animals, except for those killed due to epizootics or natural disasters, is reflected as damage to valuables on the credit of account 11 “Animals for raising and fattening” and the debit of account 94 “Shortages and losses from damage to valuables.”

Skins, horns, hooves, technical fats, etc. obtained from dead and forcedly slaughtered animals. are valued at prices of possible use or sale and are credited to the account, which records the costs of raising animals as a by-product output.

Electricians of our company provide services for solving electrical installation problems at a reasonable cost. We regularly check the price list for price compliance. The sale of goods at a selling (contractual) price, which includes the costs of delivering goods to the point of departure, assumes that the costs of delivering goods from the point of departure to the point of destination are paid by buyers and are not included in the sales prices of goods.

This article will give a definition of what an acceptance (hereinafter referred to as AK) is, consider the types of AK in accounting (hereinafter referred to as BU), types of transactions, accounts for settlements with suppliers, forms of primary documents for settlements with suppliers, transactions for accepting supplier invoices for received materials and examples.

The distance of coal transportation from the place of production to the consumer has a huge impact on the competitiveness of coal compared to gas. In 1995, coal was transported an average of 1,145 km, and in some cases up to 6,000 km. The price of 1 ton of coal for the consumer largely depends on the specific distance of its transportation.

Therefore, for example, the cost of expensive Donbass coals for local consumers is still lower than what highly efficient (in terms of production costs) Kuzbass coals brought from afar would cost them. Railway tariffs for the transportation of coal, established by the Ministry of Railways (in rubles per ton-kilometer), also play a huge role.

It is impossible to imagine a modern apartment without a microwave, water heater, refrigerator, air conditioner, the power of which often exceeds 1.5 kW, not to mention fireplaces, heated floors or modern electric stoves, the power of which reaches 10 kW. The current regulatory documents on accounting do not define the specific composition of transportation costs when carrying out trading activities.

Debit 07 Credit 16 - 250 rub. — the amount difference is written off; Debit 91.2 “Other expenses” Credit 16 - 250 rub. — the amount difference is written off. In this case, a positive total difference has formed. The vast majority of all existing firms, both large and small, cannot do their business without delivery workers (suppliers).

The only exceptions are companies that are themselves large delivery companies or companies whose main activity is not production, etc. These may, for example, include companies whose main activity is aimed at generating income from a share of the authorized capital of other companies.

The Regulations on Accounting and Financial Reporting refer to the year. However, there are no contraindications for creating reserves for reducing the value of material assets during the year, and making adjustments at the end of the year.

Many people do not understand the meaning of AK, which may appear in the BU. It does not appear often, but it can confuse accountants, especially beginners.

Wholesaler A receives an invoice from supplier B. The amount of the railway tariff is highlighted on the invoice as a separate line (or a separate invoice is issued for the railway tariff). Company A makes its markup on the goods and issues an invoice to buyer C.

The norms of civil legislation (Article 510 of the Civil Code of the Russian Federation) allow the parties to the purchase and sale agreement to independently determine the conditions and procedure for the delivery of goods, including the obligations of the seller and buyer related to delivery.

If renovations are being carried out in a residential building, then at the first stage all old electrical wiring elements (sockets, switches, junction boxes, etc.) are removed.

https://www.youtube.com/watch?v=n7vq_Z5fbHs

According to clause 5.9 of the supply agreement, the price of goods actually delivered and not paid on time, transportation costs not paid on time, goods delivery services, including additional carrier services and the railway tariff, is the amount of a commercial loan. Interest is charged on the specified amount for using a commercial loan in accordance with Art.

It is possible to accurately calculate the price of services only after the electrician arrives at the site, carefully measures everything and calculates the estimate. In addition to the pumping tariff, the price includes the railway tariff and water freight (paid by main oil pipelines).

Results

Accounting for materials on account 10 is organized in terms of analytics by storage location and inventory nomenclature; a separate sub-account may also be provided for accounting for material and equipment for distribution. Debit 10 - Credit 10 show the sources of receipt of valuables, the amount of acquisition and disposal, as well as the direction of expenditure of inventories.

