Most workers are aware that there are days in the calendar that extend the temporary period.

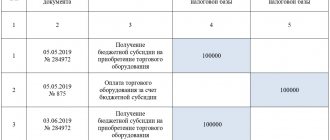

How to fill out KUDiR on the simplified tax system “Income” The object of taxation affects which sections of the book

To properly organize the circulation of documentation, you must comply with the requirements of Federal Law dated December 6, 2011 No. 402-FZ

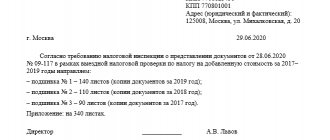

The act of acceptance and transfer of documents is intended to reflect the fact of transfer of documentation from one responsible person to another

Not all types of income received by an organization or individual entrepreneur using the simplified tax system need to be included in the tax

Currency transactions between residents and non-residents are required to be carried out in accordance with Federal law. As an active

As a result of mutual settlements with counterparties, the company accumulates certain debts, which constitute a significant share of assets

What the Ministry of Finance of the Russian Federation says about the deduction of VAT on a cash receipt Hidden text goods were purchased

Forms of travel voucher for special transport The standardized form of travel voucher for the construction vehicle ESM-2 is approved by the Resolution of the State Statistics Committee

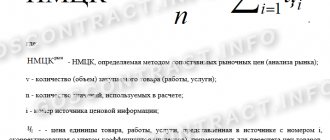

The comparable market price method involves establishing value based on prices for objects with similar