Tax deduction for treatment is refund of 13% of the cost of paid medical services.

In this article I will talk in detail about what you can get this type of deduction for, who can receive it, under what conditions, and I will write out detailed instructions.

I myself receive a social deduction every year (for treatment, education, life and health insurance, and charity). These types of deductions are called social.

Explanation of the term “tax deduction”

A deduction is a type of income that is not subject to mandatory collection. If there is official employment and taxes are paid by the employer, citizens have the right to expect a 13% refund for the treatment received. In addition, a person has similar powers when paying for medical services for a relative.

Article 219 of the Tax Code of Russia indicates that when deducting funds for services or medicines received, citizens of the Russian Federation have the right to receive part of the money spent.

Social tax deductions under Article 219 of the Tax Code of the Russian Federation

Grounds for application

An application for a tax refund for treatment (sample) is sent to the Federal Tax Service, provided that the citizen spent money in the current year:

- receiving medical services, including to close relatives - wife/husband, parents, minor children;

- paid for medications intended for recovery, rehabilitation or maintenance of health for oneself or close relatives;

- made insurance contributions for individuals on a voluntary basis, including in relation to members of his family.

The procedure and rules for obtaining a social tax deduction for treatment are reflected in Article 219, paragraph 3 of the Tax Code of the Russian Federation.

Note: the list of medical services and medications to be provided to NVs are defined in PP No. 201 of March 19, 2001.

Decree of the Government of the Russian Federation of March 19, 2001 N 201 “On approval of Lists of medical services and expensive types of treatment in medical institutions of the Russian Federation, medicines, the amounts of payment for which at the expense of the taxpayer’s own funds are taken into account when determining the amount of social tax deduction”

Nuances of social tax deductions

If relatives paid for treatment

If actual expenses for medicines were made by close relatives, then it is possible to receive a deduction.

IMPORTANT! Close relatives are spouses, parents (guardians) and minor children (natural and adopted).

In this case, in addition to the above package of documentation, certified copies of documents confirming family ties should also be submitted to the Federal Tax Service. For example, a birth certificate for a child under 18 years of age or a marriage certificate.

If another relative, common-law spouse or friend paid for the medicines, then in order to receive a tax refund you must issue a power of attorney for the purchase of medicines. Such a power of attorney does not need to be certified by a notary (Letters of the Federal Tax Service for Moscow dated March 10, 2010 No. 20-14/4/024732 @, Federal Tax Service of the Russian Federation dated May 17, 2012 No. ED-4-3/8135).

Categories of persons to receive

All citizens can take advantage of an income tax refund for treatment in 2021, provided they are officially employed and have expenses for the following items:

- payment for your own therapy and purchase of medications, as well as an insurance policy (VHI);

- provision of expenses for the health of family members, including adopted minor children.

The second point also applies to the rule for receiving medical services and spending on medicines. In addition, it is allowed to receive 13% per year if the applicant has taken out a voluntary insurance policy for relatives.

An exception to the rule is that a wife does not have the right to file 3-NDFL for her husband’s father and mother.

What about dentistry?

One of the most popular questions is whether dentistry is included in the list of expensive treatments for 3-NDFL? It turns out yes. Namely, ONLY the operation of implanting dentures.

Other dental prosthetics (so-called orthopedic dentistry) have a code. That is, the upper deduction limit is 120,000 rubles along with other social deductions during the tax period.

These conclusions are confirmed by letters from the Ministry of Health and Social Development of Russia dated November 7, 2006 No. 26949/MZ-14 and dated November 8, 2011 No. 26-3/378332-2065.

Read also

30.03.2017

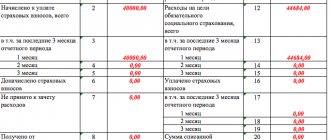

Size

The Tax Code of Russia has established a maximum limit for the amount of tax deduction (NDFL) for treatment - 120,000 rubles. The amount of compensation is summed up with other items of the citizen’s expenses:

- to the services of medical institutions;

- procurement of medicines;

- NV for education;

- transfers to the funded part of pension contributions;

- VHI, including non-state.

Read also: Law on consumer credit

There are no other restrictions or limits regarding the size of the IC, since an amount of 13% of the deductions is transferred to the recipient’s account. The main condition is compliance with the expense item, i.e. medicines or services.

Tax deductions for treatment - the list is presented in the form of codes by which the application is verified by the Federal Tax Service. Thus, the recipient can independently determine whether the expenses relate to ordinary procedures (code 1) or expensive ones (code 2).