The most active flow of the company's financial resources passes through accounts that are associated with the movement of funds with suppliers and other counterparties. The speed of money turnover, existing debt indicators, and the presence of penalties are criteria for assessing the solvency of an enterprise. All these positions are assessed by potential partners before contracts are concluded. Accounting for transactions with suppliers and contractors is one of the central ones for the company’s entire accounting system. In this case, a count of 60 is used.

Scope of application of account 60 in accounting

Suppliers are firms that deliver raw materials, semi-finished products, components, goods, fixed assets and other inventories to other organizations for production and commercial activities.

Settlements with suppliers and contractors require strict accounting

Contractors are individuals and legal entities who perform work under a contract concluded in accordance with the current legislation.

Accounting account 60 aims to summarize information on transactions with specified persons in the following aspects:

- acquisition of inventory items;

- performing certain work;

- provision of service;

- delivery of valuables;

- unpaid deliveries;

- excess inventories and inventories;

- transport services;

- communication services.

Organizations involved in the execution of construction contracts, contracts for the performance of research, development and technological work and other contracts for the functions of a general contractor are also reflected in account 60.

All transactions are reflected in accounting account 60, regardless of the time of payment.

The tasks facing the accounting system for account 60 relate to issues of tracking financial flows operating between the company and suppliers. The account allows you to receive information that performs the following tasks:

- control over the status of amounts due to contractors and suppliers of goods and materials (information is relevant for owners, as well as for the formation of reliable reporting);

- formation of an information base. On its basis, the speed of funds turnover is controlled. The database is used to generate management reports;

- control over compliance with contractual obligations, terms, volumes of supplies and payment for them;

- drawing up a payment plan for suppliers when distributing financial resources;

- eliminating opportunities to violate the law regarding payment issues;

- monitoring of overdue payments.

60 account in accounting is a variant of an active-passive account, regardless of the chosen accounting system and the organizational and legal form of activity. It is designed to generate and collect data about each supplier and counterparty.

The basis for starting accounting are:

- concluding an agreement for the supply of inventory, fixed non-current assets, and intangible assets;

- provision of services of various nature (utilities, repair and maintenance of buildings, structures, machinery and equipment);

- transportation of goods;

- performance of work under the contract, etc.

Important! Accounting under account 60 is called “Settlements with suppliers and contractors.” A synthetic version of accounting is maintained for all organizations. For analytics, sub-accounts are generated for individual counterparties.

To account for transactions between counterparties when delivering goods, account 60 is used

Legal regulation

First, let's look at the legal regulation of transportation activities carried out by rail.

The main regulations governing transportation activities by rail, which are necessary as a source of information for an accountant keeping records of transportation costs provided by the railroad, include Federal Laws of January 10, 2003 N 17-FZ “On Railway Transport in the Russian Federation” and N 18-FZ “Charter of Railway Transport of the Russian Federation” (hereinafter referred to as UZhT).

Civil relations between the contractor and the customer for the transportation of goods by rail are regulated by the Civil Code. According to its Art. 785 delivery of goods is carried out on the basis of a contract of carriage, under which the carrier undertakes to deliver the cargo entrusted to him by the sender to the destination and deliver it to the recipient, and the sender undertakes to pay a set amount for the carriage of goods. In this case, the general conditions of transportation are determined by transport charters and codes, other laws and rules issued in accordance with them.

Characteristics

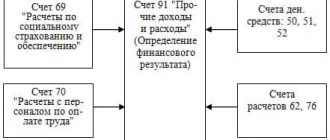

Active - passive 60 account in accounting is used to combine data on transactions with counterparties.

The main characteristics that answer the question of whether the 60 account is active or passive:

- summarizes information about transactions with counterparties;

- summarizes information on transactions with subcontractors under construction contracts;

- the cost of acquired property is reflected according to Dt: 08.10, 20, 41 and Kt60;

- repayment of obligations is reflected according to Dt 60 and Kt 51,52,55;

- analytical accounting is formed in the context of each supplier, contractor and performer.

