How to fill out KUDiR on the simplified tax system “Income”

The taxable object affects which sections of the ledger need to be completed. When referring to “Income”, the entrepreneur indicates the information required in sections I, IV and V. Examples:

- Section I. Income and expenses

- Section IV. Tax-reducing expenses

- Section V. Trade Fee Reducing Tax

Reflection of income

If the organization has switched to a simplified tax system from the general taxation system, then reflect in column 4 as part of its income the advances received before the transition to the special regime. But only if two conditions are met simultaneously. First: the organization previously calculated income tax using the accrual method. And secondly: the organization began to fulfill obligations on such advances, having already switched to a simplified system.

And on the contrary, the money that you received after the transition to the simplified system will not have to be shown as income if two conditions are met. First: previously, the organization calculated income tax using the accrual method. And second: the money was received to pay off accounts receivable, the amount of which was already taken into account as income.

This is stated in paragraph 2.4 of the Procedure, approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n.

How to fill out the KUDiR on the simplified tax system “Income minus expenses”

The simplified tax system with the object “Income minus expenses” involves filling out sections I to III. You also need a certificate for the first section summarizing the amount of income and expenses.

- Section I. Income and expenses

- Section II. Expenses on fixed assets and intangible assets

- Section III. Losses from previous periods that reduce the tax base

KUDiR in 2020 | Detailed instructions for filling

The book of accounting of income and expenses (hereinafter referred to as KUDiR) is a mandatory way of maintaining tax accounting for:

- Individual entrepreneurs on the simplified tax system, PSN, OSNO, Unified Agricultural Tax;

- Organizations (legal entities) on the simplified tax system.

There is no accounting book for UTII!

You can conduct KUDiR without errors through this service, which has a free trial period.

For each tax period, a new KUDiR is opened, entries in it are kept from January 1 to December 31 of the current year.

Please note that when combining the Patent system and the simplified tax system, it is necessary to keep separate records of income and expenses, therefore, for each type of activity its own KUDiR will be opened.

The legislation of the Russian Federation allows for maintaining KUDiR in two forms: electronic or paper. At the end of the year, the electronic KUDiR needs to be printed, the sheets in it must be numbered, the book itself must be stitched and the total number of pages must be certified by the signature of the entrepreneur or director of the organization.

In order not to compromise the integrity of the book, unfilled sections are also printed and bound. Only in this form should the KUDiR be stored and, if necessary, presented at the request of a tax inspector.

Please note once again: KUDiR is a mandatory tax register and its absence is a gross violation of accounting rules. For such a violation, a fine of 10,000 rubles is provided. The fine is the same for both organizations and individual entrepreneurs.

Instructions for filling out KUDiR

General rules for filling out KUDiR:

1) All entries are made in Russian, in chronological order, strictly by date

2) Income and expenses are indicated in rubles

3) Only those transactions that affect the calculation of the tax base and tax amount are entered into KUDiR

4) Errors in KUDiR must be corrected on the basis of supporting documents (new invoices, acts, sales receipts, etc.). All corrections are certified by the signature of the entrepreneur or head of the organization, and the date of the changes is indicated.

Title page

There are no special requirements for the KUDiR Title Page, but we recommend that you fill out the following fields:

Field "Date (year, month, day)" . The start date of maintaining KUDiR is indicated.

Field "Object of taxation" . One of the options “income” or “income reduced by expenses” is indicated.

Fill in the information: full name for individual entrepreneurs or name of organization for legal entities, INN/KPP, current account - if available, as well as the necessary addresses.

Section 1. Income and expenses

This is the most important section of KUDiR. Please fill it out carefully. Remember that “simplified people” - both individual entrepreneurs and organizations use the cash method of registering transactions, i.e. Income and Expenses are taken into account at the moment when they were actually received (produced).

With the cash method, what matters is not the moment when you shipped the goods (provided the service), but the moment when you were paid for it. Every advance received will be considered income! To take into account an Expense, you need not only to pay for the product (service), but also to receive this product from the Supplier. The advance payment you paid (without receiving the goods/services) is not an Expense and you do not need to enter it into KUDiR.

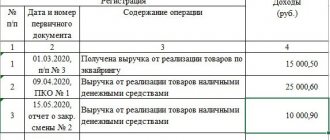

The “Income and Expenses” section consists of four main tables. Each table contains data on transactions for one quarter, which allows you to correctly calculate the amount of the advance tax payment.

