Proper documentation of conservation is a prerequisite for recognizing the costs of its implementation when calculating corporate income tax. Such a decision is formalized by order of the head of the company. The document must indicate the conservation period and list the activities that need to be carried out (clause 63 of the Guidelines for accounting for assets). After all these operations have been carried out, a corresponding act should be drawn up. There is no unified form, so the document is drawn up in any form. The act is signed by the members of the commission and approved by the head. Do not forget to indicate in the document the economic feasibility of conservation. In addition, the act must indicate: the name of the OS itself, transferred to conservation; the date of the transfer, the measures that were taken to “freeze” the funds, and the amount of costs incurred.

The completed primary document will be the basis for taking into account conservation costs in expenses, as well as suspending depreciation on the fixed asset.

Content

- What is OS conservation?

- Reasons for preserving the OS

- Consequences of conservation

- What property can be conserved?

- The procedure for registration of conservation

- More information about depreciation of fixed assets: general information

- What happens to depreciation when mothballing fixed assets?

- On the procedure for paying taxes when mothballing fixed assets

- Sale of objects under conservation

- OS depreservation procedure

What is OS conservation?

Conservation is a set of measures to temporarily stop using one or more fixed assets of an organization. Conservation involves the resumption of operation of the OS after a documented period.

The word itself comes from the Latin conservatio - “preservation”, which indicates the ultimate goal of the entire event - to save both the object itself and part of the funds in the company’s current accounts, by reducing expenses.

The conservation of an object can be compared to the suspended animation of a crocodile, when under unfavorable conditions the animal buries itself in the sand and all its vital functions slow down. Likewise, an object slows down its life inside the enterprise and - the main characteristic - temporarily does not bring economic benefits to its owners. By law, this “hibernation” cannot exceed three years. But practice shows that the conservation period of fixed assets can be extended.

Introductory information

It doesn’t matter what the reason is - either the approaching winter, or the lack of need for buildings. There should always be a conservation project for buildings and structures. It is also necessary to clearly understand what goals are being pursued and what tasks are facing the people carrying out the process. Let's look at the introductory information from which we will build. Let's assume that a building is being constructed. But there is no way to complete it before the start of the winter period. And according to technology, construction processes must be carried out at above-zero temperatures. Therefore, it became necessary to postpone the entire range of necessary work until a better time. And for this it is necessary to protect the object from precipitation and temperature changes.

Reasons for preserving the OS

This event is used, for example, in the following cases:

- The end of seasonal work, when the facilities cannot be used at other times (snow removal equipment, harvesting machines);

- Temporary downtime in production (looms with a shortage of threads);

- Reduction in production due to economic realities (non-use of one of the workshops);

- Breakdown of an object and its transfer for repairs, including the absence of necessary parts (tractor repair due to malfunctions).

What does conservation actually mean?

To do this, you must provide an action plan in two directions:

- Actual conservation;

- Reflection in documentation and in the accounting program.

The first point includes all actions related directly to your main asset. While the property is idle, it must be kept safe and in good condition.

For example, in agriculture, special equipment is used to treat fields with herbicide. This equipment is needed only in spring and summer; in cold weather, it needs to be given a place in a closed hangar, the engine should be started periodically, and the hangar should be protected from thieves.

On the other hand, conservation must be recorded in documents - it is not enough just to actually stop using the property and put it under lock and key.

Consequences of conservation

Conservation is a voluntary procedure. Even if you do not use your building, equipment or vehicle for the needs of the organization, and they become covered with dust, the tax authorities cannot oblige you to carry out this procedure.

This begs the question - if the law does not oblige you to re-register the status of an unused asset, why do you need the extra hassle? Let it sit until you need it again. Only benefits that will significantly outweigh the inconvenience and expense of it can persuade you in favor of documentary conservation.

Each enterprise must calculate the pros and cons for its specific situation and decide which path will be economically justified.