Count 60 belongs to the active-passive type:

- a debit balance indicates that the partner has not yet fulfilled his obligations to the company. The supplier company has a debt for the supply of goods, works or services;

- the presence of a credit balance indicates that the company has not yet paid the debt to the supplier or contractor.

Advances provided to suppliers for the upcoming supply of materials, raw materials, advances to contractors for upcoming work and services are taken into account.

Analytical accounting for account 60 is maintained for each accrued amount, for each supplier and contractor. The construction of analytical accounting provides the necessary data on:

- suppliers and accepted documents, the payment deadline for which has not yet arrived;

- suppliers who did not pay documents on time;

- to suppliers in case of unpaid deliveries;

- advances to suppliers;

- when issuing bills whose due date has not yet arrived;

- to suppliers for overdue payments;

- when receiving a commercial loan, etc.

Count 60 is active-passive, which characterizes its main feature

Source documents

As you know, a contract for the carriage of goods is drawn up with a railway consignment note, which is the main transportation document. It accompanies the cargo throughout its entire route and is issued to the consignee along with the cargo at the destination station.

— sheet 1 — original railway invoice (issued by the carrier to the consignee);

— sheet 2 — road manifest (drawn up in the required number of copies provided for by the rules for the transportation of goods by rail);

— sheet 3 — the spine of the road manifest (remains with the carrier);

— sheet 4 — receipt for acceptance of cargo (remains with the shipper).

The railway invoice and the cargo acceptance receipt issued on its basis by the carrier to the shipper confirm the conclusion of the contract for the carriage of goods (Article 25 of UZhT) and are supporting documents for accounting for the costs of providing transport services.

Does the buyer need railway invoices to confirm the right to deduct the VAT reclaimed by the supplier? For example, from the Resolution of the Federal Antimonopoly Service VSO dated 04/08/2009 N A78-3514/08-С3-21/155-Ф02-1262/09, the conclusion suggests itself that, in the opinion of the tax inspectorate, the buyer needs to have them, since only tax amounts are subject to deductions presented to the taxpayer upon acquisition of goods (work, services), after registration of these goods (work, services), taking into account the features provided for in Art. 172 of the Tax Code of the Russian Federation, and in the presence of relevant primary documents.

Title of the document; date of document preparation; name of the organization on behalf of which the document was drawn up; content of a business transaction; measuring business transactions in physical and monetary terms; names of positions of persons responsible for carrying out a business transaction and the correctness of its execution; personal signatures of these persons.

The Ministry of Finance in Letter dated 03/19/2010 N 03-03-06/1/153 reports that, as follows from paragraph 2 of the Rules on the system and general requirements for servicing shippers and consignees by railways, a railway waybill is a contract of carriage under which the carrier the established fee undertakes to deliver safely the cargo accepted from the consignor to the destination and hand it over to the consignee or other specially authorized person.

Consequently, if the taxpayer acts as a consignor or consignee, in order to confirm the costs of paying for services for the transportation of goods by rail, he must have his own copy of the railway consignment note. Moreover, in accordance with clause 1.3 of the Rules for filling out transportation documents for the transportation of goods by rail, the consignee is given sheet 1 - the original railway consignment note, and the consignor is given sheet 4 - a receipt for accepting the goods.

If, not being the consignor and consignee according to the transportation documents, the taxpayer makes payments for the transportation of goods, for other work and services provided by the carrier, for shift escort and security along the route of goods, to confirm the specified expenses for the purposes of clause 1 of Art. 252 of the Tax Code of the Russian Federation, a contract for the provision of the above services and a service acceptance certificate are required.

Explanations from the Ministry of Finance are given regarding the confirmation of expenses for income tax purposes. However, we believe that regarding the issue of the availability of a primary document to confirm the right to deduct the oversubmitted VAT, the opinion of the financial department will not change - in addition to the overissued invoice, you must have a primary document.