Features of filling out the declaration

The procedure for filling out the 3-NDFL declaration for expensive treatment differs little from the same procedure for other types of medical services. The exception is indicating the maximum allowable amount and entering information such as the code for expensive treatment for the tax authorities.

Most of the difficulties in preparing 3-NDFL are related to the correct determination of the type of service provided. For expensive treatment, the service code is indicated with the value “2”, while ordinary treatment is recognized with the code “1”.

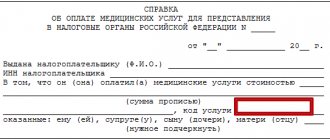

Reflection in the help

As when filling out a regular declaration, in case of expensive treatment, 5 sheets of the form must be filled out. Including title page, sections 1 and 2, Sheets A and E1.

Receipt procedure

To apply for a tax refund (13 percent) for treatment or purchase of medicines, a citizen needs:

- Fill out Form 3-NDFL for treatment at the end of the reporting period. In the declaration, indicate the payment method and/or list of drug groups.

- Request from the accounting department at the employment address a certificate of the transferred amounts subject to mandatory withholding (form 2-NDFL).

- Make copies of documents indicating family ties with the citizen for whom the applicant made payments.

- Prepare documents proving the authority to issue a social NV for expenses (therapy or surgical intervention, health improvement in a sanatorium, receipts for payment for medicines).

- Send the prepared declaration to the Federal Tax Service at your residence address, attach copies of payment receipts and other documents indicating expenses incurred.

How to get a deduction

Documents for filing a declaration for NV

To receive a refund of the mandatory contribution, you must submit documents for tax deductions for treatment under the VHI agreement (copies):

- contract for concluding health insurance or VHI policy;

- sales receipts;

- other documents certifying a citizen’s healthcare expenses.

To obtain an IR for expenses for medicines, the applicant submits the following papers:

- A prescription (in the original) from the attending doctor, drawn up on a special form. The document must have a stamp “For the Federal Tax Service” indicating the citizen’s TIN.

Sample recipe for tax authorities - Copies of payment statements indicating the amount paid and the medication prescribed.

Note: when paying excess funds for a tax liability, a citizen has the right to apply for a refund within 30 calendar days. The Federal Tax Service Inspectorate considers the application from the moment the application is registered, but not before the completion of the desk audit of the organization - article paragraph 6 of the Tax Code of Russia.

Article 78 of the Tax Code of the Russian Federation “Credit or refund of amounts of overpaid taxes, fees, insurance contributions, penalties, fines”

Copies of payment documents

If you encounter difficulties with preparing documents, filling out a declaration and submitting them to the Federal Tax Service, you can contact the department’s lawyers or consulates. Filing a tax refund for dental treatment, surgery, etc. often requires outside assistance in preparing the application. Specialists from organizations provide support in resolving the issue.

Payment documents, copies of which must be attached to the declaration, include:

- prescription form in form No. 107-1/u, issued by a doctor;

- if a refund is required for a health insurance policy, then a copy of the document signed by the applicant is attached;

- a copy of the insurance company's license to operate;

- if the expenses relate to services provided for a relative - birth papers or other documents confirming blood ties;

- for NV for parents - their own birth certificate.

Sample certificate of payment for treatment

Please note: payment slips must be issued to the citizen with whom the contract for the provision of medical services was concluded, and not to the person paying for the procedures.

Period for which you can receive a tax deduction

You can only return funds spent on therapy, surgery or the purchase of medications for the time when the actual payment was made. The declaration is submitted in the reporting period following the year of payment. For example, if medicines were purchased in 1919, then the money will be refunded in 2021.

Read also: Academic leave at the university

If the deadline is missed, reporting documentation may be submitted at another time, but no later than within three years. For example, to receive a tax deduction for treatment for 2021, the declaration can be sent from 2021 to 2021.

The procedure for registering and receiving an NV takes about 4 months. The main part of this time is spent by the Federal Tax Service checking the submitted documentation.

Deadline for filing a declaration

A declaration is submitted for a refund of 13 percent for treatment within 12 months at any time. The last day for sending reporting documents is 30.04. The time is set for those individuals who, in the previous reporting period:

- received income from the sale of real estate - sale, rent;

- conducted business activities according to the OSNO form.

Instructions for filling out 3-NDFL for therapy, surgery and the purchase of medicines

To return NV for money spent on restoring health, as well as purchasing medications, including for your family members, you must fill out a declaration. When entering information, errors are often made, which leads to refusal to accept documents by the Federal Tax Service employees. In this case you can:

- Take advantage of the advice of specialists on filling out reporting papers. As a rule, such organizations are located next to the Federal Tax Service. The cost of services is about 800 rubles, depending on the region of the Russian Federation.