Individual entrepreneurs and organizations with the object of taxation “income” must fill out columns 1 to 4, while those with the simplified tax system “income minus expenses” fill out all five columns.

Column 1 – write the serial number of the operation.

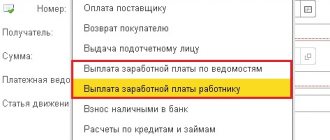

Column 2 – enter the date and number of the primary document. The primary accounting document is a payment order, a bank statement, a cash receipt and cash disbursement order, a sales receipt, a strict reporting form (receipt), a certificate of completion of work, a delivery note, a payroll, etc.

Column 3 – indicate the content of the business transaction. How much detail the essence of Income (Expense) needs to be disclosed should be decided by the individual entrepreneur or the director of the organization. There are no strict recommendations.

You can limit yourself to the brief wording “revenue from the sale of goods”, “advance payment”, or you can make a detailed entry “proceeds from the sale of 4 monitors of LLC First” under Agreement No. 5 dated 02/10/2017.

", "advance payment for services for clearing the roof from snow IP Zimin", "payment for shoe repair services Karimova S.Yu."

Remember that first of all, the entries in KUDiR should be understandable to you, as an individual entrepreneur (director of an organization), and only then to the tax inspector.

Column 4. Income taken into account when calculating the tax base.

In this column we enter all funds received into the current account or cash register, except for:

- personal funds of an individual entrepreneur;

- amounts of received (returned) loans;

- the money that the supplier returned for the defective product;

- deposits received;

- funds contributed by the founders as a contribution to the authorized capital;

- overpaid taxes transferred from the budget (and this happens).

Registration of return

What to do in situations where an individual entrepreneur or organization has to return part of the previously received payment to the supplier? In such cases, the returned amount with a “-” sign is recorded in the “Income” column, i.e. you reduce your Income by the refund amount. Please note that the entry in KUDiR must be made in the period when you returned the money. Let's take a closer look at the situation:

On March 16, 2017, an advance payment for goods in the amount of RUB 270,000 was received from Pervy LLC.

Source: https://nalog-spravka.ru/kniga-uchyota-doxodov-i-rasxodov-kudir.html

How to fill out an income book for an individual entrepreneur on a patent

KUDiR on the patent has a number of differences:

- a separate book is kept for each patent;

- funds must be registered on the day they are received at the cash desk or account;

- any document that confirms payment can be used as a basis for recording the transaction;

- Cash accounting is carried out in chronological order.

An example of filling can be seen in the screenshots below:

Topic: Firmware and page numbering in KUDiR?

Quick transition Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax) Up

- Navigation

- Cabinet

- Private messages

- Subscriptions

- Who's on the site

- Search the forum

- Forum home page

- Forum

- Accounting

- General Accounting Accounting and Taxation

- Payroll and personnel records

- Documentation and reporting

- Accounting for securities and foreign exchange transactions

- Foreign economic activity

- Foreign economic activity. Customs Union

- Alcohol: licensing and declaration

- Online cash register, BSO, acquiring and cash transactions

- Industries and special regimes

- Individual entrepreneurs. Special modes (UTII, simplified tax system, PSN, unified agricultural tax)

- Accounting in non-profit organizations and housing sector

- Accounting in construction

- Accounting in tourism

- Budgetary, autonomous and government institutions

- Budget accounting

- Programs for budget accounting

- Banks

- IFRS, GAAP, management accounting

- Legal department

- Legal assistance

- Registration

- Inspection experience

- Enterprise management

- Administration and management at the enterprise

- Outsourcing

- Enterprise automation

- Programs for accounting and tax accounting Info-Accountant

- Other programs

- 1C

- Electronic document management and electronic reporting

- Other tools for automating the work of accountants

- Clerks Guild

- Relationships at work

- Accounting business

- Education

- Labor exchange Looking for a job

- I offer a job

- Club Clerk.Ru

- Friday

- Private investment

- Policy

- Sport. Tourism

- Meetings and congratulations

- Author forums Interviews

- Simple as a moo

- Author's forum Goblin_Gaga Accountant can...

- Gaga's opusnik

- Internet conferences

- To whom do I owe - goodbye to everyone: all about bankruptcy of individuals

- Archive of Internet conferences Internet conferences Exchange of electronic documents and surprises from the Federal Tax Service

- Violation of citizens' rights during employment and dismissal

- New procedure for submitting VAT reports in electronic format

- Preparation of annual financial/accounting statements for 2014

- Everything you wanted to ask the electronic document exchange operator

- How to turn a financial crisis into a window of opportunity?