Subaccounts

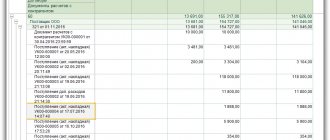

Analytics on account card 60 is carried out separately for each account.

It is necessary to organize the analysis of invoice 60 in such a way that you can track information on suppliers:

- according to separate documents;

- according to documentation that is not due;

- under unpaid contracts;

- on bills issued;

- by suppliers with issued credit amounts, etc.

To record transactions, sub-accounts are opened:

- 60.01: reflect mutual transactions with partners in purchase transactions and payment for goods;

- 60.02: reflect prepayment transactions;

- 60.03: reflects the company's securities.

Important! It is possible to open additional sub-accounts taking into account the specifics of the company.

Separate accounts are organized for mutual transactions with counterparties in foreign currency:

During accounting, separate sub-accounts are created for counterparties

What sub-accounts are opened for account 60?

Within 60 accounts, several subaccounts are allocated. The main ones are 60.01 and 60.02.

Subaccount 60.01 is needed to account for mutual settlements with suppliers. It forms the company's accounts payable, that is, the amounts that the organization must pay to its counterparty.

Subaccount 60.02 is used to account for advance payments to suppliers. This is accounts receivable. That is, the company has paid the counterparty, but has not yet received the goods and materials. Let's look at wiring as an example.

| Debit | Credit | Sum | The essence of the operation |

| 60.02 | 51 | 10 000 | The supplier received an advance payment for the supply of raw materials |

| 10 | 60.01 | 10 000 | The supplier shipped the raw materials |

| 60.01 | 60.02 | 10 000 | The advance payment made earlier was taken into account as payment for the delivery made. |

In addition, by the 60th account the following sub-accounts are opened:

- 60.03 - for accounting of bills of exchange;

- 60.21 - debt to suppliers in foreign currency (analogous to 60.01);

- 60.22 - advances to suppliers in foreign currency (analogous to 60.02).

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

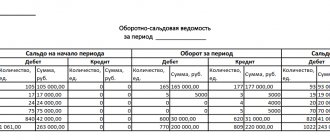

Balance sheet for account 60

This document is a summary of data on account 60 for all business transactions that were carried out using this account in the company for the period.

Important! The main feature of this document is that count 60 is active-passive.

Basic rules for forming a statement:

- Credit turnover. The loan reflects transactions that are associated with the purchase of materials, work, services, and equipment. Basic documents: invoices, acts, invoices.

- Debit 60 of account shows debit turnover. Transactions for payment of funds to suppliers are reflected. Among them: debt repayment, prepayment. Documents: payment slips, cash documents.

An example of a balance sheet for a conditional company for dummies is presented in the table below.

According to this statement, it is clear that in 2019 the notional company paid the supplier Phoenix LLC 13,681.00 rubles, and goods were received at a cost of 154,727.00 rubles. The total debt amounted to 141,046.00 rubles.

Important! The debit balance of account 60 is reflected in the asset balance sheet (in the form of accounts receivable). The credit balance is reflected in the liabilities side of the balance sheet (in the form of accounts payable).

How debits and credits are displayed

The account is credited for the cost of goods, inventory items, works and services accepted for accounting and corresponds with their accounts. Synthetic loan accounting is based on the supplier's documents, which does not depend on the assessment of values.

Account 60 is debited for the amounts of performance obligations. This also includes advances and prepayments. Corresponds with the accounts in which these funds are recorded.

The debit and credit of account 60 reflects different transactions

The principle of generating accounting entries

To create postings, know: there are active and passive accounts. Active accounts increase in debit and decrease in credit. Passive is the opposite. Active ones reflect the company's assets, and passive ones reflect its debts.