- Download (free) instructions for filling out 3-NDFL with a clear example.

Please note: when submitting to the Federal Tax Service copies of papers substantiating a citizen’s right to NV, you must have the original documents with you.

List of medicines for deductible treatment (until 2021)

The list, approved by government decree No. 458 dated 04/08/2020, contains international non-proprietary names of medicines, the purchase of which, on the recommendation of a doctor, can count on a tax deduction. Moreover, each medicine may have many other synonymous names. The names of medications indicated in the list are contained in the state register, which the Ministry of Health is obliged to publish annually (see the regulation of the Ministry of Health dated December 1, 1998 No. 01/29-15). You can find out whether the medicine you are interested in is in the state register on the website grls.rosminzdrav.ru.

If a doctor prescribed medications that are not included in this list, the patient-taxpayer will not be able to count on receiving social benefits (for periods before 2021). This is clearly stated in the letter of the Federal Tax Service in Moscow dated June 1, 2010 No. 20-14/4/ [email protected] The register displays both prescription medications and those that can be purchased in over-the-counter departments.

Let's present this list in a slightly abbreviated form; At the same time, it contains all the names of drugs, only the forms of their release are not indicated:

1. Medicines used for anesthesia, as well as those that reduce the tone of skeletal muscles:

- medications used for anesthesia (injection powders hexobarbital and sodium thiopental, solutions for injections ketamine and sodium oxybate, gas in a can of dinitrogen oxide, diethyl ether in liquid form, solution for inhalation halothane);

- local anesthetic agents (injection solution of bupivacaine and lidocaine);

- drugs that reduce the tone of skeletal muscles (powder for injection, botulinum toxin; injection solution of atracurium besylate, albumin; vecuronium bromides, pipecuronium, suxamethonium).

2. Analgesics:

- narcotics (injection solutions and tablets morphine, piritramide, trimeperidine; injection solution fentanyl and a mixture of morphine + narcotine + papaverine + codeine + thebaine);

- non-narcotic and non-steroidal medications (tablets: aspirin, diclofenac sodium, lornoxicam, ibuprofen, tramadol, nalbuphine, ketoprofen, meloxicam);

- medicine for gout - allopurinol;

- other drugs in this group (penicillamine, colchicine).

3. Antiallergic (antihistamine) drugs: ketotifen, quifenadine, chloropyramine.

4. Medications that affect the central nervous system:

- against seizures (carbamazepine, phenytoin, valproic acid, clonazepam, phenobarbital, phenytoin, ethosuximide);

- for the treatment of Parkinson's disease (biperiden, trihexyphenidyl, levodopa + carbidopa, amantadine, levodopa + benserazide);

- medications for the treatment of psychotic diseases (haloperidol, clozapine, medazepam, perphenazine, thioproperazine, phenazepam, chlorpromazine, diazepam, levomepromazine, nitrazepam, pipothiazine, thioridazine, fluspirilene, chlorprothixene, zuclopenthixol, lorazepam, periciazine, sulpiride, trifluoperazine, flufen azine);

- antidepressants (amitriptyline, clomipramine, maprotiline, moclobemide, tianeptine, citalopram, imipramine, lithium carbonate, mianserine, sertraline, fluoxetine);

- medicine for sleep disorders - zolpidem;

- medication for multiple sclerosis (interferon beta and glatiramer acetate);

- anti-drug drugs (naltrexone and naloxone);

- anticholinesterase medications (neostigmine methyl sulfate, distigmine and pyridostigmine bromides);

- other drugs from this group (nimodipine, vinpocetine, hexobendine + etamivan + etophylline).

5. Anti-infective:

- antibiotics (azithromycin, ampicillin, vancomycin, doxycycline, clarithromycin, meropenem, norfloxacin, sulfacetamide, cephaperazone, ceftazidime, ciprofloxacin, amikacin, benzathine benzylpenicillin, gentamicin, imipenem, co-trimoxazole, mesalazine, pefloxacin, chloramphenicol, cefipime, ceftriaxone, erythromycin, amoxicillin + clavulanic acid, benzylpenicillin, josamycin, carbenicillin, lincomycin, mupirocide, spiramycin, cefaclor, cefotaxime, cefuroxime);

- medicines for the treatment of tuberculosis (isoniazid, prothionamide, streptomycin, lomefloxacin, rifabutin, ethambutol, pyrazinamide, rifampicin, ethionamide);

- medications for the treatment of viral infections (acyclovir, zidovudine, lamivudine, ganciclovir, indinavir, nevirapine, didanosine, efavirenz, stavudine);