- VAT: changes in regulatory regulation and their implementation in the 1C: Accounting 8 program

- Ensuring the reliability of the results of inventory activities

- Protection of personal information. Application of ZPK "1C:Enterprise 8.2z"

- Formation of a company's accounting policy: opportunities for convergence with IFRS

- Electronic document management in the service of an accountant

- Time tracking for various remuneration systems in the program “1C: Salary and Personnel Management 8”

- Semi-annual income tax report: we will reveal all the secrets

- Interpersonal relationships in the workplace

- Cloud accounting 1C. Is it worth going to the cloud?

- Bank deposits: how not to lose and win

- Sick leave and other benefits at the expense of the Social Insurance Fund. Procedure for calculation and accrual

- Clerk.Ru: ask any question to the site management

- Rules for calculating VAT when carrying out export-import transactions

- How to submit reports to the Pension Fund for the 3rd quarter of 2012

- Reporting to the Social Insurance Fund for 9 months of 2012

- Preparation of reports to the Pension Fund for the 2nd quarter. Difficult questions

- Launch of electronic invoices in Russia

- How to reduce costs for IT equipment, software and IT personnel using cloud power

- Reporting to the Pension Fund for the 1st quarter of 2012. Main changes

- Income tax: nuances of filling out the declaration for 2011

- Annual reporting to the Pension Fund. Current issues

- New in financial statements for 2011

- Reporting to the Social Insurance Fund in questions and answers

- Semi-annual reporting to the Pension Fund in questions and answers

- Calculation of temporary disability benefits in 2011

- Electronic invoices and electronic primary documents

- Preparation of financial statements for 2010

- Calculation of sick leave in 2011. Maternity and transition benefits

- New in the legislation on taxes and insurance premiums in 2011

- Changes in financial statements in 2011

- DDoS attacks in Russia as a method of unfair competition.

- Banking products for individuals: lending, deposits, special offers

- A document in electronic form is an effective solution to current problems

- How to find a job using Clerk.Ru

- Providing information per person. accounting for the first half of 2010

- Tax liability: who is responsible for what?

- Inspections, collection, refund/offset of taxes and other issues of Part 1 of the Tax Code of the Russian Federation

- Calculation of sick sheets and insurance premiums in the light of quarterly reporting

- Replacement of unified social tax with insurance premiums and other innovations of 2010

- Liquidation of commercial and non-profit organizations

- Accounting and tax accounting of inventory items

- Mandatory re-registration of companies in accordance with Law No. 312-FZ

- PR and marketing in the field of professional services in-house

- Clerk.Ru: design change

- Building a personal financial plan: dreams and reality

- Preparation of accounting reporting. Changes in Russia accounting standards in 2009

- Kickbacks in sales: pros and cons

- Losing a job during a crisis. What to do?

- Everything you wanted to know about Clerk.Ru, but were embarrassed to ask

- Credit in a crisis: conditions and opportunities

- Preserving capital during a crisis: strategies for private investors

- VAT: deductions on advances. Questions with and without answers

- Press conference of Santa Claus

- Changes to the Tax Code coming into force in 2009

- Income tax taking into account the latest changes and clarifications from the Ministry of Finance

- Russian crisis: threats and opportunities

- Network business: quality goods or a scam?

- CASCO: insurance without secrets

- Payments to individuals

- Raiding. How to protect your own business?

- Current issues of VAT calculation and reimbursement

- Special modes: UTII and simplified tax system. Features and difficult questions

- Income tax. Calculation, features of calculus, controversial issues

- Accounting policies for accounting purposes

- Tax audits. Practice of application of new rules

- VAT: calculation procedure

- Outsourcing Q&A

- How can an accountant comply with the requirements of the Law “On Personal Data”

- The ideal archive of accounting documents

- Service forums

- Archive FAQ (Frequently Asked Questions) FAQ: Frequently Asked Questions on Accounting and Taxes

- Games and trainings

- Self-confidence training

- Foreign trade activities in harsh reality

- Book of complaints and suggestions

- Diaries

How to flash KUDiR correctly

The State does not have strictly regulated requirements for the firmware process. It is important to observe only a few conditions: the stitching area must be sealed and certified, and the pages must be numbered.

You can flash it like this:

- We fold the sheets and make holes: with a needle if the document is small, and a hole punch if it is thick.

- We thread the threads or ribbon and tie a knot on the back of the book.

This is enough to flash.