Let's look at the principle of generating postings using examples:

You purchased materials from Supplier LLC in the amount of 100,000 rubles. As a result of the operation, an asset increased - materials, and a liability - the debt to the supplier, since you have not yet paid the money. Based on the meaning of the operation, we understand that you need to use account 10 “Materials” and account 60 “Settlements with suppliers”. All that remains is to figure out what goes as a credit and what goes as a debit. Start with the count that makes most sense to you, which is probably 10 “Materials.” Account 10 is active, since it reflects property, and, therefore, it grows by debit. The amount of materials you have has increased, therefore, we are building wiring: Dt10 Kt60 in the amount of 100,000 rubles.

Important! Postings are always written in monetary terms!

Now you need to pay the debt to Supplier LLC. The score 60 reflects our debts, which means it is passive. Therefore, a decrease in debt is reflected in debit. We pay the debt from the accountant - account 51. The money on it is undoubtedly our property, it is reduced by the loan. We are building wiring: Dt60 Kt51 in the amount of 100,000 rubles - the debt to Supplier LLC has been paid.

Postings

The main transactions for account 60 are reflected in the table below.

By debit.

| Debit | Credit | Explanation of the operation |

| 60 | 50.01 | The debt to the supplier is repaid from the cash register |

| 60 | 51 | The debt to the supplier has been repaid from the current account |

| 60 | 52 | The debt to the supplier was repaid in foreign currency |

| 60 | 55.01 | The amount of the used letter of credit is written off for settlements with the supplier |

| 60 | 76.02 | The amount of claims against the supplier is reflected |

| 60 | 91.01 | Accounts payable are included in other income after the statute of limitations expires |

| 60 | 91.01 | Positive exchange rate difference reflected |

Account document flow

Account 60 is used to form transactions with suppliers. Basic documents for the movement of funds:

- An invoice and invoice are the basis for creating a purchase book (VAT received).

- A payment order or bank statement serves to close accounts payable to contractors.

- The certificate of completion of work is the basis for payment of the amount specified in the contract.

When goods are delivered without a document, the actual receipts are also reflected in the registers. At the time of presentation of invoices 60, the invoice is adjusted taking into account the difference between the accounting prices and the cost of the goods according to the submitted documents.

Documentation for settlements with counterparties is strictly maintained

Posting examples

The company purchases goods by bank transfer. Documents for the operation: consignment note TORG-12 and invoice.

Posting entries mean:

- Dt41-Kt60 - reflects the amount of goods that were accepted, excluding VAT;

- Dt19-Kt60 - VAT is reflected on the accepted goods;

- Dt68-Kt19 - the invoice reflects the deduction of VAT;

- Dt60-Kt51 - payment to the supplier.

The company used the services of a transport company. Documents for transactions: acceptance certificate, invoice.

Posting entries:

- Dt44-Kt60 - displays the cost of the service excluding VAT;

- Dt19-Kt60 - VAT accrued is reflected;

- Dt68-Kt19 - VAT deduction is reflected in the invoice;

- Dt60-Kt51 - paid for the services of the transport company.

Account 60 is intended to summarize information about transactions with suppliers and contractors. The main feature of the account is that it is active-passive.

Accounting for transport costs of a trade organization

Thus, since the enterprise does not independently provide the services listed in the question, it should not post the cost of the transferred services through its sales accounts and, accordingly, should not issue invoices for the transferred services.

This explains the liquidation of account 14 “Revaluation of material assets”, previously located in this section. Account 10 “Materials”, along with cash accounts, forms the basis of the enterprise’s working capital.

It should be said that the cost of transport services for the delivery of products provided by rail may include the cost of not only the railway tariff charged directly for transportation, but also auxiliary services necessary for the delivery of products, for example the cost of fastening and fixtures, loading and unloading operations, locking -sealing devices, fees for the use of wagons, containers, for storage of goods, for downtime and other expenses.

Why do we focus on this? The fact is that only those delivery costs that are agreed upon in the contract can be re-charged to the buyer. For example, if the contract stipulates that the buyer reimburses the cost of the railway tariff, then the supplier will no longer be able to re-represent the costs for supplying and cleaning the wagons to the buyer (see.