- antifungal drugs (amphotericin B, itraconazole, amphotericin B + methylglucamine, clotrimazole, griseofulvin, terbinafine);

- medicines for the treatment of malaria and other antiprotozoal medications (hydroxychloroquine, chloroquine, metronidazole);

- other medications from this group - bifidumbacterin;

- means for vaccination: immunobiological preparations, AIDS diagnostic test;

6. Immunosuppressive and antitumor drugs:

- cytostatic medications (azathioprine, bleomycin, vincristine, hydroxycarbamide, daunorubicin, idarubicin, calcium folinate, clodronic acid, methotrexate, oxaliplatin, prospidium chloride, tretinoin, chlorambucil, cytarabine, aranose, busulfan, vinorelbine, dacarbazine, doxorubicin, irinotecan, carboplatin, chalk falan, mitoxantrone, paclitaxel, thioguanine, fludarabine, cyclophosphamide, epirubicin, asparaginase, vinblastine, gemcitabine, dactinomycin, docetaxel, ifosfamide, carmustine, mercaptopurine, mitomycin, procarbazine, thiotepa, fluorouracil, cisplatin, etoposide);

- antihormones and hormonal drugs (aminoglutethimide, goserelin, triptorelin, anastrozole, medroxyprogesterone, flutamide, ganirelix, tamoxifen, cetrorelix);

- drugs accompanying treatment (interferon alfa, ondansetrion, lenograstim, filgrastim, molgramostim);

7. Anti-osteoporosis drugs - stimulants (alendronic acid, calcitonin, alfacalcidol, calcium carbonate + ergocalciferol).

8. Medicines that affect the blood:

- anti-anemia agents (sucrose iron hydroxide complex, folic acid, iron sulfate, cyanocobalamin, iron sulfate + ascorbic acid, epoetin beta);

- medications that affect blood clotting (alpostadil, nadroparin calcium, streptokinase, enoxaparin sodium, alteplase, pentoxifylline, ticlopidine, sodium heparin, protamine sulfate, phenindione);

- plasma substitutes and solutions (amino acids for parenteral nutrition, dextrose, hemin, pentastarch);

- plasma medications (albumin, coagulation factors VIII and IX);

- lipid-lowering medications (phospholipids + pyridoxine + nicotinic acid + adenosine monophosphate, simvastatin).

9. Drugs that affect the cardiovascular system:

- antianginal drugs (isosorbide dinitrate and mononitrate, nitroglycerin);

- drugs that treat arrhythmia (allapinin, metoprolol, quinidine, amiodarone, procainamide, etacizin, atenolol, propafenone);

- drugs that lower blood pressure (azamethonium bromide, verapamil, nifedipine, amlodipine, doxazosin, propranolol, betaxolol, methyldopa, fosinopril);

- medications to treat heart failure (valsartan, captopril, enalapril, digoxin, quinapril, irbesartan, perindopril);

- anti-shock medications (dobutamine, phenylephrine, dopamine, ephedrine).

10. Diagnostic equipment:

- X-ray contrast agents (sodium amidotrizoate, gadopentetic acid, iopromide, barium sulfate + sodium citrate + sorbitol + antifomsilan + nipagin, galactose, gadodiamide, iohexol);

- fluorescent drugs (sodium fluorescein);

- radioisotope medications (albumin microspheres, pirfotech, technefor, bromezide, pentatech, technefit (for all - 99mTs), isotonic solution of strontium-89-chloride).

11. Antiseptics:

- antiseptic - iodine;

- disinfectants (hydrogen peroxide, ethanol, chlorhexidine).

12. Medicines for gastrointestinal diseases:

- antacid and antiulcer medications (omeprazole, famotidine, pirenzepine);

- antispasmodics (atropine, platyphylline, drotaverine);

- enzymes - paccreatin;

- medications for liver failure (lactulose, artichoke leaf extract);

- antienzyme agent - aprotinin.

13. Hormonal drugs:

- antihormones and hormones that do not affect the reproductive system (betamethasone, human chorionic gonadotropin, desmopressin, levothyroxine sodium, lutropin alfa, nandrolone, somatropin, triamcinolone, follitropin beta, bromocriptine, deoxycortone, dihydrotachysterol, levothyroxine + potassium iodide, menotropins, octreotide, tetracosact id, fludrocortisone, choriogonadotropin alfa, hydrocortisone, dexamethasone, clomiphene, liothyronine + levothyroxine + potassium iodide + sodium propyloxybenzoate, methylprednisolone, prednisolone, thiamazole, follitropin alfa, cyproterone);

- androgenic drug - methyltestosterone tablets;

- estrogen drugs (hydroxyprogesterone, progesterone, dydrogesterone, ethinyl estradiol, norethisterone);

- insulin and others for diabetes (acarbose, gliclazide, glucagon, pioglitazone hydrochloride, insulin DlD, KD, Comb SrD, glibenclamide, glimepiride, metformin, gliquidone, glipizide, repaglinide).