Still, there are some general points:

| Paragraph | If you carry out conservation | If you do without conservation |

| Maintaining the main product | Pay less income tax . Costs for maintenance, security salaries, warehouse depreciation, heating, lighting can be classified as non-operating expenses, since the operating system is no longer used to generate profit. Consequently, the tax base can be reduced by the amount of these expenses when calculating income tax | Pay the same income tax as with the current operation of the OS. Without official conservation, all expenses for this OS will be recognized as expenses for the main activities of the company. Therefore, you will not be able to reduce the tax base by the amount of these expenses when calculating profit |

| Depreciation | Not credited . When mothballing lasts three months or more, depreciation charges stop. Depreciation is resumed when the fixed assets are re-preserved and is completed until all fixed assets are depreciated. The basis for calculating property tax is not reduced, since the residual value of fixed assets is not reduced due to depreciation | Accrued every month based on the useful life. Thus, the base for calculating property tax decreases every month - that is, you pay less and less for a specific OS. And at the same time, we have to reckon with sometimes significant monthly expenses due to depreciation |

| Useful life | Extends over the depreciation period. If, after reactivation, it turns out that the SPI has expired, then depreciation on the object will still be charged, and the SPI will actually be extended for this period. The inconvenience is that, despite the absence of physical wear and tear, there is still moral wear and tear, and such “freezing” will make the OS even older and sometimes unusable due to moral obsolescence | It goes on as usual until it ends. The SPI for a specific OS is approved by the organization itself, but within the time frame for each depreciation group prescribed by law in the Classification |

| Reflection in 1C | Subaccount and ticks on depreciation . For convenience, it is customary to add a subaccount 01.1 fixed assets for conservation to the synthetic, that is, general account 01 Fixed Assets. 1C allows you to disable the calculation of depreciation on fixed assets by checking the box “Affects the calculation of depreciation” in the “Preservation” section in the event directory | Accounting is carried out without OS segregation . In 1C, by default, depreciation is charged on the OS |

Recommendation

In the accounting policy, it is advisable to establish the same procedure for suspending and resuming depreciation charges for fixed assets mothballed for a period of more than 3 months, as in tax accounting. This will avoid the occurrence of temporary differences. They may lead to the formation of deferred tax liabilities.

What property can be conserved?

If the property is classified as fixed assets - that is, it is reflected in account 01 - conservation can be carried out.

Let us remind you that not all company property can be classified as OS.

To do this, four conditions must be met:

| Condition No. | The essence | Examples. Yes – the condition is met (applies to the OS), no – it is not met, does not relate to the OS |

| 1. | The object is used in production, rented out, needed for work or services, and is also involved in management | Yes: company car. Needed in management - transports the manager for official needs No : a marble monument on the territory of the enterprise, left over from the previous owners |

| 2. | The object has been in use for longer than one year | Yes: the building in which the company is located No : product packaging |

| 3. | The company does not intend to resell the property | Yes: computers for office workers No : a batch of computers purchased by the company for sale |

| 4. | The facility may bring economic benefits in the future | Yes: perennial fruit trees (for fruit sales) No : annual plantings to decorate the area |

Examples of fixed assets: houses, structures, transport, tools, office equipment, household equipment, land, water, subsoil.

The following do not apply to fixed assets: finished products, materials and goods in stock. Materials or objects in transit or during installation.

No one is conserving natural resources (land, water, subsoil), which is easily explained: according to the law of the Russian Federation, depreciation is not charged on these objects. Since fixed assets are often preserved in order to suspend depreciation charges, this reason does not apply in this situation.

Why aren't natural resources depreciated? It is believed that they can be used endlessly and will not “wear out”, although in fact they can become depleted with active use.

Temporary roofing

Construction may stop during the construction of walls and interfloor ceilings. In this case, it is necessary to protect horizontal sections of the structure from precipitation. This is especially true in cases where the walls are made of slotted bricks or are multi-layered (for example, stone and concrete blocks are combined). It is necessary to put together a lattice of boards over the unfinished building. It is covered with roofing felt on top. This is a temporary roof. You can also build a rafter structure with a sheathing of uncut boards and cover it with roofing felt on top. There is no need to cover the outside walls with anything. Nothing will happen to facing or rough brickwork in winter. Water will drain from vertical surfaces. And the moisture that the pores do absorb has an insignificant volume. Therefore, it will not cause destruction.