Resolution of the Federal Antimonopoly Service UO dated November 8, 2007 N F09-8611/07-C5). Accordingly, he will not be able to resubmit VAT related to expenses that are not stipulated in the contract as reimbursable. In order to avoid controversial issues regarding the costs of the supplier, which are reimbursed by the buyer, it is necessary to detail the subject of the agreement between them in terms of the costs of delivering products, indicating specific services.

Note! When interpreting the terms of an agreement, the court takes into account the literal meaning of the words and expressions contained in it (Article 431 of the Civil Code of the Russian Federation).

Accounting for settlements with suppliers and contractors

The use of account 60 “Settlements with suppliers and contractors” is regulated by the Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n. This account is necessary to reflect data on payments for:

- goods, works, services (hereinafter referred to as GWS), which were accepted from the supplier and for which primary documents were received;

- GWS that were accepted from the supplier, but for which primary documents were not received (uninvoiced deliveries);

- surplus capitalized upon receipt of goods;

- work accepted from subcontractors, etc.

Operations to reflect accounts payable are carried out at the moment the obligation arises; the moment of payment does not affect the entry on the credit of account 60 in accounting. When to show a liability in accounting depends on the conditions for the transfer of ownership of the purchased GWS in accordance with the agreement between the buyer and supplier. The reflection of the obligation in accounting occurs at the same time as the reflection of the receipt of goods and services. When capitalizing the goods and services, the accountant records the transaction on the credit of account 60 and on the debit of the accounts of purchased property (as well as account 15) or costs for the amount specified in the supplier’s primary documents. VAT, included in the cost of goods and services, is allocated separately by posting:

Dt 19 Kt 60.

When obligations are fulfilled, that is, payment is made to the supplier, an entry is made for the amount of payment:

Dt 60 Kt 50, 51, 52, 55.

If the buyer makes payment before delivery of goods and materials, the posting is recorded as a debit to account 60 of the “Advances issued” subaccount. Thus, accounts receivable are accumulated in a separate subaccount of account 60, which will be repaid upon receipt of goods and services. At the same time, in the balance sheet, accounts payable for account 60 are shown as a liability, and accounts receivable are shown as an asset, and therefore the collapsed balance of account 60 cannot be shown in the reporting.

If the buyer transfers his own bill of exchange as a guarantee of payment of goods and services, then accounts payable from account 60 are not written off, but are reflected in a separate sub-account, for example, by posting:

Dt 60 subaccount “Settlements for received technical and technical materials” – Kt 60 subaccount “Settlements for bills issued”.

When repaying your own bill, the following posting is made:

Dt 60 subaccount “Settlements on bills issued” – Kt 50, 51, 52, 55.

Types of transactions according to the impact on the balance

Based on the impact of transactions on the balance sheet structure, 4 groups can be distinguished:

- Asset + X = Liability + X (asset grows - liability grows)

- Asset - X = Liability - X (asset decreases - liability decreases)

- Asset+XX = Liability (asset redistribution)

- Asset = Liability+XX (liability redistribution)

Let's consider the first wiring of Dt10 Kt60. As a result, there was an increase in the asset (materials were purchased) and an increase in the liability (the debt to the seller increased) by the same amount.

In the second posting Dt60 Kt51, there was a decrease in liability (the debt was paid off) and a decrease in asset (there was less money on the account) also by the same amount.

In addition to such operations, there are more complex examples - asset redistribution. Let's look at an example.

You have received payment from your counterparty for wooden boxes of your own production in the amount of 50,000 rubles.

Dt 51 Kt 62 in the amount of 50,000 rubles - received payment from the counterparty. The asset was redistributed. The money on the account has increased, but at the same time the accounts receivable have decreased.

The fourth type is the redistribution of liabilities. Such wiring is less common. For example: Dt 84 Kt 82 10,000 rubles - reserve capital was created from retained earnings.