14. Medicines for the treatment of diseases of the kidneys and urinary system:

- for prostate adenoma (finasteride, alfuzosin, tamsulosin, creeping palm extract);

- in case of renal failure and after kidney transplantation (antithymocyte immunoglobulin, solution for peritoneal dialysis, ketoanalogues of amino acids, cyclosporine);

- diuretics (hydrochlorothiazide, mannitol, furosemide, indapamide, spironolactone).

15. Drugs used in ophthalmology:

- anti-inflammatory agents (azapentacene, pyrenoxine, lodoxamide, cytochrome + sodium succinate + adenosine + nicotinamide + benzalkonium chloride);

- miotic and antiglaucoma medications (dorzolamide drops, timolol and pilocarpine).

- agents that stimulate regeneration - emoxipine.

16. Uterine preparations:

- hormonal agents (methylergometrine, pituitrin, oxytocin, ergometrine);

- other drugs that affect the uterine muscles (dinoprost, hexoprenaline, dinoprostone).

17. Medicines for the treatment of respiratory diseases:

- against asthma (ambroxol, budesonide, disodium cromoglycate, theophylline, epinephrine, aminophylline, ipratropium bromide, nedocromil, terbutaline, beclomethasone, ipratropium bromide + fenoterol hydrobromide, salbutamol, fenoterol);

- other drugs from this group (acetylcysteine).

18. Electrolytes, nutrients:

- nutritional mixtures (phenyl-free powders and lofenalac);

- electrolytes (potassium chloride, iodide, aspartate; calcium chloride; sodium citrate and bicarbonate; magnesium aspartate; electrolyte solutions).

19. Vitamin preparations - thiamine and menadione.

Is it possible to get a deduction for dietary supplements if they are prescribed by a doctor and contain a medicinal substance previously mentioned in the List? The answer to this question was explained by Ph.D. FGBOUD PA "Privolzhsky Institute for Advanced Studies of the Federal Tax Service" A. V. Telegus. Get free trial access to the ConsultantPlus system and find out the expert’s opinion.

For information on how to draw up an application for a tax refund from the Federal Tax Service, read the material “We are preparing an application for a personal income tax refund (sample, form)” .

List of medical services for NV

Refund of personal income tax for money spent on treatment or surgical intervention of the applicant or close relatives is carried out depending on the Register.

The list of medical services includes:

- diagnostic measures and therapy during emergency medical care;

- stay in a hospital setting, including day care, including examination;

- outpatient services for the population;

- sanatorium-resort rehabilitation;

- health education.

Note: in the case of therapeutic treatment in a sanatorium, the NV is charged with expenses for the medical services received.

List of expensive types of medical services for obtaining NV

PP No. 201 dated March 19, 2001 specifies expensive types of medical care that can be compensated in full, despite the limit of 120,000 rubles.

- Surgical intervention (congenital pathologies, hematopoietic system, including operations using artificial lymph circulation, laser and coronary technologies, respiratory tract, eye diseases, central nervous system, diseases of the digestive tract.

- Prosthetics and restoration of the joint apparatus.

- Transplantation of internal organs, including tissue and bone marrow.

- Implantology, prosthetics, etc.

- Plastic and reconstructive surgical interventions.

- Therapeutic effects for disorders in the field of DNA and hereditary diseases, tumors of the thyroid gland and endocrine glands, polyneuropathy, myasthenia gravis in a difficult period, systemic damage to connective tissues, complex forms of diseases of the lymph, respiratory tract and gastrointestinal tract in minors, pancreatic diseases, leukemia, hereditary coagulation pathologies blood, anemia.

- Complex therapy of osteomyelitis, for complications in women with pregnancy, delivery and the period after the birth of a child, complex forms of diabetes mellitus, hereditary pathologies, acute diseases of the ocular and adnexal apparatus, burns, body damage of 30% or more.

- Therapeutic measures associated with the use of hemo- and peritoneal dialysis.

- Nursing newborns weighing up to 1.5 kg.

- Treatment of infertility using IVF, embryo cultivation and implantation.

Read also: Law on internship in 2021

A complete list of medical services is provided in the Registry. Other types of services and forms of rehabilitation are not subject to personal income tax refund. A similar rule applies to medications approved on the general list. In addition, medications must be paid for based on a doctor's prescription.