The procedure for registration of conservation

The conservation procedure is strictly regulated for budgetary and government institutions. As for commercial enterprises, practice shows that tax authorities are more loyal to registration of conservation.

In order for conservation to be considered legal and for you to stop accruing depreciation on fixed assets with a clear conscience, you need to take several steps:

- The company's management is assessing whether conservation is advisable. Decisions are made at general meetings.

- When the decision is made, an order is issued.

- An OS inventory is being carried out.

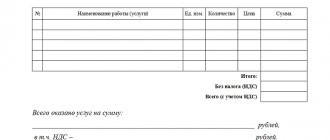

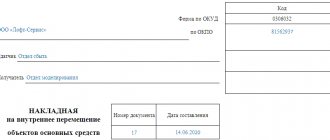

- An act on the transfer of fixed assets to conservation is drawn up.

- The information is reflected in the 1C program.

| Characteristic | Order on transfer of fixed assets to conservation | Act of conservation of fixed assets |

| Purpose | Reflects intent | Confirms a fait accompli |

| Mandatory | Is a necessary document | Is a desirable document |

| Who signs | Initiated and signed by the head of the company | All commission members appointed in the order + head |

| What information does it contain? | — Reasons for transferring to conservation; - For how long; — Responsible for the event; — Responsible for proper storage of unused OS | — List of objects for decommissioning; — Start date of conservation; — What activities will be carried out during OS downtime; — Conservation costs. |

| Sample | Unified view | Free view |

Accrual methods

When calculating, the tax base is reduced in the period to which non-operating expenses relate. Expenses for restoration and conservation are reflected in the time period in which the corresponding act was signed. It is during this period that costs are considered economically justified. Expenses for the maintenance of temporarily unused operating systems are reflected in the period of time in which they were incurred. For example, lubricants are accounted for when documents have been signed to prove their use. If the company uses the cash method, then, in addition to the above requirements, it is necessary that the costs be paid.

More information about depreciation of fixed assets: general information

Depreciation is a gradual reduction in the cost of an asset due to its wear and tear through the monthly inclusion of a share of its cost in the cost of production.

How are these write-off shares calculated? Their value is directly related to the concept of useful life of the asset (SPI). The length of the period is partially chosen by the organization, but only within specified limits. These frameworks are prescribed in the official document - OS classification.

In this classification, all possible fixed assets are divided into ten groups. The first group lists those operating systems whose SPI ranges from one year to two years. In the last, tenth group - OS with a service life of more than thirty years.

Example . Hunting and sporting weapons belong to the fifth depreciation group with a life expectancy period of seven to ten years. An organization can set the SPI for its operating system for seven, eight, nine or ten years - at its discretion.

After choosing the SPI with a linear depreciation system (in many ways the most convenient), it is calculated how much will have to be depreciated per month. For example, if a hunting weapon cost 70,000 rubles with a life expectancy of 7 years, you will need to write off:

- 70,000/7 = 10,000 rubles per year.

- 10,000/12 = 833.3 rubles per month.

What happens to depreciation when mothballing fixed assets?

If conservation does not exceed three months, depreciation is accrued on fixed assets as usual. For a longer period, as we have already discussed, depreciation is suspended.

Depreciation ceases to accrue from the first day of the month following the month in which the conservation order was issued. For example, if conservation is approved on August 15, it is no longer accrued from September 1.

Temporarily not accruing depreciation is often one of the main goals of conservation and a legal way not to do it. On the one hand, in the long term this is not very profitable. After all, fully depreciated property is listed on the balance sheet with a zero value, therefore, there is no need to pay property tax on it, while a “frozen” asset will appear on the balance sheet with its previous value, and not with its residual value.

On the other hand, if the owner, due to a decline in production, has an entire fleet of equipment idle with a huge cost and, as a result, with huge depreciation, he will not be able to include this depreciation in the cost of the finished product - otherwise it will skyrocket.