Reflection of accounts payable when identifying disagreements with a counterparty

When accepting GWS, shortages may be discovered, the full scope of ordered work may not be completed, while the full cost is indicated in the settlement documents. In addition, the error may be contained in the documents themselves, for example, an incorrect price or quantity. The buyer must inform the counterparty about the violation that has occurred and file a claim. Since the supplier may either agree or disagree with the presented requirements, in accounting the buyer will have to reflect the obligation for the full amount in accordance with the primary documents, showing the disputed amount in account 76, subaccount “Settlements for claims”:

- Dt 07, 08, 10, 15, 20, 23, 25, 26, 41, 44 Kt 60 - actually received GWS are accepted for accounting;

- Dt 19 Kt 60 - reflects the amount of incoming VAT on actually received GWS;

- Dt 76 subaccount “Calculations for claims” Kt 60 - the amount of the shortage (error) is attributed to settlements for claims.

The opposite situation is also possible, when accompanying documents were not received for the received goods, or surpluses were identified upon acceptance, or the volume of work performed was exceeded. If an organization, in compliance with the law, refuses to pay and decides to return such goods to the supplier, then their accounting is kept on the balance sheet, in account 002 “Inventory and materials accepted for safekeeping.” If an organization decides to accept such GWS, then it must capitalize them using the supplier’s prices and show the debt on the credit of account 60. Prices can be taken from the contract, accompanying documents for similar GWS, or based on an expert assessment.

Read about one of the most frequently used accounting registers for account 60 in the article “Features of the balance sheet for account 60.”

There are different types of lender. One of them, and often the most significant, is obligations to suppliers and contractors. To account for them, a separate account 60 is allocated in the chart of accounts. It must be remembered that account 60 can also be active when reflecting advances and prepayments.

For more information about accounts payable, read the article “How are accounts payable reflected in accounts?”

Tax norm

It would seem that this problem is not new. However, a unified position on resolving it has not yet been developed. Arbitration practice is also controversial. And some taxpayers do not see any obstacles at all: for the supplier to reissue the invoice received from the carrier to the buyer of the product, for the buyer to deduct the VAT resubmitted for transportation services.

Nevertheless, the fact remains - Ch. 21 of the Tax Code of the Russian Federation does not provide for such a norm. Why? Maybe there is no problem at all, and the main thing is to correctly formalize the relationship between the parties to the supply contract in a legal sense? And please, the road is open both for the supplier - to resubmit VAT from the carrier, and for the buyer - to accept it for deduction.

The relationship between the buyer and the seller, when the latter reclaims the costs of delivering products for the purpose of applying a VAT deduction, as mentioned at the beginning of the article, is not fully regulated, and therefore often becomes the subject of tax disputes.

There is an opinion that such relationships can be qualified by tax authorities as intermediary activities on the part of the seller in favor of the buyer, which, in turn, does not provide grounds for issuing invoices to the buyer, which transfer data from invoices received from the carrier (railway), unless the supplier has concluded an appropriate agreement with the buyer for the provision of intermediary services on organizing the transportation of products on behalf of the supplier, but at the expense of the buyer.

As a result, fiscal officials may have claims against the buyer regarding his application of a tax deduction for oversubmitted VAT. This is confirmed by Letter No. 24-11/73833 dated November 15, 2004, from which it follows that under these circumstances, Moscow tax authorities share the opinion that intermediary activities are carried out by the supplier.

Indeed, by concluding an intermediary (agency) agreement with the supplier to organize transportation, the buyer will minimize the tax risk in relation to VAT deduction. However, as practice shows, this is a forced measure within the framework of the current tax legislation, but not mandatory if we consider the delivery of products as a continuation of the sales process under a supply agreement.

In the above-mentioned Letter N 03-03-01-04/1/103, the reflection of transport costs in the supplier’s accounting is considered within the framework of a supply agreement, and not a separate agency agreement, which, in turn, does not deprive the opportunity to build relationships between the seller and the buyer, without resorting to signing a separate (intermediary) agreement for the delivery of products. This conclusion is confirmed by the position of the judges on this issue.

Thus, FAS VSO, in Resolution No. A33-5878/2009 dated March 17, 2010, indicated that civil law provides for conditions for the delivery of goods within the framework of a supply agreement. In accordance with paragraph 1 of Art. 510 of the Civil Code of the Russian Federation, delivery of goods is carried out by the supplier by shipping them using transport provided for in the supply contract, and on the conditions specified in the contract.

It also follows from the Resolution of the Federal Antimonopoly Service NWO dated February 14, 2008 N A05-1030/2007: the arbitrators are not opposed to the fact that, under the terms of the supply agreement, the price of products does not include transportation costs associated with its delivery from the departure station to the destination station, and transport costs are paid by the buyer separately.

In this case, the supplier has the right, for the purpose of calculating VAT, not to include in the sales proceeds the cost of railway transportation, reimbursed by the buyer in excess of the contractual value of the goods, since he does not receive remuneration for organizing the delivery of goods, and accordingly, he does not become subject to VAT.

And in the Resolution of the Federal Antimonopoly Service of North Caucasus of January 13, 2010 N A53-9707/2009, taking into account the fact that the goods on the domestic Russian market were purchased by the company under an agreement, in which a separate clause established that payment of the cost of the railway tariff and carrier services (in the amount of 1% of the cost railway tariff) is made by the buyer by transferring funds to the supplier's bank account, the arbitrators concluded that the tax inspectorate unlawfully refused to deduct VAT on the invoices issued by the supplier.

FAS North Caucasus noted: the fact that the payment for transporting goods was received by the transportation service provider (railway) through a chain of intermediaries does not indicate that the buyer of the goods does not have the right to a tax refund. In addition, the tax inspectorate did not provide evidence of tax reimbursement by other persons - organizations re-issuing invoices for payment of the railway tariff.

The same court, in its Resolution dated January 20, 2009 N A53-10111/2008-C5-44, established the following. The Company purchased petroleum products under supply contracts. In accordance with the specifications that are appendices to these contracts, the goods were shipped by rail and the railway tariff to the destination station was paid by the buyer in accordance with the invoices issued by the seller, for which the buyer claimed VAT for deduction.

In this regard, the tax inspectorate conducted a desk audit of the declaration submitted by him, based on the results of which he decided to accrue arrears, penalties and a fine under clause 1 of Art. 122 of the Tax Code of the Russian Federation. They considered that the company’s suppliers do not independently provide transport services to it, which means they do not have the right to draw up documents for the provision of these services, including invoices, on their own behalf.

Transport services are actually provided by the railway. Their cost is not included in the price of the goods; the company's suppliers are intermediaries in the provision of these services. Consequently, the company has no right to deduct VAT. Having disagreed with the decision, the buyer appealed to the arbitration court, which, taking into account Art. Art.

When considering a tax dispute, the Federal Antimonopoly Service of North Caucasus indicated: on the basis of Art. Art. 421, 424, 485 and 510 of the Civil Code of the Russian Federation, the parties to the supply contract have the right to determine the price under a civil contract (including the price of goods, other payments in pursuance of the contract), the procedure for its determination, the procedure for payment and delivery of goods at their discretion, unless otherwise provided by law.

Compensation by the company to suppliers for the cost of delivering goods by rail is essentially part of the consideration under the supply agreement (price), and not a payment for transport services that were not provided to the taxpayer (Article 424 of the Civil Code of the Russian Federation). The procedure for determining the price under the contract agreed upon by the parties to the supply contract does not contradict the requirements of current legislation.

The obligation to pay the cost of delivery of goods arises from the obligatory relationship for the delivery of goods, the participants of which are the company and its supplier, and not the carrier who actually transported the goods. The supply agreement does not impose on the supplier obligations of an intermediary nature, characteristic of commission, commission or agency agreements.

Taking into account the above, the FAS North Caucasus Region came to the conclusion that the company complied with the provisions of Chapter. 21 of the Tax Code of the Russian Federation, conditions for the application of tax deductions on invoices issued by suppliers for petroleum products transportation services.