You can print in two ways:

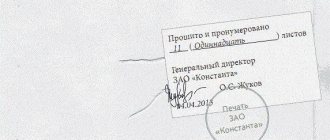

- Take a small piece of paper and bend it: the narrow part should cover the ribbon/thread from the side of the first sheet, and the wide part should cover the back. We glue and write the number of pages in words and numbers, the date, and the name of the certifier. You can put a stamp if you have one. Also don't forget to sign. It will be better if the signature is located both on the sheet and on the document.

- We make a hole in the book through all the sheets. We pass threads/ribbon through them and make a knot on the back side of the document. We fix the ends with a piece of paper on which we write the same information as in the previous method.

Ana-sm.com

Despite the fact that since 2014, individual entrepreneurs using the simplified tax system do not have to submit the KUDiR to the Tax Inspectorate when submitting annual reports, we are required to have this same KUDiR for the past year.

And it must be properly formatted: filled out correctly, the pages numbered and filed, on the last page there is the inscription “Sewn and numbered (for example) 7 (seven) sheets”, signature and seal of the individual entrepreneur. I would also like to note that since 2013, a new KUDiR form has been used for individual entrepreneurs and organizations using the simplified tax system. Since 2013, the mandatory certification of the book of income and expenses by the tax authority has been abolished. However, the stitched and numbered KUDiR must be there in any case. The fine for the absence of a book for individual entrepreneurs is 200 rubles, for organizations 10,000 rubles.

If you have not yet filled out the KUDiR, then you should familiarize yourself with the instructions for filling out the KUDiR on the simplified tax system, and in this note we will talk about filing documents, and specifically how to sew the KUDiR.

How, in principle, to staple documents correctly?

Are there any general rules?

None of the authorities that require documents to be stapled in order to ensure maximum difficulty for forgery provide instructions, rules or samples on how to do this. Although, it would seem, well, take a photo of how to staple documents and everyone will be better off. After all, this must be done “correctly”, and not otherwise.

You cannot staple sheets of one document together with a stapler, nor can you glue them together. You just have to stitch it together. This can be done using a needle and thread, stitching through sheets of paper. If there are a lot of sheets, then you will need an awl, but it is more convenient to use a hole punch and a thin strip of braid instead of thread. Some sew “on the left side”, others - “at the upper left corner”.

But then everything is the same for everyone: take a small piece of paper, paste it on top of the threads / tape, then on this piece of paper, ending up on the document itself, it is written “Sewn and numbered so many

pages. Last name I.O. Signature." A stamp is placed (if any).

So, what is needed to stitch KUDiR:

- filled out KUDiR, with numbering of sheets - hole punch or needle - thin strip of braid or thread (documents are stitched with thread twice, for strength) - office glue - paper for stickers measuring approximately 4*6 cm (not thick) - pen - stamp (if available )

We make holes through all the sheets of the document, thread the ribbon, tie it on the back side of the bound document, paste a piece of paper on top, sign (the edges of the signature and seal should extend beyond the borders of the sticker paper). That's all.

For clarity, I will give two versions of the video with stitching of documents: - from the left side

- from the upper left corner

I would like to say that the ribbon sometimes makes the inspector/receiving person from the Pension Fund smile (it was noted when I had to submit the KUDiR to the tax office), but it was very convenient when returning the book “back” (in the first year they immediately returned the book to me, putting a mark, and the next year they said: come for it in 5 days) - my KUDiR stood out very clearly from the general pile and I simply pointed to it, so I didn’t have to go through the whole pile.

Order of the Ministry of Finance of the Russian Federation dated December 30, 2005 N 167n “On approval of the form of the Book of Income and Expenses of Organizations and Individual Entrepreneurs applying the simplified taxation system, and the Procedure for filling it out”:

…

1.5. The book of income and expenses must be laced and numbered. On the last page of the Income and Expense Accounting Book, numbered and laced by the taxpayer, the number of pages it contains is indicated, which is confirmed by the signature of the head of the organization (individual entrepreneur) and sealed with the seal of the organization (individual entrepreneur - if any), and also certified by the signature of an official of the tax authority and sealed with the seal of the tax authority before the start of its maintenance. On the last page of the Taxpayer’s numbered and laced Income and Expense Book, which was kept electronically and printed on paper at the end of the tax period, the number of pages it contains is indicated, which is confirmed by the signature of the head of the organization (individual entrepreneur) and sealed with the seal of the organization ( individual entrepreneur - if available), and is also certified by the signature of an official of the tax authority and sealed with the seal of the tax authority.

—