About the foundation with a basement

In this case, quite serious problems arise. Preservation of a building requires that the temporary shelter be secure. After all, if water leaks, it can tear the entire structure. In this case, there is one popular method: you need to throw plastic bottles, one-third filled with water, into the basement. Then, when the water freezes, most of the expansion forces will be taken on by bottles immersed in the volume of ice and more susceptible to compression, and the basement will not be damaged. This method allows you to ensure the safety of the structure, but it is desirable to have 3-4 large containers per square meter.

On the procedure for paying taxes when mothballing fixed assets

Conservation of an asset does not exempt an enterprise from paying transport tax (if the asset relates to vehicles); as for property tax, it also remains payable.

Now about VAT. If a company operates under OSNO and is a VAT payer, when purchasing OS, “input VAT” is deducted. This means that this amount of VAT allocated in the invoice from the supplier will ultimately reduce the amount of tax that needs to be paid to the budget.

For some operations with fixed assets, it is necessary to restore VAT, that is, still pay it to the budget, although before that it was accepted for deduction. This must be done, for example, when contributing OS to the authorized capital or when the organization switches to the simplified tax system.

All these cases are regulated by law, but conservation is not among them. Therefore, when preserving an OS, there is no need to look for primary documents with the specified VAT when purchasing an OS and transfer it to the budget.

BASIS: VAT

When transferring fixed assets for conservation, do not restore input VAT from their residual value. However, during the period when a fixed asset is mothballed or when it is re-mothballed, the organization may have an obligation to restore the input tax. This should be done, for example, in the following cases:

- when transferring a fixed asset to the authorized capital of another organization;

- when switching from the general taxation system to a simplified one or payment of UTII;

- when starting to use the VAT exemption;

- when using a fixed asset after reactivation to perform VAT-free operations.

This procedure follows from paragraph 3 of Article 170 of the Tax Code of the Russian Federation. A similar point of view is reflected in the letter of the Federal Tax Service of Russia dated June 20, 2006 No. ШТ-6-03/614.

Situation: is it possible to deduct VAT on the cost of materials (work, services) purchased for conservation (re-preservation) and maintenance of a mothballed fixed asset?

It is possible if the organization plans to use the fixed asset in the future to perform operations subject to VAT.

This is explained by the fact that the purpose of conservation is to ensure the best preservation of the fixed asset. Therefore, the deduction of input VAT on the cost of these materials (works, services) depends on the purpose of the fixed asset after reactivation. If, after re-preservation, an organization plans to use a fixed asset to perform operations subject to VAT, then the expenses incurred during mothballing are related to the activities of the organization subject to this tax. In this case, deduct input VAT as usual. That is, after registration of the specified materials (works, services) and in the presence of an invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation). If the fixed asset is planned to be used to perform VAT-free operations, then include the input tax in the cost of materials (work, services) used during its conservation (re-preservation) (clauses 1 and 2 of Article 170 of the Tax Code of the Russian Federation).

The correctness of this point of view is confirmed by arbitration practice (see, for example, decisions of the FAS of the North-Western District dated October 16, 2008 No. A05-2658/2008, Central District dated February 15, 2007 No. A09-4610/06-13-16 and dated December 7, 2004 No. A35-2479/02-C2, Moscow District dated October 30, 2006 No. KA-A41/9298-06, Far Eastern District dated February 25, 2004 No. F03-A51/04-2/ 43, Ural District dated October 3, 2006 No. F09-8784/06-S7 and dated March 24, 2005 No. F09-977/05-AK).

However, there is another point of view. One of the main conditions for applying a tax deduction is the use of materials (work, services) to perform operations subject to VAT (clause 2 of Article 171 of the Tax Code of the Russian Federation). Since mothballed fixed assets are not used in activities subject to VAT, the organization has no grounds for applying the deduction. In addition, conservation of fixed assets is the performance of certain work for the organization’s own needs. Costs associated with the conservation of fixed assets reduce taxable profit as non-operating expenses (subclause 9, clause 1, article 265 of the Tax Code of the Russian Federation). The performance of such work is not subject to VAT (subclause 2, clause 1, article 146 of the Tax Code of the Russian Federation), therefore the organization does not have the right to deduct in this case. This conclusion was reached by the Federal Antimonopoly Service of the North-Western District in its resolution dated September 6, 2007 No. A05-13740/2006-13.

Sale of objects under conservation

The sale of objects under conservation has features characteristic of the sale of depreciable property - despite the fact that during long-term conservation, depreciation is suspended.

The similarity is that in such a sale the seller has the right to reduce the declared profit by the residual value of the fixed assets - the value that remains after accrued depreciation even before conservation.

Example . The company bought the device for the amount of 120,000 rubles. According to the classification, it will be used for five years (60 months). The monthly depreciation charge was 2,000 rubles. Three years passed, during which accrued depreciation reduced the cost of the device by 72,000 rubles. The current residual value was 48,000 rubles (120,000 - 72,000).

The device was mothballed for the entire fourth year. After which the device was sold for 82,600 rubles, including VAT of 12,600 rubles.

For tax purposes, income from sales amounted to 70,000 (82,600 - 12,600).

The company declares a profit of 22,000 rubles (the amount is 70,000, reduced by the residual value of the device - 48,000 rubles).

If the residual value exceeds the proceeds from sale, the difference between these indicators will be recognized as a loss.

In this case, it is necessary to establish the actual service life of the facility - that is, take away months of downtime. And it is from this figure that the period for writing off the loss is calculated. The loss is distributed in equal shares over the months of the period found as part of other expenses.

What a tenant needs to check in a draft real estate lease agreement

Subject of the agreement

Before concluding a contract, you need to check:

1. description of real estate;

2. area of transferred property;

3. legal title of the lessor (whether the leased object belongs to him);

4. purpose of use of the real estate;

5. possible encumbrances of the leased object.

Description of the rental object

state registration of rights to real estate;

technical accounting of real estate (BTI documents).

Documents of state registration of rights to real estate include an extract from the Unified State Register of Real Estate (USRN) and a certificate of state registration of rights. Until July 15, 2021, Rosreestr issued paper certificates. But from this date, Rosreestr stopped issuing certificates of state registration of rights.

Rights and obligations of the parties

2

The tenant should pay attention to four conditions. Method 2: obtain the landlord’s consent for each sublease of property

This method is less convenient for the tenant. But landlords most often agree to this. It is better to stipulate in the agreement the procedure for the landlord to consider the tenant’s request for the possibility of subletting the premises or part of it. In this case, the procedure for giving consent to sublease will not be indefinite in time.

Method 2

: obtain the consent of the lessor for each transfer of property for sublease. This method is less convenient for the tenant. But landlords most often agree to this. It is better to stipulate in the agreement the procedure for the landlord to consider the tenant’s request for the possibility of subletting the premises or part of it. In this case, the procedure for giving consent to sublease will not be indefinite in time.

An example of the terms of a lease agreement on the procedure for the lessor to give consent to the transfer of property for sublease

“When the Tenant requests to sublease the Premises or part thereof, the Landlord is obliged to notify the Tenant of his decision within 5 (five) working days.”

Landlords often indicate in the agreement that the tenant does not have the right to reimburse the cost of inseparable improvements: “Upon termination of the Agreement, the Tenant undertakes to transfer the premises to the Landlord along with all inseparable improvements made in the premises without reimbursement of their cost.” Such conditions are contrary to the interests of the tenant. Therefore, they must be excluded from the text of the draft agreement.

the tenant properly fulfilled his obligations under the contract;

otherwise is not provided by law or contract.

Thus, the tenant needs to ensure that in the contract:

there was no clause stating that the tenant does not have a pre-emptive right to enter into an agreement for a new term, and

a period was specified during which the tenant could exercise his pre-emptive right to conclude a new contract (for example, no later than 30 calendar days before the end of the lease term).

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia